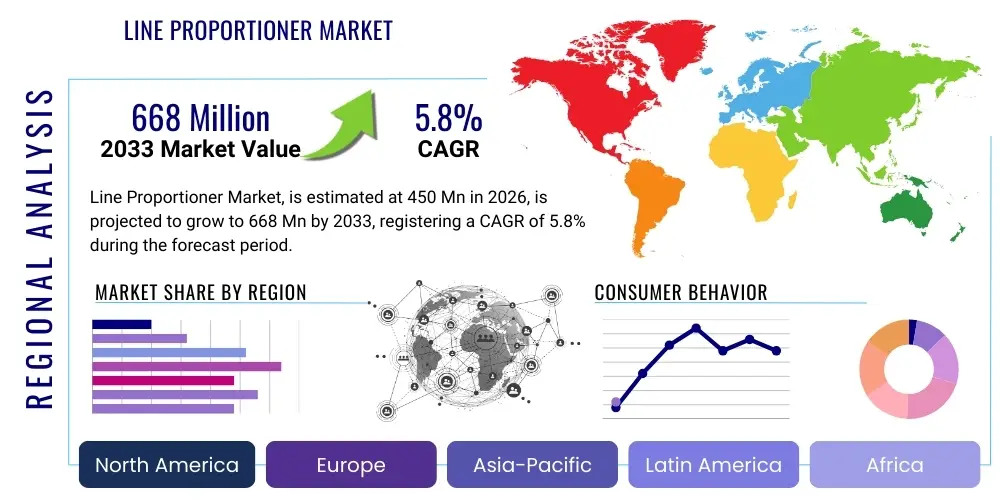

Line Proportioner Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442283 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Line Proportioner Market Size

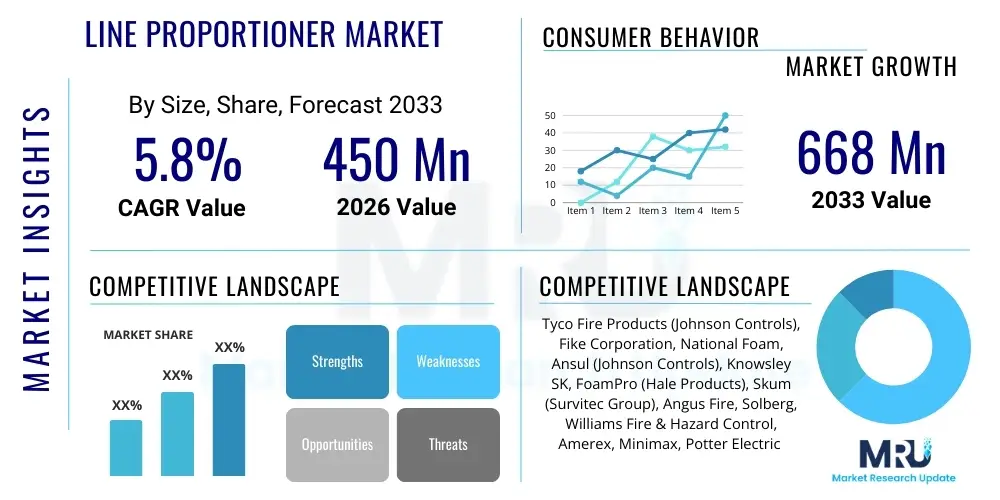

The Line Proportioner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

Line Proportioner Market introduction

The Line Proportioner Market encompasses specialized devices engineered to accurately mix two separate fluids, typically water and a concentrated additive such as fire suppression foam, chemicals, or fertilizers, at a precise and predetermined ratio. These systems are critical components in industries requiring reliable and consistent fluid proportioning to ensure operational effectiveness and safety standards are met. The core function of a line proportioner, often utilizing venturi principles or calibrated metering devices, is to inject the concentrate into the primary flow stream seamlessly, maintaining the specified ratio regardless of variations in the main flow rate or pressure, thus offering superior performance over manual or less sophisticated mixing methods. Their design emphasizes reliability, minimal pressure loss, and ease of integration into existing pipeline infrastructure.

Major applications for Line Proportioners are heavily concentrated within the fire safety and protection sector, particularly in industrial settings, aviation facilities, marine vessels, and petrochemical plants where foam firefighting systems are mandatory. Beyond fire safety, these proportioners find significant use in the chemical processing industry for precise reagent mixing, in agriculture for fertigation systems, and in municipal water treatment plants. The key benefits derived from utilizing these systems include enhanced safety due to reliable concentration delivery, optimization of resource usage (especially expensive foam concentrates), and compliance with stringent international safety regulations, such as those set by NFPA and ISO bodies. The reliability offered by fixed and portable proportioners ensures immediate readiness for emergency response scenarios.

The driving factors propelling the growth of this market are multifaceted, primarily centered around escalating global infrastructure development, stricter enforcement of industrial safety codes, and the increasing complexity of industrial operations that necessitate sophisticated fire suppression and chemical handling systems. Moreover, technological advancements focusing on electronic monitoring and enhanced ratio accuracy are making modern proportioners more desirable. The growth in the oil and gas sector, coupled with expanding logistics and storage facilities, inherently increases the demand for high-capacity and reliable foam proportioning equipment, establishing a strong foundation for sustained market expansion throughout the forecast period.

Line Proportioner Market Executive Summary

The Line Proportioner Market exhibits robust growth driven by mandatory safety regulations across high-risk industrial sectors, particularly in North America and Asia Pacific. Business trends indicate a strong shift towards highly accurate, low-pressure loss proportioners, with manufacturers focusing heavily on materials resistant to corrosive foam agents and harsh environments. Key players are investing in digitalization, incorporating smart sensors for real-time monitoring of flow rates and concentration levels, thereby enhancing preventative maintenance capabilities and operational transparency for end-users. Mergers and acquisitions remain pivotal strategies for market penetration, allowing large manufacturers to quickly acquire specialized proportioning technology and expand regional distribution networks, especially into emerging economies with nascent but rapidly growing industrial safety infrastructure.

Regionally, the Asia Pacific market is poised for the highest CAGR expansion, fueled by massive industrialization projects in China, India, and Southeast Asia, coupled with increasing governmental focus on industrial accident prevention. North America and Europe, while mature, maintain significant market share due to stringent adherence to established safety standards (e.g., NFPA requirements) and continuous replacement demand for aging infrastructure. Latin America and the Middle East & Africa (MEA) are emerging growth hubs, specifically benefiting from extensive investment in oil, gas, and petrochemical facilities, which mandates sophisticated foam proportioning systems. These regions often prioritize reliable, robust equipment capable of functioning effectively in extreme climatic conditions.

Segment trends reveal that the 'Fixed Installation' segment, primarily used in tank farms, refineries, and airport hangars, accounts for the largest market revenue due to high-volume applications and long lifespan requirements. However, the 'Portable Proportioner' segment is experiencing faster growth, driven by versatility and increasing demand from municipal fire departments and temporary industrial setups requiring rapid deployment capabilities. By application, the Fire Fighting segment dominates, but the Chemical Processing segment shows accelerated demand due to the necessity for ultra-precise proportioning in specialized chemical synthesis and batch processing operations, necessitating proportioners capable of handling highly corrosive or viscous fluids.

AI Impact Analysis on Line Proportioner Market

Common user questions regarding AI's impact on the Line Proportioner Market frequently revolve around predictive maintenance schedules, optimization of foam concentrate usage, and the integration of proportioning data into wider asset management systems. Users are keen to understand how AI algorithms can analyze flow inconsistencies, pressure fluctuations, and historical maintenance data to predict potential proportioner failures before they occur, thereby minimizing system downtime, which is critical in emergency response equipment. There is significant expectation that AI will move proportioning from static, pre-set ratios to dynamic, real-time adjustments based on fire severity or chemical reaction needs, enhancing both efficiency and safety outcomes. Furthermore, users seek clear guidance on integrating legacy proportioning hardware with modern AI-driven monitoring platforms, addressing concerns about cost and complexity of retrofit operations.

AI's role in the Line Proportioner market is transformative, shifting the focus from purely mechanical reliability to intelligent operational oversight. By leveraging machine learning models trained on sensor data (flow, pressure, ratio), AI systems can continuously verify the proportioner's performance against its optimal baseline. This capability is paramount for mission-critical applications like aircraft hangar foam systems, where failure to achieve the correct proportioning ratio could lead to catastrophic loss. The implementation of AI further supports remote diagnostics, allowing expert technicians to analyze complex operational data from centralized locations, streamlining compliance reporting, and significantly reducing the need for costly and time-consuming on-site inspections in geographically dispersed industrial complexes.

The long-term impact of AI is expected to lead to the development of 'self-calibrating' proportioners. These advanced units would use embedded AI models to dynamically adjust internal valves and metering components to counteract variables like viscosity changes due to temperature shifts or minor component wear, maintaining perfect ratio accuracy autonomously. This capability addresses one of the primary constraints in mechanical proportioning systems—the degradation of accuracy over time. Consequently, manufacturers utilizing AI platforms are positioned to capture premium market share by offering superior reliability, reduced lifecycle costs through optimized concentrate consumption, and compliance verification features essential for regulatory audits.

- Enhanced Predictive Maintenance: AI analyzes vibration, flow, and pressure data to forecast component failure, drastically reducing unplanned downtime.

- Dynamic Ratio Optimization: Machine learning algorithms adjust mixing ratios in real-time based on environmental conditions or fluid properties, maximizing effectiveness.

- Intelligent Inventory Management: AI predicts concentrate depletion rates based on usage patterns, automating ordering processes for foam or chemical additives.

- Automated Compliance Reporting: Systems generate detailed, verifiable reports on proportioning accuracy and operational status, meeting stringent regulatory requirements (NFPA, API).

- Remote Diagnostic Capabilities: AI platforms enable manufacturers to diagnose and troubleshoot issues remotely, speeding up resolution times.

- Optimization of Training and Simulation: AI-driven models simulate various failure modes, improving technician training and emergency preparedness planning.

DRO & Impact Forces Of Line Proportioner Market

The Line Proportioner Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces shaping its trajectory. The primary Driver is the non-negotiable requirement for regulatory compliance and stringent safety mandates, particularly in high-hazard environments like chemical plants and refineries. This is complemented by continuous industrial expansion in emerging economies, generating new demand for advanced fire protection infrastructure. Conversely, the market faces restraints such as the high initial capital investment required for high-accuracy proportioning systems and the technical complexity involved in integrating these units with diverse legacy firefighting apparatus. Opportunities arise through the development of smart, IoT-enabled proportioners and the increasing adoption of fluorine-free foams (FFF), which require proportioning technologies designed specifically for their unique fluid dynamics.

Key drivers include the global tightening of fire safety codes, such as revisions to NFPA standards that emphasize proportioning reliability and performance verification. Furthermore, the increasing complexity of modern industrial facilities, including massive logistics centers and sophisticated manufacturing hubs, necessitates proportioners with higher flow capacities and greater ratio precision. The growing trend toward using specialized, high-performance concentrates (both foam and chemical) that demand precise mixing to achieve effectiveness further stimulates market demand. These factors collectively create a positive demand cycle, forcing end-users to upgrade or replace older, less reliable mechanical systems with modern, electronically monitored alternatives.

Restraints are dominated by cost sensitivity, especially among smaller industrial operators or municipal fire departments with limited capital budgets, leading them to opt for lower-cost, less accurate options. Technical restraints involve the need for highly skilled labor for complex installation and ongoing calibration of electronic proportioning systems. The inherent challenge of maintaining accurate proportioning across a wide range of flow rates and pressures, particularly in portable or vehicle-mounted systems, also acts as a constraint, demanding continuous R&D investment from manufacturers to overcome these fluid dynamics challenges. Despite these hurdles, the critical nature of the proportioners ensures that demand remains relatively inelastic in essential industrial applications.

The cumulative impact forces dictate a sustained growth path, leaning heavily on mandatory replacement cycles and regulatory push. The opportunity to specialize in proportioners optimized for environmentally friendly (fluorine-free) foam agents represents a significant long-term growth catalyst. Manufacturers who successfully leverage digitalization (IoT, AI) to minimize installation complexity and offer superior remote diagnostic capabilities will effectively mitigate the constraints related to technical complexity and high maintenance costs, positioning themselves favorably in the increasingly competitive global market. Ultimately, the market growth rate is intrinsically linked to global industrial safety spending and regulatory harmonization efforts.

Segmentation Analysis

The Line Proportioner Market is systematically segmented primarily by Type (Fixed and Portable), Proportioning Ratio (1%, 3%, 6%, and custom), Application (Fire Fighting, Oil & Gas, Chemical Processing, Marine, Others), and End-User. This segmentation provides a granular view of market dynamics, revealing key areas of investment and specific technological requirements unique to different industrial environments. The fixed proportioner segment, characterized by high capacity and permanent integration into large-scale systems, continues to generate the highest revenue. However, the portable segment is crucial for rapid response and flexibility, seeing rising demand from smaller commercial entities and mobile fire suppression units. Application segmentation highlights the dominance of the fire safety sector, yet niche applications in chemical and water treatment demand specialized corrosion-resistant and highly accurate proportioning mechanisms.

Further segmentation by Technology Type, such as balanced pressure proportioning, pressure side proportioning (venturi), and around-the-pump proportioning, reveals varying levels of adoption based on system complexity and required accuracy. Balanced pressure proportioning systems, offering high accuracy across a wide flow range, command a significant premium and are preferred in large petrochemical facilities. Conversely, the simpler venturi proportioners are widely utilized in cost-sensitive or smaller-scale applications where high accuracy is secondary to reliability and affordability. Understanding these technological preferences is essential for manufacturers tailoring their product portfolio to specific end-user needs and budgetary constraints.

Geographic segmentation is crucial, with mature markets focusing on replacement and technological upgrade cycles, while emerging markets prioritize initial installation and basic functionality. The demand for specific proportioning ratios is often dictated by regional regulatory preferences regarding foam types. For instance, high-hazard facilities frequently mandate 3% or 6% proportioners for traditional protein and synthetic foams, while newer regulations promoting FFF might drive demand for customized or flexible ratio settings. This layered segmentation framework allows stakeholders to target specific opportunities related to compliance standards, infrastructure maturity, and technological adoption rates globally.

- By Type:

- Fixed Proportioners (High capacity, permanent installation)

- Portable Proportioners (Mobile, rapid deployment)

- By Proportioning Ratio:

- 1% Proportioners

- 3% Proportioners (Standard for many high-hazard applications)

- 6% Proportioners

- Custom/Variable Ratios

- By Technology:

- Balanced Pressure Proportioning Systems

- Pressure Side Proportioners (Venturi type)

- Around-The-Pump Proportioners

- Electronic Proportioning Systems

- By Application:

- Fire Fighting (Industrial, Municipal, Aviation, Marine)

- Oil & Gas (Refineries, Tank Farms)

- Chemical Processing and Manufacturing

- Water and Wastewater Treatment

- Agriculture (Fertigation)

- By End-User:

- Industrial Sector

- Commercial Buildings

- Government & Defense

- Municipal Fire Departments

Value Chain Analysis For Line Proportioner Market

The value chain for the Line Proportioner Market begins with upstream activities involving raw material procurement, primarily high-grade stainless steel, bronze, specialized alloys, and corrosion-resistant polymer components necessary for manufacturing durable equipment. Key upstream suppliers include metal foundries and specialized component manufacturers that provide valves, flow meters, and electronic sensors. Quality control at this stage is paramount, as the proportioner’s accuracy and lifespan are highly dependent on the precision engineering and material integrity required to withstand high pressure and corrosive concentrates. Manufacturers often establish long-term relationships with certified suppliers to ensure consistent quality and manage supply chain volatility.

The midstream phase focuses on manufacturing, assembly, and testing. Core activities involve precision machining of proportioner bodies, integration of metering devices, and calibration. This stage is highly technical and capital-intensive, requiring specialized facilities to meet international certification standards (e.g., UL, FM Global, CE). Direct distribution channels involve manufacturers selling high-volume or specialized units directly to large industrial end-users (like oil companies or defense contractors) or system integrators working on large infrastructure projects. This allows for customized technical support and direct negotiation on complex systems. Indirect distribution, which accounts for a significant portion of the market, relies on a network of authorized dealers, regional distributors, and specialized fire safety equipment resellers who handle smaller orders, inventory management, and localized customer service.

Downstream activities include system installation, commissioning, maintenance, and after-sales service. System integrators and specialized engineering firms often handle installation, ensuring proper integration with fire suppression tanks, pumps, and nozzles. The high value of the proportioner market is often realized through lucrative long-term maintenance contracts, focusing on regular calibration and repair, which ensures the equipment remains compliant and functional. Potential customers, acting as end-users, interact directly with distributors and service providers for procurement and post-sale support. The flow of value is optimized when robust technical training is provided to downstream partners, ensuring correct system handling and reducing the likelihood of field failures due to improper installation or maintenance procedures.

Line Proportioner Market Potential Customers

The primary purchasers and end-users of Line Proportioner technology are concentrated in industries where fire hazards are severe, or where precise fluid blending is critical to operational output. In the realm of fire suppression, potential customers include integrated energy companies managing vast tank farms and refineries (Oil & Gas sector), operators of international airports and military airbases (Aviation), and organizations owning or constructing large marine vessels, such as oil tankers and cruise ships (Marine Industry). These entities require fixed, high-volume, balanced pressure proportioning systems that guarantee performance integrity under emergency conditions. Procurement decisions in these sectors are driven almost entirely by mandated safety standards, insurance requirements, and the need for zero tolerance for equipment failure.

Another significant customer base resides within the chemical processing and manufacturing sectors. These end-users utilize proportioners not only for internal fire safety protocols but also as an integral part of their core process control. For instance, in specialty chemical production or pharmaceutical manufacturing, precise metering of reactants is vital to product quality and batch consistency. These customers prioritize electronic proportioners with enhanced monitoring capabilities and superior material compatibility to handle highly corrosive or sensitive chemical agents. Their purchasing criteria often emphasize measurement repeatability, integration ease with existing PLC/SCADA systems, and compliance with specific process quality certifications (e.g., ISO 9001).

Emerging potential customers include large-scale agricultural operations utilizing sophisticated fertigation systems, requiring precise mixing of nutrient concentrates into irrigation water, and municipal fire and rescue departments updating their mobile fleets. Municipal buyers tend to favor rugged, low-maintenance, and easy-to-operate portable or around-the-pump proportioners for vehicular applications. Furthermore, global data center operators and warehouse logistics firms, due to the density of high-value assets they protect, represent a growing niche demanding specialized clean agent or low-expansion foam proportioning equipment integrated into advanced detection and suppression systems, making them increasingly important buyers in the forecast period.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tyco Fire Products (Johnson Controls), Fike Corporation, National Foam, Ansul (Johnson Controls), Knowsley SK, FoamPro (Hale Products), Skum (Survitec Group), Angus Fire, Solberg, Williams Fire & Hazard Control, Amerex, Minimax, Potter Electric Signal Company, TFT (Task Force Tips), Chemguard (Tyco/JCI), Delta Fire, Elkhart Brass, Akron Brass, Parker Hannifin (through specific divisions), Victaulic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Line Proportioner Market Key Technology Landscape

The technological landscape of the Line Proportioner Market is shifting rapidly from purely mechanical and hydraulic systems to advanced electronic and digitally controlled solutions, driven by the demand for higher accuracy and real-time monitoring. Historically, the market was dominated by Balanced Pressure Proportioning Systems (BPPS) and Pressure Side Proportioners (PSP/Venturi). BPPS uses a pressure balancing mechanism between the water stream and the foam concentrate to ensure an accurate mix, remaining the gold standard for large, fixed installations requiring reliability over a broad flow range. However, their complexity and installation footprint are motivating the search for more compact and versatile alternatives, especially for retrofit projects.

The most significant technological advancement involves the proliferation of Electronic Proportioning Systems (EPS). These systems utilize microprocessors, highly accurate flow sensors (such as Coriolis or magnetic flow meters), and precise metering valves driven by stepping motors to actively monitor and adjust the proportioning ratio instantly. EPS technology offers unparalleled accuracy, often exceeding regulatory requirements, and provides detailed data logging capabilities, which are crucial for compliance verification and operational analysis. This digitization allows for integration with IoT frameworks, enabling remote calibration, diagnostics, and performance reporting, thereby dramatically lowering the total cost of ownership over the equipment lifespan by optimizing concentrate consumption and reducing manual calibration needs.

Current research and development efforts are focused on refining proportioning compatibility with newer, environmentally sound fire suppression agents, particularly Fluorine-Free Foams (FFF). FFFs often exhibit different viscosity and fluid dynamic properties compared to legacy AFFF foams, posing technical challenges for mechanical proportioners designed for older chemistries. Manufacturers are developing adaptive proportioning units, often based on EPS technology, that can dynamically adjust pump speeds and valve settings to maintain the required ratio across varying fluid temperatures and viscosities, thus ensuring compliance with emerging environmental mandates without sacrificing firefighting effectiveness. Furthermore, material science research is yielding new, lighter, and more corrosion-resistant composites for proportioner casings and internal components, extending product life in highly aggressive marine or industrial chemical environments.

Regional Highlights

- North America: The North American market holds a substantial share, primarily driven by the stringent adherence to NFPA standards and extensive oil, gas, and petrochemical infrastructure. The market is mature, characterized by high demand for replacement units and technological upgrades, favoring electronic and balanced pressure proportioning systems for maximum reliability. The strong presence of key manufacturing facilities in the US and Canada, coupled with continuous investment in airport safety and military installations, sustains high-value demand. Regulations concerning the phase-out of certain legacy foam types are also forcing upgrades to proportioners compatible with new, environmentally safer alternatives.

- Europe: Europe is a highly regulated market where the emphasis is heavily placed on environmental compliance and technological innovation. Countries like Germany, the UK, and France exhibit robust demand, particularly in the chemical and marine sectors. The European market leads in the adoption of advanced electronic proportioning systems due to stricter environmental legislation and safety norms (e.g., ATEX certification). The replacement market is steady, and there is increasing pressure on manufacturers to provide compact, highly efficient systems suitable for confined spaces in urban industrial areas and offshore installations.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid industrial expansion, urbanization, and large-scale infrastructure projects, especially in China, India, and Southeast Asian nations. New refinery construction, port development, and the establishment of manufacturing hubs create massive initial installation demand for fixed proportioning systems. While cost remains a significant factor, leading to higher adoption of basic mechanical proportioners in some segments, the region is quickly migrating toward advanced systems due to technology transfer and increasing foreign investment that mandates international safety benchmarks.

- Latin America: This region presents a growing but volatile market, primarily dependent on investment cycles in the oil, mining, and energy sectors, particularly in Brazil and Mexico. Demand is generally focused on robust, field-tested proportioning systems capable of operating in demanding environments with less sophisticated maintenance infrastructure. Market growth is gradually accelerating as regional governments implement stricter industrial safety regulations aimed at protecting critical national infrastructure assets.

- Middle East and Africa (MEA): The MEA market is dominated by large-scale oil and gas operations and vast petrochemical complexes, driving consistent, high-capacity demand for fixed proportioners. Nations within the Gulf Cooperation Council (GCC) are major spenders, focusing on premium, ultra-reliable proportioning systems for asset protection. The demand here is non-negotiable due to the extreme hazards involved. Africa represents an emerging opportunity, driven by burgeoning energy projects and mining activities, though procurement processes often emphasize durability and simplified operation due to logistical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Line Proportioner Market.- Tyco Fire Products (Johnson Controls)

- Fike Corporation

- National Foam

- Ansul (Johnson Controls)

- Knowsley SK

- FoamPro (Hale Products)

- Skum (Survitec Group)

- Angus Fire

- Solberg

- Williams Fire & Hazard Control

- Amerex

- Minimax

- Potter Electric Signal Company

- TFT (Task Force Tips)

- Chemguard (Tyco/JCI)

- Delta Fire

- Elkhart Brass

- Akron Brass

- Parker Hannifin (through specific divisions)

- Victaulic

Frequently Asked Questions

Analyze common user questions about the Line Proportioner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between balanced pressure and electronic line proportioners?

Balanced pressure proportioners (BPPS) are mechanical systems that equalize foam concentrate pressure with water pressure to maintain a set ratio, offering robust reliability across various flows but requiring high maintenance. Electronic proportioners (EPS) use sensors and microprocessors to actively monitor and adjust the ratio instantly using metering valves, providing higher accuracy, real-time data logging, and easier calibration, suitable for complex or high-precision applications.

How does the shift to Fluorine-Free Foams (FFF) impact proportioner technology?

The transition to FFF requires proportioners designed to handle their specific viscosity and fluid dynamics, which often differ significantly from legacy AFFF foams. FFF use drives demand for advanced Electronic Proportioning Systems (EPS) that can dynamically adjust parameters to maintain accurate mixing ratios under varying operational temperatures and pressures, ensuring firefighting effectiveness with the new agents.

Which industrial sectors are the primary drivers of demand for Line Proportioners?

The primary demand drivers are the Oil & Gas, Chemical Processing, and Aviation sectors, where mandatory safety regulations and the high value of protected assets necessitate the installation of high-capacity, highly reliable fixed proportioning systems. Municipal fire departments and marine industries are also crucial segments, particularly for portable and vehicle-mounted units.

What is the Compound Annual Growth Rate (CAGR) projected for the Line Proportioner Market?

The Line Proportioner Market is projected to grow at a CAGR of 5.8% between 2026 and 2033. This growth is primarily fueled by tightening global safety regulations, infrastructure expansion in the Asia Pacific region, and ongoing technological migration toward smart, high-accuracy electronic proportioning systems across mature markets.

How is AI being utilized to improve Line Proportioner performance and maintenance?

AI is employed for predictive maintenance by analyzing operational sensor data (flow, pressure, ratio consistency) to forecast component wear and potential failure, thereby minimizing unplanned downtime. AI also facilitates dynamic ratio optimization, allowing the proportioner to make real-time adjustments for environmental variables, significantly improving operational accuracy and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager