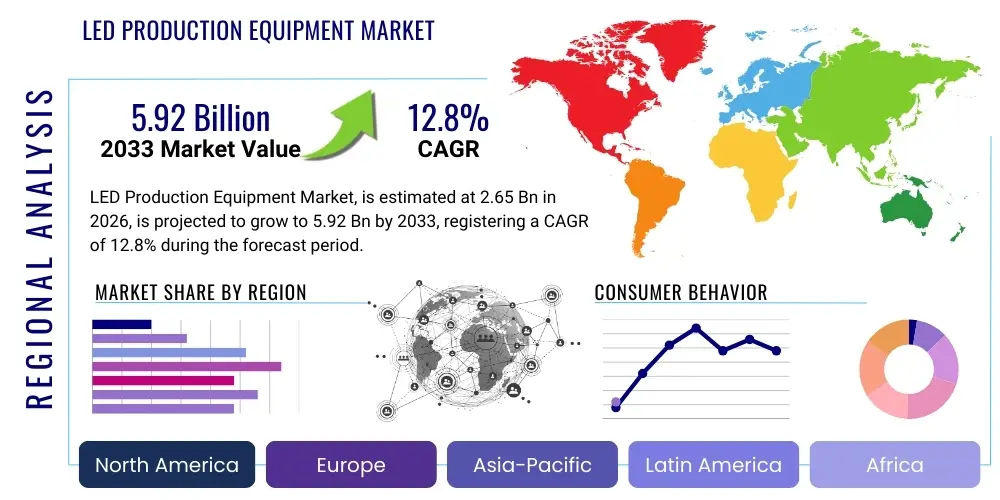

LED Production Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441693 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

LED Production Equipment Market Size

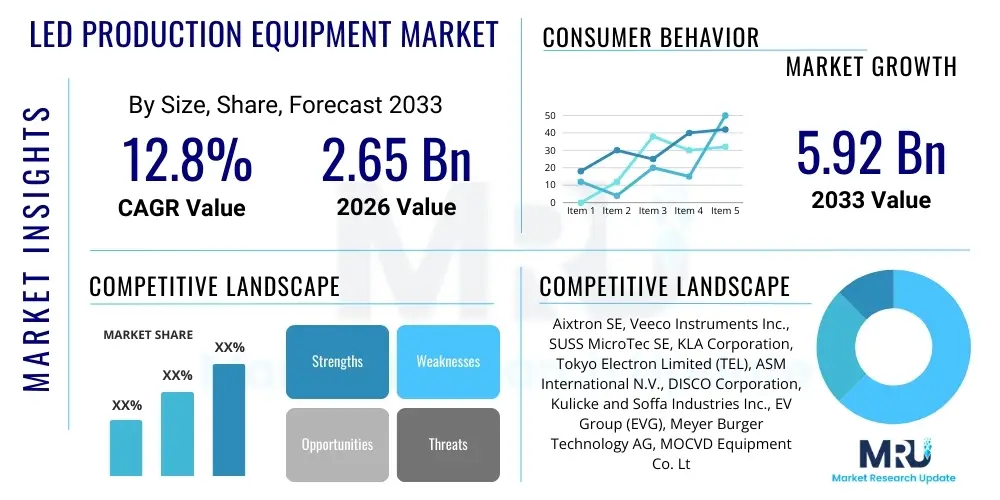

The LED Production Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 2.65 Billion in 2026 and is projected to reach USD 5.92 Billion by the end of the forecast period in 2033.

LED Production Equipment Market introduction

The LED Production Equipment Market encompasses the specialized machinery and systems required for the fabrication of Light-Emitting Diodes (LEDs) and advanced display technologies, including Mini LED and Micro LED. This equipment spans the entire manufacturing process, from epitaxy—the critical step of growing semiconductor layers on substrates—to wafer processing, chip fabrication, and final packaging. Key equipment types include Metal-Organic Chemical Vapor Deposition (MOCVD) systems, Physical Vapor Deposition (PVD) tools, photolithography apparatus, etching systems, and advanced inspection and testing machines. The market's growth is fundamentally driven by the global transition towards energy-efficient lighting solutions, the proliferation of high-definition displays in consumer electronics, automotive applications, and the accelerating adoption of next-generation display technologies like Micro LED, which demand significantly higher precision and yield from production tools.

LED production technology is characterized by high capital intensity and rapid innovation cycles. Modern LED fabrication requires ultra-precise control over material deposition and structural integrity at the nanometer scale. The continuous push for higher brightness, better color uniformity, and smaller chip sizes, especially in the development of Micro LED technology for premium displays, necessitates constant upgrades in equipment capabilities. For instance, MOCVD reactors, which are central to the epitaxial growth of III-V compound semiconductors (like GaN), must evolve to handle larger wafer sizes (e.g., 6-inch or 8-inch sapphire substrates) while maintaining exceptional uniformity and throughput. Equipment manufacturers are focused on reducing defects, enhancing throughput, and lowering the overall cost of ownership (CoO) for LED fabs globally, thereby supporting the broader industrial effort to make LED and Micro LED technology ubiquitous across various sectors.

Major applications of produced LEDs drive the demand for specific equipment types. General illumination remains a foundational segment, requiring high-volume, cost-effective processing tools. However, the high-growth segments like automotive lighting (adaptive headlights), large-scale digital signage, and high-end consumer displays (smartphones, televisions, augmented reality devices) necessitate highly sophisticated equipment capable of manufacturing minute, high-performance LED chips. The benefits derived from advanced LED production equipment include improved manufacturing yield, reduced energy consumption during fabrication, higher spectral purity of the final product, and the ability to handle novel materials like silicon or specialized compound substrates. These technological advancements ensure that LED manufacturing keeps pace with the complex demands of modern electronic design and sustainable energy goals.

LED Production Equipment Market Executive Summary

The LED Production Equipment Market is experiencing robust expansion, primarily fueled by massive capital investment in Asia Pacific, which is the global hub for LED manufacturing and display fabrication. Current business trends indicate a significant technological pivot away from traditional LED manufacturing tools towards specialized equipment required for Mini LED and Micro LED production, specifically high-throughput MOCVD systems, advanced mass transfer tools, and high-resolution inspection systems. Geopolitical factors, particularly trade relations and governmental subsidies in major producing nations (China, Taiwan, South Korea), heavily influence market investment cycles and capacity expansion. Equipment manufacturers are increasingly focusing on strategic mergers and partnerships to integrate diverse technological capabilities, such as combining epitaxial expertise with advanced wafer bonding and testing methodologies to serve the highly demanding Micro LED supply chain.

Regional trends unequivocally highlight Asia Pacific’s dominance, driven by governmental support, lower operational costs, and the presence of major downstream display manufacturers (Samsung, LG, BOE). While North America and Europe primarily focus on R&D and specialized equipment components, the vast majority of commercial production expansion occurs in APAC. This regional concentration dictates supply chain dynamics, leading to higher demand for localized technical support and rapid equipment commissioning services in Asian territories. The European market, though smaller in volume, excels in providing high-precision niche equipment, particularly in areas related to complex semiconductor processing and optical measurement systems, serving advanced research institutes and specialized industrial applications.

Segmentation trends reveal strong growth in the Epitaxy Equipment segment, particularly MOCVD, due to its foundational role in all advanced LED production. Within applications, the Display and Consumer Electronics segments show the highest growth trajectory, spurred by the continuous refresh cycles of smartphones, high-end TVs, and the emerging market for wearable AR/VR devices utilizing Micro LED displays. Furthermore, there is a distinct trend towards automation and integration of smart manufacturing capabilities within the equipment itself. Manufacturers are embedding sensors and real-time process monitoring tools to enhance predictive maintenance capabilities and optimize yield, signaling a strong convergence between equipment hardware and industrial software solutions.

AI Impact Analysis on LED Production Equipment Market

Common user questions regarding AI's influence on the LED Production Equipment Market typically revolve around yield improvement, automation levels, and the feasibility of real-time process control. Users frequently inquire: "How can AI optimize the highly complex MOCVD process?", "Will AI systems reduce the reliance on skilled human operators?", and "What are the tangible ROI benefits of integrating machine learning into inspection equipment?" These inquiries highlight a primary market expectation that AI will solve fundamental challenges related to material variability, defect detection, and achieving consistently high yields, especially critical for Micro LED production where defect rates must be near zero. The key themes summarized from user concerns are the need for actionable predictive insights, enhanced automation of critical process steps, and the necessity for robust, secure data infrastructure to support complex AI models operating in cleanroom environments.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) models is fundamentally transforming how LED production equipment operates, moving facilities towards Industry 4.0 standards. AI algorithms are proving invaluable in optimizing complex, multi-variable processes like MOCVD epitaxy, where small deviations in temperature, gas flow, or pressure can drastically affect wafer quality. By continuously analyzing massive datasets generated by in-situ sensors, AI models can detect subtle patterns indicative of impending process drift or equipment failure, allowing for proactive adjustments or predictive maintenance actions. This capability dramatically improves wafer uniformity and reduces the cycle time required for process tuning and qualification, translating directly into higher manufacturing yield and lower operational expenses for LED manufacturers.

Furthermore, AI is revolutionizing the inspection and testing segment. Traditional visual inspection is time-consuming and prone to human error, especially when dealing with the micron-sized features of Micro LEDs. AI-powered image recognition and computer vision systems can analyze high-resolution images of processed wafers instantly, identifying microscopic defects (e.g., crystal defects, particulates, uneven deposition) with far greater accuracy and speed than human operators or conventional statistical methods. The integration of deep learning allows the equipment to constantly learn from previous defect patterns, enhancing the accuracy of classification and enabling equipment suppliers to provide closed-loop control systems that automatically feed defect data back to the processing tools for continuous optimization. This shift is crucial for achieving the stringent quality requirements mandated by high-end display applications.

- Enhanced Predictive Maintenance: AI models predict equipment failures (e.g., MOCVD heating elements, vacuum pumps) based on sensor data, minimizing unplanned downtime.

- Real-time Process Optimization: Machine learning algorithms dynamically adjust parameters (temperature, flow rates) in epitaxial reactors to maintain optimal growth conditions and improve yield uniformity across large wafers.

- Automated Defect Classification (ADC): Computer vision systems utilize deep learning to inspect wafers rapidly, accurately identifying and classifying nanoscale defects essential for Micro LED quality control.

- Yield Management Systems (YMS): AI integrates data across multiple production steps (epitaxy, lithography, testing) to pinpoint bottlenecks and identify correlation between upstream process variations and final chip performance.

- Optimized Equipment Utilization: AI scheduling tools improve the throughput and utilization rates of expensive capital equipment, optimizing batch sequencing and loading procedures.

DRO & Impact Forces Of LED Production Equipment Market

The dynamics of the LED Production Equipment Market are defined by a complex interplay of drivers, restraints, and opportunities, underpinned by significant impact forces. The primary drivers include the accelerating global shift towards energy-efficient lighting, robust government incentives for semiconductor manufacturing, and the commercialization curve of Mini LED and Micro LED displays in premium consumer electronics and automotive sectors. Restraints center around the substantial initial capital investment required for establishing or expanding a fabrication plant, high technological complexity leading to steep learning curves, and volatility in raw material supply chains (e.g., precursors for MOCVD). Opportunities primarily lie in the development of disruptive technologies, such as advanced mass transfer techniques for Micro LED, equipment capable of processing alternative substrates (like Si), and expansion into new geographical markets outside of established Asian hubs. These elements together create a dynamic environment where technological superiority and strategic regional alignment dictate market success.

Specific market drivers exert substantial upward pressure on equipment demand. The automotive industry, in particular, is transitioning rapidly to advanced LED matrices for safety and aesthetic features, demanding high reliability and consistent performance from the production tools. Similarly, the consumer electronics sector, responding to intense competition in the display market, requires equipment capable of producing densely packed, high-resolution Mini LED backlights and self-emissive Micro LED panels. This demand cycle forces equipment manufacturers to continuously invest in R&D to deliver incremental improvements in throughput (wafers per hour) and yield (usable chips per wafer), making innovation a critical internal force driving competition and product differentiation. Furthermore, the decreasing cost per lumen of LEDs encourages widespread industrial and municipal adoption, sustaining a baseline demand for general illumination equipment.

Conversely, restraining forces impose hurdles that equipment providers must overcome. The high cost and long lead times associated with procuring critical equipment like MOCVD systems create significant barriers to entry for new market players and pose financial risks for existing fabs during market downturns. Moreover, the inherent complexity of Micro LED manufacturing—particularly the challenge of transferring millions of micron-sized chips onto a display substrate with sub-micron precision—requires breakthrough technologies that are still maturing, introducing technological risk. The primary impact forces shaping the market include strict environmental regulations pushing for 'green' fabrication processes, rapid technological obsolescence (where today’s cutting-edge equipment might be outdated in 3-5 years due to new display technologies), and intense competition from Chinese domestic equipment suppliers who benefit from strong governmental support and localized supply chains. These forces necessitate continuous strategic adaptation, focusing on cost-effective, high-yield solutions.

Segmentation Analysis

The LED Production Equipment Market is comprehensively segmented based on the type of equipment used, the application of the final LED product, and the geographic region. Understanding these segments is crucial as different equipment categories exhibit varying growth trajectories depending on the maturity of the corresponding LED technology. For example, the epitaxial growth equipment segment (MOCVD) remains the largest revenue generator due to its fundamental role in creating the LED structure, while segments related to mass transfer and testing are rapidly accelerating due to Micro LED commercialization efforts. Application segmentation highlights the shift from general illumination, which is maturing, towards high-growth areas like advanced displays and specialty automotive lighting, driving demand for specialized, high-precision tools. Geographical analysis confirms the concentrated production landscape in Asia Pacific, though strategic growth opportunities exist in other regions focusing on research and niche manufacturing.

- By Equipment Type:

- Epitaxy Equipment (MOCVD Reactors, Hydride Vapor Phase Epitaxy - HVPE)

- Process Equipment (Sputtering/PVD, Plasma Etching Systems, Photolithography Equipment, Chemical Mechanical Planarization - CMP)

- Test, Inspection, and Measurement Equipment (Probe Stations, Automated Optical Inspection - AOI, Electrical Testers)

- Assembly and Packaging Equipment (Die Bonders, Wire Bonders, Encapsulation Systems, Mass Transfer Equipment)

- By Application:

- General Lighting

- Automotive Lighting (Interior and Exterior)

- Displays and Signage (TVs, Monitors, Mobile Devices, Large Video Walls, AR/VR)

- Medical and Industrial (UV-C LEDs, Specialized Sensing)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, Taiwan, Rest of APAC)

- Latin America (Brazil, Rest of Latin America)

- Middle East & Africa (MEA)

Value Chain Analysis For LED Production Equipment Market

The value chain of the LED Production Equipment Market is characterized by highly specialized stages, beginning with upstream procurement of raw materials and complex subcomponents, progressing through specialized equipment manufacturing, and concluding with sophisticated distribution and after-sales service. Upstream analysis involves sourcing critical raw materials such as high-purity gases (e.g., trimethylgallium, ammonia, silane) necessary for MOCVD, specialized refractory metals for high-temperature reactor components, and complex optical systems for lithography and inspection tools. Suppliers in this phase are often chemical giants and precision engineering firms, whose quality and reliability directly impact the performance and uptime of the final production equipment. The competitive advantage at this stage often relates to securing long-term supply contracts and maintaining proprietary knowledge regarding precursor formulation and purity.

The core of the value chain is the manufacturing of the production equipment itself, typically dominated by a few global technology leaders. This stage involves intense R&D to integrate highly advanced sub-systems, including vacuum chambers, robotic wafer handling systems, advanced software control, and precise thermal management. Equipment manufacturers engage in meticulous system integration, ensuring that all components work seamlessly to achieve nanoscale precision required for modern LED chips. The distribution channel analysis shows a preference for direct sales models (Direct channel) for large-scale, capital-intensive equipment (like MOCVD and lithography) due to the necessity of complex negotiations, installation, customization, and extensive post-sales support specific to the customer’s fab configuration. Indirect channels, involving agents or specialized distributors, are sometimes utilized for standard inspection tools or peripheral equipment in smaller markets, but direct interaction ensures quality control and intellectual property protection for proprietary technology.

The downstream analysis focuses on the end-users: the LED chip manufacturers (foundries), packaging houses, and display panel manufacturers. This group dictates the demand patterns and technological specifications for the equipment. Their focus is on maximizing yield, throughput, and minimizing CoO. The interaction between equipment vendors and downstream users is highly symbiotic; vendors often co-develop next-generation tools in partnership with leading LED producers to ensure relevance and rapid market adoption. After-sales service, including maintenance, spare parts supply, and process optimization consulting, constitutes a crucial component of the value proposition, often generating substantial recurring revenue for equipment suppliers. Failure to provide prompt and expert technical support can severely impact a customer’s fabrication yield, emphasizing the importance of a robust global service network.

LED Production Equipment Market Potential Customers

The primary consumers, or potential customers, of LED production equipment are entities engaged in the large-scale manufacturing and integration of LED components across the value chain. These customers require highly reliable, high-throughput capital equipment tailored to specific production processes. The major buying segments include vertically integrated device manufacturers, which handle everything from epitaxy to packaging; specialized pure-play LED foundries that focus solely on wafer fabrication; and large consumer electronics conglomerates that operate captive manufacturing lines for proprietary display technologies like Mini LED backlights or Micro LED panels for their high-end products. These customers typically have long procurement cycles, stringent qualification requirements, and base their purchasing decisions on total cost of ownership, yield performance, and technical scalability.

A second significant customer group includes outsourced semiconductor assembly and test (OSAT) providers and specialized packaging houses. As LED manufacturing becomes increasingly commoditized, many companies outsource the assembly and final packaging of chips onto PCBs or flexible substrates. These customers drive demand for specialized assembly equipment, such as high-speed pick-and-place machines, wire bonders, and encapsulation systems designed to handle increasingly small components. With the rise of Micro LED, the demand from display manufacturers themselves has intensified, particularly for advanced mass transfer and bonding equipment, which is highly specialized and currently represents a key bottleneck in the supply chain. These buyers are often looking for customized solutions that offer high precision and can handle the logistical complexity of transferring millions of chips simultaneously.

Finally, governmental and academic research institutions represent a smaller but crucial segment of potential customers. These institutions purchase state-of-the-art, often highly flexible, low-volume equipment for developing next-generation materials, conducting pilot-scale manufacturing studies, and advancing epitaxial growth techniques beyond current commercial limitations (e.g., exploring novel substrates or advanced deep-UV LED structures). While their volume demand is low, their purchasing decisions often signal future technological trends and requirements for commercial equipment manufacturers. Vendors serving this segment focus on providing highly customizable and scientifically rigorous equipment platforms, often prioritizing precision and versatility over raw throughput, thereby serving as a critical proving ground for future commercial technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.65 Billion |

| Market Forecast in 2033 | USD 5.92 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aixtron SE, Veeco Instruments Inc., SUSS MicroTec SE, KLA Corporation, Tokyo Electron Limited (TEL), ASM International N.V., DISCO Corporation, Kulicke and Soffa Industries Inc., EV Group (EVG), Meyer Burger Technology AG, MOCVD Equipment Co. Ltd. (MOCVD-EC), Applied Materials Inc., LPKF Laser & Electronics AG, OSRAM, Universal Instruments Corporation, Toray Engineering Co. Ltd., Orbotech (KLA), Nichia Corporation, Ushio Inc., Coherent Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LED Production Equipment Market Key Technology Landscape

The core technological landscape of the LED Production Equipment Market is dominated by Metal-Organic Chemical Vapor Deposition (MOCVD) technology, which remains the industry standard for growing the high-quality epitaxial layers necessary for efficient light emission. Advanced MOCVD systems are constantly evolving to handle larger wafer sizes (up to 8 inches) and improve gas uniformity and thermal stability across the reactor chamber. The current technological focus is on enhancing the efficiency of precursor utilization and reducing deposition cycle times, directly addressing the high operational costs associated with GaN epitaxy. Furthermore, equipment manufacturers are integrating enhanced real-time monitoring tools, such as pyrometers and reflection spectroscopy, into MOCVD chambers to provide instant feedback loops, crucial for optimizing the quantum well structures and improving the internal quantum efficiency (IQE) of the resulting LED chips, particularly important for high-brightness applications.

Beyond epitaxy, significant technological advancements are centered on wafer processing and the unique demands of Micro LED fabrication. In wafer processing, high-precision deep reactive ion etching (DRIE) systems are essential for shaping the LED chips and creating highly uniform vertical structures. Photolithography equipment must provide ultra-high resolution to define the minute contact pads and features of Mini and Micro LEDs, often pushing the limits of current UV and deep-UV exposure systems. However, the most disruptive technology segment is related to the mass transfer process for Micro LEDs. This involves highly specialized equipment—including laser-based transfer systems, elastomeric stamp technology, or fluidic assembly methods—designed to accurately place millions of micron-scale chips from the donor wafer onto the target substrate (e.g., glass or flexible panel) with extreme speed and precision, maintaining transfer yield above 99.999% to ensure viability for large-scale displays. The success of Micro LED commercialization is intrinsically linked to the maturity and throughput of these nascent transfer technologies.

Inspection and test equipment also incorporate advanced technologies, driven by the need to ensure zero defects in premium displays. Automated Optical Inspection (AOI) systems are transitioning from 2D imaging to complex 3D metrology and multispectral imaging to detect subtle defects invisible to standard optical methods. High-speed electrical probe stations are critical for testing the electrical properties of every single chip on the wafer before transfer, a process requiring unprecedented parallelism and robustness. Lastly, environmental considerations are leading to innovation in plasma etching and cleaning technologies, favoring dry processes over wet chemical etching to minimize hazardous waste and water consumption. The integration of AI/ML into all these equipment types—from MOCVD control to AOI analysis—represents the overarching trend towards intelligent, fully automated fabrication facilities, leveraging big data analytics for process optimization and fault detection.

Regional Highlights

Asia Pacific (APAC) stands as the undeniable leader in the LED Production Equipment Market, both in terms of consumption and manufacturing capability. This dominance is driven by several factors, including the presence of the world's largest LED chip manufacturers (foundries) and major downstream display panel producers. Countries like China, Taiwan, and South Korea command significant market shares, heavily supported by substantial government subsidies and industrial policies aimed at semiconductor self-sufficiency and leadership in display technology (especially Mini and Micro LED). China's continuous capacity expansion, driven by both domestic demand and export ambition, creates the largest market for new capital equipment, particularly high-volume MOCVD reactors and associated processing tools. South Korea and Taiwan remain key technology hubs, focusing on high-end, specialized equipment for advanced display R&D and pilot production. The APAC region dictates global pricing trends and technological adoption timelines due to its high volume production capacity.

Europe represents a crucial, albeit smaller, market segment focusing primarily on high-precision niche equipment, innovation, and R&D. European companies, particularly those based in Germany and Switzerland, are globally recognized leaders in advanced technology areas such as vacuum systems, complex optical measurement equipment, and specialized deposition tools (e.g., PVD systems). While large-scale LED chip fabrication in Europe is limited compared to APAC, the region drives demand for equipment tailored to industrial applications, specialized automotive lighting, and advanced research into compound semiconductors. European equipment suppliers often maintain a competitive edge through proprietary technology and exceptional manufacturing quality, focusing on complex, custom solutions rather than sheer throughput volume, and often acting as critical component suppliers to the larger system integrators globally. Furthermore, strict regulatory environments in Europe encourage the development of highly efficient and environmentally friendly fabrication tools.

North America contributes significantly to the market through its strong R&D base, particularly in compound semiconductor materials and Micro LED foundational technology. North American equipment vendors (such as Veeco Instruments and KLA Corporation) are global leaders in their respective segments (e.g., MOCVD and Inspection), maintaining a strong competitive position based on technological innovation and intellectual property. The demand within North America is typically stable, driven by specialized defense applications, advanced consumer electronics prototypes, and the ongoing modernization of existing fabrication facilities. Investment in the region is often tied to strategic initiatives aimed at reducing reliance on foreign supply chains, emphasizing high-security and high-reliability equipment. Latin America and the Middle East & Africa (MEA) currently represent smaller markets, largely relying on imports of finished LED components and limited localized assembly operations, translating to lower demand for heavy-duty front-end fabrication equipment, though growing infrastructure projects are increasing demand for general illumination assembly equipment.

- China: Largest consumer of MOCVD and processing equipment, driven by massive domestic capacity expansion and government support for semiconductor independence.

- South Korea & Taiwan: Key centers for high-tech display manufacturing (Mini/Micro LED), driving demand for advanced inspection, test, and mass transfer equipment.

- United States: Strongholds in foundational R&D and manufacturing of critical, high-precision equipment components, maintaining global technological leadership in certain segments.

- Germany: European hub for advanced vacuum technology, optical systems, and specialized compound semiconductor equipment.

- Japan: A leader in precision manufacturing, providing high-quality etching, slicing, and specialized testing equipment crucial for complex LED structures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LED Production Equipment Market.- Aixtron SE

- Veeco Instruments Inc.

- SUSS MicroTec SE

- KLA Corporation

- Tokyo Electron Limited (TEL)

- ASM International N.V.

- DISCO Corporation

- Kulicke and Soffa Industries Inc.

- EV Group (EVG)

- Meyer Burger Technology AG

- MOCVD Equipment Co. Ltd. (MOCVD-EC)

- Applied Materials Inc.

- LPKF Laser & Electronics AG

- OSRAM

- Universal Instruments Corporation

- Toray Engineering Co. Ltd.

- Orbotech (KLA)

- Nichia Corporation

- Ushio Inc.

- Coherent Corp.

Frequently Asked Questions

Analyze common user questions about the LED Production Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the LED Production Equipment Market?

The primary driver is the accelerating commercialization and industrial adoption of Mini LED and emerging Micro LED display technologies across consumer electronics, automotive, and high-end signage, requiring significant investment in new, high-precision epitaxial and mass transfer equipment to handle smaller chip sizes and achieve higher yields.

Which equipment segment holds the largest market share in the LED production sector?

The Epitaxy Equipment segment, particularly Metal-Organic Chemical Vapor Deposition (MOCVD) systems, holds the largest market share. MOCVD is fundamental for growing the active semiconductor layers (GaN, InGaN) that define the performance of all LED chips, making it the highest-value and most critical production tool.

How is Micro LED technology impacting the demand for specialized production equipment?

Micro LED demands entirely new equipment categories, most notably ultra-high-precision Mass Transfer Systems and advanced Inspection & Repair tools. This shift is driving innovation away from traditional high-volume processing towards equipment capable of handling micron-scale components with near-perfect placement accuracy and defect detection capabilities.

Why is Asia Pacific the dominant region in the LED Production Equipment Market?

Asia Pacific (APAC) dominates due to concentrated global manufacturing bases in China, South Korea, and Taiwan, which benefit from extensive government subsidies, established downstream supply chains (display manufacturers), and continuous, aggressive capacity expansion programs for LED chip fabrication.

What role does Artificial Intelligence play in modern LED production equipment?

AI is integrated into modern equipment for enhanced yield management and operational efficiency. Key applications include real-time process control (optimizing MOCVD parameters), Automated Defect Classification (ADC) in inspection tools, and predictive maintenance scheduling to maximize equipment uptime and reduce manufacturing costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager