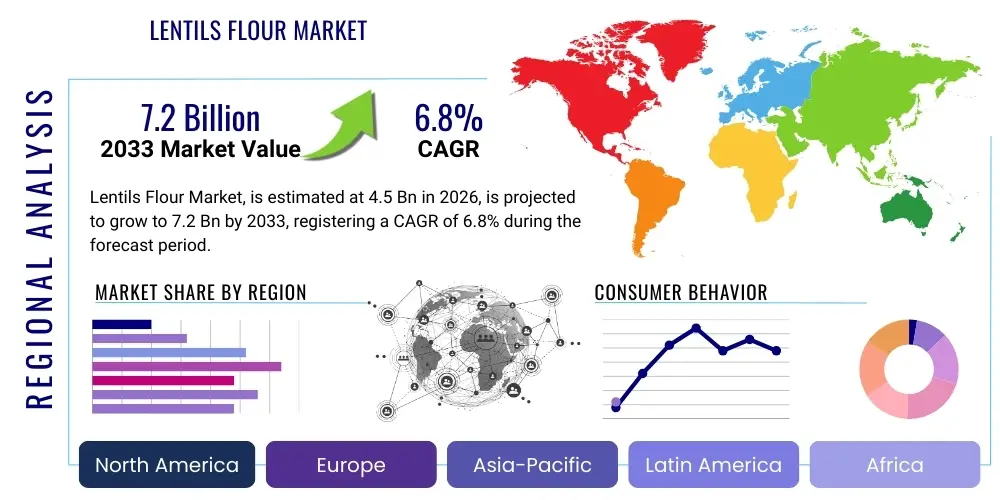

Lentils Flour Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442215 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Lentils Flour Market Size

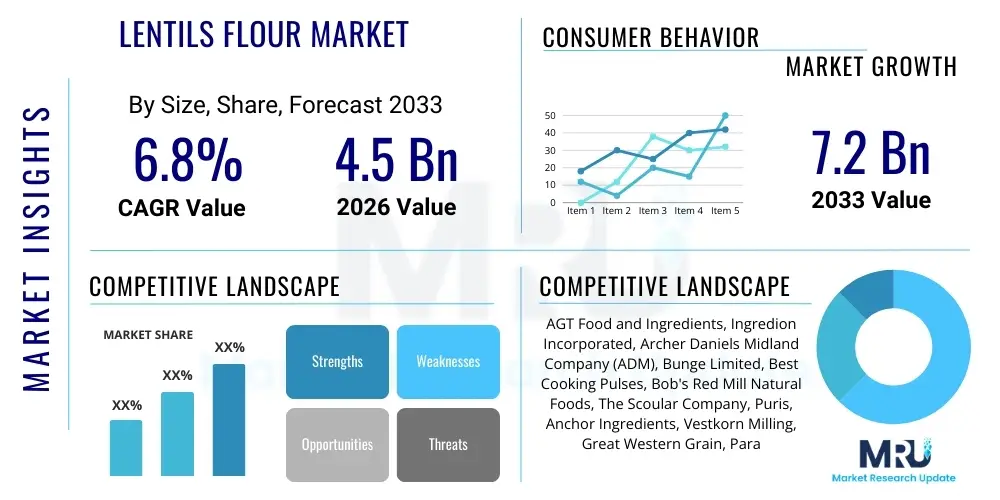

The Lentils Flour Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the escalating consumer demand for gluten-free and high-protein ingredients, driven by increasing health consciousness and dietary shifts globally. Lentil flour, recognized for its exceptional nutritional profile and versatility in diverse food applications, is rapidly transitioning from a niche ingredient to a staple component in functional food formulation, particularly across developed economies in North America and Europe.

The valuation reflects the intensive investment by key market players in expanding processing capabilities and optimizing lentil sourcing networks. Emerging markets, particularly in Asia Pacific, are witnessing a significant uptake due to traditional consumption patterns coupled with modernization in the packaged food sector. The shift towards plant-based protein sources is a fundamental macroeconomic driver supporting this expansion, ensuring sustained momentum across bakery, snacks, and specialized infant nutrition segments. Market penetration is also accelerating through strategic partnerships between lentil producers and large multinational food corporations seeking clean-label alternatives.

Lentils Flour Market introduction

The Lentils Flour Market encompasses the industrial production, distribution, and consumption of finely milled powder derived from dried lentil pulses (Lens culinaris), serving as a crucial ingredient in the global food processing industry. This flour is celebrated for its nutritional density, offering high levels of plant-based protein, dietary fiber, complex carbohydrates, and essential micronutrients such as iron and folate. Major applications span a wide spectrum of food products, including bakery items (breads, cookies), extruded snacks, pasta, breakfast cereals, batters, and meat analogues, capitalizing on its superior binding, emulsification, and texturizing properties. The primary benefits driving market expansion include its natural gluten-free status, suitability for vegan and vegetarian diets, and its role in improving the overall nutritional profile and satiety of finished products.

The driving factors for the market are multifaceted, centered around evolving consumer preferences and regulatory support for healthier food systems. The global prevalence of celiac disease and non-celiac gluten sensitivity has significantly increased the demand for wheat alternatives, positioning lentil flour as a premium substitute. Furthermore, the global imperative to reduce meat consumption and transition toward sustainable, resilient food sources strongly favors pulse-based ingredients. Technological advancements in milling, such as micronization and air classification, have improved the functional characteristics of lentil flour, minimizing beany flavor notes and enhancing its performance in complex food formulations, thereby broadening its applicability in high-end consumer packaged goods (CPGs).

Market dynamics are also influenced by sustainability metrics; lentil cultivation requires less water and fixes atmospheric nitrogen, making it an environmentally favorable crop. This environmental appeal resonates deeply with ethically conscious consumers and corporations committed to ESG (Environmental, Social, and Governance) principles. As global supply chains become more sophisticated and pricing competitive, the accessibility of diverse lentil flour types—including red, green, and specialized dehulled varieties—further stimulates product innovation and market penetration across various socioeconomic groups, confirming its role as a high-value functional food ingredient.

Lentils Flour Market Executive Summary

The Lentils Flour market is characterized by robust business trends focusing on clean label ingredient sourcing, functional food fortification, and customized formulation services. Key business trends involve significant R&D investments aimed at improving the sensory attributes of pulse flours, specifically addressing flavor neutrality and texture optimization to appeal to mainstream consumers accustomed to traditional grain products. Strategic vertical integration, from farm-level sourcing to advanced processing, is a prevalent corporate strategy adopted by major players to ensure supply chain transparency, quality control, and cost efficiency in a volatile commodity market. The burgeoning demand from the sports nutrition and geriatric nutrition sectors for high-quality, easily digestible protein powders further strengthens the commercial viability of advanced lentil flour derivatives.

Regionally, North America and Europe dominate the market share due to established health and wellness trends, high disposable incomes, and the early adoption of gluten-free diets and plant-based consumption patterns. These regions benefit from strong regulatory frameworks promoting nutritional labeling and ingredient transparency. Conversely, the Asia Pacific region is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, Westernization of dietary habits, and large populations seeking affordable protein sources. Countries like India and China, while traditional consumers of lentils, are experiencing an exponential rise in processed food demand, where lentil flour is increasingly used as an inexpensive and nutritious filler or binder, offering substantial future growth opportunities.

Segment trends indicate that the conventional lentil flour segment holds the largest volume share, primarily due to its widespread use in low-cost applications and traditional preparations. However, the organic lentil flour segment is projected to grow at a faster pace, appealing to premium consumers concerned about pesticide residue and sustainable farming practices. By application, the bakery and confectionery segment remains the dominant consumer, leveraging lentil flour for structure improvement and protein enhancement. Meanwhile, the extruded snacks and specialized dietary supplements segments are exhibiting rapid growth, driven by innovation in product formats and specialized functional formulations targeting specific health outcomes such as improved gut health and cardiovascular benefits.

AI Impact Analysis on Lentils Flour Market

User queries regarding AI in the Lentils Flour Market primarily revolve around optimizing agricultural yields, enhancing ingredient quality control, and streamlining complex supply chain logistics. Consumers and industry stakeholders are highly interested in how machine learning can predict crop diseases, manage irrigation schedules for maximum lentil harvest efficiency, and analyze genomic data to breed lentil varieties with higher protein content or improved drought resistance. Furthermore, there is significant emphasis on AI-driven quality assessment during milling—specifically using computer vision systems to detect contaminants or verify particle size distribution for specific functional requirements. The overarching expectation is that AI will reduce processing costs, minimize waste (a key sustainability goal), and standardize quality across global production batches, ensuring that the functional attributes of the lentil flour consistently meet the precise specifications required by sophisticated food manufacturing operations.

- AI-driven Precision Agriculture: Optimizing lentil crop yield predictions, reducing input costs (water, fertilizer), and proactive disease management through satellite imagery analysis.

- Automated Quality Control: Implementing machine vision and deep learning algorithms in milling facilities for real-time monitoring of particle size, color consistency, and detection of foreign material contamination.

- Supply Chain Predictive Analytics: Utilizing AI to forecast demand fluctuation, optimize inventory levels, and manage logistics routes, minimizing spoilage and ensuring timely delivery of fresh pulse batches to processing centers.

- R&D Acceleration: Employing machine learning models to analyze complex nutrient interaction data, accelerating the development of novel lentil flour blends with enhanced functional properties (e.g., improved emulsification or water holding capacity).

- Consumer Trend Forecasting: Analyzing social media data and retail purchasing patterns using AI to predict shifts in dietary preferences (e.g., favoring specific colors or varieties of lentil flour) to inform production adjustments.

DRO & Impact Forces Of Lentils Flour Market

The Lentils Flour Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and external Impact Forces. The primary drivers include the escalating global demand for plant-based protein alternatives, the rising incidence of gluten sensitivities fueling the search for wheat substitutes, and increasing governmental support for pulse consumption due to their nutritional benefits and environmental sustainability profile. These drivers collectively create a high-velocity demand environment, encouraging processors to scale up production and invest in advanced milling technologies. However, the market faces significant restraints, notably the inherent "beany" flavor profile of some traditional lentil flours, which necessitates expensive processing techniques (like de-flavoring) to achieve flavor neutrality required for high-end applications. Additionally, volatility in lentil raw material prices, often influenced by weather patterns and geopolitical factors, poses a financial risk to manufacturers, impacting profit margins and long-term planning.

Opportunities for growth are substantial, particularly through product diversification into high-margin functional ingredients such as lentil protein isolates and concentrates, which serve specialized markets like sports nutrition and clinical dietary management. Furthermore, expansion into developing economies in Africa and Southeast Asia offers untapped consumer bases where lentil consumption is traditional but formalized processing is nascent. Strategic partnerships focusing on non-GMO and organic certifications also open premium market channels. The market is also heavily influenced by external impact forces, primarily global climate change, which affects lentil yields and raw material consistency. Regulatory impacts concerning food safety standards and nutritional labeling mandates also force continuous investment in compliance and traceability systems throughout the value chain.

The cumulative impact forces dictate that innovation must be prioritized not just in processing efficiency but also in agricultural resilience. The high nutritional value and versatility of lentil flour position it favorably to overcome cost restraints, provided technological advancements continue to successfully address flavor and texture challenges. The fundamental shift towards sustainable, ethical food systems provides a long-term structural tailwind, ensuring that the market trajectory remains positive despite short-term commodity price volatility. Successfully navigating these forces requires integrated risk management spanning agronomy, processing technology, and global logistics, emphasizing supply chain robustness.

Segmentation Analysis

The Lentils Flour Market is extensively segmented based on Type, Application, and Geography, reflecting the diverse requirements of the global food industry. Segmentation by Type distinguishes between conventional and organic lentil flour, with conventional dominating in terms of volume due to cost-effectiveness, while organic rapidly gains traction driven by consumer preference for clean label and sustainably sourced ingredients. Application segmentation reveals critical end-use sectors, including bakery, snacks, soups and sauces, and specialized nutritional supplements, each utilizing the flour's unique functional attributes differently, such as its binding ability in meat alternatives or its protein content in sports bars. Geographical segmentation highlights distinct regional consumption patterns and regulatory environments that dictate market maturity and growth potential, with developed regions focused on high-value functional products and developing regions emphasizing affordable, nutritious bulk ingredients.

Further analysis of the Type segment shows that Red Lentil Flour commands a significant share, primarily due to its faster cooking time and milder flavor profile compared to Green or Brown Lentil Flour, making it highly adaptable for mass-produced goods like pasta and extruded snacks. However, specialized varieties, such as those derived from black lentils (Beluga), are gaining favor in gourmet and specialized dietary markets where high pigment content and unique micronutrient compositions are desirable. The ongoing trend toward micronized flour—ultra-fine milling techniques—is blurring the lines between traditional flour and specialized protein concentrates, significantly impacting product development strategies across all type subsegments.

In the Application landscape, the bakery segment utilizes lentil flour to enhance the protein and fiber content of traditionally low-nutritional-value products, such as white bread and pastries, aligning with public health initiatives to improve staple food nutrition. Conversely, the rapidly expanding plant-based meat and dairy alternative sector is a high-growth area, relying on lentil flour’s texturizing and binding capacity to mimic the structure of animal proteins. This segment demands high-specification flours with consistent water absorption and gelling properties. Continuous innovation in gluten-free baking technology is critical for sustained growth within this application category, as manufacturers seek to match the elasticity and mouthfeel provided by wheat gluten.

- By Type:

- Red Lentil Flour

- Green Lentil Flour

- Other Lentil Flour (Brown, Black, etc.)

- By Nature:

- Conventional

- Organic

- By Application:

- Bakery and Confectionery

- Snacks and Savory

- Soups, Sauces, and Prepared Meals

- Meat and Dairy Alternatives

- Infant Nutrition

- Dietary Supplements and Functional Foods

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Lentils Flour Market

The value chain for the Lentils Flour Market begins with the upstream segment involving lentil cultivation, harvesting, and primary processing. This stage is dominated by large-scale agricultural operations in key producing regions such as Canada, India, Australia, and Turkey. Upstream efficiency is highly dependent on agricultural inputs (seeds, fertilizer) and technology adoption (precision farming, genetic modification for hardiness). The critical transformation occurs in the midstream, which involves cleaning, dehulling, milling, and specialized processing (such as air classification to separate protein from starch). Investment in advanced milling technology is paramount in the midstream to achieve the required functional specifications (e.g., protein concentration, particle size) demanded by downstream manufacturers.

The downstream analysis focuses on the distribution and utilization of the processed flour. Distribution channels are bifurcated into direct and indirect routes. Direct sales involve high-volume contracts between major lentil flour processors and multinational food manufacturing companies (CPGs) that require large, consistent batches for continuous production lines. Indirect distribution relies on an intricate network of specialized food ingredient distributors, brokers, and retailers who supply smaller bakeries, local food service providers, and niche organic food producers. The choice of channel depends significantly on the required volume, specialization of the product (e.g., organic or high-protein isolate), and the geographic footprint of the end-user.

Crucial aspects of channel management include inventory optimization, particularly given the bulk nature of the product, and maintaining stringent quality controls throughout transit. Modern supply chain management utilizes sophisticated traceability systems to track the product from the farm to the fork, satisfying increasing consumer and regulatory demands for transparency. Value addition at the downstream level is achieved through marketing focused on the health attributes (gluten-free, high fiber) and sustainability claims associated with the final food products, ensuring that the intrinsic value of the lentil flour is successfully communicated to the end consumer, justifying potentially higher retail prices for functional foods.

Lentils Flour Market Potential Customers

Potential customers and end-users of lentil flour are highly diversified, ranging from large-scale industrial food manufacturers to specialty artisanal producers and individual consumers. Industrial bakeries represent a primary customer base, utilizing lentil flour to fortify standard bread, muffin, and cookie mixes, enhancing nutritional content while often reducing reliance on more expensive ingredients or artificial binders. The burgeoning plant-based food industry, encompassing manufacturers of meat analogues (burgers, sausages), dairy alternatives, and vegan prepared meals, constitutes a high-growth segment demanding lentil flour for its binding, structure-building, and high-protein characteristics, serving the rapidly expanding flexitarian and vegan consumer demographics globally.

The market also targets specialized customer segments, including producers of infant and geriatric nutrition products, where the flour's easily digestible protein and nutrient density are crucial for specialized dietary requirements. Furthermore, manufacturers of extruded snacks and breakfast cereals rely on lentil flour to improve texture and density, catering to the growing demand for healthier, protein-rich snacking options. Beyond food processing, the ingredient distribution sector acts as a vital intermediate customer, consolidating and reselling different specifications of lentil flour to smaller entities such as craft breweries (using pulse flours for texture modification) and small-batch dietary supplement formulators.

Ultimately, the final purchasing decision often rests with health-conscious consumers, athletes, individuals managing gluten-related disorders, and families seeking sustainable, nutritious, and cost-effective alternatives to traditional grains. Customer acquisition strategies focus heavily on demonstrating the functional benefits—texture improvement, enhanced nutritional profile, and superior sustainability credentials—to procurement teams and product development scientists within major food corporations. Loyalty is built through consistent product quality and guaranteed supply chain transparency, particularly for certified organic or non-GMO varieties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGT Food and Ingredients, Ingredion Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited, Best Cooking Pulses, Bob's Red Mill Natural Foods, The Scoular Company, Puris, Anchor Ingredients, Vestkorn Milling, Great Western Grain, Parama Agro Products, CanMar Grain Products, SunOpta Inc., Blue Ribbon, Grain Millers, PulsePro, Mountain High Organics, Artisan Grains, Crisp Sensation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lentils Flour Market Key Technology Landscape

The Lentils Flour Market is continuously evolving due to advancements in processing and formulation technology, aimed primarily at enhancing the functionality and sensory appeal of the final product. One critical technological area is advanced milling, including micronization and air classification. Micronization reduces the particle size of the flour significantly, improving water absorption and binding properties, which is essential for specialized applications like non-gluten batters and instant mixes. Air classification is pivotal for fractionation, enabling processors to efficiently separate high-protein fractions from starch and fiber components, thereby producing specialized lentil protein concentrates (LPCs) and isolates (LPIs) that command higher market prices and cater to the sports and clinical nutrition segments.

Another crucial technological development focuses on flavor masking and de-flavoring techniques. Traditional pulse flours often possess undesirable "beany" or grassy off-notes caused by lipoxygenase enzyme activity. Manufacturers are investing in various thermal, enzymatic, and fermentation treatments to neutralize these volatile compounds, resulting in a neutral-tasting flour that can be seamlessly integrated into diverse food matrices without altering the final product's intended flavor profile. High-temperature short-time (HTST) processes and extrusion cooking are also utilized not only for pathogen reduction but also for modifying protein structure, thereby improving solubility and digestibility, critical factors for infant and senior nutrition formulations.

Furthermore, the integration of automation and digitalization across the processing landscape is a key technological trend. This includes the implementation of NIR (Near-Infrared) spectroscopy and other rapid analysis tools to monitor moisture content, protein levels, and particle uniformity in real-time during milling. These integrated systems ensure unparalleled batch consistency and reduce human error, optimizing yield and meeting stringent quality control standards required by global CPG companies. The development of specialized packaging technologies, such as modified atmosphere packaging (MAP), also extends the shelf life of the flour, preventing oxidation and preserving its functional integrity during extended global transport and storage.

Regional Highlights

Regional dynamics heavily influence the consumption and production patterns of lentil flour, creating distinct growth opportunities across major continents. North America, specifically the United States and Canada, stands as a mature yet highly innovative market. Canada is one of the world's leading lentil producers and exporters, benefiting from advanced agricultural infrastructure and significant investment in processing R&D. The region’s consumption is driven by high awareness of diet-related health issues, strong demand for gluten-free products, and the pervasive trend of incorporating plant-based alternatives into daily diets. The presence of major CPG headquarters further accelerates the adoption of lentil flour in novel food formulations, particularly in the snack and breakfast cereal segments, making it a pivotal region for product innovation and technology adoption.

Europe represents a crucial market characterized by stringent food safety and sustainability regulations, favoring certified organic and traceable lentil flour products. Western European nations like Germany, the UK, and France show high per capita spending on functional foods and vegan alternatives, strongly supporting the market for high-protein isolates derived from lentils. Eastern Europe is gradually increasing its consumption base, driven by improving economic conditions and greater exposure to international dietary trends. The focus here is on clean-label ingredients and non-GMO certification, aligning with the EU’s Farm to Fork strategy, which encourages the utilization of sustainable, locally sourced plant proteins.

Asia Pacific (APAC) is projected to be the fastest-growing market globally due to its massive population base and the rapid modernization of its food processing sector. Countries such as India, traditionally the largest consumer of lentils in whole form, are seeing a shift towards processed and packaged foods, creating massive industrial demand for lentil flour as a functional ingredient. Furthermore, the rising incidence of lifestyle diseases and increasing health consciousness among the urban middle class in China and Southeast Asia are fueling demand for protein fortification and healthier snack options. While local processing capabilities are expanding, import dependency for specialized, high-quality flour remains significant in several key urban centers.

Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but offer considerable long-term potential. In LATAM, economic volatility and logistics challenges pose restraints, yet the underlying demand for affordable, nutritious ingredients, particularly in countries like Brazil and Mexico, supports local market development. The MEA region, particularly North Africa and parts of the Middle East, maintains traditional pulse consumption, offering opportunities for manufacturers to introduce fortified packaged staples using cost-effective lentil flour. Government initiatives focusing on nutritional security and combating malnutrition could serve as significant market drivers in these regions over the forecast period, emphasizing the need for robust, accessible distribution networks.

- North America: Market leader in innovation and consumption of gluten-free and plant-based foods; key driver of high-value lentil protein isolates.

- Europe: High adoption rates driven by sustainability regulations, clean-label demand, and strong consumer spending on organic products.

- Asia Pacific (APAC): Fastest-growing market fueled by urbanization, expanding middle class, and traditional large-scale consumption shifting towards packaged and processed foods.

- Latin America (LATAM): Emerging market focused on affordable fortification and basic processed food ingredients, hampered by regional economic inconsistencies.

- Middle East and Africa (MEA): Significant potential tied to governmental nutritional security programs and integration of lentil flour into fortified staple foods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lentils Flour Market.- AGT Food and Ingredients

- Ingredion Incorporated

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Best Cooking Pulses

- Bob's Red Mill Natural Foods

- The Scoular Company

- Puris

- Anchor Ingredients

- Vestkorn Milling

- Great Western Grain

- Parama Agro Products

- CanMar Grain Products

- SunOpta Inc.

- Blue Ribbon

- Grain Millers

- PulsePro

- Mountain High Organics

- Artisan Grains

- Crisp Sensation

- Roquette Frères

- Cargill, Incorporated

- Parrish & Heimbecker, Limited

- Dakota Specialty Milling

- Viterra Inc.

Frequently Asked Questions

Analyze common user questions about the Lentils Flour market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary functional benefits of using lentil flour in food manufacturing?

Lentil flour offers superior nutritional benefits, including high plant protein (20-30%) and dietary fiber. Functionally, it excels as a natural binder, emulsifier, and texturizer, enhancing the structure and water-holding capacity of baked goods and extruded products while offering a clean-label, gluten-free alternative to wheat flour. Its use improves satiety and reduces the overall caloric density of formulations.

How is the growth of the organic lentil flour segment influencing market trends?

The organic lentil flour segment is experiencing rapid growth, largely driven by heightened consumer awareness regarding sustainability, pesticide use, and GMO concerns. This segment commands a price premium and encourages processors to invest in certified sustainable sourcing and transparent supply chains, shifting the industry focus towards high-quality, specialized ingredients for the premium food market.

What major challenges does the Lentils Flour Market face regarding product acceptance?

The primary challenge remains the potential for residual 'beany' or grassy off-flavors inherent in pulse flours, which can deter mainstream consumer acceptance in sensitive applications like beverages or light snacks. Manufacturers must utilize sophisticated de-flavoring technologies, such as advanced thermal processing and enzymatic treatments, to achieve flavor neutrality and ensure seamless integration into diverse food products.

Which geographical region exhibits the most significant potential for future market expansion?

The Asia Pacific (APAC) region is forecasted to demonstrate the highest market expansion due to massive demographic factors, including rapid urbanization and the increasing penetration of organized retail and Western-style processed foods. While traditional consumption is high, the industrial demand for processed lentil flour as an affordable protein and binding agent in CPGs across China and India is the core driver of exponential future growth.

How do lentil protein isolates (LPIs) differ from standard lentil flour and what are their key applications?

LPIs are highly concentrated protein powders derived from lentil flour through air classification or wet fractionation, boasting protein levels typically exceeding 80%. Unlike standard flour (which contains starch and fiber), LPIs are specialized ingredients primarily used in high-performance applications like sports nutrition supplements, clinical nutrition formulas, and advanced vegan protein shakes where maximum protein per serving and low carbohydrate content are required.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager