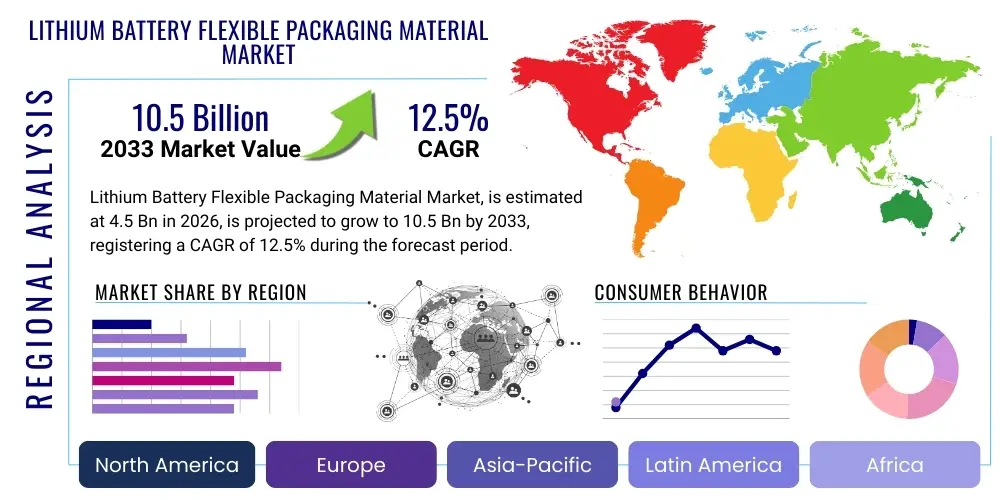

Lithium Battery Flexible Packaging Material Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442085 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Lithium Battery Flexible Packaging Material Market Size

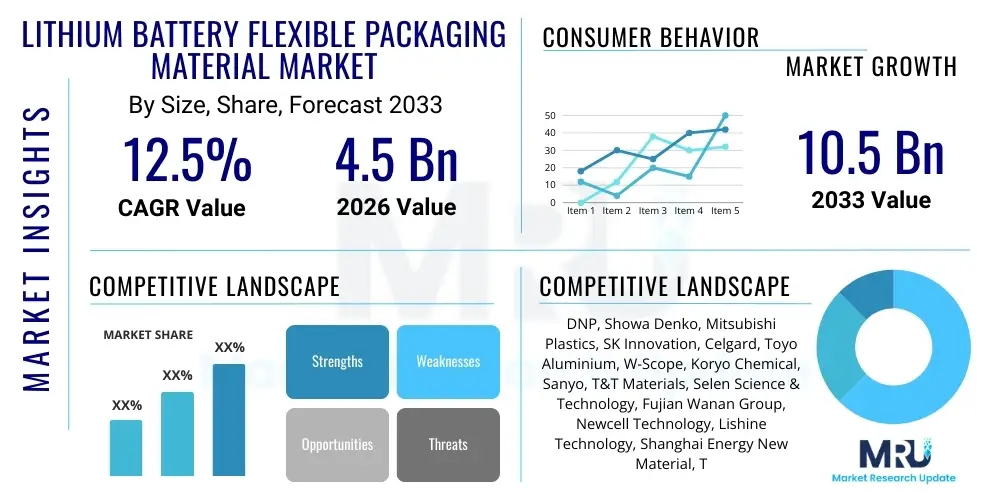

The Lithium Battery Flexible Packaging Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global acceleration in electric vehicle (EV) adoption and the continuous scaling of energy storage systems (ESS) infrastructure worldwide. Flexible packaging, primarily aluminum laminated films, provides superior volumetric energy density and thermal management characteristics crucial for high-performance lithium-ion polymer batteries, making it the preferred choice for numerous automotive and portable electronic manufacturers. The inherent adaptability and lightweight properties of these materials offer significant advantages over traditional rigid casings, directly influencing the overall efficiency and range of electric vehicles.

Market expansion is also supported by rigorous advancements in material science focused on improving moisture barrier properties and chemical resistance. Manufacturers are investing heavily in multi-layer structures, utilizing specialized polymers and adhesives to enhance the longevity and safety profile of pouch cells. Regulatory pressures mandating improved battery safety standards, particularly in high-energy density applications, further necessitate the use of advanced flexible packaging solutions capable of withstanding extreme operational conditions and mitigating the risks associated with thermal runaway. The transition towards high-nickel cathode materials, which require more robust containment solutions, subtly reinforces the demand for high-specification flexible packaging films.

Furthermore, the competitive landscape is pushing for greater standardization and reduced production costs through automated manufacturing processes. The establishment of large-scale Gigafactories globally, particularly in Asia Pacific, Europe, and North America, creates predictable and massive procurement volumes for flexible packaging materials, stabilizing pricing and fostering innovation among specialized material suppliers. The convergence of consumer electronics demand (smartphones, wearables) and high-power applications (drones, e-bikes) ensures diversified end-user demand, insulating the market from reliance on any single sector and maintaining a strong growth trajectory throughout the projected forecast period.

Lithium Battery Flexible Packaging Material Market introduction

The Lithium Battery Flexible Packaging Material Market encompasses the specialized materials, predominantly Aluminum Laminated Film (ALF), used to encase and protect lithium-ion polymer battery cells, commonly referred to as pouch cells. These packaging solutions consist of multiple layers—typically a protective outer layer (e.g., Nylon or PET), an aluminum foil layer providing the critical moisture and oxygen barrier, and an inner sealant layer (e.g., Polypropylene)—all bonded together using high-performance adhesives. The primary function is to prevent moisture ingress, ensure chemical isolation of the electrolyte and active materials, facilitate heat dissipation, and provide mechanical protection while maintaining the lightweight and flexible nature characteristic of pouch cells. This packaging is indispensable in applications demanding high energy density and flexible form factors, such as electric vehicles, tablets, smartphones, and large-scale grid energy storage systems.

The product’s versatility allows for highly customized battery designs, enabling optimal space utilization within compact devices and EV battery packs. Major applications span the entire spectrum of electrified technology, with electric mobility (Battery Electric Vehicles, Hybrid Electric Vehicles) emerging as the dominant consumer due to the intrinsic advantages of pouch cells in terms of weight reduction and thermal management efficiency compared to cylindrical or prismatic cells. Key benefits derived from utilizing these materials include improved volumetric efficiency, enhanced safety through reduced propensity for catastrophic rupture under certain conditions, and inherent weight savings, which directly contribute to extended range and performance in mobile applications. The ongoing push for lighter, faster-charging batteries solidifies the market position of flexible packaging materials as a core enabling technology.

Driving factors for this market include stringent government mandates worldwide promoting zero-emission vehicles, coupled with substantial corporate investments in renewable energy infrastructure requiring robust Energy Storage Systems (ESS). Technological shifts within the battery industry, such as the adoption of silicon-anode and solid-state battery chemistries, necessitate the development of highly specialized packaging materials capable of accommodating the greater volume expansion and electrochemical aggression associated with these next-generation components. Furthermore, the rapid proliferation of 5G technology and the continued high demand for premium portable electronic devices, requiring sleek, high-capacity batteries, sustain a vigorous demand base for high-quality aluminum laminated films and associated sealant technologies, propelling overall market growth.

Lithium Battery Flexible Packaging Material Market Executive Summary

The Lithium Battery Flexible Packaging Material Market is undergoing rapid structural transformation, defined by aggressive capacity expansions, intense R&D focusing on material durability, and a pronounced geographical concentration of manufacturing capabilities. Business trends highlight strategic collaborations between film manufacturers and major battery cell producers (Tier 1 OEMs) to co-develop custom packaging solutions optimized for specific high-performance chemistries, especially those targeting long-range electric vehicles. This integration minimizes supply chain risks and ensures materials meet stringent safety and longevity standards. Furthermore, sustainability is becoming a key business metric, driving research into recyclable packaging components and reduced solvent usage during the lamination process. Economic resilience is strong, underpinned by long-term procurement contracts typical in the automotive sector, mitigating short-term demand fluctuations and ensuring stable investment in new production lines.

Regional trends unequivocally emphasize the dominance of the Asia Pacific (APAC) region, which serves as the global epicenter for both battery cell production (South Korea, China, Japan) and raw material sourcing/processing. China, in particular, leads in manufacturing capacity and domestic EV demand, setting the pace for material innovation and cost optimization. North America and Europe are exhibiting the fastest growth rates, catalyzed by massive government subsidies and industrial policies (such as the Inflation Reduction Act in the US and the European Green Deal) aimed at localizing battery supply chains and reducing reliance on APAC imports. This localization effort creates immense opportunities for establishing new packaging material production facilities closer to burgeoning Gigafactories in Germany, Hungary, and the US Midwest, albeit facing challenges related to establishing competitive cost structures quickly.

Segment trends reveal that the Electric Vehicle (EV) application segment maintains the largest market share and exhibits the highest growth CAGR, driven by the escalating energy density requirements which favor the lightweight and flexible attributes of pouch packaging. Material segmentation is shifting towards enhanced polypropylene (PP) sealant layers, crucial for improving the heat-sealing integrity and overall resistance to aggressive organic electrolytes. The protective layer segment sees innovation aimed at improving puncture resistance without compromising overall flexibility or increasing thickness substantially. The Energy Storage System (ESS) segment is growing robustly, supported by utility-scale projects and residential installations that increasingly utilize pouch cells due to their modularity, demanding cost-effective, high-volume flexible packaging solutions.

AI Impact Analysis on Lithium Battery Flexible Packaging Material Market

User queries regarding the impact of Artificial Intelligence (AI) on the Lithium Battery Flexible Packaging Material Market predominantly revolve around optimizing manufacturing efficiency, improving defect detection rates, and accelerating materials discovery. Key themes include the application of machine vision systems for automated quality control of multi-layer film integrity, predicting equipment failures in high-precision lamination machines, and utilizing AI algorithms to model the electrochemical compatibility between new electrolyte formulations and packaging sealant layers. Users are highly concerned with how AI can mitigate the current high scrap rates associated with manufacturing complex aluminum laminated films and expect AI-driven material informatics platforms to dramatically shorten the R&D cycle for next-generation packaging components that can tolerate the high expansion stresses of silicon-anode batteries or the high temperatures of solid-state electrolyte systems. The core expectation is a transition from reactive quality control to predictive, in-line process optimization.

AI's primary influence is seen in standardizing and perfecting the complex, multi-stage manufacturing process of flexible packaging materials. The lamination process, which involves bonding layers of aluminum, nylon, and polypropylene with precision adhesives under tightly controlled temperature and pressure, is highly susceptible to microscopic defects (pinholes, delamination). AI-powered predictive algorithms analyze sensor data from these processes in real-time, adjusting parameters instantly to prevent defects before they occur, leading to superior yield rates and enhanced product consistency—a critical factor for automotive-grade battery reliability. Furthermore, AI contributes significantly to supply chain resilience by analyzing global raw material availability (aluminum, specialized polymers) and predicting procurement cost fluctuations, allowing manufacturers to optimize inventory and purchasing strategies for long-term production stability.

The deployment of advanced neural networks for image processing and anomaly detection is transforming the inspection phase. Traditional quality checks often rely on human visual inspection or basic machine vision, which may miss subtle defects in the highly reflective film surface. AI machine learning models, trained on vast datasets of defective and pristine film samples, can detect even nanoscopic flaws like micro-pinholes or minute inconsistencies in adhesive thickness, thereby guaranteeing the required moisture barrier performance essential for battery longevity. This enhanced quality assurance provided by AI is crucial for material suppliers aiming to meet the rigorous safety and performance standards demanded by Tier 1 battery manufacturers serving the premium EV market, fundamentally raising the quality floor for all flexible packaging materials produced globally.

- AI optimizes lamination processes for superior film consistency and reduced scrap rates.

- Predictive maintenance algorithms minimize downtime for high-precision manufacturing equipment.

- Machine vision systems utilize deep learning for high-speed, accurate defect detection (e.g., pinholes, delamination).

- AI-driven material informatics accelerates the discovery of novel polymer formulations for enhanced chemical resistance and thermal stability.

- Supply chain risk management enhanced through AI forecasting of raw material pricing and availability.

DRO & Impact Forces Of Lithium Battery Flexible Packaging Material Market

The market dynamics are governed by a robust synergy between accelerating demand (Drivers), inherent complexities in production (Restraints), and the strategic alignment with future energy technologies (Opportunities), all interacting through potent Impact Forces like technological shifts and regulatory demands. The primary driving force is the massive, irreversible global transition towards electric mobility and renewable energy storage, creating guaranteed, long-term demand for high-performance pouch cells and, consequently, their flexible packaging. However, the market faces significant restraints, chiefly the extreme technical difficulty in consistently manufacturing multi-layer aluminum laminated film to zero-defect standards, requiring massive capital investment and specialized expertise, thus limiting the rapid entry of new competitors. Opportunities lie in integrating flexible packaging materials into next-generation battery architectures like solid-state and silicon-anode cells, which require specialized, highly durable, and chemically inert films. These interlocking factors dictate competitive intensity, technological investment, and the overall trajectory of market growth.

The core drivers are multi-faceted, encompassing technological advancements in battery energy density, which favors the volumetric efficiency of pouch cells, and aggressive government incentives across major economies promoting EV sales and utility-scale grid modernization. Simultaneously, restraints challenge the scalable deployment of these materials. The volatility in the price and supply of key raw materials, particularly battery-grade aluminum foil and specialized polymers, poses ongoing procurement risks. Furthermore, the reliance on proprietary manufacturing technologies and patented lamination processes means high barriers to entry for manufacturers, often leading to market consolidation among a few dominant suppliers. Quality control remains a pervasive restraint; even microscopic flaws can lead to premature battery failure, necessitating stringent and often costly quality assurance regimes that inflate manufacturing overheads.

Opportunities for expansion are centered around innovation and market diversification. The burgeoning market for sustainable and recyclable flexible packaging solutions offers a significant competitive edge, appealing to environmentally conscious OEMs. The development of flexible packaging compatible with high-temperature processing required for emerging solid-state batteries represents a critical, high-value opportunity. Impact forces, such as global safety regulations (e.g., UN 38.3 testing standards) and the rising public expectation for longer-lasting, safer batteries, consistently push material suppliers to innovate and improve thermal stability and fire resistance features. Geopolitical tensions affecting critical supply chains, particularly aluminum and specialized chemical precursors, exert significant external impact forces, compelling battery manufacturers in North America and Europe to actively support the regionalization of flexible packaging production.

Segmentation Analysis

The Lithium Battery Flexible Packaging Material Market is comprehensively segmented based on material type, layer composition, and the diverse range of end-user applications, allowing for precise market analysis tailored to specific industrial needs. The segmentation by material type focuses on the composition of the film, primarily distinguishing between different types of sealant layers (e.g., cast polypropylene - CPP) and the protective outer layers (e.g., oriented nylon - OPA). Segmentation by layer composition typically analyzes the relative thickness and chemical function of the outer protective layer, the crucial aluminum foil barrier layer, and the inner sealant layer which contacts the electrolyte. This granular view is essential as each segment requires distinct manufacturing expertise and addresses specific performance criteria, particularly concerning moisture permeability and chemical integrity. The application segmentation, which separates Electric Vehicles, Consumer Electronics, and Energy Storage Systems, highlights where the largest investment and fastest growth are occurring, driven by the varying performance requirements across these sectors.

The dominant segment by application remains Electric Vehicles (EVs), encompassing both battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), demanding the highest specifications for volumetric density, thermal management, and long cycle life, necessitating premium-grade flexible packaging. Following EVs, consumer electronics maintain a steady demand base, particularly for high-end smartphones, laptops, and advanced wearables, where slimness and flexibility are paramount design considerations, driving innovation towards thinner yet robust films. The rapidly growing Energy Storage System (ESS) segment requires large volumes of flexible packaging for utility-scale grid backup and residential storage, favoring materials that prioritize long-term durability and cost-effectiveness over ultra-high power output characteristics.

The materials market is increasingly defined by the performance characteristics of the inner sealant layer. Standard CPP is being augmented by modified polypropylenes or specialized polymers offering superior chemical resistance to aggressive electrolytes and exceptional heat-sealing capabilities, which are vital for manufacturing automation and battery safety. Furthermore, the demand for high-temperature resistance is pushing the protective outer layer materials towards advanced nylon and polyethylene terephthalate (PET) composites. These precise segment differences reflect the diverse quality and cost requirements across the industrial landscape, making accurate segmentation critical for strategic decision-making and targeted product development within the flexible packaging supply chain.

- By Layer:

- Outer Protective Layer (e.g., Nylon, PET)

- Barrier Layer (Aluminum Foil)

- Inner Sealant Layer (e.g., CPP, Modified PP)

- By Material:

- Aluminum Laminated Film (ALF)

- Adhesives and Bonding Agents

- Polymer Substrates (Nylon, PP, PET)

- By Application:

- Electric Vehicles (BEVs, PHEVs)

- Consumer Electronics (Smartphones, Laptops, Tablets)

- Energy Storage Systems (ESS)

- Industrial Applications (Power Tools, Drones)

Value Chain Analysis For Lithium Battery Flexible Packaging Material Market

The value chain for Lithium Battery Flexible Packaging Material is vertically integrated and highly specialized, beginning with the upstream sourcing of fundamental raw materials and culminating in the downstream integration into finished battery cells and electric vehicles. Upstream analysis involves suppliers of high-purity aluminum foil, specialized polymer resins (Nylon, Polypropylene, PET), and high-performance lamination adhesives. This stage is characterized by high energy consumption and stringent quality requirements, demanding specialized chemical processing capabilities. Key challenges at this stage include maintaining stable pricing for aluminum and ensuring the consistent quality of polymer resins, as slight variations can compromise the integrity of the finished multi-layer film. Consolidation among primary raw material suppliers has a significant ripple effect throughout the entire value chain, dictating input costs for film manufacturers.

The core manufacturing stage involves specialized film converters who laminate these materials into the final aluminum laminated film (ALF) packaging product. These companies employ proprietary technology and high-precision machinery to bond the layers, with quality control being the most critical process step. Midstream activities are dominated by a handful of established players, primarily located in Asia, who possess the necessary expertise and scale. The downstream analysis focuses on the buyers—the battery cell manufacturers (e.g., LG Energy Solution, SK Innovation, CATL). These Tier 1 manufacturers purchase the ALF and utilize it to assemble pouch cells, which are then sold to original equipment manufacturers (OEMs) in the automotive, electronics, and energy sectors. Direct distribution channels are prevalent in this market, characterized by long-term supply agreements between the ALF manufacturers and the major battery producers, ensuring high material specificity and reliable volume supply.

Indirect distribution plays a lesser role but exists through regional distributors who supply smaller, niche battery assemblers focused on consumer goods or specialized industrial batteries. However, due to the critical nature of the material in terms of battery safety and performance, the trend favors direct, technical engagement between the packaging material supplier and the battery cell maker. This allows for rapid iteration and customization of the film structure to accommodate evolving battery chemistries, such as those incorporating silicon or high-voltage electrolytes. The value chain is inherently interdependent, with innovation at the film level directly enabling performance improvements at the cell level, making collaboration across the midstream and downstream crucial for market success.

Lithium Battery Flexible Packaging Material Market Potential Customers

The primary end-users and buyers of Lithium Battery Flexible Packaging Material are large-scale lithium-ion battery cell manufacturers, particularly those specializing in pouch cell configurations. These customers include global giants supplying the Electric Vehicle (EV) industry, such as LG Energy Solution, SK On, CATL, and Samsung SDI, which require billions of square meters of high-specification Aluminum Laminated Film (ALF) annually. The demanding technical requirements of the automotive sector mean these customers prioritize zero-defect quality, high chemical resistance, and guaranteed thermal performance over cost alone, focusing on long-term supplier relationships that ensure stability and technical support. As the EV market matures, the number of Gigafactories coming online globally directly correlates with the expansion of the potential customer base, necessitating localized supply chains capable of meeting regional demand spikes.

A second major customer segment comprises manufacturers of premium Consumer Electronics devices, including companies like Apple, Samsung Electronics, and various Asian OEMs specializing in laptops, smartphones, and wearable technologies. While their volume requirements might be smaller than the EV sector, they demand ultra-thin, highly flexible packaging materials that enable sleek product designs and maximize battery capacity within minimal space constraints. For these customers, aesthetic flexibility and weight reduction are paramount, often driving demand for advanced film coating technologies and specialized sealant formulations. The frequent product cycles in consumer electronics necessitate rapid R&D and reliable supply chain flexibility from the packaging material vendors.

Finally, the growing Energy Storage System (ESS) market represents a rapidly expanding customer group, including utility companies, renewable energy project developers, and residential storage providers (e.g., Tesla Energy, Fluence). These buyers require highly durable, long-life pouch cells suitable for stationary applications. While the energy density requirements might be slightly less stringent than for EVs, cost-effectiveness, long-term stability, and the ability to operate reliably in diverse environmental conditions (temperature, humidity) are key purchasing criteria. These ESS customers often procure cells via integrators, who in turn rely on battery manufacturers, reinforcing the critical link between the flexible packaging supplier and the final performance specifications of the installed energy system.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DNP, Showa Denko, Mitsubishi Plastics, SK Innovation, Celgard, Toyo Aluminium, W-Scope, Koryo Chemical, Sanyo, T&T Materials, Selen Science & Technology, Fujian Wanan Group, Newcell Technology, Lishine Technology, Shanghai Energy New Material, Toray Industries, Ube Industries, Solvay, DuPont |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Battery Flexible Packaging Material Market Key Technology Landscape

The technological landscape of the Lithium Battery Flexible Packaging Material Market is rapidly evolving, driven primarily by the need for superior thermal stability, enhanced puncture resistance, and improved chemical inertness to accommodate next-generation battery chemistries. A core technological focus is the perfection of the dry lamination process, which minimizes the use of volatile organic compounds (VOCs) and solvents compared to traditional wet lamination techniques, thereby improving environmental sustainability and reducing curing times. Advanced lamination technologies also focus on ensuring uniform adhesive thickness and eliminating micro-voids between layers, which are critical precursors to moisture ingress and subsequent battery degradation. Furthermore, manufacturers are exploring proprietary surface treatment techniques for the aluminum foil layer to enhance adhesion with polymer films, particularly in environments exposed to aggressive, high-voltage electrolytes. This constant push for material perfection underscores the market’s reliance on precision engineering and chemical innovation.

A significant area of technological innovation involves the development of specialized sealant layers, moving beyond standard cast polypropylene (CPP) to modified polymer blends that offer higher melting points and superior resistance to chemical attack from new electrolyte salts and additives. The integration of ceramic coatings or nano-composite additives into the protective outer layer (Nylon/PET) is also gaining traction. These composite materials are designed to dramatically increase the material’s dielectric strength and puncture resistance without increasing the film thickness significantly, addressing critical safety concerns for high-energy density automotive batteries. Research into flexible packaging materials for solid-state batteries is a cutting-edge domain, where films must withstand higher assembly temperatures and accommodate the volume changes inherent in the solid electrolyte interfaces, requiring entirely new polymer compositions and bonding agents that maintain structural integrity under extreme conditions.

Furthermore, technology related to manufacturing monitoring and quality assurance is highly critical. The adoption of advanced sensors and real-time spectrophotometric analysis systems ensures that the packaging film meets minimum barrier performance specifications (Water Vapor Transmission Rate - WVTR). Innovations in roll-to-roll processing equipment are enabling faster production speeds while maintaining nanoscale precision in alignment and tension control, essential for high-volume, cost-effective manufacturing. These technological advancements collectively aim to deliver packaging solutions that not only meet the immediate needs of current EV and consumer electronics batteries but are also proactively engineered for compatibility with future battery roadmaps, ensuring the packaging materials do not become the limiting factor in battery performance or safety improvements.

Regional Highlights

- Asia Pacific (APAC): APAC maintains its dominant position in the global market, primarily due to the massive concentration of lithium-ion battery production capacity, with major cell manufacturers located in China, South Korea, and Japan. China serves as the largest consumer and producer of both battery cells and their packaging materials, leveraging strong government support for EV deployment and a highly integrated domestic supply chain. South Korea and Japan are centers of excellence for high-quality, high-performance Aluminum Laminated Film (ALF) R&D and manufacturing, supplying Tier 1 global battery producers. The regional dynamics are characterized by intense price competition alongside relentless technical innovation, driven by the demand from local EV giants and consumer electronics manufacturers. APAC dictates global pricing and quality standards for flexible packaging materials, owing to its substantial scale and expertise in precision chemical processing and lamination technology.

- North America: North America is projected to be the fastest-growing region, fueled by unprecedented governmental support, including tax credits and investment incentives under the Inflation Reduction Act (IRA), aimed at localizing the entire battery supply chain. The region is witnessing a rapid influx of Gigafactory construction by both domestic and foreign battery producers (e.g., joint ventures between US automotive OEMs and Korean battery makers). This creates immense, localized demand for flexible packaging materials. Key growth factors include the mandatory shift towards EVs, significant investments in grid modernization and ESS deployment, and a strategic imperative to reduce reliance on Asian imports for critical battery components, encouraging new domestic manufacturing capacity for ALF.

- Europe: The European market demonstrates robust growth, driven by ambitious decarbonization targets set by the European Green Deal and stringent regulations governing vehicle emissions. Central and Eastern Europe are becoming significant hubs for battery manufacturing, attracting substantial investment from international and local players establishing localized cell production facilities. This localization effort creates immediate demand for regional supply of flexible packaging materials. Europe's focus is particularly strong on sustainability and ethical sourcing, influencing market demand toward materials that offer easier recyclability and manufacturers adhering to high environmental, social, and governance (ESG) standards, impacting procurement decisions alongside performance metrics.

- Latin America, Middle East, and Africa (LAMEA): LAMEA represents an emerging market for flexible packaging materials, driven by niche applications like remote energy storage systems, small-scale electrification projects, and slow-but-steady growth in local EV adoption, particularly in economies with accessible lithium reserves. While overall consumption volume is comparatively low, strategic opportunities exist in supporting initial battery assembly plants and supplying ESS projects tied to renewable energy installations. Growth is highly dependent on governmental infrastructure investment and the establishment of stable regulatory frameworks that encourage long-term adoption of electrified transport and decentralized power generation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Flexible Packaging Material Market.- Dai Nippon Printing Co., Ltd. (DNP)

- Showa Denko Materials Co., Ltd. (Renamed Resonac)

- Mitsubishi Plastics, Inc.

- SK Innovation Co., Ltd. (SK IE Technology)

- Celgard, LLC

- Toyo Aluminium K.K.

- W-Scope Corporation

- Koryo Chemical Co., Ltd.

- Sanyo Corporation

- T&T Materials, Inc.

- Selen Science & Technology Co., Ltd.

- Fujian Wanan Group

- Newcell Technology (Suzhou) Co., Ltd.

- Lishine Technology (Dongguan) Co., Ltd.

- Shanghai Energy New Material Technology Co., Ltd.

- Toray Industries, Inc.

- Ube Industries (UBE Corporation)

- Solvay S.A.

- DuPont de Nemours, Inc.

- Guangzhou Aoteli Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium Battery Flexible Packaging Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Aluminum Laminated Film (ALF) and why is it essential for lithium batteries?

Aluminum Laminated Film (ALF) is a multi-layered composite material—typically nylon, aluminum foil, and polypropylene—that forms the flexible casing for lithium-ion pouch cells. It is essential because the aluminum layer provides a near-perfect barrier against moisture and oxygen ingress, preventing electrolyte degradation and subsequent cell failure, while its flexible nature allows for efficient volumetric packaging in EVs and consumer electronics.

Which application segment drives the highest demand in the flexible packaging market?

The Electric Vehicle (EV) segment drives the highest and fastest-growing demand for lithium battery flexible packaging material. Pouch cells, which utilize ALF, are highly favored in EV applications due to their superior volumetric energy density, lighter weight, and efficient thermal management capabilities compared to standard rigid cell formats, directly impacting vehicle range and performance.

What are the primary safety concerns addressed by advanced flexible packaging materials?

Advanced flexible packaging materials address critical safety concerns primarily related to preventing moisture contamination and mitigating the risk of thermal runaway. Innovations focus on enhancing the heat-sealing integrity, improving the puncture resistance of the outer layer, and developing sealant layers that resist chemical degradation from highly reactive electrolytes, ensuring battery longevity and preventing catastrophic failure.

How is the market influenced by the development of solid-state batteries?

The development of solid-state batteries (SSBs) acts as a high-potential opportunity and technological driver. SSBs require flexible packaging materials capable of withstanding higher assembly temperatures and accommodating significant volume expansion cycles without compromising the hermetic seal. This necessitates R&D into specialized, high-temperature resistant polymer composites and advanced adhesive systems, creating a new, premium material segment.

Which region dominates the global manufacturing and consumption of flexible packaging material?

The Asia Pacific (APAC) region, specifically China, South Korea, and Japan, dominates the global manufacturing and consumption of lithium battery flexible packaging material. This dominance is due to the concentration of the world's largest battery cell producers (Gigafactories) in these countries, establishing APAC as the technological and volume hub for the entire lithium-ion supply chain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager