Limb Salvage Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442645 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Limb Salvage Systems Market Size

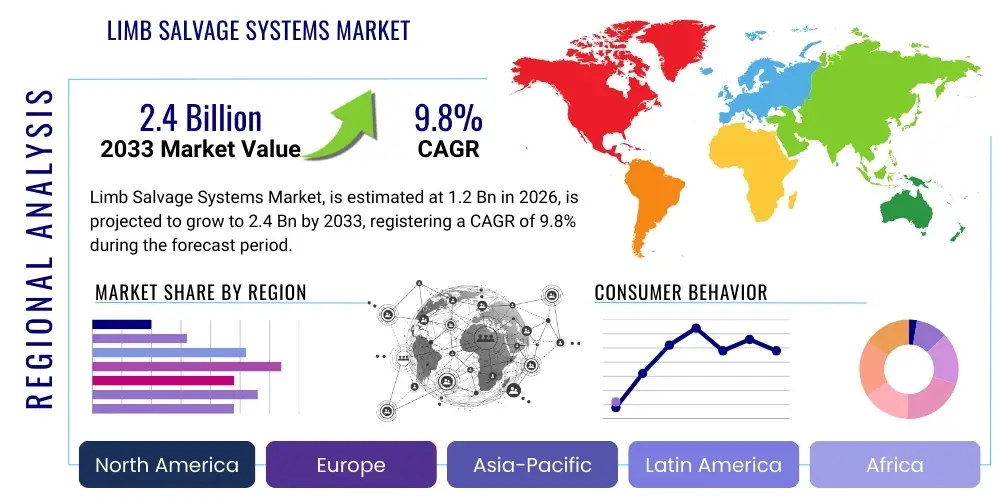

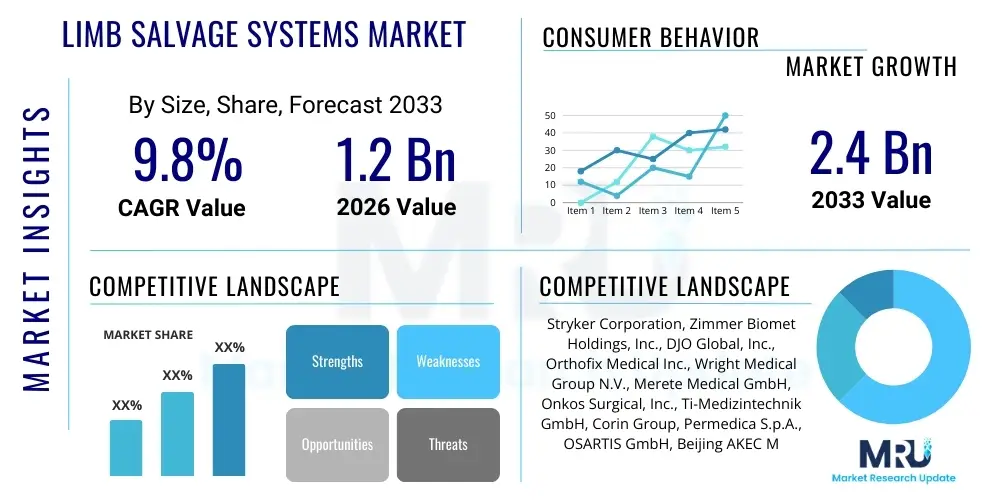

The Limb Salvage Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.4 Billion by the end of the forecast period in 2033.

Limb Salvage Systems Market introduction

The Limb Salvage Systems Market encompasses specialized orthopedic devices and prostheses designed to replace or reconstruct major joints and skeletal segments following resection due to malignant tumors, severe trauma, or complex infections, thereby avoiding amputation. These sophisticated systems are crucial for maintaining functional integrity and improving the quality of life for patients facing severe limb pathology. Market growth is fundamentally driven by the rising global incidence of bone tumors, such as osteosarcoma and Ewing's sarcoma, coupled with continuous advancements in surgical techniques and implant technology, including modular components and custom-made devices. The primary goal of these systems is to provide long-term structural support, allowing patients to regain mobility and functionality that would otherwise be permanently lost. The complexity of these procedures necessitates highly specialized surgical teams and robust product development focused on biocompatibility and mechanical longevity. The efficacy of modern chemotherapy regimens has also increased the eligibility pool for limb salvage procedures, shifting the clinical preference away from immediate amputation in many cases, particularly within the pediatric and young adult populations where preservation of the growth plate and long-term function is paramount.

Limb salvage systems are broadly applied across major skeletal segments, including the distal femur, proximal tibia, proximal humerus, and acetabulum, serving as alternatives to standard tumor resection followed by traditional amputation. Key product categories include modular endoprostheses, which offer versatility in sizing and fit during surgery, custom or patient-specific implants fabricated using advanced manufacturing techniques like 3D printing, and allograft prosthetic composites that integrate biological tissue with metal components. Major applications extend beyond oncology to severe non-union fractures, extensive bone loss due to trauma, and failed joint replacements requiring significant revision (septic or aseptic failure). The immediate benefits of utilizing these systems are significant: maintaining cosmesis, preserving neuromuscular pathways, ensuring psychological well-being, and, most importantly, achieving superior long-term functional outcomes compared to prosthetic fitting following amputation. Furthermore, improvements in implant materials, such as porous metal coatings promoting osseointegration and advanced bearing surfaces minimizing wear, are enhancing the durability and reducing the revision rates associated with these complex reconstructive surgeries, thereby solidifying their economic and clinical value proposition.

Driving factors for the substantial market expansion include the increasing global investment in orthopedic research and development, the expansion of healthcare infrastructure in emerging economies, which improves access to specialized surgical care, and a growing emphasis on personalized medicine, leading to implants specifically tailored to individual patient anatomy and pathology. The demographic trend of an aging population, which is more susceptible to complex orthopedic conditions and revision surgeries, also plays a critical role in augmenting demand. Furthermore, favorable reimbursement policies in developed markets, coupled with continuous innovation focused on minimizing surgical invasiveness and enhancing post-operative recovery, are collectively propelling the adoption rates of advanced limb salvage technologies across tertiary care hospitals and specialized orthopedic centers worldwide. The inherent complexity and high stakes of these procedures mandate continuous stringent quality control and regulatory oversight, ensuring that only the most robust and clinically validated systems reach the operating theater, thereby supporting sustained market confidence.

Limb Salvage Systems Market Executive Summary

The Limb Salvage Systems Market is characterized by robust business trends centered on technological convergence and heightened focus on patient-specific solutions. Key industry players are aggressively investing in additive manufacturing (3D printing) capabilities to create customized implants that precisely match complex anatomical defects, significantly reducing operative time and enhancing fit compared to off-the-shelf modular systems. Strategic mergers, acquisitions, and partnerships are prevalent, aimed at consolidating intellectual property, expanding geographical reach, and integrating complementary technologies, such as advanced surgical navigation systems and robotic assistance, into the limb salvage workflow. Furthermore, there is a distinct shift toward improving implant materials, prioritizing high-strength, low-wear bearing surfaces and antibacterial coatings to mitigate the persistent risk of deep surgical site infections, which remain a major cause of failure in limb salvage procedures. Companies are also focusing on evidence-based marketing, conducting rigorous clinical trials to demonstrate the long-term functional superiority and cost-effectiveness of their systems, thereby influencing clinical guidelines and procurement decisions within major hospital systems globally.

Regional trends indicate that North America and Europe currently dominate the market, driven by sophisticated healthcare infrastructure, high awareness among orthopedic oncologists, and established reimbursement mechanisms for complex procedures. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate during the forecast period. This accelerated growth in APAC is attributed to rapidly expanding healthcare expenditure, increasing urbanization leading to better access to specialized care, and a substantial, often underserved, patient population base. Governments in countries like China and India are increasingly focusing on improving cancer care and orthopedic services, creating lucrative opportunities for market penetration. In terms of segments, the Custom/Patient-Specific Implants segment is expected to show the most dynamic growth, reflecting the general trend toward personalization in medicine. Conversely, while hospitals remain the primary end-user, specialized orthopedic centers are gaining prominence due to their focus on high-volume, highly complex procedures, offering superior expertise in managing limb salvage cases.

Segment trends confirm the increasing prioritization of outcomes and quality of life. The modular systems segment, while mature, maintains significant market share due to its flexibility and economic advantages for standard defects. However, the superior biomechanical properties and patient satisfaction associated with 3D-printed custom implants are pushing adoption, despite their higher initial cost. Material science is focusing on enhanced titanium alloys and the incorporation of bio-active elements to encourage rapid bone integration and reduce stress shielding. The Application segment is heavily influenced by the rising incidence of musculoskeletal oncology, which demands innovative solutions for young patients requiring long-term, durable implants. Overall, the market trajectory is highly optimistic, underpinned by continuous technological innovation, addressing critical clinical challenges such as infection prevention and achieving robust osseointegration, ensuring that limb salvage remains the preferred treatment paradigm over amputation for eligible patients worldwide. This continued evolution ensures sustained momentum across all major market segments.

AI Impact Analysis on Limb Salvage Systems Market

Common user questions regarding AI's impact on the Limb Salvage Systems Market generally revolve around three core themes: precision in surgical planning, optimization of implant design, and enhancing patient outcome prediction. Users frequently inquire about how AI algorithms can improve the delineation of tumor margins during resection planning, a critical factor for successful limb salvage. Another major concern focuses on whether AI-driven design software can expedite the turnaround time for custom implants and optimize their load-bearing characteristics based on personalized patient biomechanics. Finally, clinicians and payers are keen to understand how AI can predict the long-term success or failure risk of a limb salvage procedure, specifically the likelihood of infection or mechanical failure, thus aiding in more informed patient selection and preoperative counseling. The underlying expectation is that AI integration will significantly reduce surgical variability, increase procedural success rates, and make the complex process of personalized implant creation more efficient and accessible, thereby lowering overall healthcare costs associated with revisions and failures.

The immediate and foreseeable impact of Artificial Intelligence (AI) integration within the Limb Salvage Systems Market is transformative, primarily through enhanced diagnostic accuracy and meticulous preoperative planning. AI-powered image segmentation and analysis tools, utilizing machine learning models trained on vast datasets of MRI and CT scans, are enabling orthopedic oncologists to achieve unprecedented precision in identifying tumor boundaries, critical for ensuring complete surgical margins while preserving maximal viable tissue. This capability directly reduces the risk of local recurrence and improves the functional outcome, which is the cornerstone of successful limb salvage. Furthermore, AI assists in optimizing surgical trajectories and predicting the necessary bone resection length, crucial steps that minimize error and standardize outcomes across different surgical teams. The deployment of predictive analytics, analyzing patient comorbidities, tumor characteristics, and surgical specifics, allows for dynamic risk stratification, helping surgeons and patients make personalized treatment decisions regarding system selection and post-operative monitoring intensity.

Beyond planning, AI significantly influences the design and manufacturing lifecycle of custom limb salvage prostheses. Generative design algorithms, leveraging AI, can iterate through thousands of potential implant geometries in hours, optimizing designs for specific load requirements, material stress distribution, and osseointegration potential, particularly crucial for complex three-dimensional defects. This automation drastically cuts down the design phase of patient-specific implants (PSIs), accelerating time-to-surgery. Moreover, AI-driven quality control systems are being implemented during the 3D printing process, ensuring that the fabricated components meet stringent biomechanical tolerances and material integrity standards. The future application involves integrating AI into intraoperative navigation systems, offering real-time guidance and verification of component placement, further enhancing accuracy. This technological synergy between advanced manufacturing and intelligent software promises to elevate the standard of care, making highly complex, customized limb salvage procedures more predictable and broadly accessible.

- AI-Enhanced Preoperative Planning: Improved tumor margin delineation and precise bone resection length prediction using advanced image analysis algorithms.

- Generative Implant Design: AI-driven optimization of customized prosthetic geometries for enhanced biomechanics and reduced stress shielding.

- Predictive Outcome Modeling: Use of machine learning to assess patient risk factors (e.g., infection, mechanical failure) for personalized system selection.

- Surgical Navigation Assistance: Real-time, AI-informed guidance during surgery to ensure accurate implant placement and alignment.

- Manufacturing Quality Control: Automated inspection of 3D-printed components ensuring adherence to strict design and material specifications.

DRO & Impact Forces Of Limb Salvage Systems Market

The Limb Salvage Systems Market is propelled by a confluence of influential factors, counterbalanced by significant constraints, while presenting notable long-term growth opportunities, all of which are subject to various impact forces. The primary drivers include the escalating global incidence of musculoskeletal malignancies, particularly among pediatric and young adult populations, where preservation of limb function is prioritized over amputation. Technological advancements, notably the sophisticated integration of custom 3D printing and advanced biocompatible materials, dramatically enhance surgical precision and long-term implant efficacy. These drivers are bolstered by increasing healthcare expenditure in emerging markets and a global shift in clinical consensus favoring limb preservation. However, growth is substantially restrained by the high procedural cost associated with limb salvage surgery, complex and lengthy regulatory approval pathways for novel custom devices, and the persistent challenge of post-operative complications, particularly deep periprosthetic joint infection, which often necessitates costly and debilitating revisions.

Opportunities for market expansion are centered on addressing these restraints through innovation. The most significant opportunities lie in the commercialization of novel anti-infective strategies, such as drug-eluting coatings and biologically integrated prostheses that minimize bacterial adherence and promote rapid osseointegration, thereby reducing revision rates. Furthermore, penetrating lucrative, yet underdeveloped, markets in the Asia Pacific and Latin America, through localized manufacturing and strategic distribution partnerships, offers substantial growth potential. The convergence of personalized medicine principles with advanced manufacturing techniques, allowing for rapid, cost-effective production of customized implants tailored specifically for revision surgeries, represents another key avenue for market capitalization. These opportunities demand significant R&D investment but promise solutions that directly mitigate the primary factors currently limiting market growth and widespread adoption. The integration of augmented reality and robotics in surgical procedures further minimizes variability and enhances precision, making complex limb salvage procedures safer and more repeatable.

The impact forces influencing the market are multifaceted, encompassing clinical, economic, and technological dimensions. Clinically, the rising success rate and improved functional outcomes of modern limb salvage procedures create a powerful positive impact, driving patient and physician preference. Economically, the cost-effectiveness of limb salvage, when accounting for the long-term societal and psychological costs of amputation and prosthetic fitting, increasingly justifies the high initial investment, positively influencing payer policies. Regulatory bodies exert significant impact, with stringent standards promoting quality but simultaneously creating barriers to rapid innovation; harmonization of these standards globally could accelerate market access. Finally, the rapid pace of materials science innovation—from high-strength polymers to novel metal alloys and ceramic coatings—acts as a continuous positive technological force, extending the lifespan and functionality of limb salvage systems. Successfully navigating these forces requires robust clinical data, strategic regulatory engagement, and sustained investment in addressing the critical challenge of infection control, which remains the single greatest threat to the success of limb salvage systems and thus, a key constraint on market growth.

Segmentation Analysis

The Limb Salvage Systems Market is intricately segmented across product type, application, material, and end-user, reflecting the diverse clinical needs and technological solutions available within orthopedic oncology and complex trauma reconstruction. Product segmentation differentiates between highly modular systems, offering intraoperative flexibility, and custom/patient-specific implants (PSIs), which provide optimal anatomical fit crucial for complex defects, driven by advancements in 3D printing. The core of the market activity is concentrated within the Application segment, where Oncological Conditions, particularly primary bone sarcomas and metastatic bone disease, dictate the highest volume of procedures, though the increasing complexity of Revision Surgeries also contributes significantly to demand for advanced systems. This structured segmentation allows manufacturers to tailor their product development strategies and marketing efforts toward specific clinical requirements and procurement landscapes across the global market.

Detailed analysis of the Material segment shows a preference shift towards sophisticated Titanium and Cobalt-Chrome alloys, valued for their strength-to-weight ratio and excellent biocompatibility, with PEEK (Polyether ether ketone) emerging for certain non-load-bearing applications or for its radiolucent properties in imaging. Titanium alloys, especially porous structures, are vital for promoting osseointegration, which is key to long-term implant stability. The End-User segmentation reveals that Hospitals, particularly large academic and regional specialty cancer centers, remain the dominant purchasers and utilizers of limb salvage systems, given the requirement for specialized infrastructure, multidisciplinary surgical teams, and comprehensive post-operative care. However, dedicated Specialty Orthopedic Centers are increasingly carving out a niche due to their focus and expertise in managing high-complexity orthopedic procedures, including extensive limb salvage reconstructions, offering focused expertise and operational efficiency.

The segmentation structure not only maps the current market landscape but also highlights areas ripe for targeted investment and growth. For instance, the demand for custom systems across all applications is accelerating, necessitating parallel growth in specialized manufacturing and digital planning services. The technological advancements across materials are directly linked to addressing clinical needs, ensuring that material choices optimize performance in terms of infection resistance and mechanical endurance. Understanding these segment dynamics is crucial for both established market leaders and emerging players seeking to capitalize on specialized niches within this technologically demanding and clinically critical sector of the orthopedic market. The increasing sophistication in material science and customization capabilities will continue to blur traditional product lines, pushing the boundaries of what is surgically and functionally achievable in limb preservation.

- Product Type:

- Modular Systems

- Custom/Patient-Specific Implants (PSIs)

- Allograft Prosthetic Composites

- Application:

- Oncological Conditions (Primary and Metastatic Tumors)

- Traumatic Injuries (Severe Bone Loss)

- Infection/Septic Conditions (Two-Stage Revisions)

- Revision Surgeries (Aseptic and Septic Failures)

- Material:

- Titanium Alloys

- Cobalt-Chrome Alloys

- PEEK (Polyether Ether Ketone)

- End-User:

- Hospitals (Academic & Tertiary Care Centers)

- Specialty Orthopedic Centers

- Ambulatory Surgical Centers (Limited Scope)

Value Chain Analysis For Limb Salvage Systems Market

The Value Chain for the Limb Salvage Systems Market is characterized by high complexity, significant regulatory scrutiny, and intensive reliance on specialized expertise at every stage, from raw material procurement to post-operative patient care. The upstream segment involves the sourcing of high-grade, biocompatible materials, primarily medical-grade titanium and cobalt-chrome alloys. This stage requires rigorous quality control and certification due to the critical nature of the implants. Raw materials are then processed into semi-finished components or utilized in advanced manufacturing processes like electron beam melting (EBM) or selective laser sintering (SLS) for 3D printing custom implants. Research and development activities, which involve bioengineering, biomechanical testing, and clinical validation, form a crucial component of the upstream value addition, establishing the intellectual property and clinical viability of the systems before commercialization. The high cost of these specialized materials and the complexity of manufacturing contribute significantly to the final product cost.

The downstream activities focus on distribution, surgical implementation, and patient follow-up. Distribution channels are typically highly regulated and involve direct sales teams or specialized distributors trained specifically in orthopedic oncology and complex reconstruction. Due to the high value and customization of the products, inventory management is less about stocking vast quantities and more about efficient supply chain logistics for rapid delivery of custom implants. Surgical implementation requires highly trained orthopedic oncology surgeons, often supported by specialized surgical representatives who assist in fitting and technique application. Education and training are therefore paramount in the downstream chain. Post-sales support includes long-term clinical data collection for outcome monitoring, material traceability, and managing potential recalls or revisions, ensuring accountability and continuous product improvement based on real-world performance metrics. The complexity of the procedures dictates that the relationship between the manufacturer, the surgical team, and the hospital procurement body is highly collaborative and long-term.

Distribution channels for limb salvage systems are bifurcated into direct and indirect routes. Direct sales channels are favored by major global players for high-volume, strategically important markets like North America and Western Europe, allowing for better margin control, direct feedback loops, and tighter control over inventory of capital equipment (e.g., specialized instrumentation kits). Indirect distribution relies on established, specialized medical device distributors, particularly in fragmented or geographically challenging markets such, as certain regions in APAC or Latin America. These partners offer local regulatory expertise and existing hospital relationships, crucial for market entry. The selection of the channel is often dependent on the degree of customization; custom patient-specific implants typically require more direct oversight to ensure precise communication between the surgeon and the design team, making the direct channel preferred for this highly valuable segment, thereby maintaining control over the complex ordering and delivery logistics unique to customized solutions.

Limb Salvage Systems Market Potential Customers

The primary end-users and potential customers of Limb Salvage Systems are specialized healthcare institutions dedicated to managing complex orthopedic pathologies, trauma, and musculoskeletal oncology. These systems are predominantly utilized in Hospitals, specifically within tertiary care centers, large university teaching hospitals, and regional cancer centers that possess the necessary multidisciplinary teams—including orthopedic oncologists, plastic surgeons, infectious disease specialists, and specialized physical therapists—and the requisite advanced imaging and operating room infrastructure. These institutions handle the highest volume of complex cases requiring both primary limb salvage surgery and subsequent revision procedures, making them the anchor customers for manufacturers of modular and custom systems. Their purchasing decisions are heavily influenced by clinical efficacy data, long-term revision rates, and the breadth of product portfolio offered by the vendor, often secured through multi-year group purchasing agreements.

Another significant customer segment comprises Specialty Orthopedic Centers, which focus exclusively on high-acuity musculoskeletal conditions. These centers, often operating outside the immediate structure of a general hospital, are characterized by streamlined processes, superior expertise in complex reconstructive surgery, and a concentrated patient population. These centers seek cutting-edge technology and often act as early adopters of novel materials, 3D printing techniques, and advanced anti-infection coatings. For manufacturers, these centers represent key opinion leader (KOL) sites, providing valuable clinical feedback and driving the adoption of premium, custom-designed limb salvage solutions. Their smaller, specialized purchasing departments prioritize clinical outcomes and technological superiority over volume discounts, providing lucrative opportunities for manufacturers focused on high-end innovation.

While Ambulatory Surgical Centers (ASCs) currently account for a smaller share, they represent a growing opportunity, particularly for less complex secondary procedures or minor revisions that do not require an intensive in-patient stay. However, the complexity, high blood loss potential, and necessity for prolonged post-operative monitoring in primary limb salvage procedures restrict their overall market share. Ultimately, the buying decision for limb salvage systems is highly technical and clinician-driven; the orthopedic surgeon acts as the crucial internal champion who specifies the required system, necessitating that manufacturers engage directly with the surgical community through educational programs, clinical symposia, and peer-to-peer training, ensuring that their products are deeply integrated into surgical decision-making protocols and preferred techniques.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.4 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stryker Corporation, Zimmer Biomet Holdings, Inc., DJO Global, Inc., Orthofix Medical Inc., Wright Medical Group N.V., Merete Medical GmbH, Onkos Surgical, Inc., Ti-Medizintechnik GmbH, Corin Group, Permedica S.p.A., OSARTIS GmbH, Beijing AKEC Medical Co., Ltd., B. Braun Melsungen AG, Johnson & Johnson (DePuy Synthes), Smith & Nephew plc, Globus Medical Inc., Medtronic plc, Tornier Inc., Stanmore Implants Worldwide Ltd., Limestone Medical Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Limb Salvage Systems Market Key Technology Landscape

The technological landscape of the Limb Salvage Systems Market is rapidly evolving, driven primarily by the transition from standardized, off-the-shelf components to highly customized, patient-specific solutions, often leveraging additive manufacturing (3D printing). Specifically, Selective Laser Melting (SLM) and Electron Beam Melting (EBM) techniques are foundational, allowing for the creation of complex lattice structures in materials like titanium. These porous structures mimic natural cancellous bone, promoting superior biological fixation and osseointegration, which is crucial for the long-term mechanical stability and biological success of the implant. Furthermore, these 3D printing technologies facilitate the precise construction of custom implants designed from patient-specific CT or MRI data, ensuring an exact anatomical fit that minimizes the need for extensive intraoperative adjustments and reduces surgical time. This technological capacity is instrumental in managing complex bone defects that modular systems cannot adequately address.

Another crucial technological frontier is advanced material science and surface engineering aimed at combating the high risk of infection. Innovations include the development of proprietary anti-bacterial coatings, often incorporating silver ions or antibiotics that elute locally over a period, directly mitigating the threat of periprosthetic joint infection (PJI), the most devastating complication in limb salvage. Simultaneously, materials research is focused on high-performance bearing surfaces, such as ceramic-on-ceramic or advanced polyethylene, to reduce wear debris and extend the functional lifespan of the implants, especially critical for young, active patients. The integration of technology also extends to pre-surgical simulation and planning software, which uses computer-aided design (CAD) and finite element analysis (FEA) to model load distribution and predict implant performance, thereby optimizing the final design before manufacturing commences.

Finally, the growing adoption of surgical navigation systems and robotic assistance plays an indirect yet vital role in the success of limb salvage procedures. These technologies enhance the precision of bone cuts and component alignment, minimizing surgical errors that could compromise the functional outcome or implant longevity. Navigation systems utilize pre-operative imaging data to provide real-time feedback during the procedure, which is particularly beneficial when resecting tumors with complex, irregular margins. The convergence of these technologies—advanced manufacturing, material engineering for biocompatibility and infection control, and digital surgical assistance—forms the backbone of modern limb salvage, ensuring that these increasingly complex and personalized treatments achieve consistently high clinical standards and drive the future direction of the reconstructive orthopedic market globally.

Regional Highlights

- North America (Dominant Market Share): North America, particularly the United States, commands the largest market share due to its sophisticated healthcare infrastructure, high prevalence of orthopedic malignancies, advanced technological adoption (especially 3D printing for custom implants), and favorable reimbursement landscape for complex surgical procedures. The region benefits from a high concentration of leading market players, significant investment in R&D, and established clinical pathways prioritizing limb salvage over amputation. Furthermore, the presence of major academic oncology centers drives demand for cutting-edge solutions and supports extensive clinical trials for new devices.

- Europe (Mature and Highly Regulated): Western Europe represents a mature market characterized by stringent regulatory environments (e.g., MDR compliance) and high quality standards. Countries such as Germany, the UK, and France are key contributors, driven by aging populations, well-funded national health services, and a strong clinical focus on revision surgery and oncology. The market here is balanced between modular systems (preferred by public health systems for cost-effectiveness) and custom solutions (utilized in specialized centers), with a strong focus on anti-infective technology innovation.

- Asia Pacific (Fastest Growth Trajectory): The APAC region is poised for the highest growth rate, fueled by rapid expansion of healthcare access, increasing disposable incomes, and improving awareness of advanced orthopedic treatments. Key drivers include large, underserved patient populations in China and India, increasing foreign direct investment in healthcare infrastructure, and rising incidence of bone tumors requiring specialized care. While cost sensitivity remains a factor, the demand for high-quality, customized treatment options is accelerating, creating significant opportunities for market entry and localized manufacturing partnerships.

- Latin America (Emerging Opportunities): The Latin American market, including Brazil and Mexico, presents emerging opportunities, though growth is often hampered by fluctuating economic conditions and variability in healthcare funding. Demand is concentrated in major urban centers and private hospitals capable of supporting complex procedures. The market is primarily served by imported systems, creating opportunities for distributors offering flexible pricing and comprehensive training support.

- Middle East and Africa (Niche Growth): The MEA region exhibits specialized growth, driven primarily by high-spending Gulf Cooperation Council (GCC) countries which invest heavily in world-class specialty hospitals, attracting medical tourism for complex procedures like limb salvage. However, vast disparities in healthcare access across the wider African continent mean the market remains segmented, with growth concentrated in specific, high-end segments utilizing international suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Limb Salvage Systems Market.- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- DJO Global, Inc.

- Orthofix Medical Inc.

- Wright Medical Group N.V. (now part of Stryker)

- Merete Medical GmbH

- Onkos Surgical, Inc.

- Ti-Medizintechnik GmbH

- Corin Group

- Permedica S.p.A.

- OSARTIS GmbH

- Beijing AKEC Medical Co., Ltd.

- B. Braun Melsungen AG

- Johnson & Johnson (DePuy Synthes)

- Smith & Nephew plc

- Globus Medical Inc.

- Medtronic plc

- Tornier Inc.

- Stanmore Implants Worldwide Ltd.

- Limestone Medical Inc.

Frequently Asked Questions

Analyze common user questions about the Limb Salvage Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Limb Salvage Systems Market?

The primary driving force is the increasing global incidence of musculoskeletal tumors (bone sarcomas) and complex trauma cases, coupled with significant technological advancements, particularly in 3D printing, enabling customized patient-specific implant solutions with improved functional outcomes.

How does 3D printing technology influence limb salvage systems?

3D printing, specifically additive manufacturing (SLM/EBM), allows for the rapid creation of custom-designed, porous implants (PSIs) that perfectly match the patient's anatomy, promoting better osseointegration and mechanical stability compared to traditional modular systems, significantly enhancing procedural success.

What are the greatest challenges facing the adoption of limb salvage systems?

The greatest challenges are the substantially high initial cost of the surgical procedure and the persistent risk of deep periprosthetic joint infection (PJI), which often necessitates complex and costly revision surgeries, impacting long-term patient outcomes and healthcare expenditure.

Which geographical region is expected to show the highest market growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest market growth rate, driven by expanding healthcare infrastructure, rising disposable incomes, increasing awareness of orthopedic oncology treatments, and a large patient base requiring advanced reconstructive solutions.

How is Artificial Intelligence (AI) being utilized in this market?

AI is primarily used to enhance preoperative planning by improving tumor margin delineation in imaging, optimizing the generative design of complex custom implants for personalized biomechanics, and providing predictive analytics for patient outcome assessment and risk stratification.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager