LED Diving Flashlight Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441652 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

LED Diving Flashlight Market Size

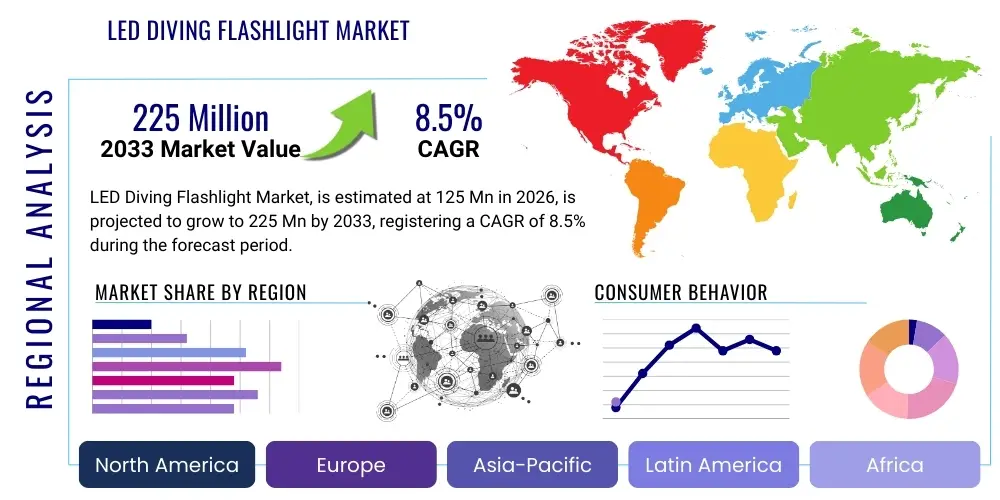

The LED Diving Flashlight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 125 Million in 2026 and is projected to reach USD 225 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global interest in marine recreation, underwater photography, and the necessity for robust, reliable illumination tools for technical and professional underwater operations. The shift from traditional halogen and HID lamps to energy-efficient, high-lumen LED technology has been a pivotal factor reshaping the commercial dynamics and product performance benchmarks within this specialized equipment sector. Market expansion is further catalyzed by innovations in battery technology, enhancing operational duration and reducing overall equipment weight, appealing directly to both the recreational diver and the professional marine researcher seeking extended underwater capability.

LED Diving Flashlight Market introduction

The LED Diving Flashlight Market encompasses highly specialized portable lighting devices designed and manufactured to withstand extreme hydrostatic pressure, saltwater corrosion, and often significant temperature fluctuations encountered in underwater environments. These flashlights utilize Light Emitting Diode (LED) technology, offering superior luminosity, extended battery life, and unparalleled reliability compared to older incandescent or High-Intensity Discharge (HID) lighting systems. Key product specifications frequently revolve around certified depth ratings (e.g., 100m, 200m+), lumen output (ranging from 500 to over 5000 lumens), beam angle characteristics (narrow spot or wide flood), and the implementation of magnetic or rotary switch mechanisms designed for reliable operation even when wearing thick diving gloves. The market caters to stringent safety and performance requirements essential for underwater activities, ranging from shallow recreational dives to deep technical explorations and commercial salvage operations.

Major applications of LED diving flashlights span a broad spectrum, prominently including recreational scuba diving where they serve as essential safety tools for communication, cave diving, and nighttime explorations. Professionally, these lights are indispensable for search and rescue (SAR) operations, commercial diving inspections (e.g., offshore rigs, ship hulls), scientific research, and increasingly, underwater videography and photography, demanding high Color Rendering Index (CRI) LEDs for accurate color representation. The primary benefits driving adoption include significantly enhanced visibility and safety, especially in low-visibility or deep-water conditions, improved energy efficiency leading to longer dive times, and superior durability stemming from advanced materials like aircraft-grade aluminum and specialized polymer composites used in casing construction.

Driving factors propelling market growth include the robust revival of global tourism centered around coastal and island destinations, which directly fuels the demand for recreational diving equipment. Furthermore, continuous technological advancements in LED chip efficiency, coupled with the miniaturization and improved performance of rechargeable lithium-ion battery packs, make diving flashlights brighter, lighter, and more convenient than ever before. Regulatory bodies emphasizing diver safety protocols and the integration of advanced lighting into personal dive computing systems also contribute significantly to the sustained market trajectory. The increased accessibility of scuba certification courses globally and the rising consumer disposable income allocated towards adventure sports further solidify the market's positive outlook.

LED Diving Flashlight Market Executive Summary

The LED Diving Flashlight Market is positioned for robust expansion, reflecting favorable macro-environmental factors such as rising global marine leisure activity and increasing investment in professional underwater infrastructure maintenance. Key business trends indicate a strong move toward product diversification, where manufacturers are increasingly segmenting offerings into high-end, feature-rich technical lights (e.g., adjustable beam focus, integrated UV light) and highly portable, user-friendly recreational backup lights. Strategic partnerships between dive gear manufacturers and specialty battery or LED component suppliers are becoming common, focused on maximizing efficiency and minimizing the form factor of future products. Furthermore, sustainability is emerging as a critical purchasing criterion, pushing companies toward offering durable, repairable, and environmentally conscious products, reducing waste in the specialized equipment sector.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market, primarily fueled by the rapid expansion of marine tourism infrastructure in Southeast Asia and rising interest in diving among the middle-class populations in China and India. Europe maintains a strong market presence, particularly in the professional and technical diving segments, driven by stringent regulatory safety standards and high adoption rates of advanced equipment in the North Sea oil and gas industry. North America remains a significant consumer, characterized by a large base of recreational divers and a strong focus on premium, branded equipment known for reliability and customer support. Investment in logistics and distribution channels that cater specifically to remote diving destinations is a major strategic focus across all leading regions.

Segmentation trends highlight the increasing dominance of high-lumen flashlights (above 3000 lumens), reflecting the demand for professional-grade illumination for underwater photography and deep-water exploration, where light attenuation is significant. The 'Technical/Professional' application segment is experiencing strong revenue growth, although 'Recreational' diving still commands the largest volume share. In terms of power source, rechargeable lithium-ion batteries are overwhelmingly preferred over disposable cells due to their better environmental profile, cost efficiency over the product lifespan, and higher power output capabilities. This shift dictates design considerations related to integrated charging systems and robust battery management systems (BMS) to ensure safety and longevity under pressure.

AI Impact Analysis on LED Diving Flashlight Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the LED Diving Flashlight Market often center on how AI can enhance diver safety, optimize battery performance, and integrate lighting control with sophisticated dive computers. Users frequently inquire about the feasibility of AI-driven light pattern recognition for underwater navigation, predictive maintenance alerts for sealing systems, and the potential for smart flashlights that autonomously adjust brightness based on ambient light conditions and water clarity. Concerns also emerge regarding the complexity and cost associated with integrating such advanced features into rugged, pressure-resistant devices, and the necessary training required for divers to utilize these sophisticated capabilities effectively. The synthesis of these questions points to a clear expectation: AI should primarily serve to increase reliability, enhance user experience through automation, and provide crucial safety margins in challenging underwater environments without compromising the core robustness of the equipment.

While AI integration is still nascent in the physical construction of the flashlight itself, its influence is profoundly felt in the supply chain, manufacturing precision, and the development of peripheral smart features. In manufacturing, AI-powered computer vision systems are deployed for microscopic quality control inspections, verifying the flawless integrity of o-rings, threads, and lens seals—components critical to pressure resistance. This drastically reduces the probability of catastrophic equipment failure due to water ingress. Furthermore, in product design, AI simulation tools are used to model thermal dissipation paths under varying underwater temperatures, optimizing passive cooling systems to prevent LED overheating and subsequent lumen decay, ensuring consistent performance throughout the dive profile.

Looking ahead, AI will increasingly contribute to the user-facing functionality of high-end models. This includes implementing algorithms for "smart beam" technology, where integrated ambient light sensors feed data to an AI processor, which then dynamically adjusts the output intensity and even the color temperature of the beam to maximize visibility and minimize light scatter (backscatter) in turbid water. Such features move the diving flashlight from a passive illumination tool to an active component of the dive safety system, capable of learning the diver's preferences and adapting to dynamic environmental conditions autonomously, thereby reducing cognitive load on the user.

- AI-enhanced Quality Control: Utilized in manufacturing to inspect seals and housing integrity, ensuring maximum pressure resistance and reliability.

- Smart Battery Management: AI algorithms optimize charging cycles and monitor real-time discharge rates, predicting remaining burn time with greater accuracy than traditional voltage monitoring.

- Dynamic Light Adjustment: Sensors and AI processors automatically adjust lumen output based on water clarity, ambient light, and distance to the subject to optimize illumination and reduce backscatter.

- Predictive Maintenance: Analyzing operational data (pressure cycles, temperature exposure) to predict potential failure points in switches or seals, alerting divers before critical equipment degradation occurs.

- Supply Chain Optimization: Using machine learning to forecast demand, manage inventory of high-value components (LED chips, specialized batteries), and streamline logistics for global distribution.

DRO & Impact Forces Of LED Diving Flashlight Market

The LED Diving Flashlight Market is propelled by significant Drivers (D), constrained by notable Restraints (R), and offers substantial Opportunities (O), all interacting under powerful Impact Forces. The primary drivers revolve around the continuous advancement of LED technology, offering higher lumens per watt and longer operational lifespan, making LED lights superior to all historical alternatives. The exponential growth in the global recreational diving community, spurred by accessible travel and robust dive tourism infrastructure, provides a large and consistent demand base. Furthermore, regulatory requirements and safety standards in professional and commercial diving continually push for the adoption of more reliable and certified lighting equipment, emphasizing redundancy and high performance. These cumulative factors exert a strong upward force on market valuation and volume growth, particularly in regions specializing in marine leisure activities and offshore energy.

Key restraints tempering growth include the relatively high initial acquisition cost of premium, professional-grade LED diving flashlights, which often feature ruggedized construction, advanced thermal management systems, and specialized certifications. This cost barrier can deter entry-level recreational divers who may opt for cheaper, lower-quality alternatives that do not meet professional standards. Another significant restraint is the stringent regulations surrounding the transportation, storage, and disposal of high-capacity lithium-ion batteries, which are classified as hazardous materials. These rules increase logistical complexities and operational costs for manufacturers and retailers operating across international borders, especially concerning air freight, impacting supply chain efficiency and product availability in specific markets.

The market is rich with strategic opportunities, particularly the integration of diving flashlights with complementary technology such as underwater cameras and video equipment. This synergy is driving demand for specialized video lights with high CRI and wide, even beam spreads, transforming the product from merely an illumination tool into an essential creative accessory. Further opportunities exist in military and government applications, including naval special forces and coastal border patrol units, which require highly robust, specialized tactical lighting solutions with specific frequency outputs (e.g., infrared). The trend toward smart diving equipment, incorporating Bluetooth or near-field communication (NFC) for diagnostics and configuration, presents a future pathway for premium product differentiation and enhanced connectivity within the diver’s ecosystem. The interplay of these factors suggests a dynamic market where technology iteration and strategic niche marketing will determine competitive success.

Segmentation Analysis

The segmentation of the LED Diving Flashlight Market provides crucial insights into the diverse needs of end-users and the varying levels of technological sophistication required across different applications. The market is primarily segmented based on product Type (Primary/Main Lights vs. Backup/Secondary Lights), Lumen Output, Power Source, and key Application areas. This granular breakdown is essential for manufacturers to tailor product specifications, pricing strategies, and distribution channels effectively. For instance, the needs of a deep-sea technical explorer demanding a >5000-lumen light with multi-hour burn time are fundamentally different from those of a casual vacation diver requiring a compact, reliable backup light for occasional use.

Analyzing segments by Lumen Output clearly shows the polarization of the market: high-volume sales are often concentrated in the mid-range (1000-3000 lumens) suitable for most recreational diving, while the highest revenue growth is often generated by the premium, high-output category (>3000 lumens) due to the higher average selling prices associated with professional use. Moreover, the segmentation based on Power Source highlights the near-universal adoption of rechargeable Li-ion batteries, reflecting their superior energy density and sustainability credentials, effectively pushing disposable battery-powered models into niche or low-cost market segments. Understanding these segment dynamics allows for precise targeting and resource allocation within the competitive landscape.

- By Type:

- Primary/Main Dive Lights

- Backup/Secondary Dive Lights

- Canister Dive Lights (Technical/Professional Use)

- By Lumen Output:

- Below 1000 Lumens

- 1000 to 3000 Lumens

- Above 3000 Lumens

- By Power Source:

- Rechargeable Lithium-ion Batteries

- Disposable Batteries (Alkaline, CR123A)

- By Application:

- Recreational Diving (Scuba, Snorkeling)

- Technical Diving (Cave, Wreck Penetration, Deep Diving)

- Professional/Commercial Diving (Inspection, Salvage, Military)

- Underwater Photography and Videography

- By Distribution Channel:

- Online Retail (E-commerce Platforms)

- Offline Retail (Specialty Dive Shops, Sporting Goods Stores)

Value Chain Analysis For LED Diving Flashlight Market

The value chain for the LED Diving Flashlight Market begins with upstream activities focused heavily on the sourcing of highly specialized and reliable components. This stage involves acquiring high-performance LED chips (such as those from Cree or Luminus), military-grade aluminum or high-impact plastic housing materials, and certified rechargeable lithium-ion cells, often necessitating strategic partnerships with highly specialized Asian component manufacturers. Critical upstream processes also include sophisticated research and development focused on thermal management systems (essential for maintaining high lumen output underwater) and waterproofing technologies (seals, magnetic switches). The quality and reliability of upstream suppliers directly dictate the performance and certification capability of the final product, creating high entry barriers for new participants seeking to compete on quality.

Midstream activities encompass the precise manufacturing, assembly, and rigorous testing phases. Given the critical safety role of diving lights, manufacturers must implement stringent quality control to ensure flawless sealing and pressure testing protocols, often exceeding industry minimum standards. Product differentiation at this stage is achieved through innovative ergonomic designs, specialized reflector geometry to control beam quality (spot vs. flood), and the integration of advanced electronics for power regulation. Following assembly, mandatory certifications (e.g., CE, RoHS, depth rating verification) are secured, which are vital prerequisites for global distribution and consumer trust, particularly in the professional application segments.

Downstream distribution channels are characterized by a mix of direct and indirect sales strategies. Indirect distribution relies heavily on a network of specialized global dive equipment distributors and local, certified dive shops (brick-and-mortar retailers), which offer personalized advice, after-sales service, and product demonstration—factors highly valued by divers. Direct channels, primarily through e-commerce platforms and brand websites, are increasingly important for reaching tech-savvy consumers globally and maintaining higher margin control. Due to the product’s specialized nature and safety implications, specialty dive shops often remain the most influential channel, providing essential product education and support, especially for complex technical lighting systems.

LED Diving Flashlight Market Potential Customers

The primary customer base for the LED Diving Flashlight Market is heterogeneous, spanning serious hobbyists, tourism-related businesses, government agencies, and industrial professionals, all united by the need for reliable underwater illumination. Recreational divers, ranging from newly certified open-water divers to experienced master divers, constitute the largest volume segment. They seek durable, user-friendly, and cost-effective primary and backup lights suitable for typical recreational depth limits. This customer group is highly influenced by branding, community recommendations, and features related to underwater photography compatibility.

A high-value customer segment comprises professional and technical divers, including cave explorers, wreck penetration specialists, commercial inspectors, and scientific marine biologists. These end-users prioritize maximum lumen output, extreme depth ratings, long burn times, and redundancy. For this segment, the purchase decision is based strictly on performance specifications, certified reliability, and compliance with stringent industry safety protocols (e.g., offshore oil and gas industry standards). They often purchase higher-priced canister lights and multiple specialized backup units.

Institutional buyers represent a consistent demand stream, encompassing naval forces, coast guards, search and rescue teams (SAR), and marine police units globally. These organizations require highly ruggedized, often military-specification (Mil-Spec) compliant flashlights with specialized features like infrared or ultraviolet outputs for tactical operations or forensic work. Furthermore, dive resorts and charter operators also function as end-users, requiring robust, easy-to-maintain lights for rental fleets and guiding activities, ensuring safety for their clientele in various diving environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125 Million |

| Market Forecast in 2033 | USD 225 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Scubapro, Mares, Light & Motion, Fenixlight, Dive Rite, Bigblue Dive Lights, OrcaTorch, Halcyon Manufacturing, UK (Underwater Kinetics), Sealife, Tovatec, Sola, Princeton Tec, Xtar, Intova, Sealife Systems, Nitecore, Tektite, X-adive, D-Sun. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Diving Flashlight Market Key Technology Landscape

The technology landscape of the LED Diving Flashlight Market is defined by the synergistic development of advanced semiconductor illumination, robust materials engineering, and intelligent power management systems designed to perform optimally in high-pressure, conductive environments. Central to performance are the High-Output LED Emitters, predominantly based on American and Asian manufacturing, particularly CREE and Luminus chips, which offer exceptional lumen per watt efficiency and a high Color Rendering Index (CRI) essential for accurate underwater color balance, especially for videography. The shift to these high-density LEDs necessitates sophisticated thermal dissipation techniques, including passive cooling through direct contact with aluminum housing (acting as a heat sink) and internal thermal sensors that dynamically manage output to prevent irreversible damage and maintain consistent light quality, a critical safety feature.

Beyond the light source, the key technological differentiators lie in mechanical robustness and user interaction. Magnetic switching technology is ubiquitous in premium diving lights because it allows for full control of output modes (high, medium, low, strobe) without requiring a direct physical breach of the waterproof seal, thereby eliminating a common point of failure under pressure. These switches utilize magnets embedded in a rotating ring or sliding mechanism, interacting with internal electronic sensors. Furthermore, the housing construction leverages advanced materials such as T6061 aircraft-grade aluminum with hard-anodized coatings (Type III) or specialized polymer resins that resist saltwater corrosion and impact damage, ensuring reliability at extreme operational depths well exceeding recreational limits.

Power management systems represent the intellectual backbone of modern diving flashlights. Integration of microcontrollers with high-capacity rechargeable Lithium-ion batteries (typically 18650 or 26650 cells) enables precise voltage regulation, ensuring a stable lumen output throughout the battery’s runtime, rather than the gradual dimming characteristic of older technologies. Advanced Battery Management Systems (BMS) are increasingly common, protecting against overcharging, deep discharge, and short-circuit risks, which are paramount safety concerns when dealing with high-energy lithium batteries underwater. Newer models also incorporate integrated USB-C charging ports with multiple sealing stages, simplifying the charging process and reducing reliance on external chargers, significantly enhancing convenience for the traveling diver.

Regional Highlights

Geographically, the LED Diving Flashlight Market exhibits distinct consumption patterns and growth dynamics across global regions, highly correlated with the prevalence of marine tourism, industrial offshore activity, and disposable income levels allocated to specialized sporting equipment. North America, encompassing the U.S. and Canada, represents a mature and high-value market. Demand here is characterized by a preference for premium brands known for innovation and reliability. The expansive recreational diving industry in Florida, California, and the Caribbean (a major destination for North American divers) drives significant sales volume, while professional applications, particularly offshore energy exploration and technical wreck diving in the Great Lakes, ensure a steady demand for high-end technical lighting solutions. Safety and warranty are paramount decision criteria in this region, often favoring manufacturers with robust localized customer support.

Europe stands out due to its diverse diving environments, ranging from the cold, technical waters of the North Sea to the recreational warmth of the Mediterranean. This region is a leader in adopting specialized and professional diving gear, driven by stringent European Union safety and environmental regulations (e.g., CE marking requirements). Countries such as Germany, the UK, and Norway demonstrate strong demand for professional-grade canister lights and specialized inspection equipment due to significant investment in offshore wind energy and traditional oil and gas infrastructure. Furthermore, European manufacturers often lead in ergonomic design and aesthetic appeal, catering to a sophisticated consumer base that values both performance and design quality.

Asia Pacific (APAC) is currently the most dynamic and fastest-growing region. This explosive growth is fueled by the rapid expansion of coastal tourism in countries like Thailand, Indonesia, the Philippines, and Australia, transforming these areas into major global diving hubs. The rising middle class in China and India has rapidly increased the consumer base for diving certifications and equipment purchases. While the market here includes significant demand for budget-friendly, entry-level lights, there is also robust expansion in the technical diving segment, particularly in parts of Australia and Japan known for demanding underwater exploration. The market structure in APAC often involves complex, multi-tiered distribution networks to reach remote island resorts and specialized dive centers, making strong local partnerships essential for market penetration.

Latin America and the Middle East & Africa (MEA) represent emerging markets with high future potential. Latin America, benefiting from world-class diving locations like the Mexican Caribbean and Galapagos Islands, shows steady growth driven by international tourism and local market development. The MEA region, particularly the Red Sea area (Egypt, Saudi Arabia), is a major dive tourism destination, driving localized demand. Growth in these regions is heavily dependent on the stability of tourism sectors and increasing investment in marine conservation and infrastructure, which necessitates professional lighting tools for monitoring and maintenance activities. Adoption rates in MEA are accelerating as regional governments invest in luxury coastal development and specialized maritime security forces.

- North America: Focus on premium recreational and high-specification technical diving equipment; high consumer awareness of battery safety.

- Europe: High standards for safety certification; strong demand driven by professional offshore maintenance and technical diving in cold waters.

- Asia Pacific (APAC): Highest growth potential driven by booming marine tourism and increasing middle-class participation in recreational diving; significant demand for mid-range and high-lumen video lights.

- Latin America: Growth tied directly to coastal tourism development and accessibility of diving education.

- Middle East & Africa (MEA): Concentrated demand around major diving hubs like the Red Sea; increasing government procurement for maritime security and inspection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Diving Flashlight Market.- Scubapro

- Mares

- Light & Motion

- Fenixlight

- Dive Rite

- Bigblue Dive Lights

- OrcaTorch

- Halcyon Manufacturing

- UK (Underwater Kinetics)

- Sealife

- Tovatec

- Sola

- Princeton Tec

- Xtar

- Intova

- Sealife Systems

- Nitecore

- Tektite

- X-adive

- D-Sun

Frequently Asked Questions

Analyze common user questions about the LED Diving Flashlight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the optimal lumen output for recreational diving flashlights?

For recreational diving, an output between 1000 and 3000 lumens is generally considered optimal, providing sufficient brightness for signaling and illuminating objects up to the limits of recreational depth while balancing battery life. Higher lumens (3000+) are typically reserved for deep technical dives or professional videography.

How important is the Color Rendering Index (CRI) in a diving light?

CRI is extremely important, especially for underwater photography and videography. A high CRI (90+) ensures that colors appear more natural and vibrant underwater, counteracting the absorption of red light wavelengths by water and providing accurate visual data for inspection or creative purposes.

What is the difference between primary and backup diving lights?

Primary lights offer higher lumen output, longer runtimes (often using larger battery packs), and are intended for continuous use during the dive. Backup lights are typically smaller, lower lumen, and designed for redundancy in case of primary light failure or for quick signaling, emphasizing reliability and portability.

Are rechargeable lithium-ion battery flashlights safe for diving?

Yes, modern lithium-ion dive lights are safe when manufactured with robust housings and integrated Battery Management Systems (BMS) that prevent overcharge, over-discharge, and thermal runaway. Users must follow manufacturer guidelines for charging and transport, especially regarding aviation regulations for high-capacity batteries.

Which factors influence the depth rating and durability of a dive light?

Depth rating is primarily determined by the material strength of the housing (usually aircraft-grade aluminum or reinforced polymers), the integrity and quality of the O-ring seals, and the design of the switch mechanism (magnetic or rotary, avoiding penetrations). Advanced thermal management also contributes to long-term durability under operational stress.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager