Linear Friction Welding Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442845 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Linear Friction Welding Machines Market Size

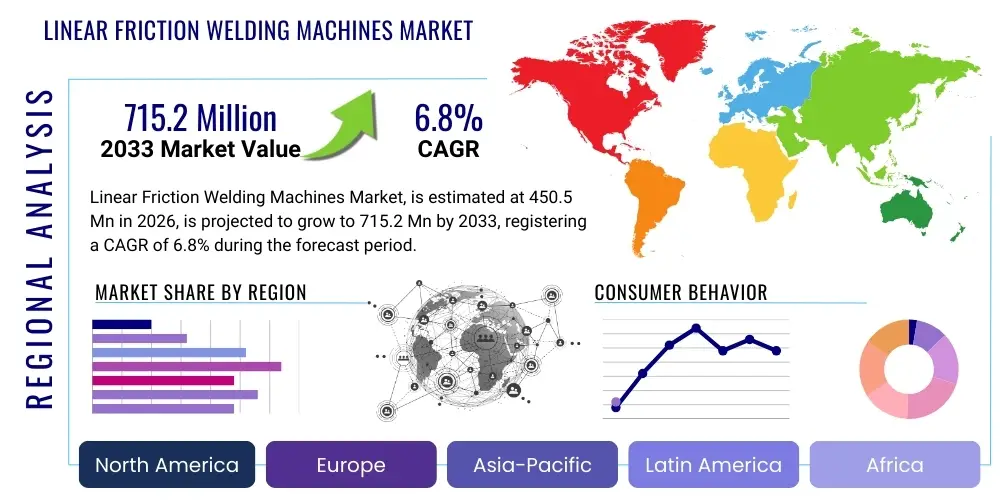

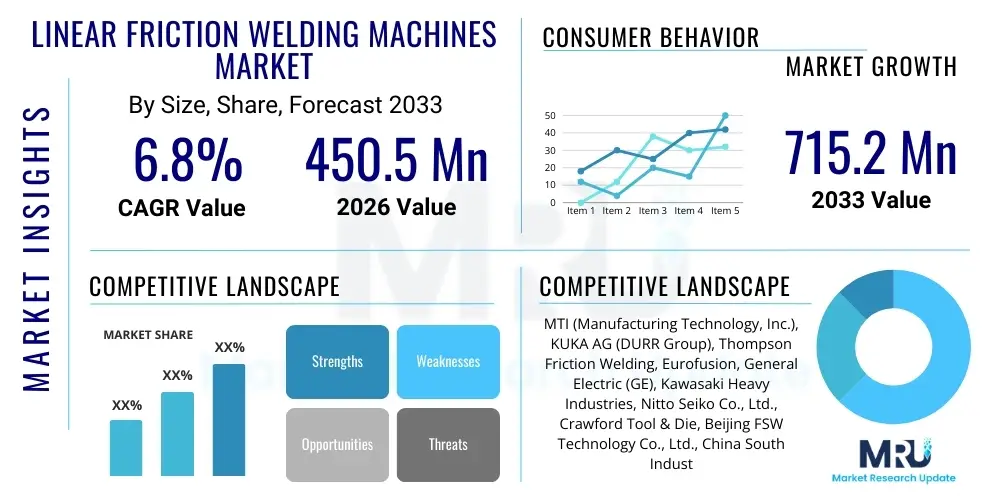

The Linear Friction Welding Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 715.2 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-integrity, lightweight components, particularly within the aerospace and automotive sectors, where superior material joining methods are critical for performance and fuel efficiency. The market expansion reflects a global shift toward solid-state welding processes that minimize the heat-affected zone (HAZ) and enable the reliable joining of dissimilar materials, a major technical challenge overcome efficiently by linear friction welding technology.

Linear Friction Welding Machines Market introduction

Linear Friction Welding (LFW) is a highly specialized, solid-state joining process that creates bonds through the controlled relative motion of two components under high pressure. One component is typically held stationary while the other oscillates linearly against it at high frequency, generating frictional heat that plasticizes the material interfaces without reaching the melting point. This results in an extremely strong, high-integrity weld characterized by a narrow heat-affected zone (HAZ) and minimal metallurgical degradation, making it indispensable for critical applications demanding exceptional mechanical properties and durability, such as complex structures in jet engines or highly stressed automotive components like turbocharger rotors and piston assemblies.

The primary applications of Linear Friction Welding Machines span across several high-value industries, most notably aerospace, where it is utilized for manufacturing critical engine components like blisks (blade integrated disks), shafts, and structural elements that require the joining of expensive, high-performance alloys. In the automotive sector, LFW is crucial for creating lightweight drivetrains, hybrid components, and enhancing the fatigue resistance of high-stress parts. The core benefits of adopting LFW technology include its ability to join dissimilar materials that are challenging or impossible to weld conventionally, high repeatability, energy efficiency, and the production of near-net-shape components that reduce post-processing costs and material waste, collectively positioning LFW as a strategic manufacturing solution.

Market growth is predominantly driven by stringent regulatory requirements for emissions and fuel economy, which necessitate continuous innovation in lightweight component manufacturing and advanced material usage. Furthermore, the global ramp-up in aerospace production, particularly for next-generation turbofans requiring complex blisk geometries, provides a robust foundation for increased demand for LFW machinery. The proliferation of electric vehicles (EVs) and hybrid vehicles, though seemingly counterintuitive, also utilizes LFW for joining specialized battery connection terminals and motor components where joint integrity is paramount, ensuring that the technology maintains relevance across evolving industrial landscapes.

Linear Friction Welding Machines Market Executive Summary

The Linear Friction Welding Machines Market is currently defined by technological sophistication and a high barrier to entry, predominantly characterized by intense competition among specialized machinery manufacturers focused on customization and process control. Current business trends indicate a strong move toward modular machine designs that offer greater flexibility for manufacturers dealing with varying component sizes and production volumes, alongside increasing integration of sophisticated sensors and control algorithms for real-time monitoring and adaptive welding adjustments. Investment cycles in this market are intrinsically linked to capital expenditure in the aerospace and high-performance automotive sectors, suggesting resilience even during broader economic volatility due to the long lifecycle and critical nature of the components manufactured using LFW.

Regionally, North America and Europe maintain dominance in terms of technological leadership and market value, primarily due to the presence of major aerospace original equipment manufacturers (OEMs) and stringent quality standards that necessitate high-precision welding techniques. However, the Asia Pacific (APAC) region, driven by rapid industrialization, burgeoning domestic aerospace programs (especially in China and India), and massive growth in electric vehicle production, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period. This regional expansion is fueling demand for standardized, reliable LFW systems suitable for high-volume, albeit potentially less complex, component fabrication, signaling a diversification of the end-user base and application scope.

Segment-wise, the market is seeing notable trends focused on the application category, with the aerospace segment retaining the highest revenue share due to the high unit cost of specialized welding systems required for engine components. However, the automotive segment, particularly the shift toward high-performance and electric vehicle components, is emerging as the fastest-growing segment, demanding faster cycle times and automation integration. Furthermore, there is a distinct trend in the machine type segment towards fully automated, integrated LFW systems that reduce human intervention and enhance throughput, addressing the industry's need for efficiency, consistency, and traceability in demanding manufacturing environments.

AI Impact Analysis on Linear Friction Welding Machines Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can improve the inherent complexity and precision requirements of Linear Friction Welding, particularly concerning predictive quality assurance, process parameter optimization, and equipment health monitoring. Key user concerns revolve around the reliability of AI algorithms in determining optimal weld conditions for dissimilar materials, the necessary data infrastructure required to train these models effectively, and whether AI integration can genuinely lead to reductions in scrap rates and setup times. Expectations center on AI enabling autonomous decision-making in real-time, allowing LFW machines to self-adjust oscillation frequencies, forging pressures, and displacement rates based on incoming sensor data to achieve consistently perfect bonds, ultimately moving welding from a semi-empirical science to a fully data-driven process within highly automated manufacturing environments.

- AI-driven predictive quality control reduces defects by analyzing real-time sensor data (temperature, pressure, displacement) against historical optimal weld profiles.

- Machine Learning (ML) algorithms optimize complex welding parameters for novel or dissimilar material combinations, accelerating R&D and setup times.

- Predictive maintenance schedules for LFW machines are enhanced by AI analysis of vibration and hydraulic system performance, minimizing unplanned downtime.

- Integration of Computer Vision (CV) with AI aids in precise component alignment and post-weld inspection, ensuring dimensional and geometric accuracy.

- AI facilitates adaptive control systems that compensate instantly for material variations or machine component wear, maintaining stringent weld quality standards autonomously.

DRO & Impact Forces Of Linear Friction Welding Machines Market

The market for Linear Friction Welding Machines is primarily driven by the escalating industrial requirement for solid-state joining processes capable of handling advanced material combinations, especially in performance-critical applications. The automotive industry’s commitment to lightweighting and the aerospace sector’s sustained production demand for complex engine components (like blisks made from nickel-based superalloys or titanium) necessitate LFW due to its inherent strength and minimal thermal distortion characteristics. Furthermore, the opportunity exists in expanding LFW applications into renewable energy sectors, such as specialized components for wind turbines and high-integrity joints in hydrogen fuel cell stack production, opening new avenues for machinery deployment beyond traditional manufacturing strongholds.

However, market growth is significantly restrained by the extremely high initial capital investment required for purchasing and installing LFW machinery, coupled with the need for highly specialized technical expertise for operation, programming, and complex maintenance procedures. These factors often limit the adoption of LFW technology to major Tier 1 suppliers and large OEMs, particularly impacting smaller and medium-sized enterprises (SMEs). The complexity of integrating LFW systems into existing automated production lines and the associated high costs for customized tooling further restrict broader market penetration, creating substantial financial hurdles that need strategic mitigation through leasing models or increased governmental R&D funding support.

Impact Forces, analyzed through the lens of Porter's Five Forces, reveal that the bargaining power of buyers is moderately high, especially large aerospace or automotive OEMs who demand customization, extended warranties, and favorable pricing due to high-volume procurement potential. Supplier power is also significant, as manufacturers rely on specialized hydraulic, control system, and high-frequency oscillation component providers, limiting raw material input flexibility. The threat of substitutes is low to moderate, as traditional fusion welding methods cannot replicate LFW's ability to join dissimilar materials with equivalent joint integrity, though alternative solid-state processes like friction stir welding pose limited competition in certain niche applications. The intensity of competitive rivalry among the few established global LFW machine manufacturers remains high, driving continuous innovation in machine speed, accuracy, and size scalability.

Segmentation Analysis

The Linear Friction Welding Machines Market is comprehensively segmented based on several critical parameters, including the type of machinery, the level of automation integrated, and the specific application sector utilizing the technology. Segmentation by Machine Type differentiates between standardized, general-purpose machines suitable for moderate volumes and customized, high-specification machines tailored for unique component geometries or extremely demanding materials often found in critical aerospace components. Analyzing the market through these segments allows stakeholders to accurately gauge demand dynamics, identify high-growth application niches, and strategically tailor product development and sales efforts to specific end-user requirements within high-reliability manufacturing ecosystems.

Further granular segmentation occurs based on the level of automation, separating manual or semi-automated systems, which require substantial operator input, from fully automated robotic cells integrated with material handling and post-weld processing capabilities, favored by high-volume automotive manufacturers. The predominant segmentation, however, remains application-based, recognizing that the demands and investment capacity of the aerospace industry fundamentally differ from those of the automotive or energy sectors, influencing machine size, precision tolerance requirements, and required forging capacity. This segmented view provides a detailed roadmap of where technological investments are most critically needed to address industry-specific manufacturing challenges and expand market opportunities efficiently.

- By Application:

- Aerospace and Defense (Turbine blades, Blisks, Shafts, Structural components)

- Automotive (Engine components, Drivetrain parts, Turbochargers, EV components)

- Oil & Gas (Drill pipes, Tool joints)

- Power Generation (Industrial gas turbines)

- Others (Medical devices, Specialized tools)

- By Machine Type:

- Standard LFW Machines (General purpose, moderate complexity)

- Custom/Modular LFW Machines (High precision, specialized tooling, large size capacity)

- By Automation Level:

- Semi-Automatic Systems

- Fully Automated and Integrated Cells (Robotic handling)

Value Chain Analysis For Linear Friction Welding Machines Market

The value chain for the Linear Friction Welding Machines Market begins significantly upstream with highly specialized suppliers providing critical components necessary for the precision and power required by these systems. This upstream analysis focuses on manufacturers of high-performance hydraulic systems, which manage the immense forging and clamping forces, alongside providers of advanced CNC control units and specialized high-frequency linear drive mechanisms (often servo-hydraulic or electromagnetic). The quality, reliability, and precision of these core components directly influence the final machine performance, creating a strong dependency on a limited number of specialized, high-quality component suppliers who maintain considerable bargaining power due to the niche technical requirements of LFW technology.

Midstream activities involve the core competencies of LFW machine builders, including system integration, design engineering, software development for process control, and the final assembly and rigorous testing of the complex machinery. Distribution channels are predominantly direct, characterized by long sales cycles involving extensive technical consultations, customized machine specifications, and comprehensive installation, training, and long-term maintenance contracts. Due to the high capital expenditure and technical nature of the equipment, sales are usually handled by in-house expert sales engineers or highly specialized regional distributors who possess deep knowledge of solid-state welding applications and the specific regulatory requirements of sectors like aerospace.

Downstream, the market is characterized by end-users—primarily large Tier 1 automotive and aerospace component manufacturers—who utilize the LFW machines to produce mission-critical parts. This downstream relationship is often collaborative, with machine manufacturers providing extensive post-sales support, process optimization consultancy, and regular software and hardware upgrades. The effectiveness of the machine in reducing scrap rates, enhancing production throughput, and maintaining metallurgical integrity is the ultimate measure of value, ensuring a continuous feedback loop that drives innovation in machine design and control systems tailored specifically to the high-performance manufacturing demands of the end-user base.

Linear Friction Welding Machines Market Potential Customers

The primary potential customers for Linear Friction Welding Machines are concentrated within high-reliability sectors where joint integrity and material performance are non-negotiable manufacturing imperatives. These customers include global aerospace OEMs and their Tier 1 suppliers responsible for manufacturing complex jet engine components, gas turbine blades, and structural airframe elements using expensive, high-strength alloys like titanium, nickel superalloys, and aluminum-lithium combinations. The drive for higher bypass ratios and greater fuel efficiency in modern jet engines directly translates into increased demand for LFW, as it is the preferred method for constructing critical blisk components essential for optimal engine performance and weight reduction in both commercial and military aviation platforms.

Another significant customer segment is the high-performance automotive industry, encompassing Tier 1 suppliers specializing in powertrain components, especially those related to turbocharging systems, specialized axles, and increasingly, components for advanced electric motors and battery assemblies where dissimilar material joining is often mandatory. The automotive sector demands LFW systems optimized for high throughput and repeatability, capable of integration into automated production lines to support the mass production requirements of global vehicle platforms. This segment is characterized by a high sensitivity to cycle time and initial capital cost, necessitating machine manufacturers to focus on automation and system longevity to meet rigorous production uptime demands.

Furthermore, critical infrastructure industries such as oil & gas and power generation represent valuable niche customers. In the oil & gas sector, LFW is essential for manufacturing robust drill pipes and tool joints capable of withstanding extreme downhole pressures and temperatures. For power generation, particularly the manufacturers of industrial gas turbines (IGTs), LFW is used to produce turbine components similar to those in aerospace applications. These customers seek machines that offer high forging capacity and exceptional process control to ensure the longevity and safety of components operating under severe thermal and mechanical stresses, emphasizing durability and precision over sheer volume, thereby maintaining a steady, albeit concentrated, demand stream for specialized LFW equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 715.2 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MTI (Manufacturing Technology, Inc.), KUKA AG (DURR Group), Thompson Friction Welding, Eurofusion, General Electric (GE), Kawasaki Heavy Industries, Nitto Seiko Co., Ltd., Crawford Tool & Die, Beijing FSW Technology Co., Ltd., China South Industries Group (CSIG), Stirtec GmbH, Suzhou Huashijie Automation Co., Ltd., Harbin Institute of Technology (HIT), Izhevsk Machine-Building Plant (Kalashnikov Concern), Shanghai Friction Welding Equipment Co., Ltd., Grenzebach Group, Siemens Energy, TWI Ltd. (Technology Provider), Taylor-Winfield Technologies, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Linear Friction Welding Machines Market Key Technology Landscape

The technology landscape of the Linear Friction Welding Machines Market is characterized by continuous advancements aimed at improving process control, increasing repeatability, and expanding the range of material combinations that can be successfully joined. A core technological focus is the development of next-generation control systems, moving beyond traditional CNC systems to incorporate high-speed, real-time closed-loop control algorithms that monitor and adjust parameters like oscillation amplitude, frequency, and forging force within microseconds. These advanced control units are crucial for minimizing flash formation and ensuring the precise amount of energy input required for optimal weld integrity, which is particularly vital when dealing with temperature-sensitive materials or highly critical components requiring zero defects, such as blisks in aero engines.

Furthermore, there is a significant technological trend toward the integration of advanced diagnostic and sensing capabilities directly into the LFW machines. This includes the deployment of high-resolution displacement transducers, acoustic emission sensors, and thermal cameras to capture comprehensive process data throughout the welding cycle. This collected data forms the foundation for AI and ML applications, allowing for sophisticated analysis of the process signature to predict weld quality before destructive testing is required, thereby ensuring Non-Destructive Testing (NDT) integration becomes a standard feature. The ability to collect and analyze massive datasets related to weld characteristics drives the long-term trend towards fully traceable, 'smart' welding operations capable of demonstrating compliance and quality assurance seamlessly.

In terms of mechanical design, the market is witnessing innovation in the development of more rigid and high-tonnage linear actuators, moving away from purely hydraulic systems towards hybrid or fully electromagnetic linear drives that offer superior control over the oscillation profile and energy delivery, which reduces machine footprint and improves energy efficiency. Specialized tooling and fixturing mechanisms designed for quick changeover and thermal stability are also critical, particularly for modular LFW systems catering to smaller batch sizes and customized production runs. These technological shifts collectively aim to lower the maintenance burden, shorten production cycles, and increase the versatility of LFW machines, allowing manufacturers to adapt rapidly to evolving material science and component complexity requirements across diverse end-user industries.

Regional Highlights

Regional dynamics play a crucial role in shaping the Linear Friction Welding Machines Market, primarily reflecting the geographical concentration of high-value manufacturing and advanced research and development activities. North America, particularly the United States, represents a dominant market share, driven by a robust aerospace and defense industry and significant government investment in next-generation material science and manufacturing technologies. The demand here is centered on high-precision, customized LFW systems used for military and commercial jet engine component fabrication, characterized by strict quality requirements and technological complexity.

Europe also holds a substantial market position, particularly Germany, the UK, and France, owing to their strong automotive engineering base, leading aerospace companies, and heavy industrial machinery manufacturing expertise. European demand often focuses on machines capable of ultra-high precision joining for specialized automotive components and critical power generation equipment, supported by collaborative R&D efforts aimed at optimizing LFW for new alloys and environmentally friendly manufacturing practices.

The Asia Pacific (APAC) region is poised for the most rapid growth, fueled by substantial industrial expansion in countries such as China, India, and Japan. While Japan maintains high technical standards similar to Europe, the growth in China and India is propelled by large-scale domestic aerospace programs, heavy investment in railway and infrastructure, and the massive scale-up of electric vehicle manufacturing. This region primarily drives demand for LFW systems that balance precision with cost-effectiveness and high-volume throughput, positioning APAC as a critical region for future revenue generation and market saturation.

- North America (US & Canada): Leadership in R&D; high demand from defense and commercial aerospace sectors; focus on complex titanium and nickel alloy joining for critical engine parts.

- Europe (Germany, UK, France): Strong adoption in high-end automotive (turbochargers, specialized axles) and industrial gas turbine manufacturing; emphasis on precision and integration into automated production lines.

- Asia Pacific (China, Japan, India): Fastest-growing region driven by mass production requirements in the automotive sector (especially EV components) and increasing domestic aerospace manufacturing capabilities.

- Latin America & MEA: Emerging markets; demand primarily linked to localized oil & gas exploration (drill pipe joining) and infrastructure development projects; characterized by fluctuating, project-based procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Linear Friction Welding Machines Market.- MTI (Manufacturing Technology, Inc.)

- KUKA AG (DURR Group)

- Thompson Friction Welding

- Eurofusion

- General Electric (GE)

- Kawasaki Heavy Industries

- Nitto Seiko Co., Ltd.

- Crawford Tool & Die

- Beijing FSW Technology Co., Ltd.

- China South Industries Group (CSIG)

- Stirtec GmbH

- Suzhou Huashijie Automation Co., Ltd.

- Harbin Institute of Technology (HIT)

- Izhevsk Machine-Building Plant (Kalashnikov Concern)

- Shanghai Friction Welding Equipment Co., Ltd.

- Grenzebach Group

- Siemens Energy

- Taylor-Winfield Technologies, Inc.

- Nippon Steel Corporation

- Daewoo Heavy Industries

Frequently Asked Questions

Analyze common user questions about the Linear Friction Welding Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Linear Friction Welding (LFW) and how does it differ from traditional welding methods?

LFW is a solid-state joining process that uses linear oscillatory motion and high pressure to create welds below the melting point, generating heat through friction. This differs from traditional fusion welding by minimizing the heat-affected zone (HAZ), enabling superior joint strength, and facilitating the joining of dissimilar, often difficult-to-weld, materials.

Which industries are the primary consumers of Linear Friction Welding Machines?

The primary consumers are the aerospace and defense sector (for critical jet engine components like blisks and shafts), the high-performance automotive industry (for turbochargers and lightweight drivetrain parts), and the power generation sector (for industrial gas turbine components).

What are the main advantages of using LFW over other solid-state welding techniques?

LFW offers superior joint integrity and high repeatability, particularly for complex component shapes and high-stress applications. Its key advantages include low material wastage, minimal thermal distortion, rapid cycle times, and high energy efficiency compared to other solid-state methods like rotary friction welding for certain geometries.

What is the projected growth trajectory for the Linear Friction Welding Machines Market in APAC?

The Asia Pacific (APAC) region is forecast to exhibit the highest growth rate, driven by rapid expansion in electric vehicle manufacturing, significant investments in domestic aerospace programs (especially in China and India), and growing requirements for high-volume, automated welding solutions across key manufacturing hubs.

How is AI and automation technology impacting the efficiency of LFW machines?

AI integration is significantly improving LFW efficiency by enabling predictive quality assurance, optimizing complex welding parameters in real-time, reducing machine setup times, and enhancing overall system traceability, leading to lower scrap rates and higher component yield in critical manufacturing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager