Laser Depaneling Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441084 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Laser Depaneling Systems Market Size

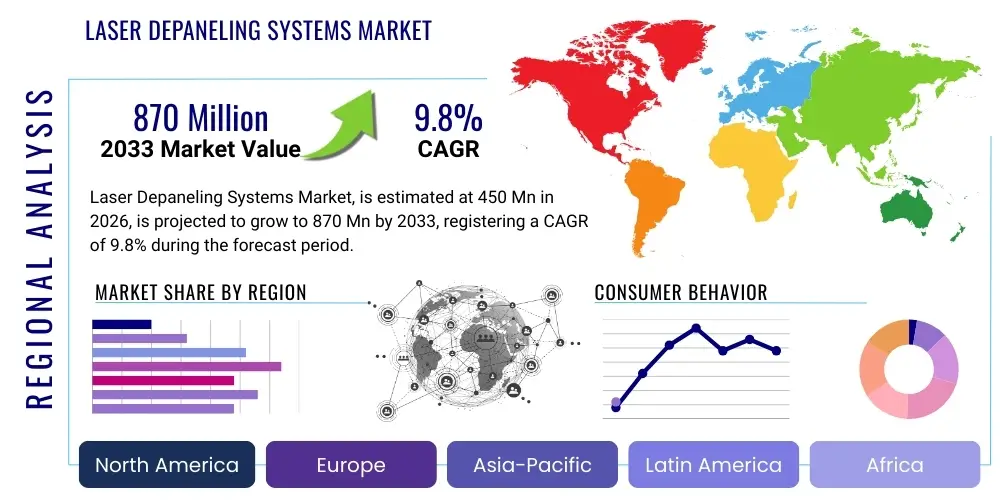

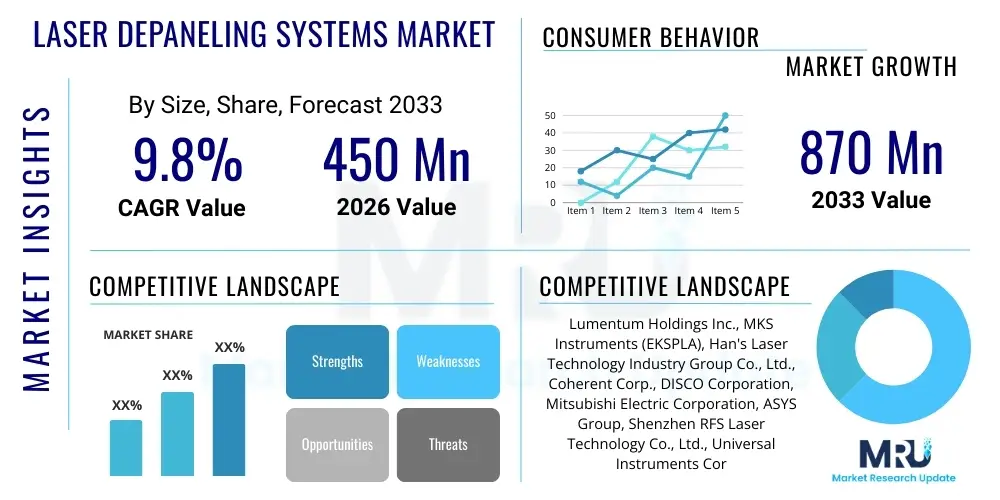

The Laser Depaneling Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 870 Million by the end of the forecast period in 2033.

Laser Depaneling Systems Market introduction

The Laser Depaneling Systems Market encompasses advanced machinery designed for separating individual electronic circuits or components from a larger manufactured panel, primarily Printed Circuit Boards (PCBs). These systems utilize high-precision laser technology, predominantly UV lasers, to cut materials with minimal mechanical stress, heat damage, and material waste, offering a superior alternative to traditional mechanical methods like routing or punching. Key applications span across consumer electronics, automotive components, medical devices, and aerospace industries, where PCB miniaturization and flexibility are paramount. The inherent benefits of laser technology, including improved edge quality, higher throughput, and compatibility with complex flexible circuit designs (FPCs), are primary driving factors. Furthermore, the global proliferation of 5G technology, the expansion of the Internet of Things (IoT) ecosystem, and the increasing demand for high-density interconnect (HDI) PCBs necessitate the precision and non-contact nature offered exclusively by laser depaneling solutions, pushing market adoption in high-volume manufacturing environments worldwide.

Laser Depaneling Systems Market Executive Summary

The global Laser Depaneling Systems market is experiencing robust growth fueled by several converging business and technological trends. Business trends highlight a significant shift towards outsourcing manufacturing to regions with specialized capabilities, particularly in Asia Pacific, which dominates both production and consumption. There is an increasing requirement for systems capable of handling a diverse range of substrate materials, including delicate ceramic substrates and advanced flexible polyimide films, pushing manufacturers to innovate in laser source technology and software control. Regional trends show rapid adoption in economies focused on high-tech manufacturing, such as China, South Korea, and Taiwan, driven by massive investments in consumer electronics and semiconductor fabrication infrastructure. In contrast, North America and Europe emphasize research and development, focusing on high-mix, low-volume applications like aerospace and high-reliability medical devices. Segment trends indicate that the Ultraviolet (UV) laser segment retains the largest market share due to its proven efficiency in ablating organic materials with minimal thermal impact (cold ablation), making it ideal for precision PCB cutting. The fastest-growing segment, however, is projected to be the picosecond and femtosecond laser systems, favored for their ultra-precision and capability to process highly sensitive or brittle materials without microcracks, thereby optimizing yield rates in complex manufacturing processes.

AI Impact Analysis on Laser Depaneling Systems Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Laser Depaneling Systems Market frequently center on themes of enhanced automation, predictive quality control, and optimized operational efficiency. Users are keenly interested in how AI algorithms can improve cut path generation, specifically minimizing processing time while maximizing precision across non-uniform panel layouts. A significant concern revolves around integrating machine learning for real-time defect detection, asking if AI can autonomously identify micro-cracks or residual material defects faster and more reliably than traditional vision systems. Furthermore, manufacturers are exploring AI’s role in predictive maintenance, seeking solutions that forecast system failures based on vibrational or thermal data, thereby reducing unplanned downtime and improving overall equipment effectiveness (OEE).

The integration of AI transforms laser depaneling from a purely mechanical process guided by CAD files into an intelligent, adaptive manufacturing step. AI algorithms enable highly complex path optimization, which is critical when processing panels with densely packed components or unconventional shapes, ensuring minimal material waste and maximizing throughput. By continuously analyzing data streams from embedded sensors, AI systems refine process parameters (such as laser power, scanning speed, and focus distance) in real-time, adapting to slight variations in substrate thickness or material composition. This level of autonomous fine-tuning leads to consistently higher quality cuts and significantly lower instances of component damage, essential for high-reliability applications like implantable medical devices or advanced automotive electronics.

Furthermore, AI-powered computer vision systems are drastically improving quality assurance within the depaneling process. These advanced systems use deep learning models trained on vast datasets of acceptable and defective cuts to immediately flag deviations, ensuring 100% inspection coverage at production speeds. This automation of quality gatekeeping not only reduces reliance on human operators for tedious inspection tasks but also establishes a closed-loop feedback mechanism where the quality findings are instantly used to adjust the laser processing parameters upstream, ensuring continuous process improvement. The ability of AI to handle the complexity and speed of modern manufacturing lines positions it as a critical element for future advancements in laser depaneling technology.

- AI-driven path planning optimizes cutting routes, minimizing cycle time and energy consumption.

- Predictive maintenance algorithms reduce unplanned downtime by anticipating component failure based on operational data.

- Machine learning enhances real-time defect recognition, improving cut precision and quality control (QC).

- Adaptive process control dynamically adjusts laser parameters based on material variations, ensuring consistent output quality.

- Automated data analysis provides actionable insights for process refinement and yield maximization (GEO optimization focus).

DRO & Impact Forces Of Laser Depaneling Systems Market

The market for Laser Depaneling Systems is fundamentally shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's trajectory and the intensity of competitive impact forces. Primary drivers include the relentless trend toward miniaturization in consumer electronics, particularly the proliferation of smaller, more complex PCBs required for smartphones, wearables, and IoT devices, which necessitate the non-contact, high-precision capabilities of lasers. Additionally, the rapid global rollout of 5G infrastructure demands specialized, high-frequency circuit boards that are best processed using laser technology to maintain signal integrity and material composition. However, market growth faces restraints, chiefly the high initial capital investment required for advanced laser systems and the complexity associated with integrating these systems into existing, often traditional, manufacturing workflows. Opportunities are abundant, driven primarily by emerging applications in flexible and rigid-flex PCBs, advanced packaging techniques like System-in-Package (SiP), and the rising demand for efficient processing of novel, sensitive materials used in electric vehicle (EV) battery management systems and specialized medical sensors. These forces collectively push market participants toward continuous innovation in speed, accuracy, and material compatibility to maintain competitive viability and address evolving regulatory standards regarding waste reduction and energy efficiency.

Segmentation Analysis

The Laser Depaneling Systems Market is segmented across multiple dimensions, including the type of laser source utilized, the processing method employed, the specific end-user industry served, and the geographical region of deployment. This segmentation highlights the diverse technical requirements across different manufacturing sectors, particularly distinguishing between high-volume consumer electronics production and specialized, high-reliability industrial applications. The technology split between Ultraviolet (UV), Carbon Dioxide (CO2), and solid-state lasers (such as fiber lasers, often used in picosecond/femtosecond configurations) dictates the material suitability and achievable precision, profoundly influencing market positioning. Furthermore, the segmentation by end-user, covering consumer electronics, automotive, and medical, reveals concentrated demand areas where stringent quality control and complex circuit geometries are mandatory. Understanding these segments is crucial for manufacturers developing targeted solutions and for stakeholders assessing market entry strategies based on technological niche and geographical manufacturing concentration.

- By Technology:

- UV Laser Depaneling Systems

- CO2 Laser Depaneling Systems

- Fiber/Picosecond/Femtosecond Laser Depaneling Systems

- By Process Type:

- Standard (Single-Beam) Depaneling

- Scanning (Multi-Beam) Depaneling

- Hybrid Depaneling (Laser and Mechanical)

- By Application:

- Rigid PCB Depaneling

- Flexible PCB (FPC) and Rigid-Flex Depaneling

- Substrate and Wafer Depaneling

- Panel Singulation

- By End-Use Industry:

- Consumer Electronics (Smartphones, Wearables, IoT)

- Automotive (ADAS, Battery Management Systems)

- Medical Devices and Healthcare

- Aerospace and Defense

- Industrial Electronics and Telecom Infrastructure

Value Chain Analysis For Laser Depaneling Systems Market

The value chain for the Laser Depaneling Systems Market begins upstream with the sourcing and manufacturing of high-purity laser components, optics, and sophisticated motion control systems. Key upstream participants include specialized laser source manufacturers (e.g., manufacturers of high-power UV and ultrafast lasers) and precision component suppliers for galvanometer scanners and industrial cameras used in vision systems. The manufacturing stage, where the actual laser depaneling systems are designed, assembled, and integrated with proprietary software, is highly concentrated among a few global technology leaders who emphasize R&D in automation and precision engineering. Downstream analysis reveals that the primary consumers of these systems are large-scale Electronic Manufacturing Services (EMS) providers and Original Equipment Manufacturers (OEMs) in sectors demanding high precision and yield, such as smartphone assembly lines and automotive component fabrication facilities.

Distribution channels are predominantly direct due to the technical complexity and high cost of the machinery. Laser depaneling system manufacturers typically sell directly to end-users, requiring extensive pre-sales consultation, customization, and post-sales support, including installation and maintenance training. Indirect channels involve a select number of specialized regional distributors or system integrators who possess deep technical expertise in laser processing and regional market access. The reliance on direct sales ensures that manufacturers maintain tight control over system deployment, software updates, and proprietary maintenance services, crucial for high-value capital equipment. This structure emphasizes robust technical partnerships and highly specialized service delivery, rather than broad, commoditized distribution networks.

The overall efficiency and competitive advantage within the value chain are increasingly defined by software integration and service capability. Companies that can seamlessly integrate AI-powered control systems and offer rapid, localized technical support for complex laser maintenance gain significant market traction. Furthermore, upstream collaboration with material science companies to ensure laser compatibility with next-generation PCB materials (e.g., advanced polymers and composite substrates) is becoming essential, driving continuous material testing and process validation across the supply chain to meet stringent industry standards.

Laser Depaneling Systems Market Potential Customers

The primary end-users and buyers of Laser Depaneling Systems are highly sophisticated manufacturing entities operating in sectors where precision, miniaturization, and high throughput are non-negotiable requirements. The largest segment of potential customers resides within the Consumer Electronics sector, specifically major OEMs producing smartphones, tablets, and advanced wearables, given their constant need to process flexible printed circuits (FPCs) with sub-micron accuracy and high production volumes. Contract manufacturers and large Electronic Manufacturing Services (EMS) providers, such as Foxconn or Flex, are significant purchasers, as they manage the assembly lines for multiple global brands and require flexible systems capable of handling a wide variety of panel designs and materials efficiently.

Another rapidly expanding customer base is the Automotive industry, driven by the shift towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS). These applications require highly reliable, complex PCBs for sensors, battery management systems (BMS), and control units. Laser depaneling is favored here because it minimizes component stress and ensures the long-term durability required for safety-critical automotive electronics. Similarly, the Medical Devices sector, including manufacturers of pacemakers, diagnostic equipment, and hearing aids, constitutes a critical customer segment, valuing the laser’s capability to process extremely small, high-density circuits made from sensitive biocompatible materials without inducing mechanical or thermal damage, ensuring compliance with rigorous regulatory standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 870 Million |

| Growth Rate | CAGR 9.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lumentum Holdings Inc., MKS Instruments (EKSPLA), Han's Laser Technology Industry Group Co., Ltd., Coherent Corp., DISCO Corporation, Mitsubishi Electric Corporation, ASYS Group, Shenzhen RFS Laser Technology Co., Ltd., Universal Instruments Corporation, Resonetics, IPG Photonics Corporation, KLA Corporation, J. P. Sercu Solutions (JPSS), Trotec Laser GmbH, Laser Photonics Corporation, Orbotech Ltd. (KLA), Osai Automation System S.p.A., Getech Automation Pte Ltd., CTI Systems S.A., 3D-Micromac AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Depaneling Systems Market Key Technology Landscape

The technological landscape of the Laser Depaneling Systems market is defined by continuous innovation in laser source physics, motion control, and integrated vision systems. The dominant technology remains the Ultraviolet (UV) solid-state laser, specifically Nd:YAG lasers operating at the third harmonic (355 nm). UV lasers are favored for "cold ablation," which minimizes the heat-affected zone (HAZ) and is crucial for processing heat-sensitive organic substrates like FR4 and polyimide used in FPCs. These systems are typically integrated with high-speed galvanometer scanners, enabling rapid and precise positioning of the laser beam, significantly boosting throughput in manufacturing environments where speed is critical.

A critical emerging trend is the increasing adoption of ultrafast lasers—picosecond and femtosecond systems. These lasers operate with extremely short pulse durations, reducing energy interaction time with the material to minimize melting and cracking, thus achieving superior edge quality even on brittle or complex multi-layer materials, such as ceramic substrates or highly sensitive HDI PCBs. While more expensive, the yield improvement and precision capabilities of ultrafast lasers position them strongly in high-end, high-reliability applications like medical implants and high-performance computing hardware. Furthermore, advanced software is integral, providing complex algorithm generation for optimized cut paths, automated material handling interface, and real-time process monitoring for quality assurance and predictive maintenance.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for laser depaneling systems, dominating both demand and supply. This dominance is driven by the region's concentration of leading EMS providers and OEMs in consumer electronics (especially in China, Taiwan, and South Korea). Significant government investment in domestic semiconductor fabrication and 5G infrastructure further accelerates the adoption of high-precision depaneling solutions. The region acts as the primary volume market where cost-efficiency and high throughput are paramount.

- North America: North America is characterized by high adoption rates in specialized, high-reliability sectors such as Aerospace, Defense, and sophisticated Medical Devices. While volume manufacturing is less concentrated than in APAC, the region leads in R&D and the early adoption of cutting-edge technologies like femtosecond laser depaneling for processing highly sensitive or novel materials. Demand is driven by stringent quality standards and the need for localized, secure manufacturing processes.

- Europe: The European market demonstrates steady growth, driven primarily by the high-value Automotive sector (EVs, ADAS components) and advanced Industrial Electronics. Germany, in particular, remains a hub for laser technology development and application engineering. European manufacturers focus on automation and integration, emphasizing sophisticated Industry 4.0 compliant systems that offer full traceability and minimal environmental footprint.

- Latin America, Middle East, and Africa (MEA): These regions represent emerging markets for laser depaneling systems. Growth in Latin America is tied to localized electronics assembly and automotive manufacturing. The MEA region, particularly the UAE and Saudi Arabia, shows nascent demand linked to investments in high-tech infrastructure and diversification efforts away from oil reliance, generating future opportunities for specialized electronics manufacturing facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Depaneling Systems Market.- Lumentum Holdings Inc.

- MKS Instruments (EKSPLA)

- Han's Laser Technology Industry Group Co., Ltd.

- Coherent Corp.

- DISCO Corporation

- Mitsubishi Electric Corporation

- ASYS Group

- Shenzhen RFS Laser Technology Co., Ltd.

- Universal Instruments Corporation

- Resonetics

- IPG Photonics Corporation

- KLA Corporation

- J. P. Sercu Solutions (JPSS)

- Trotec Laser GmbH

- Laser Photonics Corporation

- Orbotech Ltd. (KLA)

- Osai Automation System S.p.A.

- Getech Automation Pte Ltd.

- CTI Systems S.A.

- 3D-Micromac AG

Frequently Asked Questions

Analyze common user questions about the Laser Depaneling Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of laser depaneling over mechanical routing?

The primary advantage is precision cutting without mechanical stress or tool wear, significantly reducing micro-cracks, component damage, and material dust. Laser depaneling also allows for complex, non-linear cut paths necessary for flexible circuits (FPCs) and high-density interconnect (HDI) PCBs, achieving higher yield rates and superior edge quality compared to traditional methods.

Which laser technology segment dominates the market and why?

The Ultraviolet (UV) laser technology segment currently dominates the market. UV lasers (355 nm) are ideal because they use a process called "cold ablation," which minimizes the heat-affected zone (HAZ). This characteristic is crucial for processing organic PCB materials like FR4 and polyimide without causing significant thermal damage to sensitive electronic components or substrates, enabling high-volume production.

How is the adoption of 5G technology influencing the demand for these systems?

The global rollout of 5G necessitates the use of complex, high-frequency, and multi-layered PCBs to handle increased data transmission speeds and bandwidth. Laser depaneling systems are essential for precisely singulating these sensitive boards without compromising signal integrity or structural stability, making them a critical requirement for manufacturers supporting 5G infrastructure and device production.

What are the key restraints affecting the growth of the Laser Depaneling Systems Market?

The main restraint is the high initial capital investment required for purchasing advanced laser equipment, particularly ultrafast (picosecond/femtosecond) systems. Additionally, the complexity of integrating these specialized systems into existing, often diverse, manufacturing workflows and the need for highly skilled operators to manage and maintain the technology present significant barriers to entry for smaller manufacturers.

Which end-user industries are driving the fastest adoption rates?

The fastest adoption rates are being driven by the Consumer Electronics sector (smartphones, wearables) due to ongoing miniaturization and the high volume of flexible circuit processing, and the Automotive sector, specifically for advanced driver-assistance systems (ADAS) and electric vehicle (EV) battery management electronics, which demand extreme reliability and precision cutting of specialized materials.

The market analysis presented herein reflects a comprehensive evaluation of technical trends, competitive landscapes, and emerging application spaces shaping the future of laser depaneling systems globally. Detailed segmentation and technological insights provide a foundation for strategic decision-making in the high-precision manufacturing sector.

The relentless pursuit of electronic device miniaturization, coupled with increasing complexity in multi-layer board design, solidifies the position of laser depaneling as the indispensable technology for modern electronics manufacturing. The transition towards ultrafast laser technology represents the next major evolutionary step, promising even greater precision and material versatility, particularly for high-value applications where zero defects are mandatory. Regional manufacturing shifts, especially the sustained growth and technological maturation in Asia Pacific, continue to define the market’s volume and velocity. Stakeholders must align their investment strategies with the rapid developments in AI integration and automation to maintain a competitive edge and optimize overall equipment effectiveness (OEE) in this high-stakes industrial domain.

Further analysis into the competitive dynamics reveals a strong focus among key players on expanding service offerings and global support networks, recognizing that post-sale service is a critical differentiator for complex capital equipment. Companies are strategically partnering with material suppliers and PCB design houses to develop proprietary process parameters for new substrates, ensuring their systems remain compatible with future generations of electronic hardware. The long-term outlook remains highly positive, driven by persistent demand from IoT device proliferation, sophisticated medical electronics, and the ongoing transformation of the automotive industry toward fully electric and autonomous vehicles, all requiring the superior cutting capabilities offered by advanced laser depaneling solutions.

The segmentation analysis by application confirms that flexible PCB (FPC) and rigid-flex depaneling represents the most lucrative segment, experiencing faster growth than traditional rigid PCB processing. This is directly attributable to the market saturation of flexible circuits in personal communication devices and sophisticated wearable technology. Manufacturers focusing on flexible circuit processing must prioritize UV and ultrafast laser technologies capable of precise, clean cuts on polyimide films without generating excessive heat or charring the delicate substrate. This segment also benefits significantly from AI-driven visual inspection systems that ensure perfect alignment and detect minute material defects unique to flexible materials, maintaining stringent quality standards required by premium electronic brands. The convergence of these technological demands reinforces the necessity for vendors to offer holistic, integrated depaneling solutions rather than standalone hardware units, pushing the market towards more robust, software-centric platforms.

In terms of process type, the trend is moving away from basic single-beam systems toward advanced scanning and multi-beam technologies. Scanning depaneling systems, often utilizing sophisticated galvanometer mirrors, allow for rapid manipulation of the laser spot, achieving significantly faster processing speeds per panel. Multi-beam configurations further enhance throughput by allowing multiple cuts to occur simultaneously or by dividing the cutting task across several laser heads. This efficiency gain is vital for meeting the incredibly high throughput demands of tier-one contract manufacturers who operate at razor-thin margins and depend on maximizing uptime and minimizing cycle time. The capital expenditure required for multi-beam systems is substantial, but the long-term OEE benefits in high-volume environments justify the investment, particularly in cost-sensitive Asian manufacturing hubs where production volumes are immense and continuous operation is standard practice.

The end-use industry segmentation confirms the critical role of Consumer Electronics, which acts as the largest volume consumer. However, the fastest growth rates are being witnessed in the Automotive sector, primarily driven by safety-critical applications like advanced driver-assistance systems (ADAS) modules and the electronics required for high-voltage battery management systems (BMS) in electric vehicles. These automotive components often utilize highly specialized substrate materials (sometimes ceramic or metal-core) that require the non-contact, high-precision processing capabilities of laser systems to ensure longevity and prevent component failure under harsh operating conditions. The stringent quality and traceability requirements within the automotive supply chain inherently favor the highly controlled and repeatable processes delivered by laser depaneling, cementing this sector as a major strategic focus for market vendors aiming for high-margin growth.

Focusing on technological deep dives, the shift toward femtosecond laser technology warrants specific attention. While UV lasers offer cold ablation, femtosecond lasers achieve what is often termed 'non-thermal' ablation. This ultra-fast process removes material before the heat can conduct into the surrounding area, virtually eliminating the heat-affected zone (HAZ) even in thermally sensitive materials like LCP (Liquid Crystal Polymer) or specialized glass-reinforced polymers. This capability is paramount for processing the thinnest and most sensitive PCBs, particularly those used in advanced flexible medical sensors or high-density microprocessors where any thermal damage could compromise device function. Although these systems currently carry the highest acquisition cost, their unparalleled precision and capability to handle future material compositions solidify their future market position in high-tech, high-value manufacturing niches, indicating a long-term trend towards increased sophistication in laser source technology.

Finally, the impact of Generative Engine Optimization (GEO) in the context of this market centers on utilizing advanced analytics and simulation tools. GEO leverages large datasets of manufacturing outcomes, including component specifications, material properties, and historical laser settings, to autonomously generate optimized manufacturing plans. For depaneling systems, this means the system could, for a new panel design, predict the optimal laser power, speed, and cut path geometry with minimal human intervention, dramatically reducing setup time and material wastage during prototyping or process validation. This optimization extends beyond simple efficiency; it contributes to sustainability by minimizing waste material and reducing energy consumption per unit, appealing to environmentally conscious manufacturers and meeting emerging regulatory requirements worldwide, thereby enhancing the market visibility and relevance of manufacturers who adopt these AI-driven planning tools.

The dynamics of the global supply chain continue to place pressure on manufacturers of laser depaneling systems to improve delivery times and ensure local support. The reliance on highly specialized components, particularly high-power laser sources and precision optics, means that supply chain disruptions, such as those experienced globally in recent years, can significantly impact lead times for new equipment. Consequently, major market players are investing in vertical integration or establishing dual-sourcing strategies for critical components to mitigate risk. This focus on supply chain resilience is a growing competitive factor, directly influencing customer purchasing decisions, particularly for large EMS providers who prioritize uninterrupted production schedules. Moreover, vendors are expanding their localized technical centers in key manufacturing regions to provide immediate service and application engineering expertise, reducing reliance on cross-continental support and improving machine uptime, a metric highly valued by end-users.

In terms of competitive differentiation, the convergence of hardware excellence and software intelligence is becoming the defining standard. Laser depaneling system providers are increasingly competing not just on the speed and precision of the laser cutting head itself, but on the sophistication of the integrated software platform. Features such as augmented reality (AR) tools for operator training, advanced connectivity protocols for seamless integration into factory-wide Manufacturing Execution Systems (MES), and proprietary algorithms for thermal management and debris removal are critical selling points. These software enhancements maximize system utilization and enable complex automation, ensuring the laser system operates as an integral part of an Industry 4.0 compliant smart factory. This shift emphasizes that the value proposition is moving from a pure capital expenditure (CapEx) model toward a more integrated technological partnership that delivers continuous process optimization.

The long-term opportunity landscape is notably broadened by the rise of new substrate materials beyond traditional FR4 and polyimide. These include specialized ceramic materials used in high-frequency radar modules, ultra-thin flexible glass substrates being explored for advanced display technology, and composite materials required for robust aerospace applications. Processing these novel materials often requires unique laser wavelengths and pulse characteristics, offering a significant opportunity for market players who invest in specialized material processing R&D. Vendors capable of providing validated, high-yield depaneling processes for these challenging substrates will unlock high-margin growth segments, differentiating themselves from competitors focused solely on high-volume consumer electronics processing. Furthermore, environmental regulations driving the shift towards lead-free soldering and halogen-free substrates also implicitly favor laser processing, as it is non-contact and avoids many of the chemical and mechanical complications associated with traditional routing of these alternative materials.

The increasing complexity of system integration represents a significant challenge but also a latent opportunity. As manufacturing processes become more automated, the laser depaneling machine must communicate seamlessly with upstream processes (like assembly and testing) and downstream processes (like quality inspection and material handling). Manufacturers are therefore focused on developing open-architecture control systems that are easily programmable and compatible with various robotic material handlers and factory management software platforms. Companies that provide robust APIs and comprehensive data logging capabilities are better positioned to serve the needs of large, highly integrated smart factories. This move towards open integration fosters an ecosystem where third-party developers can create custom applications for optimization, further enhancing the system's utility and customer lock-in for the primary hardware vendor. The demand for highly configurable and scalable systems is particularly high in regions like Europe and North America where bespoke manufacturing requirements are common.

Addressing the specific technological segment of CO2 lasers: although UV lasers dominate for organic PCB materials, CO2 lasers (typically 10.6 µm) maintain a vital niche, particularly for thicker substrates, ceramic materials, and certain specialized plastics used in industrial components. While they operate via thermal ablation, their high power and cost-effectiveness for thicker material removal make them essential in specific applications. The market is witnessing refinements in CO2 laser technology, including pulsed CO2 lasers, which mitigate some of the traditional thermal damage issues associated with continuous wave systems, broadening their applicability in markets requiring higher power but less stringent thermal control than high-end FPC manufacturing. However, the overarching market trend continues to favor shorter wavelengths (UV and ultrafast) for the majority of the growing high-density and flexible circuit applications.

In the context of competitive analysis, strategic alliances and mergers and acquisitions (M&A) are crucial factors reshaping the market landscape. Larger equipment providers are actively acquiring smaller, niche technology firms specializing in specific laser sources (e.g., femtosecond technology) or proprietary software/vision systems to rapidly integrate advanced capabilities and expand their intellectual property portfolio. This consolidation trend, particularly notable in the APAC region, aims to create integrated solution providers offering end-to-end manufacturing equipment, from front-end lithography to back-end depaneling. For end-users, this means fewer vendors but access to more comprehensive, vertically integrated solutions, potentially simplifying procurement and service agreements. Smaller, highly innovative companies must strategically position themselves as attractive acquisition targets by focusing heavily on breakthrough technology that offers measurable improvements in processing yield or speed, especially in the challenging arena of new materials processing.

The role of environmental, social, and governance (ESG) factors is increasingly influencing procurement decisions. Laser depaneling is inherently more sustainable than mechanical routing due to reduced material waste (no cutter bits to dispose of), lower energy consumption compared to high-power mechanical systems, and the absence of cutting dust requiring complex filtration and disposal. Market leaders are proactively highlighting these ESG benefits in their marketing and product specifications, appealing to large multinational corporations committed to reducing their carbon footprint and supply chain waste. The development of laser systems that are optimized for energy efficiency—for example, incorporating smart cooling systems and idle-power reduction features—is becoming a competitive necessity, particularly when bidding for contracts with environmentally conscious OEMs in Europe and North America, further driving technological advancements that align economic benefit with environmental responsibility.

Furthermore, the segmentation by geography underscores the market's heavy reliance on export and international trade. Given that most high-precision laser sources and components originate in North America and Europe, while the majority of consumption and system integration occurs in Asia, the market is highly sensitive to geopolitical factors, trade tariffs, and intellectual property protection regulations. Manufacturers must navigate complex international supply chains and local compliance requirements. The strategic establishment of regional assembly and service centers in high-growth areas, like Southeast Asia, is becoming essential not only for reducing logistical costs and lead times but also for mitigating regulatory risks associated with cross-border technology transfer. This geographical spread of manufacturing capability ensures quicker response times to market shifts and customer needs, supporting the AEO requirement of delivering localized value.

The detailed examination of the Value Chain reveals a crucial dependency on the precision motion control segment. Galvano scanner technology, which dictates the speed and accuracy with which the laser beam can be positioned, is a key bottleneck and area of innovation. Improvements in galvo speed, coupled with advanced control algorithms that compensate for dynamic inertia and thermal drift, directly translate into higher throughput and sustained precision for the depaneling system. Upstream suppliers of these specialized motion components, along with suppliers of high-resolution machine vision cameras and sophisticated optics, hold significant bargaining power. For downstream system integrators, successful technology transfer and integration of the latest motion control technologies are vital for maintaining a competitive product offering, ensuring their depaneling solutions remain at the cutting edge of achievable manufacturing tolerances and speed.

Finally, the evolution of software within these systems extends deeply into data security and intellectual property protection. As laser systems connect to factory networks and manage sensitive CAD data for cutting paths, ensuring robust cyber security is paramount, especially in high-security environments like the aerospace and defense sectors. Vendors are now offering enhanced encryption and secure connectivity solutions as standard features, addressing rising concerns over industrial espionage and data integrity. Furthermore, software licensing models are evolving, with some vendors offering subscription-based access to advanced features (e.g., AI path optimization algorithms) rather than outright purchase. This shift allows manufacturers to access cutting-edge tools with lower upfront capital expenditure while ensuring the vendor maintains a continuous revenue stream and facilitates continuous software updates, a model increasingly favored for high-value industrial automation equipment across the globe.

The continuous focus on automation within the Laser Depaneling Market is also driving significant advancements in material handling and system integration. Modern depaneling systems are rarely standalone machines; they are incorporated into fully automated production lines involving automated loading and unloading via robotic arms, integration with conveyer systems, and direct interfacing with upstream pick-and-place machines and downstream testing equipment. The performance benchmark is increasingly defined by the overall cell efficiency, not just the laser speed. This demands that system manufacturers provide robust, flexible automation interfaces and sophisticated cell control software capable of managing complex queuing, buffering, and error recovery procedures. The competitive advantage lies with providers who can deliver turnkey, fully integrated automation solutions that minimize human intervention and maximize lights-out manufacturing capability, pushing the boundaries of true Industry 4.0 adoption within electronics manufacturing facilities worldwide.

Furthermore, the regulatory landscape regarding safety and operational standards impacts the design and adoption of these systems. As high-power lasers are used, strict adherence to international safety standards (such as IEC 60825-1) is mandatory. Manufacturers are investing heavily in safety features, including fully enclosed systems, redundant interlocks, and advanced fume extraction mechanisms, to ensure compliance and protect operators. The increasing scrutiny on environmental factors also mandates efficient fume management and material recycling processes, particularly concerning the debris generated during the ablation of specific plastic and composite substrates. Offering systems with certified, highly efficient filtration and waste collection infrastructure is becoming an essential requirement for market entry in regulated geographies like Europe, reinforcing the need for continuous engineering refinement beyond core laser performance.

The segmentation by Application, specifically Rigid PCB Depaneling versus FPC Depaneling, highlights divergent technological requirements. Rigid PCB depaneling often involves thicker materials (e.g., 1.6 mm FR4) and requires higher average power lasers capable of deep, high-speed cuts, often using UV or specialized fiber lasers. FPC depaneling, conversely, involves ultra-thin (often less than 0.1 mm) polyimide films and demands the absolute minimum of thermal influence, making UV and ultrafast lasers the non-negotiable standard. The market is increasingly seeing systems designed specifically for one application or the other, or highly configurable systems that can dynamically switch parameters, addressing the common need of EMS providers to handle a high mix of both rigid and flexible circuit board types efficiently. This trend toward application-specific optimization, rather than general-purpose solutions, drives specialized component sourcing and software development, particularly for proprietary parameter libraries tailored to specific material stacks.

In summary, the Laser Depaneling Systems Market is driven by technological imperatives stemming from electronic miniaturization and high-speed communications infrastructure. The market’s future is intrinsically linked to advancements in ultrafast laser physics, sophisticated AI integration for autonomous control, and the ability of manufacturers to deliver high-quality, fully integrated, and environmentally compliant automation solutions across key global manufacturing hubs, particularly those serving the high-growth flexible electronics and automotive sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager