Liquid Flavor Enhancers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440996 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Liquid Flavor Enhancers Market Size

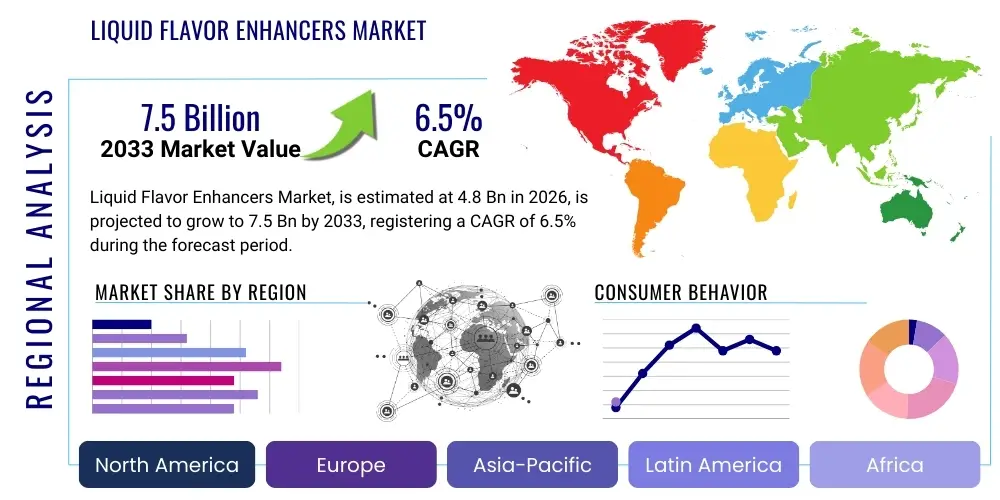

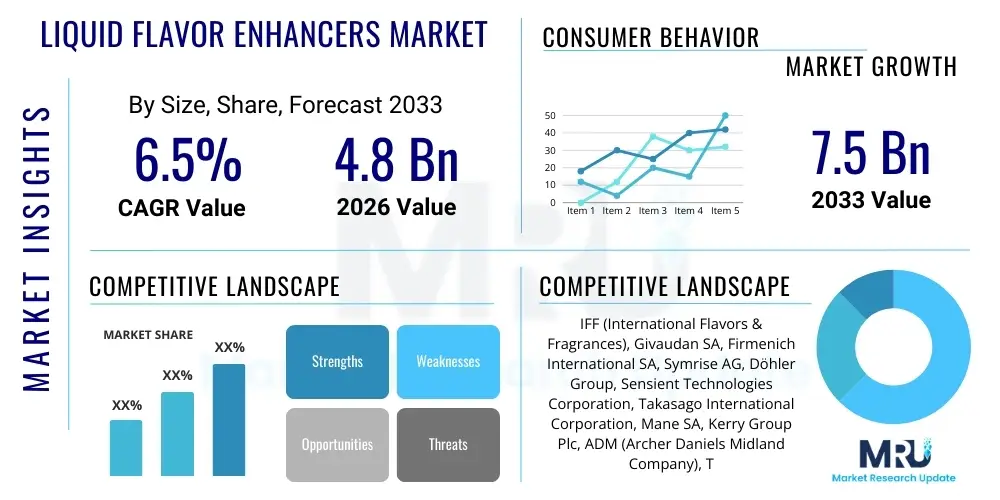

The Liquid Flavor Enhancers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the evolving consumer preference for customized, low-calorie, and functional beverage options, necessitating highly concentrated and easily dispensable flavor solutions. The shift away from traditional sugary sodas towards flavored water and sports drinks, coupled with innovations in natural flavor encapsulation technologies, further solidifies this upward trajectory.

Market expansion is also heavily influenced by the food service industry and the rapid growth of Ready-to-Drink (RTD) product categories globally. Liquid flavor enhancers offer manufacturers flexibility in production, enabling rapid adjustments to flavor profiles based on seasonal demand or trending tastes without complex reformulation processes. The efficiency and cost-effectiveness of liquid formulations compared to powdered or solid additives make them indispensable in large-scale industrial food and beverage production, ensuring consistency and ease of integration into continuous processing lines. This operational efficiency is a critical factor supporting the forecast growth rates across multiple application segments.

Liquid Flavor Enhancers Market introduction

The Liquid Flavor Enhancers Market encompasses concentrated liquid additives designed to modify, enhance, or impart specific sensory attributes, primarily taste and aroma, to food and beverage products. These products are high-potency formulations, often derived from natural extracts, synthetic compounds, or blends, which allow end-users—ranging from industrial food manufacturers to household consumers—to achieve desired flavor profiles with minimal product volume. Their primary application resides in enhancing plain beverages (like water and tea), dairy products, confectionery, and baked goods, offering versatility across diverse dietary needs, including low-sugar and high-protein formulations.

The primary benefits driving the adoption of liquid flavor enhancers include their superior solubility and dispersion characteristics compared to powdered alternatives, ease of use and dosage control, and their ability to withstand varied processing conditions (such as high heat or low pH). Key driving factors for market growth involve heightened consumer focus on hydration and wellness, leading to increased consumption of flavored functional water; the rising demand for customization and personalization in both commercial and home food preparation; and the continuous advancement in flavor technology, particularly in masking off-notes prevalent in functional ingredients like proteins and vitamins. These factors collectively push manufacturers towards sophisticated liquid delivery systems.

Liquid Flavor Enhancers Market Executive Summary

The Liquid Flavor Enhancers Market is characterized by robust business trends focusing on sustainability and clean label ingredients. Manufacturers are heavily investing in research and development to replace synthetic enhancers with natural sources, such as fruit and botanical extracts, responding directly to consumer scrutiny regarding artificial ingredients. Mergers, acquisitions, and strategic partnerships aimed at securing specialized extraction and formulation technologies are becoming common, driving consolidation and specialized expertise within the flavor industry. This emphasis on natural enhancement aligns with broader global food industry shifts toward transparency and health-centric formulations, particularly in the sports nutrition and weight management categories.

Regionally, North America and Europe currently dominate the market due to established infrastructure, high levels of consumer disposable income, and stringent regulatory environments fostering innovation in high-quality, safe ingredients. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by rapid urbanization, increasing Western dietary influences, and the expansion of the organized retail sector, leading to higher consumption of processed and convenience foods requiring flavor customization. Segment-wise, the natural flavor enhancer category is rapidly outpacing synthetic segments. Furthermore, the application segment focused on beverages, specifically functional and enhanced waters, maintains the largest market share, reflecting global trends towards healthy hydration.

AI Impact Analysis on Liquid Flavor Enhancers Market

User queries regarding AI’s impact on the Liquid Flavor Enhancers Market center primarily on how Artificial Intelligence and machine learning (ML) optimize flavor creation, predict consumer preferences, and enhance supply chain efficiency. Users frequently ask if AI can accurately design novel flavor combinations that appeal to niche demographic segments or mask undesirable tastes in emerging functional ingredients (like plant proteins). The central expectation is that AI will significantly accelerate R&D cycles, reducing the time and cost associated with sensory testing and iterative flavor modification. Concerns often revolve around the intellectual property of AI-generated formulas and the potential displacement of traditional flavor chemists.

AI's influence is transforming flavor development from an artisanal craft into a data-driven science. Machine learning algorithms analyze vast datasets of consumer feedback, regional taste trends, chemical compositions, and sensory panel results to rapidly identify successful flavor pairings and predict future market demand with high accuracy. This capability allows flavor houses to drastically reduce the iterative development time, often leading to proprietary formulas that are optimized for specific parameters such as cost, stability, and target demographic acceptance. Furthermore, AI models are increasingly utilized in quality control within manufacturing, ensuring batch-to-batch consistency in flavor concentration and delivery, which is paramount for concentrated liquid products.

- AI-driven Predictive Modeling: Forecasting flavor trends and consumer acceptance based on social media data and sales history, optimizing product launches.

- Accelerated R&D: Utilizing ML to analyze chemical structures and sensory data, speeding up the creation of novel or customized liquid enhancer formulations.

- Off-Note Masking Optimization: Deploying AI to precisely formulate enhancers that neutralize bitter, metallic, or earthy tastes associated with supplements and functional ingredients.

- Supply Chain and Inventory Management: Using predictive analytics to optimize raw material sourcing and inventory levels for high-demand natural extracts, minimizing waste.

- Automated Quality Control (QC): Implementing vision systems and analytical AI in production lines to ensure consistent color, viscosity, and concentration of liquid products.

- Personalized Flavor Recommendations: Potential future application in B2C platforms recommending specific enhancer profiles based on user health data and preferences.

DRO & Impact Forces Of Liquid Flavor Enhancers Market

The Liquid Flavor Enhancers Market is propelled by substantial drivers, primarily the burgeoning global demand for convenience foods and beverages that offer enhanced functionality, often requiring low or zero-calorie flavor solutions. However, the industry faces notable restraints, including stringent regulatory frameworks governing food additives, particularly in developed regions like the EU and North America, which necessitate costly and time-consuming approval processes for novel ingredients. Opportunities abound in the realm of natural and organic flavor sources, coupled with the application of advanced extraction technologies (like supercritical fluid extraction) to produce clean label, high-potency liquids. The interplay of these forces—the continuous consumer push for healthier customization and the technological ability to deliver it—defines the market’s high growth potential, even amid regulatory hurdles.

Impact forces currently shaping the competitive landscape include rapid ingredient substitution and technological obsolescence. As consumer preferences pivot quickly towards natural profiles, companies failing to invest in natural flavor chemistry risk losing market share to agile, innovative competitors. Furthermore, the intense price competition, especially in the high-volume artificial sweetener and flavor segments, pressures margins. The threat of substitutes is moderate, primarily stemming from advanced powdered concentrates that offer better stability in certain applications, though liquid enhancers generally maintain an advantage in immediate solubility and ease of dosing. Regulatory approval timelines serve as a powerful external force, impacting market entry and product commercialization strategies significantly, pushing companies toward ingredients with already established safety profiles.

The primary driver remains the shift in consumer health priorities. Consumers globally are actively reducing sugar intake while simultaneously demanding enhanced sensory experiences. Liquid flavor enhancers provide an ideal bridge, enabling manufacturers to deliver intense flavor without adding calories or compromising the nutritional profile of the base product, particularly visible in the water and sports drink categories. The expansion of niche dietary requirements, such as keto, vegan, and gluten-free diets, further mandates the use of highly specific, concentrated liquid ingredients that meet strict formulation criteria without adding bulk or non-compliant components. This flexibility ensures their continued indispensable role in product development across diverse segments.

Segmentation Analysis

The Liquid Flavor Enhancers Market is structurally segmented based on origin, type, application, and distribution channel, providing a granular view of consumption patterns and market potential. Origin segmentation, distinguishing between natural and artificial sources, is critical as consumer preference increasingly favors natural extracts, dictating R&D investment flows. Type segmentation covers various functional additives, including flavors specific to beverages, dairy, and confectionery, often categorized by taste profiles (e.g., fruit, sweet, savory, spice). Application segmentation highlights the dominance of the beverage industry, although significant growth is observed in savory food preparation and nutraceuticals. Analyzing these segments helps stakeholders pinpoint high-growth areas and tailor product offerings to specific end-user needs and regional regulatory requirements, ensuring targeted market penetration strategies.

- Origin:

- Natural Liquid Flavor Enhancers

- Artificial Liquid Flavor Enhancers

- Type:

- Fruit & Vegetable Flavors (e.g., Citrus, Berry, Tropical)

- Sweet Flavors (e.g., Vanilla, Chocolate, Caramel)

- Savory Flavors (e.g., Broth, Meat, Cheese)

- Spice & Herb Flavors (e.g., Cinnamon, Mint, Basil)

- Sweetener Enhancers (e.g., Stevia blends, Monk Fruit liquids)

- Application:

- Beverages (Water, Sports Drinks, Soft Drinks, Alcoholic Mixers, Tea & Coffee)

- Dairy Products (Yogurt, Milk, Ice Cream)

- Confectionery & Bakery

- Savory & Processed Foods

- Pharmaceuticals & Nutraceuticals

- Distribution Channel:

- B2B (Direct Sales to Manufacturers)

- B2C (Retail, E-commerce)

Value Chain Analysis For Liquid Flavor Enhancers Market

The value chain for liquid flavor enhancers begins with the upstream sourcing of raw materials, which involves the cultivation, harvest, and preliminary processing of natural ingredients (fruits, botanicals, spices) or the chemical synthesis of artificial compounds. This upstream segment is highly specialized, relying on secure supply chains for high-quality, traceable inputs. Extractors and chemical suppliers convert these raw materials into essential oils, distillates, and primary flavor molecules. Ensuring sustainable and ethical sourcing, particularly for exotic natural ingredients, is a growing priority in this initial stage, heavily influencing the final cost and market acceptance of the enhancer product.

The core value addition occurs in the manufacturing and formulation phase, where specialized flavor houses employ advanced techniques such as encapsulation, emulsification, and blending to stabilize the concentrated liquids, enhance their shelf life, and ensure functional performance (e.g., heat stability, solubility). This phase requires significant technological investment in R&D and quality control infrastructure. Distribution channels, both direct and indirect, link these specialized manufacturers to the downstream end-users. Direct distribution is common for large B2B contracts with major food and beverage corporations, ensuring precise customization and technical support. Indirect channels, involving regional distributors and specialized ingredient brokers, cater to smaller manufacturers and the retail B2C market.

The downstream analysis focuses on the integration of these liquid enhancers into the final consumer products across diverse applications—from global beverage giants requiring bulk solutions to local bakeries needing specialty flavor drops. End-user feedback loops are critical in this final stage, guiding future flavor development and modification. E-commerce platforms are increasingly important for B2C distribution, offering niche and customizable flavor kits directly to consumers, bypassing traditional retail intermediaries. The efficiency of the entire chain hinges on rigorous quality assurance at every step, ensuring the liquid concentrates maintain potency and safety until they reach the final consumer product.

Liquid Flavor Enhancers Market Potential Customers

The primary consumers of liquid flavor enhancers are large-scale food and beverage manufacturers that require consistent, high-potency ingredients for mass production. This includes multinational corporations in the soft drink, bottled water, and sports nutrition sectors, where flavor consistency and the ability to deliver specific functional attributes (like vitamin fortification or sugar reduction) are paramount. These B2B customers value liquid enhancers for their superior integration into automated production lines, reduced storage footprint, and precise dosing capability, which minimizes production variations and waste.

Secondary but rapidly growing segments include the dairy industry (for flavored milk and yogurt), the confectionery and baking industry (for highly concentrated extracts that withstand baking temperatures), and the specialized nutraceutical and pharmaceutical sectors. In nutraceuticals, liquid enhancers are indispensable for masking the often bitter or unpleasant tastes of essential vitamins, minerals, and functional botanicals, making supplements palatable. Additionally, the B2C segment, consisting of individual consumers and small artisanal food businesses, constitutes a crucial growing market, driven by the desire for personalized flavor customization in home cooking, baking, and beverage preparation, often utilizing concentrated flavor drops for water or coffee.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IFF (International Flavors & Fragrances), Givaudan SA, Firmenich International SA, Symrise AG, Döhler Group, Sensient Technologies Corporation, Takasago International Corporation, Mane SA, Kerry Group Plc, ADM (Archer Daniels Midland Company), Tate & Lyle PLC, B.V. Kikkoman Corporation, Synergy Flavors, Flavorchem Corporation, Treatt Plc, Gold Coast Ingredients, Wixon, T. Hasegawa Co., Ltd., WILD Flavors and Specialty Ingredients (Cargill), FONA International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Flavor Enhancers Market Key Technology Landscape

The technological landscape of the Liquid Flavor Enhancers Market is dominated by advancements in flavor delivery systems designed to maximize stability, bioavailability, and shelf life. Key technologies revolve around microencapsulation and nanoemulsification, which protect volatile flavor compounds from degradation caused by heat, light, oxidation, or pH variations during processing and storage. Microencapsulation involves trapping the liquid flavor within a protective polymer matrix, ensuring controlled release only when consumed or mixed, thereby preventing flavor loss and prolonging efficacy. This is particularly vital for highly volatile natural essential oils and extracts, improving their integration into water-based products where they normally exhibit poor solubility.

Another pivotal technological area is the refinement of natural extraction techniques, moving towards cleaner and more efficient methods such as Supercritical Fluid Extraction (SFE) using CO2. SFE allows for the precise isolation of desired flavor molecules without using harsh chemical solvents, aligning perfectly with the clean label trend that is currently sweeping the global food industry. Furthermore, advanced analytical chemistry techniques, including high-resolution mass spectrometry and nuclear magnetic resonance (NMR), are being used extensively for precise flavor profiling and quality control, ensuring that the liquid concentrates maintain their complex sensory signature batch after batch, which is crucial for maintaining brand consistency in global supply chains.

Finally, the integration of computational chemistry and AI platforms is emerging as a disruptive force. These technologies enable manufacturers to model and predict the stability and organoleptic properties of new flavor blends before physical synthesis, drastically cutting down on laboratory development time. Furthermore, specialized solvent systems and high-throughput screening methods are continuously being developed to create water-soluble liquid enhancers that are more concentrated and stable than previous generations, allowing end-users to achieve greater flavor impact with smaller inclusion rates, reducing overall formulation costs.

Regional Highlights

The global market for liquid flavor enhancers exhibits distinct regional consumption patterns and growth drivers, heavily influenced by local regulatory environments and dietary habits. North America and Europe currently represent the largest consumption hubs, characterized by high consumer awareness regarding diet and health, leading to a strong demand for low-sugar, high-protein, and functional beverages that rely heavily on sophisticated liquid flavor masking and enhancement technologies. These regions benefit from mature food processing infrastructure and the presence of leading global flavor houses, driving technological innovation and premium product offerings.

The Asia Pacific (APAC) region is forecasted to be the most rapidly expanding market, fueled by significant demographic and economic shifts. Increasing disposable incomes, fast-paced urbanization, and the growing acceptance of Western convenience foods are accelerating the demand for processed and packaged beverages requiring flavor enhancement. Countries like China, India, and Southeast Asian nations are seeing exponential growth in the consumption of bottled water and instant beverages. However, flavor profiles in APAC often lean towards unique tropical fruits, spices, and savory applications, necessitating customized product development tailored to local palates.

Latin America (LATAM) and the Middle East and Africa (MEA) also present considerable opportunities. In LATAM, the focus is shifting towards healthier hydration and away from traditional sugary drinks, driving demand for innovative liquid concentrates. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is experiencing significant growth in the ready-to-drink beverage sector and dairy consumption, requiring stable, heat-resistant liquid flavor formulations suitable for diverse distribution environments. Local regulatory compliance and climate considerations (storage stability) are key factors influencing product adoption in these emerging markets, requiring specialized manufacturing expertise.

- North America: Market leader driven by high penetration of health and wellness trends (zero-calorie water enhancers, sports nutrition) and established R&D infrastructure.

- Europe: Strong demand for natural and organic certified liquid enhancers, underpinned by strict clean-label regulations and sophisticated consumer expectations for traceability.

- Asia Pacific (APAC): Fastest-growing region, driven by urbanization, expanding middle class, high consumption of processed food, and demand for exotic local flavor profiles.

- Latin America (LATAM): Emerging market characterized by a pivot towards functional beverages and rising use of natural sweeteners (e.g., Stevia) in liquid formats.

- Middle East and Africa (MEA): Growing adoption in the dairy and packaged beverage industries; focus on heat-stable and cost-effective liquid solutions for mass market appeal.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Flavor Enhancers Market.- IFF (International Flavors & Fragrances)

- Givaudan SA

- Firmenich International SA

- Symrise AG

- Döhler Group

- Sensient Technologies Corporation

- Takasago International Corporation

- Mane SA

- Kerry Group Plc

- ADM (Archer Daniels Midland Company)

- Tate & Lyle PLC

- B.V. Kikkoman Corporation

- Synergy Flavors

- Flavorchem Corporation

- Treatt Plc

- Gold Coast Ingredients

- Wixon

- T. Hasegawa Co., Ltd.

- WILD Flavors and Specialty Ingredients (Cargill)

- FONA International

- Sethness Caramel Color

- Chr. Hansen Holding A/S

- Koninklijke DSM N.V.

- Ingredion Incorporated

- Corbion N.V.

- Naturex (Givaudan)

- Kalsec Inc.

- Omega Ingredients

Frequently Asked Questions

Analyze common user questions about the Liquid Flavor Enhancers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between liquid flavor enhancers and traditional flavor powders?

Liquid flavor enhancers offer superior solubility, especially in cold or water-based applications, ensuring immediate and uniform flavor dispersion. They also typically allow for more precise dosing in continuous industrial processes and are often used when moisture content must be carefully controlled, unlike some powders.

How are clean label trends impacting the development of liquid flavor enhancers?

The clean label movement mandates a shift from artificial colors and flavors towards natural liquid extracts derived from fruits, vegetables, and botanicals. This requires advanced extraction technologies (like SFE) to ensure high potency and stability of natural liquid concentrates without synthetic preservatives or solvents.

Which application segment currently dominates the Liquid Flavor Enhancers Market?

The beverage segment, specifically enhanced water, sports drinks, and functional beverages, holds the largest market share. This dominance is driven by global health trends promoting hydration and reduced sugar consumption, where liquid enhancers are crucial for delivering appealing taste without added calories.

What role does microencapsulation play in liquid flavor technology?

Microencapsulation protects volatile liquid flavor compounds from degradation (heat, light, oxidation) and ensures controlled release. This technology significantly improves the shelf life, stability, and sensory profile of the enhancer when integrated into complex food matrices or exposed to harsh processing conditions.

Which geographical region is anticipated to show the fastest growth rate?

Asia Pacific (APAC) is projected to exhibit the highest CAGR due to rapid economic development, changing consumer dietary habits favoring packaged foods and beverages, and increasing investment by major flavor houses to cater to region-specific taste preferences.

Are liquid flavor enhancers generally considered safe for consumption?

Yes, provided they comply with stringent regulatory standards set by bodies like the FDA (U.S.) and EFSA (Europe). Manufacturers must use approved ingredients and adhere to maximum inclusion limits. Clean-label and naturally derived enhancers are increasingly preferred by consumers due to perceived safety.

What are the key raw materials used in the production of natural liquid enhancers?

Key raw materials include essential oils extracted from citrus fruits, tropical fruits, and specialty botanicals like vanilla beans, cocoa beans, and various spices. Sourcing quality and sustainable raw materials is a critical and complex part of the upstream value chain.

How does the B2B distribution channel differ from B2C in this market?

B2B distribution involves direct, customized sales of bulk, highly concentrated formulations to large food and beverage manufacturers, often requiring specific technical support. B2C utilizes retail and e-commerce platforms to sell smaller, often consumer-ready liquid drops or concentrates for household use.

What impact do artificial sweeteners have on the flavor enhancer formulation process?

Artificial and high-intensity sweeteners (like sucralose or saccharin) often carry undesirable off-notes (e.g., bitterness). Flavor enhancers are crucial for masking these off-notes, creating a balanced and pleasant taste profile in low-sugar or zero-calorie liquid products, necessitating specialized flavor chemistry.

How is blockchain technology being adopted in the flavor market?

Blockchain is being explored primarily for supply chain transparency and traceability, particularly for high-value natural extracts. It allows manufacturers to verify the origin, quality, and ethical sourcing of ingredients, supporting clean label claims and reducing risk of fraudulent materials.

What is the shelf life expectancy of typical industrial liquid flavor concentrates?

The typical shelf life ranges from 6 to 24 months, highly dependent on the formulation, the use of encapsulation technology, the preservative system, and storage conditions. Concentrated liquid formats generally offer better long-term stability than many fresh or highly diluted flavorings.

Why are liquid flavors preferred over solid forms for beverages?

Liquid flavors integrate seamlessly and instantaneously into liquid bases without requiring prolonged mixing or concerns about incomplete dissolution, ensuring clarity and homogeneity in the final beverage product, which is crucial for consumer acceptance.

What is the main restraint preventing faster growth in the liquid flavor market?

The most significant restraint is the complex and highly regulated approval process for introducing novel food additives or flavor compounds, particularly in regions with strict regulatory bodies like the EU, leading to high compliance costs and extended time-to-market.

How does the sports nutrition segment utilize liquid flavor enhancers?

The sports nutrition segment relies heavily on liquid enhancers to flavor protein shakes, pre-workout mixes, and hydration solutions. Their primary function is masking the strong, often unpleasant, metallic or earthy tastes associated with high concentrations of whey protein isolates, BCAAs, and electrolytes.

What role do flavor stabilizers play in liquid enhancer formulations?

Flavor stabilizers, often emulsifiers or hydrocolloids, are crucial for preventing phase separation (creaming or sedimentation) in the liquid concentrate, ensuring that the flavor remains uniformly suspended and potent throughout its shelf life, particularly important for complex oil-in-water emulsions.

How is the confectionery industry adopting liquid flavor concentrates?

The confectionery industry uses highly concentrated liquid flavors to achieve vibrant, precise flavor profiles in gums, hard candies, and fillings. Liquids offer high heat stability and intense flavor delivery with minimal impact on the physical texture or moisture content of the finished candy.

What impact does regional palate preference have on product development?

Regional palate preference profoundly influences R&D. For example, APAC demands are high for authentic spice and savory notes, while Western markets focus on complex fruit blends and indulgent sweet profiles. Manufacturers must customize liquid flavor enhancer palettes specifically for local market acceptance.

What is Generative Engine Optimization (GEO) in the context of this market report?

GEO involves structuring the report content (headings, summaries, tables) in a clear, semantic, and highly organized manner using precise HTML tags and detailed lists, allowing large language models and generative AI systems to accurately parse, summarize, and retrieve specific market data points efficiently.

How are costs managed in the production of high-grade natural liquid flavor enhancers?

Costs are managed through optimized extraction yields (e.g., using SFE), long-term contracts with sustainable raw material suppliers to mitigate price volatility, and high-tech flavor concentration processes that maximize potency, reducing the required dosage per unit of final product.

What is the opportunity related to sustainable sourcing in this market?

The opportunity lies in securing certified, ethically sourced, and sustainable raw materials for natural liquid enhancers. Consumers and large corporate buyers increasingly prefer suppliers who demonstrate strong environmental stewardship and social responsibility, opening premium market segments.

How do liquid enhancers contribute to food waste reduction?

Their high concentration and stability mean less product is needed for flavoring, and their precise dosing capabilities minimize errors and batch failures during manufacturing, indirectly contributing to reduced ingredient spoilage and overall food waste.

What is the definition of a functional beverage in the context of flavor enhancement?

A functional beverage is enriched with health-promoting additives (vitamins, probiotics, protein, collagen). Liquid flavor enhancers are essential in these products to ensure the added functional components, which often have metallic or bitter tastes, are effectively masked to create a pleasant drinking experience.

Why is the dairy industry increasing its adoption of liquid flavor enhancers?

The dairy industry uses liquid enhancers to create a wide variety of flavored milks, yogurts, and ice creams, meeting consumer demand for flavor innovation. Liquid formats integrate well into cold dairy processes and help mask the often tart notes associated with fermented products like yogurt.

What are the primary risks associated with artificial liquid flavor enhancers?

Primary risks include regulatory changes leading to ingredient delisting, consumer resistance driven by clean-label preferences, and the potential for off-notes or flavor instability if not properly formulated. Manufacturers must continuously monitor global regulatory guidelines.

How is digitalization changing the sales process for liquid flavor ingredients?

Digitalization allows for more efficient B2B sales through customized online portals, enables virtual flavor sampling using advanced sensory data, and facilitates direct communication between flavor houses and R&D teams globally, accelerating the custom formulation process.

What are the differences between aqueous and oil-based liquid flavor enhancers?

Aqueous (water-based) enhancers are preferred for beverages and clear liquids due to high solubility. Oil-based enhancers, often used in emulsions or fat-containing products like confectionery and dairy, are necessary when the flavor molecule is hydrophobic (oil-soluble).

How do liquid flavor enhancers maintain flavor consistency across production batches?

Consistency is maintained through precise, highly automated dosing equipment and rigorous analytical testing (Gas Chromatography/Mass Spectrometry) of the liquid concentrate itself, ensuring the flavor profile and concentration adhere strictly to specifications before shipment to the end-user.

What technological challenge is posed by masking the taste of plant proteins?

Plant proteins (e.g., pea, soy, rice) often possess strong, inherent earthy or bitter notes. The technological challenge involves formulating liquid enhancers that chemically interact with these compounds or utilize high-impact flavor profiles to fully mask the undesirable taste without leaving an artificial aftertaste.

What are the current trends in tropical fruit liquid flavor enhancement?

Current trends involve complex, multi-fruit blends (e.g., mango-passionfruit-guava) often combined with subtle botanical notes (like hibiscus or elderflower) to create sophisticated and authentic tasting liquid concentrates for premium juice and sparkling water applications.

How does packaging innovation affect the B2C segment of the liquid flavor enhancer market?

B2C success relies heavily on convenient, precise dispensing packaging, such as squeeze bottles with measurement indicators or dropper mechanisms. Innovative packaging ensures product integrity, prevents spillage, and encourages controlled usage by the home consumer, maximizing value.

What is the role of regional distribution partners in the flavor market value chain?

Regional distributors provide essential local logistics, warehousing, and regulatory expertise. They bridge the gap between large flavor manufacturers and smaller, regional food producers, ensuring timely delivery and technical support tailored to local market needs and storage conditions.

How significant is the savory liquid flavor enhancer segment?

The savory segment, while smaller than beverages, is highly significant, driven by the demand for umami enhancers, liquid broths, and concentrated meat/cheese notes used in instant meals, processed meats, and sauces, providing high impact flavor with minimal added sodium.

What is the predicted impact of volatile raw material pricing on market profitability?

Volatility in pricing for natural raw materials, often subject to climate and geopolitical factors, can suppress profit margins for flavor houses. Companies mitigate this through long-term sourcing contracts and by investing in synthetic biology alternatives that offer stable, bio-identical compounds.

What are the primary factors driving M&A activities among flavor companies?

M&A activities are primarily driven by the need to acquire specialized technology (e.g., advanced extraction or microencapsulation IP), expand geographical reach (especially into high-growth APAC markets), and secure key talent in sensory and flavor chemistry.

How do Liquid Flavor Enhancers support personalized nutrition trends?

Liquid enhancers are critical for personalized nutrition by allowing consumers or specialized manufacturers to precisely adjust the flavor profile of bespoke nutrient bases (like personalized protein or vitamin blends) without altering the macro- or micronutrient content, enabling maximum palatability.

What are the challenges in maintaining the natural color of liquid botanical extracts?

Natural colors in botanical extracts are often highly sensitive to light, heat, and pH, leading to fading or browning. Advanced stabilization techniques, including specialized emulsion systems and microencapsulation, are necessary to maintain the visual appeal of the liquid enhancer.

What is the current competitive intensity level in the Liquid Flavor Enhancers Market?

Competitive intensity is high, characterized by the dominance of a few multinational giants (Givaudan, IFF, Symrise) that heavily invest in R&D and strategic acquisitions, while numerous smaller, specialized firms compete fiercely by offering niche, innovative, and highly natural ingredient solutions.

How do stringent European regulations affect product innovation?

Strict European regulations, particularly regarding the approval of synthetic ingredients and mandatory allergen labeling, force manufacturers to focus heavily on proven natural sources, clean label formulations, and rigorous safety documentation, leading to high-quality but slower innovation cycles.

What technological advancements are crucial for producing stable savory liquid enhancers?

For savory enhancers (like concentrated broths), crucial advancements include optimizing high-pressure processing (HPP) for microbial safety and using specific amino acid blends and flavor precursors to ensure a deep, authentic umami profile that remains stable under retort or sterilization conditions.

What is the projected future direction for sweetener-enhanced liquid flavor products?

The future direction involves the increased use of blended natural, high-intensity sweeteners (like Stevia and Monk Fruit) combined with specialized flavor modulators to eliminate the characteristic aftertaste, aiming to achieve the sensory experience of sugar without the caloric load.

In the Value Chain, why is the Formulation stage considered the most critical?

The formulation stage is most critical because it involves combining raw extracts into a stable, potent, and application-ready liquid concentrate. This requires proprietary knowledge in emulsification, stabilization, and blending to ensure the final product meets functional and safety specifications.

What are the key drivers for using liquid enhancers in coffee and tea products?

Liquid enhancers provide easy flavor customization in both B2C and B2B coffee/tea applications (e.g., syrups, concentrates). They offer consistent flavor delivery for high-volume foodservice operations and cater to consumer demand for unique, often seasonal, flavor pairings (e.g., pumpkin spice, lavender).

How is patenting intellectual property utilized in this market?

Companies actively patent new flavor molecules, advanced extraction methods, and specialized delivery systems (e.g., novel encapsulation matrices). IP protection is essential for securing a competitive advantage over proprietary flavor profiles that are costly and time-consuming to develop.

What is the typical concentration level for B2B liquid flavor enhancers?

Industrial B2B liquid flavor enhancers are typically highly concentrated, often requiring inclusion rates of less than 0.5% (w/w) in the final product. This high concentration minimizes transportation costs, storage requirements, and the impact on the base product formulation.

What is the primary barrier to entry for new companies in the liquid flavor enhancement market?

The primary barrier is the significant capital investment required for specialized R&D laboratories, advanced manufacturing equipment (especially for encapsulation), and the necessity of navigating complex global regulatory approval pathways for food additives.

How is the concept of ‘authenticity’ defined in flavor development today?

Authenticity is defined by the ability of the liquid enhancer to replicate the sensory experience of the natural source material (e.g., a real strawberry) with high fidelity. This often requires complex natural extract blending to capture both the taste and the aroma nuances, moving beyond simple single-note flavors.

How does climate change pose a risk to the natural flavor enhancer segment?

Climate change poses a risk by causing unpredictable yields and quality variations in key agricultural raw materials (e.g., vanilla, coffee, cocoa, and specific fruits), leading to raw material scarcity and price volatility for manufacturers relying on natural liquid extracts.

What is the significance of the shift from solvent-based to water-soluble liquid enhancers?

The shift is significant because water-soluble enhancers meet clean label demands by avoiding organic solvents, improve safety, and are essential for formulating clear, stable beverages where traditional oil-based extracts would cause cloudiness or instability.

How do manufacturers ensure the stability of citrus flavors in acidic liquid products?

Citrus flavors, being volatile, require specialized stabilization techniques, including high-efficiency emulsifiers and encapsulation within protective matrices, which shield the flavor molecules from the degradative effects of low pH and pasteurization heat common in fruit juice drinks.

What is the forecasted trend for artificial flavor enhancers through 2033?

While the overall market shifts toward natural alternatives, artificial enhancers will maintain relevance in segments where high-heat stability, low cost, or intense flavor impact (like certain confectioneries or non-food applications) are prioritized, though their growth rate will be slower than the natural segment.

What is the primary function of flavor modulators in liquid concentrates?

Flavor modulators are specialized liquid additives that do not impart a flavor themselves but alter the perception of other ingredients, enhancing sweetness, blocking bitterness (anti-bitterness), or increasing salt perception, critical for optimizing low-sodium or low-sugar liquid products.

How do manufacturers cater to the rising demand for vegan-certified liquid flavors?

To cater to vegan demand, manufacturers ensure that all carriers, solvents, and source materials used in the liquid concentrate formulation are strictly plant-derived, avoiding gelatin, carmine, dairy derivatives, or any animal testing, requiring rigorous supply chain verification.

What distinguishes flavor extracts from liquid flavor concentrates in this market?

Extracts are typically derived directly from the source material and may contain non-flavor components, whereas concentrates are highly refined liquid formulations where flavor components are intensified and often compounded with carriers and stabilizers for specific performance characteristics.

How is the pharmaceutical industry using concentrated liquid flavor enhancers?

Pharmaceutical companies use high-grade liquid flavors to improve patient compliance by making liquid medications (especially for pediatric and geriatric patients) more palatable, effectively masking the strong medicinal taste of active pharmaceutical ingredients (APIs).

What impact does the circular economy model have on flavor ingredient sourcing?

The circular economy encourages the utilization of by-products from other food processing operations (e.g., fruit peels, coffee husks) as sustainable raw materials for extracting liquid flavor components, reducing waste and creating new, traceable sources of natural flavor compounds.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager