Lightweight Aggregate Concrete Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442612 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Lightweight Aggregate Concrete Market Size

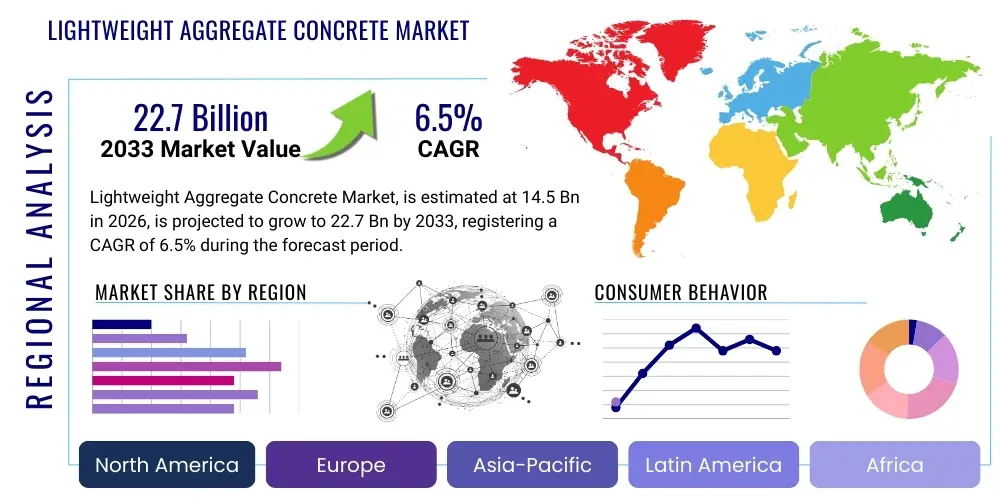

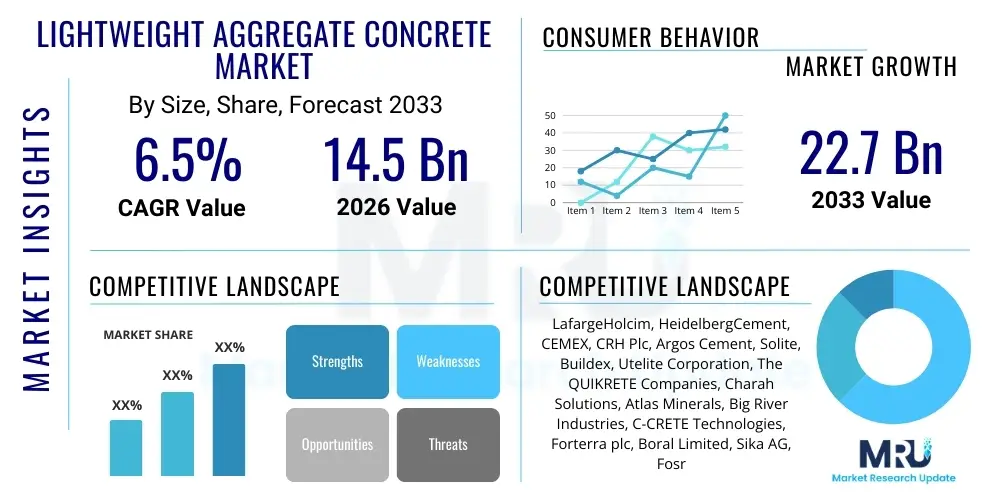

The Lightweight Aggregate Concrete Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 22.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global need for sustainable construction materials that offer enhanced thermal performance and structural efficiency, particularly in dense urban environments where minimizing dead load is paramount for high-rise construction.

Lightweight Aggregate Concrete Market introduction

Lightweight Aggregate Concrete (LWAC) constitutes a pivotal segment within the broader construction materials industry, characterized by its significantly lower density compared to traditional normal-weight concrete. This reduction in density is achieved through the incorporation of lightweight aggregates, suchvolving expanded clay, shale, slate, or synthetic materials like sintered fly ash. LWAC retains crucial structural properties while offering superior insulation, reduced dead loads, and improved fire resistance, making it an increasingly favored material for complex architectural and engineering projects globally. Its primary function is to optimize structural design, enabling lighter foundational requirements and larger spans, thereby enhancing material efficiency and reducing overall project costs, especially in regions prone to seismic activity where mass reduction is critical.

The core product features of LWAC include a density typically ranging from 1,120 to 1,920 kg/m³, coupled with compressive strengths comparable to conventional concrete in structural applications. Major applications span high-rise buildings, bridge decks, prefabricated elements, geotechnical fills, and insulating layers in commercial and residential structures. The inherent insulating properties of LWAC contribute significantly to energy efficiency in buildings, aligning with stringent global green building mandates and reducing long-term operational costs for property owners. Furthermore, the ease of handling and placement due to its lighter weight accelerates construction timelines and enhances on-site safety and logistical efficiency, which are powerful drivers for its adoption across developed and rapidly developing economies.

Key market benefits driving the expansive adoption of LWAC include its superior thermal conductivity characteristics, which are often three to four times better than normal concrete, leading to substantial energy savings. The reduced dead load is perhaps the most significant structural benefit, allowing for substantial material savings in foundations and supporting elements, which is critical for construction on soft soils or where large foundational depths are cost-prohibitive. Furthermore, governmental initiatives worldwide promoting infrastructure modernization and sustainable building codes act as potent driving factors. These regulations prioritize materials that reduce carbon footprints and enhance building longevity and performance, directly favoring LWAC over traditional heavy concrete alternatives, ensuring its sustained market relevance through the forecast period.

Lightweight Aggregate Concrete Market Executive Summary

The Lightweight Aggregate Concrete Market is experiencing robust expansion driven by pronounced global urbanization trends, necessitating construction solutions that are both structurally sound and resource-efficient. Current business trends indicate a strong pivot toward specialty LWAC formulations, including those incorporating recycled aggregates or bio-based binders, aligning with circular economy principles. Major construction firms are increasingly integrating LWAC into precast modular construction due to its consistency and rapid deployment capabilities, reflecting a shift away from traditional, fully site-dependent casting methods. Investment in R&D is focused on enhancing the strength-to-weight ratio and refining production methods to reduce the energy intensity of aggregate sintering, aiming for a lower embodied carbon footprint for the final product, which is vital for competitive differentiation in key regional markets.

Regionally, the Asia Pacific (APAC) market dominates in terms of consumption volume, primarily fueled by massive infrastructure projects in China and India, coupled with rapid residential development across Southeast Asia. North America and Europe, while slower in volume growth, lead in technology adoption and regulatory stringency, driving demand for premium, high-performance LWAC used in complex civil engineering projects and deep-water oil and gas applications. European trends are heavily influenced by the European Green Deal, mandating the use of materials that comply with high energy performance standards, boosting the segment of insulating LWAC. Conversely, the Middle East and Africa (MEA) exhibit strong growth potential due to diversification efforts away from oil economies, leading to significant investments in smart city development and large-scale architectural projects requiring innovative, lightweight structural solutions.

Segmentation trends highlight the expanded clay, shale, and slate (ExCS) aggregate type as maintaining market leadership, offering the best balance between structural performance and cost. However, the sintered fly ash segment is forecast to exhibit the highest CAGR due to increased waste utilization mandates and the ready availability of fly ash as a industrial byproduct, offering a cost-effective and environmentally friendly alternative. Structural LWAC remains the largest application segment, fundamentally tied to high-rise commercial and residential construction. Geotechnical fill and insulating concrete are emerging rapidly, demonstrating the material's versatility beyond sheer structural support into niche areas requiring thermal or acoustic performance enhancement. Overall, the market shows a clear trajectory toward specialized, performance-driven products catering to specific engineering challenges.

AI Impact Analysis on Lightweight Aggregate Concrete Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Lightweight Aggregate Concrete Market reveals key themes centered around process optimization, quality control, and predictive maintenance. Users frequently inquire about how AI algorithms can optimize mix designs—specifically adjusting aggregate ratios and admixture dosages in real-time to maintain consistent density and strength despite variations in raw material quality. Concerns also revolve around the potential for AI-driven automation in the precasting process, seeking to understand its efficiency gains versus initial implementation costs. A significant expectation is the use of predictive AI models to forecast material degradation, optimizing maintenance schedules for structures built with LWAC, and ensuring long-term structural integrity. Users are actively exploring AI's role in reducing material wastage and improving the sustainability profile of LWAC production by analyzing energy consumption patterns in the sintering process.

The implementation of machine learning is already beginning to revolutionize quality assurance in LWAC production. AI-powered image recognition and sensor fusion are used to monitor the particle size distribution and porosity of lightweight aggregates during manufacturing, ensuring conformity before mixing. This drastically reduces the probability of batch rejection due to inconsistent material properties, a common challenge with naturally derived lightweight aggregates. Furthermore, integrating AI into Building Information Modeling (BIM) platforms allows engineers to simulate the performance of LWAC under various environmental stresses (thermal cycling, humidity, loading), providing highly accurate, performance-based specifications that minimize over-engineering and material use, optimizing both cost and environmental impact.

Looking forward, the influence of AI will extend deeper into logistics and supply chain management for LWAC components. Predictive analytics can optimize inventory levels of raw aggregates and cement, anticipating demand fluctuations based on construction project timelines and external economic indicators. This enhanced foresight minimizes storage costs and ensures just-in-time delivery for large-scale projects. The overall trajectory suggests AI will serve not only as a tool for production efficiency but also as a core enabler for delivering certified, high-performance, and traceable LWAC products, fundamentally raising the quality benchmark for the entire industry.

- AI-driven optimization of concrete mix proportions to ensure consistent low density and high compressive strength.

- Predictive maintenance analytics for early detection of structural issues in LWAC-built infrastructure, extending lifespan.

- Enhanced quality control using machine vision systems to analyze aggregate size and surface morphology in real-time.

- Automation of precast LWAC production lines using robotics guided by machine learning algorithms for improved precision.

- Integration of AI with BIM for accurate life cycle assessment and simulation of LWAC performance under extreme loads.

- Optimization of energy consumption during the thermal treatment (sintering) of lightweight aggregates through algorithmic control.

- Supply chain management optimization using predictive models to forecast demand and manage aggregate inventory efficiently.

DRO & Impact Forces Of Lightweight Aggregate Concrete Market

The Lightweight Aggregate Concrete Market dynamics are shaped by a complex interplay of structural efficiency demands, environmental compliance requirements, and inherent material handling constraints. Key drivers include the global surge in high-rise and large-span construction where minimizing dead load is structurally and economically advantageous, coupled with stricter energy efficiency standards in building codes promoting superior thermal insulation. Restraints largely center on the higher initial material cost compared to normal-weight concrete, logistical challenges related to sourcing specialized aggregates, and the perception of complexity in handling and quality control specific to lightweight mixes. Opportunities reside predominantly in developing novel, ultra-lightweight aggregates using industrial byproducts, penetrating the growing prefabrication market, and expanding applications in specialist infrastructure areas like floating structures and seismic-resistant construction. These factors collectively exert significant impact forces on market expansion, pushing manufacturers toward innovation in material science and process optimization.

Drivers: A primary driver is the accelerating urbanization trend, particularly in Asia and Africa, which necessitates the construction of taller, more structurally efficient buildings capable of resisting higher seismic and wind loads. LWAC's inherent property of reducing the dead weight by 25% to 40% minimizes required foundation sizes and reinforcing steel consumption, leading to significant cost savings in overall structural framing. Furthermore, the rising awareness and implementation of green building standards, such as LEED and BREEAM, strongly favor LWAC due to its exceptional thermal performance. This insulating capability dramatically reduces heating and cooling loads, contributing to lower operational energy consumption and a smaller carbon footprint over the building's lifetime, thereby aligning with global sustainability targets and providing tangible value to developers seeking energy certification.

Restraints: Despite its numerous advantages, the higher initial cost of lightweight aggregates, particularly those requiring energy-intensive production processes like sintering, acts as a significant restraint. This cost differential makes LWAC less competitive for standard, low-rise construction projects where conventional concrete suffices. Another critical restraint involves quality assurance; achieving consistent workability and uniform density in LWAC mixes requires specialized expertise and stricter process control compared to conventional concrete. The logistical complexity associated with transporting highly specialized aggregates across various regions, especially in emerging markets where supply chain infrastructure is less developed, further challenges widespread adoption and cost-effectiveness, prompting developers to seek simpler, locally sourced alternatives.

Opportunities: Significant market opportunities lie in the rapidly expanding precast and modular construction sector, where LWAC’s characteristics—lightweight for transport and handling, and predictable dimensions—are highly valued for accelerating construction cycles. The shift toward sustainable construction provides fertile ground for the development of aggregates derived from industrial and agricultural waste streams (e.g., expanded rice husk ash, recycled expanded polystyrene beads), which lowers material costs and improves the environmental profile of the product. Furthermore, LWAC is uniquely positioned for growth in specialized engineering applications, including the construction of floating marine platforms, underground utility protection, and complex bridge decks requiring minimal weight to maximize load capacity, offering high-margin growth avenues for specialized LWAC producers.

- Drivers: Demand for high-rise, seismic-resistant structures; rigorous energy efficiency regulations in developed markets; reduction in foundation and structural steel costs.

- Restraints: High initial material cost of specialized aggregates; challenges in maintaining consistent quality control and mix workability; logistical complexity in sourcing aggregates.

- Opportunity: Expansion in precast and modular construction systems; utilization of industrial waste streams (fly ash, slag) for aggregate production; specialized civil engineering applications (bridge decks, marine structures).

- Impact Forces: High structural performance demands necessitate innovation, while sustainability mandates drive cost reduction through waste utilization, forcing market polarization toward high-performance structural and insulating applications.

Segmentation Analysis

The Lightweight Aggregate Concrete market is systematically segmented based on the type of aggregate used, which dictates the material's final properties; the application area, reflecting its primary end-use; and the intended end-user industry, highlighting the consumer base. Detailed segmentation allows for targeted product development and market penetration strategies, ensuring that specific requirements for density, strength, and thermal conductivity are met across diverse construction environments. The aggregate type segmentation is critical as it defines the cost structure and sourcing logistics, ranging from energy-intensive expanded mineral aggregates to byproduct-derived options. Application segmentation clearly delineates the market split between structural elements, insulation requirements, and non-structural uses like fill material, providing a clear map of consumption trends.

- By Aggregate Type: Expanded Clay, Shale, and Slate (ExCS), Expanded Perlite, Sintered Fly Ash, Pumice and Scoria, Others (e.g., Vermiculite, Recycled Aggregates).

- By Application: Structural Concrete, Insulating Concrete, Geotechnical Fills and Landscaping, Precast Elements and Products, Others (e.g., Fire protection).

- By End-User: Residential Construction, Commercial Construction, Infrastructure (Roads, Bridges, Tunnels), Industrial Construction.

Value Chain Analysis For Lightweight Aggregate Concrete Market

The value chain for Lightweight Aggregate Concrete is intricate, commencing with the energy-intensive upstream processing of raw materials. Upstream activities involve the quarrying and processing of natural raw materials (like clay, shale, or volcanic rocks) or the acquisition and preparation of industrial byproducts (like fly ash). The crucial step here is the high-temperature thermal expansion or sintering process required to create the lightweight, porous aggregate structure. This stage is capital-intensive and dictates the final quality, cost, and embodied energy of the aggregate. Key challenges upstream include optimizing kiln efficiency to reduce energy consumption and ensuring the consistency of raw material feedstock to maintain uniformity in the resulting lightweight granules, which directly influences the performance of the final concrete mix.

The midstream segment involves the blending of these lightweight aggregates with cement, water, and specialized admixtures to produce the final LWAC mix. This phase is handled either by ready-mix concrete suppliers or precast manufacturers. Distribution channels are varied: direct sales dominate for large infrastructure or high-rise projects requiring continuous, high-volume supply, often delivered via specialized ready-mix trucks designed to handle the material's unique flow characteristics. Indirect channels, involving distributors or specialized building material retailers, cater primarily to smaller commercial projects or specialized insulating applications. The sophistication of the mixing process, including precise moisture control to prevent aggregate floatation or segregation, is a critical success factor in this segment.

The downstream component involves the application and end-use of the LWAC, spanning from high-rise commercial structures and vital infrastructure elements (bridge decks) to insulating floor and roof screeds. Direct interaction occurs between the concrete manufacturer and large construction contractors or specialized civil engineering firms. Indirect flows often involve precast element manufacturers who incorporate LWAC into modular panels, blocks, or beams, which are then sold through construction material supply chains to sub-contractors and builders. Ensuring quality installation, including appropriate curing protocols specific to LWAC, is paramount in the downstream segment to fully realize the material's benefits, ultimately delivering superior thermal performance and structural efficiency to the final end-user.

Lightweight Aggregate Concrete Market Potential Customers

Potential customers for Lightweight Aggregate Concrete are highly diversified, primarily comprising entities engaged in large-scale structural engineering and specialized construction projects where weight reduction, thermal performance, and durability are non-negotiable requirements. The primary end-users are large general contractors specializing in high-rise commercial, residential, and mixed-use developments. These contractors favor LWAC for the economic advantages derived from reduced foundation loads and the enhanced compliance with stringent building energy codes. Furthermore, government agencies responsible for maintaining and expanding critical infrastructure, such as departments of transportation and public works for bridges, tunnels, and elevated roads, are significant buyers, leveraging LWAC’s lower density for reduced structural stress and enhanced longevity.

Another crucial segment of buyers includes specialized precast concrete manufacturers. These entities utilize LWAC to fabricate components such as lightweight wall panels, architectural facades, roof slabs, and utility vaults. The lower weight of these precast elements facilitates easier, safer, and faster transportation and installation on-site, thereby accelerating the construction schedule and reducing reliance on heavy lifting equipment. The demand from the precast sector is intrinsically linked to the growing trend of modular construction, particularly in Europe and North America, where standardization and rapid deployment are prioritized to address housing shortages and infrastructural backlogs efficiently.

Finally, niche buyers include geotechnical engineering firms and energy sector operators. Geotechnical firms utilize LWAC, often in its insulating or fill capacity, for applications such as lightweight embankment fills over unstable soils or as backfill around underground utility piping, minimizing ground pressure and enhancing stability. In the energy sector, particularly deep-water oil and gas, LWAC is specified for its use in creating lightweight, thermally insulating well casings or protective coatings, requiring a specific combination of low density and high pressure resistance. These diverse end-users emphasize performance-based procurement, often prioritizing highly specified LWAC formulations over general-purpose materials, indicating a sophisticated buyer landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 22.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LafargeHolcim, HeidelbergCement, CEMEX, CRH Plc, Argos Cement, Solite, Buildex, Utelite Corporation, The QUIKRETE Companies, Charah Solutions, Atlas Minerals, Big River Industries, C-CRETE Technologies, Forterra plc, Boral Limited, Sika AG, Fosroc International, Saint-Gobain, Votorantim Cimentos, Arcosa Lightweight. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lightweight Aggregate Concrete Market Key Technology Landscape

The technology landscape in the Lightweight Aggregate Concrete market is primarily centered around optimizing aggregate production and refining concrete mix design methods to maximize performance while minimizing density. A core technology involves the rotary kiln and sintering process, used to expand or calcine materials like clay, shale, and fly ash. Recent advancements focus on implementing waste heat recovery systems and using alternative, low-carbon fuels in these kilns to significantly reduce the embodied energy associated with aggregate manufacturing, addressing a major sustainability challenge. Furthermore, sophisticated process control systems, leveraging IoT sensors and data analytics, are being deployed to maintain precise temperature and duration during the expansion phase, ensuring uniform particle structure and porosity, which is vital for the final concrete properties.

In the concrete manufacturing phase, advanced chemical admixture technology plays a pivotal role. Specialized superplasticizers and viscosity modifying agents are essential for achieving high workability in LWAC while maintaining stability, preventing segregation or 'floating' of the lightweight particles, a common technical hurdle. Air-entraining agents are also utilized to enhance freeze-thaw resistance and durability. Furthermore, the industry is witnessing increased adoption of high-performance mixing equipment that features advanced shear mixing capabilities, ensuring a homogenous distribution of aggregates and cement paste without crushing the porous aggregates. This technological evolution in mixing is crucial for producing ultra-high-performance LWAC suitable for demanding structural applications like long-span bridges and high-rise core walls.

Digital technologies are increasingly integrated throughout the design and construction lifecycle. Building Information Modeling (BIM) software now includes specialized libraries and analytical tools for LWAC, allowing structural engineers to accurately model the thermal, acoustic, and structural performance of lightweight concrete elements. This integration facilitates optimized material usage and accurate simulation of structural behavior. Furthermore, non-destructive testing (NDT) techniques, often coupled with ultrasonic pulse velocity and rebound hammers, are employed for quality assurance on site, verifying the density and strength consistency of the placed LWAC without compromising the structure, driving confidence in the material's performance and accelerating project sign-offs.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily driven by massive government investments in infrastructure development, rapid urbanization, and a soaring demand for residential and commercial spaces, particularly in China, India, and Southeast Asia. Countries like India are heavily adopting LWAC for high-rise residential projects to manage structural loads efficiently and meet burgeoning housing demands. The region’s growth is characterized by the high consumption of sintered fly ash and expanded clay aggregates due to their local availability and cost-effectiveness relative to imported materials, though challenges related to inconsistent quality control in smaller markets persist.

- North America: The North American market is highly mature and focused on high-performance and specialty LWAC applications. Growth is stable, propelled by regulatory mandates for energy-efficient buildings and the reconstruction/rehabilitation of aging infrastructure, especially bridge decks and elevated highways in the U.S. and Canada. LWAC is primarily used here to minimize seismic loads in California and reduce weight on existing bridge foundations. The market favors high-quality expanded shale and clay aggregates, often used in conjunction with advanced admixtures to achieve maximum durability and fire resistance.

- Europe: Europe exhibits moderate growth, underpinned by stringent environmental regulations (e.g., the EU’s Energy Performance of Buildings Directive) that make LWAC a preferred material for achieving near-zero energy buildings (nZEBs). The focus is heavily on insulating LWAC for floor and roof screeds and precast panels. Western European countries, particularly Germany and the UK, are pioneers in utilizing LWAC in modular construction systems to reduce construction waste and improve site efficiency, capitalizing on the material's thermal properties and lightweight characteristics.

- Latin America (LATAM): The LATAM market is poised for significant expansion, fueled by increasing construction activity in Brazil, Mexico, and Chile. The demand is often tied to reconstruction efforts following natural disasters, where LWAC’s resistance to seismic forces and general durability offer long-term structural integrity benefits. Economic volatility and inconsistent aggregate supply chains, however, present constraints. Key applications include structural elements for multi-family residential buildings and lightweight partitions for rapid internal fit-outs.

- Middle East and Africa (MEA): The MEA region demonstrates high potential, driven by ambitious mega-projects and smart city initiatives in the UAE, Saudi Arabia, and Qatar. LWAC is highly valued here for its thermal insulation properties, which are critical for mitigating extreme heat conditions, reducing reliance on air conditioning, and lowering energy costs significantly. Projects require high-specification structural LWAC capable of withstanding harsh desert environments, often focusing on locally sourced perlite and expanded clay aggregates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lightweight Aggregate Concrete Market.- LafargeHolcim

- HeidelbergCement

- CEMEX

- CRH Plc

- Argos Cement

- Solite

- Buildex

- Utelite Corporation

- The QUIKRETE Companies

- Charah Solutions

- Atlas Minerals

- Big River Industries

- C-CRETE Technologies

- Forterra plc

- Boral Limited

- Sika AG

- Fosroc International

- Saint-Gobain

- Votorantim Cimentos

- Arcosa Lightweight

Frequently Asked Questions

Analyze common user questions about the Lightweight Aggregate Concrete market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Lightweight Aggregate Concrete over traditional concrete?

The primary advantage of Lightweight Aggregate Concrete (LWAC) is its significantly lower density, typically reducing the dead load of the structure by 25% to 40%. This enables larger spans, minimizes foundation requirements, and often leads to substantial cost savings in supporting structural steel and foundations. Additionally, LWAC offers superior thermal insulation properties, enhancing building energy efficiency.

Are there any significant cost disadvantages associated with using Lightweight Aggregate Concrete?

Yes, the most significant disadvantage is the higher initial material cost. Specialized lightweight aggregates, such as expanded clay or shale, require energy-intensive production processes (sintering), making the raw LWAC mix typically more expensive per cubic yard compared to conventional concrete. The economic benefit is realized through long-term operational savings and structural optimization.

In which construction applications is Lightweight Aggregate Concrete most effective?

LWAC is highly effective in high-rise buildings and complex civil infrastructure projects like long-span bridge decks, elevated roads, and marine structures where dead load minimization is critical. It is also extensively used in precast modular construction and for insulating floor and roof screeds due to its excellent thermal resistance.

How do sustainability mandates affect the growth of the Lightweight Aggregate Concrete Market?

Sustainability mandates strongly favor LWAC due to its superior insulating properties, which lower a building's operational energy consumption, and the increasing use of recycled industrial byproducts (like fly ash) as lightweight aggregates. This alignment with green building certification standards (LEED, BREEAM) drives adoption in environmentally conscious markets, especially Europe and North America.

What are the key types of lightweight aggregates used in structural concrete?

The key lightweight aggregate types used for structural applications include Expanded Clay, Shale, and Slate (ExCS), due to their optimal balance of strength and low density. Sintered Fly Ash is also widely utilized, particularly where high volumes of industrial byproducts are available, offering a strong, sustainable, and cost-effective alternative.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager