Lithium Battery Nickel Plated Steel Strips Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442061 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Lithium Battery Nickel Plated Steel Strips Market Size

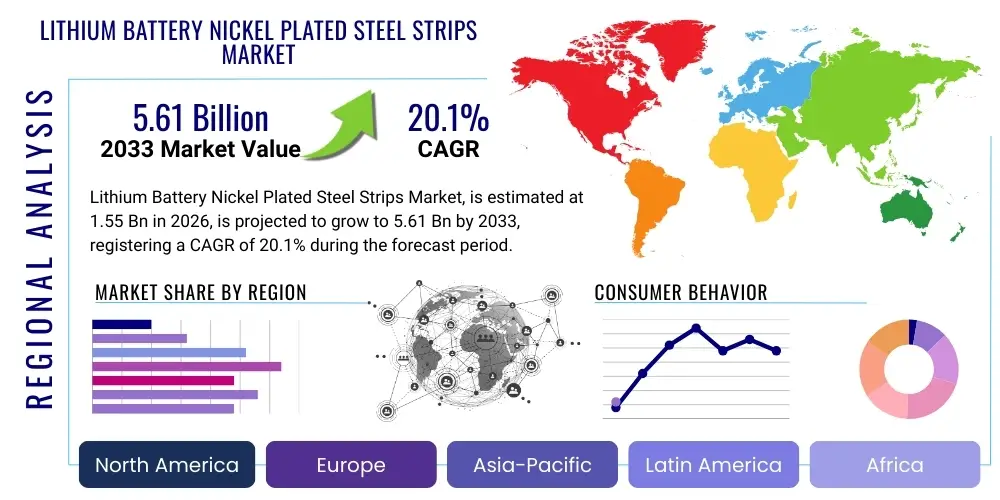

The Lithium Battery Nickel Plated Steel Strips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.1% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 5.61 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the accelerating global transition towards electric mobility and the necessary build-out of large-scale energy storage systems (ESS). These strips are essential components providing reliable electrical connection, mechanical stability, and critical corrosion resistance within the challenging operating environments of modern lithium-ion battery packs, ensuring long-term performance and safety.

Lithium Battery Nickel Plated Steel Strips Market introduction

The Lithium Battery Nickel Plated Steel Strips Market encompasses the manufacturing, supply, and distribution of specialized metal strips used primarily for interconnecting individual battery cells (cylindrical, prismatic, or pouch) within a larger battery module or pack. These strips are typically manufactured from low-carbon steel (such as SPCC or equivalent grades) and coated with a thin, uniform layer of high-purity nickel via advanced electroplating processes. This composite structure is engineered to leverage the high strength and cost-effectiveness of steel while utilizing nickel’s superior electrical conductivity, excellent weldability, and resistance to corrosion and oxidation, which are crucial attributes for maintaining stable performance in high-power applications.

The core function of these strips is to facilitate the complex electrical circuits necessary for energy flow, thermal management, and safety monitoring within battery packs utilized across various sectors. Major applications include Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), various consumer electronics requiring high drain rates (laptops, power tools), and increasingly, grid-scale and residential Energy Storage Systems (ESS). The primary benefits derived from using nickel-plated steel, as opposed to pure nickel or copper alloys, include significant cost optimization, enhanced mechanical rigidity that minimizes vibration damage, and superior spot-welding characteristics essential for high-throughput automated assembly lines.

Driving factors propelling market growth are intrinsically linked to the macroeconomic shift towards decarbonization. Mandates for phasing out internal combustion engines, coupled with massive investments in renewable energy infrastructure requiring robust grid stabilization solutions, necessitate an exponential increase in lithium-ion battery production. Furthermore, continuous technological advancements in battery design, particularly the adoption of higher energy density cells and complex module architectures, necessitate tighter tolerance controls and higher quality standards for the interconnecting strips, thereby driving demand for premium, precision-engineered products.

Lithium Battery Nickel Plated Steel Strips Market Executive Summary

The global Lithium Battery Nickel Plated Steel Strips Market is characterized by robust expansion, primarily fueled by unprecedented growth in the electric vehicle (EV) sector, which consumes the largest volume of these materials. Business trends highlight a strong focus on supply chain localization, particularly in North America and Europe, driven by geopolitical concerns and the push for regional self-sufficiency in battery production (gigafactories). Manufacturers are increasingly investing in sophisticated continuous plating and precision slitting technologies to meet stringent demands for dimensional accuracy and plating uniformity required by automated battery assembly lines. Key segment trends show heightened demand for strips with customized dimensions (e.g., varying thickness for different current carrying capacities) and specialized surface treatments to optimize ultrasonic or laser welding performance, moving away from standardized products.

Regional trends indicate that the Asia Pacific (APAC) region, led by China, South Korea, and Japan, currently dominates the market both in production capacity and consumption, owing to the concentration of major battery cell manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI). However, North America and Europe are exhibiting the highest growth rates, spurred by favorable regulatory environments, massive governmental subsidies (such as the US Inflation Reduction Act), and significant capital expenditure announcements by automotive OEMs moving into vertical battery integration. This geographical shift is reshaping the competitive landscape, pushing established APAC suppliers to build offshore facilities while simultaneously fostering local raw material and component suppliers in the West.

Overall, the market remains highly competitive, with pricing pressure modulated by volatile nickel commodity prices. Strategic imperatives for market participants include achieving vertical integration (from steel coil to plated strip), enhancing R&D for advanced alloys and plating chemistries to improve resistance to thermal runaway and degradation, and securing long-term supply agreements with tier-one battery manufacturers. The market's future trajectory is dependent on continued advancements in battery chemistry, where nickel-plated steel strips are expected to maintain dominance over alternatives due to their optimized balance of cost, performance, and reliability.

AI Impact Analysis on Lithium Battery Nickel Plated Steel Strips Market

Analysis of common user questions regarding the influence of Artificial Intelligence (AI) on the Lithium Battery Nickel Plated Steel Strips Market reveals primary concerns centered on manufacturing efficiency, quality assurance, and supply chain stability. Users frequently inquire: "How can AI optimize the electroplating process for uniform thickness?" "Can AI models predict potential strip defects before costly battery integration?" and "Will AI integration reduce the skilled labor requirement in production?" These questions underscore key themes: the demand for hyper-precision in material attributes, the need for predictive maintenance to ensure operational continuity, and the desire to mitigate high operational costs through smart automation. The general expectation is that AI will transform production from reactive quality control to proactive process optimization, minimizing waste and ensuring materials meet the increasingly narrow specifications mandated by high-performance battery designs, ultimately enhancing the overall safety and longevity of the final battery products.

AI is set to revolutionize the stringent quality control protocols required for these conductive materials. Given that even microscopic defects or minor variations in plating thickness can severely impact cell performance, thermal management, and long-term degradation, AI-driven visual inspection systems utilizing machine learning algorithms offer unprecedented accuracy. These systems can instantaneously analyze high-resolution images of continuous coils for imperfections, surface contaminants, or variations in grain structure, vastly outperforming traditional human inspection or simpler sensor-based checks. This shift ensures a higher yield of premium-grade material necessary for critical applications like high-performance EVs and aviation-grade batteries, reducing assembly line stoppages and improving overall material integrity.

Furthermore, AI models play a crucial role in optimizing complex manufacturing processes, such as continuous cold rolling and electroplating. By analyzing vast datasets encompassing variables like current density, electrolyte temperature, steel base composition variability, and line speed, AI can dynamically adjust process parameters in real-time. This dynamic tuning ensures that the nickel layer achieves maximum adhesion, precise thickness uniformity across the strip width and length (critical for consistent welding), and the desired crystalline structure required for optimal conductivity. This predictive control minimizes material waste during setup and run time, translating directly into significant cost savings for manufacturers operating in this highly capital-intensive segment of the battery supply chain.

- AI-driven Predictive Maintenance: Utilizing sensor data from rolling and plating equipment to forecast component failure, minimizing unexpected downtime and maximizing plant utilization rates.

- Optimized Quality Control (QC): Machine vision systems powered by deep learning identify microscopic defects, plating inconsistencies, and dimensional variations faster and more accurately than traditional methods.

- Real-time Process Optimization: AI algorithms adjust electroplating parameters (current density, bath composition, temperature) instantaneously to ensure uniform nickel layer thickness and composition.

- Supply Chain Resilience: Machine learning models predict volatile nickel commodity pricing and logistical bottlenecks, enabling proactive procurement strategies.

- Enhanced Yield Management: Reduction of scrap material by identifying processing inefficiencies early in the continuous manufacturing stream.

DRO & Impact Forces Of Lithium Battery Nickel Plated Steel Strips Market

The market dynamics are governed by a robust confluence of accelerating drivers related to global electrification, tempered by significant restraints linked primarily to raw material volatility and intense quality demands, presenting substantial opportunities in advanced material customization. The principal driver is the mandate for increased electrification across transportation and utility sectors, which ensures sustained, high-volume demand for lithium-ion battery cells, directly translating to a need for connecting components. Conversely, nickel price volatility poses a severe restraint, as nickel represents a substantial portion of the material cost, making long-term pricing and procurement strategy extremely challenging for strip manufacturers. Opportunities are emerging through the development of solid-state battery technology, which may require new, specialized interconnect materials or bonding techniques that favor the mechanical properties of customized steel cores.

The primary impact forces shaping the competitive landscape are technological innovation and regulatory pressures. The necessity for higher energy density cells translates to thinner packaging and increased thermal stress, requiring strips with enhanced mechanical strength and optimized thermal dissipation characteristics. This technological push forces suppliers to invest heavily in advanced cold-rolling and precision-slitting capabilities. Simultaneously, stringent global regulations concerning hazardous substances (like REACH and RoHS) and sustainability mandates pressure manufacturers to adopt cleaner production processes and ensure full material traceability, increasing compliance costs but also acting as a barrier to entry for smaller, less compliant players. The power of buyers (large battery manufacturers) is exceptionally high due to their consolidation and mass purchasing power, necessitating strong strategic alliances among strip suppliers.

Specifically, market growth is driven by the expansion of automotive gigafactories globally, creating localized demand centers that require just-in-time delivery of precision materials. However, a significant restraint is the technological challenge of maintaining high corrosion resistance and minimizing electrical resistance across millions of spot welds, requiring extremely high standards for nickel purity and plating integrity, leading to elevated R&D expenses. The key opportunity lies in expanding the product portfolio to include specialized materials for high-temperature applications and fast-charging requirements, potentially involving multilayer plating or alloying the nickel layer to enhance its specific performance characteristics beyond standard corrosion resistance.

Segmentation Analysis

The Lithium Battery Nickel Plated Steel Strips Market is comprehensively segmented based on material specifications, application type, and the dimensional characteristics required for specific battery cell formats. Segmentation by product type typically focuses on the thickness of the plating layer and the overall strip dimension (width and thickness), as these factors directly correlate with current carrying capacity and weldability. Application segmentation provides insights into the highest growth areas, differentiating between the immense volume requirements of Electric Vehicles (EVs) and the specialized needs of portable electronics or stationary energy storage systems (ESS). Understanding these segments is crucial for manufacturers to optimize production capabilities and strategically allocate resources toward high-demand, high-margin product variants.

- By Nickel Plating Thickness:

- Thin Plating (less than 3 µm)

- Medium Plating (3 µm to 6 µm)

- Thick Plating (above 6 µm)

- By Strip Dimension (Thickness):

- Thin Gauge (less than 0.15 mm)

- Standard Gauge (0.15 mm to 0.25 mm)

- Thick Gauge (above 0.25 mm)

- By Core Material Grade:

- Standard Cold-Rolled Steel (e.g., SPCC)

- High-Strength Steel Alloys

- Stainless Steel Substrates (Niche Applications)

- By Application:

- Electric Vehicles (BEV, PHEV)

- Portable Consumer Electronics (Laptops, Phones)

- Power Tools and Industrial Equipment

- Energy Storage Systems (Grid and Residential ESS)

Value Chain Analysis For Lithium Battery Nickel Plated Steel Strips Market

The value chain for Lithium Battery Nickel Plated Steel Strips begins with the upstream procurement of specialized raw materials: high-quality cold-rolled steel coils and high-purity nickel sources. Upstream activities involve careful selection of steel suppliers capable of delivering coils with uniform thickness, excellent surface finish, and low impurity levels, as these factors directly affect the subsequent plating process and final strip performance. Nickel suppliers are typically large global mining and refining companies. Manufacturers in the middle of the value chain focus on sophisticated processes, including precision slitting, continuous cleaning, and high-speed electroplating, where the quality of the plating bath management is paramount to achieving the required uniformity and adhesion.

Downstream analysis focuses on the distribution channels and end-user integration. Distribution is predominantly direct, especially to Tier 1 battery cell manufacturers and large automotive OEMs who integrate the strips into their proprietary battery modules and packs. Given the tight tolerances and Just-in-Time (JIT) delivery required for high-volume automated battery assembly, direct relationships ensure efficient technical support and reliable supply. Indirect distribution, involving specialized metals distributors, serves smaller battery pack integrators or specialized electronics manufacturers, providing smaller batch sizes and localized inventory management, albeit at potentially higher cost.

The high criticality of these strips means that suppliers often integrate vertically by controlling the slitting and surface treatment phases, but full vertical integration into steel production is rare due to the capital intensity. The main value addition occurs during the precision electroplating stage, where proprietary technologies and process controls differentiate competitors. Efficient logistics and rigorous quality control protocols (e.g., PPAP, ISO certifications) are essential throughout the chain, linking material specifications to final vehicle safety and performance standards.

Lithium Battery Nickel Plated Steel Strips Market Potential Customers

The primary end-users and buyers of Lithium Battery Nickel Plated Steel Strips are major participants in the global electrification ecosystem, spanning from component manufacturing to final system integration. The most significant customer base comprises tier-one lithium-ion cell manufacturers, such as those producing high-volume cylindrical cells (18650, 21700, 4680 formats), as these strips are integral to the mass production process for interconnecting thousands of cells into modules. Battery pack assemblers, including major automotive original equipment manufacturers (OEMs) that insource battery assembly, represent another critical customer segment, demanding highly customized, pre-cut strips delivered according to precise geometric specifications for their proprietary pack designs.

Secondary but rapidly growing customer segments include specialized manufacturers of high-power industrial tools, particularly those requiring superior conductivity and thermal stability for heavy-duty cycling (e.g., cordless construction equipment). Furthermore, integrators of large-scale Energy Storage Systems (ESS), both grid-level utility installations and residential battery backup systems, constitute a substantial customer segment. These ESS integrators prioritize durability, corrosion resistance, and materials that promise decades of maintenance-free operation under potentially harsh environmental conditions, often requiring thicker-gauge strips for higher current loads over extended periods. Given the component's role in safety and performance, purchasing decisions are heavily influenced not just by price, but by supplier track record, quality certifications, and the ability to guarantee consistent material properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 5.61 Billion |

| Growth Rate | 20.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsui Kinzoku Die-Casting, Tanaka Precious Metals, Suzhou Dongshan Precision Manufacturing Co., Ltd., Sumitomo Metal Mining Co., Ltd., Shaanxi Jinrui New Materials Technology Co., Ltd., Dongguan Xinyu Equipment Co., Ltd., Hubei Zhongke Electronic Material Co., Ltd., Shanghai Wanzhong Steel Strip Co., Ltd., Shenzhen Jiazhao Industry Co., Ltd., Zhejiang Sanmei Copper & Nickel Strip Co., Ltd., H&T Presspart, Nippon Steel Corporation, POSCO, JFE Steel Corporation, Thyssenkrupp AG, Gremtek Materials, Huajia Nickel Strip, Zhejiang Changyuan New Materials Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Battery Nickel Plated Steel Strips Market Key Technology Landscape

The key technology landscape in the Lithium Battery Nickel Plated Steel Strips Market is dominated by advancements in precision metal processing and electrochemistry, aimed at achieving superior material uniformity and integrity necessary for high-speed automated battery assembly. Continuous electroplating techniques represent the core technology, where manufacturers utilize sophisticated, high-speed lines to deposit a highly uniform nickel layer onto the steel substrate. Critical technological focus areas include the development of proprietary electrolyte chemistries (often sulfamate-based baths) that ensure maximum adherence and minimize internal stress in the plating layer, preventing flaking or cracking during subsequent processing or battery operation. Furthermore, advanced online monitoring systems, utilizing spectroscopic and Eddy current technologies, are essential for real-time measurement and control of plating thickness and purity, crucial for meeting tight regulatory and performance specifications.

Precision slitting and edging technologies are equally vital, ensuring the strips are delivered with extremely tight dimensional tolerances (often measured in micrometers) and smooth, burr-free edges. Burrs or uneven edges can compromise the insulating layers within the battery pack, leading to short circuits or premature failure. Manufacturers employ high-precision rotary shear slitting equipment coupled with advanced computerized numerical control (CNC) systems to maintain accuracy across miles of continuous strip material. These technologies often include automated packaging systems designed to prevent surface damage or contamination during transport, as the cleanliness of the strip surface directly impacts the quality of ultrasonic or laser welding performed at the battery assembly stage.

The emerging technological frontier involves surface modification and functional coatings aimed at optimizing weldability and enhancing specific performance parameters. Research is focused on developing duplex or multilayer plating structures that combine the corrosion resistance of nickel with potentially greater current carrying capacity or enhanced thermal dissipation properties. Furthermore, specific surface treatments (e.g., slight roughening or pre-treatment washes) are being optimized to ensure consistent, low-resistance connections when utilizing advanced laser welding systems employed by automotive OEMs. The integration of advanced process simulation software allows manufacturers to model the effects of different plating parameters on the final product's microstructure, accelerating material innovation and reducing time-to-market for specialized strips required by next-generation battery designs.

Regional Highlights

The Lithium Battery Nickel Plated Steel Strips Market exhibits distinct regional dynamics driven by the concentration of battery manufacturing capabilities and governmental electrification mandates. The Asia Pacific (APAC) region stands as the undisputed global leader, accounting for the majority of both production and consumption. This dominance is centered in countries like China, which hosts the world's largest battery manufacturing base (gigafactories), South Korea (home to major players like LG Energy Solution and Samsung SDI), and Japan (known for high-quality, specialized material suppliers). APAC benefits from established supply chains, lower operational costs, and an immense domestic market for electric vehicles and consumer electronics. The region drives technological trends in high-volume, cost-effective manufacturing processes, setting the global standard for scale.

Europe represents the second-fastest growing region, spurred by aggressive decarbonization goals, the phase-out of internal combustion engines, and substantial political support aimed at localizing the battery value chain (e.g., Battery Passport regulations and investment in domestic gigafactories). Countries such as Germany, Poland, and Hungary are becoming key hubs for battery module assembly, creating significant, localized demand for precision components like nickel-plated steel strips. European manufacturers are prioritizing sustainability metrics and traceability, often demanding materials compliant with stringent environmental standards and robust auditing processes, pushing suppliers toward cleaner manufacturing techniques and localized supply agreements to mitigate transit risks.

North America is experiencing dramatic expansion, primarily fueled by supportive policies like the US Inflation Reduction Act (IRA), which incentivizes domestic battery production and component sourcing. This regulatory framework is triggering billions in investment from both foreign and domestic battery manufacturers (e.g., joint ventures between major OEMs and Korean cell makers). The demand in North America is highly concentrated in the EV sector, especially for new cell formats like the 4680 cylindrical design, requiring customized strip widths and thicknesses. Market entrants are prioritizing rapid capacity expansion and establishing localized plating facilities to meet stringent domestic content requirements and secure long-term supply contracts with major automotive players.

- Asia Pacific (APAC): Dominates the market due to the concentration of global battery manufacturing hubs; characterized by high-volume production and competitive pricing; leading centers are China, South Korea, and Japan.

- Europe: Rapidly accelerating market growth driven by strict emission regulations and localized gigafactory construction; high demand for sustainable sourcing and material traceability.

- North America: Significant growth stimulated by the Inflation Reduction Act (IRA); focus on establishing domestic supply chains and manufacturing specialized strips for new EV cell architectures.

- Latin America & MEA: Emerging markets with potential, currently characterized by lower consumption volumes but increasing interest in stationary energy storage projects and early-stage EV adoption programs, relying primarily on imported materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Nickel Plated Steel Strips Market.- Mitsui Kinzoku Die-Casting

- Tanaka Precious Metals

- Suzhou Dongshan Precision Manufacturing Co., Ltd.

- Sumitomo Metal Mining Co., Ltd.

- Shaanxi Jinrui New Materials Technology Co., Ltd.

- Dongguan Xinyu Equipment Co., Ltd.

- Hubei Zhongke Electronic Material Co., Ltd.

- Shanghai Wanzhong Steel Strip Co., Ltd.

- Shenzhen Jiazhao Industry Co., Ltd.

- Zhejiang Sanmei Copper & Nickel Strip Co., Ltd.

- H&T Presspart

- Nippon Steel Corporation

- POSCO

- JFE Steel Corporation

- Thyssenkrupp AG

- Gremtek Materials

- Huajia Nickel Strip

- Zhejiang Changyuan New Materials Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium Battery Nickel Plated Steel Strips market and generate a concise list of summarized FAQs reflecting key topics and concerns.Why are nickel-plated steel strips preferred over pure nickel strips in battery packs?

Nickel-plated steel strips offer a critical advantage in cost efficiency and mechanical strength compared to pure nickel. While pure nickel provides slightly higher conductivity, nickel-plated steel offers superior rigidity, reducing component damage during vibration, and significantly lowers material costs while maintaining excellent weldability and sufficient corrosion resistance for standard battery environments.

What is the typical thickness requirement for the nickel plating layer?

The optimal nickel plating thickness usually ranges between 3 to 6 micrometers (µm). This range balances the need for excellent surface conductivity and corrosion protection with cost control. Thicker plating increases material cost and might affect weld characteristics, while thinner plating risks insufficient corrosion resistance, particularly in high-humidity or high-temperature environments.

How does the demand for electric vehicles (EVs) specifically affect this market?

The EV sector is the single largest driver of the lithium battery nickel plated steel strips market. The mass production of cylindrical cells (e.g., 21700 and 4680 formats) requires vast quantities of precision strips for cell interconnection. The high voltage and high current demands of EVs necessitate extremely uniform, high-quality strips to ensure the safety and longevity of the battery pack.

What are the main risks associated with nickel price volatility for strip manufacturers?

Nickel price volatility is the most significant raw material risk. Since nickel is a critical component, unpredictable price swings directly impact the cost of goods sold, compression of profit margins, and challenges in fulfilling long-term fixed-price contracts with major battery manufacturers. Companies mitigate this through hedging strategies and securing long-term supply agreements.

What is the role of precision slitting technology in strip manufacturing?

Precision slitting technology ensures the nickel-plated steel strips meet the stringent dimensional tolerances (width and edge quality) required for automated welding processes. High-precision slitting minimizes burrs and dimensional variance, which are crucial factors that prevent potential short circuits and ensure consistent, high-integrity electrical connections within the densely packed battery module.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager