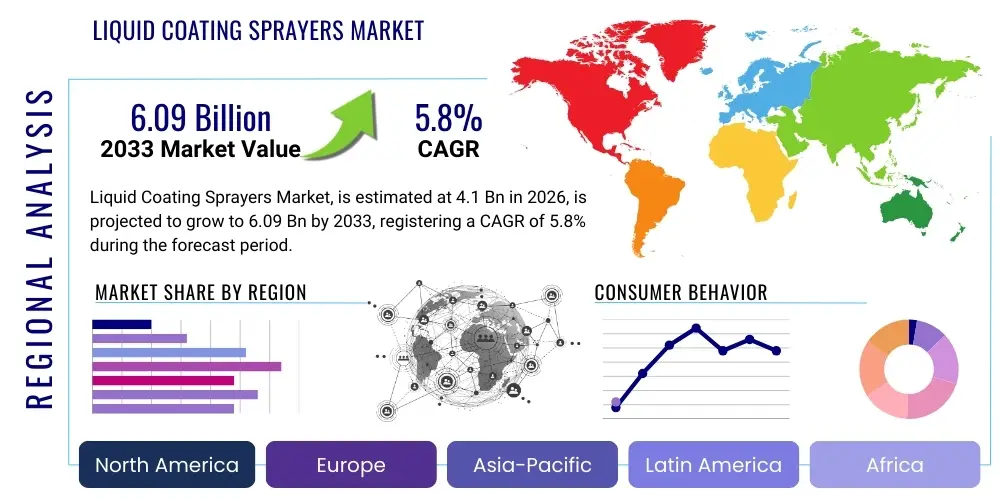

Liquid Coating Sprayers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442908 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Liquid Coating Sprayers Market Size

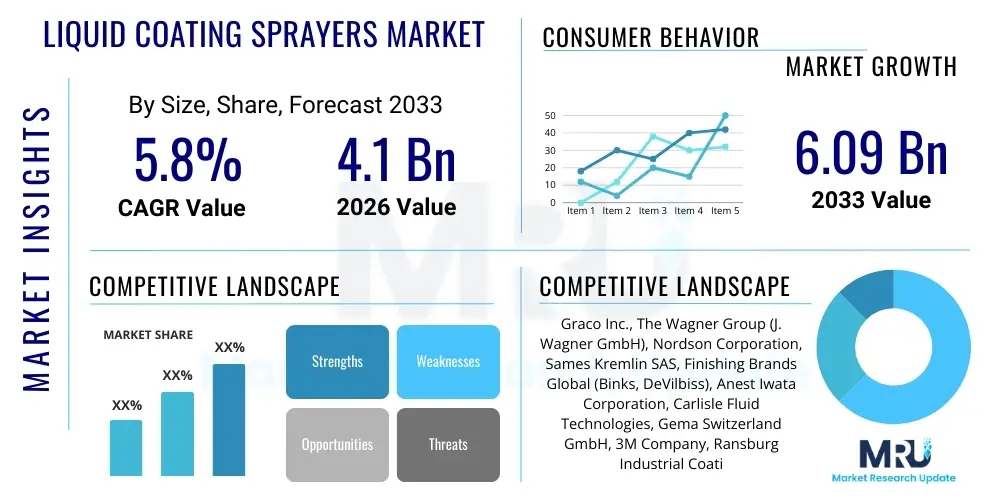

The Liquid Coating Sprayers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.09 Billion by the end of the forecast period in 2033.

Liquid Coating Sprayers Market introduction

The Liquid Coating Sprayers Market encompasses a diverse range of equipment designed for the atomization and efficient application of liquid coating materials onto various substrates. These systems are crucial in numerous industrial and commercial sectors, enabling the uniform application of paints, protective layers, sealants, and aesthetic finishes. Key product categories include air sprayers, airless sprayers, High Volume Low Pressure (HVLP) systems, and specialized electrostatic equipment, each tailored for specific viscosity levels, coverage requirements, and environmental considerations. The fundamental advantage of these devices lies in their ability to deliver superior finish quality, high transfer efficiency, and faster application speeds compared to traditional methods like brushing or rolling, thereby minimizing material waste and labor costs.

Major applications driving the demand for advanced liquid coating sprayers include the automotive sector, where precision finishing is paramount for durability and aesthetics, and the general industrial sector, covering machinery, heavy equipment, and consumer electronics. Furthermore, the construction and architectural sectors rely heavily on these tools for large-area coverage and protective anti-corrosion coatings. The continuous evolution toward advanced liquid coatings, particularly waterborne and high-solids formulations, necessitates continuous innovation in sprayer technology to handle these materials effectively while complying with increasingly stringent environmental regulations concerning Volatile Organic Compounds (VOC) emissions.

Driving factors propelling market expansion include robust global industrialization, especially in emerging economies, coupled with increased infrastructure spending that mandates durable protective coatings for assets. The continuous demand for high-quality, defect-free finishes in high-value products, such as aerospace components and luxury goods, also contributes significantly. Moreover, the focus on enhancing operational efficiency and reducing worker exposure to hazardous materials encourages the adoption of automated and robotic spraying systems, pushing manufacturers to develop ergonomic, efficient, and technologically integrated spraying solutions designed for diverse production environments, ranging from small job shops to fully automated assembly lines.

Liquid Coating Sprayers Market Executive Summary

The Liquid Coating Sprayers Market is characterized by a dynamic shift towards automation and sustainability, primarily fueled by the industrial manufacturing renaissance in Asia Pacific and the stringent environmental standards enforced across North America and Europe. Business trends highlight intense competition centered on developing highly efficient equipment, specifically HVLP and electrostatic systems, which maximize material transfer efficiency and minimize overspray. Manufacturers are increasingly integrating smart features, such as IoT connectivity and digital control interfaces, into spray guns and pumps to facilitate precise process monitoring and predictive maintenance, catering to the growing need for optimized production processes in high-throughput environments.

Regionally, the Asia Pacific (APAC) market exhibits the highest growth potential, attributed to rapid expansion in automotive manufacturing, construction activities, and shipbuilding across countries like China, India, and Southeast Asian nations. North America and Europe maintain leading positions in terms of technological adoption and value, driven by high labor costs necessitating robotic integration and early compliance with environmental regulations favoring low-VOC coatings. Segment trends indicate that Airless and Air-Assisted Airless technologies are dominating high-volume industrial applications due to their speed and ability to handle viscous materials, while automated systems, particularly robotic arms equipped with specialized spray nozzles, are gaining traction in controlled industrial settings where consistency and repeatability are non-negotiable quality metrics.

AI Impact Analysis on Liquid Coating Sprayers Market

User questions related to AI's influence on the Liquid Coating Sprayers Market frequently revolve around topics such as the feasibility of real-time defect detection, the optimization of spraying patterns to reduce material waste, and the potential for autonomous system calibration. Users are keen to understand how AI-powered vision systems can supersede manual quality checks and ensure paint thickness uniformity across complex geometries. Key concerns often center on the computational infrastructure required to implement AI-driven process control and the return on investment (ROI) for retrofitting existing industrial coating lines with advanced cognitive capabilities. The consensus expectation is that AI will transition liquid coating from a skilled, manual process to a highly optimized, data-driven operation, drastically improving throughput and minimizing material defects.

The application of Artificial Intelligence within the liquid coating sprayer domain primarily focuses on enhancing process precision and quality assurance. AI algorithms, often integrated with high-speed cameras and sensors, can analyze the spray pattern, droplet size distribution, and coating thickness in real-time, instantly identifying deviations or inconsistencies. This allows for automated, micro-second adjustments to parameters such as fluid pressure, air flow, and gun distance, thereby maintaining optimal transfer efficiency and minimizing costly rework. Furthermore, AI-driven predictive maintenance models utilize historical operational data (e.g., pump cycles, pressure fluctuations, temperature logs) to forecast equipment failures, significantly reducing unplanned downtime and optimizing maintenance schedules, transforming the operational reliability of large-scale coating facilities.

Ultimately, AI enables a paradigm shift towards hyper-customization and smart manufacturing in the coatings industry. By learning from millions of coating cycles, AI systems can develop optimized spraying trajectories and parameter sets for specific part geometries and coating chemistries, a capability unattainable through traditional programming. This not only standardizes the final product quality but also provides unprecedented traceability and compliance documentation, which is crucial in regulated industries like aerospace and medical devices. The ability of AI to instantly adapt to minor environmental changes (temperature, humidity) within the booth ensures consistent output regardless of external factors, positioning AI as a critical enabler for achieving near-perfect first-pass yield rates.

- Real-time quality control and defect detection via integrated vision systems.

- Predictive maintenance planning for pumps, nozzles, and automation components.

- Optimization of fluid delivery parameters (pressure, flow) based on coating material viscosity and temperature.

- Autonomous trajectory generation for robotic coating applications, reducing programming time.

- Data-driven process standardization and compliance documentation generation.

DRO & Impact Forces Of Liquid Coating Sprayers Market

The Liquid Coating Sprayers Market growth trajectory is significantly influenced by a confluence of accelerating drivers, restrictive restraints, and high-potential opportunities, collectively forming complex impact forces. Key drivers include the global resurgence of industrial manufacturing, especially in the automotive, aerospace, and general metal fabrication sectors, coupled with strict regulatory mandates globally that favor the use of spray equipment designed for high transfer efficiency and minimized VOC emissions. However, market expansion is challenged by restraints such as the substantial capital investment required for high-end automated and robotic coating systems, especially for Small and Medium Enterprises (SMEs), and the requirement for highly skilled technical personnel to operate and maintain sophisticated electronic fluid control systems, leading to operational complexity and higher training overheads.

Opportunities for market players lie primarily in the integration of Internet of Things (IoT) capabilities for remote monitoring and diagnostics, and the development of specialized equipment optimized for new generations of eco-friendly coatings, such as high-solids epoxies and waterborne acrylics. The continuous infrastructure boom in developing regions also presents sustained opportunities for protective coating equipment. The primary impact forces shaping the market involve the continuous pressure from end-users to achieve zero-defect finishes and maximize material utilization, which heavily favors the adoption of electrostatic and automated HVLP technologies over traditional conventional sprayers, subsequently driving innovation in nozzle design and fluid handling precision.

The shift towards customization and smaller batch production in various industries necessitates flexible coating solutions, pushing manufacturers towards modular and easily reconfigurable spraying systems. Furthermore, global environmental policies, particularly those related to solvent usage and waste disposal, act as a powerful external force, compelling the entire supply chain to invest in closed-loop cleaning systems and equipment specifically rated for reduced air pollution. Overcoming the initial investment barrier through flexible financing models and demonstrating clear, measurable ROI improvements through material savings are crucial strategies for market penetration, particularly in cost-sensitive industrial sectors where operational expenditure optimization is a key determinant of equipment procurement decisions.

Segmentation Analysis

The Liquid Coating Sprayers Market is comprehensively segmented based on technology, end-use application, product type, and capacity, providing a granular view of market dynamics. Technology segmentation includes conventional Air Spray, high-efficiency HVLP (High Volume Low Pressure), sophisticated Air-Assisted Airless, and high-throughput Airless sprayers, along with specialized Electrostatic applicators. End-use applications span critical sectors such as Automotive, General Industrial, Aerospace, Construction/Infrastructure, and Furniture/Wood Finishing. Analyzing these segments reveals that while high-efficiency systems are rapidly replacing conventional methods due to material cost savings and regulatory compliance, the demand for specialized robotic applicators within the automotive and aerospace segments continues to command the highest market value due to stringent quality requirements and complex geometries.

- By Technology: Air Spray, Airless, Air-Assisted Airless, HVLP (High Volume Low Pressure), Electrostatic.

- By Product Type: Manual Spray Guns, Automatic Spray Guns, Powder Coating Guns, Pumps (Diaphragm, Piston), Robots and Automation Systems.

- By End-Use Application: Automotive (OEM & Aftermarket), Aerospace & Defense, General Industrial (Machinery, Appliances), Construction & Infrastructure, Wood & Furniture, Marine.

- By Capacity: High Volume (Industrial), Medium Volume (Commercial), Low Volume (Residential/DIY).

Value Chain Analysis For Liquid Coating Sprayers Market

The value chain for the Liquid Coating Sprayers Market begins with upstream suppliers providing critical raw materials and specialized components, including precision machined parts, high-grade alloys for fluid passages, electronic control units (ECUs), and specialized seals and hoses capable of handling abrasive and corrosive coating materials. These suppliers play a vital role in ensuring the durability and performance of the final spray equipment. Manufacturers then engage in precision engineering, assembly, calibration, and rigorous quality testing of various components, ranging from complex pneumatic pumps and fluid heaters to intricate nozzle designs and ergonomic spray gun bodies. The emphasis at the manufacturing stage is on maximizing material transfer efficiency (MTE) and ensuring operational safety and compliance with global pressure vessel standards, which necessitates continuous investment in R&D for fluid dynamics and atomization technologies.

Downstream analysis focuses heavily on the distribution channel, which is typically bifurcated into direct sales channels, predominant for high-value automated systems and large industrial clients (e.g., automotive OEM assembly lines), and indirect channels, which involve a network of authorized distributors, specialized dealers, and integrators serving the SME sector, commercial painting contractors, and the aftermarket. Integrators are particularly crucial, as they specialize in combining spray equipment with robotic arms, ventilation systems, curing ovens, and conveyor belts to deliver turnkey coating solutions. The choice between direct and indirect distribution often depends on the complexity of the sale, the level of after-sales technical support required, and the geographic reach needed to serve fragmented end-use markets efficiently.

Logistical efficiency and robust technical support are critical differentiators in the value chain. As spray equipment requires periodic maintenance, parts replacement, and calibration, the post-sale service network maintained by manufacturers and distributors is essential for minimizing customer downtime. The increasing adoption of digital platforms facilitates better inventory management for spare parts and enables remote diagnostic services, further streamlining the value chain and enhancing customer satisfaction. Strong partnerships between equipment manufacturers and major paint/coating suppliers are also integral, ensuring that the spraying equipment is perfectly optimized for specific coating chemistries, which is vital for achieving desired finish quality and performance characteristics.

Liquid Coating Sprayers Market Potential Customers

The primary end-users and potential customers of the Liquid Coating Sprayers Market are concentrated in large-scale manufacturing and critical maintenance sectors requiring high-quality, durable surface finishes. The most significant customer base resides within the Automotive industry, encompassing original equipment manufacturers (OEMs) for vehicle bodies and components, as well as the aftermarket and collision repair shops that rely on portable and manual systems. Aerospace and Defense customers represent a high-value segment, demanding specialized, high-precision sprayers for application of functional coatings, corrosion inhibitors, and specialized radar-absorbent materials, often requiring advanced electrostatic and robotic systems to meet stringent military and aviation standards for coating thickness and adhesion.

General Industrial customers, including manufacturers of heavy machinery, agricultural equipment, household appliances, and electronics casings, form the largest volume base, utilizing diverse sprayer types for protective and aesthetic finishes on metal, plastic, and composite parts. Furthermore, the Construction and Infrastructure sector is a massive consumer of airless sprayers and heavy-duty protective coating systems for applying fireproofing, waterproofing, and anti-corrosion treatments to bridges, pipelines, structural steel, and commercial buildings. The marine and shipbuilding industry also constitutes a niche but critical customer group, demanding specialized, high-pressure equipment for ultra-thick, anti-fouling, and highly durable protective coatings for vessels operating in harsh environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.09 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Graco Inc., The Wagner Group (J. Wagner GmbH), Nordson Corporation, Sames Kremlin SAS, Finishing Brands Global (Binks, DeVilbiss), Anest Iwata Corporation, Carlisle Fluid Technologies, Gema Switzerland GmbH, 3M Company, Ransburg Industrial Coating Equipment, Wilmar Corporation, EXEL Industries, SATA GmbH & Co. KG, Pittsburgh Spray Equipment Company, Ecco Finishing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Coating Sprayers Market Key Technology Landscape

The current technology landscape in the Liquid Coating Sprayers Market is defined by the pursuit of higher transfer efficiency (MTE), superior finish quality, and process automation, moving away from conventional low-efficiency systems. High Volume Low Pressure (HVLP) technology remains critical, utilizing a high volume of air at very low pressure to atomize paint, significantly reducing overspray and material waste, making it the preferred choice for applications requiring fine finish and strict VOC compliance. Simultaneously, Airless and Air-Assisted Airless technologies continue to evolve, enhancing pump designs (piston and diaphragm) to handle increasingly viscous, high-solids, or abrasive coatings used in protective and heavy-duty industrial applications, enabling high film build in a single pass.

Electrostatic spraying represents a pinnacle of efficiency, using an electrical charge on the atomized paint particles and grounding the substrate to attract the coating. This process dramatically increases MTE, particularly on metallic parts with complex geometries, ensuring paint wraps around edges (Faraday cage effect minimization). Recent innovations focus on combining electrostatic charging with advanced rotary atomizers and precise fluid metering systems to maintain consistency even with challenging waterborne coatings, which require specialized insulation and grounding techniques to facilitate effective charging. The integration of high-precision fluid dynamics controls, often managed by Programmable Logic Controllers (PLCs) and microprocessors, ensures repeatable results regardless of batch size or operator skill.

The most transformative trend is the pervasive integration of industrial robotics and automation systems into coating lines. These robotic systems utilize sophisticated 3D vision systems and advanced software algorithms (sometimes AI-enhanced) to determine optimal spray trajectories and speeds, resulting in unparalleled uniformity and speed. Modern coating booths feature advanced environmental controls, including temperature and humidity regulation, complemented by IoT sensors embedded in the spray equipment. These sensors wirelessly transmit performance data—such as nozzle wear, pressure drops, and material consumption—to central monitoring systems, facilitating real-time remote diagnostics and supporting the transition towards Industry 4.0 compliant smart factories across the global manufacturing base.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of growth, driven by massive investments in automotive production (China, India, Japan, South Korea) and aggressive infrastructure development. The region's demand is high for both advanced robotic systems in OEM plants and cost-effective, high-throughput airless sprayers for construction and shipbuilding. Rapid urbanization and subsequent industrial expansion create a sustained need for efficient coating solutions across diverse manufacturing segments, positioning APAC as the largest consumer of spray equipment by volume.

- North America: Characterized by high labor costs and stringent environmental regulations (EPA standards), North America leads in the adoption of automated, robotic spraying systems and high-efficiency technologies like HVLP and sophisticated electrostatic applicators. The market is driven by aerospace manufacturing, high-end automotive refinishing, and robust general industrial sectors prioritizing operational efficiency, material savings, and safety features.

- Europe: Europe represents a mature market defined by strict sustainability mandates (REACH regulations) which compel industries to utilize low-VOC, waterborne, and high-solids coatings. The European market focuses heavily on precision engineering, demanding highly reliable, German-engineered systems that offer exceptional control and repeatability, especially within the automotive, machinery manufacturing, and complex material application sectors (e.g., carbon fiber components).

- Latin America (LATAM): This region exhibits moderate but steady growth, heavily influenced by automotive assembly plants and infrastructure projects in countries like Brazil and Mexico. The market often balances cost-effectiveness with performance, showing significant usage of reliable Airless and entry-level Air-Assisted systems for large commercial painting and smaller industrial fabrication tasks.

- Middle East and Africa (MEA): Growth in MEA is spearheaded by large-scale oil and gas, infrastructure, and construction projects, necessitating heavy-duty protective coating sprayers (e.g., for pipelines, storage tanks, and industrial complexes). The demand is typically for rugged, high-pressure equipment capable of applying thick, specialized protective coatings resistant to extreme temperatures and corrosion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Coating Sprayers Market.- Graco Inc.

- The Wagner Group (J. Wagner GmbH)

- Nordson Corporation

- Sames Kremlin SAS

- Finishing Brands Global (Binks, DeVilbiss)

- Anest Iwata Corporation

- Carlisle Fluid Technologies

- Gema Switzerland GmbH

- 3M Company

- Ransburg Industrial Coating Equipment

- Wilmar Corporation

- EXEL Industries

- SATA GmbH & Co. KG

- Pittsburgh Spray Equipment Company

- Ecco Finishing

- Pneumatic Components Ltd (PCL)

- Fuji Spray

- Titan Tool Inc.

- Spray Engineering Devices Ltd.

- Astro Pneumatic Tool Company

Frequently Asked Questions

Analyze common user questions about the Liquid Coating Sprayers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of HVLP sprayers over traditional air sprayers?

The primary driver is the superior material transfer efficiency (MTE) of HVLP systems, which minimizes overspray, resulting in significant material cost savings and crucial compliance with environmental regulations regarding Volatile Organic Compound (VOC) emissions due to lower paint consumption.

How is environmental regulation influencing the design of new liquid coating sprayers?

Environmental regulations, particularly regarding VOC limits, necessitate the design of sprayers optimized for high-solids and waterborne coatings. This requires specialized fluid handling components, precise heating capabilities, and high-efficiency atomization techniques (like advanced electrostatic and HVLP) to ensure proper application and curing of these complex, eco-friendly materials.

Which end-use industry contributes most significantly to the Liquid Coating Sprayers Market revenue?

The Automotive sector, including both Original Equipment Manufacturers (OEM) and the large aftermarket segment, generates the highest revenue due to its requirement for ultra-high precision, automated coating processes, and continuous demand for high-quality, defect-free finishes on vehicle bodies and components.

What is the role of IoT and connectivity in modern industrial coating equipment?

IoT integration allows for real-time monitoring of critical operational parameters such as pressure, temperature, and flow rate. This data supports predictive maintenance scheduling, remote diagnostics, optimizes process control, and provides comprehensive traceability, aligning the equipment with Industry 4.0 smart factory protocols.

What are the main challenges facing the growth of automated liquid coating systems?

The primary challenges include the substantial initial capital investment required for robotic arms and integrated spray booths, the complexity associated with integrating these systems into existing production lines, and the necessity for highly specialized technical expertise for programming and maintenance of sophisticated automation software and hardware.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager