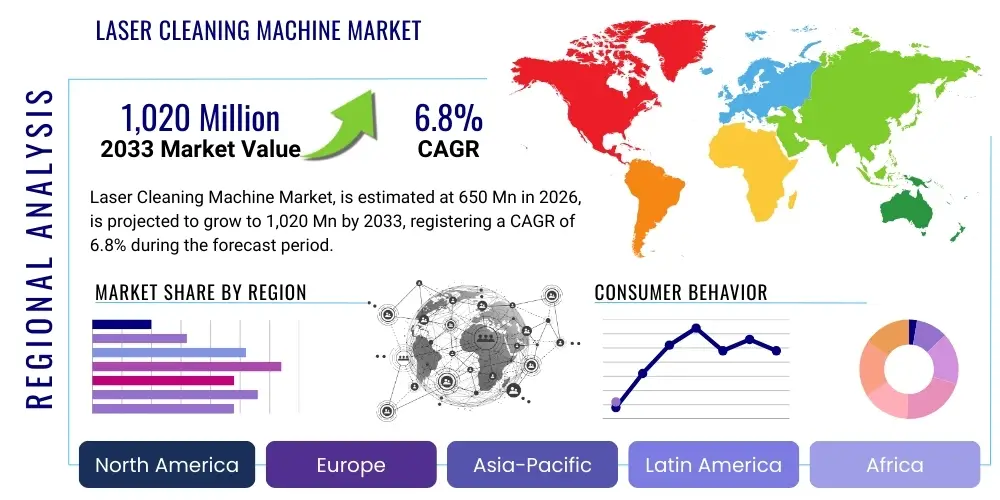

Laser Cleaning Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443262 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Laser Cleaning Machine Market Size

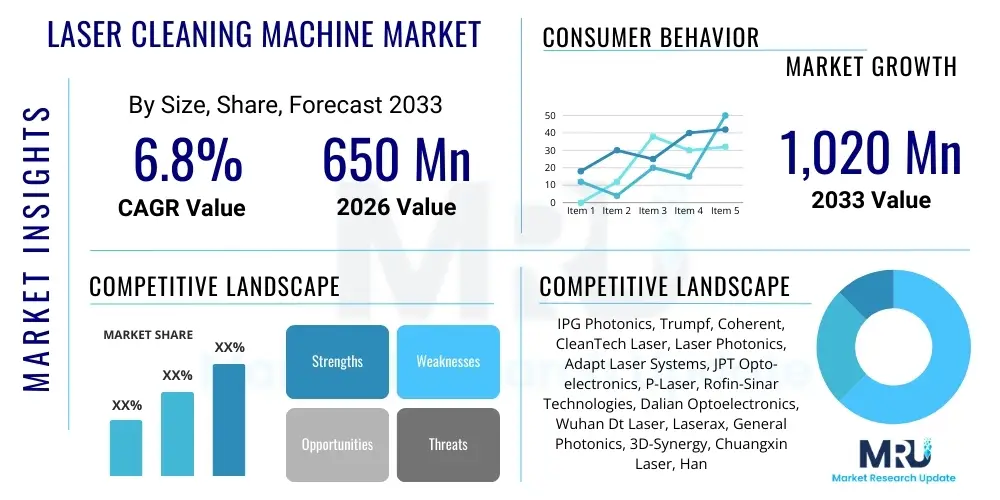

The Laser Cleaning Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,020 Million by the end of the forecast period in 2033.

Laser Cleaning Machine Market introduction

The Laser Cleaning Machine Market encompasses advanced industrial equipment designed to remove contaminants, rust, paint, oil, and various coatings from surfaces using focused laser light ablation, offering a highly efficient, non-contact, and environmentally friendly alternative to traditional cleaning methods such as sandblasting, chemical washing, or abrasive techniques. These machines utilize high-peak-power pulsed lasers, primarily fiber lasers, to selectively vaporize contaminants without damaging the underlying substrate. Product portfolios range from handheld, low-power systems used for sensitive heritage restoration to high-power automated robotic systems integrated into manufacturing assembly lines, addressing critical needs across several capital-intensive industries.

Major applications driving market adoption include preparation for welding and bonding in automotive and aerospace manufacturing, mold cleaning in the rubber and plastic sectors, surface preparation for painting or coating, and corrosion removal in infrastructure maintenance and marine environments. The fundamental benefit of laser cleaning lies in its precision, minimal waste generation, zero consumables requirement, and improved operational safety, making it a powerful tool for industries striving for sustainable manufacturing practices and enhanced product quality. The technology ensures superior surface quality control, crucial for highly regulated sectors like medical device production and high-precision electronics fabrication.

Driving factors for the substantial market expansion include stringent environmental regulations limiting the use of chemical solvents and hazardous abrasive media, escalating automation requirements in global manufacturing hubs to reduce labor costs and improve consistency, and the continuous technological advancements leading to more powerful, portable, and cost-effective laser sources. Furthermore, the increasing focus on extending the lifecycle of industrial assets and complex components through effective maintenance and restoration techniques is significantly boosting demand for highly specialized laser cleaning solutions tailored for complex geometries and sensitive materials, cementing the market's trajectory toward robust long-term growth.

Laser Cleaning Machine Market Executive Summary

The global Laser Cleaning Machine Market is currently characterized by rapid technological innovation, shifting regulatory landscapes, and increasing industrial investment in automation. Current business trends indicate a strong move toward high-power (greater than 100W) and fully integrated robotic laser cleaning systems, driven by major players focusing on turnkey solutions for large-scale industrial applications, particularly within electric vehicle (EV) battery manufacturing and complex metal processing. Furthermore, competitive intensity is rising as Asian manufacturers introduce cost-competitive fiber laser technology, challenging established Western dominance, leading to increased price sensitivity but also wider accessibility for Small and Medium-sized Enterprises (SMEs) across various emerging economies seeking sustainable cleaning alternatives.

Regionally, Asia Pacific (APAC), spearheaded by China, Japan, and South Korea, is the fastest-growing market segment, fueled by massive investments in manufacturing automation, robust automotive production capacity, and intensive infrastructure development. North America and Europe maintain a leading share in terms of technological sophistication and high-value applications, focusing heavily on precision cleaning in aerospace, defense, and high-end electronics. These developed regions are leading the adoption of advanced pulsed laser technologies and sophisticated software controls for complex surface treatment, demonstrating a higher average selling price (ASP) due to stringent quality control demands and safety requirements.

Segment trends reveal that the Fiber Laser segment dominates the market due to its superior efficiency, long service life, and decreasing cost profile compared to solid-state or CO2 lasers. By application, the Automotive sector remains the primary consumer, leveraging laser cleaning for surface preparation before battery welding, paint stripping, and assembly line maintenance. The market also exhibits significant growth potential in the Restoration and Conservation segment, catering to the unique requirements of heritage sites and precision components where non-abrasive techniques are mandatory, signifying diversification beyond core industrial manufacturing and highlighting the versatility of laser technology.

AI Impact Analysis on Laser Cleaning Machine Market

Common user inquiries regarding AI's impact frequently center on how machine learning enhances cleaning precision, optimizes energy consumption, and enables autonomous operation within complex manufacturing environments. Users are keenly interested in predictive maintenance capabilities, asking if AI algorithms can detect early signs of component degradation or forecast optimal pulse settings based on real-time surface feedback. The core concern revolves around the integration complexity and the requirement for specialized data scientists to manage AI-driven systems. Ultimately, users expect AI to transition laser cleaning from a manual or semi-automated process into a fully adaptive and self-optimizing system capable of handling highly variable contamination profiles and substrate geometries without human intervention, ensuring zero substrate damage and maximizing throughput in high-volume production lines.

AI integration is fundamentally transforming laser cleaning systems by enabling dynamic process control and automated decision-making. Through embedded sensors and advanced vision systems, AI algorithms can instantly analyze the contamination layer’s composition and thickness (e.g., rust, paint, or grease) and subsequently adjust critical laser parameters—such as pulse energy, repetition rate, and scanning speed—in real-time to achieve optimal ablation efficiency while rigorously preventing damage to the base material. This level of adaptability is crucial for applications involving heterogeneous surfaces or highly sensitive components, dramatically improving cleaning consistency and repeatability across diverse industrial processes where manual tuning would be impractical or result in variances.

Furthermore, AI facilitates predictive maintenance and operational optimization for laser cleaning machine fleets. Machine learning models analyze vast datasets generated by system usage, temperature monitoring, and component stress metrics to accurately predict potential equipment failures, minimizing unexpected downtime and optimizing scheduled service intervals. In terms of efficiency, AI-powered trajectory planning allows robotic systems to calculate the most energy-efficient path for laser scanning complex 3D geometries, reducing overall cycle time and significantly lowering energy consumption per cleaned part, thereby enhancing the overall Total Cost of Ownership (TCO) for end-users committed to lean manufacturing principles and smart factory deployment.

- AI enables real-time parameter adjustment (pulse energy, frequency) based on contamination detection.

- Predictive maintenance algorithms reduce downtime by forecasting component failure in high-power lasers.

- Machine Vision and Deep Learning facilitate automated target recognition and classification for selective cleaning.

- AI optimizes robotic path planning for complex 3D surface geometries, improving throughput and energy efficiency.

- Enhanced quality control systems use AI to verify cleaning completeness and confirm zero substrate damage post-process.

DRO & Impact Forces Of Laser Cleaning Machine Market

The Laser Cleaning Machine Market is subject to robust market drivers, significant technical restraints, and compelling strategic opportunities, all converging to shape its growth trajectory and competitive landscape. The primary drivers revolve around the global mandate for sustainable industrial practices, necessitating the replacement of environmentally detrimental chemical cleaning agents and abrasive blasting methods. This push for green technology, coupled with the relentless pursuit of manufacturing automation and precision surface treatment in high-tech industries (like EV battery manufacturing and semiconductors), creates a strong underlying demand. However, the market faces restraints centered on the high initial capital investment required for high-power pulsed fiber laser systems and the requisite specialized technical expertise needed for operation and maintenance, limiting adoption among smaller enterprises or regions with underdeveloped technical infrastructure.

Opportunities in this sector are primarily driven by the emergence of ultra-high-power compact laser sources, making portable and handheld units more powerful and thus applicable to heavier industrial cleaning tasks, expanding the potential customer base beyond fixed factory installations. Furthermore, diversification into non-traditional applications such as medical device sterilization, sensitive electronic component cleaning, and heritage restoration presents new revenue streams. The most significant impact force on the market is the continuous decline in the cost of high-power fiber laser modules coupled with regulatory pressure favoring eco-friendly processes. This combination rapidly accelerates the feasibility and adoption rate of laser cleaning, moving it from a niche, high-cost solution to a mainstream industrial standard, effectively transforming the cleaning landscape across traditional sectors like marine and heavy machinery.

The balance of these forces suggests a highly dynamic market where technological advancement (opportunity) consistently works to overcome cost barriers (restraint). The market’s long-term sustainability is strongly supported by global environmental compliance mandates (driver). The intensity of these impact forces dictates that companies that successfully lower the TCO through modular designs and robust service networks, while simultaneously leveraging AI for optimized performance, will capture significant market share. Geopolitical manufacturing shifts, particularly the acceleration of automotive and electronics production in APAC, further amplify demand, ensuring sustained high growth rates throughout the forecast period, emphasizing the strategic importance of this technology in modern industrial decarbonization efforts.

Segmentation Analysis

The Laser Cleaning Machine Market segmentation provides a granular view of market dynamics based on technology type, power output, application industry, and operational mode, allowing stakeholders to understand specific areas of growth and technological adoption. The analysis highlights the pivotal role of fiber laser technology due to its superior beam quality and operational longevity, which heavily influences purchasing decisions across all end-use sectors. Further differentiation is observed between fixed (automated) and handheld (portable) systems, reflecting the dichotomy between high-volume production requirements and flexible maintenance or localized cleaning tasks, with the fastest growth projected in integrated robotic solutions driven by the Industry 4.0 paradigm.

Segmentation by power output is crucial as it correlates directly with application complexity and material throughput rates. Low-power lasers (below 50W) are predominantly used for delicate or precision cleaning in microelectronics and fine art restoration, where substrate preservation is paramount. Conversely, high-power lasers (above 100W) are essential for rapid industrial processes such as heavy rust removal, thick paint stripping on large vehicles, or high-speed weld preparation in shipbuilding and construction, necessitating robust cooling systems and advanced beam delivery mechanisms to manage thermal loads efficiently during continuous operation.

Application diversity continues to expand the market’s reach, moving beyond the traditional industrial sectors. While Automotive and Aerospace remain core segments demanding high-precision cleaning for critical component integrity, significant emerging opportunities are noted in the Mold & Tooling sector, where laser cleaning substantially reduces mold maintenance time and improves product quality by eliminating residue buildup. Furthermore, the Electronics and Semiconductor industry is increasingly adopting ultra-precision laser cleaning for delicate wafer and component surface preparation, minimizing particle contamination and driving demand for specialized laser sources with exceptionally high beam quality and highly precise depth control mechanisms.

- By Technology:

- Fiber Laser Cleaning Machines (Dominant segment due to efficiency and reduced maintenance)

- Solid-State Laser Cleaning Machines (Used for specific high-power pulsed applications)

- CO2 Laser Cleaning Machines (Niche applications requiring different wavelengths)

- By Power Output:

- Low Power (<50W) (Precision cleaning, restoration, electronics)

- Medium Power (50W–100W) (General industrial maintenance, surface preparation)

- High Power (>100W) (Heavy rust removal, paint stripping, high-throughput manufacturing)

- By Application:

- Automotive Industry (Weld preparation, paint stripping, mold cleaning, EV battery production)

- Aerospace and Defense (Component maintenance, surface ablation, bonding preparation)

- Manufacturing and Heavy Industry (Rust removal, corrosion control, infrastructure maintenance)

- Electronics and Semiconductors (Precision cleaning of sensitive components)

- Restoration and Conservation (Art, heritage sites, delicate materials)

- Mold & Tooling Cleaning (Rubber, plastic, and composite mold maintenance)

- By Operation Mode:

- Handheld/Portable Systems (Flexibility, localized cleaning, maintenance)

- Automated/Fixed Systems (Integrated robotics, high-volume production lines)

Value Chain Analysis For Laser Cleaning Machine Market

The value chain of the Laser Cleaning Machine Market begins with upstream component suppliers, primarily focused on the core laser source technology. This segment is highly concentrated, dominated by key players providing high-power pulsed fiber lasers, specialized optics (lenses, mirrors, beam delivery systems), and high-precision galvanometer scanners. The quality, reliability, and cost structure of these upstream components—particularly the fiber laser engine itself—dictate the final performance and overall cost-efficiency of the cleaning machine. Consolidation and strategic partnerships between laser manufacturers and system integrators are common to secure proprietary technology and ensure supply chain stability, especially regarding high-specification laser modules.

The midstream comprises the original equipment manufacturers (OEMs) and system integrators who take the raw laser components, integrate them with mechanical systems (such as robotic arms, enclosures, cooling units), advanced software controls, and specialized sensor feedback mechanisms. System integrators play a crucial role in customizing standard laser engines into application-specific machines tailored for industries like aerospace or automotive, often involving complex robotic integration and safety compliance certification. Manufacturing capabilities are increasingly focused on modular design to allow for easier repair, upgrades, and customization, enhancing the flexibility of the final cleaning solution delivered to the end-user.

Downstream distribution channels are segmented into direct sales models, prevalent for complex, high-value integrated robotic systems where direct technical support and consultation are mandatory, and indirect sales through distributors and regional representatives, particularly for standardized or handheld portable units targeting SMEs. Aftermarket services, including maintenance contracts, calibration, and replacement of consumable optics (though minimal compared to traditional cleaning), form a critical revenue stream. The successful downstream engagement relies heavily on providing comprehensive technical training and application engineering expertise to ensure end-users maximize the precision and efficiency of the laser cleaning process across their diverse industrial requirements.

Laser Cleaning Machine Market Potential Customers

Potential customers, or end-users, for laser cleaning machines span a diverse array of industrial and non-industrial sectors, all sharing the requirement for high-precision, non-contact surface treatment, and efficient contaminant removal. The primary industrial consumers include major global manufacturers within the Automotive sector, which utilizes laser cleaning extensively for pre-welding preparation in chassis assembly, paint stripping for restoration or repair, and essential maintenance of complex, multi-cavity molds used in producing plastic and rubber components like tires and dashboards. The shift towards Electric Vehicle (EV) manufacturing is accelerating demand, specifically for the precise surface preparation required before battery module welding to ensure optimal electrical conductivity and safety.

Secondly, the Aerospace and Defense industries represent a high-value segment, where component integrity is non-negotiable. Laser cleaning is employed for preparing critical aerospace parts for thermal barrier coatings, removing oxides from turbine blades during maintenance, and ensuring precision bonding surfaces for composite structures. Due to the high cost of components and stringent regulatory oversight, these customers prioritize systems offering certified repeatability, non-destructive cleaning, and comprehensive data logging capabilities. Furthermore, general manufacturing facilities, including heavy machinery, pipeline infrastructure, and shipbuilding, constitute a broad customer base focused on corrosion removal and surface refurbishment of large assets to extend operational lifecycles.

Beyond heavy industry, niche yet rapidly growing customer segments include organizations involved in Cultural Heritage Preservation and Fine Arts Restoration, where the ability to selectively remove dirt, grime, or failed coatings without altering the substrate is critical for irreplaceable artifacts. Similarly, the Electronics industry, particularly semiconductor fabrication and high-precision PCB assembly, demands ultra-clean surfaces free from microscopic particulates, pushing the boundary for low-power, high-precision laser cleaning systems. These customers seek solutions that minimize thermal impact and completely eliminate the risk of chemical contamination inherent in traditional wet cleaning processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,020 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics, Trumpf, Coherent, CleanTech Laser, Laser Photonics, Adapt Laser Systems, JPT Opto-electronics, P-Laser, Rofin-Sinar Technologies, Dalian Optoelectronics, Wuhan Dt Laser, Laserax, General Photonics, 3D-Synergy, Chuangxin Laser, Han's Laser, Hymson Laser, Maxphotonics, GW Laser. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Cleaning Machine Market Key Technology Landscape

The technological landscape of the laser cleaning market is predominantly defined by the maturation and cost reduction of high-peak-power pulsed fiber lasers. These lasers, typically operating in the infrared spectrum (1064 nm wavelength), offer superior efficiency and flexibility compared to older solid-state technologies. The reliance on fiber laser technology stems from its ability to deliver short pulses (nanoseconds to picoseconds) with very high peak power, which is essential for achieving the ablation threshold of contaminants rapidly without transferring significant heat energy to the underlying substrate. Advanced beam delivery systems, including flexible fiber optic cables and compact galvanometer scanners, are crucial technological components enabling precise movement and controlled energy deposition over complex 3D surfaces in both automated and handheld configurations, significantly boosting operational versatility.

A secondary, yet rapidly evolving technological focus involves sophisticated control systems and real-time process monitoring. Modern laser cleaning machines incorporate advanced sensing technologies, such as plasma detection, optical coherence tomography (OCT), and thermal cameras, to provide immediate feedback on the cleaning process. This integrated feedback loop is vital for ensuring non-destructive cleaning, as the system can autonomously halt the process or adjust parameters the moment the laser penetrates the contaminant layer and begins to interact with the base material. The development of proprietary software algorithms to interpret this sensor data and translate it into dynamic laser control settings represents a significant area of competitive differentiation and technological investment among leading market players.

Furthermore, the market is seeing a push toward integrating ultrafast lasers (picosecond and femtosecond lasers) for ultra-precision applications, primarily within the electronics and medical device manufacturing sectors. Although significantly higher in cost, ultrafast lasers minimize the heat-affected zone (HAZ) almost entirely, allowing for the cleaning of highly thermally sensitive materials, offering resolutions down to the sub-micron level. Parallel technological developments focus on enhancing portability and usability, including the design of lighter, more ergonomic handheld applicators and the incorporation of robust, industrial-grade cooling systems that maintain performance integrity during extended high-duty-cycle operation, expanding the scope of feasible applications beyond traditional fixed industrial settings and into field maintenance operations.

Regional Highlights

-

Asia Pacific (APAC): Dominant Growth Hub

The APAC region currently represents the fastest-growing and most dynamic market for laser cleaning machines, driven primarily by the massive scale of its manufacturing and industrial sectors, particularly in China, Japan, and South Korea. China stands as the global leader in both production and consumption, characterized by aggressive automation adoption across its automotive, electronics, and heavy machinery industries. Government initiatives promoting advanced manufacturing techniques and environmental sustainability are strongly favoring the adoption of laser technology over chemical processes. The rapid expansion of electric vehicle (EV) production in APAC, necessitating stringent quality control for battery welding and component preparation, has created a substantial and immediate demand for high-power integrated laser cleaning systems, making this region critical for global revenue generation and volume throughput.

Market expansion in Southeast Asian nations (e.g., India, Vietnam) is accelerating, driven by foreign direct investment and the establishment of new manufacturing supply chains. While these emerging economies initially focus on cost-effective, medium-power portable systems for maintenance and general surface preparation, the increasing complexity of local production is gradually necessitating the transition to automated, fixed cleaning solutions. Competitive pricing from local manufacturers, particularly in the fiber laser component space, is crucial in driving widespread adoption across the diverse industrial landscape of the region, emphasizing value and operational efficiency as key purchase determinants.

-

North America: Technological Leadership and High-Value Applications

North America holds a leading position in terms of market value, prioritizing high-specification, technologically advanced laser cleaning solutions for critical applications. The demand is heavily concentrated in the Aerospace & Defense sectors, where certified cleaning processes and strict material integrity requirements mandate the use of the most precise laser systems, often involving custom-engineered solutions. Furthermore, the robust maintenance, repair, and overhaul (MRO) industry, particularly in oil, gas, and aging infrastructure, utilizes high-power laser cleaning for corrosion and coating removal, valuing reliability and compliance with stringent operational safety standards.

The region is characterized by high labor costs, making the integration of fully automated, robotic laser cleaning cells an economically compelling solution for large manufacturers. Investment in R&D, particularly in integrating AI and machine vision for autonomous operation, is higher than the global average, reflecting the market’s focus on process optimization and reduced reliance on manual labor. The market is receptive to premium products offering superior performance and integration capabilities, ensuring that North America remains a crucial innovation driver and a key market for established Western laser technology firms.

-

Europe: Regulatory Compliance and Industrial Modernization

Europe’s laser cleaning market growth is intrinsically linked to the continent's strict environmental regulations (e.g., REACH), which heavily restrict the use of volatile organic compounds (VOCs) and hazardous cleaning chemicals. This regulatory pressure provides a powerful structural tailwind for the adoption of green, zero-waste laser cleaning technology across core industrial nations like Germany, Italy, and France. The Automotive industry, including significant component suppliers, remains a strong consumer, investing heavily in laser cleaning for pretreatment stages of next-generation mobility components and modernizing legacy manufacturing lines.

A notable segment in Europe is the Conservation and Restoration sector, reflecting the region's strong focus on cultural heritage preservation. Demand here is for specialized, low-power, high-precision pulsed lasers used to clean sensitive historical materials, requiring unique operational training and technical support. European manufacturers are strong innovators in developing user-friendly, modular, and portable cleaning units that meet diverse industrial needs while maintaining rigorous European Union (EU) safety and quality standards, focusing on providing high reliability and robust long-term technical service.

-

Latin America (LATAM): Emerging Industrialization Focus

The LATAM market is in an emerging phase, characterized by gradual but accelerating adoption, primarily concentrated in industrialized nations such as Brazil and Mexico, fueled by automotive assembly plants and growing oil & gas infrastructure maintenance needs. Initial market entry often involves the use of portable, medium-power laser systems for localized rust removal and general maintenance tasks, driven by cost-efficiency requirements. High investment barriers and import duties often slow the rapid integration of high-end automated systems.

Market growth is closely tied to external investment and the stabilization of regional economic conditions. As local manufacturing complexes mature and require higher quality control standards, the demand for fixed, high-throughput laser cleaning solutions is expected to rise. Distributors and system integrators play a vital role here, focusing on providing localized technical support and financing options to mitigate the high initial capital expenditure challenge for regional industrial players, emphasizing the TCO benefits over multi-year operational cycles.

-

Middle East and Africa (MEA): Infrastructure and Energy Reliance

The MEA market's demand for laser cleaning is largely concentrated within the massive Oil & Gas sector and ongoing large-scale infrastructure and construction projects in the Gulf Cooperation Council (GCC) countries. Laser cleaning is highly valued for maintenance and integrity management of pipelines, storage tanks, and critical energy infrastructure components where efficient corrosion and scale removal is essential for operational safety and longevity. The harsh desert environment and the need for durable, field-deployable cleaning solutions contribute to the specific requirements of this region.

Growth is steady, driven by ambitious diversification plans beyond traditional fossil fuels, including investments in renewable energy infrastructure and high-tech manufacturing hubs (e.g., Neom in Saudi Arabia). While high-power industrial systems for heavy-duty maintenance dominate the current application profile, the market remains reliant on imported technology and specialized foreign expertise. Establishing local service centers and providing certified training programs are crucial steps for suppliers aiming to secure long-term market presence and support the region’s expansive industrial growth ambitions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Cleaning Machine Market.- IPG Photonics

- Trumpf

- Coherent

- CleanTech Laser

- Laser Photonics

- Adapt Laser Systems

- JPT Opto-electronics

- P-Laser

- Rofin-Sinar Technologies

- Dalian Optoelectronics

- Wuhan Dt Laser

- Laserax

- General Photonics

- 3D-Synergy

- Chuangxin Laser

- Han's Laser

- Hymson Laser

- Maxphotonics

- GW Laser

Frequently Asked Questions

Analyze common user questions about the Laser Cleaning Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of laser cleaning over traditional methods like sandblasting?

Laser cleaning is a non-contact, non-abrasive, and chemical-free process, eliminating secondary waste and substrate damage. It offers superior precision, reduced operational costs (no consumables), and is significantly more environmentally friendly than traditional abrasive or chemical cleaning techniques, leading to higher surface quality and enhanced component longevity.

Which power output range is most suitable for heavy industrial rust removal?

For heavy industrial applications such as rapid rust removal, thick paint stripping, or processing large surface areas, High Power systems (typically exceeding 100W, often ranging into the kilowatt level for industrial automation) are required to achieve the necessary throughput and ablation speed efficiently while managing high-duty cycles without overheating.

Is laser cleaning safe for sensitive materials, such as historical artifacts or thin aerospace alloys?

Yes, laser cleaning is highly safe for sensitive materials when utilizing appropriate parameters and low-power (under 50W) pulsed laser technology. The precision control allows for selective contaminant removal with minimal thermal impact, preventing damage or alteration to the underlying substrate, which is essential for restoration and high-precision manufacturing.

How does the cost structure of laser cleaning systems compare to conventional industrial cleaning equipment?

Laser cleaning systems typically have a high initial capital expenditure compared to traditional equipment. However, the Total Cost of Ownership (TCO) is often lower over the operational lifespan due to near-zero consumable costs, reduced maintenance requirements, lower waste disposal fees, and superior operational efficiency, especially in high-volume production settings.

What is the role of automation and robotics in the modern laser cleaning machine market?

Automation, utilizing robotic arms and integrated CNC stages, is crucial for high-throughput and complex geometry cleaning, particularly in the Automotive and Aerospace sectors. Integration ensures consistent, repeatable quality, minimizes human exposure to industrial environments, and allows for real-time monitoring and control using advanced AI and sensor feedback systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager