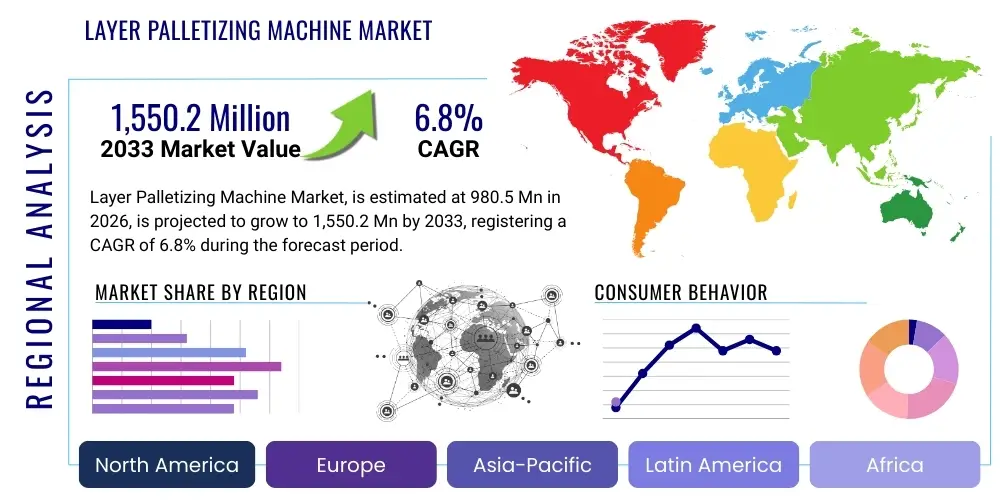

Layer Palletizing Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441963 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Layer Palletizing Machine Market Size

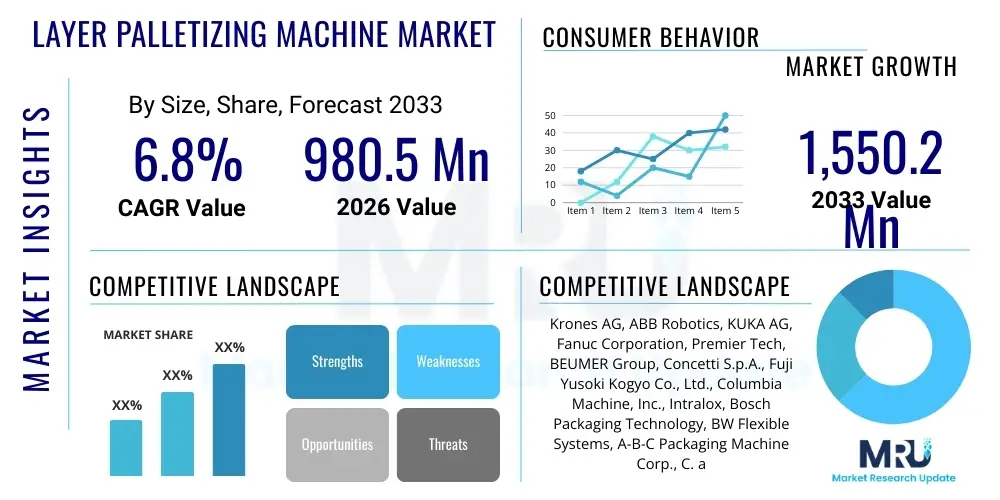

The Layer Palletizing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 980.5 Million in 2026 and is projected to reach USD 1,550.2 Million by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the increasing demand for enhanced automation across high-throughput industrial sectors, particularly within fast-moving consumer goods (FMCG) and food and beverage production. Layer palletizers offer superior speed and precision compared to conventional methods, addressing critical operational needs for efficiency and reduced labor costs in large-scale logistics and distribution centers globally. The economic viability of these sophisticated machinery solutions is driving widespread adoption across developing and developed economies.

Layer Palletizing Machine Market introduction

The Layer Palletizing Machine Market encompasses advanced automated systems designed to stack products, cases, bags, or other containers onto pallets in defined, stable layer configurations. These systems are crucial components in end-of-line packaging operations, facilitating efficient shipment preparation and maximizing storage density. Layer palletizers are segmented primarily by operational speed (high-level, low-level) and mechanical sophistication (conventional automatic, robotic). The core product description involves intricate mechanical and software systems capable of handling diverse product weights and sizes, ensuring optimal layer interlocking patterns for transport stability. Major applications span industries requiring bulk handling and precise stacking, including breweries, soft drink manufacturers, large-scale food processing facilities, pharmaceutical distributors, and chemical manufacturers.

The primary benefits derived from the deployment of layer palletizing machines include significant labor reduction, minimization of product damage during handling, and dramatic improvement in throughput efficiency. By automating the repetitive, ergonomically challenging task of pallet stacking, companies can reallocate human resources to more complex supervisory or quality control roles. Driving factors fueling market expansion include the global surge in e-commerce, which necessitates faster and more reliable distribution networks; stringent safety regulations promoting automation to reduce workplace injuries; and continuous technological advancements in robotics and vision systems that enhance machine flexibility and speed. Furthermore, the persistent pressure on manufacturing sectors to optimize supply chain costs makes the investment in high-capacity palletizing solutions highly compelling, particularly in economies experiencing rapid industrialization and escalating wage costs.

The market landscape is characterized by innovation focused on modular designs and rapid changeover capabilities, addressing the increasing product variety (SKU proliferation) seen in consumer markets. Palletizing solutions are evolving to handle unconventional packaging formats, demanding greater adaptability from machine manufacturers. Key industry stakeholders are investing heavily in connectivity features, enabling seamless integration with Warehouse Management Systems (WMS) and Manufacturing Execution Systems (MES) to facilitate real-time performance monitoring and predictive maintenance. This shift toward Industry 4.0 compliant machinery further solidifies layer palletizers as essential infrastructure for modern, resilient manufacturing operations, setting the stage for sustained market expansion through the forecast period.

Layer Palletizing Machine Market Executive Summary

The Layer Palletizing Machine Market is experiencing robust business trends driven by the imperative for operational resilience and efficiency gains within global supply chains. Key business trends include a pronounced shift toward robotic palletizing systems due to their superior flexibility, smaller footprint, and enhanced handling capabilities for delicate or irregularly shaped products. Furthermore, market competition is fostering greater emphasis on customized solutions and service contracts, moving beyond standard equipment sales to integrated system offerings. Corporate strategic investments are focused on mergers and acquisitions to consolidate technological expertise, particularly in software integration and end-of-arm tooling (EOAT) development, ensuring competitive advantage in sophisticated automation segments. The overarching trend involves manufacturers prioritizing total cost of ownership (TCO) assessments, recognizing that high upfront automation investment yields substantial long-term returns through efficiency and labor savings.

Regionally, the Asia Pacific (APAC) market is anticipated to demonstrate the highest growth rate, fueled by massive industrial expansion, government initiatives supporting manufacturing automation (such as "Made in China 2025" and "Make in India"), and rapid urbanization leading to increased demand for packaged goods. North America and Europe, while mature, maintain dominant market shares due to high existing automation levels and early adoption of advanced technologies like AI-driven pattern recognition and collaborative robotics in palletizing. Investment in cold chain logistics infrastructure in these regions is also driving demand for specialized layer palletizing solutions capable of operating reliably in harsh temperature environments. The Middle East and Africa (MEA) region shows emerging promise, particularly driven by large-scale infrastructural projects and investments in local food production facilities aimed at enhancing regional food security.

In terms of segment trends, the automatic operation segment dominates the market, reflecting the widespread adoption of high-speed, high-volume production lines. Within product types, robotic palletizers are rapidly gaining ground, threatening the dominance of conventional high-level palletizers, largely owing to improved ROI metrics and scalability. The Food & Beverage application sector remains the largest segment consumer, specifically driven by the beverage industry’s requirement for continuous, high-speed case handling. However, the Pharmaceutical and Chemical industries are exhibiting accelerated adoption rates, driven by stringent tracking requirements and the need for precision stacking to prevent cross-contamination and ensure package integrity. The trend across all segments is the increasing integration of vision systems and sensors to enhance quality control directly within the palletizing process, aligning automation with zero-defect manufacturing goals.

AI Impact Analysis on Layer Palletizing Machine Market

User queries regarding AI’s impact on the Layer Palletizing Machine Market frequently revolve around performance optimization, adaptability to variable product mixes, and the future integration of machine vision for quality assurance. Common concerns include: "How does AI improve pallet stacking efficiency and stability?" "Can AI handle unpredictable SKU variations without extensive reprogramming?" and "Will AI-powered vision systems replace human inspection entirely?" Analysis indicates that users expect AI to transition palletizing systems from rigid, pre-programmed operations to highly adaptive, learning environments. Key themes highlight the expectation that AI will optimize complex layer formation algorithms in real-time, reducing material waste and maximizing pallet density, thereby directly impacting logistical costs. Furthermore, users anticipate AI will significantly reduce downtime by implementing superior predictive maintenance models based on continuous operational data analysis, shifting maintenance practices from reactive to proactive, ensuring minimal disruption to high-volume end-of-line processes.

The integration of artificial intelligence (AI) and machine learning (ML) is fundamentally transforming the operational paradigm of layer palletizing machines, moving them towards true smart manufacturing assets. AI algorithms are now deployed to calculate optimal pallet patterns for mixed product loads (rainbow pallets) in real-time, a previously manual and time-intensive task. This optimization maximizes container utilization and reduces damage during transit, directly improving profitability for logistics providers and manufacturers alike. Machine vision systems powered by deep learning identify subtle defects in packaging, misplaced labels, or instability during the stacking process with accuracy far surpassing traditional sensor-based systems. This capability ensures that only high-quality, securely stacked pallets leave the production facility, adhering to strict customer and regulatory standards.

Furthermore, AI is pivotal in enhancing the diagnostic capabilities of these machines. By analyzing vast datasets generated during operation—including motor temperatures, cycle times, vibration profiles, and energy consumption—AI models can predict component failures long before they occur. This predictive maintenance capability dramatically boosts the Overall Equipment Effectiveness (OEE) of palletizing lines, minimizing unplanned stoppages which are costly in high-throughput environments. The next phase of AI integration is focused on collaborative robotics (cobots) used in palletizing, where AI ensures safe and efficient interaction between human operators and machinery, especially in semi-automatic setups or during complex product changeovers, further broadening the applicability of advanced automation in diverse manufacturing contexts.

- AI-driven real-time layer pattern optimization for mixed SKU loads.

- Enhanced predictive maintenance minimizing unplanned downtime and boosting OEE.

- Deep learning-based machine vision for superior quality control and defect detection.

- Autonomous fault diagnosis and self-correction mechanisms in robotic systems.

- Improved energy consumption profiling and optimization through ML models.

- Facilitation of human-robot collaboration (cobots) in complex palletizing tasks.

DRO & Impact Forces Of Layer Palletizing Machine Market

The dynamics of the Layer Palletizing Machine Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market direction and growth velocity. The primary driving forces include the escalating global demand for automation to counteract rising labor costs and shortages, especially in developed economies, coupled with the critical need for increased throughput and efficiency in the manufacturing sector. Restraints largely center around the significant initial capital investment required for high-end automatic and robotic systems, presenting a considerable barrier to entry for Small and Medium-sized Enterprises (SMEs). Additionally, the need for highly skilled technicians to operate, program, and maintain these complex machines poses a workforce challenge, particularly in rapidly industrializing regions where specialized labor is scarce. Opportunities are abundant, rooted in the potential for mass adoption in emerging economies and continuous technological innovation, especially the development of modular, scalable, and software-defined palletizing solutions that lower the entry barrier and increase operational flexibility.

Key drivers strongly influencing adoption include the necessity for superior product protection during transit, which layer palletizers provide through consistently precise stacking, mitigating losses due to damage. Furthermore, the global expansion of e-commerce requires logistics centers and distribution facilities to handle massive volumes with stringent speed requirements, making manual processes obsolete. The Impact Force resulting from these drivers is a market pull towards higher speed and greater technological integration (Industry 4.0 compatibility). Conversely, the restraining force of high initial cost is moderated by the growing availability of leasing and financing options, alongside the demonstrable rapid return on investment (ROI) achieved through operational expenditure savings and increased productivity. Regulatory mandates concerning workplace safety also subtly drive adoption, as automated palletizing drastically reduces repetitive strain injuries and accidents associated with manual handling of heavy goods.

The primary opportunity in the market lies in targeting smaller production environments through the deployment of flexible, collaborative robotic palletizing solutions that offer a smaller footprint and lower entry price point than conventional high-level systems. This expansion into the SME sector, particularly in packaging and logistics services, represents a significant growth vector. Another powerful opportunity stems from customizing solutions for specialized or non-standard applications, such as handling temperature-sensitive pharmaceutical products or unusually shaped containers, where conventional machines struggle. The combination of sustained automation demand (Driver), mitigating financial barriers through financing (Restraint mitigation), and technological penetration into new market segments (Opportunity) generates a powerful, positive cumulative impact force, ensuring sustained, above-average growth for the layer palletizing machine sector through the forecast period 2026-2033.

Segmentation Analysis

The Layer Palletizing Machine Market is rigorously segmented based on product functionality, operational mechanism, and end-use application, providing clarity on diverse consumer needs and technological trajectories. This structured segmentation is critical for market participants to identify niche opportunities, tailor product development, and refine sales strategies effectively. Product type segmentation distinguishes between conventional high-level and low-level machines—defined by their product entry height—and the highly flexible robotic systems, which are increasingly defining the market's future. Operationally, the divide between fully automatic systems, dominating high-volume environments, and semi-automatic systems, often favored by smaller firms or those with highly varied product inputs, dictates investment profiles. Application segmentation highlights the dominance of the Food & Beverage sector but underscores the rapid acceleration of adoption in Pharmaceuticals and Consumer Goods, driven by quality and compliance mandates.

- By Product Type: High-Level Palletizers, Low-Level Palletizers, Robotic Palletizers.

- By Operation: Automatic, Semi-Automatic.

- By Application: Food & Beverage, Pharmaceuticals, Chemicals, Consumer Goods, Others (e.g., Building Materials, Logistics).

Value Chain Analysis For Layer Palletizing Machine Market

The value chain of the Layer Palletizing Machine Market begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized steels, aluminum alloys, and high-precision electronic components (sensors, PLCs, motors, and robotics arms). Key upstream suppliers include steel manufacturers, specialized robotics component suppliers (e.g., encoders, actuators), and industrial software developers providing proprietary control systems. The efficiency and quality control implemented at this stage, particularly the reliance on high-quality servo motors and robust structural materials, directly influence the final reliability and performance metrics of the palletizing machine. Strong relationships with reliable robotics core technology providers are essential for integrators focusing on robotic palletizing solutions, ensuring access to the latest generation of flexible and fast manipulators.

Mid-stream, the value chain focuses on core manufacturing, system integration, software development, and assembly. This involves designing the machine architecture, assembling mechanical components, integrating electrical systems, and, crucially, developing or customizing the sophisticated software required for pattern generation, system diagnostics, and seamless communication with enterprise resource planning (ERP) systems. Distribution channels are varied but typically involve a combination of direct sales for large, customized installations and indirect sales through a global network of specialized systems integrators, distributors, and value-added resellers (VARs). The direct channel ensures better control over complex project execution, while the indirect channel leverages local expertise for localized support and quicker market penetration in diverse geographical areas. Effective distribution hinges on minimizing transit damage and providing swift, localized installation support.

Downstream activities center on deployment, maintenance, and after-sales service, which are critical differentiators in this market. Since palletizers are long-term capital assets, customers heavily prioritize ongoing support, availability of spare parts, and remote diagnostic capabilities. The final customer (end-user) utilizes the machine within their end-of-line packaging setup. The value capture moves beyond the initial equipment sale to lucrative long-term service contracts, software update subscriptions, and performance consulting, which enhance machine life and productivity. Optimization of the downstream process through digital tools (e.g., remote monitoring, virtual reality training) is a growing trend, ensuring high machine uptime and maximizing customer satisfaction and retention.

Layer Palletizing Machine Market Potential Customers

The Layer Palletizing Machine Market targets a broad spectrum of industrial end-users characterized by high-volume production and complex logistical demands for packaged goods. The primary buyers are large-scale manufacturing and processing facilities that require automated, continuous, and high-speed packaging lines to meet immense consumer demand. These customers typically operate 24/7 or three-shift cycles, making machine reliability and throughput paramount investment criteria. The largest cohort includes multinational food and beverage corporations, particularly those handling bottled water, soft drinks, beer, dairy products, and canned goods, where uniformity and speed are non-negotiable. These end-users seek fully automatic, high-level palletizers capable of handling thousands of cases per hour with minimal human intervention, focusing on maximizing pallet stability for extensive distribution networks.

A rapidly expanding customer base resides within the pharmaceutical and chemical sectors, driven less by sheer volume than by stringent regulatory requirements concerning product traceability, integrity, and non-contact handling. Pharmaceutical companies utilize layer palletizers for precise, often slower, handling of sensitive medical supplies or packaged drugs, prioritizing gentle handling and validated stacking patterns to maintain compliance. The chemical industry, dealing with potentially hazardous materials, requires specialized machinery designed for corrosive environments and equipped with enhanced safety features. For these customers, the investment justification rests on compliance, safety, and the elimination of human error, rather than simply maximizing throughput speed.

Furthermore, third-party logistics (3PL) providers and large distribution centers (DCs), especially those supporting the flourishing e-commerce sector, represent significant potential customers. These entities often require flexible robotic palletizing solutions capable of handling mixed SKUs and varying package sizes frequently (rainbow palletizing), necessitating machines with quick reconfiguration capabilities. The increasing demand for automation in warehousing and the modernization of cold chain logistics further broadens the customer base, requiring rugged, software-integrated machines. Ultimately, any organization struggling with escalating manual labor costs, aiming to increase stacking density, or requiring consistently high packaging quality across its supply chain is a prime potential customer for layer palletizing technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 980.5 Million |

| Market Forecast in 2033 | USD 1,550.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Krones AG, ABB Robotics, KUKA AG, Fanuc Corporation, Premier Tech, BEUMER Group, Concetti S.p.A., Fuji Yusoki Kogyo Co., Ltd., Columbia Machine, Inc., Intralox, Bosch Packaging Technology, BW Flexible Systems, A-B-C Packaging Machine Corp., C. automática, PALLAYPACK, Sidel (Tetra Laval), Mollers North America, Arrowhead Systems, Inc., SSI SCHAEFER, Wulftec International Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Layer Palletizing Machine Market Key Technology Landscape

The technological landscape of the Layer Palletizing Machine Market is defined by a rapid transition toward sophisticated digital integration and advanced robotics, collectively forming the backbone of modern end-of-line automation. Conventional mechanical systems, while still prevalent, are being augmented or replaced by solutions incorporating complex servo motor controls, enabling smoother, faster, and more precise movements critical for handling fragile goods. A pivotal technology is the adoption of advanced Programmable Logic Controllers (PLCs) and industrial PCs (IPCs) which serve as the central nervous system, managing complex sequence execution, speed optimization, and real-time interface with upstream packaging machinery. The efficiency of contemporary palletizers is intrinsically linked to the algorithms used for generating optimal stacking patterns, maximizing load stability and pallet cube utilization, an area increasingly benefiting from AI and ML modeling.

Furthermore, robotics technology represents the fastest-growing segment in terms of innovation. Specifically, articulated arm robots and gantry robots are now common, offering high flexibility and a wide range of motion, making them ideal for handling diverse product formats, often referred to as 'random' or 'mixed case' palletizing. End-of-arm tooling (EOAT) technology has seen significant advancements, with vacuum cups, mechanical grippers, and hybrid systems designed for rapid changeover and versatile handling of different packaging materials—from shrink-wrapped trays to flexible bags. Vision systems, often utilizing 2D and 3D cameras, are becoming standard features, enabling machines to accurately identify product orientation, verify layer integrity, and guide robotic arms with micron-level precision, directly supporting quality assurance mandates.

The paramount technology trend aligning with Industry 4.0 standards is connectivity. Modern layer palletizers are equipped with IoT sensors and communication protocols (like OPC UA or proprietary industrial Ethernet standards) to facilitate seamless data exchange. This enables remote monitoring, predictive maintenance, and integration into broader manufacturing execution systems (MES) and enterprise resource planning (ERP). Manufacturers are focusing heavily on developing user-friendly Human-Machine Interfaces (HMIs) featuring intuitive graphical programming tools, reducing the reliance on specialized programming skills and allowing production staff to manage changeovers and troubleshoot minor issues efficiently. This focus on connectivity and usability is crucial for ensuring rapid deployment and maximizing the return on investment for end-users across various industrial scales.

Regional Highlights

The Layer Palletizing Machine Market exhibits varied growth dynamics and adoption rates across major geographical regions, influenced by differences in labor costs, industrialization levels, and technological maturity. North America and Europe currently represent the largest revenue share, characterized by high automation penetration, stringent workplace safety regulations, and early adoption of high-speed, robotic, and interconnected palletizing solutions. Demand in these regions is driven primarily by the need to optimize existing logistics infrastructure, replace aging conventional machinery, and maintain competitive labor costs through automation. Investments are heavily concentrated on sophisticated software integration and flexible systems to manage growing product diversity.

Asia Pacific (APAC) stands out as the highest growth region globally. The market expansion here is fueled by massive investments in new manufacturing capabilities, particularly in China, India, and Southeast Asian nations, driven by rising domestic consumption and foreign direct investment in processing facilities. These economies are rapidly transitioning from manual operations directly to high-capacity automatic and robotic palletizing systems to handle burgeoning volumes in the food and beverage and e-commerce logistics sectors. Government support for industrial modernization further accelerates this trend, compensating for lower initial labor costs compared to Western markets.

Latin America (LATAM) and the Middle East and Africa (MEA) represent emerging markets where growth is steadily accelerating. In LATAM, demand is often tied to resource processing and large-scale consumer goods manufacturing, with investments prioritizing robust, easy-to-maintain conventional palletizers before transitioning fully to robotics. The MEA region's growth is largely focused on major infrastructure projects, including food security initiatives and new chemical processing plants, driving demand for reliable, high-capacity machinery. While starting from a smaller base, these regions offer significant future opportunities as their industrial bases mature and logistic requirements intensify.

- North America: Market leader in adopting robotic palletizers and sophisticated Industry 4.0 integration; focus on retrofitting and high-speed efficiency in food and beverage.

- Europe: Strong emphasis on energy efficiency, precision engineering, and adherence to strict safety standards (CE Mark); significant adoption in pharmaceuticals and chemicals.

- Asia Pacific (APAC): Fastest growing region, driven by rapid industrialization, massive production volumes, and government incentives for factory automation in China and India.

- Latin America (LATAM): Growing demand in the beverage and agriculture sectors; slower adoption of high-end robotics, but increasing investment in reliable semi-automatic and conventional automatic systems.

- Middle East and Africa (MEA): Emerging market driven by new manufacturing capacity development, infrastructure investments, and focus on enhancing local food processing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Layer Palletizing Machine Market.- Krones AG

- ABB Robotics

- KUKA AG

- Fanuc Corporation

- Premier Tech

- BEUMER Group

- Concetti S.p.A.

- Fuji Yusoki Kogyo Co., Ltd.

- Columbia Machine, Inc.

- Intralox

- Bosch Packaging Technology

- BW Flexible Systems

- A-B-C Packaging Machine Corp.

- C. automática

- PALLAYPACK

- Sidel (Tetra Laval)

- Mollers North America

- Arrowhead Systems, Inc.

- SSI SCHAEFER

- Wulftec International Inc.

Frequently Asked Questions

What is the projected CAGR for the Layer Palletizing Machine Market between 2026 and 2033?

The Layer Palletizing Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period from 2026 to 2033, driven by increasing automation needs across global manufacturing and logistics sectors.

Which type of layer palletizer is experiencing the highest growth rate?

Robotic Palletizers are exhibiting the highest growth rate due to their superior flexibility, adaptability to mixed SKUs, smaller operational footprint, and enhanced capabilities in integrating advanced vision systems and AI for real-time optimization.

How does AI impact the operational efficiency of layer palletizing systems?

AI significantly impacts efficiency by enabling real-time calculation of optimal stacking patterns for complex or mixed loads, improving predictive maintenance to minimize unplanned downtime, and enhancing quality control through advanced machine vision defect detection.

Which geographical region is expected to dominate market growth?

The Asia Pacific (APAC) region is forecasted to dominate market growth in terms of absolute growth rate, spurred by rapid industrialization, expansion of domestic consumer markets, and substantial investments in new automated manufacturing facilities, particularly in China and India.

What is the primary factor restraining the widespread adoption of automated layer palletizers?

The primary restraint is the high initial capital investment required for purchasing, integrating, and deploying high-speed automatic and robotic layer palletizing systems, which can pose a financial barrier for smaller or medium-sized enterprises (SMEs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager