Laser Phosphor Display Technology Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442963 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Laser Phosphor Display Technology Market Size

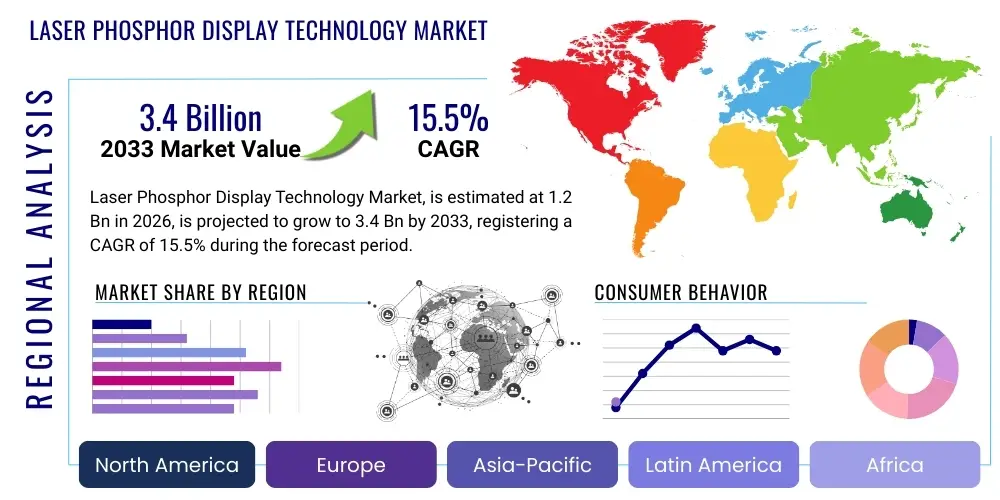

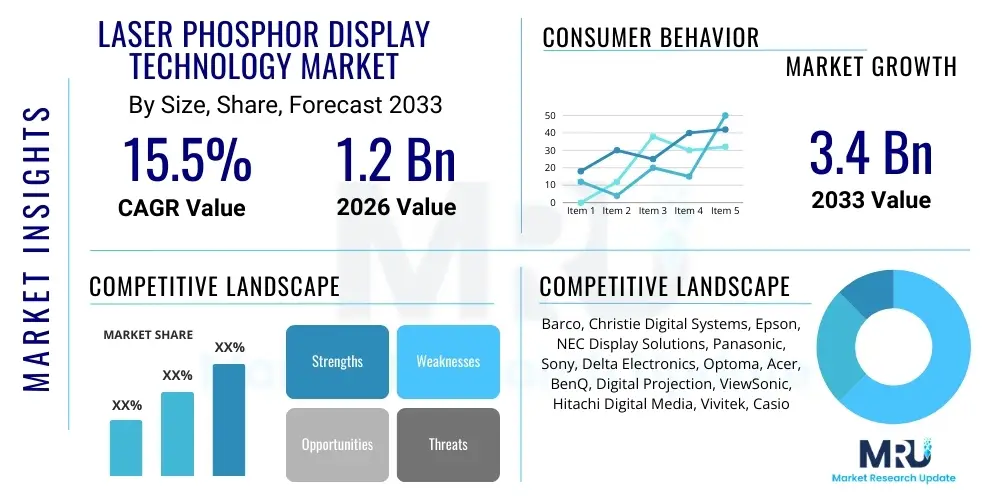

The Laser Phosphor Display Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033. This substantial growth is driven primarily by the superior efficiency, extended lifespan, and enhanced color gamut offered by laser phosphor projectors compared to traditional lamp-based systems, positioning LPD technology as the preferred choice across various high-luminosity applications.

Laser Phosphor Display Technology Market introduction

The Laser Phosphor Display (LPD) Technology Market encompasses the manufacturing, distribution, and utilization of projection systems that employ a laser light source combined with a phosphor wheel to generate vivid, high-brightness images. Unlike conventional projectors that use high-pressure lamps, LPD systems utilize blue lasers to excite a rotating yellow phosphor wheel, converting the light into secondary colors which are then combined to form a full-color spectrum display. This innovative approach yields significantly higher energy efficiency, remarkable color saturation (often exceeding Rec. 709 standards), and a lifespan that can reach up to 20,000 hours without maintenance, drastically reducing the total cost of ownership (TCO).

Major applications for LPD technology span a wide spectrum, including large-venue entertainment, professional simulation environments, digital cinema, control rooms, and high-end educational institutions. The product is defined by its core components: high-power laser diodes, sophisticated thermal management systems, and precision optical engines (often utilizing DLP or 3LCD chipsets). The inherent benefits of LPD systems—including instant on/off capability, consistent brightness over time, and virtually maintenance-free operation—are acting as significant driving factors, accelerating the adoption rate globally, particularly in sectors requiring continuous, reliable high-fidelity visual output, such as 24/7 command and control centers and immersive museum exhibits.

Laser Phosphor Display Technology Market Executive Summary

The Laser Phosphor Display Technology Market is characterized by robust business trends focusing on miniaturization, increased brightness levels exceeding 30,000 lumens, and the integration of advanced networking capabilities for remote management and monitoring. Key industry players are aggressively investing in R&D to optimize phosphor material composition and improve laser efficiency, leading to faster product cycles and enhanced competitive differentiation in key verticals like entertainment and simulation. The consolidation of projector manufacturers and solution providers seeking to offer end-to-end display ecosystems is a notable business strategy, ensuring seamless integration of LPD technology within complex AV installations and addressing growing demand for immersive visual experiences across public spaces and corporate environments, driving overall market momentum.

Regionally, Asia Pacific (APAC) currently dominates the market, propelled by rapid infrastructure development in emerging economies like China and India, coupled with massive investments in digital transformation initiatives across education and commercial sectors. However, North America and Europe maintain strong market shares driven by high replacement rates of legacy equipment in specialized segments such as simulation and fixed installations in auditoriums. Segment trends indicate that the 10,000 to 20,000 lumens segment is experiencing the fastest growth due to its versatility for medium-to-large venues, while the 4K and higher resolution capabilities are becoming standard requirements, particularly in digital cinema and advanced visualization applications, thereby demanding continuous technological advancement and refinement of optical pathways within LPD systems.

AI Impact Analysis on Laser Phosphor Display Technology Market

User inquiries frequently center on how Artificial Intelligence (AI) will optimize LPD performance, particularly regarding image quality, lifespan, and remote maintenance. Common themes include the potential for AI algorithms to dynamically manage laser power output based on ambient light conditions or content displayed (Dynamic Laser Dimming), predicting component failure (Predictive Maintenance), and enhancing color consistency over thousands of operational hours. Users are concerned about whether AI integration will significantly increase the upfront cost of LPD units, offset the current low maintenance advantage, or require specialized infrastructure for data processing, indicating a high expectation for operational efficiency improvements without added complexity, thus summarizing the focus on predictive diagnostics and automated calibration.

The market anticipates that AI will profoundly impact the operational expenditure (OPEX) of LPD systems by moving maintenance from reactive to predictive paradigms. AI-driven sensor data analysis can detect micro-fluctuations in laser current, temperature, or phosphor wheel rotation long before they cause noticeable display degradation. This capability is invaluable in mission-critical environments, such as control rooms or medical training facilities, where display failure is unacceptable. Furthermore, AI algorithms are being developed to execute sophisticated image processing tasks, including real-time geometric correction, edge blending optimization across multiple projectors, and contrast enhancement, ensuring optimal visual quality regardless of the installation environment or aging component state.

Another major area of impact involves content delivery and interaction. AI is crucial in developing smart environments where the LPD system automatically adjusts its settings (brightness, resolution, content cropping) based on audience size, viewing angle, or defined user roles detected through integrated sensors. This intelligence elevates LPD technology from a mere display device to an integrated component of smart infrastructure, particularly in high-traffic public displays, interactive museum exhibits, and advanced simulation cockpits, thereby increasing the intrinsic value proposition and expanding the addressable market for high-fidelity LPD solutions.

- AI enables predictive maintenance, minimizing downtime and extending the effective lifespan of laser components through continuous operational monitoring.

- Dynamic Laser Dimming and power management optimization are facilitated by AI, enhancing energy efficiency and maintaining consistent brightness over operational cycles.

- Automated calibration and real-time image adjustment (e.g., color balance, geometric correction) using machine learning models simplify multi-projector installations.

- AI improves content delivery and relevance by linking display parameters to contextual data inputs (e.g., audience detection, environmental conditions).

- Enhanced quality control during manufacturing processes is achieved by leveraging AI for defect detection in laser diodes and phosphor materials.

DRO & Impact Forces Of Laser Phosphor Display Technology Market

The trajectory of the Laser Phosphor Display Technology market is shaped by a confluence of accelerating drivers, persistent restraints, emerging opportunities, and competitive impact forces. The core drivers are centered around the technological superiority of laser sources, offering unparalleled brightness, expanded color space, and significantly reduced maintenance burdens compared to legacy display technologies. This inherent efficiency and longevity directly address the increasing operational demands of large venues, simulation centers, and professional visualization markets, demanding continuous, high-fidelity visual output. Conversely, market restraints largely revolve around the high initial capital expenditure associated with high-lumen laser systems, creating a barrier to entry for budget-sensitive organizations, and the complexities associated with managing high-power laser systems, requiring specialized installation expertise.

Opportunities are arising primarily from the shift toward immersive experiences, such as dome projection, virtual reality (VR) training environments using LPD simulation, and the proliferation of 4K and 8K resolution content, demanding projectors capable of handling massive data throughput and maintaining pixel-perfect fidelity across wide screens. The transition of the cinema industry from traditional lamp projection to laser projection (Laser Cinema) represents a massive, high-value opportunity segment. Impact forces, driven by intense competition, include downward price pressure, rapid iteration of product specifications (e.g., faster refresh rates, higher contrast ratios), and the competitive threat posed by large flat panel LED/LCD walls becoming more cost-effective for smaller, high-resolution indoor spaces. Navigating these forces requires manufacturers to focus on innovative component supply chains and maximizing laser light source output optimization.

Drivers:

One of the primary drivers propelling the adoption of Laser Phosphor Display technology is the significantly reduced total cost of ownership (TCO) compared to traditional high-pressure mercury lamp projectors. While the initial investment in LPD systems is often higher, the operational savings accumulated over the system’s lifespan—due to the elimination of expensive lamp replacements, reduced energy consumption per lumen output, and minimal cooling requirements—make them economically compelling, especially for organizations running projectors continuously for thousands of hours annually. This financial advantage is crucial for large-scale institutional buyers such as universities, museums, and conference centers managing substantial AV equipment portfolios.

A second major catalyst is the superior performance metrics offered by LPD technology, specifically regarding color reproduction and brightness consistency. Laser light sources provide a much broader color gamut, closer to the Rec. 2020 standard, which is critical for specialized applications like digital cinema and scientific visualization where color accuracy is paramount. Furthermore, unlike lamps, which degrade rapidly, LPD systems maintain their brightness levels far longer, ensuring that the visual experience remains high quality throughout the device's operational life. This reliability is highly valued in high-stakes environments like air traffic control centers and military simulation rooms where consistent visual data is mandatory for operational safety and training effectiveness.

- Superior energy efficiency and reduction in power consumption compared to lamp-based systems.

- Extended operational lifespan of the light source (up to 20,000 hours), drastically reducing maintenance costs and downtime.

- Enhanced color fidelity, brightness stability, and wider color gamut suitable for demanding professional applications.

- Growing demand for immersive and large-screen projection systems across entertainment and education sectors.

- Quiet operation and instant on/off functionality enhancing user convenience in conference rooms and auditoriums.

Restraints:

The principal restraint limiting market penetration is the substantial initial capital expenditure (CapEx) required for high-lumen LPD projectors. Despite the long-term TCO benefits, the initial procurement cost remains significantly higher than that of comparable lamp-based or even standard LED display solutions. This high upfront investment poses a considerable challenge for small and medium-sized enterprises (SMEs) or educational institutions operating with stringent, short-term budgetary constraints, often forcing them to opt for lower-cost, shorter-lifespan alternatives, thereby slowing the overall market transition to laser technology.

Another restraint involves the technical complexities and regulatory compliance associated with high-power laser devices. High-brightness LPD systems require specialized thermal management and precise handling to ensure safety compliance (e.g., Class 1 or Class 2 ratings) and optimal performance. Installation and servicing often require technicians with specialized training in laser optics and safety protocols, adding complexity to the deployment process, particularly in regions with less developed technical infrastructure. Furthermore, concerns regarding potential regulatory changes related to laser safety standards, though currently stable, introduce a minor element of uncertainty for future product designs.

- High initial investment cost (CapEx) compared to conventional projection and display technologies.

- Perceived complexity and need for specialized expertise in installation and maintenance of high-power laser systems.

- Competition from rapidly evolving alternative display technologies, specifically large format LED video walls and high-resolution OLED screens.

- Potential limitations in light output in extremely high ambient light environments, requiring careful installation planning.

Opportunities:

A significant opportunity for market expansion lies in the burgeoning demand for immersive digital experiences and advanced simulation environments. As industries like aerospace, automotive design, and medical training increasingly rely on high-fidelity visual simulation, the need for LPD systems capable of seamless multi-channel blending, ultra-high resolution (4K and 8K), and high refresh rates is accelerating. LPD technology is perfectly positioned to meet these stringent technical specifications, offering unparalleled visual realism and operational consistency crucial for critical training and design review applications, enabling manufacturers to capture high-margin contracts in these specialized fields.

Furthermore, the global shift towards environmentally sustainable technology offers a strong market opportunity. LPD systems are inherently 'greener' than lamp-based projectors due to their lower power consumption, the absence of mercury (a hazardous material found in traditional lamps), and longer operational lifespan, which reduces electronic waste. Positioning LPD technology as a sustainable, eco-friendly display solution appeals strongly to governments, environmentally conscious corporations, and public sector organizations that adhere to green procurement mandates, creating a substantial competitive advantage and opening doors to public sector tenders globally as sustainability becomes a core purchasing criterion.

- Exploitation of the burgeoning digital signage and architectural projection mapping sectors requiring high brightness and color flexibility.

- Increasing adoption of laser technology in the mainstream digital cinema sector as exhibitors seek reliable, high-contrast, DCI-compliant projection systems.

- Development of portable, high-brightness LPD systems for use in temporary installations, events, and rapidly deployable visualization needs.

- Integration into collaborative technologies, such as interactive whiteboards and large-format displays in corporate meeting rooms and educational classrooms.

Impact Forces:

The competitive landscape exerts significant impact forces on pricing and innovation cycles within the LPD market. Intensive rivalry among key manufacturers (e.g., Christie, Barco, NEC, Panasonic) leads to rapid technological iteration and a constant drive toward cost reduction through supply chain optimization. This competitive pressure mandates continuous investment in R&D to maintain differentiation, focusing on achieving higher lumen output per watt and improving thermal efficiency, which benefits end-users through enhanced product performance and, eventually, lower prices as manufacturing scale increases.

A secondary, yet powerful, impact force is the substitution threat posed by alternative display technologies. While LPD remains superior for truly massive screens (e.g., 100 inches and above) and complex geometries (dome, curved screens), high-resolution fine-pitch LED video walls are rapidly gaining ground in applications requiring extremely high brightness and zero maintenance for indoor, close-viewing environments. Manufacturers must continuously articulate the specific value proposition of LPD—its scalability, image uniformity across vast areas, and geometric flexibility—to counter the encroachment of modular LED display solutions, particularly in the professional indoor signage and corporate meeting room segments.

- Intense price competition and product feature parity among leading manufacturers driving down average selling prices.

- Substitution threat from advancing LED video wall and OLED display technologies for mid-size applications.

- Rapid technological cycles demanding constant R&D investment in laser diode efficiency and phosphor material science.

- Influence of regulatory standards (e.g., DCI specifications for cinema) dictating product development pathways.

Segmentation Analysis

The Laser Phosphor Display Technology market is extensively segmented based on key functional attributes, application verticals, and light output characteristics, allowing for targeted product development and marketing strategies. The primary segmentation by light output differentiates between low, medium, and high-lumen categories, directly correlating with the intended venue size and complexity of the projection requirement. Understanding these segments is crucial because the material costs, cooling requirements, and pricing structures vary drastically; for instance, a 5,000-lumen corporate projector targets a different cost matrix than a 35,000-lumen digital cinema unit, which requires far more sophisticated laser arrays and thermal management systems.

Segmentation by application vertical reveals where the highest growth opportunities lie. The Entertainment and Education sectors historically represent major volume buyers, utilizing LPD for auditoriums, lecture halls, and museum exhibits, prioritizing long lifespan and low maintenance. Conversely, the Simulation and Control Room segments are driven by performance requirements—color accuracy, reliability, and resolution—making them high-value, albeit lower volume, segments. Analyzing these segments provides strategic insight into distribution channel optimization, as Simulation and Digital Cinema often rely on specialized system integrators, while Corporate and Education utilize broader IT and AV reseller networks.

- By Light Output:

- Low Brightness (Below 5,000 Lumens)

- Medium Brightness (5,000 – 15,000 Lumens)

- High Brightness (Above 15,000 Lumens)

- By Resolution:

- WXGA/WUXGA

- 4K and Higher

- By End User Vertical:

- Digital Cinema

- Education

- Corporate and Government

- Simulation and Visualization

- Large Venue and Events

- By Component:

- Laser Diodes

- Phosphor Wheels and Materials

- Optical Engines

Value Chain Analysis For Laser Phosphor Display Technology Market

The value chain for the Laser Phosphor Display Technology market begins with upstream component manufacturing, primarily focusing on high-efficiency laser diodes (often blue lasers), specialized phosphor materials (typically ceramics or organic compounds tailored for wavelength conversion), and precision optical components like lenses and micro-displays (DLP chips or LCD panels). These highly specialized components are sourced from a limited number of global suppliers, requiring strong, integrated supply chain management from the major projector manufacturers. Quality control at this stage is critical, as the performance and lifespan of the final LPD unit are directly determined by the quality of the laser diodes and the phosphor wheel’s efficiency and thermal stability.

Midstream activities involve the assembly and integration of these components into the final projector unit, including the development of proprietary thermal management systems and complex image processing electronics. This stage is dominated by major projection brands who leverage their intellectual property in optical engine design and cooling technologies. Distribution channels for the finished product are bifurcated: direct sales and specialized system integrators handle high-end applications like digital cinema and simulation, requiring bespoke installation and calibration services, whereas indirect channels, utilizing large AV distributors and authorized resellers, serve the higher volume corporate and education markets, capitalizing on standardized installation procedures and broader geographic reach.

Downstream activities involve post-sale support, including maintenance, servicing, and training. Given the low maintenance requirement of LPD systems compared to traditional projectors, the focus shifts to software updates, network management integration, and predictive maintenance services leveraging IoT and AI. The longevity of the products means customer relationship management extends over many years, offering opportunities for manufacturers to monetize long-term service contracts and software subscriptions related to remote monitoring and system health diagnostics, reinforcing manufacturer-customer relationships throughout the substantial operational lifespan of the installed units.

Laser Phosphor Display Technology Market Potential Customers

Potential customers for Laser Phosphor Display technology are predominantly organizations requiring high-brightness, reliable, and large-format projection solutions where minimizing operational disruption is paramount. The primary end-users include entities in the entertainment sector, such as movie theater chains adopting laser projection systems to enhance image quality and reduce recurring lamp costs, and large-scale event organizers utilizing high-lumen LPD for architectural mapping and massive stage displays. These customers prioritize color fidelity and light output stability for delivering premium visual experiences across vast audiences, justifying the higher initial CapEx associated with laser solutions.

Beyond entertainment, the corporate and governmental sectors are critical buyers. Specifically, customers running 24/7 mission-critical operations, such as utility control rooms, emergency response centers, and military command posts, are key potential customers. For these buyers, the LPD system’s long lifespan and operational reliability without failure are more valuable than the initial cost. Similarly, universities and large educational institutions purchasing projectors for main lecture halls and specialized visualization labs constitute a high-volume customer segment, motivated by the desire to reduce AV staff workload associated with frequent lamp replacements in busy environments, alongside a demand for high-quality visual aids for teaching and research.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Barco, Christie Digital Systems, Epson, NEC Display Solutions, Panasonic, Sony, Delta Electronics, Optoma, Acer, BenQ, Digital Projection, ViewSonic, Hitachi Digital Media, Vivitek, Casio |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Phosphor Display Technology Market Key Technology Landscape

The core technological landscape of the Laser Phosphor Display market is dominated by advancements in three key areas: laser light source engineering, specialized phosphor materials, and optical processing. Modern LPD systems primarily use high-power blue laser diodes, selected for their efficiency and ability to excite yellow phosphor compounds effectively. Current R&D efforts focus on increasing the power density of these laser arrays while maintaining thermal stability and minimizing speckle, a common optical challenge in laser projection. Improvements in solid-state light source packaging are leading to more compact, high-lumen projector designs suitable for previously inaccessible smaller venues, expanding the technology’s applicability beyond large-scale installations.

Material science is another critical technological frontier, specifically the development of advanced phosphor wheels. Initially, polymer-based wheels were used, but the industry is rapidly shifting toward ceramic or metallic phosphor wheels due to their superior thermal conductivity and resistance to thermal degradation under intense laser bombardment. These advanced materials enable higher brightness levels without compromising the long-term color fidelity of the system, addressing key user expectations regarding consistency. Furthermore, some manufacturers are experimenting with multi-color laser systems (Red and Green lasers combined with a blue laser and phosphor converter) to achieve even wider color gamuts, moving closer to the full cinema standard (Rec. 2020) requirements for professional visualization and high-end digital media.

Finally, the optical engine and processing hardware are continuously evolving. The integration of high-speed 4K and 8K capable Digital Light Processing (DLP) chips and high-resolution 3LCD panels is essential for supporting demanding content. Furthermore, manufacturers are incorporating powerful embedded processors and software algorithms to manage complex tasks like edge blending, warping, geometric correction, and dynamic contrast ratio enhancement in real-time. Networked connectivity and the implementation of IoT sensors are standard, enabling remote management and predictive diagnostics, which solidify LPD systems as integral components of smart AV infrastructure, ready for integration with enterprise resource planning (ERP) and building management systems.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by massive government investment in infrastructure development, rapid urbanization, and extensive growth in the education and entertainment sectors, particularly in China, South Korea, and India. The expanding middle class and the subsequent rise in cinema attendance and event hosting create high demand for high-brightness, reliable display solutions, establishing APAC as the epicenter for LPD adoption volume.

- North America: This region holds a significant market share, characterized by high technological maturity and early adoption of premium LPD systems in specialized fields such as advanced simulation (military and aerospace), high-end post-production, and digital signage in major metropolitan areas. Replacement cycles for legacy lamp-based systems in universities and large corporate headquarters are a continuous driver of market volume and high-value upgrades.

- Europe: Western Europe demonstrates steady growth, led by stringent regulatory requirements for energy efficiency and environmental sustainability, favoring the low-power consumption profile of LPD technology. Key drivers include the revitalization of cultural venues, museums, and historical sites utilizing LPD for projection mapping and immersive installations, coupled with consistent demand from the automotive design and research sectors for advanced visualization tools.

- Latin America (LATAM): The LATAM market is developing, with growth concentrated in Brazil and Mexico. Adoption is currently focused on the digital cinema transition and the expansion of large university campuses. Economic volatility occasionally restrains large capital expenditures, but the long-term TCO benefits of LPD are increasingly making them attractive options for large public and private sector buyers seeking durable equipment.

- Middle East and Africa (MEA): Growth in the MEA region is strongly linked to significant investment in tourism, entertainment mega-projects, and large government control room installations in GCC countries (e.g., UAE and Saudi Arabia). These projects demand world-class, high-lumen projection technology for prestige venues, driving demand for top-tier LPD manufacturers focusing on large-scale and architectural projection solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Phosphor Display Technology Market.- Barco N.V.

- Christie Digital Systems USA, Inc.

- Epson Corporation

- NEC Display Solutions, Ltd.

- Panasonic Corporation

- Sony Corporation

- Delta Electronics, Inc.

- Optoma Corporation

- Acer Inc.

- BenQ Corporation

- Digital Projection International

- ViewSonic Corporation

- Hitachi Digital Media

- Vivitek (Delta Group)

- Casio Computer Co., Ltd.

- Canon Inc.

- Leyard Optoelectronic Co., Ltd.

- InFocus Corporation

- Maxell, Ltd.

- JVC Kenwood Corporation

Frequently Asked Questions

Analyze common user questions about the Laser Phosphor Display Technology market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Laser Phosphor Display (LPD) and traditional lamp projection?

LPD technology utilizes a solid-state blue laser light source that excites a phosphor wheel to create the required primary colors, whereas traditional projectors use high-pressure mercury vapor lamps. The key advantages of LPD are significantly longer lifespan (up to 20,000 hours), drastically reduced maintenance, superior color fidelity, and higher energy efficiency, leading to a much lower total cost of ownership over the product's operational life compared to frequent lamp replacements and associated labor costs typical of legacy systems.

Is Laser Phosphor Technology suitable for high-resolution applications like 4K and 8K digital cinema?

Yes, Laser Phosphor Technology is highly suitable for demanding high-resolution applications, including 4K and emerging 8K standards. LPD systems offer the brightness and consistent light output required to illuminate large screens accurately, often supporting broad color standards like DCI-P3 and Rec. 2020. Leading manufacturers utilize high-precision DLP or 3LCD chips in combination with LPD light engines to deliver the necessary pixel density and image clarity required for premium digital cinema and advanced visualization environments, ensuring minimal degradation over time.

What are the key driving factors behind the growth of the LPD market in Asia Pacific (APAC)?

The growth in APAC is primarily driven by massive infrastructure investments in new commercial complexes, entertainment venues, and educational institutions in rapidly developing economies. These projects demand modern, reliable display solutions. Furthermore, the quick conversion rate of existing commercial cinema screens from legacy Xenon lamps to LPD systems, coupled with government initiatives promoting digital education and large-scale public displays, fuels regional market expansion and volume procurement.

How does the initial high capital cost of LPD systems impact small and medium-sized venues?

The high initial capital cost acts as a barrier to entry for many small and medium-sized venues with limited budgets, often causing them to defer adoption or opt for lower-cost alternatives. However, the market is addressing this through the introduction of lower-lumen, more affordable LPD models and flexible financing or leasing options. Additionally, the quantifiable long-term savings from eliminating lamp consumables and minimizing technician callouts often makes the LPD investment justifiable through improved long-term financial modeling and decreased operational expenses.

What is the competitive threat posed by LED video walls to Laser Phosphor Display Technology?

Fine-pitch LED video walls pose a competitive substitution threat, particularly in high-brightness indoor signage and corporate meeting rooms where high resolution and zero maintenance are prioritized. While LED walls excel in smaller to mid-sized static installations, LPD maintains a decisive advantage in applications requiring extremely large screen sizes (over 100 inches), complex projection geometry (domes, curved screens), and highly nuanced color blending across multiple seamlessly tiled images, leveraging its inherent scalability and optical flexibility that fixed-panel LED walls cannot match.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager