Laser Soldering Robotic Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441419 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Laser Soldering Robotic Machine Market Size

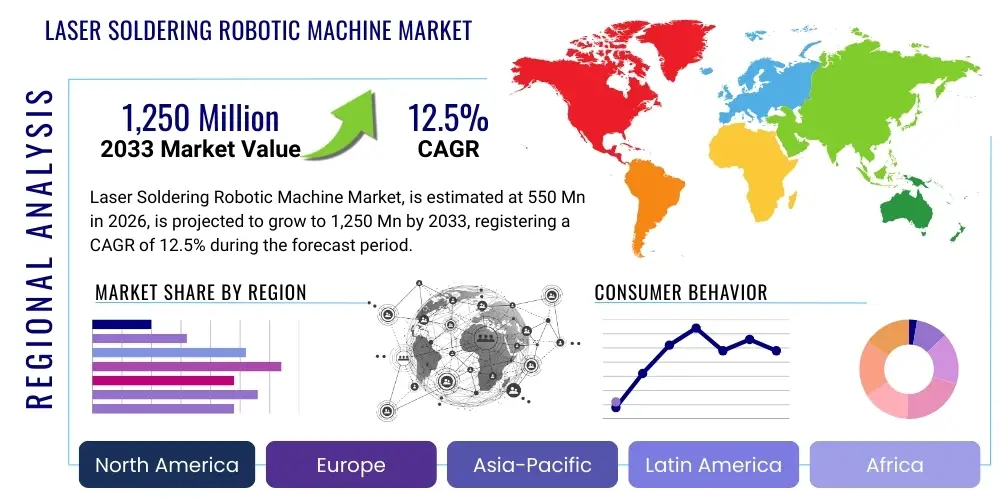

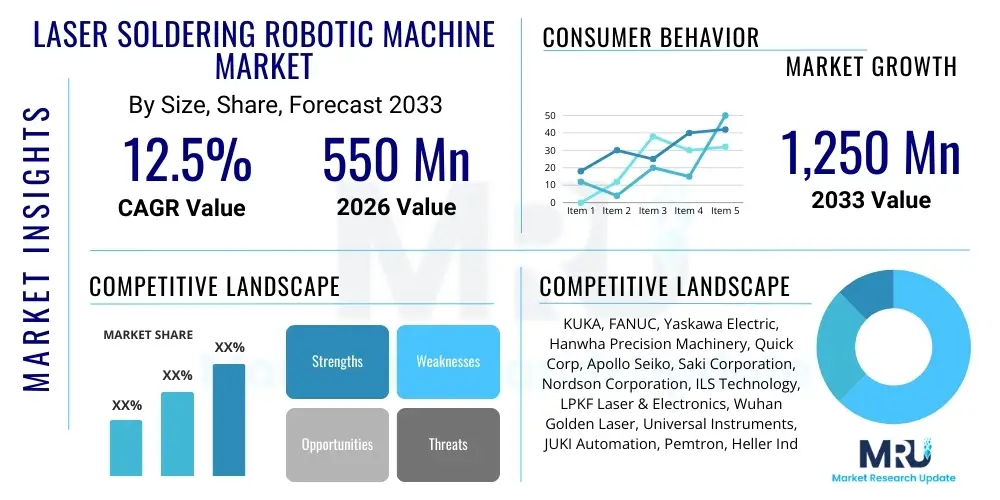

The Laser Soldering Robotic Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $550 Million in 2026 and is projected to reach $1,250 Million by the end of the forecast period in 2033.

Laser Soldering Robotic Machine Market introduction

The Laser Soldering Robotic Machine Market encompasses specialized automated systems designed for high-precision, non-contact soldering processes utilizing laser technology. These sophisticated machines integrate industrial robotic arms, high-powered laser sources (typically fiber or diode), advanced vision systems, and precise temperature control mechanisms to achieve superior joint quality, speed, and repeatability compared to traditional contact soldering methods. The core function involves directing focused laser energy onto the solder joint, melting the solder paste or wire rapidly and localizedly, minimizing thermal stress on surrounding components. This capability is critical in modern electronics manufacturing where miniaturization and high component density demand extreme accuracy and minimal heat exposure.

The primary product offerings within this market include standalone robotic laser soldering cells, integrated laser soldering modules for existing assembly lines, and fully customized automation solutions tailored for specific high-volume applications in industries such as automotive electronics, consumer electronics, medical devices, and aerospace. Major applications involve soldering surface-mounted devices (SMD), through-hole components in highly sensitive areas, flexible printed circuit boards (FPCBs), and intricate components that require selective heating. The precision afforded by laser technology makes these machines indispensable for complex assemblies like sensor integration, battery modules, and advanced driver-assistance systems (ADAS) components, where reliability is paramount.

Key benefits driving market adoption include significantly improved solder joint reliability, increased production throughput, reduced thermal damage risk to heat-sensitive components, and lower maintenance costs compared to conventional soldering tips that require frequent replacement. Driving factors for market growth stem from the relentless trend of miniaturization in electronic devices, the rapid expansion of the electric vehicle (EV) sector requiring specialized battery module connections, and the overarching industry need for high levels of automation to ensure consistency, quality control, and reduced labor reliance in manufacturing processes across global supply chains. Furthermore, the push towards Industry 4.0 and smart factory integration accelerates the deployment of these networked, data-generating robotic systems.

Laser Soldering Robotic Machine Market Executive Summary

The Laser Soldering Robotic Machine Market is experiencing robust growth driven by the convergence of advanced automation technologies and the stringent demands of high-density electronic packaging. Business trends indicate a strong shift towards flexible manufacturing setups and custom automation solutions, particularly those that integrate sophisticated machine vision and artificial intelligence for real-time process optimization and quality verification, moving away from rigid, dedicated lines. Major industry players are focusing on developing high-speed galvanometer scanners and improved beam shaping techniques to enhance efficiency and handle complex 3D soldering geometries. Strategic partnerships between robotic manufacturers and laser source suppliers are increasing, aiming to offer integrated, user-friendly solutions that simplify deployment and maintenance for end-users, especially contract manufacturers facing diverse production requirements.

Regionally, Asia Pacific (APAC) dominates the market share due to its entrenched position as the global hub for electronics manufacturing, notably in China, South Korea, and Taiwan, where heavy investment in automation capacity expansion is ongoing to maintain competitiveness and address rising labor costs. North America and Europe demonstrate significant growth potential, primarily driven by the increasing complexity of automotive electronics, aerospace component manufacturing, and the localized production of high-value medical devices, where quality standards necessitate the precision of laser technology. These regions are prioritizing highly automated, high-mix, low-volume production lines that benefit significantly from the adaptability of robotic laser systems.

Segment trends reveal that the Fiber Laser segment maintains dominance due to its high power, excellent beam quality, and longevity, although Diode Lasers are gaining traction for cost-sensitive, medium-precision applications. Application-wise, Electronics Assembly, particularly consumer electronics and telecommunications infrastructure (5G components), remains the largest segment, but the Automotive sector is projected to exhibit the fastest growth, propelled by the transition to electric vehicles and the resultant demand for reliable, high-integrity soldering of battery management systems (BMS) and power electronics. The adoption rate among Contract Manufacturers (CMs) is rapidly increasing as they seek flexible tools to manage varied client requirements efficiently, driving demand for multi-axis robotic platforms capable of handling diverse component geometries.

AI Impact Analysis on Laser Soldering Robotic Machine Market

Common user questions regarding AI's impact on laser soldering robotics frequently revolve around whether AI can truly enhance solder joint quality beyond current machine vision systems, how predictive maintenance will reduce expensive downtime, and the feasibility of real-time parameter self-adjustment based on material variations. Users are concerned about the complexity of integrating AI algorithms into existing manufacturing execution systems (MES) and the potential cost implications of required hardware upgrades, while simultaneously expecting AI to deliver unprecedented levels of defect detection and process consistency. The key themes emerging from this analysis are the expectation of truly adaptive manufacturing, where the robot acts autonomously to optimize processes based on deep learning from historical and real-time operational data, transforming quality control from merely detection to proactive prevention, thereby optimizing yield rates significantly.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is set to revolutionize the Laser Soldering Robotic Machine Market by moving the technology beyond mere programmed automation into the realm of true adaptive manufacturing. AI algorithms, particularly those leveraging deep learning, are increasingly being applied to interpret complex sensor data—including thermal profiles, laser power stability, and high-resolution visual feedback—to identify micro-anomalies in solder joints that human operators or standard rules-based machine vision systems often miss. This enhancement dramatically boosts the reliability of quality assurance processes and reduces the risk of field failures, which is critical in safety-critical applications like aerospace and autonomous vehicles. The ability of AI to categorize defects with greater specificity allows for faster root cause analysis and continuous improvement cycles.

Furthermore, AI is instrumental in optimizing the soldering process itself. Instead of relying on static, pre-programmed parameters, AI models can analyze incoming component tolerances, substrate variations, and environmental factors (such as ambient temperature) in real time and dynamically adjust laser power, exposure time, and robot trajectory. This predictive control ensures optimal thermal management for every single joint, maximizing bond integrity while minimizing heat-affected zones (HAZ). Additionally, AI-driven predictive maintenance models analyze vibration data, motor currents, and thermal signatures of the robotic system and laser source to forecast potential component failures, scheduling maintenance proactively, thereby maximizing machine uptime and overall equipment effectiveness (OEE) in high-volume production environments.

- AI enables highly precise, real-time solder joint defect detection, surpassing traditional machine vision capabilities.

- Machine Learning optimizes laser parameters (power, duration, focus) dynamically based on material and environment variations.

- Predictive maintenance driven by AI minimizes unexpected downtime and extends the operational life of expensive laser components.

- AI-enhanced robotic path planning improves throughput by calculating the most efficient, collision-free movement sequence for complex board layouts.

- Deep learning models facilitate autonomous quality confirmation and automated calibration, reducing reliance on manual oversight.

DRO & Impact Forces Of Laser Soldering Robotic Machine Market

The market dynamics are governed by significant Drivers (D), inherent Restraints (R), and compelling Opportunities (O), which collectively define the Impact Forces (I) shaping the industry’s trajectory. The primary driver is the accelerating trend toward miniaturization and high-density packaging (HDP) in electronics, necessitating the unparalleled precision of laser soldering for minute components and heat-sensitive substrates like FPCBs. Simultaneously, the global push for enhanced manufacturing automation, particularly in high-wage economies and industries with critical quality requirements (such as electric vehicles and medical devices), provides a strong impetus for investment in these advanced robotic systems. The restraint landscape is dominated by the high initial capital expenditure associated with procuring sophisticated laser sources, multi-axis robots, and integrated vision systems, coupled with the need for specialized technical expertise for programming and maintenance. Furthermore, the material-specific challenges related to laser absorption rates and the selection of appropriate flux materials can sometimes limit application scope or increase development time. However, the market is poised for growth due to significant opportunities, particularly the untapped potential within the rapidly expanding battery manufacturing sector (for EV and storage solutions) and the increasing demand for customized automation solutions for high-mix, low-volume production runs.

The Drivers section highlights several fundamental market shifts accelerating adoption. The stringent quality standards in industries like medical technology and aerospace require the exceptional repeatability and reliability that only robotic laser soldering can provide, ensuring compliance with rigorous regulatory frameworks. Moreover, the environmental and efficiency benefits derived from using non-contact, energy-efficient laser processes compared to large, power-intensive reflow ovens or complex selective soldering baths contribute significantly to adoption, aligning with corporate sustainability goals. The increasing complexity of modern electronics, featuring sensitive ICs and varying component heights on a single board, makes traditional contact methods infeasible, cementing the necessity for highly focused laser energy. This technological superiority in handling intricate tasks is a non-negotiable driver.

Addressing the Restraints, the complexity of integrating laser soldering into existing brownfield manufacturing sites often presents a significant hurdle, requiring not only capital investment but also extensive retooling and employee training, which slows down the adoption cycle for smaller manufacturers. Furthermore, the specialized nature of laser soldering means that process development can be highly iterative and dependent on specific material properties (e.g., solder alloy composition and pad metallization), requiring significant upfront research and engineering hours, which acts as a technical barrier to entry. Nevertheless, the Opportunities in developing compact, standardized laser soldering modules compatible with standard collaborative robot (cobot) platforms promise to lower the entry cost and broaden accessibility, particularly to Small and Medium Enterprises (SMEs). Additionally, continued innovation in solid-state laser technology, aiming for higher power efficiency and reduced maintenance requirements, promises to mitigate the operational cost restraints over the forecast period, making the technology viable for an ever-increasing range of production scenarios.

Segmentation Analysis

The Laser Soldering Robotic Machine Market is fundamentally segmented based on the type of laser technology employed, the specific application area, and the primary end-user industry utilizing these automated systems. This segmentation is crucial for understanding the diverse market dynamics and technological preferences across different manufacturing environments globally. Technological segmentation differentiates between fiber lasers, which offer high beam quality and stability suitable for micro-soldering, and diode lasers, which are often favored for cost-effectiveness and applications requiring broader heat distribution. The application segments clearly delineate where the precision and speed of laser soldering deliver the greatest value, ranging from the high volume and density of consumer electronics to the high reliability and stringent testing requirements of automotive power modules and aerospace components. The end-user perspective reveals where the primary investment capital originates, distinguishing between Original Equipment Manufacturers (OEMs) who integrate these machines into proprietary production lines and Contract Manufacturers (CMs) who rely on flexibility to serve multiple clients.

Analysis of these segments indicates that technological advancements in fiber laser systems, including improved focusing mechanisms and higher energy efficiency, continue to drive premium growth segments, particularly where miniaturization pressures are most intense. Conversely, the growth rate in the application segment is heavily influenced by macroeconomic trends, notably the pervasive shift toward electrification in the automotive industry, which requires reliable interconnection of cells and modules within battery packs—a task ideally suited for highly precise, automated laser systems. Geographic concentration of manufacturing capacity also dictates segment performance; for instance, the concentration of Tier 1 electronics suppliers in Asia Pacific heavily influences the demand for high-throughput robotic cells tailored for smartphone and networking equipment assembly. Understanding these interdependencies is key to formulating accurate market forecasts.

The strategic differentiation of product offerings along these segment lines allows vendors to target specific industry pain points. For example, offering integrated safety features and validated processes is paramount for the medical device segment, while sheer speed and compatibility with high-mix production software are essential selling points for contract manufacturers. The continued development of standardized, modular robotic cells facilitates easier integration across all end-user groups, bridging the gap between highly customized, expensive solutions and off-the-shelf automation. This trend towards modularity and user-friendliness is expected to significantly impact the market share distribution among end-users over the forecast period, democratizing access to high-precision soldering technology.

- By Technology

- Fiber Laser Soldering Robots

- Diode Laser Soldering Robots

- CO2 Laser Soldering Robots

- By Application

- Electronics Assembly (Consumer Electronics, Telecommunication)

- Automotive Electronics (ADAS, BMS, Power Modules)

- Medical Devices (Implants, Diagnostic Equipment)

- Aerospace and Defense

- Industrial Equipment and Others

- By End-User

- Original Equipment Manufacturers (OEMs)

- Electronic Manufacturing Services (EMS) / Contract Manufacturers (CMs)

- By Axis Configuration

- 3-Axis Robots

- 4-Axis Robots

- 6-Axis (Articulated) Robots

Value Chain Analysis For Laser Soldering Robotic Machine Market

The value chain for the Laser Soldering Robotic Machine Market begins with the upstream suppliers responsible for core components, moves through the midstream activities of system integration and manufacturing, and culminates in the downstream channels encompassing distribution, installation, and aftermarket service. The upstream phase is dominated by highly specialized technology providers, particularly manufacturers of high-power laser sources (such as fiber and diode lasers), precision robotic arms (often leveraging established industrial robotics platforms from key vendors like FANUC or KUKA), advanced machine vision systems, and sophisticated motion control hardware and software. The quality and performance of these core components directly dictate the final machine’s capabilities, making component sourcing a critical strategic activity. Suppliers of specialized soldering materials, including flux and solder alloys optimized for laser absorption, also form a key part of the upstream segment, ensuring process compatibility.

The midstream segment is characterized by complex system integration, where specialized automation companies and the major robotic machine manufacturers design, assemble, and test the complete laser soldering cell. This involves engineering the optimal coupling of the laser delivery system (including optics and galvanometer scanners) with the robot’s path planning software and the vision system for accurate component recognition and positioning. This phase adds significant intellectual property and value, transforming disparate components into a unified, high-precision manufacturing tool. Manufacturing often involves cleanroom assembly and rigorous calibration procedures to ensure the machine meets required soldering accuracy and speed specifications, tailored specifically for industrial environments like high-volume EMS facilities or specialized OEM lines.

Downstream activities focus on reaching the end-users through efficient distribution channels. Direct distribution is common for large, highly customized projects, especially those involving major OEMs in the automotive and aerospace sectors, allowing for specialized technical consultation and post-sale support. Indirect distribution utilizes a network of specialized automation distributors and system integrators who possess regional expertise and often combine the laser soldering machine with other auxiliary equipment (like conveyors or inspection stations) to provide turnkey solutions. Aftermarket services, including preventative maintenance, calibration, process optimization consulting, and supply of consumables (such as laser optics and solder material), represent a significant and recurring revenue stream, crucial for ensuring long-term customer satisfaction and machine uptime.

Laser Soldering Robotic Machine Market Potential Customers

The primary potential customers and end-users of Laser Soldering Robotic Machines span across high-tech manufacturing industries that require soldering processes characterized by high precision, low thermal impact, superior reliability, and high throughput. The largest consumer base is currently the Electronic Manufacturing Services (EMS) providers and Contract Manufacturers (CMs), who require flexible, high-volume automation tools to efficiently manage complex product mixes for clients in consumer electronics, computing, and telecommunications. These entities often operate under tight production schedules and need versatile systems capable of handling frequent changeovers between different circuit board types and component configurations, making robotic systems highly desirable due to their programmability and adaptability. The ability to guarantee solder joint integrity is critical for maintaining client contracts and reducing expensive rework.

A rapidly expanding segment of potential customers includes Original Equipment Manufacturers (OEMs) within the Automotive industry, particularly those focused on Electric Vehicles (EVs) and Advanced Driver-Assistance Systems (ADAS). The fabrication of battery management systems (BMS), power inverters, high-density sensor modules, and critical control units demands the highest level of solder joint consistency to ensure long-term reliability and safety, which laser soldering uniquely provides by minimizing thermal stress on sensitive components. OEMs in this sector are making significant long-term investments in dedicated robotic laser soldering lines to internalize quality control and secure proprietary process knowledge, often bypassing CMs for the most critical assemblies. This group values precision, traceability, and robust integration into their highly automated assembly plants.

Furthermore, specialized industries such as Medical Device manufacturing and Aerospace and Defense contractors represent high-value potential customers, although they typically involve lower production volumes. In the medical sector, applications involve micro-soldering intricate components for implants, hearing aids, and diagnostic equipment where component size is minuscule and failure tolerance is zero. Aerospace companies utilize these machines for soldering high-reliability communication modules and control electronics that must withstand extreme temperature variations and mechanical stress. For these customers, the key selling points are the machine's repeatability, compliance with stringent regulatory requirements (e.g., ISO 13485), and the capacity for complete process validation and data logging, making them willing to invest in premium, highly sophisticated robotic solutions to safeguard product integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,250 Million |

| Growth Rate | CAGR 12.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KUKA, FANUC, Yaskawa Electric, Hanwha Precision Machinery, Quick Corp, Apollo Seiko, Saki Corporation, Nordson Corporation, ILS Technology, LPKF Laser & Electronics, Wuhan Golden Laser, Universal Instruments, JUKI Automation, Pemtron, Heller Industries, IPG Photonics, Laserline GmbH, Trumpf Group, Automation Tooling Systems (ATS), Janome Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Laser Soldering Robotic Machine Market Key Technology Landscape

The technological landscape of the Laser Soldering Robotic Machine Market is defined by the synergistic integration of advanced laser physics, sophisticated robotics, and high-speed digital control systems. Core technologies include high-efficiency fiber lasers, which are favored for their small beam spot size, excellent power stability, and long maintenance intervals, making them ideal for precise micro-soldering applications found in consumer electronics and advanced sensor production. Furthermore, the evolution of diode lasers, offering higher power output at a more competitive cost, is expanding the application range into areas requiring greater heat input, such as large-scale battery tabs and power electronics modules. The critical advancement in this domain involves beam shaping technology, which utilizes complex optics and diffractive elements to achieve tailored thermal profiles, ensuring that the necessary energy is delivered precisely to the joint without overheating adjacent components or the substrate, optimizing the balance between process speed and component integrity.

Robotics technology forms the second pillar of the landscape, moving predominantly toward high-speed, high-accuracy articulated robots (6-axis) and specialized gantry or SCARA systems, chosen based on the required working envelope and payload. The accuracy of movement and repeatability (often sub-20 micron level) is non-negotiable for handling minute electronic components. A crucial technological element is the integration of advanced galvanometer scanners, which allow for rapid, non-contact beam repositioning within the robot's workspace. These scanners dramatically reduce overall cycle time by eliminating the need for full robot arm movement between closely spaced solder points, leading to significant throughput gains, especially in high-density printed circuit board (PCB) assembly. The coordination between the robot's motion controller and the galvanometer system is managed by specialized software that includes laser safety interlocks and sophisticated path optimization algorithms.

A third essential technology is the deployment of high-resolution, multi-spectral machine vision systems, often incorporating confocal or 3D profilometry sensors. These vision systems are integral for auto-teaching the solder points, compensating for component misalignment (fiducial recognition), and, most critically, performing in-line quality inspection. Vision feedback enables the system to measure the height and volume of the solidified solder joint in real-time, feeding data back for process correction (closed-loop control). The transition towards integrating these vision and control systems with centralized Manufacturing Execution Systems (MES) and leveraging Industrial Internet of Things (IIoT) connectivity ensures full process traceability and facilitates remote monitoring and diagnostic capabilities, underpinning the market's alignment with Industry 4.0 standards and enabling seamless data exchange for future AI-driven process improvements across manufacturing facilities globally.

Regional Highlights

-

Asia Pacific (APAC): Global Manufacturing Hub and Dominance

The Asia Pacific region currently holds the dominant share in the Laser Soldering Robotic Machine Market, fueled by its unparalleled position as the global manufacturing center for electronics, automotive components, and medical devices. Countries like China, South Korea, Taiwan, and Japan are heavily invested in advanced automation solutions to combat rising labor costs, improve product quality consistency, and scale production rapidly to meet global demand for consumer electronics (smartphones, 5G equipment) and advanced computing hardware. The sheer volume of PCB assembly and flexible circuit production in this region necessitates high-speed, reliable soldering technologies, making robotic laser systems an essential capital investment for major Electronic Manufacturing Services (EMS) providers and local OEMs. Government initiatives in countries like China, promoting 'Made in China 2025,' further encourage the adoption of high-precision, domestically manufactured automation tools, driving both consumption and local production capacity.

Furthermore, APAC is at the forefront of the Electric Vehicle (EV) revolution, particularly in China and South Korea, where massive battery Gigafactories are being established. Laser soldering robots are critical for connecting battery tabs and busbars within EV battery packs, requiring extremely robust, repeatable welds to ensure battery safety and longevity. This burgeoning EV supply chain represents the fastest-growing application segment in the region. The competitive landscape in APAC is highly dynamic, featuring intense competition between global market leaders and sophisticated local suppliers who are increasingly developing competitive laser and robotic solutions tailored to the unique scale and cost constraints of the region, emphasizing throughput efficiency above all else.

-

North America: High-Value, Specialized Manufacturing Focus

North America represents a significant and growing market, characterized by a focus on high-mix, low-volume production, high-value manufacturing sectors, and stringent quality regulations, particularly in aerospace, defense, and advanced medical device manufacturing. Adoption is driven by the necessity for complete process traceability, extreme component reliability, and the requirement to handle proprietary, complex assemblies, often incorporating sensitive military-grade or medical-grade electronics. The increasing reshoring of specialized manufacturing tasks, driven by geopolitical concerns and supply chain resilience objectives, further boosts the demand for highly automated, flexible robotic cells that can be quickly repurposed.

Investment in the region is heavily concentrated among OEMs in the automotive and aerospace industries, particularly those integrating ADAS components and developing sophisticated communication systems where failure is unacceptable. The technological focus in North America leans towards systems integrating advanced AI, highly sophisticated vision systems, and comprehensive data logging capabilities, positioning the region as a leader in adopting truly smart, Industry 4.0 compliant laser soldering solutions. The market here values specialized application expertise and long-term service contracts offered by vendors, prioritizing robust operational performance and compliance over minimizing initial capital cost.

-

Europe: Automation and Automotive Excellence

Europe constitutes a mature market with high automation penetration, driven by strong manufacturing bases in Germany, Italy, and France, particularly within the automotive, industrial equipment, and advanced machinery sectors. The European market is rapidly transitioning towards EV manufacturing and sustainable industrial practices, necessitating high-precision soldering for power electronics, sensors, and control units within vehicles. Regulatory pressures concerning quality and environmental standards often mandate the use of highly controlled processes, which favors the non-contact, energy-efficient nature of laser soldering technology.

The regional market exhibits a strong demand for integrated solutions that minimize footprint and seamlessly connect with existing production infrastructure. European end-users, primarily OEMs, emphasize modularity, ease of retooling, and adherence to strict safety standards (CE certification). Research and development efforts across the region focus on improving laser spot size control and developing new fluxless or low-residue soldering methods compatible with laser application, aiming to reduce post-soldering cleaning steps. Germany, being a hub for high-end automotive suppliers, remains a pivotal consumer of laser soldering robotics for critical engine and chassis control assemblies.

-

Latin America and Middle East & Africa (LAMEA): Emerging Growth Centers

LAMEA currently represents a smaller, but rapidly emerging market. Growth in Latin America, particularly Mexico and Brazil, is linked to the expansion of local electronics assembly operations and the establishment of manufacturing hubs catering to North American demand, leveraging competitive labor costs alongside high automation standards. The adoption is primarily concentrated among major EMS providers setting up regional facilities, demanding cost-effective, yet reliable, high-throughput robotic solutions to serve export markets.

The Middle East and Africa regions are showing nascent growth, driven primarily by investments in developing local high-tech infrastructure, defense manufacturing capabilities, and renewable energy projects (solar components, energy storage systems). While the market size remains smaller, targeted investments in specific, high-reliability sectors, such as defense electronics in the Gulf countries and automotive assembly plants in South Africa, indicate future localized growth opportunities, focusing initially on turnkey systems requiring minimal local engineering expertise.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Laser Soldering Robotic Machine Market.- KUKA

- FANUC

- Yaskawa Electric

- Hanwha Precision Machinery

- Quick Corp

- Apollo Seiko

- Saki Corporation

- Nordson Corporation

- ILS Technology

- LPKF Laser & Electronics

- Wuhan Golden Laser

- Universal Instruments

- JUKI Automation

- Pemtron

- Heller Industries

- IPG Photonics

- Laserline GmbH

- Trumpf Group

- Automation Tooling Systems (ATS)

- Janome Corporation

- Shenzhen Greatec Automation Technology Co., Ltd.

- Techman Robot (Quanta Storage)

- Epson Robots

- Staubli International AG

- Seica S.p.A.

Frequently Asked Questions

Analyze common user questions about the Laser Soldering Robotic Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of laser soldering over traditional soldering methods?

Laser soldering offers superior advantages including non-contact heating, extremely localized thermal input which prevents damage to heat-sensitive components, faster process cycles, and higher positional accuracy (repeatability), crucial for miniaturized and high-density electronics assembly and high-reliability components.

How does the integration of AI affect the efficiency and cost of laser soldering robots?

AI significantly boosts efficiency by enabling real-time, adaptive process control, automatically adjusting laser parameters for material variation, minimizing defects, and implementing predictive maintenance to reduce costly, unplanned downtime. While initial investment may be higher, AI integration maximizes throughput and minimizes long-term operational costs.

Which laser technology (Fiber vs. Diode) is most prevalent in the current market?

Fiber laser technology is currently the most prevalent and preferred choice, especially for micro-soldering and high-precision tasks, due to its excellent beam quality, stability, and longevity. However, diode lasers are gaining market share in applications requiring greater cost-efficiency or larger spot sizes, such as battery pack assembly.

What is the key driver for the adoption of laser soldering robots in the automotive industry?

The primary driver is the rapid proliferation of Electric Vehicles (EVs) and complex ADAS components. Laser soldering ensures the high integrity and reliability required for safety-critical power electronics and battery management systems (BMS), mitigating thermal stress and guaranteeing stable connections under harsh operational conditions.

What is the typical range for the initial investment cost of a laser soldering robotic machine?

The initial investment for a high-precision laser soldering robotic cell can vary widely based on complexity, ranging from medium-range costs for a basic SCARA-based cell to significantly higher costs for sophisticated, integrated 6-axis robotic systems featuring high-power fiber lasers, advanced machine vision, and AI-enabled closed-loop control.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager