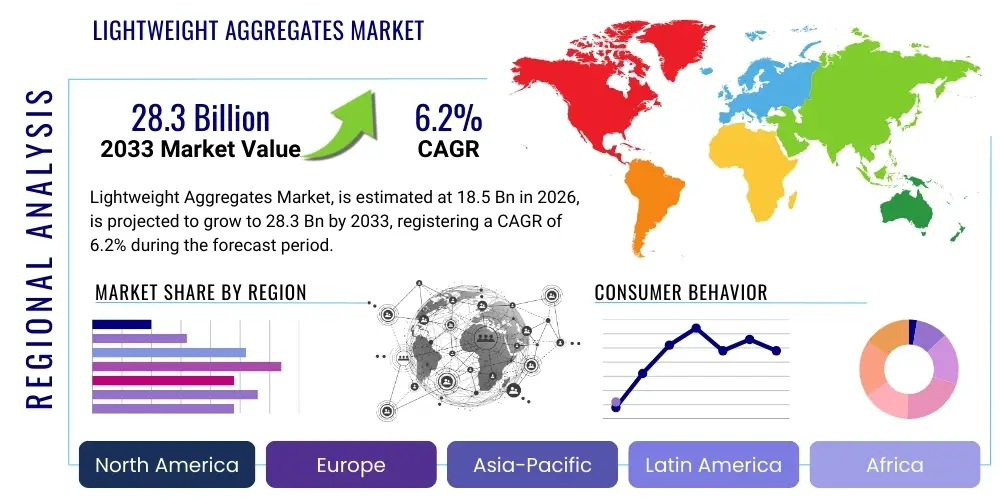

Lightweight Aggregates Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442420 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Lightweight Aggregates Market Size

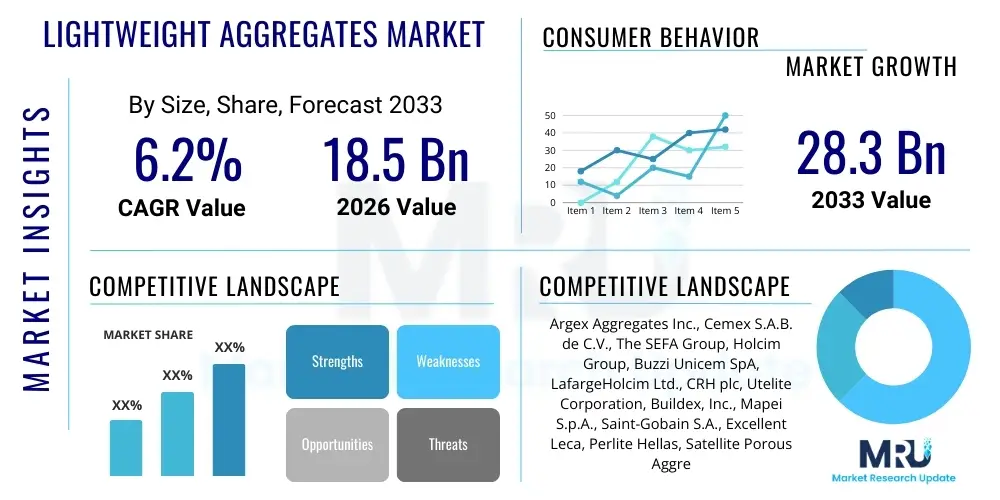

The Lightweight Aggregates Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 28.3 Billion by the end of the forecast period in 2033.

Lightweight Aggregates Market introduction

The Lightweight Aggregates (LWA) market encompasses materials characterized by a significantly lower bulk density compared to conventional aggregates like natural sand and gravel. These materials, often derived from volcanic sources (pumice, scoria), industrial byproducts (fly ash, slag), or specialized processes (expanded clay, shale, slate), possess unique properties such as high thermal insulation, enhanced porosity, and reduced dead load, making them indispensable in modern construction and geotechnical applications. LWA production involves heating raw materials to incipient fusion, causing them to expand and form a cellular structure, thereby drastically reducing density while maintaining sufficient structural integrity for various engineering uses.

Major applications of lightweight aggregates span structural concrete, where they reduce the overall weight of high-rise buildings and long-span bridges; geotechnical fills, utilized for stabilizing soft soils and reducing lateral earth pressure; and insulation products, including lightweight masonry blocks and insulating screeds, enhancing energy efficiency in buildings. Furthermore, LWA finds increasing use in horticultural substrates and filtering media due to their excellent drainage and high surface area. The inherent benefits, such as decreased transportation costs associated with lower material weight and the environmental advantages of utilizing waste streams like fly ash, are fundamentally driving market adoption across developed and developing economies.

Key driving factors accelerating market expansion include rapid urbanization, leading to intensified infrastructure development and the construction of complex, tall structures requiring high-performance, lower-density concrete. Concurrently, stringent energy efficiency regulations aimed at reducing building energy consumption are boosting the demand for lightweight insulating materials. The global push toward sustainable construction practices favors LWA derived from recycled industrial waste, positioning these materials as vital components in circular economy initiatives within the building sector, ensuring sustained market growth throughout the forecast period.

Lightweight Aggregates Market Executive Summary

The global Lightweight Aggregates market is defined by robust growth, driven primarily by escalating infrastructure investment in Asia Pacific and regulatory mandates promoting sustainable, energy-efficient construction practices worldwide. Key business trends indicate a strong shift towards synthetic and industrial byproduct aggregates, such as Expanded Clay, Shale, and Slag (ECCSS), owing to consistent quality and supply chain reliability compared to natural sources. Manufacturers are focusing on optimizing rotary kiln processes and sintering techniques to improve product consistency and reduce energy input, addressing both cost efficiency and environmental stewardship. Strategic mergers, acquisitions, and technological collaborations, particularly in production scalability and material blending, are central to the competitive landscape, aimed at securing larger geographic footprints and specialized application niches.

Regionally, Asia Pacific (APAC) stands as the dominant market, propelled by massive governmental investments in residential housing, commercial complexes, and crucial infrastructure projects (e.g., high-speed rail, port expansions) in China and India. North America and Europe demonstrate mature market characteristics, focusing on advanced applications like high-performance lightweight concrete (HPLC) and specialized geotechnical uses, driven by strict standards for seismic resilience and thermal performance. Latin America and the Middle East and Africa (MEA) are emerging as high-growth regions, spurred by urbanization megatrends and energy sector-related construction activities, particularly in GCC nations focused on large-scale urban development projects.

Segment trends reveal that the structural concrete application segment maintains the largest market share due to the necessity for reduced dead loads in modern high-rise construction. However, the geotechnical and road base segment is projected to experience the fastest growth, primarily attributable to increased utilization in slope stabilization, bridge abutments, and minimizing settlement in soft soil regions. By material type, expanded clay and shale segments continue to hold prominence, yet the utilization of fly ash and bottom ash derived aggregates is rapidly increasing due to their cost-effectiveness and alignment with waste management objectives, further solidifying the market’s trajectory toward resource efficiency and functional performance across all end-user sectors.

AI Impact Analysis on Lightweight Aggregates Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Lightweight Aggregates market predominantly center on optimizing production processes, improving quality control, and streamlining supply chain logistics. Common questions explore how machine learning can predict the optimal firing temperature for specific raw material compositions to maximize expansion and minimize energy use, thereby reducing operational costs and carbon footprint. Users are also keenly interested in AI's role in real-time quality assurance, using computer vision and sensor data to instantly detect inconsistencies in aggregate particle size, density, and cellular structure. Furthermore, predictive maintenance powered by AI is a major theme, focusing on minimizing unplanned downtime of energy-intensive equipment like rotary kilns. The overarching expectation is that AI will drive efficiency, precision, and sustainability, transforming the traditionally labor-intensive and energy-heavy LWA manufacturing process into a highly optimized, data-driven operation.

- Predictive Quality Control: AI algorithms analyze raw material input characteristics (chemical composition, moisture content) to predict optimal sintering parameters, ensuring consistent aggregate quality and density distribution in real-time.

- Energy Optimization: Machine learning models fine-tune kiln firing curves and cooling rates, minimizing energy consumption per ton of aggregate produced, directly addressing high operational energy costs.

- Supply Chain Efficiency: AI-driven logistics planning optimizes transportation routes for bulky LWA, reducing delivery times and fuel consumption, critical for managing low-density, high-volume materials.

- Equipment Predictive Maintenance: Sensors and AI predict potential failures in heavy machinery (e.g., crushers, kilns), scheduling maintenance preemptively to maximize uptime and operational lifespan.

- New Material Formulation: AI simulations accelerate the testing and development of novel LWA formulations using previously untested or complex industrial waste streams, broadening the raw material base.

DRO & Impact Forces Of Lightweight Aggregates Market

The Lightweight Aggregates market dynamics are powerfully shaped by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and potent impact forces. Key drivers include accelerating global infrastructure development, particularly in emerging economies where population density necessitates rapid, large-scale construction using materials that reduce structural load and construction time. The growing emphasis on green building certifications and reduced carbon footprints mandates the use of aggregates derived from industrial waste (e.g., fly ash, expanded blast furnace slag), directly favoring the LWA sector. Furthermore, the functional superiority of LWA in specialized applications such as high-performance concrete, geotechnical stabilization, and deep foundation construction provides a compelling advantage over conventional aggregates, ensuring sustained demand growth.

Conversely, significant restraints hinder market expansion, primarily revolving around the high initial capital expenditure required for LWA manufacturing facilities, particularly specialized rotary kilns and sintering equipment. The manufacturing process itself is highly energy-intensive, leading to high production costs that make LWA susceptible to fluctuations in global energy prices, occasionally diminishing their competitiveness compared to readily available, low-cost natural aggregates. Additionally, variability in the quality and composition of industrial waste streams, which serve as crucial raw materials for synthesized LWA, poses technical challenges for consistent product output and adherence to strict construction standards, demanding sophisticated material pre-processing and quality control measures.

Opportunities for profound market growth exist in the development of innovative, ultra-lightweight and highly insulating LWA for prefabricated construction elements, aligning with the industrialization of the building sector. The increased application of LWA in environmental engineering, such as wastewater treatment filtration and porous paving systems for stormwater management, opens significant new revenue streams outside traditional construction. Crucially, technological advancements focusing on reducing the energy intensity of production—including plasma gasification and advanced fluid bed techniques—promise to mitigate the key cost constraint, further strengthening the market’s competitive position against conventional alternatives, especially in densely populated urban centers where transportation costs heavily favor lighter materials.

Segmentation Analysis

The Lightweight Aggregates market is meticulously segmented based on raw material type, application, and geographic region, reflecting the diverse origins and specialized uses of these low-density construction components. The segmentation provides critical insight into demand patterns, revealing dominance by industrial waste-derived and artificially expanded materials due to their consistent supply and advantageous environmental profile. Analyzing the application segments confirms the primacy of structural uses, yet points toward rapidly increasing adoption in non-structural and geotechnical fields driven by specific engineering requirements for lightweight backfills and superior thermal insulation performance, allowing stakeholders to target strategic growth niches efficiently.

- By Type:

- Expanded Clay, Shale & Slate (ECCSS)

- Perlite

- Vermiculite

- Pumice & Scoria

- Fly Ash & Cinder

- Others (Slag, Diatomite)

- By Application:

- Structural Concrete

- Non-Structural Concrete (Blocks, Panels)

- Geotechnical Fill

- Road Base & Fill

- Water Treatment & Filtration

- Horticultural Applications

- Others (Refractory, Insulating Materials)

- By End-Use Industry:

- Residential Construction

- Non-Residential Construction (Commercial, Industrial)

- Infrastructure (Roads, Bridges, Tunnels)

- Water & Wastewater Management

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Lightweight Aggregates Market

The value chain for the Lightweight Aggregates market begins with the sourcing of raw materials, which are broadly categorized into natural deposits (e.g., clay, shale, pumice, scoria) and industrial byproducts (e.g., fly ash, bottom ash, blast furnace slag). Upstream analysis involves high dependency on the mining sector for natural materials and strategic alliances with power generation and metallurgical industries for reliable, high-volume access to waste streams. The procurement and quality verification of these raw materials are crucial, as variations directly impact the final aggregate properties. For synthesized LWA, energy inputs—primarily natural gas or coal for kiln firing—represent a significant upstream cost component, making energy price volatility a critical factor influencing overall production economics and competitive pricing strategies.

The core manufacturing stage involves complex thermal processing, such as rotary kiln expansion or sintering, where material expansion and cellular structure formation occur. This stage requires substantial capital investment and specialized technical expertise to manage temperatures (often above 1,000°C) and retention times to achieve the desired lightweight properties and mechanical strength. Downstream activities focus on post-processing, including crushing, screening, and grading the LWA to meet specific application requirements (e.g., fine aggregates for mortar, coarse aggregates for structural concrete). Quality assurance, including density and absorption testing, is paramount before packaging and distribution. Direct and indirect sales channels are employed, depending on the volume and specialization of the sale.

Distribution channels are multifaceted. Direct sales are common for large-scale infrastructure projects or specialized applications, where manufacturers negotiate directly with major construction companies, geotechnical engineers, or ready-mix concrete suppliers, ensuring tailored material delivery and technical support. Indirect distribution, leveraging construction material dealers, regional distributors, and specialized building product retailers, facilitates market penetration for smaller volumes and general construction use, particularly lightweight blocks and insulation materials. Efficient logistics are critical due to the low bulk density and high transportation costs relative to the material’s weight, necessitating localized production or highly optimized freight networks to maintain competitive pricing against conventional, locally sourced heavy aggregates.

Lightweight Aggregates Market Potential Customers

The primary consumers of Lightweight Aggregates are concentrated within the construction and civil engineering sectors, driven by the need for reduced dead load, improved thermal performance, and specific geotechnical stability requirements. End-users include large civil infrastructure contractors specializing in bridge construction, tunnel lining, and major road projects where utilizing lightweight fill material is essential for minimizing settlement on soft soils and reducing lateral pressure against retaining structures. Ready-mix concrete producers represent a massive customer segment, utilizing LWA to formulate high-performance lightweight concrete (HPLC) used extensively in high-rise commercial and residential buildings, reducing foundation costs and increasing seismic resilience.

Another crucial customer segment involves manufacturers of precast concrete products, such as lightweight masonry blocks, panels, and insulating structural elements, who benefit significantly from LWA’s superior thermal insulation properties and ease of handling. The growth of prefabricated and modular construction methodologies is increasing the demand from these manufacturers. Furthermore, geotechnical engineers and environmental remediation firms constitute a growing market, purchasing LWA for applications like specialized backfills, ground improvement techniques, slope stabilization, and as filtration media in municipal wastewater treatment plants, leveraging the material’s porosity and light weight for specialized engineering solutions. Agricultural and horticultural buyers, though smaller in volume, represent a specialized niche utilizing perlite and vermiculite for soil amendments and hydroponic systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 28.3 Billion |

| Growth Rate | Insert CAGR 6.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Argex Aggregates Inc., Cemex S.A.B. de C.V., The SEFA Group, Holcim Group, Buzzi Unicem SpA, LafargeHolcim Ltd., CRH plc, Utelite Corporation, Buildex, Inc., Mapei S.p.A., Saint-Gobain S.A., Excellent Leca, Perlite Hellas, Satellite Porous Aggregate, Virginia Vermiculite, LLC, Europerl, Lhoist Group, Diatomite Production Group, US Perlite, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lightweight Aggregates Market Key Technology Landscape

The manufacturing technology for Lightweight Aggregates is primarily centered on thermal treatment processes designed to induce cellular expansion in raw materials. The dominant technology remains the rotary kiln, especially utilized for expanding clay, shale, and slate (ECCSS). Modern rotary kiln technology focuses heavily on enhancing thermal efficiency through improved insulation, optimized burner design, and preheating zones to minimize energy consumption, addressing the industry's major cost constraint. Innovations in kiln control systems, often integrating advanced sensor technology and predictive software, allow for precise management of temperature profiles, ensuring uniform expansion, reduced clinker formation, and consistent final product density and strength characteristics, essential for structural applications.

Sintering technology is prominently employed for processing industrial byproducts, particularly fly ash. This involves pelletizing the ash and heating it below the melting point to create porous, fused aggregates. Recent technological advancements in sintering focus on incorporating binders and additives that reduce the required firing temperature, further conserving energy and enabling the use of a wider range of low-quality or variable ash streams. Furthermore, advanced processing techniques are being developed for natural materials like perlite and vermiculite, utilizing flash heating processes that rapidly expand the minerals into highly porous structures, typically for non-structural insulation and horticultural applications, requiring lower initial capital outlay compared to full-scale rotary kilns.

In terms of application technologies, there is a significant focus on optimizing mix designs for Lightweight Aggregate Concrete (LWAC) and High-Performance Lightweight Concrete (HPLC). This includes utilizing specialized admixtures and supplementary cementitious materials (SCMs) to address challenges related to water absorption and achieving desired workability and ultimate compressive strength. Emerging technologies also include the development of sophisticated blending equipment capable of mixing LWA with foamed materials or recycled construction and demolition waste (CDW) to create ultra-lightweight composite materials for specialized insulating applications, driving material efficiency and expanding the market utility of LWA beyond traditional heavy civil engineering projects and into advanced prefabricated systems.

Regional Highlights

Regional dynamics within the Lightweight Aggregates market are dictated by varying levels of construction activity, regulatory frameworks promoting sustainability, and the availability of suitable raw materials (both natural deposits and industrial waste). The consumption profile differs significantly, with mature markets focusing on specialized, high-performance applications, while developing regions prioritize high-volume usage in general infrastructure and urbanization projects.

- Asia Pacific (APAC): Dominates the global market, driven by unparalleled levels of urbanization and massive state-backed infrastructure projects, particularly in China, India, and Southeast Asian nations. Demand is robust across all segments, with heavy consumption in high-rise buildings requiring structural LWAC to mitigate seismic risk and high dead load.

- North America: Characterized by high technological maturity, focusing on specialized uses like geotechnical engineering (e.g., bridge abutments, foundation backfills) and energy-efficient building standards (insulating concrete). Stringent environmental regulations favor the use of aggregates derived from industrial waste like fly ash.

- Europe: Exhibits high demand for thermal insulation applications, driven by ambitious Net Zero carbon goals and strict energy performance directives for buildings. Focuses intensely on recycled and sustainable aggregates, leading to innovation in expanded clay and perlite for specialized insulating screeds and blocks.

- Latin America (LATAM): Showing strong growth potential, fueled by increasing residential construction and public works in major economies like Brazil and Mexico. The market often utilizes locally available natural materials like pumice and scoria, alongside growing adoption of imported engineered aggregates for complex structural projects.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) states, driven by mega-projects (e.g., NEOM, Dubai urban expansions) requiring construction materials that perform well in high-temperature environments and reduce structural weight in complex designs. The emphasis is on structural and non-structural concrete applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lightweight Aggregates Market.- Argex Aggregates Inc.

- Cemex S.A.B. de C.V.

- The SEFA Group

- Holcim Group

- Buzzi Unicem SpA

- LafargeHolcim Ltd.

- CRH plc

- Utelite Corporation

- Buildex, Inc.

- Mapei S.p.A.

- Saint-Gobain S.A.

- Excellent Leca

- Perlite Hellas

- Satellite Porous Aggregate

- Virginia Vermiculite, LLC

- Europerl

- Lhoist Group

- Diatomite Production Group

- US Perlite, Inc.

- Volcanic Aggregate Corporation

Frequently Asked Questions

Analyze common user questions about the Lightweight Aggregates market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of using Lightweight Aggregates (LWA) in construction?

The primary benefits of using LWA include a significant reduction in structural dead load, which lowers foundation costs and allows for taller structures; superior thermal and acoustic insulation properties, improving building energy efficiency; and enhanced fire resistance. For geotechnical projects, LWA minimizes settlement in soft soils and reduces lateral pressures against retaining walls.

Which material type holds the largest share in the Lightweight Aggregates Market?

Expanded Clay, Shale, and Slate (ECCSS) aggregates typically hold the largest market share globally within the synthesized segment. However, the rapidly increasing utilization of industrial byproducts, specifically Fly Ash and Slag, is rapidly growing its market presence due to cost-effectiveness and alignment with circular economy mandates.

How do Lightweight Aggregates contribute to sustainable construction?

LWA contributes to sustainability primarily by reducing the energy required for heating and cooling buildings due to enhanced insulation. Furthermore, LWA manufactured from industrial waste streams such as fly ash and slag effectively diverts large volumes of non-recyclable materials from landfills, promoting resource efficiency and a reduced carbon footprint.

What is the main driver for LWA demand in the Asia Pacific region?

The main driver for LWA demand in the Asia Pacific region is rapid urbanization coupled with massive governmental investment in infrastructure development. This necessitates the construction of dense, high-rise residential and commercial buildings where the reduction of structural dead load and seismic resilience are critical engineering requirements, favoring lightweight concrete usage.

What are the key technological challenges facing LWA manufacturers?

Key technological challenges include managing the high energy intensity required for the rotary kiln and sintering processes, leading to elevated production costs and carbon emissions. Consistency in the quality and composition of raw material inputs, particularly industrial waste, also requires advanced pre-treatment and sophisticated process control systems to ensure final product reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager