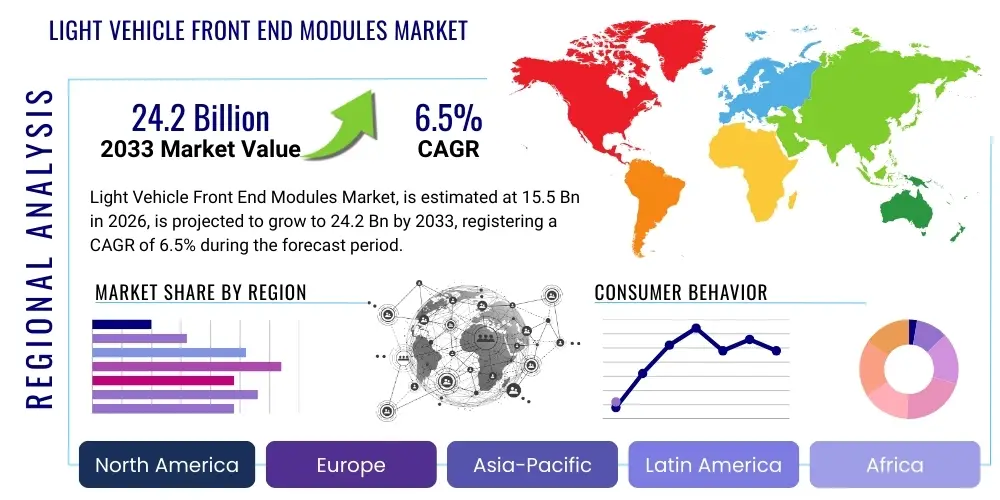

Light Vehicle Front End Modules Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442501 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Light Vehicle Front End Modules Market Size

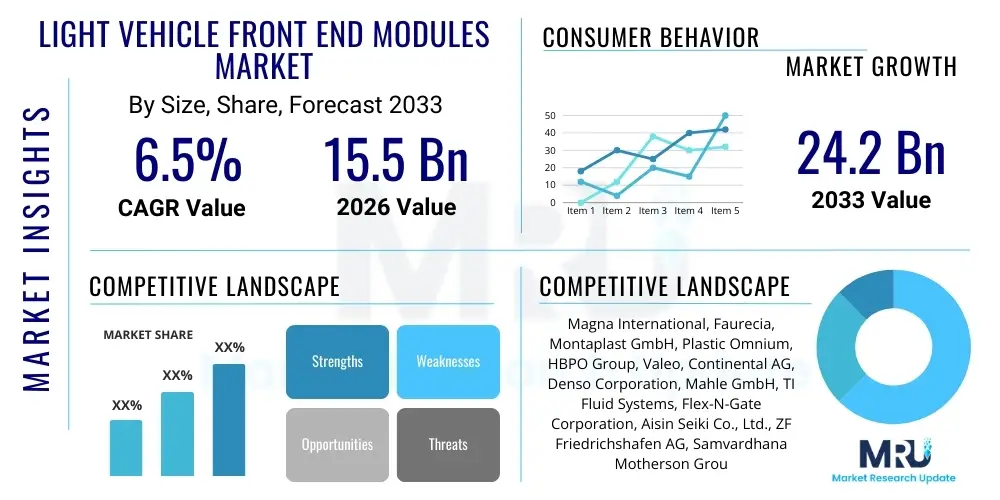

The Light Vehicle Front End Modules Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 24.2 Billion by the end of the forecast period in 2033.

Light Vehicle Front End Modules Market introduction

The Light Vehicle Front End Modules (FEMs) Market encompasses the design, manufacture, and integration of complex structural assemblies situated at the front of a vehicle, supporting critical systems such as the cooling package, lighting, bumper fascia, and various sensor units. These modules are delivered to Original Equipment Manufacturers (OEMs) as pre-assembled, just-in-sequence (JIS) components, significantly streamlining the vehicle assembly process and reducing complexity on the final assembly line. The primary functions of the FEM include providing structural integrity, optimizing thermal management, absorbing crash energy, and ensuring precise alignment for aerodynamic components and advanced driver-assistance systems (ADAS) sensors. Historically, FEMs were complex arrangements of stamped metal parts, but modern designs increasingly utilize lightweight composites, advanced plastics, and hybrid materials to meet stringent fuel efficiency and safety regulations while accommodating the dense electronic packaging required by contemporary vehicle architectures.

Product description highlights the essential role of the FEM as a carrier structure that integrates numerous mechanical and electrical components, transitioning assembly from fragmented parts to a consolidated, tested sub-system. Major applications span across passenger cars, SUVs, and light commercial vehicles globally, driven by the universal automotive need for assembly efficiency and weight reduction. Key benefits derived from adopting FEMs include improved production logistics, lower overall vehicle weight, enhanced crash performance due to optimized energy absorption zones, and increased flexibility in vehicle design iteration. The modular approach allows OEMs to efficiently manage platform variations and integrate sophisticated cooling systems necessary for turbocharged engines and electric vehicle powertrains. This shift towards complex, pre-validated modules is crucial for maintaining competitive production schedules.

Driving factors propelling the expansion of this market are intrinsically linked to overarching automotive trends, specifically the rapid adoption of electric vehicles (EVs) and the mandated integration of sophisticated ADAS features. EVs require highly optimized thermal management systems for battery and power electronics cooling, which is efficiently managed within the FEM structure. Furthermore, the proliferation of radar, lidar, and camera systems necessitates precise, stable mounting locations that the FEM provides, ensuring accurate sensor calibration and functionality. Regulatory pressures regarding pedestrian safety and stricter crash test standards also favor FEM designs that can incorporate complex, energy-absorbing structures. Coupled with the relentless pursuit of manufacturing efficiency by global OEMs, the light vehicle front end module market is poised for sustained, robust growth throughout the forecast period, driven by technological advancement in material science and electronic integration.

Light Vehicle Front End Modules Market Executive Summary

The Light Vehicle Front End Modules Market demonstrates robust business trends centered on lightweighting, increased complexity due to electrification, and supply chain rationalization through integrated sourcing. Strategic partnerships between tier-one suppliers (the primary FEM assemblers) and material manufacturers are intensifying to develop high-performance thermoplastic and composite solutions that offer superior weight savings and structural performance compared to traditional steel structures. The industry is seeing a notable trend toward "smart FEMs" that come pre-equipped with active grille shutters, sophisticated wiring harnesses, and complex sensor arrays, reducing the integration burden on OEMs. Investment in automated assembly processes and advanced simulation techniques for crash management and thermal performance is a key differentiator among leading market participants, ensuring high quality and rapid time-to-market for new vehicle platforms. The transition toward global, modular vehicle architectures is reinforcing the demand for standardized, yet highly customizable, front end solutions.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China and India, represents the highest growth potential, fueled by massive increases in light vehicle production and the accelerating adoption of domestic EV models. Europe, characterized by stringent environmental regulations and a strong push toward advanced safety features, maintains a high demand for premium, highly engineered FEMs that incorporate active aerodynamics and complex cooling circuits for smaller, high-output powertrains. North America continues to prioritize robust, durable FEMs suitable for larger SUV and pickup truck segments, though the market is rapidly adapting to EV mandates, driving demand for innovative thermal management solutions within the module structure. These regional variances necessitate highly localized manufacturing and supply chain strategies to meet specific regulatory and consumer preference requirements efficiently.

Segmentation trends reveal significant shifts across material type and component integration. The Plastic/Composite segment is expanding rapidly, displacing metal FEMs due to superior weight reduction capabilities, although hybrid modules (combining metal sub-frames with composite carriers) are gaining traction, particularly for heavy-duty applications requiring extreme stiffness. From a component perspective, the integration of complex cooling systems designed for high-voltage battery systems and inverter units is a primary growth area, driven by battery electric vehicles (BEVs). Furthermore, the OEM channel dominates sales, given the specialized nature and just-in-time delivery requirements of these assemblies, while the small, albeit growing, aftermarket segment focuses primarily on crash repair replacements. The overall market trajectory is defined by increasing system complexity being managed through modularization, translating into high value-add for specialized Tier 1 suppliers.

AI Impact Analysis on Light Vehicle Front End Modules Market

Common user questions regarding AI's impact on the Light Vehicle Front End Modules Market primarily revolve around how AI can enhance design optimization, accelerate prototyping, and improve manufacturing quality control. Key themes center on utilizing generative design algorithms to create ultra-lightweight, topologically optimized structures that maximize crash energy absorption while minimizing material use. Users are concerned about the shift from traditional engineering methods to AI-driven design, questioning the validation process for complex, organic shapes derived by algorithms, especially concerning stringent regulatory compliance. Furthermore, there is high interest in how AI-powered predictive maintenance and quality assurance systems, utilizing computer vision and machine learning on the assembly line, can detect microscopic flaws in composite structures or ensure the precise calibration of pre-mounted ADAS sensors, which are critical functional elements integrated into modern FEMs. Expectations are high that AI will significantly reduce design cycles, enabling faster iteration tailored to specific vehicle platform requirements.

- AI-Driven Generative Design: Optimizing complex lattice structures for maximum stiffness-to-weight ratio and tailored crash performance, resulting in lighter modules.

- Manufacturing Quality Control: Deployment of machine learning algorithms for real-time defect detection (e.g., composite void analysis, weld integrity checking) during assembly.

- Supply Chain and Logistics Optimization: Predictive analytics enhancing the Just-in-Sequence (JIS) delivery of complex modules to OEM assembly lines, minimizing inventory risk.

- Thermal Management Simulation: AI and Digital Twins accelerating the design and validation of complex cooling system layouts integrated within the FEM for EV battery performance.

- Component Integration Precision: Using AI vision systems to ensure precise alignment and calibration of integrated ADAS sensors (radar, lidar) during module pre-assembly.

- Predictive Failure Analysis: Machine learning models analyzing sensor data from in-use vehicles to predict potential fatigue failure points in composite or hybrid FEM structures.

DRO & Impact Forces Of Light Vehicle Front End Modules Market

The Light Vehicle Front End Modules Market is shaped by a confluence of accelerating drivers related to electrification and regulatory mandates, balanced against significant restraints imposed by material costs and integration complexity. Opportunities primarily stem from new material science breakthroughs and expanding penetration in emerging markets. The principal driver is the continuous pressure on OEMs to achieve weight reduction goals to improve fuel economy or increase EV range; FEM modularization allows for efficient use of lightweight plastics and composites. Secondly, the increasing sophistication of ADAS and the necessity for stable, precise mounting platforms for sensors fuel demand for highly engineered FEMs. The core restraints involve the high initial investment required for tooling and specialized assembly lines for complex composite FEMs, coupled with volatility in raw material prices (e.g., engineering thermoplastics and aluminum). Furthermore, the strict requirement for Just-in-Sequence (JIS) delivery imposes significant logistical complexity and risk on suppliers.

Opportunities are abundant in the development of next-generation bio-based and recycled composite materials that meet stringent automotive requirements while addressing sustainability mandates. The adoption of customizable, scalable FEM designs that can accommodate multiple powertrain options (ICE, Hybrid, BEV) on the same platform offers a lucrative avenue for standardization and cost reduction for suppliers. Impact forces within this market are predominantly defined by the bargaining power of OEMs, who leverage their consolidated purchasing power to negotiate prices, and the intense rivalry among Tier 1 suppliers, who compete aggressively on technological capabilities, delivery precision, and material innovation. The threat of substitutes is relatively low, as the fundamental function of the FEM—consolidated structural and thermal support—is indispensable, although alternative structural materials and new vehicle architectures (like skateboards for EVs) continuously influence design parameters.

The regulatory environment acts as a strong external impact force; global safety standards (e.g., pedestrian protection, offset frontal crash tests) constantly push the boundaries of FEM design toward complex, multi-material solutions that require sophisticated simulation and testing. This environment creates high barriers to entry for new competitors lacking deep engineering expertise. Technological innovation, especially in injection molding and composite welding, acts as a pivotal force, enabling suppliers to create modules with higher integration density and improved tolerances. The balance of these dynamic forces—weight reduction demands, electrification integration, stringent safety requirements, and material costs—dictates the strategic direction of R&D and manufacturing capacity investment across the global market landscape, favoring suppliers capable of providing highly integrated, multi-functional assemblies.

Segmentation Analysis

The Light Vehicle Front End Modules Market is strategically segmented based on crucial criteria that reflect technological design evolution, material science advancements, and fundamental application differences across the automotive spectrum. Key segmentation categories include the material used in construction (driving weight and cost), the specific components integrated into the module (reflecting complexity and thermal requirements), the type of vehicle utilizing the module (defining size and performance needs), and the sales channel through which the module reaches the vehicle manufacturer. Understanding these segments is vital for suppliers to tailor product offerings and manufacturing processes, particularly as the industry transitions toward electrification and increasingly complex ADAS integration. The predominance of plastic and hybrid materials reflects the global imperative for lightweighting, while the growth in electric vehicles directly impacts the cooling fan assembly and thermal integration segments.

- By Material Type:

- Plastic/Composite

- Metal (Steel/Aluminum)

- Hybrid (Combination of Metal and Composites)

- By Component:

- Radiator Support

- Headlamp Mounts and Supports

- Air Guide Systems

- Cooling Fan Assembly and Shroud

- Bumper Beam Integration

- Horns and Wire Harnesses

- By Vehicle Type:

- Passenger Cars (Sedans and Hatchbacks)

- SUVs and Crossovers

- Light Commercial Vehicles (LCVs)

- Premium and Luxury Vehicles

- By Sales Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

Value Chain Analysis For Light Vehicle Front End Modules Market

The value chain for the Light Vehicle Front End Modules Market is highly complex, starting with specialized upstream suppliers providing raw materials and specialized components, moving through highly integrated Tier 1 manufacturing and assembly, and concluding with just-in-sequence delivery to the OEM. Upstream analysis begins with raw material providers supplying engineering plastics (e.g., polypropylene, polyamide, polycarbonate), various grades of steel, and aluminum necessary for constructing the structural elements. Component suppliers, often Tier 2 and Tier 3, provide critical integrated systems such as cooling modules (radiators, condensers), fan assemblies, lighting components (headlamp units), and electronic sensors (radar, wiring harnesses). The efficiency and cost-effectiveness of the final module are heavily dependent on the quality and timely delivery of these upstream specialized sub-components, demanding stringent supplier management and strategic sourcing capabilities from the Tier 1 assemblers.

The core of the value chain is the Tier 1 manufacturer/assembler, often referred to as the system integrator (e.g., HBPO, Magna, Faurecia). This stage involves extensive R&D, structural design validation (crash simulation), tooling, and the complex assembly of hundreds of individual parts into the final, tested module. The value proposition here is the consolidation of logistics and assembly complexity away from the OEM. Distribution channels are predominantly direct, dictated by the logistical demands of Just-in-Sequence (JIS) or Just-in-Time (JIT) delivery. Direct distribution involves established, often co-located, logistics hubs or dedicated supply lines running directly to the OEM's assembly plant, sometimes managed through specialized logistics providers. This direct model ensures that the correct module variant arrives at the production line precisely when needed, minimizing inventory and maximizing assembly throughput for the OEM.

Downstream analysis focuses on the final customer, the automotive OEM, who integrates the FEM into the vehicle body. Post-sale, the aftermarket channel emerges, dealing predominantly with replacement parts necessitated by collision damage. Although the aftermarket constitutes a smaller volume than the OEM channel, it requires a different distribution structure, often involving independent distributors and certified repair centers. The overall value chain is characterized by high capital intensity at the manufacturing level, significant intellectual property related to composite molding and structural design, and an extreme reliance on technological integration and precision logistics. Indirect sales, while minimal for new vehicle production, play a vital role in providing repair and service components, often through official parts distribution networks managed or authorized by the OEMs.

Light Vehicle Front End Modules Market Potential Customers

The primary and most critical customer base for the Light Vehicle Front End Modules Market consists of global Original Equipment Manufacturers (OEMs) across all major automotive producing regions. These OEMs, including industry giants like Volkswagen Group, General Motors, Toyota, Ford, Stellantis, Hyundai-Kia, and emerging electric vehicle manufacturers such as Tesla and numerous Chinese EV startups, rely heavily on Tier 1 FEM suppliers to manage system integration complexity and ensure manufacturing agility. OEMs seek suppliers capable of co-designing modules that meet specific vehicle platform requirements for crash safety, thermal management, weight targets, and aesthetic integration, demanding high precision and large-scale volume production capability. The decision to outsource FEM assembly is strategic for OEMs, allowing them to focus internal resources on core competencies like final assembly, powertrain calibration, and software development, while delegating complex sub-assembly management to specialized partners.

Beyond the major established OEMs, an increasingly important segment of potential customers includes emerging automotive manufacturers, particularly those dedicated exclusively to electric vehicles. These new entrants often lack the extensive internal component manufacturing infrastructure of legacy companies and rely entirely on sophisticated Tier 1 partners for complex modules like the FEM. For these companies, the FEM supplier is not just a parts provider but a critical engineering partner responsible for delivering validated thermal and structural systems that are essential for maximizing EV performance and range. This segment offers significant growth opportunities for suppliers who can demonstrate expertise in battery cooling system integration and advanced material usage suitable for lightweight EV platforms, often requiring greater flexibility in design and shorter lead times compared to traditional models.

The third category of potential customers involves the global network of independent repair shops, collision centers, and authorized dealership service centers, which form the aftermarket demand channel. While not purchasing modules in the same volumes as OEMs, this segment generates steady, high-margin demand for replacement modules resulting from vehicle collisions. As modern FEMs are highly integrated and often damaged beyond repair in even moderate accidents, replacement of the entire module assembly is common. These customers require reliable, certified parts that match OEM specifications exactly, driving demand for suppliers who can manage a comprehensive spare parts logistics system alongside their primary OEM production responsibilities, ensuring long-term product availability and quality standards for repair operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 24.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Magna International, Faurecia, Montaplast GmbH, Plastic Omnium, HBPO Group, Valeo, Continental AG, Denso Corporation, Mahle GmbH, TI Fluid Systems, Flex-N-Gate Corporation, Aisin Seiki Co., Ltd., ZF Friedrichshafen AG, Samvardhana Motherson Group, Gestamp Automoción, S.A., Schaeffler AG, Hella GmbH & Co. KGaA, BorgWarner Inc., Grupo Antolin, Lydall, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Light Vehicle Front End Modules Market Key Technology Landscape

The technological landscape of the Light Vehicle Front End Modules Market is defined by innovations aimed at achieving multi-material integration, optimizing thermal performance, and ensuring structural compliance in high-volume production settings. A pivotal technology is advanced injection molding, specifically low-pressure injection molding and hybrid injection techniques, which allow for the production of large, complex, and highly accurate composite carrier structures capable of bearing significant loads. These techniques facilitate the integration of metal inserts and mounting points directly into the plastic matrix, creating robust hybrid modules that offer the strength of metal in critical zones and the weight savings of composites elsewhere. Furthermore, advancements in specialized bonding agents and joining techniques (such as vibration welding and ultrasonic welding) are essential for securely and reliably assembling dissimilar materials without compromising structural integrity or adding excessive weight, a critical factor for crash safety compliance.

Another crucial technological area is the integration of thermal management solutions, which has intensified with the proliferation of electric vehicles and high-performance turbocharged internal combustion engines. This involves the use of advanced computer-aided engineering (CAE) tools and computational fluid dynamics (CFD) simulation to optimize air flow paths, maximize cooling efficiency for the battery pack and power electronics (in EVs), and ensure rapid thermal response. Active grille shutter (AGS) systems are becoming standard components integrated into the FEM; these electronically controlled louvers automatically adjust to balance aerodynamic efficiency (closing the grille at high speed) and cooling requirements (opening the grille under high load), significantly impacting vehicle efficiency and performance. Suppliers must possess expertise in integrating the electrical actuators and control systems for these active aerodynamics directly into the module's architecture.

Finally, the growing sophistication of ADAS demands high-precision manufacturing and calibration technologies. The FEM is the primary mounting location for critical ADAS sensors, including forward-looking radar, lidar units, and high-definition cameras. Maintaining micron-level tolerances for sensor positioning is paramount, as even minor misalignments can drastically compromise safety system performance. Therefore, the technology landscape includes specialized robotic assembly and non-contact measurement systems (e.g., laser scanning) employed on the assembly line to ensure that every module meets exacting specifications for sensor calibration before shipment. This requirement transforms the FEM from a passive structural component into a highly complex, functional electronic and structural sub-system, driving high R&D investment into mechatronics and precise assembly automation techniques among leading market players.

Regional Highlights

Market dynamics for Light Vehicle Front End Modules exhibit distinct characteristics across major global regions, influenced by localized production volumes, regulatory demands, and the speed of electric vehicle adoption. Asia Pacific (APAC) stands out as the fastest-growing market, primarily due to the dominant production volumes in China and the burgeoning automotive industry in India and Southeast Asia. The APAC market is characterized by a strong demand for cost-effective, high-volume FEMs, but is increasingly shifting towards sophisticated, lightweight composite solutions driven by China's aggressive EV production targets and corresponding government subsidies aimed at promoting vehicle lightweighting. Local Chinese suppliers are rapidly scaling up technological capabilities, though major international Tier 1 suppliers retain a strong presence through joint ventures.

- Asia Pacific (APAC): Dominates global production volume; strong growth driven by China's massive EV market and stringent domestic regulations favoring lightweight composites. Focus on cost optimization and speed of modular integration.

- Europe: Characterized by demand for highly engineered, premium FEMs incorporating advanced features like active grille shutters and highly efficient thermal management systems for complex hybrid and diesel powertrains. Strict EU safety and emission standards necessitate multi-material structures and superior crash performance.

- North America: Significant segment growth tied to large SUV, Crossover, and pickup truck segments. Rapid acceleration in demand for FEMs optimized for large electric pickup platforms, focusing on robust structural integrity and highly sophisticated battery cooling loop integration.

- Latin America (LATAM): Market characterized by price sensitivity and simpler module designs, though gradually adopting global trends in lightweighting and modularization, particularly in major manufacturing centers like Brazil and Mexico.

- Middle East and Africa (MEA): Small but emerging market, reliant primarily on imported vehicle architectures. Demand focuses on durability and resilience to extreme temperature conditions, driving interest in robust cooling package integration within the FEM.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Light Vehicle Front End Modules Market.- Magna International

- Faurecia

- Montaplast GmbH

- Plastic Omnium

- HBPO Group (A joint venture between Plastic Omnium and Hella)

- Valeo

- Continental AG

- Denso Corporation

- Mahle GmbH

- TI Fluid Systems

- Flex-N-Gate Corporation

- Aisin Seiki Co., Ltd.

- ZF Friedrichshafen AG

- Samvardhana Motherson Group

- Gestamp Automoción, S.A.

- Schaeffler AG

- Hella GmbH & Co. KGaA

- BorgWarner Inc.

- Grupo Antolin

- Lydall, Inc.

Frequently Asked Questions

Analyze common user questions about the Light Vehicle Front End Modules market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Light Vehicle Front End Module (FEM) and why is it crucial for modern cars?

The FEM is a complex, pre-assembled structural unit delivered to the OEM assembly line that integrates critical components such as the radiator, cooling fans, air conditioning condenser, headlamps, and mounting points for ADAS sensors. It is crucial because it simplifies vehicle assembly, reduces weight through the use of composites, and optimizes crash energy absorption and thermal management systems, especially in electric vehicles.

How is the growth of Electric Vehicles (EVs) impacting the demand for FEMs?

The shift to EVs significantly boosts demand for highly customized FEMs. EVs require advanced, integrated thermal management systems for high-voltage batteries and power electronics, and the FEM serves as the primary structural carrier for these complex cooling loops, driving innovation in material heat dissipation and system integration.

Which materials are dominating the construction of next-generation Front End Modules?

The market is increasingly dominated by Plastic/Composite materials, such as engineering thermoplastics (e.g., polyamides and polypropylene) reinforced with glass fibers, often used in conjunction with Hybrid designs that incorporate high-strength steel or aluminum inserts in critical load-bearing areas to maximize lightweighting without compromising safety.

What are the key technical challenges facing FEM suppliers regarding ADAS integration?

The primary challenge is maintaining micron-level precision and stability for the mounting points of sensitive ADAS sensors (radar, lidar). Suppliers must guarantee that the composite or hybrid structure retains dimensional stability under all operating conditions (temperature, vibration) to ensure accurate sensor calibration and reliable safety system performance.

What is the significance of the Just-in-Sequence (JIS) delivery model for this market?

JIS delivery is essential because FEMs are large, specialized assemblies that vary significantly by vehicle trim and options. Suppliers must manufacture and deliver the exact module variant required, in the precise sequence of the OEM's assembly line, usually within a narrow time window, minimizing inventory and maximizing the OEM’s production flow efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager