LED Obstruction Lights Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442136 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

LED Obstruction Lights Market Size

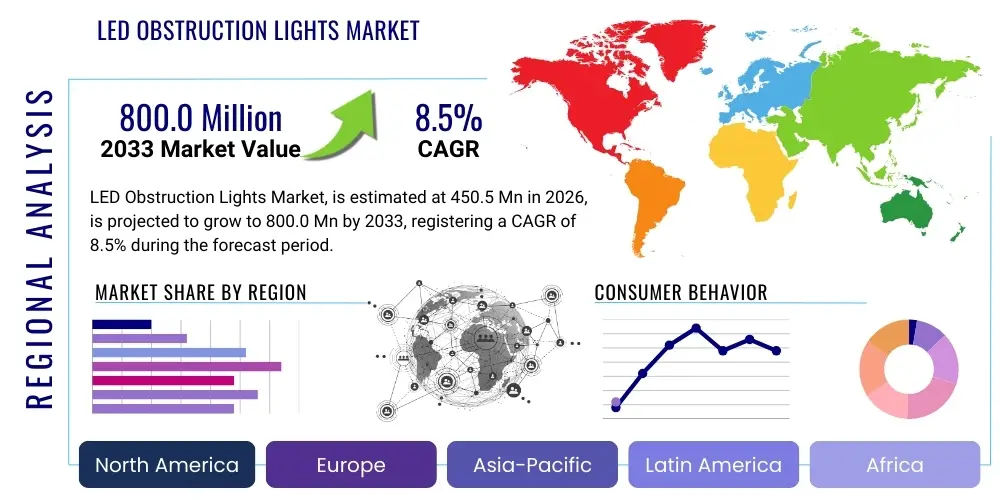

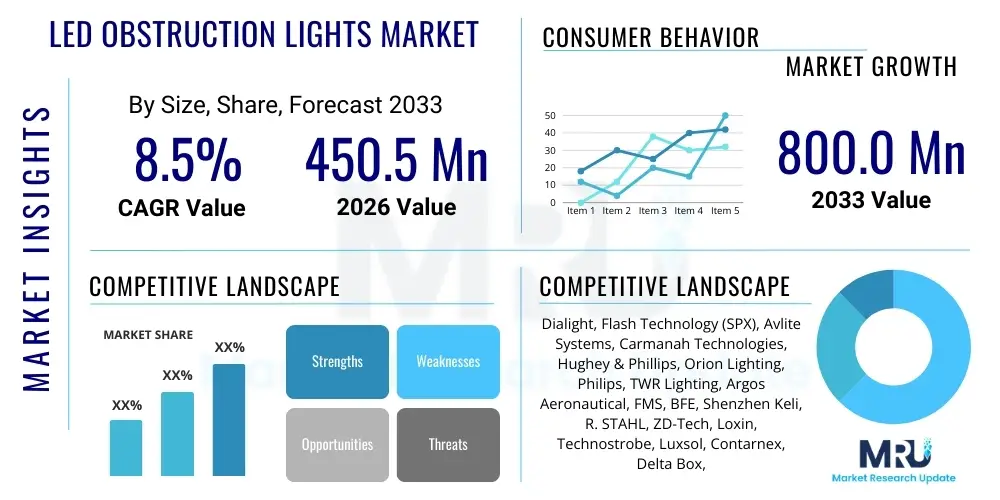

The LED Obstruction Lights Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 800.0 Million by the end of the forecast period in 2033. This robust expansion is primarily attributed to stringent governmental regulations mandating the use of advanced aviation safety lighting systems across high-rise structures, communication towers, and energy infrastructure globally. The inherent advantages of LED technology, such as significantly lower power consumption, extended operational lifespan, and reduced maintenance requirements compared to traditional incandescent or xenon flash lights, are pivotal in accelerating market adoption. Furthermore, increasing global investments in renewable energy infrastructure, particularly large-scale wind farms and solar thermal plants, necessitate reliable obstruction lighting solutions compliant with International Civil Aviation Organization (ICAO) and Federal Aviation Administration (FAA) standards, thereby fueling demand.

The transition toward sustainable infrastructure development worldwide is a significant underlying factor supporting the market valuation increase. Regulatory bodies are increasingly focusing on energy efficiency, making LED-based solutions the preferred choice for new installations and retrofitting projects. Developed economies in North America and Europe demonstrate mature market penetration, driven by rigorous compliance and the necessity to replace aging infrastructure. Meanwhile, rapid urbanization and massive infrastructure projects in the Asia Pacific region, specifically in countries like India and China, are creating substantial greenfield opportunities for LED obstruction light manufacturers. This geographical shift in investment focus ensures sustained market buoyancy over the forecast horizon, translating into tangible revenue growth for key industry stakeholders.

LED Obstruction Lights Market introduction

The LED Obstruction Lights Market encompasses the manufacturing, distribution, and implementation of highly durable, energy-efficient lighting solutions designed to enhance the visibility of high-structure obstacles for aircraft navigation, adhering strictly to global aviation safety protocols. These devices are critical safety components installed on various structures, including telecommunication masts, broadcast towers, wind turbines, tall buildings, and specialized industrial facilities, ensuring compliance with standards set forth by authorities such as the ICAO and the FAA. The transition from legacy lighting technologies, such as incandescent and xenon, to Light Emitting Diode (LED) technology represents a fundamental shift driven by operational cost efficiencies, superior reliability, and environmental sustainability. LED obstruction lights offer distinct advantages, including minimal heat emission, resilience to vibration and harsh weather conditions, and substantially reduced maintenance schedules, making them indispensable for critical infrastructure safeguarding.

Major applications for LED obstruction lights span across critical infrastructure sectors. Telecommunication towers and broadcast facilities constitute a core market segment due to their sheer height and geographical spread, requiring continuous compliance monitoring and reliable long-term lighting performance. Airports utilize these lights extensively for marking perimeter fences, control towers, and various navigational aids. Crucially, the burgeoning global development of wind energy necessitates high-intensity LED obstruction lights for marking vast wind farm arrays, often located in remote or offshore environments, where durability and minimal maintenance are paramount considerations. The demand is further solidified by urban development trends, where high-rise commercial and residential buildings must be clearly marked in dense metropolitan airspaces, adhering to urban aviation safety codes.

The market growth is primarily driven by three core factors: first, the mandatory nature of aviation safety regulations, which are continuously being updated and enforced across jurisdictions; second, the life-cycle cost benefits associated with LEDs, offering superior return on investment through energy savings and extended product life; and third, the global expansion of infrastructure, including 5G network rollouts requiring new tower construction and substantial governmental expenditure on renewable energy projects. These driving forces collectively ensure that the LED obstruction lights market remains structurally resilient and experiences continuous, stable growth over the projected period, underpinned by safety mandates and technological innovation focused on improving visibility and operational resilience.

LED Obstruction Lights Market Executive Summary

The LED Obstruction Lights Market is characterized by vigorous growth, fueled by global aviation safety mandates, infrastructure expansion, and technological innovation. Key business trends indicate a strong move toward integrated, smart lighting solutions that incorporate monitoring and predictive maintenance capabilities, aligning with the broader Industry 4.0 paradigm. Manufacturers are increasingly focusing on modular designs, enabling simplified installation and quicker replacement cycles, alongside the development of specialized lights for niche applications, such as high-intensity lights for offshore platforms and medium-intensity solutions for rapidly deployed temporary structures. Mergers and acquisitions remain a strategic tool for market consolidation, allowing established players to gain access to proprietary technologies and expand geographical reach, particularly into rapidly developing economies in Asia Pacific and specialized regulated markets in Europe. Furthermore, sustainability is emerging as a critical competitive differentiator, with companies prioritizing low-voltage, solar-powered systems to reduce environmental impact and operational costs for end-users, especially in remote installations.

Regional trends reveal significant disparities in maturity and growth trajectory. North America and Europe dominate in terms of technological adoption and stringent regulatory adherence, driving demand for premium, highly certified products. These regions are characterized by intensive retrofitting activities, replacing older incandescent systems. Conversely, the Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by unprecedented infrastructure investment, rapid industrialization, and massive renewable energy projects, particularly wind farm construction in coastal areas. Latin America and the Middle East & Africa (MEA) present emerging market opportunities, spurred by modernization of transportation infrastructure, including new airport construction and significant investments in oil and gas infrastructure where flare stacks and tall processing equipment require robust marking. The regulatory framework in MEA is slowly converging toward international standards, creating a stable, long-term demand curve.

Segment-wise, the market is primarily segmented by light intensity (Low, Medium, High) and application. High-intensity obstruction lights, mandated for structures exceeding 150 meters, are witnessing strong growth due to the construction of ultra-tall skyscrapers and large wind turbines. Application trends highlight the sustained dominance of the Telecommunication Towers segment, although the fastest growth is anticipated in the Wind Turbine application, reflecting the global commitment to decarbonization and renewable energy capacity expansion. Technological advancements are focused on improving light source efficiency and developing compliance-monitoring software integrated directly into the lighting systems, allowing for real-time status updates and automatic reporting of failures, thus addressing major operational concerns for infrastructure owners and improving overall safety compliance levels.

AI Impact Analysis on LED Obstruction Lights Market

Common user questions regarding AI's impact on the LED Obstruction Lights Market generally revolve around how Artificial Intelligence can enhance maintenance efficiency, improve regulatory compliance monitoring, and optimize energy consumption. Users frequently inquire about the feasibility of integrating machine learning algorithms for predictive failure analysis—specifically, anticipating LED lifespan deterioration or sensor malfunction before it impacts safety operations. There is also significant curiosity about how AI-driven image processing or sensor data analysis can automatically verify the operational status of lights, particularly on widely distributed assets like wind farms or vast telecommunication networks, reducing the need for costly and frequent physical inspections. Key concerns center on data security, the complexity of implementation in legacy systems, and the standardization of AI interfaces across different manufacturer platforms. Expectations are high for AI to transform operational expenditure (OpEx) by moving from reactive or scheduled maintenance models to highly precise, condition-based maintenance strategies, ensuring maximum uptime and safety compliance.

The integration of AI technologies, particularly machine learning and advanced sensor data analytics, offers transformative potential for the operation and maintenance of LED obstruction lighting systems. AI algorithms can process vast amounts of data from integrated light sensors, power monitors, and environmental sensors (temperature, humidity, vibration) to establish baseline operational profiles. Deviations from these profiles—even minor shifts in current draw or light output intensity—can be flagged as indicators of potential impending failures. This capability shifts maintenance practices from time-based scheduling, which can be inefficient and costly, to true predictive maintenance. Such enhanced monitoring significantly improves reliability, crucial for aviation safety, and drastically reduces unexpected downtime, minimizing the risk of non-compliance penalties.

Furthermore, AI plays a crucial role in optimizing energy management for obstruction lighting, particularly in solar-powered and remote installations. Machine learning models can analyze local weather patterns, seasonal visibility requirements, and energy storage levels to dynamically adjust light intensity while remaining compliant with mandated minimum requirements. This dynamic adjustment capability ensures that battery reserves are optimally managed during prolonged periods of low solar input, maximizing system autonomy and operational resilience. The use of generative AI in designing optimal light positioning and beam configuration for complex structures is also an emerging application, ensuring superior visibility while minimizing light pollution in adjacent areas.

- AI-driven predictive maintenance modeling minimizes unexpected failures and non-compliance risk.

- Automated compliance verification using image recognition and data analytics streamlines regulatory reporting.

- Optimization of energy consumption in solar-powered systems through machine learning of environmental factors.

- Real-time performance monitoring and automated anomaly detection using integrated sensor data processing.

- Improved supply chain efficiency and inventory management based on AI-driven forecasting of component replacement needs.

- Potential use of Generative AI (GenAI) for optimizing photometric design and placement on complex structures.

DRO & Impact Forces Of LED Obstruction Lights Market

The dynamics of the LED Obstruction Lights Market are governed by a complex interplay of regulatory mandates, technological evolution, and economic factors, summarized effectively by the Drivers, Restraints, and Opportunities (DRO) framework. Primary drivers include the global harmonization and stringent enforcement of aviation safety regulations (ICAO/FAA), mandating reliable marking systems for new and existing tall structures. Significant capital investment in global infrastructure, especially large-scale wind energy projects and 5G network expansion, further accelerates demand. Restraints predominantly center around the high initial capital expenditure associated with purchasing and installing certified, high-quality LED systems compared to older technologies, which can deter adoption in price-sensitive emerging markets. Additionally, perceived complexity in integrating advanced monitoring systems and varying regulatory interpretations across different national airspaces pose challenges. Opportunities lie in the continued transition toward sustainable, solar-powered LED systems, the integration of smart IoT features for remote diagnostics, and market penetration into rapidly industrializing regions where compliance frameworks are maturing.

Impact forces within this market are substantial, largely originating from the enforcement environment. Governmental and civil aviation authorities exert an exceptionally high impact force due to their power to mandate specifications and operational requirements, fundamentally determining market demand and technological trajectory. Economic forces, particularly the declining cost of LED components and improvements in battery storage technology, exert a moderate-to-high facilitating impact, making advanced systems more economically viable over their lifecycle. Competition is fierce among established global leaders and regional manufacturers, pushing continuous innovation in durability, efficiency, and compliance certification standards. Technological impact forces are currently driving the most rapid change, promoting the shift toward networked, low-voltage, and self-monitoring systems, increasing the barrier to entry for non-compliant or technologically stagnant manufacturers.

The strongest impact force remains the safety imperative; non-compliance carries severe legal and operational consequences, ensuring that infrastructure owners prioritize certified LED obstruction lights as a mission-critical component. This safety focus guarantees consistent, inelastic demand. Furthermore, the increasing complexity and size of modern infrastructure, such as offshore wind farms extending hundreds of kilometers, necessitate lighting systems capable of operating autonomously for extended periods under extreme conditions, amplifying the market's dependence on robust and technologically sophisticated LED solutions. Addressing the high initial cost restraint through favorable financing models or government subsidies for safety upgrades represents a crucial area for unlocking significant untapped potential in developing economies.

Segmentation Analysis

The LED Obstruction Lights Market is comprehensively segmented based on Light Intensity Type, Application, Technology, and Sales Channel, reflecting the diverse regulatory requirements and end-user needs across various vertical industries. Segmentation by intensity is crucial as it directly correlates with the height of the obstacle and the required visibility range, determined by international standards (ICAO Annex 14) and national regulations (e.g., FAA Advisory Circulars). The Application segment details the varied end-users, where needs range from stationary, urban high-rise structures to highly dynamic and remote installations like offshore wind turbines, each demanding specialized product specifications concerning durability, ingress protection, and operational redundancy. The granular segmentation allows manufacturers to tailor product development and marketing strategies to meet specific compliance thresholds and environmental challenges inherent in each category.

- By Type (Light Intensity):

- Low Intensity Obstruction Lights (Type A, B, C, D)

- Medium Intensity Obstruction Lights (Type A, B, C)

- High Intensity Obstruction Lights (Type A, B)

- By Application:

- Telecommunication Towers and Broadcast Antennas

- Airports and Heliports (Approach Lights, Taxiway Lights, etc.)

- Wind Turbines and Wind Farms (Onshore and Offshore)

- High-Rise Buildings and Skylines

- Industrial Facilities (Chimneys, Flare Stacks, Cooling Towers)

- Bridges and Cranes

- By Technology:

- Standard LED Systems

- Solar-Powered LED Systems

- IoT-Integrated Smart LED Systems

- By Sales Channel:

- Direct Sales (Large Infrastructure Projects)

- Distributors and System Integrators (Maintenance and Retrofit)

Value Chain Analysis For LED Obstruction Lights Market

The value chain for the LED Obstruction Lights Market begins with upstream activities involving the sourcing and processing of raw materials, primarily focusing on high-quality semiconductor components for LEDs, advanced optics (lenses and diffusers), durable housing materials (aluminum, polycarbonate), and specialized power management circuitry. Key suppliers in this segment include major semiconductor manufacturers and optics specialists. Successful integration at this stage relies heavily on ensuring component quality, reliability, and thermal management capabilities to achieve the required lifespan and intensity certification. Manufacturing and assembly follow, where core expertise lies in thermal engineering, precise circuit integration, and rigorous testing protocols to meet FAA/ICAO photometric and ingress protection standards (IP ratings). This stage adds significant value through compliance certification and quality assurance, validating the product's suitability for mission-critical safety applications.

Downstream activities involve specialized distribution channels and installation service providers. Due to the highly regulated nature of the product, distribution often relies on specialized distributors and system integrators who possess expert knowledge of regional aviation regulations and possess the technical capacity to advise on complex compliance requirements. Direct sales are common for large-scale, strategic infrastructure projects (e.g., national 5G rollouts or major wind farm developers), allowing manufacturers to maintain tight control over pricing and customized solutions. Indirect channels, through regional value-added resellers (VARs) and electrical wholesalers, dominate the retrofit and small-to-medium-scale maintenance markets, providing logistical and local support. The final stage involves installation, commissioning, and long-term maintenance services, often requiring certified technicians to ensure adherence to installation standards and operational functionality verification.

The competitive leverage within the value chain is typically concentrated at two points: the upstream technology phase, where proprietary LED and optics designs grant a performance edge, and the downstream service and certification phase, where the ability to provide expert regulatory consulting and integrated, remote monitoring solutions dictates customer preference. Digitalization plays an increasing role, with specialized software and IoT integration becoming value-added components that enhance the product offering beyond the physical light fixture itself. Effective inventory management and robust after-sales support are crucial for maintaining customer satisfaction, especially given the lengthy operational lifespan expected of these safety devices.

LED Obstruction Lights Market Potential Customers

Potential customers for LED Obstruction Lights are diverse, spanning governmental, commercial, and renewable energy sectors, united by the mandatory requirement to comply with air safety regulations for high structures. The primary end-users are operators and owners of infrastructure that penetrates navigable airspace. This includes major global telecommunication providers who manage extensive networks of towers, requiring certified lighting for continuous compliance. Furthermore, the civil aviation sector, including airport operators and air traffic control bodies, constitutes a foundational customer base for marking airport infrastructure and navigational aids. The energy sector, encompassing traditional power generators, utility companies, and, most significantly, developers and operators of onshore and offshore wind farms, represents the fastest-growing customer segment due to the vast number of tall turbines being installed globally. These entities prioritize low-maintenance, highly reliable, and often solar-powered systems suitable for remote operation.

Other key buyers include commercial real estate developers specializing in high-rise buildings, often mandated by urban planning regulations to install certified obstruction lighting on rooftops and architectural features. Industrial customers operating processing plants, refineries, and chemical facilities purchase these systems to mark flare stacks, chimneys, and tall industrial equipment. Governmental and military entities purchase specialized obstruction lights for sensitive installations, radar systems, and communication masts, often requiring enhanced security and durability features. The purchasing decision is overwhelmingly driven by compliance, system reliability, and Total Cost of Ownership (TCO), rather than initial price, given the mission-critical nature of the safety function provided by these lights.

A burgeoning potential customer base lies within the burgeoning drone and urban air mobility (UAM) sector. Although regulations are still evolving, the increasing density of drone traffic and future electric vertical takeoff and landing (eVTOL) operations will likely necessitate new, lower-level marking requirements for smaller, distributed infrastructure within urban environments. This anticipation opens a future segment focused on highly granular and networked lighting solutions, potentially integrated with smart city platforms. Manufacturers must therefore track evolving urban air safety mandates to capitalize on this emerging application area.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 800.0 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dialight, Flash Technology (SPX), Avlite Systems, Carmanah Technologies, Hughey & Phillips, Orion Lighting, Philips, TWR Lighting, Argos Aeronautical, FMS, BFE, Shenzhen Keli, R. STAHL, ZD-Tech, Loxin, Technostrobe, Luxsol, Contarnex, Delta Box, Cooper Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Obstruction Lights Market Key Technology Landscape

The LED Obstruction Lights Market is defined by continuous technological advancement focused on improving system efficiency, reliability, and connectivity. Central to the current landscape is the evolution of thermal management systems, crucial for maximizing the lifespan and maintaining the photometric output of high-intensity LEDs, especially in extreme environments ranging from desert heat to arctic cold. Manufacturers employ advanced heat sink materials and designs to ensure LED junctions operate within optimal temperature ranges, directly impacting product longevity and compliance assurance. Another pivotal technology is the development of ultra-efficient optics, including Fresnel lenses and customized diffusers, which precisely control the beam angle and intensity distribution required by ICAO and FAA standards, maximizing visibility while minimizing light trespass and energy waste. The incorporation of redundant circuitry and monitoring capabilities, such as dual LED arrays and integrated fail-safe mechanisms, is standard practice, addressing the safety-critical nature of these devices and ensuring operational continuity even in the event of component failure. Compliance certification methodologies are also continually refined, requiring rigorous testing of intensity, color fidelity, flash rate, and electromagnetic compatibility (EMC) to guarantee safety standards are met globally.

The most transformative trend involves the integration of Internet of Things (IoT) capabilities. Modern LED obstruction lights are increasingly equipped with embedded microprocessors, network connectivity (often cellular or satellite), and smart sensors. This integration allows for real-time remote diagnostics, performance monitoring, and centralized control. Operators can remotely verify light status, battery health, solar charge levels, and ambient conditions, dramatically reducing the need for physical inspection trips, which are particularly costly and hazardous for remote installations like mountaintop towers or offshore wind farms. These smart systems often feature self-testing routines and automatic fault reporting, instantly notifying maintenance teams of any deviation from compliance requirements. This connectivity facilitates the move towards sophisticated data analytics and AI-driven predictive maintenance models, enhancing operational efficiency and regulatory compliance reporting.

Furthermore, power source innovation, primarily focused on solar-powered systems, represents a significant technological cornerstone, particularly for remote and off-grid installations. Advancements in high-efficiency monocrystalline solar panels, coupled with highly robust, long-cycle lithium-ion or lithium-ferro-phosphate (LiFePO4) battery banks, have allowed manufacturers to create entirely self-sufficient, certified lighting solutions capable of maintaining operational requirements even after extended periods of inclement weather or low sunlight. The focus is also shifting towards low-voltage DC operation, reducing power conversion losses and enhancing compatibility with renewable energy sources. This continuous technological refinement ensures that LED obstruction lights remain energy-efficient, environmentally friendly, and capable of meeting the stringent demands of modern infrastructure projects worldwide, driving further market adoption across critical application segments.

Regional Highlights

- North America: This region holds a significant market share, driven by strict enforcement of FAA regulations and high levels of infrastructure modernization. The market is mature, characterized by high demand for advanced, certified Medium and High-Intensity lights, particularly for existing telecommunication towers and extensive airport systems undergoing mandatory upgrades. The presence of major industry players and robust defense infrastructure investments further solidify its market position, focusing heavily on IoT integration for remote monitoring and predictive maintenance solutions.

- Europe: Europe is a key market propelled by ICAO compliance standards and substantial governmental investment in offshore wind energy. Countries like Germany, the UK, and the Netherlands represent primary growth centers, necessitating durable, certified High-Intensity lights capable of withstanding harsh marine environments. The European market prioritizes energy efficiency and environmental sustainability, accelerating the adoption of certified solar-powered LED systems and smart lighting grids compliant with regional environmental protection directives concerning light pollution.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive infrastructure development, and exponential expansion of 4G/5G networks across China, India, and Southeast Asia. The demand here is driven by both greenfield projects (new high-rise construction, new airports) and large-scale renewable energy infrastructure build-outs. While cost sensitivity is higher compared to Western markets, regulatory compliance is steadily tightening, driving a shift toward quality, certified LED solutions, particularly Medium and Low-Intensity systems for widespread applications.

- Latin America: This region represents an emerging market with moderate growth, primarily tied to modernization of civil aviation infrastructure and expansion of energy grids. Regulatory harmonization and economic stability are key determinants of market speed. Demand is focused on robust, cost-effective LED solutions for marking mining infrastructure, broadcast towers, and improving airport safety standards in growing economic hubs like Brazil and Mexico.

- Middle East and Africa (MEA): MEA shows high growth potential, driven by major investment in oil and gas infrastructure (requiring specialized explosion-proof lights for flare stacks), massive real estate projects, and modernization of air travel facilities (e.g., in the GCC countries). The Middle East focuses on premium, highly durable systems, while the African market is increasingly adopting solar-powered LED solutions to overcome infrastructural limitations related to grid reliability and access in remote installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Obstruction Lights Market.- Dialight

- Flash Technology (SPX)

- Avlite Systems

- Carmanah Technologies

- Hughey & Phillips

- Orion Lighting

- Philips

- TWR Lighting

- Argos Aeronautical

- FMS

- BFE

- Shenzhen Keli

- R. STAHL

- ZD-Tech

- Loxin

- Technostrobe

- Luxsol

- Contarnex

- Delta Box

- Cooper Industries

Frequently Asked Questions

Analyze common user questions about the LED Obstruction Lights market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the LED Obstruction Lights Market?

The primary factor driving market growth is the stringent and continuously evolving global aviation safety regulations (ICAO and FAA mandates) that require all high-rise structures, communication towers, and renewable energy assets like wind turbines to be marked with highly reliable obstruction lighting for aircraft safety.

How do I choose the correct intensity level for an LED obstruction light installation?

The correct intensity level (Low, Medium, or High) is determined by the maximum height of the structure above ground level (AGL) and the surrounding terrain, based strictly on specific requirements outlined by regulatory bodies like the ICAO (Annex 14) or national aviation authorities, typically requiring expert consultation during the planning phase.

What are the key benefits of solar-powered LED obstruction lighting systems?

Solar-powered systems offer critical advantages, including operational autonomy in off-grid or remote locations, significant reduction in electricity costs, elimination of trenching/cabling expenses, and enhanced environmental sustainability, making them ideal for wind farms and remote telecommunication towers.

How is IoT technology transforming the maintenance of obstruction lighting?

IoT integration allows for remote, real-time monitoring of light performance, battery health, and operational status. This facilitates predictive maintenance, automated fault reporting, and centralized control, drastically reducing the need for manual inspections and ensuring continuous compliance with safety mandates.

Which geographical region exhibits the fastest growth potential in this market?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR) due to rapid urbanization, immense investment in infrastructure (including 5G networks and renewable energy projects), and the ongoing process of adopting and enforcing international aviation safety standards across major developing economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager