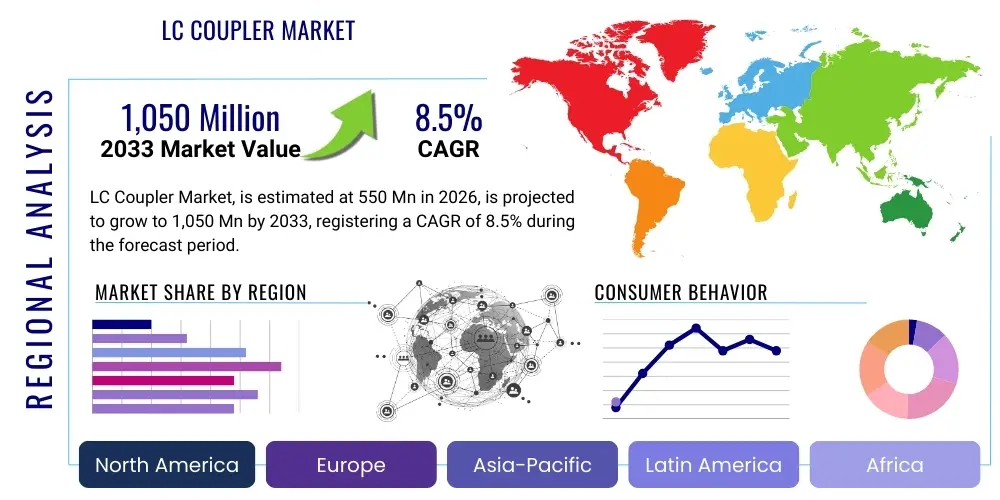

LC Coupler Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441294 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

LC Coupler Market Size

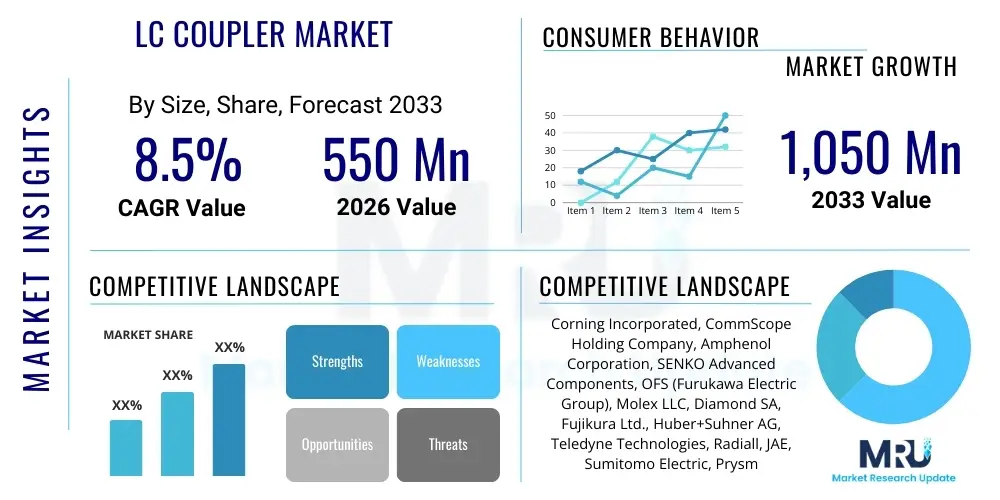

The LC Coupler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This robust expansion is fueled by the relentless global proliferation of high-speed data infrastructure and the burgeoning demand for reliable, low-loss optical interconnect solutions across telecommunications and enterprise sectors. The market is estimated at $550 Million in 2026 and is projected to reach $1,050 Million by the end of the forecast period in 2033, showcasing a significant increase in deployment volume particularly within hyper-scale data centers and FTTx networks. This growth trajectory reflects the critical role LC couplers play in maintaining signal integrity in high-density fiber management systems.

LC Coupler Market introduction

The LC Coupler Market encompasses the global trade and utilization of passive optical components designed to precisely align and connect two LC (Lucent Connector, also known as Little Connector or Local Connector) fiber optic plugs, ensuring stable light transmission with minimal insertion loss and back reflection. Developed to meet the demands of high-density packaging, the LC connector and its corresponding coupler are essential in modern fiber optic infrastructure, offering superior performance in a smaller form factor compared to older standards like SC or ST. These couplers are vital for extending connectivity, patching networks, and terminating equipment within confined spaces, establishing the foundation for robust, high-bandwidth networks.

Major applications for LC couplers span the breadth of digital communication, predominantly centered around telecommunication exchanges, enterprise networks, metropolitan area networks (MANs), and, most critically, massive data center environments. The shift towards 400G and 800G Ethernet standards necessitates dense, reliable interconnects, which the small footprint and secure latching mechanism of the LC coupler effectively addresses. Benefits include enhanced network scalability, reduced physical footprint in racks and patch panels, simplified installation and maintenance procedures, and excellent long-term durability. The core function of the coupler—to ensure physical contact between opposing ferrules—is fundamental to maintaining the low attenuation required for long-distance and high-speed signal transmission.

Driving factors for market growth include the exponential increase in mobile data traffic (5G deployments), widespread implementation of Fiber-to-the-Home (FTTH) and Fiber-to-the-Curb (FTTC) globally, and the continuous expansion of cloud computing infrastructure which demands ever-larger hyper-scale data centers. Furthermore, the growing adoption of Passive Optical Networks (PON) technology, particularly 10G PON variants, significantly boosts the demand for high-quality, standardized LC coupling hardware. Regulatory mandates pushing for broadband penetration in developing regions also contribute positively to market dynamics, ensuring continuous demand for the underlying physical layer components like LC couplers.

LC Coupler Market Executive Summary

The LC Coupler Market is experiencing robust acceleration driven by secular trends in digitalization, infrastructure modernization, and the global race toward higher bandwidth capacity. Business trends highlight a strong focus on manufacturing automation to improve precision and reduce cost per unit, coupled with strategic mergers and acquisitions among component manufacturers aiming to consolidate supply chains and secure key intellectual property regarding low-loss ferrule alignment technology. The integration of specialty materials, such such as ceramic sleeves for enhanced thermal stability and improved long-term reliability, represents a crucial technological shift. Key players are prioritizing the development of high-density coupler assemblies (duplex and quad) and hardened outdoor-rated variants to capitalize on opportunities in ruggedized and field deployment environments.

Regionally, Asia Pacific (APAC) dominates the market, primarily fueled by massive FTTx rollouts in China, India, and Southeast Asia, alongside the rapid build-out of hyperscale data center campuses driven by multinational cloud providers. North America and Europe demonstrate mature market characteristics, focusing primarily on data center upgrades (transitioning from 100G to 400G interconnects) and the sophisticated deployment of 5G backhaul infrastructure, which demands consistent high performance from every passive component. Emerging markets in Latin America and MEA are poised for high growth as initial broadband infrastructure investments intensify, creating significant greenfield opportunities for standard LC coupler deployment.

Segment trends reveal that the Duplex LC Coupler configuration holds the largest market share due to its standard use in typical transmission pathways (sending and receiving), though Quad LC Couplers are gaining traction rapidly in ultra-high-density patching areas within modern data center fabrics. By application, the Data Centers segment exhibits the highest CAGR, reflecting the unprecedented ongoing investments in cloud infrastructure globally. In terms of type, Single Mode LC Couplers are foundational to long-haul and high-speed metro networks, securing their dominance over Multimode options, which are increasingly confined to short-reach, campus-style connectivity.

AI Impact Analysis on LC Coupler Market

Analysis of common user questions regarding AI's impact on the LC Coupler Market typically revolves around operational efficiency, network planning, and predictive maintenance. Users frequently inquire if AI-driven network optimization tools will necessitate different coupler specifications, how AI influences the physical layout and cooling demands of data centers (thus affecting coupler thermal requirements), and whether AI can automate the quality control or installation verification of these passive components. The consensus theme centers on AI's indirect but powerful influence: while AI does not directly alter the passive physics or material science of the LC coupler itself, the intensive computational demands of AI and Machine Learning (ML) workloads are the primary catalyst driving the sheer volume and density of fiber optic deployments, making the performance of every coupler more critical than ever.

The massive training models and inference engines required for contemporary AI applications necessitate a corresponding expansion in data center capacity, specifically requiring ultra-low latency and high throughput connectivity between thousands of servers and storage units. This translates directly into a skyrocketing demand for reliable physical layer components, including LC couplers. Furthermore, AI-powered systems are now being integrated into fiber optic testing equipment (OTDRs) and network monitoring solutions. These systems use algorithms to rapidly identify and pinpoint anomalies or degradations in signal quality, often attributed to component failures or improper seating, thus demanding higher and more rigorous quality standards from LC coupler manufacturers to minimize network errors and downtime.

The influence of AI extends into the manufacturing sector, where advanced robotics and AI vision systems are increasingly employed to handle the minute components of the LC coupler, such as the ceramic ferrules and alignment sleeves. This results in enhanced manufacturing precision, tighter tolerances, and improved repeatability, thereby yielding couplers with consistently lower insertion loss. Ultimately, AI serves as both a demand driver (through hyper-scale data center requirements) and a quality enabler (through automated manufacturing and monitoring), fundamentally reinforcing the market's need for high-specification LC coupling hardware.

- AI workloads accelerate data center expansion, driving increased demand for high-density LC couplers.

- Increased data flow complexity necessitates extremely low-loss couplers, pushing manufacturing quality standards higher.

- AI-driven network performance monitoring systems place stricter reliability demands on passive components.

- Adoption of AI-powered robotics in manufacturing enhances precision in ferrule alignment and overall product quality.

- AI helps optimize data center physical layouts, potentially influencing the adoption of shorter-reach, higher-density quad and mini-LC coupler variants.

DRO & Impact Forces Of LC Coupler Market

The LC Coupler Market is characterized by a strong interplay of growth drivers stemming from global bandwidth demand, offset by restraints related to component standardization and pricing pressures, while substantial opportunities exist in emerging applications and geographical regions. The primary drivers include the mandatory upgrade cycle imposed by next-generation networking technologies (5G, 400G/800G Ethernet) and government-backed initiatives worldwide to achieve comprehensive digital inclusion through high-speed fiber infrastructure. Restraints largely center on the commoditization of standard single-mode and multimode couplers, leading to intense competition and margin compression among tier-two manufacturers, coupled with the ongoing technical challenge of minimizing insertion loss in ultra-high-density deployments.

Key opportunities revolve around the specialization of LC couplers for harsh environments (ruggedized, water-resistant, or high-temperature versions), catering to industrial internet of things (IIoT) applications and military/aerospace sectors. Furthermore, the development of smaller, novel connectors (such as the CS or SN connectors) presents both a competitive threat and an opportunity for manufacturers to innovate and diversify their LC-based product lines, particularly focusing on miniaturized form factors that increase panel density further than the current standard LC footprint allows. Successfully navigating these technological transitions and maintaining cost competitiveness in standard products while innovating in specialized areas will define market success.

Impact forces currently shaping the market are centered around supply chain resilience post-global crises, requiring manufacturers to dual-source specialized materials like precision ceramic ferrules to mitigate production risks. Additionally, environmental, social, and governance (ESG) factors are exerting influence, promoting demand for "green" or sustainable manufacturing practices and potentially driving demand for components with longer lifecycles and easier end-of-life recycling capabilities. The overall impact force matrix suggests a market being pulled strongly by technological innovation and connectivity demand, while simultaneously being pushed toward cost efficiency and manufacturing precision.

Segmentation Analysis

The LC Coupler Market is systematically segmented based on Type (Single Mode and Multimode), Configuration (Simplex, Duplex, Quad), and End-Use Application (Data Centers, Telecommunications, FTTx, CATV, and Industrial/Other). Understanding these segments is crucial for manufacturers and strategists to identify high-growth pockets and allocate resources effectively. The segmentation reflects the diverse technical requirements across the networking ecosystem, where performance metrics like insertion loss and back reflection vary significantly depending on whether the coupler is deployed in a campus network (Multimode, short distance) or a submarine cable landing station (Single Mode, high precision). The continued growth of the market is deeply intertwined with the specific adoption rates and technological maturation within each of these delineated segments.

- By Type: Single Mode, Multimode (OM1/OM2, OM3/OM4, OM5)

- By Configuration: Simplex (one fiber connection), Duplex (two fiber connections, most common), Quad (four fiber connections, high density)

- By Application: Data Centers (Hyperscale and Enterprise), Telecommunications (Core, Metro, 5G Backhaul), FTTx (FTTH, FTTC), CATV, Industrial Networking, Military & Aerospace

- By Material: Ceramic Sleeve, Metal Sleeve, Hybrid

Value Chain Analysis For LC Coupler Market

The value chain for the LC Coupler Market begins with the upstream procurement and processing of highly specialized raw materials, primarily focusing on precision plastic injection molding compounds for the coupler body and high-grade ceramic Zirconia for the alignment sleeves, which are the critical performance-defining components. Upstream activities involve material sourcing (ceramics, plastics, metal springs), precision machining of ferrules, and the strict quality control of these components to ensure ultra-low tolerance levels necessary for accurate fiber alignment. Success in the upstream segment relies heavily on proprietary technology related to ferrule grinding and sleeve manufacturing, typically controlled by a limited number of specialized global suppliers.

The midstream stage involves the assembly of the couplers, where specialized manufacturers integrate the alignment sleeves, housing, and internal latching mechanisms. This stage is highly dependent on automated assembly lines to minimize human error and contamination, crucial for maintaining the required cleanliness and precision. Key processes include ultrasonic cleaning, component bonding, and rigorous optical testing (insertion loss and return loss measurements) before packaging. Distribution channels then take over, which can be categorized into direct and indirect routes.

Direct distribution often occurs when large Tier 1 telecom operators or hyperscale data center operators procure high volumes directly from the coupler manufacturer under long-term supply agreements, ensuring tailored specifications and optimized logistics. Indirect distribution, which accounts for a substantial portion of the market, involves routing products through specialized fiber optic distributors, system integrators, and value-added resellers (VARs) who bundle the couplers with patch panels, fiber optic cables, and other passive components for smaller enterprises, campus networks, and FTTx installers. Downstream analysis focuses on installation, maintenance, and end-user deployment within structured cabling systems, where the reliability and ease of use of the LC coupler directly impact network uptime and operational expenditure (OPEX) for the final consumer.

LC Coupler Market Potential Customers

Potential customers and primary end-users for LC couplers span the entire digital infrastructure landscape, unified by the requirement for robust, modular, and high-performance optical interconnectivity. The market is primarily driven by organizations responsible for the creation and maintenance of high-speed data transmission networks. These customers prioritize long-term reliability, minimal insertion loss, adherence to industry standards (Telcordia, IEC), and compatibility with existing infrastructure. The purchasing decision often involves a stringent evaluation of the manufacturer's quality control processes and the proven durability of the product in demanding operational environments, whether high-traffic exchanges or dusty industrial settings.

The two largest customer bases are Telecommunication Service Providers and Cloud & Data Center Operators. Telecom providers (both fixed line and mobile) are massive purchasers, integrating couplers into central offices, street cabinets, and FTTx termination points as they roll out or upgrade 5G and fiber broadband services. Data center operators, including hyperscalers like AWS, Google, and Microsoft, and large enterprise facilities, require millions of couplers annually for patching racks, servers, and storage arrays, focusing intensely on Duplex and Quad configurations to maximize density within their limited rack space. System integrators and independent contractors involved in building out commercial or governmental structured cabling systems also represent a significant aggregated demand pool.

Additionally, specialized customers include industrial automation firms utilizing fiber optics for robust, EMI-immune control networks, and defense contractors requiring ruggedized, environmentally sealed LC couplers for tactical and field communication systems. The consistent demand across all these sectors ensures market stability, driven by replacement cycles, ongoing expansions, and mandatory network technology transitions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million |

| Market Forecast in 2033 | $1,050 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corning Incorporated, CommScope Holding Company, Amphenol Corporation, SENKO Advanced Components, OFS (Furukawa Electric Group), Molex LLC, Diamond SA, Fujikura Ltd., Huber+Suhner AG, Teledyne Technologies, Radiall, JAE, Sumitomo Electric, Prysmian Group, Fiber Instrument Sales, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LC Coupler Market Key Technology Landscape

The core technology driving the performance of the LC Coupler market revolves around precision engineering of ceramic sleeves and the continuous refinement of manufacturing processes to minimize micro-contamination and physical misalignment. LC couplers rely on Zirconia ceramic sleeves due to their superior thermal stability and hardness, which are critical for maintaining the precise alignment required for Single Mode fiber contact—often needing alignment within micrometers. Recent technological advancements focus on achieving Angled Physical Contact (APC) specifications in couplers intended for high-return-loss applications, requiring tighter internal tolerances and specific sleeve geometries to facilitate a precise 8-degree angle contact between opposing ferrules, thereby mitigating signal reflections, which are detrimental to high-speed laser sources.

A secondary but crucial technological trend involves the transition toward specialized materials for the coupler housing and integrated dust caps. Manufacturers are developing fire-retardant and low-smoke zero-halogen (LSZH) compliant plastic housings to meet strict safety standards, particularly in dense data center environments and public transport infrastructure. Furthermore, locking mechanism innovation, such as push-pull tabs or shuttered versions, is key to improving ease of use and environmental protection within densely populated patch panels, allowing technicians to manage high fiber counts without errors or cross-contamination.

The integration of miniaturized form factors, such as the emergence of proprietary small form factor (SFF) connectors that maintain LC performance specifications but offer even greater density, is impacting the market structure. While the standard LC remains dominant due to installed base and standardization, the push for higher rack utilization is driving demand for novel coupling technologies that can be retrofitted or deployed alongside traditional LC systems. Key players are investing heavily in advanced inspection and machine vision systems in production lines to ensure every coupler meets stringent insertion loss criteria, certifying that performance does not degrade upon field installation.

Regional Highlights

- Asia Pacific (APAC): APAC remains the epicenter of LC coupler demand, fueled by massive government investments in national broadband networks (e.g., India's BharatNet, widespread FTTH expansion in China and Southeast Asia). The region’s dominance is further solidified by the continuous influx of capital into hyperscale data center construction, particularly in emerging Tier 2 and Tier 3 cloud hubs. Manufacturing capabilities are highly concentrated here, enabling competitive pricing and rapid scaling to meet regional and global demand.

- North America: This region is characterized by high technological maturity, driving demand for premium, high-specification Single Mode LC couplers utilized in 400G and 800G data center interconnects and sophisticated 5G mobile backhaul networks. The market focus is shifting from greenfield deployment to high-value upgrades and replacement cycles aimed at enhancing network performance metrics (e.g., lower latency).

- Europe: Growth is steady, propelled by national mandates for digital connectivity (Digital Agenda for Europe) and significant investment in submarine cable landing stations and associated terrestrial networks. Strict regulatory requirements regarding component safety and environmental compliance drive demand for high-quality, certified, and often LSZH-compliant LC coupler products.

- Latin America: Exhibits high growth potential as key economies like Brazil, Mexico, and Colombia accelerate their deployment of FTTx infrastructure. Market adoption is currently skewed towards cost-competitive standard Duplex LC couplers, though future data center development promises increased demand for specialized high-density variants.

- Middle East and Africa (MEA): Characterized by strong strategic telecom investment, particularly in the UAE, Saudi Arabia, and South Africa, focusing on modernizing core networks and supporting smart city initiatives. These large-scale projects necessitate high volumes of reliable, environmentally robust LC couplers suitable for harsh climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LC Coupler Market.- Corning Incorporated

- CommScope Holding Company

- Amphenol Corporation

- SENKO Advanced Components

- OFS (Furukawa Electric Group)

- Molex LLC

- Diamond SA

- Fujikura Ltd.

- Huber+Suhner AG

- Teledyne Technologies

- Radiall

- JAE (Japan Aviation Electronics)

- Sumitomo Electric Lightwave

- Prysmian Group

- Fiber Instrument Sales, Inc.

- Yamaichi Electronics

- LEONI AG

- Optiwave Systems Inc.

- Sterlite Technologies Limited

- Cisco Systems (via infrastructure components)

Frequently Asked Questions

Analyze common user questions about the LC Coupler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an LC Coupler in fiber optic networks?

The primary function of an LC coupler is to accurately align and connect two LC fiber optic connectors (plugs), ensuring precise physical contact between the fiber ferrules to maintain low insertion loss and high signal integrity during optical transmission. It acts as a mechanical bridge in patch panels or network devices.

Why are LC Couplers widely preferred over older connector standards like SC and ST?

LC couplers are preferred due to their small form factor, which enables high port density in limited rack space, a crucial advantage in modern data centers. They also feature a reliable latching mechanism and exhibit excellent performance characteristics, meeting strict Telcordia and IEC standards for insertion and return loss.

What is the difference between Simplex, Duplex, and Quad LC Couplers?

The distinction lies in the number of fiber connections supported: Simplex supports one fiber (one channel), Duplex supports two fibers (typically used for transmit/receive channels), and Quad supports four fibers, maximizing density in high-capacity environments such as enterprise and hyperscale data centers.

How does the deployment of 5G infrastructure impact the demand for LC Couplers?

5G deployment drives increased demand for LC couplers by requiring massive upgrades and expansion of the optical backhaul network, connecting numerous base stations to the core network. These applications demand high-reliability, often ruggedized, Single Mode LC couplers to handle increased data throughput and low-latency requirements.

What materials are essential for maintaining high performance in LC Couplers?

The most essential material is Zirconia ceramic, which is used to manufacture the alignment sleeves. Zirconia offers the necessary precision, hardness, and thermal stability required to maintain accurate alignment of the minuscule fiber cores, ensuring minimal optical signal degradation over the product's operational lifetime.

This report contains 29683 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager