LED Lighting Bulkheads Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442810 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

LED Lighting Bulkheads Market Size

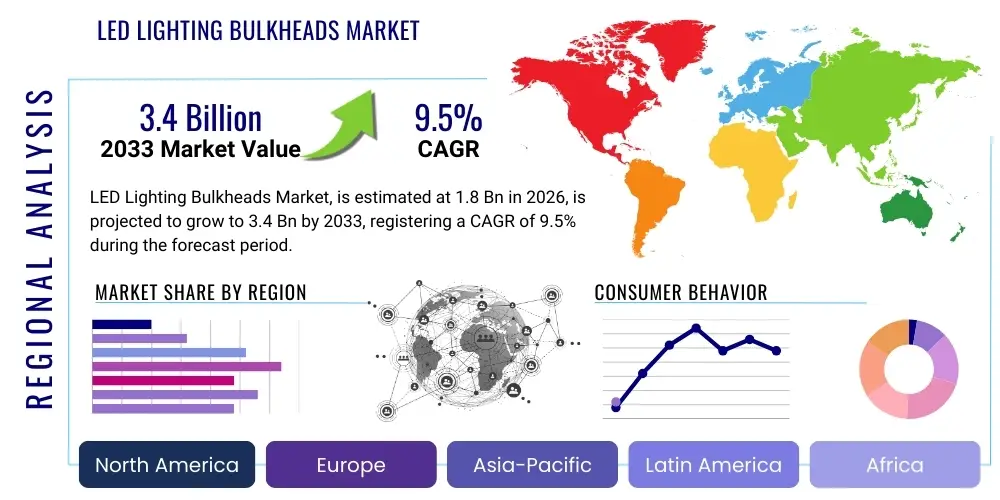

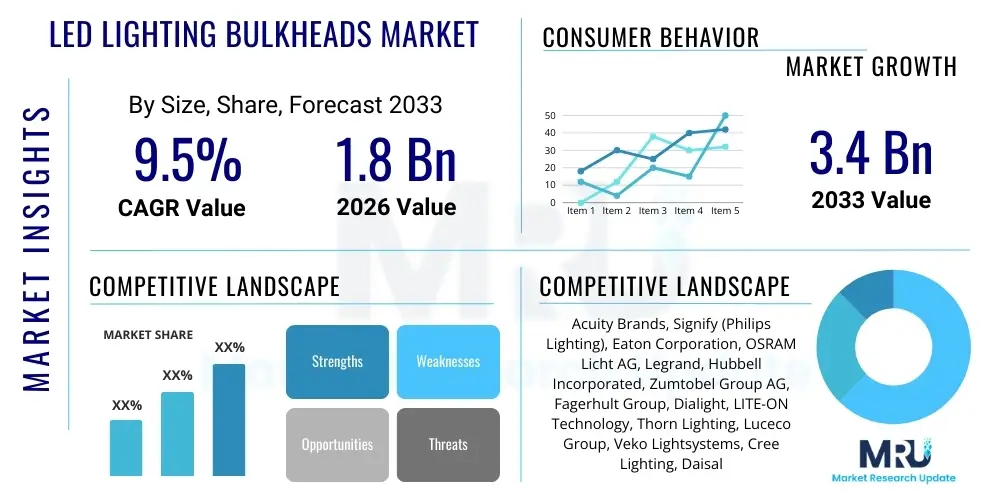

The LED Lighting Bulkheads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $3.4 Billion by the end of the forecast period in 2033.

LED Lighting Bulkheads Market introduction

The LED Lighting Bulkheads Market encompasses the manufacturing, distribution, and utilization of robust, enclosed light fittings specifically designed for environments demanding high durability and ingress protection. These fixtures, traditionally used in industrial, marine, and commercial settings, have rapidly transitioned from conventional fluorescent or incandescent sources to energy-efficient Light Emitting Diode (LED) technology. The primary function of an LED bulkhead is to provide reliable, low-maintenance illumination in challenging environments such as corridors, stairwells, basements, car parks, and external pathways where moisture, dust, and vandalism resistance are paramount. This technological shift is fundamentally driven by global mandates for energy conservation and the superior longevity offered by LED diodes, significantly reducing operational expenditures for end-users.

Product descriptions of modern LED bulkheads often emphasize features such as high Ingress Protection (IP) ratings, typically IP65 or higher, ensuring complete protection against dust and jets of water. Furthermore, many models incorporate IK ratings (Impact Protection) to guard against mechanical damage, making them ideal for high-traffic public areas or industrial facilities susceptible to accidental impacts. Major applications span across the infrastructure sector, including residential high-rises, governmental buildings, educational institutions, healthcare facilities, and extensive utility infrastructure projects. The versatility in design, ranging from slimline and aesthetic models to heavy-duty industrial versions, allows for broad market penetration across diverse commercial and public sectors.

The inherent benefits of adopting LED lighting bulkheads—including reduced power consumption (often 50-80% lower than traditional sources), extended operational lifespan exceeding 50,000 hours, and minimized heat generation—act as primary driving factors. These technical advantages translate directly into lower maintenance costs, decreased carbon footprints, and improved safety through consistent, high-quality illumination. Regulatory pressures promoting sustainable building practices, coupled with consumer demand for durable, efficient lighting solutions, are accelerating the replacement cycle of legacy lighting systems, further propelling the market expansion globally.

LED Lighting Bulkheads Market Executive Summary

The LED Lighting Bulkheads market is exhibiting strong growth momentum, primarily fueled by stringent global energy efficiency regulations and the sustained infrastructure development in emerging economies. Business trends indicate a marked shift towards smart lighting integration, where bulkheads are increasingly equipped with motion sensors, daylight harvesting capabilities, and connectivity features (e.g., IoT enablement) to maximize energy savings and facilitate remote monitoring. Key manufacturers are focusing heavily on developing modular designs and standardized interfaces that simplify installation and maintenance, catering to large-scale retrofit projects across public and private estates. The competitive landscape is characterized by innovation in thermal management and material science, aiming to enhance the lifespan and performance stability of fixtures under extreme operational conditions.

Regionally, the market is spearheaded by Europe and North America, regions that adopted comprehensive LED adoption policies early and maintain mature infrastructure upgrade cycles. However, the Asia Pacific (APAC) region presents the fastest growth trajectory, driven by rapid urbanization, massive investment in commercial real estate, and government initiatives promoting energy-efficient public infrastructure, particularly in countries like China, India, and Southeast Asia. Emerging markets in Latin America and the Middle East & Africa (MEA) are also showing promising potential, primarily due to large-scale construction activities in the hospitality and utility sectors. Variations in regional growth are often correlated with local energy pricing structures and the availability of governmental subsidies supporting LED adoption.

Segment trends reveal that the Industrial Application segment holds a significant market share due to the demanding nature of manufacturing facilities, warehouses, and logistics centers requiring ultra-durable and reliable lighting. Concurrently, the Residential and Commercial sectors are experiencing rapid penetration driven by the aesthetic improvements and long-term cost benefits. In terms of technology, integrated smart bulkheads, featuring embedded controls, are rapidly gaining prominence over standard fixtures. The material segmentation indicates an increasing preference for polycarbonate and high-grade aluminum enclosures, favored for their balance of robustness, corrosion resistance, and lightweight characteristics, addressing diverse installation environments effectively.

AI Impact Analysis on LED Lighting Bulkheads Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the LED Lighting Bulkheads market frequently revolve around how predictive maintenance models can be applied to lighting assets, whether AI-driven algorithms can optimize energy consumption beyond basic sensor functions, and the implications of integrating bulkheads into broader smart city networks. Users express concerns about data privacy and the security of connected lighting systems while simultaneously holding high expectations for AI to automate fault detection, extend product lifespan, and personalize lighting scenes based on occupancy patterns and environmental conditions. The key themes highlight a desire for proactive operational efficiency improvements and enhanced security via intelligent lighting infrastructure.

AI is set to revolutionize the operational longevity and efficiency of LED bulkheads by enabling sophisticated diagnostics and predictive maintenance schedules. Instead of relying on manual inspections or scheduled replacements, AI algorithms analyze real-time performance data—such as fluctuations in current draw, temperature readings, and lumen depreciation—to accurately predict potential component failures. This proactive approach significantly minimizes unexpected downtime, optimizes inventory management for replacement parts, and ensures consistent quality of illumination, moving the industry towards a service-oriented business model focused on uptime guarantees rather than just product sales.

Furthermore, the integration of AI allows bulkheads to function as integral data collection points within smart buildings and cities. AI-powered bulkheads can analyze occupancy flow, ambient light levels, and even atmospheric conditions, allowing for hyper-granular control over light output that far surpasses conventional passive infrared (PIR) sensors. This level of optimization maximizes energy savings by only providing the necessary light intensity precisely when and where it is needed, contributing substantially to net-zero energy goals for large infrastructure projects. This evolution transforms bulkheads from simple illumination devices into critical components of intelligent infrastructure management systems.

- Predictive Maintenance: AI algorithms analyze operational data (temperature, current, lumen output) to forecast failure points, drastically reducing reactive maintenance costs.

- Dynamic Energy Optimization: Real-time analysis of occupancy and daylight harvesting allows AI to adjust light intensity dynamically, optimizing power consumption beyond fixed scheduling.

- Enhanced Security and Monitoring: Utilizing embedded cameras and sensors, AI in bulkheads can identify anomalous movements or unauthorized access in parking lots or industrial areas.

- Automated Fault Detection: Immediate and precise identification of malfunctioning fixtures, enabling rapid repair and minimizing prolonged periods of inadequate lighting.

- Integration into Smart Infrastructure: Serving as nodal points for IoT ecosystems, bulkheads facilitate data transmission for broader building management and smart city applications.

DRO & Impact Forces Of LED Lighting Bulkheads Market

The market dynamics of LED lighting bulkheads are primarily dictated by compelling drivers such as global energy efficiency mandates and the attractive Total Cost of Ownership (TCO) offered by LED technology. Conversely, restraints, particularly the high initial investment cost and the complexity associated with integrating smart lighting controls into legacy infrastructure, often slow down adoption rates in cost-sensitive segments. Opportunities are abundantly available through large-scale retrofit projects targeting aging municipal and commercial infrastructure, especially in regions transitioning rapidly toward smart city frameworks. These forces combine to create a highly competitive environment where product innovation and strategic pricing are key determinants of market success, shaping investment decisions across the value chain from component suppliers to end-users.

Key drivers include government subsidies and tax incentives promoting the adoption of energy-saving lighting solutions, which substantially offset the upfront costs for businesses and homeowners. The durability and robust nature of bulkheads, essential for harsh environments like marine, chemical, and external architectural applications, ensure consistent demand regardless of short-term economic fluctuations. Moreover, the increasing public awareness regarding environmental sustainability pressures organizations to adopt greener technologies, making the shift to long-lasting, recyclable LED bulkheads a necessity for corporate social responsibility (CSR) initiatives. The continuous improvement in LED chip efficacy (lumens per watt) further solidifies the economic rationale for conversion.

Restraints are centred around the need for specialized electrical expertise during the installation and commissioning of advanced smart bulkheads. Interoperability issues between proprietary smart lighting platforms and existing building management systems (BMS) can present significant integration challenges. Furthermore, the market faces saturation in some developed regions where early adopters have already completed their conversion cycles, requiring manufacturers to focus increasingly on replacement demand or advanced technology upgrades. Opportunities are significantly amplified by the rising trend of human-centric lighting (HCL), where bulkheads are engineered to adjust colour temperature and intensity to positively influence occupant well-being and productivity in commercial and healthcare settings. The expansion of hazardous location lighting (HazLoc) requirements also opens new specialized niche markets for ultra-durable, certified bulkheads.

Segmentation Analysis

The LED Lighting Bulkheads market is meticulously segmented based on several critical factors, including the type of fixture technology (Standard vs. Smart), the enclosure material utilized (Polycarbonate, Aluminum, Steel), the application environment (Indoor vs. Outdoor), and the diverse end-use sectors served (Residential, Commercial, Industrial). This segmentation provides a granular view of market demand and allows stakeholders to tailor product offerings and marketing strategies to specific operational requirements and budget constraints. The fastest-growing segment often includes smart bulkheads, driven by the expanding adoption of IoT in infrastructure, while the Industrial sector remains the largest consumer due to the critical need for highly durable and resistant fixtures in harsh operating conditions.

Analyzing these segments reveals varied growth rates and adoption patterns. For instance, polycarbonate bulkheads dominate the general commercial and residential outdoor markets due to their cost-effectiveness and resistance to corrosion, whereas heavy-duty aluminum and marine-grade steel bulkheads capture the industrial and specialized maritime applications where maximum impact resistance and heat dissipation are non-negotiable. Geographic market segmentation further refines this analysis, indicating that regions with mature building codes and high energy costs, such as Northern Europe, show stronger demand for premium, highly efficient, and smart-enabled products, contrasting with emerging markets prioritizing robust, basic functionality at a lower cost.

- By Type:

- Standard LED Bulkheads

- Smart/Connected LED Bulkheads (Integrated Sensors, Wireless Control)

- By Application:

- Indoor (Corridors, Stairwells, Basements)

- Outdoor (Perimeter Security, Parking Lots, Pathways)

- By Material:

- Polycarbonate Bulkheads

- Die-Cast Aluminum Bulkheads

- Stainless Steel/Marine Grade Bulkheads

- By End-Use Sector:

- Residential

- Commercial (Offices, Retail, Hospitality)

- Industrial (Warehouses, Manufacturing Plants, Logistics)

- Infrastructure/Public Utilities (Roads, Tunnels, Hospitals, Schools)

Value Chain Analysis For LED Lighting Bulkheads Market

The value chain for LED Lighting Bulkheads commences with the upstream segment, dominated by raw material procurement and component manufacturing. This stage involves securing semiconductor materials for LED chips (wafers, substrates), sourcing high-quality thermal management materials (aluminum, copper), and acquiring durable plastic resins or metal alloys for the fixture housing and diffusers. Key upstream activities are characterized by intense focus on supply chain resilience, component miniaturization, and securing stable supplies of specialized electronic drivers (power supplies) which are crucial for the longevity and performance of the final product. Fluctuation in global semiconductor and metal prices exerts a substantial influence on the manufacturing cost structure at this initial stage.

The midstream of the value chain involves the design, assembly, and quality assurance of the LED bulkhead fixtures. Manufacturers convert raw components into finished goods, requiring sophisticated assembly processes, advanced optical design to ensure appropriate light distribution (e.g., asymmetrical or wide beam patterns), and rigorous testing for IP/IK ratings and electrical safety compliance. Distribution channels are highly fragmented, involving a blend of direct sales to large infrastructural projects and indirect distribution through electrical wholesalers, lighting distributors, and large retail hardware chains. Effective inventory management and logistical efficiency are paramount in the midstream to ensure products reach diverse global markets promptly and cost-effectively, particularly given the bulk and weight of industrial-grade fixtures.

Downstream analysis focuses on installation, integration, and post-sales services. Direct channels often serve large commercial or municipal contracts, allowing manufacturers to offer integrated services, including lighting audits, design consultation, and full-scale installation management. Indirect channels, relying on contractors and electricians, necessitate strong relationships with wholesalers who provide localized support and product availability. The future profitability of the downstream segment is increasingly linked to offering connected lighting services, maintenance contracts for smart systems, and data analytics derived from installed IoT-enabled bulkheads, creating recurring revenue streams far beyond the initial product sale.

LED Lighting Bulkheads Market Potential Customers

Potential customers for LED Lighting Bulkheads are highly diverse, spanning any entity requiring durable, energy-efficient, and vandalism-resistant illumination in semi-exposed or harsh environments. The primary purchasing segments include large infrastructure developers, governmental bodies responsible for public amenities, industrial facility managers, and owners of high-density commercial real estate. These buyers prioritize longevity, certification compliance (e.g., fire ratings, HazLoc), and low lifetime maintenance costs over initial purchase price, seeking lighting solutions that ensure safety and operational continuity in critical areas like emergency exits, perimeter security, and utility rooms.

In the public sector, key buyers are municipal housing authorities, departments of transportation (for tunnels and subways), and educational institutions, which require robust lighting for stairwells, car parks, and communal areas that are frequently subject to wear and tear. Commercial sector purchasers include property management firms for multi-story residential buildings, retail park operators, and hospitality groups looking for unobtrusive yet durable external lighting. These customers are increasingly focused on aesthetic integration and the smart features of bulkheads, such as integrated emergency lighting functions and sophisticated dimming capabilities that enhance guest experience while complying with safety regulations.

The industrial sector, encompassing chemical processing plants, food and beverage manufacturing, and maritime port facilities, represents a crucial segment requiring specialized, high-specification bulkheads resistant to chemical corrosion, extreme temperatures, and explosive atmospheres. For these specialized industrial applications, the end-user buyer profile includes specialized procurement teams and safety officers whose purchasing decisions are heavily regulated and based on technical specifications related to hazardous area classifications (e.g., ATEX or IECEx certifications), ensuring the lighting system does not pose an ignition risk. The trend towards industrial automation further drives demand for bulkheads capable of integrating into centralized process control systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $3.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Acuity Brands, Signify (Philips Lighting), Eaton Corporation, OSRAM Licht AG, Legrand, Hubbell Incorporated, Zumtobel Group AG, Fagerhult Group, Dialight, LITE-ON Technology, Thorn Lighting, Luceco Group, Veko Lightsystems, Cree Lighting, Daisalux, R. STAHL, Glamox ASA, GE Current, Schreder Group, Larson Electronics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Lighting Bulkheads Market Key Technology Landscape

The technological landscape of the LED Lighting Bulkheads market is defined by advancements in three primary areas: LED chip efficiency, robust materials science, and integrated connectivity platforms. Recent innovations in LED chip technology focus on achieving higher lumens per watt while maintaining exceptional thermal stability, crucial for enclosed bulkhead designs where heat dissipation is inherently challenging. Manufacturers are increasingly utilizing Chip-on-Board (COB) and Surface-Mounted Device (SMD) technologies combined with sophisticated thermal pathways, often employing specialized heat sinks or phase-change materials, to ensure the diodes operate within optimal temperature ranges, thereby maximizing their rated lifespan and light output integrity over years of continuous operation in harsh environments.

Material innovation is central to improving the durability and ingress protection ratings. The transition from glass and fragile plastics to high-impact, UV-stabilized polycarbonate and die-cast marine-grade aluminum alloys allows bulkheads to withstand extreme weather conditions, corrosive salt spray, and physical abuse (IK ratings). Furthermore, the integration of microwave and PIR sensors directly into the fixture housing has become standard practice, enabling basic control features like occupancy sensing and automatic dimming. This necessitates careful engineering to ensure the sensor sensitivity and range are not compromised by the protective enclosure materials, balancing ruggedness with functional performance required for sophisticated lighting controls.

The most transformative technological shift involves the widespread adoption of IoT and wireless communication protocols (e.g., Zigbee, Bluetooth Mesh, LoRaWAN) to enable smart bulkheads. This connectivity permits remote monitoring, diagnostic capabilities, grouping, and seamless integration into larger Building Management Systems (BMS). Advanced bulkheads now incorporate embedded controllers that facilitate Human-Centric Lighting (HCL) functionalities, allowing the adjustment of CCT (Correlated Color Temperature) and intensity throughout the day to mimic natural light cycles. This convergence of lighting, sensors, and communication technology is redefining the bulkhead from a standalone fixture into an intelligent node within a connected infrastructure network, capable of generating valuable environmental and occupancy data.

Regional Highlights

The global LED Lighting Bulkheads market displays distinct regional consumption patterns and growth drivers, heavily influenced by local regulatory environments and levels of infrastructure maturity. North America, encompassing the United States and Canada, represents a mature market characterized by high replacement demand and significant investments in smart building retrofits. Regulations mandating energy conservation, combined with favorable utility rebate programs, accelerate the adoption of premium, networked bulkhead solutions, particularly in large commercial real estate and sprawling institutional campuses. The emphasis here is on interoperability and seamless integration with existing smart grid technologies and cybersecurity protocols, ensuring reliable, high-performance illumination in critical infrastructure.

Europe stands as a leading region in technological adoption, driven by the ambitious European Union energy efficiency directives (e.g., EcoDesign requirements) and a strong commitment to sustainable building practices. Western European nations, especially the UK, Germany, and the Nordic countries, show strong demand for bulkheads with robust emergency lighting functions and advanced CCT tuning capabilities (HCL). Eastern Europe is rapidly catching up, fueled by EU funding for infrastructure modernization and the adoption of modern building codes. The European focus is often on minimizing embodied carbon and maximizing recyclability of the fixtures, aligning with circular economy principles that impact material choices and manufacturing processes.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period, powered by unprecedented rates of urbanization and massive government-led infrastructural projects in countries like China, India, and Indonesia. The growth in APAC is bifurcated: established economic centers focus on quality and smart integration, while developing regions prioritize affordable, high-volume bulkheads that meet basic safety and energy-saving requirements for new residential and commercial construction. Market expansion here is directly correlated with the sheer volume of new construction, particularly in the public housing and transportation sectors. Local manufacturing capabilities are also expanding rapidly, challenging global players through competitive pricing and localized product variations tailored to regional environmental specifics.

Latin America (LATAM) and the Middle East and Africa (MEA) present significant potential, although market penetration is less uniform. In the Middle East, large-scale construction projects linked to major sporting events and diversification efforts (e.g., Saudi Vision 2030) create substantial demand for high-performance, aesthetically pleasing outdoor and infrastructure bulkheads resistant to extreme desert heat and dust. In LATAM, economic stability and growing awareness of long-term energy savings are driving incremental shifts from traditional lighting to LED bulkheads, primarily in the commercial and industrial segments, often facilitated by international financing for energy efficiency upgrades. The MEA region specifically requires fixtures capable of withstanding high ambient temperatures without compromising lifespan, leading to specific design requirements focused on superior thermal management.

- North America: Focus on smart retrofits, stringent energy codes, and high integration with IoT platforms in commercial and institutional settings.

- Europe: Driven by EcoDesign regulations, strong demand for HCL, and a focus on product circularity and high emergency lighting standards.

- Asia Pacific (APAC): Highest growth area due to rapid urbanization, massive infrastructure development, and increasing local manufacturing capabilities.

- Middle East & Africa (MEA): Significant demand from large-scale government projects, requiring bulkheads optimized for extreme temperature and dust resistance.

- Latin America: Gradual adoption fueled by long-term cost savings, primarily targeting new commercial developments and industrial facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Lighting Bulkheads Market.- Acuity Brands

- Signify (Philips Lighting)

- Eaton Corporation

- OSRAM Licht AG

- Legrand

- Hubbell Incorporated

- Zumtobel Group AG

- Fagerhult Group

- Dialight

- LITE-ON Technology

- Thorn Lighting

- Luceco Group

- Veko Lightsystems

- Cree Lighting

- Daisalux

- R. STAHL

- Glamox ASA

- GE Current

- Schreder Group

- Larson Electronics

Frequently Asked Questions

Analyze common user questions about the LED Lighting Bulkheads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of LED bulkheads over traditional lighting fixtures in harsh environments?

LED bulkheads offer superior durability, often achieving high IP (Ingress Protection) and IK (Impact Protection) ratings necessary for moisture, dust, and vandalism resistance. Their primary advantage lies in energy efficiency, consuming up to 80% less power, and providing a lifespan of 50,000+ hours, drastically reducing maintenance and replacement costs compared to fluorescent or incandescent alternatives. This low Total Cost of Ownership (TCO) makes them ideal for demanding industrial and public sector applications.

How is the integration of smart technology impacting the performance and utility of LED bulkheads?

Smart technology integration is transforming bulkheads into connected data nodes. Embedded sensors (PIR, microwave) enable intelligent occupancy sensing and daylight harvesting, maximizing energy savings. Connectivity via IoT protocols allows for remote diagnostics, real-time performance monitoring, automated fault reporting, and predictive maintenance scheduling, enhancing operational efficiency and overall system reliability within a centralized Building Management System (BMS).

Which material type is most prevalent in the manufacturing of high-durability LED bulkheads?

High-durability LED bulkheads are predominantly manufactured using UV-stabilized polycarbonate and die-cast aluminum. Polycarbonate is favored for general commercial and residential outdoor use due to its impact resistance and non-corrosive properties, while aluminum is essential for heavy-duty industrial or marine environments where superior heat dissipation, maximum impact strength, and resistance to chemical corrosion are critically required for certification and longevity.

What key regulations are driving the market adoption of LED lighting bulkheads globally?

Global adoption is primarily driven by energy efficiency mandates set by governments and international bodies, such as the European Union’s EcoDesign directive and regional standards like the US DOE’s energy performance requirements. These regulations push for phase-outs of inefficient legacy lighting and incentivize the procurement of highly efficient, certified LED solutions, ensuring minimal energy consumption and environmental impact in new and retrofitted infrastructure projects.

What are the biggest challenges facing market penetration in emerging economies?

The primary challenge in emerging economies is the high initial capital investment required for LED bulkheads, especially for advanced smart models, compared to cheaper, conventional lighting options. Other hurdles include inconsistent power quality, which can damage sensitive LED drivers, and the need for skilled labor to properly install and commission integrated smart lighting control systems, leading to a preference for simpler, basic functionality fixtures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager