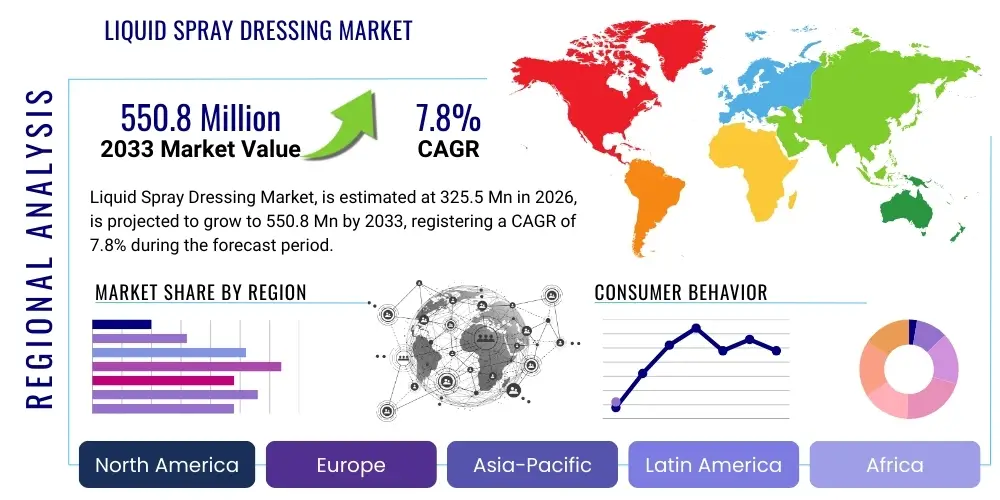

Liquid Spray Dressing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441253 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Liquid Spray Dressing Market Size

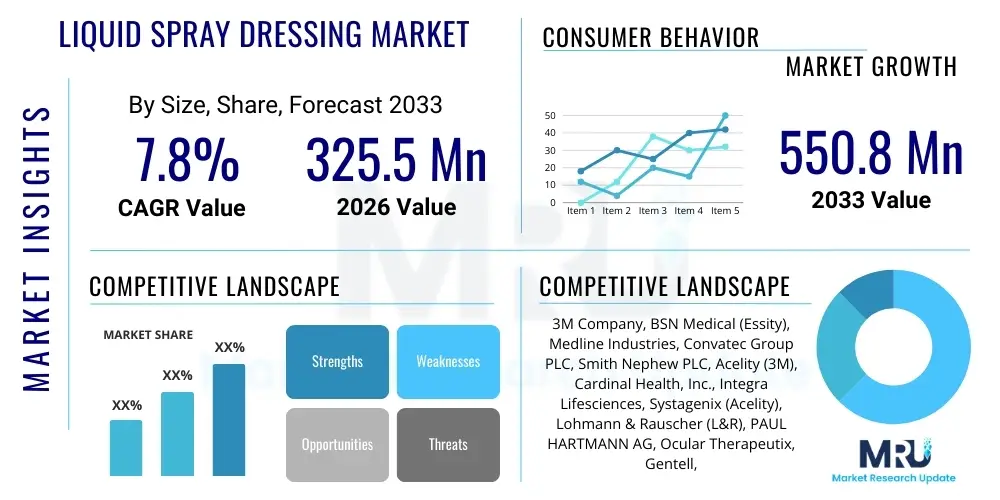

The Liquid Spray Dressing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 325.5 Million in 2026 and is projected to reach USD 550.8 Million by the end of the forecast period in 2033.

Liquid Spray Dressing Market introduction

The Liquid Spray Dressing Market encompasses sterile, film-forming liquid polymers dispensed via an aerosol spray system, designed to create a thin, transparent, and protective barrier over minor wounds, abrasions, burns, and surgical incisions. These dressings offer significant advantages over traditional gauze and adhesive bandages, primarily due to their ease of application, conformance to irregular body contours, and semi-permeable nature, which allows the wound to breathe while protecting it from external contaminants and moisture. Product innovation focuses heavily on enhancing breathability, improving adhesion characteristics, and integrating antimicrobial agents to prevent infection. The primary applications span across hospitals, surgical centers, emergency care, and, increasingly, home healthcare settings. The market growth is fundamentally driven by the rising prevalence of chronic wounds, the increasing number of surgical procedures globally, and the growing demand for convenient, non-invasive wound care solutions that minimize dressing changes and patient discomfort. Furthermore, the enhanced efficacy of newer formulations containing advanced healing promoters and biodegradable polymers is positioning spray dressings as a preferred choice in modern wound management protocols, especially for superficial or hard-to-reach injuries.

Liquid Spray Dressing Market Executive Summary

The Liquid Spray Dressing Market is characterized by robust growth stemming from accelerated adoption in both professional medical environments and consumer-level first aid kits, reflecting a global shift toward advanced and convenient wound care management. Key business trends indicate intensified merger and acquisition activities, particularly focused on consolidating proprietary technology related to film-forming polymers and aerosol delivery systems, ensuring manufacturers can offer highly durable, water-resistant, and flexible products. Regional trends highlight North America and Europe as dominant revenue generators due to sophisticated healthcare infrastructure and high disposable income, while the Asia Pacific region is demonstrating the fastest growth trajectory, spurred by expanding medical tourism, rapid urbanization, and significant government investment in improving hospital facilities and infection control standards. Segment trends reveal a strong performance in the chronic wound application segment, driven by the aging population and the associated rise in diabetes and pressure ulcers, coupled with a notable pivot towards specialized biodegradable and silicone-based formulations that reduce skin irritation and facilitate painless removal, thereby enhancing overall patient compliance and treatment efficacy across diverse demographic groups.

AI Impact Analysis on Liquid Spray Dressing Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Liquid Spray Dressing Market commonly revolve around three major themes: how AI can optimize manufacturing and supply chain processes, the potential for AI-driven personalized treatment plans utilizing advanced dressings, and the role of machine learning in accelerating new material discovery. Users express strong expectations for AI to automate quality control during the spraying mechanism assembly and formulation mixing, ensuring uniformity and sterility across large batches, which is critical for medical devices. Furthermore, significant interest lies in how AI-powered diagnostics (e.g., image analysis of wound healing progression) could dictate the specific timing and type of spray dressing reapplication, moving beyond standard clinical protocols toward precision wound care tailored to individual patient healing rates. Finally, there is considerable user anticipation that generative AI will dramatically shorten the R&D cycle for identifying novel, highly biocompatible polymers or intelligent additives that respond dynamically to changes in the wound microenvironment, such as pH or temperature fluctuations, enhancing the overall functionality of the dressing.

The integration of AI into the Liquid Spray Dressing lifecycle promises to revolutionize efficiency from production to post-market surveillance. In manufacturing, predictive maintenance driven by AI algorithms minimizes downtime and maximizes the yield of consistent, high-quality aerosol components. This sophisticated level of operational optimization reduces manufacturing costs and ensures the consistent quality required for regulatory compliance. Furthermore, the application of AI in clinical settings involves advanced image processing techniques where algorithms can assess wound size, depth, and infection status with higher accuracy than human visual inspection. This diagnostic capability allows healthcare providers to confirm the suitability of a spray dressing instantly and monitor its effectiveness remotely, thereby reducing the necessity for frequent in-person consultations and minimizing disruption to the protective barrier.

Looking forward, AI is expected to enable the next generation of smart spray dressings. This involves developing dressings that contain embedded biosensors whose data is processed by machine learning models to provide real-time feedback on the wound healing environment. These intelligent systems could potentially trigger the controlled release of therapeutic agents, such as growth factors or antibiotics, precisely when and where they are needed most. This predictive therapeutic capacity represents a paradigm shift from passive protection to active, responsive treatment. Moreover, AI will play an indispensable role in streamlining global regulatory approval processes by efficiently analyzing vast datasets of clinical trial results and identifying potential safety signals or efficacy trends much faster than traditional statistical methods, thereby accelerating market entry for innovative spray dressing technologies.

- AI optimizes manufacturing efficiency, minimizing defects in aerosol delivery systems.

- Machine learning enhances diagnostic accuracy for wound assessment, improving product selection.

- Predictive analytics supports supply chain management, ensuring timely availability of sterile products.

- AI accelerates R&D for novel, biocompatible, and responsive film-forming polymers.

- Intelligent monitoring systems enable remote tracking of wound healing under the spray film.

DRO & Impact Forces Of Liquid Spray Dressing Market

The Liquid Spray Dressing market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and impact forces. A major driver is the accelerating demographic shift towards an older population globally, which inherently increases the prevalence of chronic conditions like diabetes and vascular diseases, leading directly to a higher incidence of complex wounds requiring specialized, easy-to-apply dressings. This is compounded by the rising surgical volumes worldwide, where spray dressings are highly valued for securing primary closures and protecting incision sites post-operation, offering a superior alternative to traditional methods that might limit mobility or cause secondary tissue damage upon removal. The convenience, portability, and reduced application time associated with spray formats are powerful market motivators, particularly in emergency medicine and remote care settings where rapid response is critical, further bolstering adoption rates across various healthcare environments.

Conversely, the market faces significant restraints, primarily centered around regulatory hurdles and issues related to reimbursement policies. Classifying novel spray dressings, especially those containing advanced bio-active ingredients or specialized carriers, often involves protracted clinical trials and stringent regulatory reviews, particularly in markets governed by agencies like the FDA and EMA, which can delay product launches and increase development costs. Furthermore, in many developing economies, the relatively higher per-unit cost of specialized spray dressings compared to conventional bandages limits widespread adoption, particularly in public healthcare systems operating under tight budgetary constraints. Another technical restraint involves challenges related to consistent film thickness and even coverage, particularly in complex anatomical areas, and the difficulty some users experience in achieving adequate adherence without overspray.

The opportunities available within this market are substantial and primarily focused on technological advancement and geographic expansion. The development of biodegradable and environmentally friendly spray formulations presents a significant avenue for growth, appealing to increasing environmental consciousness among consumers and healthcare providers. Moreover, integrating highly effective antimicrobial peptides, antifungal agents, and analgesic components directly into the spray matrix promises a multifunctional product that not only protects but actively aids in infection prevention and pain management, commanding a premium price point and addressing critical clinical needs. From a geographic standpoint, strategic market penetration into emerging economies in Asia Pacific and Latin America, through localized manufacturing and optimized distribution channels, represents a vast, untapped consumer base poised for explosive growth as healthcare infrastructure modernization accelerates, shifting the global demand centroid over the forecast period.

Segmentation Analysis

The Liquid Spray Dressing Market is segmented extensively across application, product type, material, end-user, and distribution channel, providing a granular view of specific growth areas and consumer preferences. Understanding these segments is crucial for manufacturers looking to tailor their R&D efforts and marketing strategies to maximize market penetration. The application segment, for instance, dictates the performance requirements, with dressings for chronic wounds demanding long wear time and superior moisture management, whereas acute wound applications prioritize quick-drying and high flexibility. Product type segmentation distinguishes between generic protective sprays and specialized therapeutic sprays, with the latter commanding higher average selling prices due to incorporated active pharmaceutical ingredients (APIs) or advanced polymeric compositions, catering to complex clinical requirements. Geographic analysis further refines this view, highlighting disparate regulatory landscapes and healthcare expenditure patterns that influence segment uptake across continents.

- Product Type:

- Standard Protective Spray Dressings

- Therapeutic/Antimicrobial Spray Dressings

- Biodegradable Spray Dressings

- Waterproof and Flexible Sprays

- Application:

- Chronic Wounds (Diabetic Foot Ulcers, Pressure Ulcers, Venous Leg Ulcers)

- Acute Wounds (Burns, Cuts, Abrasions, Minor Traumas)

- Surgical Incision Sites

- Skin Tears and Blisters

- Material:

- Polyurethane

- Acrylic Co-Polymers

- Silicone-based Polymers

- Chitosan and Hydrocolloids (in spray form)

- End-User:

- Hospitals and Surgical Centers

- Specialized Clinics (Dermatology, Burn Centers)

- Ambulatory Surgical Centers (ASCs)

- Home Healthcare and First Aid

- Distribution Channel:

- Direct Sales (Institutional Procurement)

- Retail Pharmacy Chains

- Online Sales Channels (E-commerce)

Value Chain Analysis For Liquid Spray Dressing Market

The value chain for the Liquid Spray Dressing Market begins with complex upstream activities focused on the sourcing and synthesis of specialized chemical components. This stage involves the procurement of highly purified raw materials, primarily including film-forming polymers (such as medical-grade polyurethane or silicone), propellants (often non-flammable and medical-grade liquefied gases), and various stabilizing and active agents like antiseptics or moisturizers. Success at the upstream level is heavily dependent on maintaining rigorous quality control and securing reliable, long-term relationships with chemical manufacturers who can meet the stringent biocompatibility and sterility standards required for medical devices. High costs associated with R&D for novel, high-performance polymers that offer superior breathability and adherence represent a significant value add at this foundational stage, as these proprietary formulations often define the final product's clinical efficacy and market differentiation.

The midstream phase centers on manufacturing, packaging, and sterilization. This involves sophisticated, controlled environment processes where the liquid formulation is precisely mixed and filled into high-pressure aerosol cans, followed by valve crimping and application of the sterile cap. Sterilization, typically through methods like gamma irradiation or ethylene oxide, is a non-negotiable step that ensures product safety before distribution. Key downstream activities include inventory management and direct distribution to major institutional clients, such as large hospital networks, where contracts are often negotiated through specialized medical supply distributors. This direct channel accounts for a significant portion of the market value due to the high volume and consistency of institutional orders, necessitating efficient logistics and cold chain management for certain advanced formulations that may be temperature-sensitive.

The market employs both direct and indirect distribution channels. The direct channel focuses on major institutional buyers, leveraging specialized sales forces to educate clinicians and procurement managers on the clinical benefits and cost-effectiveness of the spray dressings. Conversely, the indirect channel, which includes retail pharmacies, drugstores, and the rapidly growing e-commerce platforms, targets the consumer segment for minor wound care and first aid applications. E-commerce platforms are becoming increasingly vital as they offer greater product transparency, competitive pricing, and convenience for home healthcare users. Effective utilization of both channels requires distinct marketing strategies: clinical evidence and cost-of-care analysis for the direct channel, and user-friendly packaging and clear instructions for the consumer-facing indirect channel, ensuring maximum market reach and customer engagement across all end-user segments.

Liquid Spray Dressing Market Potential Customers

The primary end-users and buyers of Liquid Spray Dressings span a wide spectrum of the healthcare ecosystem, ranging from acute care facilities to the rapidly expanding segment of consumer-level home care. Hospitals and large surgical centers represent the most significant institutional customers. These facilities consistently require high volumes of sterile, versatile dressings for use in operating rooms (post-operative incisions), emergency departments (trauma and burns), and general wards (managing minor abrasions and securing IV sites). The efficiency and speed of application provided by spray dressings are critical in high-throughput environments like emergency care, making them indispensable procurement items. Furthermore, specialized burn centers and wound care clinics heavily rely on these products because the non-contact application minimizes pain and the transparent film allows for continuous observation of the healing process without removal, a significant benefit for sensitive wounds.

Beyond institutional settings, ambulatory surgical centers (ASCs) and physician offices are increasingly important customers, particularly as more minor procedures shift out of traditional hospitals due to cost considerations. ASCs favor spray dressings for their inventory efficiency and ease of use, contributing to faster patient turnover and superior infection control post-procedure. The military and defense sectors also constitute a vital niche market. Field medics and combat support personnel require highly portable, durable, and quick-setting wound treatments for battlefield applications where environmental factors and immediate medical access are severely compromised. The ability of liquid spray dressings to instantly form a protective seal in austere conditions makes them essential tactical medical supplies, often requiring specialized, rugged packaging to ensure functional integrity in harsh environments.

The fastest-growing customer base is the home healthcare and retail consumer segment. Driven by the increasing prevalence of chronic diseases managed at home (e.g., elderly patients with diabetes or mobility issues) and the general consumer demand for superior, modern first aid products, retail sales through pharmacy chains and online platforms are skyrocketing. These individual consumers are drawn to the product's convenience, water resistance, and the ability to cover awkward body parts seamlessly. Home healthcare providers, who manage patient care outside the clinic, are key influencers in this segment, often recommending specific brands of spray dressings that offer easy application for caregivers and maximum comfort for patients, thereby driving consistent repeat purchases within the non-clinical distribution channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 325.5 Million |

| Market Forecast in 2033 | USD 550.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, BSN Medical (Essity), Medline Industries, Convatec Group PLC, Smith Nephew PLC, Acelity (3M), Cardinal Health, Inc., Integra Lifesciences, Systagenix (Acelity), Lohmann & Rauscher (L&R), PAUL HARTMANN AG, Ocular Therapeutix, Gentell, Inc., Molnlycke Health Care AB, Cure Medical, Derma Sciences (Integra), Avanos Medical, Inc., Organogenesis Inc., Advanced Medical Solutions Group PLC, ConvaTec Healthcare B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liquid Spray Dressing Market Key Technology Landscape

The technological landscape of the Liquid Spray Dressing Market is defined by continuous innovation across three main pillars: the formulation chemistry, the propellant and delivery system, and the integration of advanced functional additives. In formulation chemistry, the trend is moving away from simple acrylic films toward sophisticated polymeric blends, particularly those utilizing medical-grade silicone and highly engineered polyurethanes. Silicone-based formulations are gaining traction due to their superior biocompatibility, minimal adherence to the wound bed, and reduced potential for skin stripping upon removal or reapplication. Furthermore, the development of solvent-free or low-toxicity solvent systems is a major technological focus, addressing concerns regarding irritation and the environmental impact of traditional volatile organic compounds (VOCs). Researchers are concentrating on optimizing polymer chain length and cross-linking density to achieve a balance between mechanical strength, elasticity, and vapor permeability, essential features for an effective protective barrier that promotes moist wound healing.

In the delivery system domain, innovations are aimed at improving application control and consistency. Traditional high-VOC propellants are being phased out in favor of eco-friendly, non-flammable propellants like hydrofluoroalkanes (HFAs) or sophisticated airless pump systems that minimize propellant release while ensuring an even, fine mist. A key area of advancement involves nozzle design and valve mechanics engineered to control the spray pattern precisely, ensuring uniform coverage even on large or highly irregular surfaces, thereby preventing pooling or inconsistent film thickness, which can compromise the integrity of the barrier. Moreover, controlled dose delivery mechanisms are being developed to help clinicians manage inventory and ensure that the correct amount of active ingredient or film-forming solution is applied with each actuation, leading to greater standardization of care and reduction in material wastage across institutional settings.

The integration of functional additives represents the frontier of technological development, shifting spray dressings from passive barriers to active therapeutic agents. This includes encapsulating highly potent antimicrobial agents, such as silver nanoparticles, chlorhexidine, or specialized antimicrobial peptides (AMPs), which offer sustained release properties directly into the wound microenvironment to prevent colonization and treat incipient infections without systemic drug exposure. Additionally, incorporating growth factors, analgesic compounds (e.g., lidocaine), or moisturizers (like hyaluronic acid) into the spray matrix is enhancing the utility of these dressings, positioning them as comprehensive wound management tools that simultaneously protect, heal, and alleviate pain. Future technological advances are anticipated to focus on developing smart dressings that incorporate pH indicators or color-changing dyes which react to enzymatic activity or changes in bacterial load, providing clinicians with immediate, visual feedback on the wound's status without the need to disturb the protective film.

Regional Highlights

The global Liquid Spray Dressing Market exhibits distinct regional maturity and growth patterns, heavily influenced by healthcare spending, regulatory frameworks, and demographic shifts. North America, particularly the United States, holds the dominant share of the market revenue. This dominance is attributed to several key factors, including the presence of major industry players, extremely high levels of healthcare expenditure, sophisticated medical infrastructure, and a swift adoption rate of technologically advanced wound care products. The high prevalence of chronic diseases, such as obesity and diabetes, fuels the continuous demand for premium, specialized spray dressings to manage complex chronic ulcers effectively. Furthermore, robust reimbursement policies and a general willingness among consumers and healthcare systems to invest in products that demonstrably improve patient outcomes and reduce hospitalization time solidify North America's leadership position in innovation and market value.

Europe represents the second-largest market, characterized by stringent regulatory environments, especially under the European Medicines Agency (EMA), which ensures high standards of quality and efficacy. Countries like Germany, the UK, and France are significant contributors, driven by aging populations and well-established public healthcare systems that prioritize cost-effective wound management solutions. The European market shows a strong preference for environmentally sustainable products, driving demand for biodegradable polymer formulations and low-VOC propellants. Market growth in this region is steady, supported by institutional procurement protocols that favor long-term contracts with suppliers offering validated, clinically proven spray dressing technologies that align with established European wound care guidelines and infection control mandates.

Asia Pacific (APAC) is projected to be the fastest-growing market during the forecast period. This rapid expansion is fundamentally driven by colossal healthcare infrastructure development across emerging economies like China, India, and South Korea, coupled with significant growth in medical tourism and improving access to modern medical facilities. While pricing sensitivity remains a factor, rising disposable incomes, increasing awareness regarding advanced wound care, and governmental initiatives aimed at upgrading public health services are propelling the adoption of spray dressings. Manufacturers are increasingly focusing on establishing local production facilities and customized distribution networks within APAC to capitalize on the vast patient base and circumvent complex import logistics, indicating a strategic shift of manufacturing and distribution capabilities towards this high-growth region to satisfy escalating local demand efficiently.

- North America: Market leader due to high healthcare expenditure, rapid technological adoption, and high prevalence of chronic wounds.

- Europe: Second-largest market; focuses on clinical validation, stringent regulatory compliance, and demand for sustainable formulations.

- Asia Pacific (APAC): Fastest-growing region driven by massive infrastructure investments, increasing medical awareness, and a burgeoning patient population.

- Latin America (LATAM): Emerging growth market characterized by improving healthcare access and increasing foreign investment in medical device distribution.

- Middle East and Africa (MEA): Growth potential tied to urbanization, modernizing private healthcare sectors, and increasing focus on infection control protocols.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liquid Spray Dressing Market.- 3M Company

- BSN Medical (Essity)

- Medline Industries

- Convatec Group PLC

- Smith Nephew PLC

- Acelity (3M)

- Cardinal Health, Inc.

- Integra Lifesciences

- Systagenix (Acelity)

- Lohmann & Rauscher (L&R)

- PAUL HARTMANN AG

- Ocular Therapeutix

- Gentell, Inc.

- Molnlycke Health Care AB

- Cure Medical

- Derma Sciences (Integra)

- Avanos Medical, Inc.

- Organogenesis Inc.

- Advanced Medical Solutions Group PLC

- ConvaTec Healthcare B.V.

Frequently Asked Questions

Analyze common user questions about the Liquid Spray Dressing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of liquid spray dressings over traditional bandages?

Liquid spray dressings offer superior convenience, seamless conformity to irregular body contours, water resistance, and are semi-permeable, allowing oxygen exchange vital for healing while blocking bacteria. They minimize dressing changes and often reduce pain upon removal compared to adhesive bandages.

Are spray dressings suitable for deep or heavily exuding chronic wounds?

Generally, liquid spray dressings are best suited for superficial, minor wounds, abrasions, surgical incisions, and securing primary dressings. They are typically not recommended as the sole primary dressing for deep wounds or those with heavy exudate, which require dressings with high absorption capacity.

What are the main material types used in advanced liquid spray dressing formulations?

The primary materials include medical-grade polyurethane polymers, acrylic co-polymers, and advanced silicone-based formulations. Silicone is increasingly favored for its flexibility, breathability, and non-traumatic removal properties, enhancing patient comfort.

How is regulatory approval impacting the launch of new spray dressing technologies?

Regulatory bodies (like the FDA and EMA) require extensive biocompatibility and clinical efficacy data. New formulations, especially those incorporating antimicrobial agents or biologics, face protracted approval timelines, which is a significant factor affecting the speed of market entry for innovative products.

Which geographical region is experiencing the fastest growth in the Liquid Spray Dressing Market?

The Asia Pacific (APAC) region is projected to register the highest growth rate, driven by massive investments in healthcare infrastructure, increasing surgical volumes, rising disposable incomes, and greater adoption of modern, disposable medical products in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager