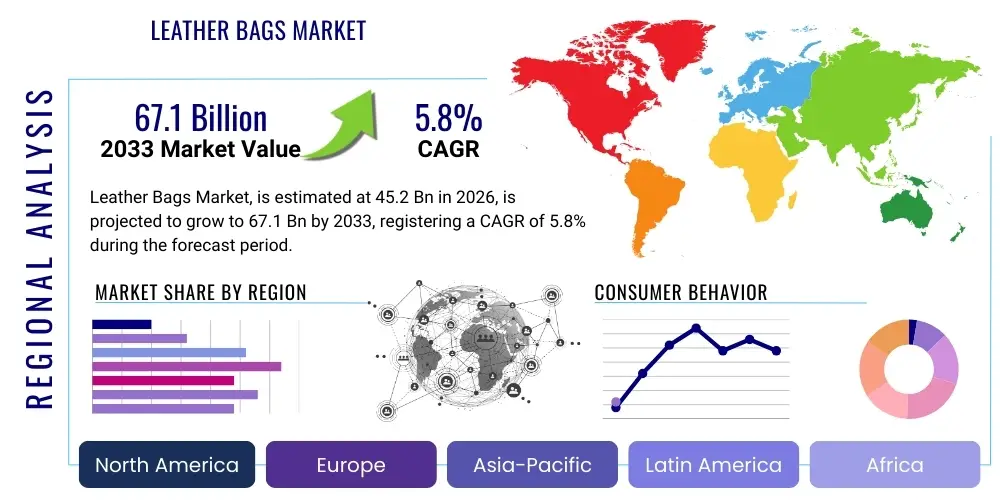

Leather Bags Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441169 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Leather Bags Market Size

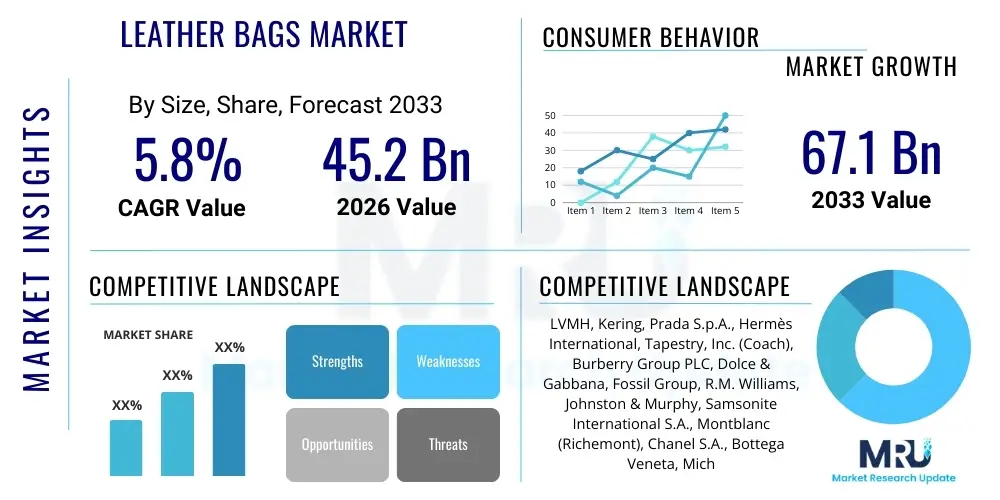

The Leather Bags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 67.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by increasing consumer disposable income in emerging economies, the enduring perception of leather bags as a status symbol, and continuous innovation in design and manufacturing processes, particularly utilizing sustainable and ethically sourced materials. The market displays resilience against economic fluctuations due to the high replacement cycle and demand from the luxury segment.

Leather Bags Market introduction

The Leather Bags Market encompasses the manufacturing, distribution, and sale of various bags made predominantly from animal hides (genuine leather) or high-quality synthetic alternatives (PU or vegan leather). These products range extensively across different categories, including high-end luxury handbags, functional business briefcases, casual backpacks, and specialized travel luggage. The market's intrinsic value lies in leather's durability, aesthetic appeal, and ability to age gracefully, which commands premium pricing, particularly in designer segments. Geographically, the market is highly competitive, with strong manufacturing hubs in Asia Pacific (especially India and China) and dominant consumption centers in North America and Europe, where fashion trends originate and drive global demand. The adoption of digital retail channels has dramatically reshaped the market landscape, offering wider accessibility to niche brands and custom products.

Major applications of leather bags span personal use, professional environments, and travel. Handbags, including totes and clutches, dominate the women's segment, serving both utilitarian and fashion purposes, often reflecting seasonal trends. Briefcases and messenger bags are essential in the professional sphere, emphasizing functionality, security, and prestige. Travel bags and durable backpacks, particularly those catering to the outdoor and adventure segments, prioritize robustness and capacity. The enduring benefits of leather bags include superior longevity compared to synthetic materials, resistance to wear and tear when properly maintained, and perceived brand value. Consumers view these items as long-term investments, contributing to sustained demand across economic cycles.

Driving factors for the sustained market expansion are manifold. Firstly, the global rise in urbanization and the proliferation of organized retail have made luxury and premium leather goods more accessible. Secondly, aggressive marketing and branding strategies by established global luxury conglomerates, coupled with celebrity endorsements and social media influence, continually create aspirational demand. Furthermore, innovations in tanning and processing techniques are addressing previous concerns related to environmental impact, leading to the development of chrome-free and vegetable-tanned leathers that appeal to eco-conscious consumers. The increasing demand for customized and personalized leather goods also provides significant impetus for growth, enabling brands to cater directly to individual consumer preferences and ensure product exclusivity, thereby maintaining high price points and market interest.

Leather Bags Market Executive Summary

The Leather Bags Market is characterized by robust growth projections, anchored by shifting business trends favoring direct-to-consumer (DTC) models and rapid digitalization of sales channels. Businesses are increasingly leveraging advanced supply chain technologies to enhance transparency regarding sourcing and manufacturing ethics, a critical factor for millennial and Gen Z consumers. A major trend involves the fusion of traditional craftsmanship with high-tech materials and functional additions, such as integrated charging ports and RFID blocking technology in wallets and briefcases. Competition remains intense, primarily dominated by a few global luxury houses that control pricing power and set industry trends. However, smaller, specialized brands focusing on sustainability and unique design aesthetics are successfully carving out niche markets, driving innovation in material sourcing, including the use of innovative non-animal leathers derived from mushroom or fruit waste.

Regionally, the market exhibits divergent dynamics. Asia Pacific (APAC) is the engine of volumetric growth, driven by burgeoning middle classes in countries like China and India, exhibiting a rapidly growing appetite for Western luxury and accessible premium brands. North America and Europe, while mature, remain dominant in terms of value, serving as primary hubs for design innovation and luxury consumption. These regions are also leading the charge in adopting stringent environmental regulations, prompting manufacturers to prioritize sustainable practices and circular economy initiatives, such as repair and resale programs. Emerging markets in Latin America and the Middle East show potential, particularly within the tourism and high-net-worth individual (HNWI) segments, which maintain high demand for globally recognized luxury brands and limited-edition collections.

Segment trends highlight a strong resurgence in the popularity of functional, multi-purpose bags, reflecting hybrid work models and lifestyle flexibility. Crossbody bags and high-end backpacks are gaining traction across both gender segments due to their practical appeal. Furthermore, the segmentation by material shows increasing consumer acceptance and demand for high-quality synthetic leather (vegan leather), primarily driven by ethical concerns, although genuine leather maintains its stronghold in the high-end luxury bracket due to its heritage and inherent quality. Distribution trends overwhelmingly favor the online segment, accelerated by the pandemic, forcing brands to invest heavily in immersive e-commerce experiences, virtual fitting rooms, and personalized digital marketing to replicate the tactile experience of in-store luxury purchases.

AI Impact Analysis on Leather Bags Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Leather Bags Market frequently revolve around three key themes: how AI enhances personalized shopping experiences, how machine learning optimizes complex luxury supply chains, and the role of generative AI in design innovation. Consumers are interested in knowing if AI can predict fashion trends more accurately than human designers, leading to less waste and more sustainable production cycles. Furthermore, operational stakeholders often query AI’s capability in authenticating genuine leather products and detecting counterfeits, a critical challenge in the luxury sector. The overall expectation is that AI will streamline design-to-shelf processes, personalize consumer interactions, and bolster brand integrity, ultimately driving efficiency and customization in a traditionally craft-heavy industry. AI is transitioning from a back-end analytical tool to a front-end consumer interface, promising tailored product recommendations and improved forecasting capabilities that minimize overstocking and production lag.

AI's primary influence centers on predictive analytics for demand forecasting and inventory management. By analyzing vast datasets—including social media trends, regional sales histories, macroeconomic indicators, and competitor pricing—AI models can predict consumer preferences for specific styles, colors, and material attributes with far greater precision than traditional methods. This optimization drastically reduces the risk of holding obsolete inventory and allows manufacturers to implement just-in-time production methodologies, resulting in significant cost savings and reduced environmental footprints associated with unsold goods. For example, AI can identify a micro-trend favoring specific buckle designs in the European market before it fully manifests, enabling rapid design iteration and market deployment.

In the consumer-facing domain, AI powers personalized marketing campaigns and enhanced digital experiences. Chatbots and virtual assistants, driven by natural language processing (NLP), provide 24/7 customer service and style consultation, simulating the personalized attention found in high-end boutiques. Furthermore, computer vision and deep learning algorithms are being employed for quality control, automatically detecting minute flaws in leather hides or stitching during the manufacturing process, ensuring only defect-free products reach the consumer. This blend of operational efficiency and elevated customer interaction solidifies AI's role as a transformative technology rather than a mere supplementary tool, fundamentally altering how leather goods are conceived, produced, and sold globally.

- AI-driven trend forecasting minimizes production waste and optimizes material procurement.

- Machine learning algorithms enhance supply chain transparency and ethical sourcing verification.

- Generative AI assists designers in rapid prototyping and creation of new, marketable patterns and styles.

- AI-powered visual inspection systems improve quality control, identifying defects in leather textures and stitching.

- NLP-enabled chatbots provide personalized customer recommendations and virtual shopping assistance.

- Deep learning models strengthen anti-counterfeiting measures through product authentication via unique identifiers and image recognition.

- Predictive inventory management reduces warehousing costs and improves fulfillment efficiency across DTC channels.

DRO & Impact Forces Of Leather Bags Market

The Leather Bags Market is driven by the intrinsic desire for luxury and status associated with genuine leather goods, robust demand from high-growth economies, and the continuous adoption of digital commerce channels, which expand market reach. Restraints primarily stem from volatile raw material prices, particularly the cost and availability of high-quality animal hides, and the escalating scrutiny regarding the environmental impact of traditional tanning processes, including the use of heavy metals. Opportunities are abundant in the ethical and sustainable leather sector, including the rise of high-quality vegan alternatives and investment in circular economy models (repair, reuse, resale). These forces are profoundly shaping industry strategy, compelling companies to balance premium positioning with ethical compliance, while simultaneously leveraging technology to manage supply chain risks and enhance product integrity.

Key drivers include rising global discretionary income, especially among the middle- and upper-middle classes in Asia, who view branded leather goods as essential status markers. The cultural significance of leather accessories, combined with effective global branding by established luxury houses, sustains high demand. Additionally, the functional durability and perceived value retention of leather bags compared to textile alternatives encourage consumer investment. However, these drivers are tempered by significant restraints. The animal rights movement and environmental pressure groups exert considerable influence, pushing consumers away from traditional leather towards sustainable or lab-grown alternatives. Furthermore, the inherent susceptibility of the luxury market to economic downturns, although historically resilient, poses a risk, as high-ticket items are often the first to be curtailed during periods of recession or geopolitical instability.

The principal opportunity lies in diversification and innovation within the materials science domain. Investment in bio-based leathers (e.g., derived from cactus, pineapple leaves, or mushroom mycelium) allows brands to address sustainability concerns without sacrificing aesthetic appeal or durability. Furthermore, the expansion of repair and refurbishment services not only aligns with circular economy goals but also generates new revenue streams and enhances customer loyalty by extending product lifecycles. Impact forces, such as changing generational preferences—where Gen Z prioritizes brand transparency and ethical sourcing—are reshaping marketing and production standards. Brands that successfully integrate verifiable sustainability claims with high-quality design are positioned to capture the next wave of market growth, utilizing these external pressures as catalysts for positive internal change and competitive differentiation.

Segmentation Analysis

The Leather Bags Market is comprehensively segmented based on product type, material, distribution channel, and end-user, providing a granular view of market dynamics and consumer behavior across various categories. The structure of segmentation reflects both functional requirements (e.g., backpacks vs. briefcases) and ethical considerations (e.g., genuine vs. synthetic leather). Understanding these segments is crucial for strategic market positioning, allowing companies to tailor their product offerings, pricing strategies, and marketing efforts to specific demographic and psychographic consumer clusters. The fastest-growing segments typically involve smaller, multi-functional designs, driven by the shift towards convenience and portability in urban lifestyles, while the enduring luxury segments continue to drive market value through high average selling prices (ASPs).

Segmentation by product type is highly diverse, ranging from classic luggage and briefcases, which cater to specialized needs, to the dominant category of handbags and purses, which are subject to rapid fashion cycles. The material segmentation differentiates between genuine leather, which includes exotic hides and various tanning methods (e.g., vegetable-tanned, chrome-tanned), and synthetic or vegan leather alternatives. This distinction is increasingly vital as consumer ethics influence purchasing decisions. Furthermore, the segmentation across distribution channels is undergoing rapid transformation, with the online segment continuously expanding its market share, necessitating significant digital infrastructure investment from all market participants, especially luxury brands historically reliant on physical flagship stores.

The end-user segmentation clearly separates demand between the traditionally dominant women’s segment, which purchases bags as both functional items and fashion accessories, and the rapidly growing men’s segment, characterized by increased interest in high-quality professional and travel accessories. Unisex products, especially backpacks and messenger bags, represent a hybrid category responding to fluid modern style preferences. This layered segmentation reveals that market growth is not monolithic; rather, it is concentrated in high-performance materials and channels that offer exceptional convenience, driven by a consumer base increasingly prioritizing provenance, quality, and ethical manufacture over mere brand visibility.

- Product Type:

- Handbags (Shoulder Bags, Totes, Clutches, Satchels)

- Backpacks

- Briefcases and Messenger Bags

- Wallets and Coin Purses

- Luggage and Travel Bags

- Small Leather Goods (SLGs)

- Material:

- Genuine Leather (Cowhide, Sheepskin, Exotic Leather)

- Synthetic Leather (PU Leather, PVC Leather)

- Sustainable/Vegan Leather (Plant-based, Lab-grown)

- Distribution Channel:

- Offline (Specialty Stores, Department Stores, Exclusive Brand Outlets)

- Online (E-commerce Portals, Brand Websites, Social Commerce)

- End-User:

- Women

- Men

- Unisex/Gender-Neutral

Value Chain Analysis For Leather Bags Market

The value chain of the Leather Bags Market begins significantly upstream with the sourcing of raw animal hides and the subsequent processes of tanning and dyeing. Upstream activities are characterized by high complexity and regulatory scrutiny, particularly concerning chemical usage in tanning. Key upstream participants include abattoirs, hide processors, and specialized tanneries, often concentrated in countries with strong livestock industries or advanced chemical processing capabilities, such as Brazil, Argentina, and Italy. The efficiency and sustainability of the tanning process directly impact the quality and eventual marketability of the final leather product; thus, securing reliable, high-grade, and ethically certified leather is a critical competitive factor for downstream manufacturers.

The midstream phase involves manufacturing, design, and assembly, where raw leather is transformed into finished bags through highly specialized artisanal techniques, utilizing skilled labor for cutting, stitching, and finishing. This stage often incorporates advanced CAD/CAM technologies for precise pattern cutting, optimizing material usage and minimizing waste. Downstream activities involve distribution, marketing, and retail. Distribution channels are bifurcated into direct channels (owned boutiques and brand e-commerce) and indirect channels (wholesalers, department stores, and multi-brand luxury e-tailers). The shift towards DTC models allows brands greater control over pricing, inventory, and crucial customer relationship management, providing richer data for future design and marketing strategies.

Direct distribution, facilitated by the brand’s flagship stores and dedicated online platforms, ensures control over the brand narrative and customer experience, which is paramount in the luxury segment. Indirect channels offer broader geographical reach but require careful management of inventory and brand representation to maintain exclusivity. Effective supply chain management, from securing ethical hides to ensuring timely delivery to diverse global retail points, determines operational profitability and competitive advantage. The increasing prevalence of digital channels not only influences sales but also dictates marketing spend, heavily leaning towards AEO-optimized content, social media engagement, and immersive virtual shopping experiences to drive conversion.

Leather Bags Market Potential Customers

The primary potential customers for the Leather Bags Market are segmented into several distinct profiles, ranging from high-net-worth individuals (HNWIs) seeking ultra-luxury, bespoke items to fashion-conscious millennials and Gen Z consumers prioritizing accessible luxury and ethically sourced products. The largest segment remains the professional urban population, across both genders, requiring durable, functional, and aesthetically pleasing bags for work and daily commutes. End-users in this segment prioritize features such as laptop compartments, RFID protection, and robust construction suitable for daily rigorous use. This cohort represents the backbone of demand for premium and accessible luxury brands, valuing long-term quality over fast fashion disposables.

A rapidly expanding customer base includes the affluent middle class in emerging markets, particularly within APAC. These consumers, driven by aspiration and increased disposable income, are moving away from unbranded goods toward recognized international brands as symbols of social mobility and achievement. They are highly responsive to localized marketing campaigns and accessible price points offered by premium segment brands. Furthermore, travelers constitute a significant segment, demanding specialized leather luggage and durable travel bags that withstand international transit and reflect personal style. These buyers prioritize lightweight construction coupled with high durability and security features.

The increasingly influential segment of ethically minded consumers, particularly younger generations, are potential buyers for brands that offer verifiable sustainability credentials. They seek products made from vegetable-tanned, chrome-free, or innovative vegan leathers, demanding complete supply chain transparency. These buyers are often willing to pay a premium for ethical sourcing, viewing their purchase as a reflection of their values. Therefore, brands that clearly communicate their commitment to environmental and social governance (ESG) standards are best positioned to capture this high-value, high-loyalty demographic, ensuring the longevity of their customer base by aligning product offerings with modern ethical expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 67.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH, Kering, Prada S.p.A., Hermès International, Tapestry, Inc. (Coach), Burberry Group PLC, Dolce & Gabbana, Fossil Group, R.M. Williams, Johnston & Murphy, Samsonite International S.A., Montblanc (Richemont), Chanel S.A., Bottega Veneta, Michael Kors (Capri Holdings), Dior, Balenciaga, Celine, Tod's S.p.A., Mulberry Group PLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Leather Bags Market Key Technology Landscape

The Leather Bags Market is witnessing a significant influx of technological innovations primarily focused on sustainability, production efficiency, and anti-counterfeiting measures. In the manufacturing phase, advanced laser cutting and computer numerically controlled (CNC) stitching machines are utilized to achieve unparalleled precision and reduce material waste, moving away from entirely manual, artisanal production towards a blend of craft and automation. Furthermore, the development and commercial scaling of bio-tanning processes, which replace harmful heavy metals like chromium with vegetable-based or synthetic alternatives, represent a critical technological shift aimed at creating genuinely sustainable leather that maintains the required luxurious texture and durability, appealing to environmentally conscious consumers and satisfying regulatory demands.

A crucial technological development is the implementation of digital tracking and authentication systems throughout the supply chain. Technologies such as Near Field Communication (NFC) tags, Radio-Frequency Identification (RFID) chips, and blockchain technology are being integrated into luxury bags. These technologies serve multiple purposes: they provide consumers with verifiable provenance data, detailing the origin of the hide, the tanning process, and the artisan who crafted the product, thereby bolstering trust and transparency. More importantly, these digital identities serve as robust tools for combating the pervasive issue of counterfeit goods, allowing brands and consumers to instantly verify authenticity via a simple smartphone scan, protecting brand integrity and consumer investment in genuine products.

Furthermore, technology is redefining the design and customization experience. Three-dimensional (3D) printing is being used for rapidly prototyping complex hardware components like buckles and clasps, accelerating the design iteration cycle. On the consumer interaction front, augmented reality (AR) and virtual reality (VR) technologies are enhancing the online shopping experience. Customers can virtually "try on" or visualize how a bag looks in real-life settings using their smartphones, mitigating the risk associated with purchasing high-value items sight unseen. These digital tools are essential for bridging the gap between the traditional luxury retail environment and the growing preference for e-commerce, ensuring a high-touch, immersive experience remains accessible regardless of the purchase channel.

Regional Highlights

- North America: The North American market is characterized by high consumer awareness regarding brand heritage and ethical production. It holds a significant share of the global market value, driven by a robust luxury consumer base and strong retail infrastructure, particularly in the United States. Demand is heavily concentrated in the premium segments, with a noticeable trend towards functional backpacks and sustainable/vegan leather options, reflecting health and wellness trends and ethical consumption. Major cities like New York and Los Angeles serve as key trendsetters, often adopting European luxury trends rapidly. The market is highly competitive, necessitating substantial investment in digital marketing and localized inventory management to meet varied regional tastes and quick fulfillment expectations. Brands focus heavily on DTC models and personalized digital experiences.

- Europe: Europe remains the core hub for luxury leather goods, driven by long-standing heritage brands predominantly located in France and Italy. This region dictates global fashion trends and maintains the highest average selling prices (ASPs) due to the perception of superior craftsmanship and brand legacy. Italy, specifically, is critical for its advanced tanning industry and artisanal manufacturing clusters. The market is mature but highly focused on quality, exclusivity, and adherence to stringent EU environmental regulations, which mandates innovation in sustainable production methods. Economic stability in core Western European nations fuels steady demand, emphasizing bespoke services and limited-edition collections.

- Asia Pacific (APAC): APAC is the fastest-growing region, contributing the highest volume growth to the global market. This expansion is powered by the burgeoning middle classes in China, India, and Southeast Asian nations, where acquiring luxury leather bags is seen as a tangible display of economic success. While China is the primary driver of both production and consumption, markets like South Korea and Japan demonstrate high demand for niche, high-quality, and fashion-forward brands. The region is highly sensitive to digital influence, with social commerce and local e-commerce platforms playing a dominant role in purchasing decisions. The key challenge is navigating the fragmented distribution landscape and managing the high prevalence of counterfeit goods.

- Latin America: The Leather Bags Market in Latin America is characterized by volatility but shows strong potential, particularly in economies like Brazil and Mexico, which possess both significant manufacturing capabilities and a growing affluent consumer segment. Demand is often concentrated in metropolitan areas, favoring internationally recognized brands. Local consumers highly value durability and classic designs due to economic uncertainty and replacement costs. The market is currently reliant on imports for high-end luxury goods, but domestic production capacity, especially in Brazil (renowned for its cattle industry and leather processing), provides a foundation for regional growth, focusing primarily on exports and serving the domestic premium segment.

- Middle East and Africa (MEA): The MEA market, largely driven by the Middle Eastern Gulf Cooperation Council (GCC) states, is distinguished by an exceptionally high demand for ultra-luxury and bespoke leather goods, fueled by a high concentration of HNWIs. Consumption patterns are often influenced by tourism, tax-free shopping, and regional cultural preferences for opulent and branded items. Africa represents an emerging market with significant long-term potential, focusing initially on functional and durable bags. The region acts as a gateway for international luxury brands seeking high-value transactions, with key retail centers in Dubai and Riyadh setting regional trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Leather Bags Market.- LVMH Moët Hennessy Louis Vuitton SE

- Kering SA

- Prada S.p.A.

- Hermès International

- Tapestry, Inc. (Coach, Kate Spade)

- Burberry Group PLC

- Dolce & Gabbana

- Fossil Group, Inc.

- R.M. Williams

- Johnston & Murphy

- Samsonite International S.A.

- Montblanc (Richemont)

- Chanel S.A.

- Bottega Veneta

- Michael Kors (Capri Holdings)

- Dior

- Balenciaga

- Celine

- Tod's S.p.A.

- Mulberry Group PLC

Frequently Asked Questions

Analyze common user questions about the Leather Bags market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the sustainable and vegan leather bags segment?

The sustainable and vegan leather bags segment is primarily driven by heightened consumer ethical awareness, particularly among millennial and Gen Z buyers, concerning animal welfare and the environmental impact of traditional chrome tanning. Technological advancements in bio-based materials (like mushroom or cactus leather) offer comparable durability and aesthetics to genuine leather, accelerating consumer acceptance and market viability, supported by strong brand endorsement of ethical sourcing practices.

How is e-commerce affecting the luxury leather bags market?

E-commerce is profoundly transforming the luxury segment by offering direct-to-consumer (DTC) channels, enabling brands to control their narrative, manage inventory more effectively, and gather valuable customer data. Digital platforms, enhanced by features like AR/VR try-ons and sophisticated personalization, are expanding the geographical reach of luxury brands, moving high-value purchases online while maintaining exclusivity and premium customer service standards.

What are the primary challenges related to raw material sourcing in this market?

The primary challenges involve volatility in the pricing of high-quality animal hides, coupled with increasing demand for ethical and traceable sourcing. Regulatory pressures concerning chemical usage in traditional tanning (especially chromium) require expensive infrastructure upgrades, while ensuring verifiable provenance from the farm to the final product remains complex due to lengthy and opaque global supply chains.

Which geographical region shows the highest potential for volumetric growth for leather bags?

Asia Pacific (APAC), specifically led by emerging economies such as China and India, exhibits the highest potential for volumetric growth. This growth is underpinned by rapid urbanization, a substantial increase in middle-class disposable income, and a strong cultural affinity for internationally recognized luxury brands as symbols of status and social ascent. Investment in regional manufacturing and distribution is accelerating to meet this surging demand.

What role does technology play in combating the proliferation of counterfeit luxury leather goods?

Technology plays a critical role in anti-counterfeiting efforts through the integration of digital security features such as blockchain-based digital certificates, NFC and RFID chips embedded within the products. These technologies provide consumers and retailers with immutable, verifiable data regarding a bag’s provenance and authenticity, allowing for instant verification and robust protection against illicit market activities that undermine brand value and consumer trust.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager