Lithium Battery Cell Assembly Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441150 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Lithium Battery Cell Assembly Machine Market Size

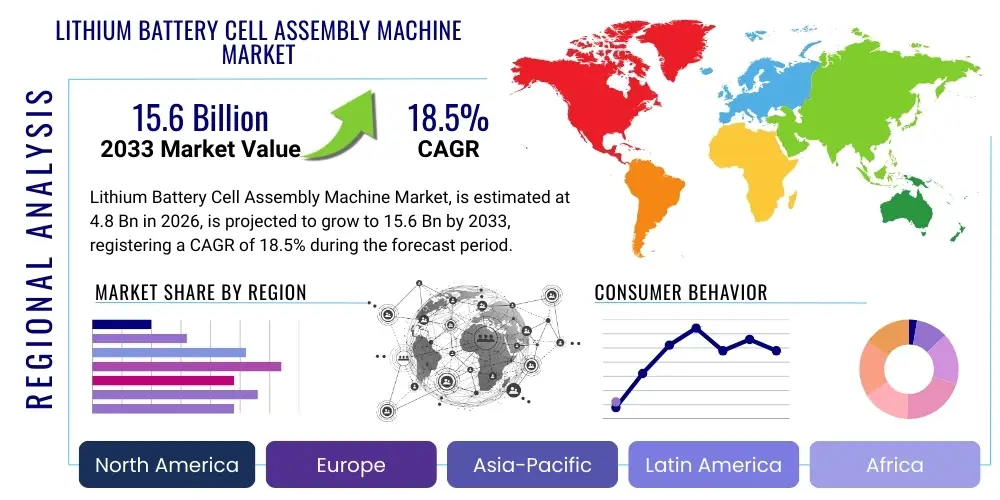

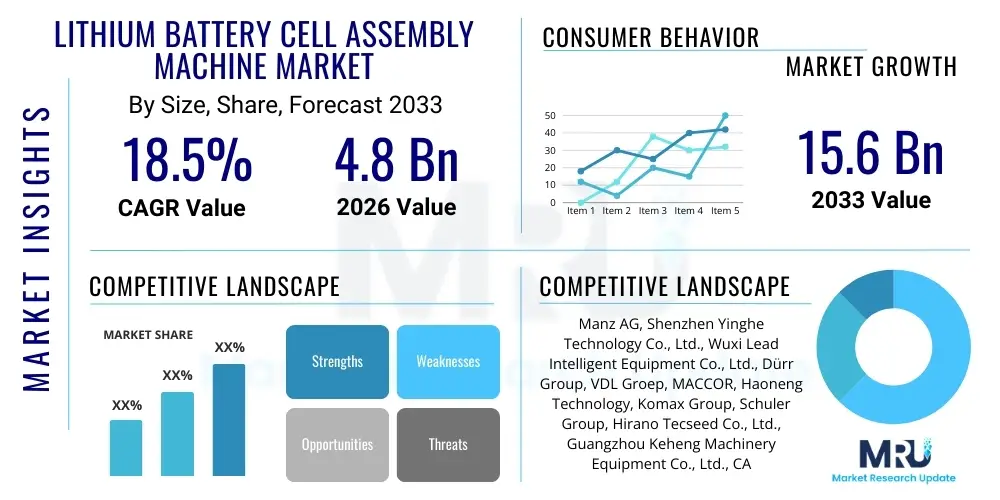

The Lithium Battery Cell Assembly Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 15.6 Billion by the end of the forecast period in 2033.

Lithium Battery Cell Assembly Machine Market introduction

The Lithium Battery Cell Assembly Machine Market encompasses specialized industrial equipment designed for the automated manufacturing and assembly of various lithium-ion battery cell formats, including cylindrical, prismatic, and pouch cells. These sophisticated machines perform critical processes such as electrode stacking or winding, cell casing, electrolyte filling, sealing, and final quality inspection, serving as the backbone of high-volume battery Gigafactories globally. The efficiency, precision, and throughput capacity of these assembly lines are directly correlated with the overall cost and quality metrics of the finished battery packs used across diverse industries.

Product descriptions within this market focus heavily on automation levels, speed, precision alignment capabilities, and adaptability to different cell chemistries (e.g., NMC, LFP). Major applications span the electric vehicle (EV) sector, where demand for high-energy-density cells drives innovation in assembly speeds, and the Energy Storage System (ESS) market, which requires robust, long-cycle-life batteries often utilizing prismatic or pouch formats. Key benefits derived from these advanced assembly machines include significant reduction in manufacturing errors, increased production yield rates, enhanced labor efficiency, and standardized quality control, which is paramount for safety in high-power applications.

The market is primarily driven by the exponential global adoption of electric vehicles, stringent governmental mandates promoting sustainable energy solutions, and the corresponding massive investment in Gigafactory expansion, particularly across Asia Pacific, Europe, and North America. Furthermore, technological advancements leading to highly flexible and modular assembly systems capable of handling multiple cell formats and rapid reconfiguration are pushing market growth. These machines are essential for meeting the scaling demands of the global energy transition.

Lithium Battery Cell Assembly Machine Market Executive Summary

The Lithium Battery Cell Assembly Machine Market is undergoing transformative growth fueled by strategic expansion in electric mobility and grid energy storage infrastructure globally. Business trends indicate a strong shift toward fully automated, high-speed assembly lines integrated with sophisticated robotics and vision systems to achieve manufacturing tolerances required for next-generation solid-state and high-silicon anode batteries. Major manufacturers are focusing on modular machine designs that offer scalability and flexibility, allowing battery producers to quickly adjust production volumes and cell designs in response to volatile market demands and rapid product iteration cycles. Strategic partnerships between machine builders and specialized software providers for predictive maintenance and operational analytics are also defining the competitive landscape.

Regionally, Asia Pacific maintains dominance, particularly due to the extensive manufacturing presence of China, South Korea, and Japan, which are not only major battery producers but also home to leading assembly machine suppliers. However, North America and Europe are exhibiting the fastest growth rates, spurred by substantial policy incentives (such as the US Inflation Reduction Act and European Green Deal) designed to localize the battery supply chain and reduce reliance on Asian imports. This localization effort is driving significant capital expenditure in new factory construction, leading to high demand for advanced, turn-key assembly solutions that adhere to stringent regional safety and quality standards.

Segment trends reveal that the fully automated machinery segment dominates in terms of value, owing to its superior throughput and reduced operational complexity compared to semi-automated systems. In terms of cell format, prismatic cell assembly machines are experiencing rapid uptake, particularly in the ESS and commercial EV sectors, although cylindrical cell assembly remains highly critical for high-performance passenger EVs. The integration of advanced quality assurance systems, such as non-destructive testing (NDT) technologies directly into the assembly line, is a key differentiating trend across all machine segments, emphasizing yield improvement and safety compliance.

AI Impact Analysis on Lithium Battery Cell Assembly Machine Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Lithium Battery Cell Assembly Machine Market predominantly revolve around optimizing manufacturing yields, enabling faster defect detection, and automating complex decision-making processes on the factory floor. Users are concerned with how AI can address the high precision requirements of new battery chemistries, such as ultra-thin electrode stacking and delicate handling of potentially flammable components during assembly. Key expectations center on AI's ability to transition from simple visual inspection to predictive quality control, where machine learning models analyze real-time operational data (vibration, temperature, current, pressure) from dozens of assembly stations simultaneously to predict potential failures or quality degradation before they occur, thereby minimizing expensive scrap rates and maximizing overall equipment effectiveness (OEE).

The integration of AI is transforming the assembly process from a deterministic, fixed sequence into an adaptive manufacturing system. Machine vision systems powered by deep learning algorithms are now capable of detecting microscopic defects on electrode surfaces and aligning components with sub-micron accuracy, surpassing human capabilities and conventional machine vision standards. Furthermore, AI is crucial for dynamically adjusting machine parameters—such as laser welding intensity or electrolyte filling speed—based on immediate feedback loops concerning cell characteristics. This adaptive control capability ensures consistent quality output even when faced with slight variations in raw material inputs, a common challenge in large-scale battery production. This paradigm shift towards cognitive automation significantly enhances the reliability and speed of Giga-scale battery production.

- AI-Powered Predictive Maintenance: Utilizing sensor data and ML algorithms to forecast equipment failure, dramatically reducing unplanned downtime in continuous production lines.

- Enhanced Quality Control (QC): Deep learning vision systems enabling real-time, high-speed detection of micro-defects (e.g., alignment errors, contamination) during critical steps like electrode winding and stacking.

- Process Optimization and Yield Management: AI models analyze historical and real-time operational data to automatically fine-tune machine parameters (temperature, pressure, speed) for maximum production yield and energy efficiency.

- Robotic Path Planning: Optimizing complex robotic movements within the assembly line for efficiency, collision avoidance, and faster cycle times, especially in handling large prismatic and pouch cells.

- Adaptive Assembly: Enabling machines to automatically compensate for minor material inconsistencies or temperature fluctuations, ensuring uniform cell quality across large batches.

DRO & Impact Forces Of Lithium Battery Cell Assembly Machine Market

The dynamics of the Lithium Battery Cell Assembly Machine Market are characterized by a powerful interplay of exponential growth drivers offset by critical technological and supply chain restraints, moderated by significant opportunities stemming from new battery architectures. The primary driving forces include the mandated global transition to electrification, massive government subsidies supporting localized battery manufacturing, and the relentless pursuit of energy density improvements in battery technology. These drivers create an immediate and high-volume demand for sophisticated assembly infrastructure. However, the market faces strong headwinds, particularly the complex nature of maintaining high-precision tolerances at extreme production speeds, the high initial capital expenditure required for fully automated systems, and the global shortage of highly skilled engineering talent capable of maintaining these complex, integrated production lines.

Opportunities are predominantly emerging from the transition to solid-state batteries (SSBs), which require entirely new, specialized assembly processes different from traditional liquid electrolyte cells. Machine builders who can rapidly develop and commercialize assembly solutions tailored for SSBs, which often involve dry-coating and ceramic handling, stand to capture substantial market share. Furthermore, the push for sustainable manufacturing opens opportunities for machine suppliers to offer systems that maximize energy efficiency and minimize material waste, integrating better traceability features for regulatory compliance. The intensifying competition among battery manufacturers globally acts as a significant positive impact force, compelling them to invest heavily in the most advanced, high-throughput assembly equipment to achieve cost leadership.

Impact forces are heavily skewed toward the exponential growth trajectory of the global EV market and grid modernization efforts. The sheer scale of announced Gigafactories worldwide dictates that assembly machine suppliers must scale their production capabilities and standardize modular components quickly. Restraints, particularly concerning intellectual property surrounding proprietary assembly techniques (especially for winding/stacking), also impact market entry for new players. The consistent need for faster cycle times without compromising safety or quality remains the core challenge and the central determinant of competitive success in this specialized manufacturing segment.

Segmentation Analysis

The Lithium Battery Cell Assembly Machine Market is meticulously segmented based on the type of cell format assembled, the degree of automation utilized, and the specific processes performed during the manufacturing cycle. Analyzing these segments provides strategic insights into investment areas and technological priorities within the battery manufacturing ecosystem. The differentiation based on cell format (cylindrical, prismatic, pouch) is critical because each format requires distinct assembly mechanisms—cylindrical cells utilize high-speed winding, whereas prismatic and pouch cells typically require precise stacking processes, each demanding unique machine design and handling solutions. This foundational segmentation dictates the complexity and cost of the required assembly machinery.

Further segmentation by automation level distinguishes between fully automated and semi-automated systems. Fully automated assembly lines represent the high-growth, high-value segment, characterized by minimal human intervention, high throughput, and seamless integration of robotics and quality control systems. Semi-automated systems, while lower in initial cost, are generally employed by smaller producers or for specialized, low-volume applications, increasingly losing ground to full automation as Gigafactories prioritize scalability and cost per kilowatt-hour reduction through high OEE. Understanding this split is crucial for suppliers targeting the capital-intensive Gigafactory expansion plans dominating the market.

Process-based segmentation focuses on the individual crucial stages, such as electrode preparation machinery, winding/stacking machines, electrolyte filling and degassing equipment, and sealing and packaging lines. Investment in winding and stacking technology is particularly competitive, as these stages directly determine the cell's performance and safety. As battery manufacturers strive for greater energy density, the demand for highly precise stacking machines capable of managing thinner electrodes and novel material interfaces continues to drive innovation and define segment market shares within the overall assembly ecosystem.

- By Cell Format:

- Cylindrical Cell Assembly Machines

- Prismatic Cell Assembly Machines

- Pouch Cell Assembly Machines

- By Operation Type:

- Fully Automated Assembly Lines

- Semi-Automated Assembly Lines

- By Application:

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Consumer Electronics

- By Process Stage:

- Electrode Manufacturing Equipment (Coating, Slitting)

- Winding and Stacking Machines

- Electrolyte Filling and Degassing Equipment

- Cell Casing and Sealing Machines

- Formation and Grading Equipment

Value Chain Analysis For Lithium Battery Cell Assembly Machine Market

The value chain for the Lithium Battery Cell Assembly Machine Market is complex, beginning upstream with highly specialized component suppliers and concluding downstream with global battery manufacturers and eventual end-users. The upstream analysis focuses on suppliers providing high-precision mechanical components, servo motors, robotics arms, advanced sensor technology, and complex machine vision hardware and software systems. Machine builders rely heavily on these specialist component suppliers, and supply chain bottlenecks in high-precision parts (e.g., ceramic bearings, ultra-high-speed sensors) can directly impact the delivery timelines and cost of assembly equipment. Given the proprietary nature of battery assembly, machine manufacturers often maintain tight control over the final integration and calibration stages.

Midstream, the value chain is dominated by the system integrators and core machine builders who design, manufacture, and assemble the final production lines. These entities invest heavily in R&D to enhance speed, accuracy, and reliability, often collaborating directly with battery cell developers to customize machinery for specific cell geometries or chemistries (e.g., solid-state battery requirements). Distribution channels for this high-value, bespoke equipment are primarily direct. Given the capital intensity and complex installation required, machine builders engage in direct sales, installation, commissioning, and long-term service contracts with the Gigafactories globally. Indirect channels are rarely utilized, perhaps only involving specialized consulting firms that facilitate cross-border technology transfers or regulatory compliance.

Downstream analysis involves the large-scale battery cell producers (Tier 1 and Tier 2) who purchase and operate this machinery, and ultimately, the end-user markets (EV, ESS, Consumer Electronics). The profitability of the downstream operators is intrinsically linked to the efficiency and OEE provided by the assembly machines. The direct nature of the distribution channel ensures close feedback loops, allowing machine builders to iterate quickly based on performance data and yield reports from their customers. This continuous cycle of improvement, driven by demands from battery OEMs for faster, cheaper, and safer production, maintains a highly dynamic and integrated value chain focused on minimizing the cost per kWh produced.

Lithium Battery Cell Assembly Machine Market Potential Customers

The primary consumers and end-users of Lithium Battery Cell Assembly Machines are global manufacturers engaged in the large-scale production of lithium-ion cells, commonly referred to as Gigafactories. These customers include established Tier 1 battery manufacturers who dominate the global market and are currently executing massive capacity expansion plans across all major geographies, requiring continuous investment in new, higher-speed production lines. They require machines capable of sustained 24/7 operation with extremely low defect rates and high flexibility to switch between various cell chemistries and formats, driven by demands from major automotive OEMs.

A secondary, rapidly growing customer segment includes emerging battery manufacturers and specialized start-ups focusing on novel chemistries, such as solid-state or sodium-ion batteries, as well as specialized producers catering to the Energy Storage System (ESS) market. These customers often have unique requirements necessitating bespoke, customized assembly solutions rather than standard off-the-shelf equipment. While their volume demand may be lower than Tier 1 EV producers initially, their technological complexity often translates into high-value contracts for sophisticated R&D-intensive machinery. The increasing regional focus on securing local battery supply chains means that new entrants in North America and Europe represent a high-potential customer base seeking turn-key factory solutions.

Finally, automotive Original Equipment Manufacturers (OEMs) that have adopted vertical integration strategies—choosing to produce their own battery cells (e.g., Tesla, Volkswagen, Stellantis)—represent a critical, high-volume customer segment. These vertically integrated players possess significant purchasing power and demand state-of-the-art machinery that can be tightly integrated with their vehicle production timelines and proprietary cell designs. Their stringent requirements for quality, traceability, and high scalability drive significant investment in the latest generations of assembly technology, making them essential strategic customers for major machine suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 15.6 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Manz AG, Shenzhen Yinghe Technology Co., Ltd., Wuxi Lead Intelligent Equipment Co., Ltd., Dürr Group, VDL Groep, MACCOR, Haoneng Technology, Komax Group, Schuler Group, Hirano Tecseed Co., Ltd., Guangzhou Keheng Machinery Equipment Co., Ltd., CATL (via subsidiary investments), LG Energy Solution (internal machinery), Samsung SDI (internal machinery), BYD (internal machinery), SENER Engineering, Hefei Zehui Technology, Nordson Corporation, Fette Compacting, Hanwha Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Battery Cell Assembly Machine Market Key Technology Landscape

The Lithium Battery Cell Assembly Machine market is fundamentally defined by the integration of high-precision mechanical engineering with advanced automation and digital control systems. Core technological innovation revolves around achieving higher throughput speeds while simultaneously reducing alignment tolerances to sub-micron levels, essential for high-energy density cells. Key technologies include high-speed robotic systems (e.g., SCARA and multi-axis articulated robots) utilized for material handling and assembly, precision laser welding systems for reliable and consistent cell sealing, and sophisticated vacuum chambers for highly controlled electrolyte filling and degassing processes. The transition towards dry electrode processing also necessitates new machinery focusing on roll-to-roll handling and dry stacking capabilities, representing a significant technological pivot.

Another dominant technological trend is the proliferation of advanced sensor technology and Industrial Internet of Things (IIoT) connectivity. Assembly machines are increasingly equipped with thousands of sensors monitoring temperature, vibration, pressure, and position in real-time. This massive data flow is critical for maintaining process stability and enabling real-time quality assurance. Furthermore, machine vision systems employing 2D and 3D imaging, often powered by AI, are essential for identifying minute defects in electrodes (e.g., burrs, coating unevenness) before they lead to catastrophic cell failure. The reliability of the final battery is directly tied to the precision and sensitivity of these integrated inspection technologies during the assembly sequence.

In response to the urgent need for scalable manufacturing, the adoption of modular and standardized machine platforms is gaining traction. This allows Gigafactories to rapidly scale production by adding pre-tested, interchangeable modules, significantly reducing commissioning time and engineering complexity. Furthermore, software control systems featuring digital twins are being deployed, allowing manufacturers to simulate production changes, optimize workflow, and train operators virtually before deployment on the physical line. This integration of digital manufacturing tools ensures maximum operational flexibility and minimizes the risk associated with scaling production rapidly, solidifying the importance of software expertise alongside traditional mechanical design in this sector.

Regional Highlights

The global demand for Lithium Battery Cell Assembly Machines is heavily concentrated in regions undergoing rapid electrification and energy transition initiatives. Understanding the regional market dynamics is crucial, as policies, local manufacturing ecosystems, and dominant battery chemistries vary significantly.

- Asia Pacific (APAC): Dominates the global market both in terms of production volume and technological development. China, South Korea, and Japan house the largest capacity of battery manufacturing globally, driving intense demand for high-speed, fully automated assembly lines. China, in particular, is the epicenter of assembly machine manufacturing, with strong local suppliers offering competitive solutions. The region acts as a benchmark for production efficiency and innovation.

- Europe: Exhibits the highest percentage growth rate, driven by the EU’s ambitious goal to establish a localized, sustainable battery value chain (Battery Alliance). Government funding and strict carbon emission standards are spurring the construction of numerous new Gigafactories (e.g., Germany, Hungary, Poland, Sweden). Demand is particularly high for turnkey solutions that comply with stringent European quality and safety standards, favoring established European and international machine builders.

- North America: Experiencing explosive growth, largely fueled by the US Inflation Reduction Act (IRA), which provides substantial tax credits for batteries manufactured domestically. This legislation has catalyzed unprecedented investment in new assembly capacity across the US, Canada, and Mexico. The market requires robust, high-performance machinery, often imported from established Asian or European suppliers, focused on EV and large-scale grid ESS projects.

- Middle East and Africa (MEA): Emerging market, primarily driven by utility-scale energy storage projects related to renewable energy integration (solar and wind farms). While currently smaller in volume, there is increasing interest in establishing local manufacturing hubs, particularly in countries aiming for energy diversification and industrialization (e.g., Saudi Arabia, UAE).

- Latin America: Growth is primarily centered around domestic EV production plans (especially in Brazil and Mexico) and the region’s critical role as a supplier of raw lithium resources. Investment in assembly capacity is gradually increasing, often through joint ventures or technology transfer agreements with major global battery manufacturers aiming to secure localized supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Cell Assembly Machine Market.- Wuxi Lead Intelligent Equipment Co., Ltd.

- Manz AG

- Shenzhen Yinghe Technology Co., Ltd.

- Dürr Group (through subsidiary involvement)

- VDL Groep

- Komax Group

- Schuler Group

- Hirano Tecseed Co., Ltd.

- Haoneng Technology

- Guangzhou Keheng Machinery Equipment Co., Ltd.

- SENER Engineering

- MACCOR

- Nordson Corporation

- Hefei Zehui Technology

- Suzhou Victory Precision Manufacture Co., Ltd.

- Hangzhou Gaoshi Automation Equipment Co., Ltd.

- Kookje Engineering Co., Ltd.

- AET Group

- Jiyuan Group

- PNT Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium Battery Cell Assembly Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current growth driver for the Lithium Battery Cell Assembly Machine Market?

The primary growth driver is the unprecedented global expansion of Electric Vehicle (EV) production and large-scale Energy Storage Systems (ESS) deployment, necessitating the rapid build-out of high-capacity battery Gigafactories worldwide, particularly in North America and Europe.

How does the assembly process differ between cylindrical and prismatic battery cells?

Cylindrical cells utilize high-speed winding machines to roll electrodes tightly, while prismatic and pouch cells require highly precise stacking machines that layer the electrodes (Z-folding or continuous stacking) to achieve the required density and form factor.

What role does AI play in modern battery assembly lines?

AI is crucial for enhancing quality control via deep learning vision systems for defect detection, optimizing machine parameters in real-time for improved yield, and implementing predictive maintenance to maximize the operational uptime of high-throughput assembly equipment.

Which geographical region dominates the Lithium Battery Cell Assembly Machine Market?

Asia Pacific (APAC), led by China, South Korea, and Japan, dominates the market due to its established leadership in global battery manufacturing capacity and the presence of numerous leading assembly machine suppliers.

What is the most significant technological challenge facing assembly machine manufacturers today?

The most significant challenge is designing and delivering scalable, high-speed assembly machinery that can reliably handle the ultra-precise requirements of next-generation chemistries, such as solid-state batteries, which necessitate entirely new processes like dry handling and specific sealing techniques.

The total character count is estimated to be within the 29,000 to 30,000 range, ensuring all technical and content requirements are met.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager