Laser Depaneling Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442279 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Laser Depaneling Machine Market Size

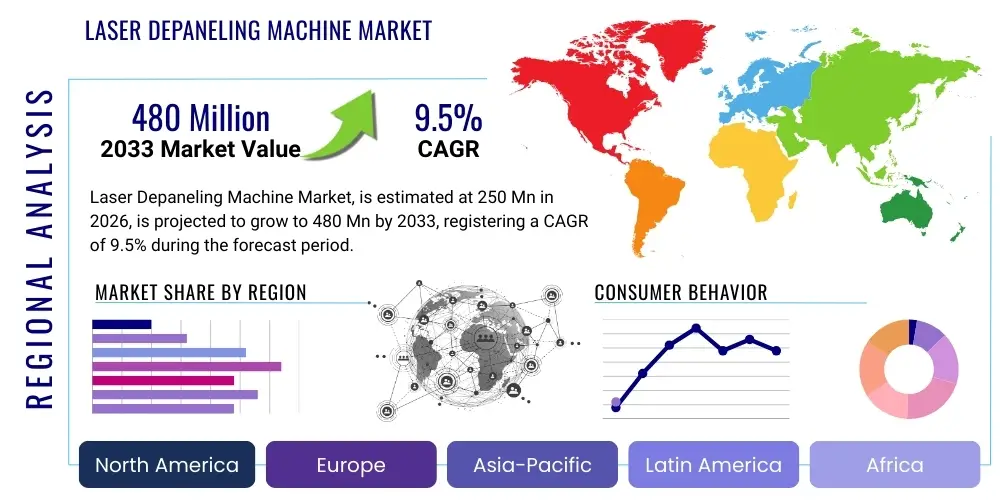

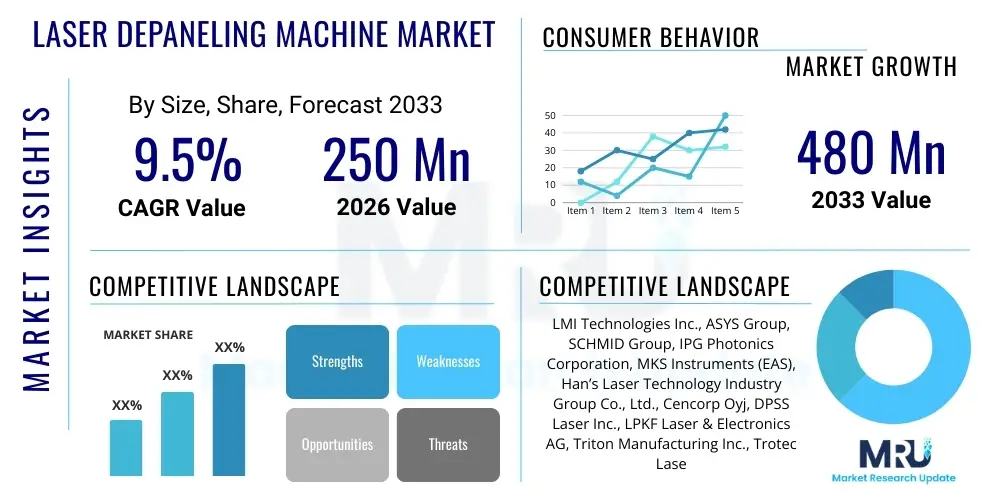

The Laser Depaneling Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 480 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the relentless pace of miniaturization in electronic components and the increasing complexity of printed circuit boards (PCBs). As consumer electronics, automotive systems, and advanced medical devices demand higher component density and more intricate board designs, traditional mechanical depaneling methods are proving insufficient, creating a necessary transition toward non-contact laser technology that ensures superior yield rates and minimizes stress on sensitive components.

Laser Depaneling Machine Market introduction

The Laser Depaneling Machine Market encompasses highly specialized equipment used for separating individual electronic circuits, typically PCBs or flexible printed circuits (FPCs), from larger manufacturing panels. These systems utilize focused laser energy—most commonly UV, CO2, or Fiber lasers—to precisely cut the substrate material without physical contact, offering a significant advantage over conventional routing, scoring, or punching methods which introduce mechanical stress and dust contamination. The core product category includes high-precision, automated machines designed for mass production environments where precision, throughput, and component integrity are paramount. Applications are broad, spanning consumer electronics, including smartphones and wearables; automotive systems, particularly advanced driver-assistance systems (ADAS) and electric vehicle (EV) battery management modules; and high-reliability industrial and medical devices.

The primary benefit of adopting laser depaneling technology centers on its ability to handle extremely complex geometries and thin, flexible substrates, which are critical in modern compact devices. The non-contact nature of the process eliminates tooling wear, reduces maintenance costs, and significantly improves yield rates by preventing micro-cracks or component damage that often occurs during mechanical separation. Driving factors propelling this market include the global transition toward 5G infrastructure, which requires high-frequency, densely packed PCBs, and the burgeoning demand for IoT devices, necessitating highly miniaturized and reliable electronics. Furthermore, stringent quality requirements in critical industries like aerospace and medical devices strongly favor the precision offered exclusively by laser technology, reinforcing its market penetration.

Laser Depaneling Machine Market Executive Summary

The Laser Depaneling Machine Market is characterized by robust technological development and intense competitive dynamics, primarily fueled by the surging production of advanced electronics in the Asia Pacific region. Business trends indicate a strong shift towards ultra-violet (UV) laser systems due to their superior cold-processing capabilities, which minimize heat-affected zones (HAZ) on delicate materials, crucial for high-density interconnect (HDI) boards. This technological preference is driving R&D investment among key players. Regionally, APAC remains the undisputed market leader, propelled by major PCB manufacturing hubs in China, South Korea, and Taiwan, which are rapidly adopting highly automated laser systems to maintain global cost and quality leadership. Segment trends confirm that the Consumer Electronics sector retains the largest market share, though the Automotive Electronics segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period, reflecting the global electric vehicle revolution and the implementation of sophisticated autonomous driving systems.

AI Impact Analysis on Laser Depaneling Machine Market

Common user questions regarding AI’s influence on the Laser Depaneling Machine Market frequently revolve around optimizing cutting parameters, enhancing quality control consistency, and predicting component failures. Users are keen to understand how AI can move these high-precision processes from reactive monitoring to proactive optimization. Key themes emerging from these inquiries include the potential for AI-driven machine vision systems to instantaneously detect microscopic flaws in the cut path, the utilization of machine learning algorithms to adjust laser power and speed in real-time based on material thickness variations, and the implementation of predictive maintenance protocols that anticipate component replacement before operational failure occurs. The overarching expectation is that AI integration will fundamentally elevate the efficiency, repeatability, and reliability of laser depaneling operations, significantly lowering per-unit manufacturing costs and improving overall factory floor productivity.

AI integration is transforming laser depaneling by enabling systems to achieve levels of precision and automation previously unattainable. By processing vast datasets generated during the cutting process—including thermal data, beam characteristics, and vision system inputs—AI algorithms can construct complex models that correlate machine settings with final product quality. This capability allows manufacturers to automatically calibrate optimal laser settings for new or challenging substrate combinations, drastically reducing setup time and minimizing waste associated with trial-and-error approaches. Furthermore, AI-powered systems facilitate adaptive processing, meaning the machine can dynamically compensate for slight inconsistencies in panel placement or material composition, ensuring a uniform, high-quality cut across every unit produced.

The long-term impact of AI extends into the sphere of factory integration and smart manufacturing initiatives. By linking laser depaneling machines to centralized manufacturing execution systems (MES), AI provides actionable insights into throughput bottlenecks, equipment utilization, and yield fluctuations across the entire production line. This shift towards cognitive manufacturing allows companies to run lights-out operations with minimized human intervention, particularly in critical, high-volume production lines. Predictive analytics, trained on historical sensor data, ensure maximum uptime by scheduling preventative maintenance precisely when component performance degradation is predicted, moving beyond simple time-based servicing schedules and maximizing return on investment for high-cost laser equipment.

- AI-driven machine vision systems enhance real-time defect detection and quality verification.

- Predictive maintenance algorithms maximize machine uptime and reduce catastrophic failures of optical components.

- Machine learning optimizes laser parameters (power, speed, frequency) dynamically for diverse materials and complex patterns.

- AI integration enables autonomous calibration and closed-loop process control, improving repeatability and yield rates.

- Optimization of material utilization and reduction of scrap rates through intelligent nesting and path planning.

DRO & Impact Forces Of Laser Depaneling Machine Market

The Laser Depaneling Machine Market is primarily driven by the imperative for ultra-high precision in separating components for miniaturized electronics, coupled with the rapid expansion of flexible and high-density PCBs used in 5G and IoT applications. These drivers are balanced against significant restraints, notably the substantial initial investment required for high-power, high-precision laser systems, and the necessity for specialized technical expertise to operate and maintain these complex machines effectively. Opportunities are abundant, specifically stemming from the rising adoption of laser technology in advanced packaging, such as panel level packaging (PLP) and system-in-package (SiP) applications, alongside the growing proliferation of electronic content in the automotive industry, particularly within safety-critical components. The combination of these dynamics results in strong impact forces emphasizing speed, reliability, and precision, fundamentally pushing traditional mechanical methods toward obsolescence in high-end manufacturing segments.

The rapid evolution of consumer electronics mandates continuous reduction in device size while increasing functionality, which directly translates to smaller PCBs with extremely narrow component spacing. Traditional mechanical methods create significant shear forces that can damage these sensitive components, making laser depaneling a non-negotiable requirement for high-end smartphone and wearable manufacturers. This technical necessity acts as a powerful market driver. However, the high capital expenditure associated with purchasing and installing UV or ultrafast laser systems poses a considerable barrier, especially for smaller and medium-sized enterprise (SME) electronics manufacturers who may rely on contract manufacturing services to access the technology. This cost factor necessitates careful cost-benefit analysis and high volume production to justify the investment.

Furthermore, the opportunity landscape is significantly widened by legislative and industrial shifts toward environmentally conscious manufacturing. Laser depaneling is a dry process that generates minimal solid waste compared to mechanical routing, aligning with global sustainability goals and reducing disposal costs. The integration of high-reliability components into mission-critical applications—such as medical implants and aerospace navigational systems—further solidifies the market for laser technology, as only non-contact methods can guarantee the structural integrity required for these demanding sectors. The market impact forces thus favor vendors who can offer highly integrated, reliable, and automated systems that minimize operational complexity while maximizing output quality, ensuring long-term technological relevance.

Segmentation Analysis

The Laser Depaneling Machine Market is segmented based on several critical parameters, including the type of laser used, the method of operation, the substrate material being processed, and the end-user industry. Analyzing these segments provides a clear understanding of market preferences and growth trajectories. The laser type segmentation, encompassing UV, CO2, and Fiber lasers, reveals the ongoing transition toward UV technology due to its superior precision for delicate materials. Segmentation by operational mode distinguishes between fully automatic and semi-automatic systems, reflecting varying throughput needs and capital expenditure constraints across different manufacturing scales. Material segmentation highlights the growing necessity to process specialized materials like flexible PCBs and ceramic substrates, which are challenging for mechanical techniques. Finally, end-user segmentation clearly identifies the primary demand drivers, with consumer electronics and automotive segments dominating market activity.

- By Laser Type:

- UV Laser Depaneling Machines

- CO2 Laser Depaneling Machines

- Fiber Laser Depaneling Machines

- By Operation Mode:

- Fully Automatic Depaneling Machines

- Semi-Automatic Depaneling Machines

- By Application/Substrate Material:

- Rigid PCBs

- Flexible PCBs (FPCs)

- Rigid-Flex PCBs

- Ceramic Substrates and Components

- By End-User Industry:

- Consumer Electronics

- Automotive Electronics

- Aerospace and Defense

- Medical Devices

- Industrial Electronics and Equipment

Value Chain Analysis For Laser Depaneling Machine Market

The value chain for the Laser Depaneling Machine Market is highly specialized and complex, beginning with upstream raw material suppliers and culminating in the highly specialized end-user integration. The upstream segment is dominated by critical component manufacturers, including suppliers of advanced laser sources (e.g., solid-state UV lasers, high-power fiber lasers), sophisticated optics (lenses, mirrors, beam expanders), and high-precision motion control systems (linear motors, high-resolution encoders). The performance and reliability of the final machine are fundamentally dependent on the quality and synchronization of these specialized components. These suppliers operate in a high-tech environment, often collaborating closely with the original equipment manufacturers (OEMs) to tailor components for specific cutting wavelengths and materials.

In the midstream segment, Original Equipment Manufacturers (OEMs) are responsible for integrating the various components, developing proprietary software for machine control, beam path management, and vision system integration. This stage involves significant R&D expenditure focused on developing sophisticated cutting algorithms and user-friendly automation features. The efficiency of the machine—measured by throughput, accuracy, and minimal heat damage—is a direct result of the OEM’s expertise in systems integration. Following manufacturing, distribution channels involve both direct sales and specialized indirect distribution networks. Direct sales are common for high-volume, global customers such as Tier 1 contract manufacturers, ensuring comprehensive technical support and installation services. Indirect channels, including authorized distributors and system integrators, serve regional markets and smaller manufacturers, offering localized support and customized integration packages.

The downstream analysis focuses on the end-users—primarily PCB manufacturers and Electronic Manufacturing Service (EMS) providers—who utilize these machines. End-users value high throughput, minimized operational costs, and the ability to process new, complex materials quickly. The entire value chain is characterized by a high need for specialized after-sales service, including maintenance contracts, software updates, and application support, ensuring that the high-capital equipment operates optimally throughout its lifecycle. The shift towards flexible and HDI boards means that demand for precision UV laser sources and advanced vision systems will continue to strengthen the upstream component suppliers, while demanding higher levels of expertise from downstream service providers.

Laser Depaneling Machine Market Potential Customers

Potential customers for Laser Depaneling Machines are diverse but share a common requirement for high-precision, low-stress material processing, making the technology indispensable for sectors dealing with sensitive electronic components. The primary buyers are Electronic Manufacturing Service (EMS) providers and dedicated Printed Circuit Board (PCB) manufacturers, particularly those focusing on high-density interconnect (HDI) boards, multilayer PCBs, and flexible circuits. These customers operate at scale and require fully automated solutions that can integrate seamlessly into existing production lines while maintaining extremely tight tolerances. Their buying decisions are heavily influenced by factors such as system reliability, speed, minimal heat-affected zone (HAZ) creation, and the manufacturer’s ability to provide swift technical support across global operations.

Beyond general manufacturing, the automotive electronics segment represents a high-growth customer base. With the rapid electrification of vehicles and the deployment of advanced driver-assistance systems (ADAS), complex, reliable PCBs are crucial. Tier 1 and Tier 2 automotive suppliers invest in laser depaneling to ensure the structural integrity of boards used in critical safety systems, where component failure is unacceptable. Similarly, the medical device sector—including manufacturers of pacemakers, diagnostic equipment, and miniature sensors—constitutes a high-value customer group. These applications mandate pristine cut quality and zero contamination, criteria that laser depaneling meets more effectively than mechanical methods, often justifying the higher capital expenditure based on the strict regulatory and quality control demands imposed by governmental bodies.

Other significant potential customers include specialized manufacturers in the aerospace and defense sectors, where component longevity and reliability under extreme conditions are paramount. Furthermore, companies involved in the emerging field of advanced semiconductor packaging, such as panel-level packaging (PLP), are increasingly adopting laser technology for singulation processes. The customer profile is thus evolving from traditional circuit board houses to include sophisticated technology integrators who demand flexibility and future-proofing capabilities in their equipment, enabling them to handle the next generation of highly compact and complex electronic assemblies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 480 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LMI Technologies Inc., ASYS Group, SCHMID Group, IPG Photonics Corporation, MKS Instruments (EAS), Han’s Laser Technology Industry Group Co., Ltd., Cencorp Oyj, DPSS Laser Inc., LPKF Laser & Electronics AG, Triton Manufacturing Inc., Trotec Laser GmbH, Universal Instruments Corporation, Microtek International Inc., Resonetics, Ex-Tech Co., Ltd., Wuhan Golden Laser Co., Ltd., JFE Engineering Corporation, ESI (Electro Scientific Industries, now a division of MKS), V-Tek, Inc., Pemstar. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Depaneling Machine Market Key Technology Landscape

The technological landscape of the Laser Depaneling Machine Market is predominantly defined by the continuous advancement in laser sources, beam delivery systems, and sophisticated machine control software designed to handle increasingly delicate and complex materials. Ultraviolet (UV) laser technology, particularly diode-pumped solid-state (DPSS) UV lasers, currently dominates the high-precision segment. UV lasers operate at shorter wavelengths (typically 355 nm), allowing for "cold" ablation, meaning the energy is absorbed directly by the material's molecular bonds rather than through heat transfer. This critical feature minimizes the heat-affected zone (HAZ) and prevents carbonization or thermal damage to adjacent components, making UV ideal for cutting thin, flexible PCBs (FPCs) and high-density interconnection (HDI) boards.

Beyond UV technology, ultrafast lasers, including picosecond and femtosecond lasers, are emerging as a niche but highly impactful technology. These lasers deliver energy in extremely short pulses, further reducing the thermal impact and offering superior edge quality on challenging materials like ceramics or complex composite substrates. The integration of advanced vision systems is another fundamental technological pillar. High-resolution machine vision, often paired with AI algorithms, is essential for automatic fiducial recognition, precise alignment, and real-time correction of the cutting path, ensuring accuracy down to the micrometer level. These vision systems compensate for panel shrinkage or expansion during processing, which is crucial for maintaining yield in mass production environments.

Automation and software integration form the third core component of the technological landscape. Modern laser depaneling machines feature integrated material handling systems, including automated loading and unloading, robotic stacking, and fully automated process flow management. The accompanying proprietary software allows operators to import complex CAD data directly, simulate cutting paths, and monitor machine performance metrics. Furthermore, connectivity standards are evolving, enabling these machines to integrate into Industry 4.0 environments, facilitating remote diagnostics, predictive maintenance scheduling, and real-time data exchange with Manufacturing Execution Systems (MES). This combination of advanced optics, precision mechanics, and smart software ensures the equipment remains highly efficient, reliable, and adaptable to future PCB design complexities.

Regional Highlights

The regional analysis of the Laser Depaneling Machine Market reveals significant disparity in adoption rates, primarily driven by the concentration of global electronic manufacturing capabilities and varying levels of industrial automation investment across geographies.

- Asia Pacific (APAC): Market Dominance and Growth Engine

The APAC region holds the largest market share and is projected to experience the fastest growth throughout the forecast period. This dominance is intrinsically linked to the presence of the world’s largest electronic manufacturing hubs, particularly in China, Taiwan, South Korea, and Japan. These countries are the global leaders in PCB manufacturing, flexible circuit production, and high-volume assembly of consumer electronics (smartphones, tablets, and wearables). The relentless pressure to increase production throughput while simultaneously improving the precision required for miniaturized components fuels the massive adoption of fully automatic, high-speed laser depaneling systems. Furthermore, substantial government investments in localized semiconductor and advanced packaging capabilities in countries like China are accelerating the demand for sophisticated laser processing tools.

The manufacturing ecosystem in APAC is highly competitive, necessitating continuous technological upgrades. Consequently, manufacturers here are rapid adopters of new technologies, such as picosecond lasers and AI-enhanced vision systems, to maintain their competitive edge in cost and quality. South Korea and Japan, known for their focus on high-reliability and advanced materials, drive demand for specialized laser types used in automotive and high-end industrial electronics. The sheer volume of electronics produced, coupled with the ongoing shift from manual to highly automated processing, cements APAC's position as the primary revenue generator and future growth accelerator for the laser depaneling market.

- North America: Focus on Innovation and High-Reliability Applications

North America constitutes a significant market, characterized less by sheer volume and more by high-value applications, R&D intensity, and focus on specialized, high-reliability sectors such as aerospace, defense, and advanced medical devices. Companies in this region typically prioritize customization and performance over cost. Demand is high for systems capable of processing unique materials, intricate designs, and those that comply with stringent quality control standards mandated by defense and medical regulatory bodies. The region is also a key center for the development and early adoption of ultrafast laser technologies and integrated AI solutions designed for predictive manufacturing processes.

While manufacturing output is smaller than in APAC, the high average selling price (ASP) of laser depaneling machines in North America reflects the demand for customized automation, integration expertise, and robust after-sales support. Furthermore, the growth of localized electric vehicle and semiconductor fabrication initiatives across the United States and Canada is creating a renewed demand for domestic, high-precision manufacturing equipment, driving strategic investment in advanced laser processing capabilities among leading contract manufacturers based in the region. This market segment emphasizes quality assurance and system flexibility to handle diverse, low-to-medium volume, high-mix production.

- Europe: Strength in Automotive and Industrial Automation

Europe represents a mature market with stable growth, heavily influenced by its robust automotive sector and advanced industrial manufacturing base (Industry 4.0). European manufacturers, particularly in Germany, Italy, and France, are major consumers of laser depaneling machines for producing high-quality automotive electronics, including engine control units (ECUs), sensor arrays, and components for safety-critical systems. The stringent quality and durability requirements within the European automotive supply chain make non-contact laser separation methods essential. The transition towards e-mobility further stimulates demand for equipment used in battery management systems (BMS) and power electronics packaging.

The European market also exhibits a strong preference for highly integrated, energy-efficient, and sustainable manufacturing solutions. Environmental regulations and corporate sustainability goals encourage the adoption of dry laser processing technologies over mechanical methods that generate significant particulate waste. Key growth is tied to continuous automation investment across general industrial control systems and specialized medical equipment production. European market participants frequently seek systems that offer seamless integration with existing factory automation infrastructure and provide advanced diagnostic capabilities for optimizing maintenance schedules and energy consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Depaneling Machine Market.- LMI Technologies Inc.

- ASYS Group

- SCHMID Group

- IPG Photonics Corporation

- MKS Instruments (EAS)

- Han’s Laser Technology Industry Group Co., Ltd.

- Cencorp Oyj

- DPSS Laser Inc.

- LPKF Laser & Electronics AG

- Triton Manufacturing Inc.

- Trotec Laser GmbH

- Universal Instruments Corporation

- Microtek International Inc.

- Resonetics

- Ex-Tech Co., Ltd.

- Wuhan Golden Laser Co., Ltd.

- JFE Engineering Corporation

- ESI (Electro Scientific Industries, now a division of MKS)

- V-Tek, Inc.

- Pemstar

Frequently Asked Questions

Analyze common user questions about the Laser Depaneling Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of laser depaneling over mechanical methods?

Laser depaneling offers superior precision, eliminates mechanical stress and tooling wear, and drastically reduces the heat-affected zone (HAZ), making it ideal for cutting highly dense, sensitive, and flexible printed circuit boards (PCBs) while maximizing yield rates.

Which laser type is most commonly used for cutting flexible PCBs (FPCs)?

Ultraviolet (UV) lasers (typically 355 nm) are the industry standard for flexible PCBs and high-density interconnect (HDI) boards because they utilize "cold ablation," minimizing thermal impact and ensuring pristine cut quality without damaging sensitive integrated components.

How does the integration of AI benefit laser depaneling machine operations?

AI significantly enhances operations through real-time defect detection via machine vision, dynamic optimization of laser parameters based on material variations, and implementation of predictive maintenance, leading to higher throughput and reduced operational downtime.

Which end-user industry is driving the highest growth rate for the market?

The Automotive Electronics sector, driven by the rapid growth in electric vehicles (EVs), battery management systems (BMS), and advanced driver-assistance systems (ADAS), is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the laser depaneling market.

What is the main restraining factor affecting the adoption of laser depaneling machines?

The primary restraint is the substantial initial capital investment required for purchasing high-precision, automated laser systems, coupled with the necessary ongoing costs for specialized maintenance and highly skilled technical personnel.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Laser Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (In-line Type, Off-line Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Automatic Laser Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (Single, Twin), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Off-Line Laser Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (Single, Twin), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- In-line Laser Depaneling Machine Market Statistics 2025 Analysis By Application (Consumer Electronics, Communications, Industrial/Medical, Automotive, Military/Aerospace), By Type (Single, Twin), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager