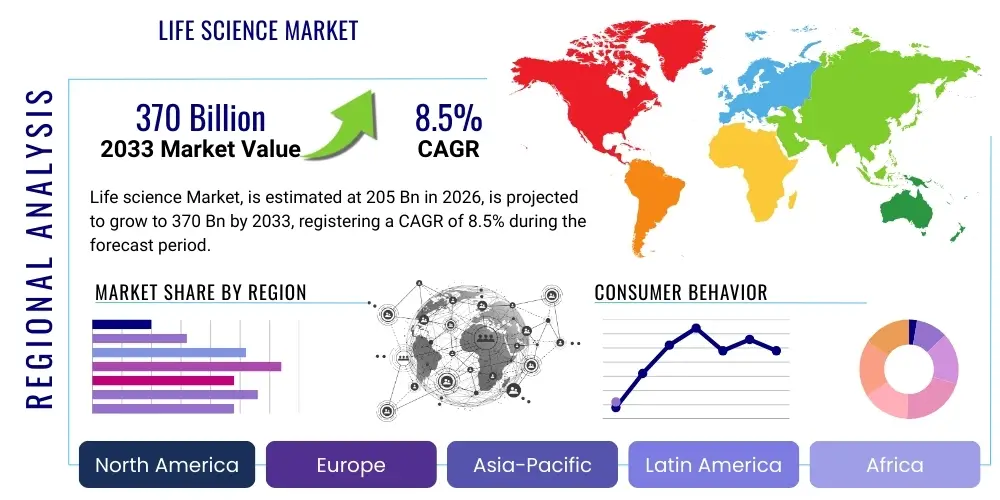

Life science Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441579 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Life science Market Size

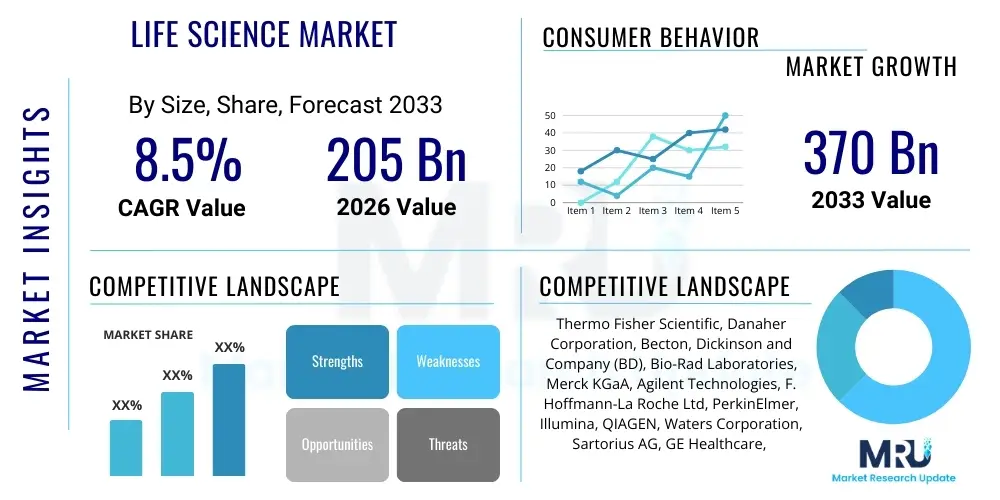

The Life science Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $205 Billion in 2026 and is projected to reach $370 Billion by the end of the forecast period in 2033.

Life science Market introduction

The Life Science Market encompasses a vast array of instruments, reagents, consumables, software, and services used in research, development, and clinical applications across pharmaceuticals, biotechnology, diagnostics, and academic institutions. This sector is fundamentally driven by the accelerating pace of biological discovery, fueled by technological advancements in areas like genomics, proteomics, and advanced cell culture techniques. Products range from sophisticated analytical instruments, such as mass spectrometers and next-generation sequencers (NGS), to essential laboratory infrastructure, including bioreactors and specialized robotic automation systems. These tools are indispensable for investigating disease mechanisms, developing novel therapeutics, ensuring public health safety, and advancing agricultural biotechnology.

Major applications within the life science market are centered on drug discovery and development, personalized medicine initiatives, and complex disease diagnostics. The market provides critical support for every stage of the pharmaceutical pipeline, from initial target identification and validation using high-throughput screening (HTS) to preclinical testing and large-scale clinical trials. Furthermore, the increasing prevalence of chronic and infectious diseases globally necessitates continuous investment in life science tools for rapid and accurate diagnosis, driving demand for molecular and immunological testing platforms. The convergence of life sciences with data analytics and computational biology has created new avenues for growth, making data management and bioinformatics solutions integral components of the modern laboratory ecosystem.

Key benefits derived from the robust life science market include faster time-to-market for innovative therapies, improved diagnostic accuracy leading to better patient outcomes, and a deeper understanding of biological systems. Driving factors include substantial increases in R&D expenditure by pharmaceutical and biotechnology firms, enhanced funding for fundamental research from government and private organizations, and the paradigm shift toward precision medicine. Additionally, the need for enhanced biosecurity and preparedness for pandemics has elevated the strategic importance and investment profile of core life science technologies, particularly those related to vaccine development and rapid pathogen identification.

Life science Market Executive Summary

The Life Science Market is currently experiencing robust growth, heavily influenced by dynamic business trends such as strategic mergers and acquisitions aimed at consolidating specialized technology portfolios, and significant venture capital influx into early-stage biotech companies focusing on disruptive platforms like gene editing and cell therapy. Business models are evolving towards integrated solutions, where vendors provide not just instruments but comprehensive workflows, including consumables, proprietary reagents, and integrated software platforms, enhancing customer stickiness and operational efficiency. The push for digitalization and laboratory automation represents a major cross-cutting trend, optimizing resource utilization and accelerating experimental turnaround times across both academic and industrial settings.

Geographically, growth remains concentrated in established North American and European markets due to high R&D spending and mature regulatory environments. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market, driven by increasing government investments in healthcare infrastructure, a rising patient pool, and the development of local biotechnology manufacturing capabilities. Regional trends highlight divergent regulatory landscapes; while North America focuses on accelerating breakthrough designations, Europe emphasizes stringent quality control and standardization. Latin America and MEA are focused on expanding access to basic diagnostic and research tools, driven by public health initiatives.

Segment trends indicate strong performance in the technology segment, specifically driven by Next-Generation Sequencing (NGS) and mass spectrometry, which are essential for high-resolution biological analysis. The applications segment is dominated by drug discovery, where the demand for specialized assay development and complex compound screening remains paramount. Within end-users, Pharmaceutical and Biotechnology companies represent the largest expenditure category, focusing intensely on scaling up biomanufacturing processes and adopting advanced therapeutic modalities like monoclonal antibodies and nucleic acid-based drugs. The trend towards outsourcing clinical research and specialized lab services is also influencing segment dynamics, favoring contract research organizations (CROs) and contract manufacturing organizations (CMOs).

AI Impact Analysis on Life science Market

User inquiries frequently center on how Artificial Intelligence (AI) will redefine drug discovery timelines, improve diagnostic accuracy, and necessitate changes in laboratory data infrastructure within the life science sector. Key concerns revolve around the integration challenges of AI with existing legacy lab systems, the requirement for vast, high-quality, standardized biological datasets to train effective models, and ethical issues surrounding data privacy and algorithm transparency. Users highly anticipate AI’s potential to dramatically reduce the costs associated with identifying viable drug candidates, optimizing clinical trial design by predicting patient response, and enabling the acceleration of personalized therapeutic approaches. The overall consensus highlights AI as a critical transformative technology shifting life science research from purely hypothesis-driven exploration to data-driven prediction and validation, demanding new skills and significant investment in computational infrastructure.

- Accelerated Target Identification: AI algorithms swiftly analyze complex genomic and proteomic data to identify novel disease targets, drastically reducing initial research phases.

- Optimized Drug Synthesis: AI models predict compound efficacy, toxicity, and synthesis pathways, optimizing lead optimization and minimizing experimental failure rates.

- Enhanced Diagnostic Precision: Machine learning improves medical imaging analysis and molecular data interpretation, leading to earlier and more accurate disease detection.

- Streamlined Clinical Trials: AI optimizes patient selection, predicts trial outcomes, and manages large clinical datasets, reducing trial duration and cost.

- Personalized Medicine Advancement: AI integrates individual patient data (genomics, lifestyle, electronic health records) to tailor therapeutic interventions and dosage.

- Automated Lab Operations: AI drives sophisticated laboratory automation and robotics, optimizing workflows and improving repeatability of experiments.

- Bioinformatics and Data Management: AI tools efficiently process, analyze, and visualize massive multi-omics datasets generated by advanced life science instruments.

DRO & Impact Forces Of Life science Market

The market dynamics are governed by a complex interplay of driving forces, inherent limitations, and untapped strategic avenues. Primary drivers include unprecedented advancements in biological understanding, particularly gene editing technologies such as CRISPR, and the global imperative to combat emerging infectious diseases and manage non-communicable chronic conditions effectively. These drivers necessitate continuous investment in cutting-edge instrumentation and specialized reagents. Restraints primarily involve the rigorous and protracted regulatory approval processes required for novel medical devices and therapeutics, particularly in established Western markets, alongside the substantial initial capital expenditure required to establish and maintain highly sophisticated research laboratories and manufacturing facilities. This high cost barrier often limits adoption speed, especially in developing economies.

Significant market opportunities reside in the rapid commercialization of personalized medicine, leveraging biomarkers and genetic profiling to deliver targeted therapies, moving away from the traditional one-size-fits-all approach. Another major opportunity lies in the expansion of biomanufacturing capacity, driven by the increasing demand for biologic drugs, including monoclonal antibodies and cell and gene therapies, necessitating high-performance bioprocessing equipment. Furthermore, digitalization offers opportunities for vendors to provide software-as-a-service (SaaS) models for data management and laboratory information management systems (LIMS), providing recurring revenue streams and deeper integration with customer workflows.

Impact forces currently shaping the market include technological advancements that are rapidly obsoleting older platforms, forcing companies to maintain rigorous R&D pipelines. The force of regulatory harmonization across various regions, while slow, is influencing manufacturing and clinical trial standards globally. Supplier power is high for highly specialized consumables and proprietary reagents, while buyer power remains significant for large pharmaceutical companies negotiating bulk purchases of capital equipment. The threat of substitutes is relatively low for core technologies like NGS, but high for specific assay formats, which can be rapidly replaced by superior, high-throughput alternatives. Overall, innovation velocity and regulatory compliance are the two most powerful impact forces determining competitive success.

Segmentation Analysis

The Life Science Market is intricately segmented based on technology, application, and end-user, reflecting the diverse requirements of the research and clinical communities. Technology segmentation analyzes the sophisticated tools and platforms utilized, ranging from molecular biology techniques like sequencing and PCR to highly complex analytical instrumentation. Application segmentation details the primary uses of these technologies, with drug discovery and diagnostics being the most capital-intensive areas. End-user segmentation provides insight into market consumption patterns, distinguishing between high-volume users such as pharmaceutical companies and high-growth sectors like academic research institutes and contract service providers. This multi-dimensional segmentation is crucial for understanding specific market pain points and allocating strategic resources effectively.

- Technology

- Genomics Technologies (Sequencing, Microarrays, PCR)

- Proteomics Technologies (Mass Spectrometry, Protein Microarrays)

- Cell Culture and Cell Therapy Technologies

- Laboratory Automation and Informatics

- Flow Cytometry

- Microscopy and Imaging

- Centrifugation and Filtration

- Application

- Drug Discovery and Development

- Clinical Diagnostics

- Biotechnology and Biomanufacturing

- Forensics and Environmental Testing

- Academic Research

- End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Government Agencies

Value Chain Analysis For Life science Market

The Life Science value chain begins with upstream activities focused on raw material sourcing and the highly intellectual process of research and development of novel instruments, reagents, and specialized software. Upstream suppliers are concentrated in areas providing high-purity chemicals, specialized biological components (enzymes, antibodies), and precision engineering components for instrumentation manufacturing. Key challenges in the upstream segment include maintaining supply chain integrity, ensuring quality control for highly sensitive biological materials, and managing intellectual property rights related to proprietary assay designs. Strategic sourcing and vertical integration are increasingly observed strategies among major market players to mitigate supply risks and control input costs.

The midstream involves the core activities of manufacturing, assembly, quality assurance, and packaging of final products, including complex instruments like NGS platforms and bulk production of reagents and consumables. Distribution channels are critical and include a mix of direct sales forces, specialized distributors, and third-party logistics providers. Direct sales are preferred for high-value capital equipment requiring extensive technical support and installation, ensuring deep customer engagement and training. Indirect channels, primarily distributors and e-commerce platforms, are frequently used for routine consumables, common reagents, and lower-cost items, offering efficient market reach and inventory management.

Downstream activities focus on sales, marketing, customer support, and post-sale services. This segment is characterized by intensive application support, crucial for ensuring customer satisfaction and maximizing the utility of sophisticated instruments. End-users, including pharmaceutical companies and academic labs, utilize these tools for complex applications such as high-throughput screening, clinical testing, and basic research. The shift towards integrated digital platforms means that software maintenance and data security consulting are becoming essential components of the downstream value proposition, creating recurring service revenue streams and strengthening the overall customer relationship.

Life science Market Potential Customers

Potential customers within the Life Science Market are highly diverse but unified by the need for validated, reliable, and high-performance tools to advance biological knowledge and develop commercial products. The largest segment of buyers comprises global Pharmaceutical and Biotechnology companies, which require instrumentation for drug discovery, clinical development, quality control in manufacturing, and large-scale genetic analysis. These entities prioritize scalability, regulatory compliance, and high throughput capabilities when making purchasing decisions, often entering into multi-year contracts or bulk purchasing agreements for core instruments and reagents.

Academic and governmental research institutions represent another crucial customer segment. These buyers are typically focused on fundamental research, disease modeling, and grant-funded projects. Their purchasing behavior is often dictated by grant cycles and the need for cutting-edge technology to maintain competitiveness in publications and scientific breakthroughs. While budget constraints can be significant, the demand for highly advanced, innovative tools—like cryo-electron microscopes or single-cell sequencing platforms—remains consistently high, driving technology adoption.

The burgeoning Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) sector forms a rapidly growing customer base. These organizations act as intermediaries, serving pharmaceutical clients and requiring high flexibility, stringent quality management systems, and a broad portfolio of compatible instrumentation to handle diverse project requirements efficiently. Diagnostic laboratories and hospitals also constitute a significant end-user category, particularly driving demand for molecular diagnostics platforms, immunoassays, and automated laboratory systems that support high-volume clinical testing and patient management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $205 Billion |

| Market Forecast in 2033 | $370 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Danaher Corporation, Becton, Dickinson and Company (BD), Bio-Rad Laboratories, Merck KGaA, Agilent Technologies, F. Hoffmann-La Roche Ltd, PerkinElmer, Illumina, QIAGEN, Waters Corporation, Sartorius AG, GE Healthcare, Shimadzu Corporation, Eppendorf AG, Bio-Techne Corporation, 10x Genomics, Abcam, Lonza Group, Wuxi AppTec. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Life science Market Key Technology Landscape

The technological landscape of the Life Science Market is characterized by intense innovation, primarily centered on achieving higher resolution, greater throughput, and enhanced automation capabilities across all research phases. Next-Generation Sequencing (NGS) remains a foundational technology, evolving rapidly towards ultra-high-throughput platforms and long-read sequencing methods, which are critical for detecting complex structural variations and enabling large-scale population genomics studies. Complementary advancements in sample preparation and bioinformatics software are essential to fully leverage the data output from these powerful sequencers. Similarly, advancements in mass spectrometry, particularly in proteomics, are enabling deep profiling of cellular systems and crucial biomarker identification, moving beyond simple protein quantification to detailed post-translational modification analysis.

A significant shift is observed in cellular analysis techniques, driven by the explosive growth of cell and gene therapies. Single-cell technology, including single-cell genomics and transcriptomics (e.g., platforms provided by 10x Genomics), allows researchers to understand heterogeneity within tissues at unprecedented resolution, fundamentally changing cancer biology and immunology research. Furthermore, the integration of advanced automation and robotics systems is transforming laboratories into high-efficiency environments, minimizing human error, and accelerating repetitive tasks such as compound screening and biobanking. These automated systems are often complemented by sophisticated Laboratory Information Management Systems (LIMS) and electronic lab notebooks (ELNs) to ensure data integrity and workflow reproducibility.

The convergence of physical technologies with digital solutions represents the future of the life science tools market. High-content screening (HCS) and sophisticated imaging systems, often leveraging AI for image analysis, enable faster and more informative phenotypic assays. Furthermore, the development of specialized consumables, such as proprietary cell culture media, advanced bioreactors, and specialized filtration membranes, is paramount for scaling up complex biomanufacturing processes. Success in the life science market increasingly depends not only on the core instrument technology but also on providing a complete, technologically integrated ecosystem that encompasses reagents, software, and localized technical support.

Regional Highlights

- North America: North America, led by the United States, commands the largest share of the global life science market due to massive R&D expenditure by established pharmaceutical and biotech giants and robust funding from governmental bodies like the National Institutes of Health (NIH). The region is a global epicenter for technological innovation, hosting key clusters such as the Boston-Cambridge area and the San Francisco Bay Area, which foster high levels of venture capital investment in early-stage life science tools companies. Regulatory frameworks, while rigorous, offer accelerated pathways for breakthrough devices and drugs, stimulating market entry. The high adoption rate of sophisticated automation and genomic technologies characterizes this region.

- Europe: Europe represents a mature and highly strategic market, driven by significant public sector funding for fundamental research (e.g., Horizon Europe programs) and the presence of numerous global pharmaceutical companies headquartered in countries like Switzerland, Germany, and the UK. While regulatory processes are centralized under the European Medicines Agency (EMA), ensuring consistent standards, market growth is primarily fueled by advancements in personalized diagnostics and the scaling up of biomanufacturing capacity, particularly in vaccine production and advanced therapeutics. Germany and the UK remain crucial hubs for manufacturing and specialized academic research.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period. This acceleration is primarily driven by massive government investments in healthcare modernization and scientific research infrastructure, particularly in China and India. The rising prevalence of chronic diseases, coupled with a large patient population, drives demand for diagnostic testing and local drug development capabilities. Japan maintains a strong presence in advanced instrumentation and precision medicine, while emerging markets like South Korea and Australia are increasingly contributing through specialized biotech innovation and clinical trial acceleration.

- Latin America: This region presents a market focused on expanding access to basic life science tools and improving public health infrastructure. Growth is driven by the need to combat endemic infectious diseases and manage rising non-communicable diseases. Regulatory diversity and economic volatility remain challenges, but strategic partnerships between global vendors and local distributors are essential for market penetration, particularly in high-growth countries like Brazil and Mexico, which are increasing their domestic pharmaceutical production.

- Middle East and Africa (MEA): The MEA market is characterized by focused investment from Gulf Cooperation Council (GCC) countries, aiming to diversify economies through specialized healthcare and biotechnology research hubs (e.g., Saudi Arabia’s Vision 2030 initiatives). Demand is strong for high-quality diagnostic equipment and specialized consumables required for genetic disease screening and managing prevalent chronic conditions. Africa presents significant long-term potential, primarily driven by international aid and public health initiatives focused on infectious disease surveillance and control, requiring robust and affordable point-of-care testing tools.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Life science Market.- Thermo Fisher Scientific

- Danaher Corporation

- Becton, Dickinson and Company (BD)

- Bio-Rad Laboratories

- Merck KGaA

- Agilent Technologies

- F. Hoffmann-La Roche Ltd

- PerkinElmer

- Illumina

- QIAGEN

- Waters Corporation

- Sartorius AG

- GE Healthcare

- Shimadzu Corporation

- Eppendorf AG

- Bio-Techne Corporation

- 10x Genomics

- Abcam

- Lonza Group

- Wuxi AppTec

Frequently Asked Questions

Analyze common user questions about the Life science market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Life Science Market?

The market is primarily driven by substantial global increases in R&D investment by pharmaceutical and biotechnology companies, rapid technological advancements in genomics and proteomics, and the escalating demand for advanced personalized medicine solutions and biomanufacturing capacity.

How is Next-Generation Sequencing (NGS) technology impacting the market?

NGS is a foundational growth driver, significantly accelerating drug discovery, clinical diagnostics, and academic research by enabling high-throughput, comprehensive genetic analysis. Its decreasing cost and increasing speed make it essential for large-scale population health and precision oncology studies.

Which geographical region exhibits the fastest growth in the Life Science Market?

The Asia Pacific (APAC) region, specifically countries like China and India, is anticipated to record the highest Compound Annual Growth Rate (CAGR), fueled by government modernization of healthcare infrastructure, increasing research funding, and a growing local biotechnology sector.

What challenges restrain the widespread adoption of advanced life science tools?

Key restraints include the high initial capital investment required for sophisticated instrumentation, stringent and complex regulatory approval processes, and a global shortage of highly specialized technical personnel needed to operate and maintain these advanced systems.

What role does Artificial Intelligence (AI) play in the Life Science sector?

AI is transformative, significantly impacting drug discovery by accelerating target identification, optimizing clinical trial design, and enhancing the precision of diagnostic image and data analysis, moving research towards more efficient and data-driven methodologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Life Science & Analytical Instruments Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Life Science Instruments & Reagents Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Multi Cuvette Spectrophotometer For Life Science Market Size Report By Type (Portable, Benchtop), By Application (Biotechnology, Pharmaceuticals, Biomedical Technologies, Life Systems Technologies, Cosmeceuticals, Medical Devices, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Life Science Plastic Bottles Market Size Report By Type (Polystyrene(PS) Bottles, Polyethylene (PE) Bottles, Polycarbonate (PC) Bottles, Polypropylene (PP) Bottles, PETG Bottles, Others), By Application (Laboratory, Hospital, Pharmaceutical industry, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fume Hood Air Flow Monitors Market Statistics 2025 Analysis By Application (Life Science and Pharmaceutical, Hospitals and Laboratories, Universities and Academics, Government Facilities, Others), By Type (Fume Hood Digital Air Flow Monitor, Fume Hood Analog Air Flow Monitor), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager