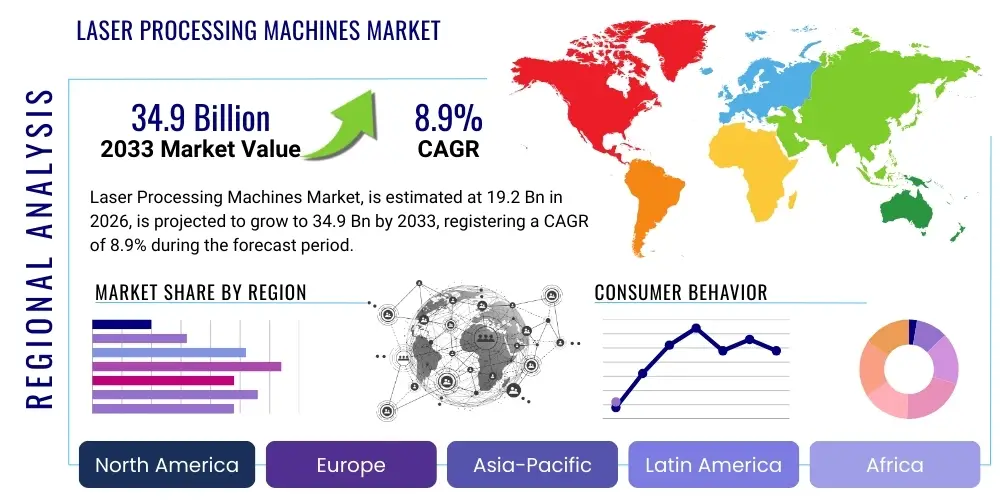

Laser Processing Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443629 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Laser Processing Machines Market Size

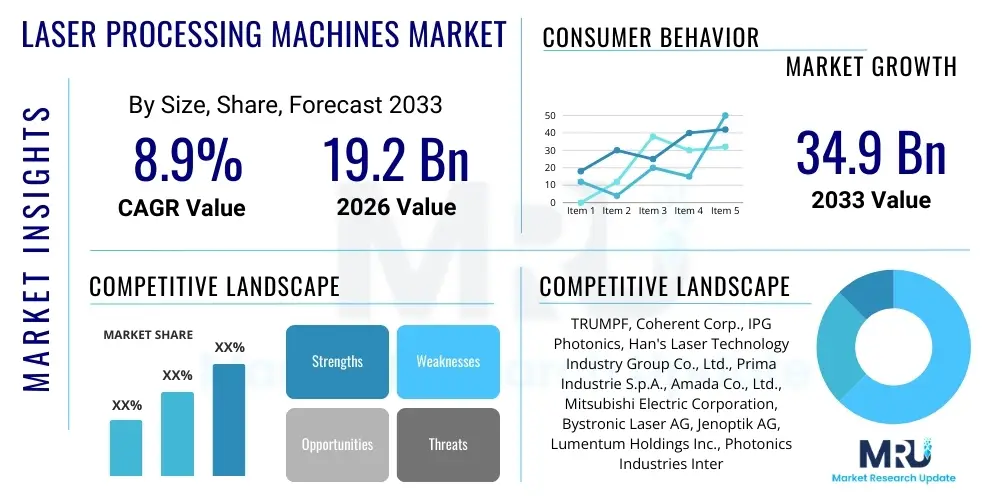

The Laser Processing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 19.2 Billion in 2026 and is projected to reach USD 34.9 Billion by the end of the forecast period in 2033.

Laser Processing Machines Market introduction

The Laser Processing Machines Market encompasses advanced industrial systems that utilize highly concentrated light energy to modify materials through processes such as cutting, welding, drilling, marking, and ablation. These machines employ various laser types—including fiber, CO2, excimer, and diode lasers—each tailored for specific material interactions and precision requirements. The core function of these products is to provide non-contact, high-precision, and high-speed material processing solutions, which are critical across demanding manufacturing sectors. The versatility and efficiency of laser processing technology make it a foundational element in modern automated production lines, offering substantial advantages over traditional mechanical methods, especially when dealing with complex geometries and delicate components.

Major applications for laser processing machines span key industrial verticals, notably automotive manufacturing for cutting high-strength steel and welding chassis components, electronics production for PCB micro-drilling and semiconductor scribing, and the medical device industry for precision surgical tool manufacturing and material sterilization. The inherent benefits of laser technology, such as minimal material waste, reduced heat-affected zones (HAZ), superior repeatability, and the ability to process extremely hard or brittle materials, drive their increasing adoption. Furthermore, the push towards miniaturization in electronics and lightweighting in transportation necessitate the precision capabilities that only advanced laser systems can consistently deliver.

Driving factors for sustained market growth include the accelerating integration of automation and Industry 4.0 principles globally, increasing demand for highly customized and complex components, and significant technological advancements in laser source efficiency and beam delivery systems, particularly fiber lasers. The robust expansion of the electric vehicle (EV) sector, requiring specialized battery welding and cutting techniques, further fuels the deployment of high-power laser systems. Geographically, rapid industrialization and sophisticated manufacturing investments in the Asia Pacific region, particularly China and South Korea, solidify its dominance as both a production and consumption hub for these specialized machines.

Laser Processing Machines Market Executive Summary

The global Laser Processing Machines Market is defined by intense technological competition and a pronounced shift toward higher power, increased automation, and smart manufacturing integration. Current business trends are characterized by a focus on developing ultra-short pulse (USP) lasers, such as femtosecond and picosecond lasers, which offer unparalleled cold ablation capabilities essential for processing advanced materials like composites and next-generation semiconductors without thermal damage. Leading manufacturers are emphasizing modular designs and integrating sophisticated software for process monitoring and adaptive control, aligning with the principles of the Industrial Internet of Things (IIoT). Strategic mergers, acquisitions, and collaborative partnerships aimed at broadening application portfolios, particularly in additive manufacturing (3D printing) and micro-processing, are pervasive strategies shaping the competitive landscape.

Regional market dynamics indicate that the Asia Pacific (APAC) region remains the epicenter of market growth, driven by massive investments in consumer electronics assembly, automotive production, and photovoltaic manufacturing, especially within China, Japan, and South Korea. North America and Europe, while growing at a slightly slower pace, focus intensely on adopting high-value, highly specialized laser systems for aerospace, defense, and high-precision medical device manufacturing, prioritizing advanced quality control and regulatory compliance. These mature markets are key adopters of high-end fiber and excimer lasers, leveraging automation to offset high labor costs, thereby maintaining a focus on optimizing throughput and yield in highly critical manufacturing environments.

Segment trends reveal that the Fiber Laser segment continues to dominate the market by technology type, primarily due to its high efficiency, low maintenance requirements, and scalability in power output, making it ideal for both high-volume cutting and high-power welding applications. The Welding and Cutting applications collectively account for the largest market share, essential for heavy industry and automotive fabrication. However, the Marking and Engraving segment is witnessing rapid expansion, propelled by stringent regulatory requirements for product traceability and anti-counterfeiting measures across pharmaceuticals, food & beverage, and electronics. The Electronics and Semiconductor end-user segment is anticipated to exhibit the fastest CAGR, directly linked to global chip demand, display panel manufacturing, and the continuous trend toward device miniaturization, demanding exceptional levels of micromachining precision.

AI Impact Analysis on Laser Processing Machines Market

User inquiries regarding AI's influence on the Laser Processing Machines Market overwhelmingly center on themes of process optimization, predictive maintenance, and autonomous operation. Common questions include: "How will AI improve laser cutting quality and speed?", "Can AI predict component failure in laser sources?", and "What role does machine learning play in optimizing complex laser parameters for new materials?". These questions highlight user expectations for AI to transcend basic automation, transitioning toward true cognitive manufacturing environments where laser systems can dynamically self-adjust, learn from operational data, and significantly reduce material waste and downtime. Key concerns often revolve around data privacy, the cost of implementing AI infrastructure, and the need for skilled operators capable of managing these intelligent systems, suggesting a focus on ease of integration and return on investment.

The incorporation of Artificial Intelligence and Machine Learning (ML) algorithms is rapidly transforming the operational efficiency and capabilities of laser processing machines, moving them from fixed, pre-programmed tools to adaptive, intelligent systems. AI algorithms are particularly effective in analyzing real-time sensor data from the laser head, beam delivery optics, and cooling systems. By processing massive datasets related to temperature, vibration, power fluctuations, and material response, AI models can precisely predict the optimal parameters (power, speed, focal distance) necessary to achieve target quality specifications, particularly when processing highly variable or novel materials like superalloys or advanced polymers. This real-time optimization capability drastically minimizes setup time and scrap rates, which is a major value proposition for end-users seeking maximal throughput.

Furthermore, AI is fundamentally changing maintenance protocols, shifting from scheduled preventative maintenance to highly accurate predictive maintenance (PdM). Machine learning models analyze historical performance data and detect subtle anomalies in acoustic signatures or power consumption that signal imminent component degradation, such as beam misalignment or cooling system failure, long before they lead to catastrophic breakdowns. This predictive capacity allows manufacturers to schedule maintenance precisely when needed, maximizing machine uptime and minimizing unexpected production stops. The ultimate goal is the creation of fully autonomous laser cells where AI manages material handling, process execution, quality inspection via integrated vision systems, and self-diagnosis, significantly enhancing the overall effectiveness of the manufacturing operation.

- Predictive Quality Control: AI uses real-time monitoring of melt pool dynamics (via vision and thermal sensors) to adjust laser parameters dynamically, ensuring consistent quality and defect detection instantaneously during processing.

- Autonomous Parameter Optimization: Machine Learning algorithms automatically determine the ideal power settings, feed rates, and focal points for new or complex materials based on learned historical data, drastically cutting down on manual trial-and-error experimentation.

- Predictive Maintenance (PdM): AI analyzes sensor data (vibration, temperature, power) to forecast component failure in laser sources or optics, scheduling maintenance precisely to maximize uptime and extend component life.

- Enhanced Automation and Robotics Integration: AI-driven vision systems facilitate precise part localization and alignment, enabling seamless integration of laser processing machines with robotic material handling and loading systems in fully automated production cells.

- Process Simulation and Digital Twins: AI aids in creating high-fidelity digital twins of the laser manufacturing process, allowing operators to simulate the effects of parameter changes on material properties before physical implementation, accelerating process development.

DRO & Impact Forces Of Laser Processing Machines Market

The Laser Processing Machines Market growth is robustly propelled by key drivers, primarily the burgeoning demand for high-precision manufacturing solutions across the electronics and automotive industries, particularly for electric vehicle (EV) battery welding and structural lightweighting. The overarching global trend toward industrial automation (Industry 4.0) mandates the high repeatability and speed offered by laser technology, replacing slower, less precise mechanical methods. However, the market faces significant restraints, chiefly the substantial initial capital investment required for high-power fiber and specialized USP laser systems, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the operational complexity and the scarcity of highly skilled technicians trained to program and maintain these advanced laser systems pose ongoing constraints to broader adoption.

Significant opportunities abound, particularly in emerging applications such as laser additive manufacturing (3D printing) for complex metal parts, which is transitioning from prototyping to mass production, and the exponential growth expected in the advanced semiconductor and display panel manufacturing sectors, driving demand for excimer and ultra-fast lasers for highly accurate micro-processing. The shift toward sustainable manufacturing practices also presents an opportunity, as laser processing often eliminates the need for environmentally harmful coolants and reduces material waste compared to mechanical machining. Successful market navigation hinges on developing more affordable, user-friendly, and energy-efficient laser systems that address the restraints related to cost and operational complexity, while actively investing in the high-growth application areas.

The market is governed by several powerful impact forces that shape its competitive dynamics and technological direction. Technological advancement is a dominant force, characterized by the continuous improvement in laser source efficiency, power output, and beam quality, leading to faster processing speeds and superior surface finishes. Supplier power is moderate to high, as the market relies heavily on a few core component providers for key technologies like high-power diodes and specialty optics. Conversely, buyer power is also strong, driven by large automotive and electronics manufacturers demanding stringent performance specifications, customization, and competitive pricing. The threat of substitutes, while present from waterjet and plasma cutting, is relatively low in high-precision and micro-processing segments where lasers offer unique advantages. Regulatory requirements, especially concerning safety (Class 1 enclosures) and material traceability, also exert significant influence on product development and market entry strategies.

Segmentation Analysis

The Laser Processing Machines Market is comprehensively segmented based on technology, process type, power output, and end-user industry, providing a granular view of specific growth trajectories within the broader market landscape. Technological segmentation, primarily covering Fiber, CO2, Excimer, and Diode lasers, reveals the ongoing transition favoring solid-state technologies due to their high electrical efficiency and exceptional beam quality. The segmentation by process type—cutting, welding, marking, drilling, and ablation—highlights the diverse functional capabilities of laser systems, with cutting and welding dominating large-scale industrial use while drilling and ablation are crucial for micro-processing applications in electronics.

Segmentation by power output (low, medium, high) further differentiates the market, with high-power lasers increasingly adopted in heavy industrial applications like ship building and automotive structural component manufacturing, while low and medium power lasers remain staples for intricate marking and medical device fabrication. The end-user analysis provides critical insights, confirming the automotive and electronics sectors as the primary consumers, although robust growth is anticipated from emerging sectors such as renewable energy (solar panel production) and advanced packaging. Understanding these segment dynamics is essential for market participants to tailor their product offerings and strategic investments toward the most lucrative and rapidly evolving application areas.

- By Technology:

- Fiber Lasers

- CO2 Lasers

- Excimer Lasers

- Diode Lasers

- Solid-State Lasers (Nd:YAG, etc.)

- Ultra-Short Pulse (USP) Lasers (Femtosecond, Picosecond)

- By Process Type:

- Laser Cutting

- Laser Welding

- Laser Marking & Engraving

- Laser Drilling

- Laser Ablation & Surface Treatment

- By Power Output:

- Low Power (up to 1 kW)

- Medium Power (1 kW to 6 kW)

- High Power (Above 6 kW)

- By End-User Industry:

- Automotive

- Electronics and Semiconductor

- Aerospace and Defense

- Medical Devices

- Industrial Machinery

- Packaging

- Jewelry and Artwork

Value Chain Analysis For Laser Processing Machines Market

The value chain for laser processing machines begins with upstream activities dominated by specialized component manufacturing, including laser source production (diodes, resonators, gain media), advanced optics (lenses, mirrors, beam combiners), and control systems (CNC units, software). A high degree of specialization and proprietary technology exists at this stage, particularly among key suppliers of high-power industrial fiber lasers and USP sources, granting significant bargaining power to these upstream providers. Companies like IPG Photonics and Coherent not only manufacture components but also integrate vertically into final system assembly, maximizing their control over quality and innovation. Efficient sourcing of these highly precise components, which often dictates the final system performance, is critical for machine integrators.

The midstream involves the design, assembly, integration, and testing of the complete laser processing system. This stage includes mounting the laser source, designing the beam delivery system (scanners, galvanometer systems), integrating sophisticated cooling and fume extraction units, and packaging the system into safe, often Class 1, enclosures. Major machine builders like TRUMPF, Amada, and Han's Laser focus their competitive strategies here by optimizing machine architecture for speed, accuracy, and reliability, offering custom tooling and automation features tailored to specific customer needs (e.g., large format cutting tables or robotic welding cells). This manufacturing stage requires high engineering proficiency and adherence to stringent international safety standards.

The downstream segment encompasses distribution, sales, installation, and post-sales services. Distribution channels are typically a mix of direct sales forces for large, strategic accounts (like tier-1 automotive suppliers) and a network of specialized, local distributors or value-added resellers (VARs) for reaching smaller enterprises and specific geographic markets. Post-sales support, including preventative maintenance contracts, application engineering consulting, spare parts supply, and operator training, constitutes a significant revenue stream and a key differentiator in a high-investment machinery market. The quality and responsiveness of this service network are paramount, as machine downtime directly translates to major production losses for end-users, solidifying the importance of reliable, localized technical support.

Laser Processing Machines Market Potential Customers

The primary end-users and buyers of laser processing machines are large-scale manufacturing entities requiring highly repeatable and precise material modification capabilities across various complex production environments. In the automotive sector, customers include OEMs and their Tier 1 suppliers who utilize high-power fiber lasers for 3D cutting of hydroformed parts, remote welding of chassis components, and specialized welding techniques for EV battery packs (pouch cells, cylindrical cells). The rigorous quality standards and high volume requirements inherent in this industry mandate investments in high-speed, automated laser solutions capable of continuous, reliable operation, making these firms substantial purchasers of advanced, high-power systems.

Another major demographic consists of electronics and semiconductor manufacturers. These buyers, including display panel producers and integrated circuit (IC) packaging firms, require ultra-precise micro-machining capabilities, often relying on excimer lasers for annealing or USP lasers for clean, thermal-damage-free cutting and drilling of delicate materials like flexible PCBs, glass substrates, and semiconductor wafers. Their purchasing decisions are driven by the need for sub-micron accuracy, minimal heat-affected zone, and integration with highly clean automated environments, placing a premium on machine stability and process control software.

Furthermore, medical device manufacturers represent a high-value customer segment, requiring stringent material sterilization and incredibly precise processing for items like coronary stents, pacemakers, and surgical tools. These firms utilize low to medium power laser systems, primarily Nd:YAG and sometimes USP lasers, for highly controlled cutting, welding, and deep-engraving (marking) that meet rigorous regulatory standards such as FDA approval. Other important customer groups include general job shops offering contract manufacturing services, aerospace firms demanding processing of exotic superalloys, and renewable energy companies involved in precise solar cell scribing and thin-film processing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 19.2 Billion |

| Market Forecast in 2033 | USD 34.9 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TRUMPF, Coherent Corp., IPG Photonics, Han's Laser Technology Industry Group Co., Ltd., Prima Industrie S.p.A., Amada Co., Ltd., Mitsubishi Electric Corporation, Bystronic Laser AG, Jenoptik AG, Lumentum Holdings Inc., Photonics Industries International, Rofin-Sinar Technologies (Bystronic Group), Trotec Laser GmbH, Universal Laser Systems, DPSS Lasers Inc., Hypertherm Associates, Mazak Optonics Corporation, Wuhan Golden Laser Co., Ltd., Novanta Inc. (Synrad), Laserline GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Processing Machines Market Key Technology Landscape

The technological landscape of the Laser Processing Machines Market is highly dynamic, driven by relentless innovation in solid-state laser physics and beam control systems. Fiber lasers represent the most commercially impactful technology currently, offering unparalleled efficiency (up to 40% wall-plug efficiency), exceptional beam quality, and high power scalability, making them the default choice for high-volume cutting and welding of metals. Continuous developments focus on pushing the power limits of single-mode fiber lasers beyond 20 kW for extremely thick material processing and developing integrated intelligent feedback loops that dynamically manage beam profile characteristics (such as beam wobble or focusing) in real-time, optimizing the process for varying material conditions and thicknesses. The reduced maintenance and robust nature of fiber technology further solidifies its position as the market leader across industrial applications.

A second critical area of innovation is the proliferation of Ultra-Short Pulse (USP) lasers, specifically picosecond and femtosecond systems, which are essential for advanced micro-processing applications. These lasers deliver energy in extremely short bursts, enabling "cold ablation" where material is removed before significant heat transfer occurs to the surrounding area, virtually eliminating the Heat Affected Zone (HAZ). This capability is indispensable for processing sensitive materials like sapphire, flexible polymers, glass, and advanced semiconductors without introducing thermal stress or micro-cracks. Ongoing research focuses on improving the average power output of these USP systems while maintaining pulse stability and lowering the overall cost of ownership, thereby transitioning them from niche scientific tools to mainstream industrial micromachining workhorses for tasks such as precision drilling and display panel cutting.

Furthermore, the integration of advanced optics and software control systems is redefining precision and versatility. Adaptive optics, including deformable mirrors and active optical elements, are being deployed to compensate for thermal lensing and maintain optimal beam focus across long processing cycles and changing environmental conditions. Enhanced sensor integration, including high-speed cameras and pyrometers, feeds data directly into machine control units, forming the basis for AI-driven process monitoring and closed-loop control. This evolution towards highly integrated, software-defined beam delivery systems allows one machine to execute a wider range of processes with minimal human intervention, effectively merging the capabilities of traditional laser systems with the flexibility required for agile manufacturing environments.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region in the Laser Processing Machines Market, fueled primarily by its dominance in the global electronics manufacturing, automotive production, and general machinery sectors. China stands as the global powerhouse, characterized by aggressive domestic investment in high-end laser technology, driven by supportive government policies aimed at technological self-sufficiency and scaling industrial automation. South Korea and Taiwan are key markets for highly specialized micro-processing lasers due to their significant roles in semiconductor, display panel (OLED/LCD), and consumer electronics production. The robust demand for localized production efficiency and the rapid expansion of EV battery manufacturing across the region ensure continued high demand for both high-power fiber lasers (for welding/cutting) and USP lasers (for micro-machining).

- North America: North America represents a mature, high-value market characterized by early adoption of advanced laser technologies, particularly in aerospace, defense, and high-precision medical device manufacturing. The demand here is driven by stringent quality standards and the need to process specialized, often difficult-to-machine, materials such as titanium alloys and composites. The region shows strong growth in the adoption of laser additive manufacturing (L-AM) systems and sophisticated automation solutions. Investments in developing next-generation battery technology and domestic semiconductor fabrication plants further stimulate the market for high-performance excimer and ultra-fast laser processing equipment, prioritizing customization and system integration quality over purely cost-driven solutions.

- Europe: Europe is a vital market, renowned for its technological leadership in machine tool building and advanced manufacturing, particularly in Germany (the largest single European market), Italy, and Switzerland. The focus is heavily placed on R&D, implementing Industry 4.0 standards, and maintaining high environmental and safety regulations. European manufacturers are key innovators in high-power CO2 and specialized fiber laser systems, catering extensively to the high-end automotive, industrial machinery, and complex tool-making sectors. The emphasis on high-quality engineering and energy efficiency drives the demand for premium, highly automated, and precision-engineered laser systems designed for reliability and seamless integration into highly sophisticated production lines.

- Latin America (LATAM): The LATAM market exhibits moderate growth, concentrated primarily in industrialized nations such as Brazil and Mexico, which serve as major manufacturing hubs for global automotive OEMs and general fabrication needs. Market penetration is generally focused on standard, high-reliability laser cutting and welding machines (primarily CO2 and mid-power fiber lasers) used in metal fabrication and structural applications. While growth is steady, adoption of ultra-high-end or micro-processing equipment remains slower compared to APAC and North America, primarily due to prevailing economic volatility and relatively lower R&D expenditure in advanced manufacturing techniques, requiring suppliers to focus on competitive pricing and localized support infrastructure.

- Middle East and Africa (MEA): The MEA region is currently the smallest market but shows potential, primarily driven by substantial investments in infrastructure, oil & gas (requiring specialized pipeline welding), and diversification initiatives. The key demand originates from construction, metal fabrication job shops, and growing defense-related manufacturing projects, particularly in countries like Saudi Arabia and the UAE. Adoption centers around durable, reliable fiber laser cutting systems for basic industrial processes. Market expansion is contingent on broader economic stabilization and increased foreign direct investment in localized, diversified manufacturing capabilities beyond the traditional reliance on the energy sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Processing Machines Market.- TRUMPF GmbH + Co. KG

- Coherent Corp.

- IPG Photonics Corporation

- Han's Laser Technology Industry Group Co., Ltd.

- Prima Industrie S.p.A.

- Amada Co., Ltd.

- Mitsubishi Electric Corporation

- Bystronic Laser AG

- Jenoptik AG

- Lumentum Holdings Inc.

- Photonics Industries International

- Rofin-Sinar Technologies (Bystronic Group)

- Trotec Laser GmbH

- Universal Laser Systems

- DPSS Lasers Inc.

- Hypertherm Associates

- Mazak Optonics Corporation

- Wuhan Golden Laser Co., Ltd.

- Novanta Inc. (Synrad)

- Laserline GmbH

Frequently Asked Questions

Analyze common user questions about the Laser Processing Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of high-power fiber lasers in manufacturing?

The primary driver is the exceptional wall-plug efficiency (up to 40%), superior beam quality, and high power scalability of fiber lasers, which enable faster processing speeds and significantly lower operational costs compared to older CO2 or Nd:YAG systems, crucial for mass production in automotive and heavy industry.

How are Ultra-Short Pulse (USP) lasers used in the semiconductor industry?

USP lasers (femto/picosecond) are vital for micro-machining and scribing sensitive semiconductor materials, glass, and display panels. They utilize "cold ablation" to remove material with minimal heat-affected zones, ensuring the integrity and functionality of miniature electronic components.

What impact does Industry 4.0 integration have on laser processing machines?

Industry 4.0 integration enables laser machines to communicate seamlessly within a smart factory ecosystem, leveraging IoT sensors and AI to achieve real-time process monitoring, predictive maintenance, automated parameter adjustments, and full robotic cell integration, maximizing productivity and minimizing downtime.

Which geographic region holds the largest market share for laser processing machines?

The Asia Pacific (APAC) region currently holds the largest market share, driven by massive production volumes in consumer electronics, electric vehicles (EVs), and robust government investments aimed at boosting domestic high-tech manufacturing capabilities, particularly in China and South Korea.

What are the main constraints limiting the widespread adoption of advanced laser processing technology?

The main constraints include the high initial capital investment required for state-of-the-art laser systems and associated automation, coupled with the ongoing challenge of a shortage of highly skilled technicians required for programming, operating, and maintaining these complex, highly technical systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager