Laser Direct Structuring (LDS) Grade Resin Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441512 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Laser Direct Structuring (LDS) Grade Resin Market Size

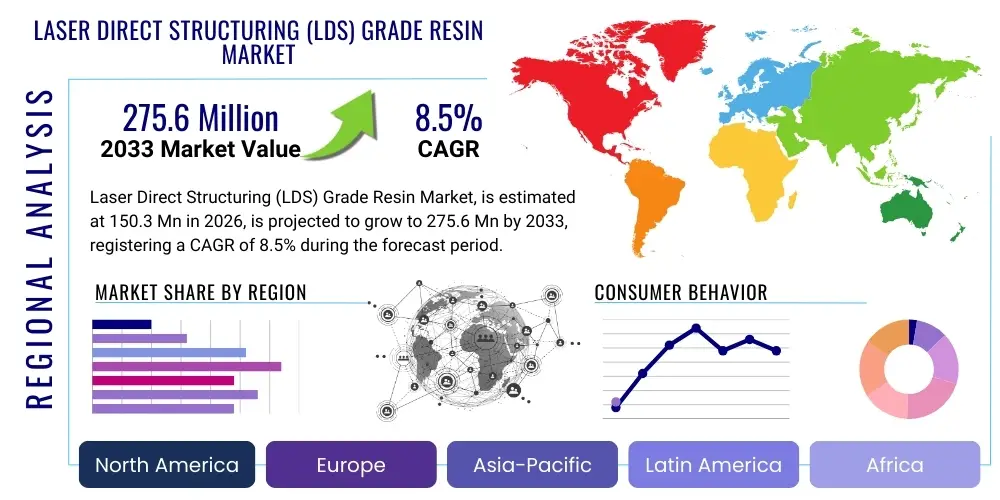

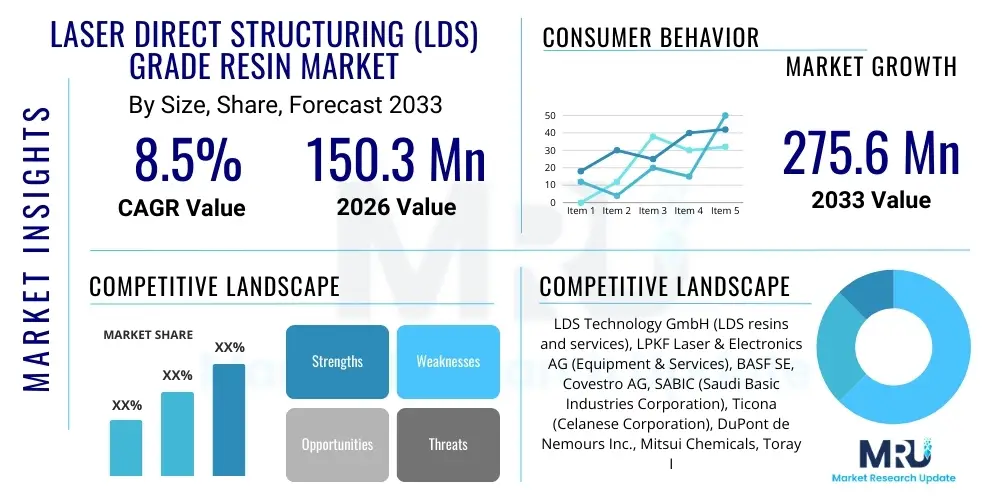

The Laser Direct Structuring (LDS) Grade Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 150.3 Million in 2026 and is projected to reach USD 275.6 Million by the end of the forecast period in 2033.

Laser Direct Structuring (LDS) Grade Resin Market introduction

The Laser Direct Structuring (LDS) Grade Resin Market encompasses specialized thermoplastic materials utilized in the manufacturing of Molded Interconnect Devices (MIDs). These resins are compounded with metallic-organic additives that, when exposed to a laser beam, activate the additives, creating microscopic rough surfaces upon which conductive traces (circuit patterns) are subsequently plated. This technology allows for the direct creation of three-dimensional electronic circuits onto molded plastic parts, eliminating the need for traditional printed circuit boards (PCBs) in certain applications and leading to smaller, lighter, and more complex electronic components.

LDS Grade Resins offer significant advantages over conventional materials, including design flexibility, miniaturization capabilities, and cost efficiency in mass production of 3D circuits. Major applications include internal antennas for smartphones, notebooks, and tablets, as well as complex sensor housings, medical devices, and automotive components. The versatility of LDS technology supports complex geometric structures, enabling manufacturers to integrate mechanical and electronic functions into a single component, thereby reducing assembly steps and overall system size. Common resin types include Polybutylene Terephthalate (PBT), Polyamide (PA), Polycarbonate (PC), and Polyphenylene Sulfide (PPS), selected based on required thermal, mechanical, and electrical properties.

Market expansion is primarily driven by the relentless trend towards miniaturization in consumer electronics and the exponential growth of the Internet of Things (IoT) ecosystem, which demands compact, high-performance antennas and integrated sensor modules. The inherent benefits of LDS technology—such as enhanced signal integrity, reduced footprint, and high reproducibility—make these resins indispensable in the development of next-generation 5G enabled devices and advanced driver-assistance systems (ADAS) in the automotive sector. Regulatory pushes for sustainable manufacturing processes and the ongoing innovation in resin compounding also contribute substantially to market demand.

Laser Direct Structuring (LDS) Grade Resin Market Executive Summary

The Laser Direct Structuring (LDS) Grade Resin Market is witnessing robust growth, underpinned by fundamental shifts in consumer electronics and automotive manufacturing demanding high-density 3D circuitry. Key business trends indicate strong investment in R&D aimed at developing high-performance resins capable of withstanding extreme temperatures and offering superior laser activation characteristics, specifically targeting 5G millimeter-wave applications and high-frequency communication protocols. Strategic partnerships between resin suppliers, laser equipment manufacturers, and electronic component producers are crucial for optimizing the entire LDS processing value chain and accelerating adoption in new sectors such as smart industrial machinery and complex medical diagnostics devices.

Regionally, Asia Pacific (APAC) dominates the global market, driven by the massive concentration of consumer electronics manufacturing hubs in countries like China, South Korea, and Taiwan. However, North America and Europe are exhibiting significant growth rates, largely fueled by the high-value automotive electronics market, where LDS resins are integral to ADAS systems, radar sensors, and advanced lighting modules. Strict regulatory standards in these Western markets also necessitate the use of high-reliability, specialty resins, pushing average selling prices higher compared to commodity resin applications.

Segmentation trends highlight the dominance of high-performance resins like PPS and PA for applications requiring superior mechanical strength and thermal resistance, particularly in automotive and industrial sectors. The application segment is heavily skewed toward integrated antenna components, which benefit maximally from the 3D design flexibility offered by LDS technology. Furthermore, the increasing complexity of sensors required for immersive AR/VR devices and industrial automation is creating a rapidly expanding demand sub-segment, positioning sensors as a key future growth engine alongside continued antenna miniaturization.

AI Impact Analysis on Laser Direct Structuring (LDS) Grade Resin Market

User inquiries regarding AI's impact on the LDS Grade Resin Market typically center on optimization of the manufacturing process, predictive quality control, and advanced material discovery. Key concerns revolve around how AI can enhance laser activation precision, minimize material waste during compounding and molding, and accelerate the development cycle for new resin formulations tailored to specific frequency requirements (especially 5G and beyond). Users anticipate that AI-driven data analysis will lead to faster defect detection in 3D circuit plating and optimize machine parameters (laser speed, power, focus) in real-time, significantly improving yield rates and reducing operational complexity in high-volume production facilities globally.

- AI-driven optimization of laser parameters (power, speed, focal length) to ensure uniform and precise activation surfaces.

- Predictive maintenance analytics applied to LDS manufacturing equipment, maximizing uptime and reducing unplanned downtime.

- Enhanced material formulation through machine learning, accelerating the discovery of novel metallic additives for superior electrical performance and thermal stability.

- Automated optical inspection (AOI) systems utilizing deep learning for high-speed, accurate detection of plating defects and trace irregularities on 3D molded parts.

- Supply chain optimization using AI algorithms to forecast demand for specific resin grades, managing inventory and mitigating raw material price volatility.

DRO & Impact Forces Of Laser Direct Structuring (LDS) Grade Resin Market

The market dynamics are defined by a complex interplay of rapid technological advancements (Drivers), established material and processing challenges (Restraints), and the emergence of new high-value applications (Opportunities), all moderated by powerful external Impact Forces such as regulatory shifts and global supply chain stability. The primary drivers revolve around technological integration, specifically the demand for complex 3D circuits in miniaturized electronics, while restraints include the high initial investment required for LDS infrastructure and the limited availability of high-performance, cost-effective resin formulations compatible with extreme thermal cycling.

Drivers

The foremost driver accelerating market penetration is the pervasive demand for miniaturized, high-performance electronic components, particularly in the rapidly evolving consumer electronics sector. Modern devices, such as smartphones, smart watches, and AR/VR headsets, necessitate integrating multiple antennae, sensors, and functional components within incredibly constrained spaces. LDS technology, powered by specialty resins, facilitates the creation of compact, three-dimensional circuits (MIDs) that significantly reduce component size and weight compared to traditional planar PCBs, thereby meeting the stringent design requirements of portable and wearable technology. This advantage is particularly pronounced in 5G devices, where the intricate routing needed for millimeter-wave antenna modules is best achieved using the precision and flexibility of the LDS process.

A second critical driver is the aggressive adoption of advanced electronic systems within the automotive industry, specifically for Advanced Driver-Assistance Systems (ADAS) and sophisticated infotainment setups. LDS resins are essential for manufacturing reliable, high-temperature-resistant sensor housings, radar components, and integrated lighting modules. As vehicles become increasingly autonomous and connected, the volume and complexity of embedded electronics surge, demanding materials that offer superior dielectric properties and mechanical stability under harsh operating conditions. The drive towards electric vehicles (EVs) and autonomous driving further solidifies the role of LDS grade resins as a foundational material for future automotive electronic architecture.

- Exponential growth in IoT, wearable devices, and 5G infrastructure requiring smaller, integrated antennae.

- Increasing integration of complex sensors and radar systems in automotive ADAS applications.

- Design flexibility and reduction in assembly costs achieved by consolidating multiple components onto a single 3D molded substrate.

Restraints

A primary restraint inhibiting broader market growth is the substantial initial capital investment required for establishing LDS manufacturing capabilities. The process demands specialized, high-precision laser equipment, sophisticated injection molding tools, and specific cleanroom environments to manage the metallic additive compounding process effectively. This high barrier to entry limits the pool of potential manufacturers, particularly small and medium enterprises (SMEs), and consolidates manufacturing expertise among a few large original equipment manufacturers (OEMs) and specialized contract manufacturers, thereby slowing the overall market adoption rate across diverse industries.

Furthermore, the inherent material limitations and processing constraints associated with LDS technology act as a constraint. Not all engineering thermoplastics are suitable for the LDS process; the resin must be specifically compounded with laser-activatable fillers, which can sometimes compromise the base material's original mechanical or thermal performance. Achieving optimal adhesion during the subsequent copper plating process remains a technical challenge, often requiring careful management of surface roughness and environmental factors. Additionally, there is a risk of material property degradation when high-temperature performance is necessary, limiting the use of certain cost-effective resins in high-power or extreme-environment applications, such as under-the-hood automotive components.

- High initial investment costs for specialized laser equipment and processing infrastructure.

- Limited availability and high cost of certain high-performance LDS-compatible resin grades (e.g., high-Tg PPS).

- Technical complexity in achieving consistent laser activation and subsequent plating adhesion across various polymer types.

Opportunities

Significant market opportunities exist in the expansion into high-reliability, long-lifecycle industrial and medical applications. Industrial automation and robotics require highly durable, custom-shaped sensors and connectors that can withstand vibration, chemical exposure, and elevated temperatures. LDS technology provides the necessary precision and material integrity for these demanding environments, moving beyond traditional consumer application limits. Similarly, the trend toward miniature, complex diagnostic tools and implantable medical devices requires biocompatible resins capable of intricate circuit patterns, representing a high-margin opportunity for specialized LDS resin suppliers.

A second compelling opportunity lies in the development of materials specifically engineered for next-generation communication frequencies, including 6G and advanced satellite communications. These technologies demand resins with ultra-low dielectric loss (low Df) and stable dielectric constants (low Dk) to maintain signal integrity at extremely high frequencies. Resin manufacturers who successfully innovate materials that meet these stringent electrical requirements while retaining excellent laser activation properties will secure a strategic advantage in the rapidly evolving telecommunications infrastructure market, especially in the production of massive MIMO antenna arrays and high-speed data transmission modules.

- Penetration into high-reliability markets: industrial sensing, complex medical devices, and aerospace electronics.

- Development of next-generation resins with ultra-low dielectric loss properties suitable for 6G and satellite communication systems.

- Expansion into packaging and interconnect solutions for semiconductor components, leveraging 3D capabilities.

Impact Forces

The market is strongly impacted by two primary forces: the pace of regulatory standardization and the volatility of upstream raw material costs. Global standardization efforts, particularly around 5G deployment and automotive safety protocols (ISO 26262), dictate the material quality and reliability standards for LDS components. Compliance drives material innovation and manufacturing discipline, acting as a mandatory market entry barrier. Simultaneously, fluctuations in the price of base polymers (like PBT or PPS) and the specialized metallic compounds used as laser activators directly influence manufacturing costs and, consequently, the final price competitiveness of LDS components versus traditional fabrication methods, requiring sophisticated risk management strategies across the value chain.

Segmentation Analysis

The Laser Direct Structuring (LDS) Grade Resin Market is fundamentally segmented based on the type of base polymer utilized and the end-use application area, reflecting the diverse performance requirements across various industries. The material type segmentation (PBT, PPS, PA, etc.) is critical because the chosen resin dictates the component's mechanical strength, thermal endurance, chemical resistance, and, most importantly, its dielectric properties necessary for optimal electronic functionality. The application segmentation (Antennas, Sensors, Connectors) drives volume and specialization, as component complexity and required reliability vary significantly between high-volume consumer goods and mission-critical automotive or medical applications. Understanding these segments is key to strategic resource allocation, focusing R&D on materials that meet the rigorous demands of fast-growing, high-value end-use sectors.

High-performance segments, specifically those utilizing PPS and high-temperature polyamides, are expected to exhibit the fastest growth due to their indispensability in harsh environments prevalent in the automotive and industrial sectors. While PBT remains a volume leader due to its balance of cost and performance in standard consumer electronics, the shift toward smaller, more powerful 5G devices is continuously pushing demand toward materials with superior thermal stability. Geographically, manufacturing proximity to major electronics assembly hubs remains a critical factor, ensuring that resin suppliers maintain robust distribution and technical support networks in key APAC regions to service the dominant antenna application segment efficiently.

- By Material Type:

- Polybutylene Terephthalate (PBT)

- Polyphenylene Sulfide (PPS)

- Polyamide (PA)

- Liquid Crystal Polymer (LCP)

- Others (e.g., Polycarbonate, Specialty Blends)

- By Application:

- Antennas (e.g., Mobile Devices, Wi-Fi Modules)

- Sensors (e.g., Automotive Radar, Temperature, Pressure Sensors)

- Connectors and Interconnects

- Medical Devices

- Others (e.g., LED Housings, Industrial Components)

Value Chain Analysis For Laser Direct Structuring (LDS) Grade Resin Market

The value chain for the LDS Grade Resin Market begins with upstream chemical suppliers providing base polymers and specialized metallic-organic compounds. This is followed by compounders, who incorporate the laser-activatable additives into the resin pellets, ensuring uniform dispersion and optimal material characteristics. The midstream involves injection molding companies and contract manufacturers who mold the resin into the final 3D component shape. Downstream processing, which is the core of LDS technology, involves laser activation and subsequent plating (electroless plating) to form the conductive circuits. Distribution channels are highly specialized, often involving direct sales from resin suppliers to compounders and then to large-scale electronic component manufacturers or specialized LDS service providers, minimizing indirect distribution to maintain quality control and technical support. Direct channels dominate for high-volume, strategic partnerships.

The upstream segment is highly concentrated, with a few global chemical giants controlling the production of high-performance engineering plastics like PPS and LCP, giving them significant pricing power. The compounding stage, where the proprietary LDS additives are introduced, represents a critical value-add step, requiring deep material science expertise. The downstream plating and assembly are often vertically integrated within major electronic OEMs or handled by highly specialized contract manufacturing service providers who possess the necessary cleanroom facilities and large-scale plating baths. Technical expertise and intellectual property related to both resin formulation and laser processing parameters are key competitive differentiators throughout the chain.

The value chain is characterized by strong technological interdependency. Innovations in the upstream resin formulation directly affect the efficiency and precision of the downstream laser processing. For instance, developing a resin that requires less laser power or allows for faster plating times significantly impacts the cost structure and scalability of the final product. Therefore, close collaboration between resin producers, compounding experts, and the end-use electronic manufacturers (the ultimate buyers) is essential to optimize material specifications for specific applications, ensuring the resin meets all performance criteria, from thermal stability in the car engine to miniaturization requirements in a mobile phone antenna.

Laser Direct Structuring (LDS) Grade Resin Market Potential Customers

The primary end-users and buyers of LDS Grade Resins are large-scale Original Equipment Manufacturers (OEMs) and Electronics Manufacturing Service (EMS) providers operating within sectors demanding highly integrated 3D electronic functionality. This includes major players in the consumer electronics industry, such as global smartphone manufacturers and peripheral device producers, who require millions of compact antennas and integrated sensor modules annually. The automotive Tier 1 suppliers (e.g., those providing ADAS systems, radar, and connectivity modules) represent the second largest high-value customer group, prioritizing material reliability, thermal performance, and compliance with stringent safety standards for long-term use.

Furthermore, specialized industrial and medical device manufacturers constitute a high-growth customer segment. Companies developing advanced factory automation sensors, complex robotics controls, and miniature diagnostic medical instruments rely on the precision and integration capabilities of LDS technology. These buyers prioritize customizability and material certification (e.g., biocompatibility for medical applications) over sheer volume, often driving demand for specialty resins like LCP and high-grade PA. Procurement decisions in all these segments are highly technical, driven by material specifications such as dielectric constant, thermal distortion temperature, and adherence to specific laser processing tolerances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.3 Million |

| Market Forecast in 2033 | USD 275.6 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LDS Technology GmbH (LDS resins and services), LPKF Laser & Electronics AG (Equipment & Services), BASF SE, Covestro AG, SABIC (Saudi Basic Industries Corporation), Ticona (Celanese Corporation), DuPont de Nemours Inc., Mitsui Chemicals, Toray Industries, EMS-Grivory, DSM (now part of Royal DSM), Sumitomo Chemical Co. Ltd., Victrex plc, DIC Corporation, Evonik Industries AG, Solvay SA, Shanghai Genius Electronic Co., Ltd., Polyplastics Co., Ltd., Asahi Kasei Corporation, Shin-Etsu Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Direct Structuring (LDS) Grade Resin Market Key Technology Landscape

The core technology enabling the LDS Grade Resin Market is the specialized laser processing method, typically involving Nd:YAG or fiber lasers operating at specific wavelengths (often 1064 nm) optimized to activate the metallic-organic additives embedded within the thermoplastic resin. This laser-induced activation process, known as metallization, chemically reduces the compound at the surface, creating a finely textured, palladium-containing surface structure. This surface then acts as a catalyst for subsequent electroless plating (usually copper, followed by nickel and gold), which forms the permanent, highly conductive circuit trace directly onto the molded plastic component. Technological advancements are focused on improving the laser activatability of newer, higher-performance resins that inherently resist high temperatures, broadening the application scope.

Recent technological innovations are centered on enhancing process efficiency and resolution. Manufacturers are increasingly adopting high-speed galvanometer laser scanning systems and multi-beam laser setups to boost throughput for high-volume consumer applications, thereby reducing the per-component manufacturing cost. Furthermore, there is significant research dedicated to optimizing resin compounding to achieve ultrafine circuit trace resolution (below 100 µm line width and spacing), critical for advanced high-frequency components such as 5G antenna arrays and highly dense interconnects required for augmented reality (AR) devices. This pushes resin compounders to engineer additives that yield consistent activation while minimizing negative impacts on the resin's mechanical properties.

Another crucial element of the technological landscape is the development of robust quality control and monitoring systems. Integrating advanced vision systems and AI-powered inspection tools allows manufacturers to verify laser activation consistency and plating quality in real-time, which is essential given the three-dimensional nature of the components. The move towards specialized resins, such as Liquid Crystal Polymer (LCP), for microwave applications is also a key technological trend, necessitating specialized laser parameters and highly controlled plating environments to ensure the integrity of ultra-sensitive high-frequency circuits. The confluence of high-precision optics, material science, and chemical engineering defines the competitive edge in this highly technical market.

Regional Highlights

The regional dynamics of the LDS Grade Resin Market are profoundly influenced by manufacturing cluster locations, local technological adoption rates, and specific industry specialization (e.g., electronics vs. automotive). Asia Pacific (APAC) stands as the dominant market in terms of volume consumption, driven by its massive production capacity for consumer electronics and mobile devices. North America and Europe, while smaller in volume, represent high-value markets focused on highly regulated applications such as premium automotive sensors, medical technology, and advanced defense systems, demanding high-performance, specialized resin grades.

- Asia Pacific (APAC): APAC is the global manufacturing hub for electronics, making it the largest consumer of LDS grade resins, particularly for antenna and connector applications in smartphones and tablets. Countries like China, South Korea, Taiwan, and Japan host major EMS providers and OEMs that utilize LDS technology extensively to achieve miniaturization and complex 3D circuit designs necessary for competitive consumer devices. The rapid rollout of 5G infrastructure continues to drive substantial demand for PBT and standard PA resins, although demand for high-performance PPS is increasing due to automotive sector growth in the region. The region benefits from a well-established supply chain for both resin compounding and large-scale LDS processing services, ensuring cost-effectiveness and rapid scaling.

- North America: This region is characterized by high demand for specialized, high-reliability LDS applications, particularly within the automotive electronics (ADAS components, radar sensors) and defense/aerospace sectors. North American companies prioritize materials with superior thermal resistance and long-term durability, leading to a focus on high-grade PPS and custom-blended resins. Innovation in medical devices, including miniature surgical tools and complex diagnostics, also provides a stable, high-margin revenue stream. The market growth here is driven less by volume and more by the complexity and critical nature of the integrated electronic functions.

- Europe: Europe represents a mature market with strong growth tied primarily to the high-end automotive industry, particularly in Germany and Italy, where LDS technology is integrated into advanced lighting systems, control units, and robust industrial automation components. European regulations emphasize product longevity and sustainability, driving demand for materials with inherent environmental resilience and superior quality assurance. The presence of major Tier 1 automotive suppliers and specialized LDS service bureaus ensures continuous uptake of high-performance resins, often exceeding the technical specifications required in other regions.

- Latin America, Middle East, and Africa (MEA): These regions currently hold smaller market shares, primarily serving localized electronics assembly or maintenance operations. However, steady infrastructure investment and growing automotive manufacturing clusters (e.g., Mexico, Brazil) are gradually increasing the adoption of LDS technology. The growth potential lies in the future establishment of local manufacturing bases for basic consumer electronics and telecommunications infrastructure development, requiring standard-grade PBT LDS resins.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Direct Structuring (LDS) Grade Resin Market.- BASF SE

- Covestro AG

- SABIC (Saudi Basic Industries Corporation)

- DuPont de Nemours Inc.

- Celanese Corporation (Ticona)

- Mitsui Chemicals

- Toray Industries

- DSM (now part of Royal DSM)

- Sumitomo Chemical Co. Ltd.

- Victrex plc

- DIC Corporation

- Evonik Industries AG

- Solvay SA

- Polyplastics Co., Ltd.

- Asahi Kasei Corporation

- EMS-Grivory

- Shin-Etsu Chemical Co., Ltd.

- LDS Technology GmbH

- LPKF Laser & Electronics AG

- Shanghai Genius Electronic Co., Ltd.

Frequently Asked Questions

What is Laser Direct Structuring (LDS) Grade Resin and its primary function?

LDS Grade Resin is a specialty thermoplastic material compounded with metallic-organic additives. Its primary function is to serve as the base substrate for Molded Interconnect Devices (MIDs), enabling the direct creation of conductive 3D circuit traces on the plastic surface through laser activation and subsequent plating processes.

Which applications drive the highest demand for LDS resins?

The highest demand is driven by the consumer electronics sector, primarily for manufacturing integrated antennas in 5G smartphones, tablets, and wearable devices, followed closely by the automotive industry for radar sensors and Advanced Driver-Assistance Systems (ADAS) components.

Which material types dominate the LDS Grade Resin market?

Polybutylene Terephthalate (PBT) and Polyphenylene Sulfide (PPS) dominate the market. PBT is favored for cost-effective, high-volume consumer applications, while PPS is essential for high-performance, thermally demanding applications in the automotive and industrial sectors.

How does the LDS process contribute to electronic miniaturization?

The LDS process integrates mechanical housing and electronic circuitry into a single 3D component, eliminating the need for bulky traditional PCBs, wires, and connectors, thereby significantly reducing the overall size, weight, and complexity of modern electronic assemblies.

What is the projected Compound Annual Growth Rate (CAGR) for the LDS Grade Resin Market?

The Laser Direct Structuring Grade Resin Market is projected to grow at a CAGR of 8.5% between 2026 and 2033, driven largely by continued technological advancements in 5G communications and automotive electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager