Laser Pointer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441981 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Laser Pointer Market Size

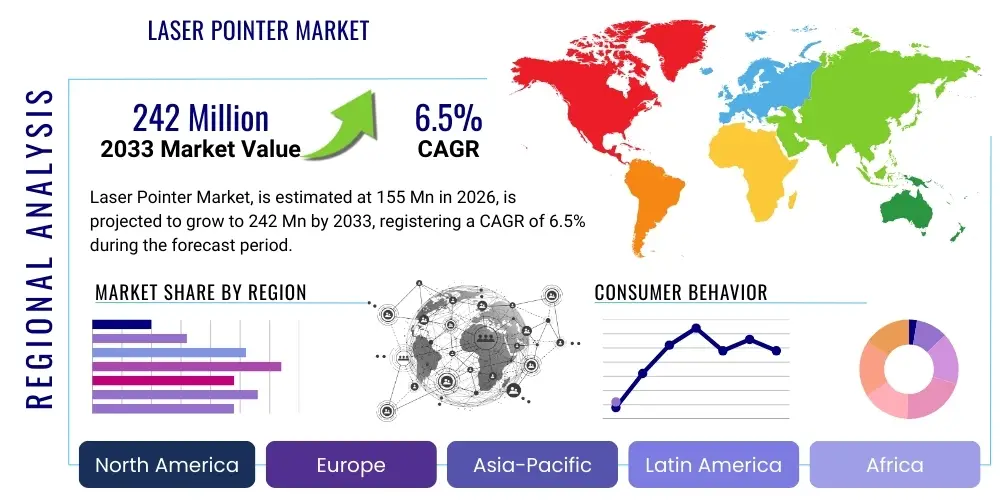

The Laser Pointer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 155 Million in 2026 and is projected to reach USD 242 Million by the end of the forecast period in 2033. This consistent expansion is primarily driven by the increasing integration of digital presentation tools in corporate and academic settings, coupled with technological advancements leading to more powerful, safer, and feature-rich laser devices.

Market expansion is also heavily influenced by the adoption of high-power laser systems in specialized industrial and military applications, such as targeting, sighting, and advanced alignment tasks. While the presentation segment remains foundational, the robust growth in niche markets requiring precision and durability contributes significantly to the overall market valuation trajectory. Regulatory environments, particularly regarding power output classifications, play a crucial role in shaping product development and regional market access.

Laser Pointer Market introduction

The Laser Pointer Market encompasses the manufacturing, distribution, and sales of handheld or mounted devices that emit a highly collimated beam of light, primarily for highlighting objects or points of interest. These devices utilize semiconductor lasers (diodes) to generate light in various visible and occasionally non-visible spectrums, most commonly red (635-670 nm) and green (520-532 nm). Major applications span across educational demonstrations, professional business presentations, astronomy (for pointing out constellations), construction and alignment, and tactical military and law enforcement sighting systems. The fundamental benefits include enhanced clarity during communication, increased audience focus, ease of use, and portability. Key driving factors fueling market growth include the global surge in hybrid work models necessitating sophisticated remote presentation tools, the standardization of technical training using visual aids, and continuous innovation in battery life and laser safety features.

Modern laser pointers increasingly incorporate smart features such as integration with presentation software (e.g., PowerPoint, Keynote) via Bluetooth, gyroscope-based air mouse functionality, and internal memory for basic data storage. This convergence of pointing functionality with remote control capabilities transforms the device from a simple marker into a comprehensive presentation tool. The market is highly competitive, characterized by rapid product life cycles and a constant push towards greater energy efficiency and higher visibility, especially for green lasers which are perceived as brighter under typical lighting conditions compared to red lasers of equivalent power output. Safety standards, such as those established by the FDA and IEC, dictate market entry and product classification, influencing consumer trust and professional adoption.

Furthermore, the diversification of applications into niche industrial sectors, such as non-contact measurement and precise spatial indexing, broadens the market scope beyond traditional consumer electronics. Manufacturers are focusing on ruggedized designs suitable for harsh environments, incorporating shock resistance and ingress protection (IP) ratings, which attracts industrial and military procurement. The perceived value addition, combined with lowering manufacturing costs of reliable laser diodes, ensures sustained market buoyancy and accessibility for a wider range of consumers and professionals globally.

Laser Pointer Market Executive Summary

The Laser Pointer Market exhibits robust business trends driven by technological miniaturization and the expanding scope of professional and academic digital engagement. Key trends include the shift towards sophisticated, multi-functional presentation remotes that integrate laser pointing capabilities with advanced connectivity protocols like Bluetooth LE, enhancing user interaction and seamless digital transition. Furthermore, regulatory scrutiny, particularly around high-power pointers, is shaping manufacturing processes, pushing major vendors toward certified, safer Class 2 and Class 3R devices, while specialty markets maintain demand for higher-output devices under strict control protocols.

Regionally, North America and Europe currently dominate the market due to high corporate spending on presentation technology and strong academic infrastructure favoring advanced teaching aids. However, the Asia Pacific region (APAC) is projected to register the fastest growth, fueled by rapid urbanization, expanding educational sectors, and booming industrial activities, particularly in China and India, which require cost-effective alignment and pointing tools. The increasing proliferation of inexpensive manufacturing capabilities in Southeast Asia further accelerates market penetration across developing economies, although quality control remains a primary differentiator for premium brands.

In terms of segmentation, the Presentation Application segment holds the largest market share, reflecting its ubiquity in corporate boardrooms and classrooms. However, the Industrial/Military segment is gaining traction due to higher average selling prices and sustained demand for durable, high-specification devices. Within the Product Type segment, green laser pointers are experiencing accelerated growth, largely attributed to their enhanced visibility compared to traditional red pointers, commanding a premium price point, and becoming the de facto standard for professional outdoor or large-venue use. Manufacturers are strategically optimizing supply chains and prioritizing R&D into solid-state green laser technology to maintain competitiveness and meet evolving consumer demands for optimal visibility and battery performance.

AI Impact Analysis on Laser Pointer Market

User queries regarding AI’s impact on the Laser Pointer Market frequently center on whether AI-powered projection or augmented reality (AR) tools will render physical pointers obsolete, and how AI can integrate into existing presentation peripherals. Key user themes reveal concerns about the potential replacement of traditional pointing functionality by virtual or gesture-based controls managed by AI systems, especially in remote or holographic presentation environments. Conversely, users also inquire about leveraging AI to enhance the pointer's utility, such as using machine vision to stabilize the beam, automatically adjust color contrast based on background, or integrate voice commands for advanced slide control synchronized via an AI-driven presentation platform. The consensus is that AI will likely augment, rather than replace, physical pointing devices, transforming them into smarter input tools that interact seamlessly with AI-enabled software ecosystems.

The integration of AI features is expected to drive innovation in the high-end segment of the laser pointer market. For instance, AI algorithms could analyze the user's pointing patterns and automatically correct for hand tremors, ensuring a consistently stable point on the screen, a feature highly valued in professional lecturing. Furthermore, AI could be utilized for predictive battery management and real-time environment sensing, adjusting laser power dynamically to comply with safety regulations based on proximity detection or ambient light levels. These advancements transition the laser pointer from a passive highlighting instrument to an active, intelligent interface component.

This shift necessitates significant investment in specialized embedded processors and sensor technology within the pointer device itself, increasing complexity but simultaneously boosting average selling prices and profit margins for innovative manufacturers. While basic, low-cost pointers will remain available, the premium market will be defined by software integration and AI-driven convenience features, ensuring the device retains relevance even as augmented reality and virtual whiteboarding solutions gain prominence in educational and corporate spheres. The primary concern—obsolescence—is mitigated by the physical, undeniable clarity and simplicity that a focused laser beam offers, which virtual solutions often struggle to replicate perfectly in diverse real-world lighting conditions.

- AI-Enhanced Gesture Control: Utilizing machine learning for precise interpretation of non-verbal cues and enhanced slide navigation using pointer movements.

- Automated Beam Stabilization: AI algorithms compensating for human hand shake or vibration, delivering a perfectly steady point.

- Smart Environmental Adaptation: Real-time adjustment of laser output intensity and color filter based on background color and ambient light conditions for optimal visibility.

- Predictive Maintenance and Battery Management: AI analysis of usage patterns to forecast battery depletion and optimize power consumption.

- Integration with AR/VR Training Systems: Using physical laser pointers as input devices within AI-generated training simulations for precision interaction.

- Voice Command Synchronization: Linking pointer functions (e.g., highlighting, annotation) with AI-driven voice assistants for hands-free operation.

DRO & Impact Forces Of Laser Pointer Market

The Laser Pointer Market is significantly propelled by several key drivers, foremost among them being the pervasive digitization of educational and corporate training methodologies globally, necessitating effective highlighting tools for complex data visualization. The convenience, portability, and instant efficacy of laser pointers in directing audience attention remain unmatched by most alternative technologies. However, market growth faces considerable restraints, primarily the stringent safety regulations imposed by governmental bodies (like the FDA in the US and international bodies) concerning power output, leading to consumer confusion and imposing limitations on product design. Opportunities for expansion lie in the development of premium, feature-rich pointers with enhanced safety features and advanced connectivity, targeting high-value professional sectors and specialized industrial inspection applications. These dynamics—combining robust demand, regulatory friction, and technological potential—form a complex interplay of impact forces shaping the market’s evolutionary path.

Impact forces are heavily weighted by technological convergence; the merging of laser pointers with sophisticated presentation remote technology offers significant market momentum. Conversely, the negative publicity associated with misuse, particularly concerning aviation safety or potential eye hazards from cheap, non-compliant high-power imports, acts as a powerful restraining force, necessitating strong quality control and consumer education efforts from reputable manufacturers. The rapid growth of the green laser pointer segment, driven by superior perceived brightness and visibility, underscores a critical technological driver, shifting consumer preference away from traditional red diodes for professional use cases. Market equilibrium is maintained by manufacturers balancing innovation with compliance, ensuring products are both effective and legally permissible across diverse international jurisdictions.

Furthermore, the cost structure of laser diodes represents a dual force: declining diode costs act as a driver, making pointers highly accessible even in low-income markets, thereby increasing volume sales. Conversely, the necessity to integrate expensive safety mechanisms (e.g., mandatory protective filters, shutter systems, and automated low-power modes for higher class devices) to meet regulatory requirements often offsets these cost savings, acting as a restraint on pricing flexibility for premium models. The market’s sustainability hinges on continuous improvement in diode efficiency and the standardization of professional safety protocols across all end-user environments.

Segmentation Analysis

The Laser Pointer Market is systematically segmented based on various technical and application-specific criteria to cater to diverse end-user requirements. Primary segmentation includes Laser Color (e.g., Red, Green, Blue), which directly impacts visibility and suitability for specific environments; Application (e.g., Presentations, Education, Industrial, Military), which determines the required power output and ruggedness; and Power Output (e.g., Class 1, Class 2, Class 3R), reflecting safety standards and intended operational scope. This granular division allows manufacturers to target specific verticals with tailored product offerings, ensuring compliance and optimal performance.

Further analysis of segmentation reveals that the Presentation segment dominates in volume sales, while the Industrial/Military segment commands a higher market value due to specialized requirements for durability, extended battery life, and high precision. The Green Laser segment is witnessing the most rapid growth globally, replacing red lasers as the preferred choice in professional settings where high visibility against digital screens or outdoor backgrounds is crucial. Regional preferences also influence segmentation; for example, North American corporate markets favor Class 2 devices integrated into multi-function presentation remotes, emphasizing user-friendliness and safety compliance for mass deployment.

Strategic market players constantly monitor these segment trends to optimize their production lines and marketing strategies. The proliferation of low-cost, high-power imports challenges established market structures, emphasizing the need for premium brands to differentiate through certified safety, software integration, and superior build quality. Understanding the nuances within each segment, such as the specific wavelength requirements for astronomical viewing versus industrial alignment, is critical for achieving market penetration and sustaining competitive advantage in this evolving landscape.

- By Laser Color:

- Red Laser Pointers (Most common, economical)

- Green Laser Pointers (Higher visibility, premium pricing)

- Blue/Violet Laser Pointers (Niche applications, technical requirements)

- Other Colors

- By Power Output Classification:

- Class 1 (Non-hazardous, <0.39 mW)

- Class 2 (Low power, <1 mW, eye safe for momentary exposure)

- Class 3R (Moderate power, 1 mW - 5 mW)

- Class 3B (Medium power, 5 mW - 500 mW, restricted professional/industrial use)

- By Application:

- Presentations and Corporate Use (Remote control integration)

- Education and Academia (Scientific demonstrations, lecture halls)

- Industrial and Construction (Alignment, leveling, measurement)

- Military and Law Enforcement (Targeting, sighting, signaling)

- Entertainment and Astronomy (Pointing out constellations, novelty uses)

- By Product Type:

- Handheld Pointers (Standard consumer models)

- Pen Pointers (Executive and portable designs)

- Integrated Pointers (Built into presentation remotes or measuring equipment)

Value Chain Analysis For Laser Pointer Market

The value chain for the Laser Pointer Market begins with upstream activities focused heavily on the procurement and manufacturing of specialized components, primarily laser diodes (semiconductor chips), optical lenses (collimating optics), and housing materials (metals or plastics). Key upstream suppliers include diode manufacturers, often based in Asia Pacific, who provide the core technology that determines the pointer’s color, power, and efficiency. The quality and cost effectiveness of these diodes significantly influence the final product's market positioning and profitability. Intense R&D efforts in the upstream segment focus on improving diode thermal management and efficiency to allow for higher power output within mandated safety limits.

Midstream activities involve the actual assembly, quality control, calibration, and final packaging of the laser pointer. Reputable manufacturers integrate advanced testing protocols to ensure compliance with international eye safety standards (e.g., IEC 60825-1). This stage also includes the integration of advanced features such as USB connectivity, wireless presentation remote circuitry, and proprietary software integration. Downstream activities encompass the distribution and sales channels, which are bifurcated into direct sales to large corporate and military clients, and indirect channels relying heavily on e-commerce platforms, mass-market electronics retailers, and specialized industrial suppliers. The high volume of online sales necessitates strong supply chain logistics and robust counterfeit mitigation strategies.

Distribution channels are critical determinants of market reach. For high-volume, low-cost consumer pointers, indirect channels via large online retailers (Amazon, Alibaba) dominate, prioritizing efficiency and broad accessibility. Conversely, highly regulated, high-power industrial and military pointers are often sold through specialized, certified direct distributors who can provide necessary technical support, regulatory documentation, and bulk customization. The rise of direct-to-consumer (D2C) models for established brands, leveraging brand reputation and certified safety claims, allows manufacturers greater control over pricing and customer relationship management, optimizing value capture across the chain.

Laser Pointer Market Potential Customers

The Laser Pointer Market serves a broad spectrum of end-users, reflecting the versatility of the device across professional, educational, and consumer domains. Primary end-users include corporate executives, marketing professionals, and trainers who utilize the pointers extensively for business presentations and client pitches to maintain audience engagement and highlight complex data points visually. Educators, ranging from university professors to K-12 teachers, constitute a massive user base, relying on pointers for classroom instruction, lab demonstrations, and interactive learning sessions, utilizing features like remote slide control integrated into the pointer device.

Beyond the traditional presentation segment, significant demand originates from specialized industrial sectors. Engineers and construction managers use high-precision laser pointers for alignment, measuring, and surveying tasks, requiring devices with robust housing, high beam stability, and specific wavelengths. Furthermore, government sectors, including military, defense, and law enforcement agencies, procure high-output, ruggedized laser pointers for tactical sighting, targeting practice, and long-distance signaling applications. These segments demand adherence to rigorous specifications regarding durability, temperature tolerance, and beam power, resulting in high-value sales contracts.

A growing, albeit highly regulated, customer base includes astronomy enthusiasts who use specialized green laser pointers (often high-power, Class 3R) to precisely trace constellations and astronomical features in the night sky. The consumer segment also includes general users who purchase pointers for pet toys, novelty items, or rudimentary non-professional tasks. Addressing the specific needs of each group—from low-cost, compliant Class 2 pointers for educators to durable, certified Class 3B devices for industrial technicians—is central to maximizing market opportunity and ensuring product relevance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155 Million |

| Market Forecast in 2033 | USD 242 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Quartet, Kensington, Logitech, Esddi, DYMO, ViviMage, Jasper Laser, Shenzhen Optoelectronics, Changchun New Industries Optoelectronics, Beamshot, Wicked Lasers, LaserGlow, Z-Bolt, New Energy Technology, Laser Components GmbH, Brookstone, PowerLink, Advanced Laser Technology, Starlight Lasers, CNI Lasers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Pointer Market Key Technology Landscape

The technology landscape of the Laser Pointer Market is fundamentally shaped by advancements in semiconductor laser diode technology. Red lasers traditionally utilize aluminum gallium arsenide (AlGaAs) diodes, offering cost-effectiveness but lower visibility. The primary technological innovation driving market growth is the widespread adoption of green lasers, which often use diode-pumped solid-state (DPSS) frequency-doubling technology or, increasingly, direct green diode (DGD) technology (520 nm). DGDs are gaining preference as they eliminate the bulky crystal components required by DPSS, resulting in smaller, more energy-efficient, and temperature-stable green pointers, greatly enhancing portability and operational lifetime. This transition is essential for catering to professional markets that demand high visibility and reliability.

Further technological differentiation occurs in the integration of smart electronics. Modern laser pointers incorporate microcontrollers, Bluetooth or RF transmitters, and gyroscope sensors, transforming them into multi-functional presentation tools. Capacitive touch sensors and specialized software drivers enable seamless compatibility with leading presentation software, allowing users to control slides, annotate, or navigate cursors remotely. Enhanced safety features are also a key technological focus, including thermal regulation circuits to prevent overheating of higher-power diodes, and sophisticated interlock mechanisms that automatically reduce power output or shut off the beam upon detecting rapid movement or proximity to sensitive areas, such as aircraft.

The evolving standards for connectivity, specifically USB-C charging and wireless pairing stability, are crucial for maintaining user convenience in the professional segment. Material science also plays a role, with manufacturers utilizing high-grade aluminum alloys for heat dissipation and durability in industrial models. Overall, the technological trajectory focuses on achieving higher power output within mandated safety classes, improving beam quality (collimation and spot size), and seamlessly merging the laser pointing function with comprehensive digital presentation control systems to maximize utility and user satisfaction in diverse application environments.

Regional Highlights

- North America: This region holds a significant market share, driven by high corporate expenditure on professional presentation tools and early adoption of educational technology. The market is characterized by a strong preference for multi-functional, certified Class 2 pointers integrated into presentation remotes. Stringent adherence to FDA safety standards ensures the prevalence of high-quality, branded products, though regulatory complexity regarding imported high-power devices remains a constraint. The U.S. and Canada are leading consumers, particularly within their extensive higher education and military sectors, focusing on reliable wireless connectivity and robust design.

- Europe: Europe represents a mature market with steady growth, primarily fueled by the strong presence of international corporations and a highly structured academic environment. Germany, the UK, and France are key contributors. European regulations (IEC standards) heavily influence product design, emphasizing environmental sustainability alongside safety. There is a notable demand for high-precision laser tools in the industrial automation and construction sectors across Central Europe, favoring durable, high-specification devices designed for harsh working conditions.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing market due to rapid industrialization, expanding educational infrastructures, and the increasing volume of manufacturing output. Countries like China, India, Japan, and South Korea are experiencing massive growth in the adoption of professional presentation aids. China dominates the manufacturing base, leading to highly competitive pricing and widespread availability. However, the market faces challenges related to inconsistent application and enforcement of laser safety regulations, especially in the low-cost consumer segment. The booming technology sector in South Korea and Japan drives demand for premium, integrated smart pointers.

- Latin America (LATAM): The LATAM market is characterized by moderate but consistent growth, supported by growing foreign investment in corporate infrastructure and educational modernization initiatives, particularly in Brazil and Mexico. Price sensitivity is a major factor, leading to a strong demand for cost-effective, basic laser pointers. Improved digital connectivity across major urban centers facilitates the adoption of more advanced presentation tools, gradually shifting consumer preference towards reliable, mid-range devices.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated in the Gulf Cooperation Council (GCC) countries, driven by large-scale construction projects and defense spending which require specialized industrial and military laser sighting equipment. Educational reforms and the establishment of new corporate hubs contribute to consumer demand for presentation pointers. Market dynamics are heavily influenced by procurement cycles in the defense and government sectors, favoring high-specification products from international vendors capable of providing stringent quality assurance and maintenance services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Pointer Market.- Quartet

- Kensington

- Logitech

- Esddi

- DYMO

- ViviMage

- Jasper Laser

- Shenzhen Optoelectronics

- Changchun New Industries Optoelectronics (CNI)

- Beamshot

- Wicked Lasers

- LaserGlow

- Z-Bolt

- New Energy Technology

- Laser Components GmbH

- Brookstone

- PowerLink

- Advanced Laser Technology

- Starlight Lasers

- Laser Tools Co., Inc.

Frequently Asked Questions

Analyze common user questions about the Laser Pointer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a red laser pointer and a green laser pointer?

Green laser pointers typically use a wavelength around 532 nm and are perceived as significantly brighter and more visible to the human eye than red laser pointers (635-670 nm) of the same power output, making green lasers preferable for large halls, daylight, or outdoor use, despite their higher cost and potentially more complex technology (DPSS or DGD).

Are high-power laser pointers legal for public use?

High-power laser pointers (Class 3B and above, often >5 mW) are generally restricted and illegal for sale as consumer products in many jurisdictions, including the US (FDA) and Europe, due to significant eye and aviation hazards. Most pointers sold for presentations are limited to Class 2 (<1 mW) to ensure eye safety during momentary exposure.

How is the Laser Pointer Market impacted by wireless presentation technology?

Wireless presentation technology drives demand for integrated laser pointers. Modern pointers often function as multi-purpose presentation remotes, incorporating RF/Bluetooth connectivity, cursor control, and slide advancement capabilities, ensuring the device remains central to professional digital workflows rather than becoming obsolete.

Which application segment holds the largest market share in the Laser Pointer Market?

The Presentations and Corporate Use application segment holds the largest volume market share, driven by the global requirement for effective communication tools in corporate training, meetings, and academic lecturing across all major economic regions.

What is the projected Compound Annual Growth Rate (CAGR) for the Laser Pointer Market?

The Laser Pointer Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period of 2026 to 2033, driven by innovation in smart features and increasing adoption in the Asia Pacific region.

What safety standards govern the manufacturing of laser pointers globally?

Globally, manufacturing is governed by the International Electrotechnical Commission (IEC) standard 60825-1, which classifies laser products by power output and potential hazard. In the United States, the Food and Drug Administration (FDA) enforces regulations specifying power limits and mandatory labeling requirements for consumer devices.

How is AI expected to enhance the functionality of future laser pointers?

AI integration is expected to introduce features such as automated beam stabilization to counteract human tremor, smart environmental adaptation for optimal beam intensity, and advanced gesture recognition for seamless interaction with presentation software, thereby augmenting the device's utility beyond simple pointing.

Which geographical region is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to achieve the fastest growth rate, propelled by rapid infrastructure development, robust growth in the education and corporate sectors, and a strong manufacturing base facilitating high market volume.

Are laser pointers used in the construction and industrial sectors?

Yes, laser pointers are extensively used in construction and industrial sectors for highly precise alignment, leveling, and measurement tasks. These applications typically demand ruggedized, high-stability devices often falling into Class 3R or regulated Class 3B categories, specialized for professional use.

What are the key restraint factors impacting market expansion?

The key restraint factors include stringent government regulations concerning maximum permissible power output to mitigate eye safety risks, negative media attention regarding misuse of high-power imported devices, and increasing competition from sophisticated, virtual pointing features in advanced projection systems.

What differentiates premium laser pointers from mass-market models?

Premium laser pointers differentiate themselves through certified adherence to safety standards, inclusion of advanced connectivity (e.g., dedicated Bluetooth/RF), integrated presentation control features (e.g., air mouse), superior optics for a crisp beam spot, and durable, ergonomically designed housing materials.

What is the significance of direct green diode (DGD) technology?

DGD technology represents a shift from older Diode-Pumped Solid State (DPSS) systems, allowing manufacturers to create smaller, lighter, and more temperature-stable green laser pointers by eliminating the bulky internal crystal components, improving energy efficiency and overall reliability.

How does the value chain for laser pointers start?

The value chain initiates with upstream activities focused on the procurement and manufacturing of critical components, specifically high-quality semiconductor laser diodes, which are the fundamental light-emitting elements determining the pointer's performance characteristics, color, and power classification.

What role do e-commerce platforms play in the distribution of laser pointers?

E-commerce platforms are the dominant indirect distribution channel for consumer and low-to-mid-range professional laser pointers, offering wide market accessibility, competitive pricing, and efficient logistics, significantly impacting volume sales globally.

Which classification of laser pointer is generally considered safe for presentations?

Laser pointers classified as Class 2 (output power less than 1 milliwatt) are generally considered safe for presentations, as the human blink reflex provides adequate protection against eye injury from momentary exposure, making them the standard for widespread corporate and educational use.

What is the role of key companies like Logitech and Kensington in this market?

Companies like Logitech and Kensington primarily focus on the high-value segment of multi-functional presentation remotes, integrating certified, safe Class 2 laser pointers with advanced wireless connectivity and software features to target corporate professionals and educators.

Is there an application for laser pointers in the field of astronomy?

Yes, astronomers and enthusiasts use green laser pointers, usually Class 3R, to accurately trace and point out constellations, planets, and other celestial objects, benefiting from the green light's high visibility in low-light night sky conditions.

How is the market addressing the environmental concerns related to battery usage?

The market is addressing battery concerns by increasing the adoption of rechargeable lithium-ion or integrated batteries (USB-C charging) in professional models, improving diode energy efficiency, and promoting long-life power sources to reduce the environmental impact associated with disposable batteries.

What is the primary driving factor for the growth of the green laser segment?

The primary driving factor for the green laser segment's growth is their superior visibility compared to red lasers, enabling clearer and more effective pointing in brightly lit rooms, against modern digital displays, or during outdoor activities, thus meeting higher professional demands.

How does the military segment differ in its demand for laser pointers?

The military segment demands highly specialized, ruggedized laser pointers, often higher power (Class 3B), used for tactical sighting, targeting, and long-distance signaling. These devices require superior durability, temperature tolerance, and adherence to specific military performance standards, resulting in higher average selling prices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager