Lithium Battery Pretreatment Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442399 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Lithium Battery Pretreatment Machine Market Size

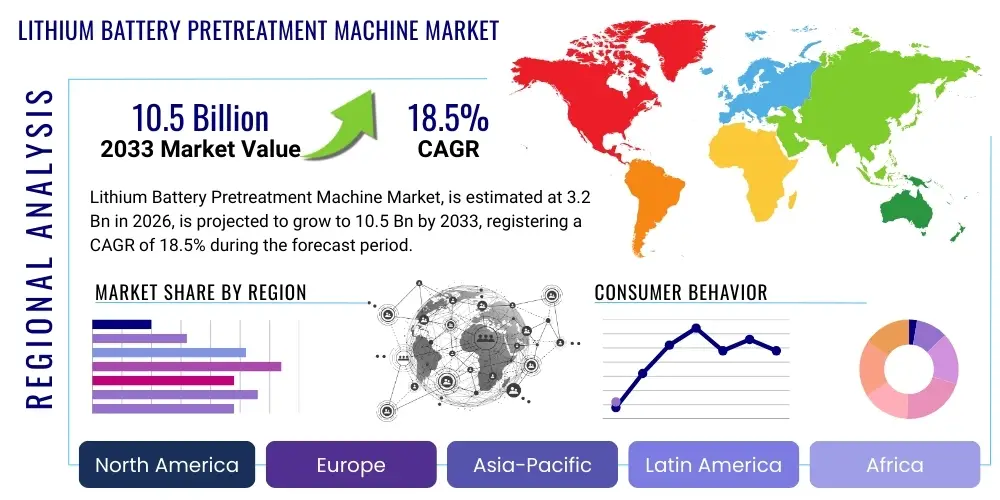

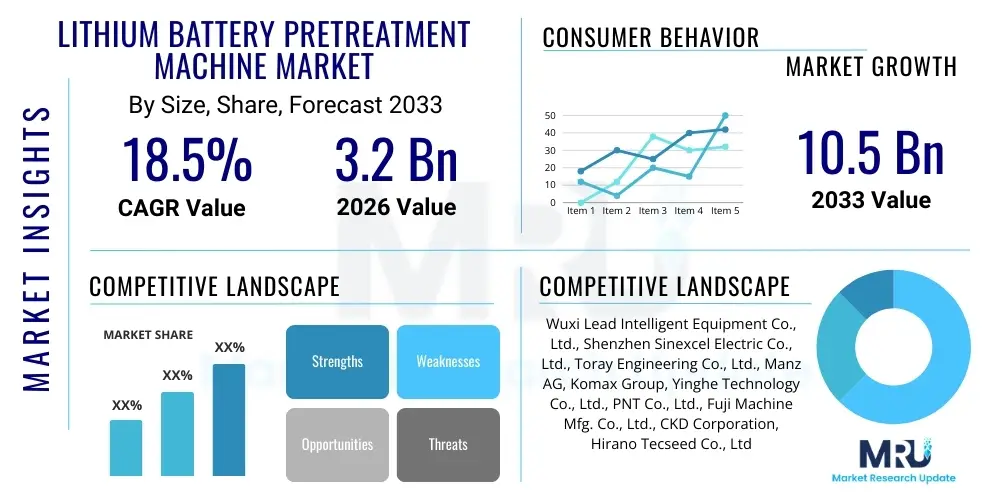

The Lithium Battery Pretreatment Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

Lithium Battery Pretreatment Machine Market introduction

The Lithium Battery Pretreatment Machine Market encompasses sophisticated automated equipment critical for preparing electrode materials and assembling raw cell components prior to electrolyte filling and final packaging. This crucial phase, often referred to as the middle stream of battery manufacturing, involves high-precision processes such as coating, drying, calendering, slitting, and winding or stacking. The fundamental product description includes specialized machinery like high-speed coaters (slot-die or doctor blade), vacuum drying ovens, precision roll-to-roll calenders, high-tolerance slitting machines that minimize burrs, and automated high-speed winding or stacking apparatus. These machines are engineered to handle sensitive materials like anode (graphite/silicon) and cathode (NMC, LFP, NCA) foils, ensuring uniformity in thickness, width, and alignment, which directly dictates the safety, energy density, and lifespan of the final battery cell. The stringent quality requirements necessary for modern electric vehicle (EV) batteries and large-scale energy storage systems (ESS) are the primary drivers for technological advancement and market growth in this sector.

Major applications of these pretreatment machines span across three significant sectors: Electric Vehicles (EVs) and hybrid vehicles, where performance and reliability are paramount; large-scale Energy Storage Systems (ESS) used for grid stabilization and renewable energy integration, demanding high throughput and long cycle life; and Consumer Electronics (CE), which requires highly customized and often smaller-scale production lines for devices like smartphones and laptops. The growing global shift towards electrification, spurred by governmental policies promoting sustainable energy and phase-outs of internal combustion engines, places immense pressure on battery manufacturers (gigafactories) to scale up production rapidly while maintaining impeccable quality control. Consequently, the demand for highly efficient, fully automated, and intelligent pretreatment machinery that can operate continuously with minimal defects is escalating across all major battery manufacturing hubs, particularly in Asia Pacific and increasingly in North America and Europe.

The core benefits derived from advanced lithium battery pretreatment machines include significantly improved manufacturing yields, enhanced cell consistency, reduced operational costs through high automation, and crucial minimization of contamination and defects that could lead to thermal runaway or premature cell failure. Key driving factors fueling this market expansion include unprecedented capital expenditure in new gigafactories globally, regulatory mandates emphasizing battery safety and traceability (e.g., EU Battery Regulation), intense competition among battery manufacturers forcing adoption of the latest high-speed, high-precision equipment, and ongoing R&D efforts focusing on next-generation battery chemistries (solid-state, silicon anodes) which necessitate even stricter material handling and pretreatment tolerances. The ability of these machines to seamlessly integrate into Industry 4.0 environments, utilizing IoT and real-time data analytics, further solidifies their central role in the future of energy storage production.

Lithium Battery Pretreatment Machine Market Executive Summary

The Lithium Battery Pretreatment Machine Market is experiencing a paradigm shift characterized by unprecedented business trends driven by rapid global gigafactory expansion, particularly in high-volume regions like China, South Korea, and emerging markets in Europe and the United States. Key business trends include the consolidation of machinery suppliers offering integrated turnkey solutions, the necessity for high capital investment in fully automated production lines to reduce labor costs and increase precision, and a strong focus on modular and flexible machine designs capable of adapting to various cell formats (cylindrical, prismatic, pouch) and evolving chemistries. The market is witnessing intensive technological competition focused on increasing processing speeds—such as coating and slitting speeds—without compromising micron-level precision, which is vital for achieving high-energy-density cells. Strategic collaborations between machinery providers and major battery producers are becoming standard practice, ensuring equipment specifications align precisely with next-generation cell designs and production throughput goals, thereby accelerating the commercialization timeline of new battery technologies and maximizing operational efficiencies across the manufacturing supply chain.

Regional trends indicate that Asia Pacific remains the dominant manufacturing hub, accounting for the largest share of equipment demand due to established giants like CATL, LG Energy Solution, and Samsung SDI driving massive output volumes. However, significant growth momentum is observed in Europe and North America, fueled by protective industrial policies (e.g., Inflation Reduction Act in the US, Green Deal Industrial Plan in the EU) aimed at localizing the battery supply chain and reducing dependence on Asian imports. These regions are seeing massive greenfield investments in gigafactories, often necessitating the purchase of the newest, most advanced, and highly localized (service and maintenance) machinery. This geopolitical shift is altering sourcing patterns, demanding that equipment suppliers establish stronger local manufacturing and support presences in the West, which inherently increases market complexity but also provides substantial revenue opportunities for specialized automation firms. The European market, in particular, emphasizes sustainability and energy efficiency in machine operation, aligning with stringent regional environmental and industrial standards.

Segment trends underscore the dominance of machines designed for high-capacity applications, particularly in the EV and ESS sectors, which collectively command the majority market share and exhibit the highest growth rates. Within the machine type segment, Slitting Machines and Winding/Stacking Machines are seeing rapid innovation. Slitting machines are transitioning toward zero-burr technologies and advanced tension control systems to prevent micro-short circuits, while stacking machines are increasingly leveraging highly complex, high-speed robotic systems and laser cutting techniques to handle large format electrodes with extreme accuracy, especially for prismatic and pouch cells. Furthermore, there is a pronounced segment trend toward dry electrode processing equipment, though still nascent, driven by the potential environmental and cost benefits associated with eliminating solvent-based coating and drying processes. This push towards dry processes, if commercialized effectively, could fundamentally reshape the demand profile for traditional wet processing pretreatment machines, introducing a significant wave of replacement demand in the latter half of the forecast period.

AI Impact Analysis on Lithium Battery Pretreatment Machine Market

Analysis of common user questions reveals strong interest centered around how Artificial Intelligence (AI) can mitigate the high failure rates and quality control challenges inherent in high-speed battery production. Users frequently inquire about the feasibility of AI for real-time defect detection beyond human capacity, the potential for predictive maintenance to minimize costly equipment downtime, and how machine learning algorithms can optimize complex, multi-variable pretreatment processes like coating and calendering to maximize yield and energy density. Key themes include concerns about data integration across diverse machine types, the accuracy of AI models in identifying nuanced sub-micron defects, and the return on investment (ROI) associated with implementing expensive AI vision systems and control software. Users anticipate that AI integration will shift pretreatment from reactive quality assurance to proactive process optimization, demanding smarter machines that can self-calibrate and adapt to material variances instantaneously.

The adoption of AI is revolutionizing the operation and efficiency of lithium battery pretreatment machinery, moving far beyond simple automation to genuine intelligent manufacturing. By integrating deep learning algorithms with advanced sensors (e.g., high-resolution cameras, laser profilometers, thermal sensors), AI enables immediate, non-contact inspection of electrode materials during high-speed production, capable of identifying microscopic pinholes, coating inconsistencies, edge defects, and foreign material contamination that conventional methods often miss. This real-time feedback loop is crucial; AI models instantaneously adjust machine parameters (such as coating gap, drying temperature, or roller pressure in calendering) to correct deviations before excessive material is wasted, thus drastically improving yield rates and ensuring every cell meets stringent performance criteria required for automotive safety standards.

Furthermore, AI-driven predictive maintenance represents a massive operational advantage, particularly given the high cost and complexity of pretreatment equipment. Machine learning algorithms analyze continuous sensor data from motors, bearings, and control systems to predict potential mechanical failures hours or days before they occur. This allows manufacturers to schedule maintenance precisely when needed, rather than relying on fixed intervals, minimizing unscheduled downtime which can cost millions per day in a gigafactory environment. The application of AI also extends to process recipe optimization. By correlating input variables (raw material characteristics, machine settings) with output quality metrics (cell capacity, impedance), AI systems iteratively refine pretreatment recipes, finding optimal settings faster and more effectively than traditional human-led experimentation, accelerating the ramp-up time for new product lines and optimizing resource consumption.

- Enhanced Defect Detection: AI machine vision systems enable sub-micron defect identification on electrode foils, drastically reducing risk of internal short circuits.

- Predictive Maintenance: Utilization of ML to analyze machine vibration and temperature data, forecasting equipment failure and maximizing uptime.

- Real-Time Process Optimization: Closed-loop AI control adjusting coating speed, tension, and drying parameters based on instantaneous quality feedback.

- Resource Efficiency: AI modeling optimizes solvent usage and energy consumption in drying ovens, contributing to lower operating expenses.

- Accelerated R&D: Machine learning facilitates rapid discovery of optimal manufacturing parameters for novel battery chemistries (e.g., solid-state precursors).

DRO & Impact Forces Of Lithium Battery Pretreatment Machine Market

The market is defined by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively generating powerful impact forces shaping the competitive landscape. The primary driver is the exponentially increasing global demand for lithium-ion batteries across the Electric Vehicle and Energy Storage System sectors, mandating massive investment in high-throughput manufacturing capacity globally. This is compounded by governmental and regulatory pressures, such as strict safety standards and policies favoring domestic battery production (e.g., IRA, European Battery Act), compelling battery manufacturers to rapidly adopt the most advanced, high-precision pretreatment machinery. The core restraint, however, lies in the extremely high initial capital expenditure required for sophisticated, fully automated pretreatment lines, coupled with the scarcity of highly skilled engineering talent necessary to operate, maintain, and integrate these complex systems effectively. Furthermore, the inherent volatility in raw material costs (lithium, nickel, cobalt) can occasionally temper investment decisions for new equipment procurement, particularly for smaller market players.

Opportunities abound in technological innovation, specifically in the commercialization of dry electrode technology, which bypasses solvent usage and reduces the footprint and energy demands of traditional coating and drying processes—a major potential disruptive force. Another key opportunity lies in providing advanced retrofitting and upgrade services to existing gigafactories, enabling them to transition older machinery to modern Industry 4.0 standards with integrated AI and IoT capabilities, thereby extending asset life and improving efficiency. The geopolitical fragmentation of the battery supply chain offers specialized equipment manufacturers significant chances to establish strong regional presences in emerging manufacturing hubs in North America and Europe, capitalizing on the desire for localized, non-Asian-sourced automation solutions. Addressing the lack of skilled labor through enhanced, user-friendly software interfaces and remote diagnostic capabilities also represents a significant service opportunity for key market players.

The resulting impact forces compel manufacturers to prioritize precision, speed, and automation simultaneously. Regulatory adherence, particularly regarding workplace safety and environmental compliance, drives equipment design toward closed-loop systems and solvent recovery mechanisms. Economic forces emphasize total cost of ownership (TCO), making energy efficiency and durability core competitive factors. Consequently, the market sees intense competition among machine vendors to offer higher throughput (faster coating/slitting/stacking speeds) while guaranteeing micron-level accuracy. The most substantial impact force is the necessity for technological convergence: successful vendors are those who can integrate advanced mechanical engineering (precision rollers, high-tolerance alignment) with cutting-edge software (AI vision, real-time control, IoT connectivity) to deliver holistic, intelligent production solutions that meet the demanding specifications of automotive-grade battery production.

Segmentation Analysis

The Lithium Battery Pretreatment Machine Market is comprehensively segmented based on machine type, battery cell format, and end-use application, providing a structured view of demand dynamics across the manufacturing landscape. Segmentation by machine type is critical as it reflects the specific technological processes involved in electrode preparation, distinguishing between solvent-based and potential dry processes. Major segments include coating/drying machines, which are fundamental to laying down active materials; calendering machines, which determine electrode density; and slitting/cutting and winding/stacking machines, which handle the precise physical assembly of the cell components. The end-use application split, dominated by EVs and ESS, highlights where the highest volume and most stringent quality demands originate, influencing the necessary investment in advanced, high-speed equipment.

Further segmentation by cell format (cylindrical, prismatic, and pouch) demonstrates the different pretreatment technologies required, as prismatic and pouch cells often utilize stacking methodologies, while cylindrical cells primarily rely on high-speed winding. This differentiation drives demand for specialized machinery: stacking requires complex robotic placement and alignment systems, whereas winding prioritizes speed and accurate tension control. The market’s evolution is also leading to finer segmentation based on automation level, distinguishing between semi-automatic lines (often used in R&D or smaller-scale production) and fully automatic, integrated production lines characteristic of modern gigafactories. Analyzing these segments is essential for understanding where technological investment is concentrated and predicting future growth hotspots, particularly the increasing shift toward highly customized stacking solutions for large-format prismatic cells prevalent in modern automotive battery packs.

- By Machine Type:

- Coating and Drying Machines (Slot-Die Coaters, Vacuum Dryers)

- Calendering Machines (High-Precision Roll Presses)

- Slitting and Cutting Machines (Rotary Cutting, Laser Cutting)

- Winding and Stacking Machines (High-Speed Continuous Winders, Z-Stacking Robots)

- Accessory and Auxiliary Equipment (Mixing, Electrode Handling)

- By Battery Cell Format:

- Cylindrical Cells

- Prismatic Cells

- Pouch Cells

- By Application:

- Electric Vehicles (EVs, PHEVs)

- Energy Storage Systems (ESS)

- Consumer Electronics (CE)

- Industrial & Others (Power Tools, Medical Devices)

Value Chain Analysis For Lithium Battery Pretreatment Machine Market

The value chain for the Lithium Battery Pretreatment Machine Market begins with upstream material suppliers providing the foundational components necessary for machinery construction, primarily focusing on highly specialized, high-tolerance mechanical and electronic components. This includes precision steel and aluminum alloys capable of withstanding high pressures and temperatures (essential for calenders and drying ovens), advanced servo motors and robotics for high-speed motion control, complex sensor arrays (vision systems, laser displacement sensors), and sophisticated programmable logic controllers (PLCs) and industrial computing hardware crucial for automation. Upstream stability and quality are paramount, as the performance of the pretreatment machinery is directly dependent on the micron-level accuracy and reliability of these core components. Key upstream activities involve specialized material processing and the manufacturing of high-reliability automation parts tailored specifically for demanding cleanroom environments typical of battery production, requiring strong partnerships between machinery OEMs and component suppliers.

The midstream stage is occupied by the original equipment manufacturers (OEMs) of the pretreatment machines themselves. These companies perform critical activities such as R&D (developing proprietary coating dies, advanced winding algorithms), system integration (combining mechanical, electrical, and software components), manufacturing, and rigorous quality testing. OEMs serve as the primary link between technological innovation and mass production capability. Distribution channels in this specialized market are highly technical and often direct. Due to the high value, complexity, and customization required, machinery sales are typically managed through direct sales teams engaging in long-term consultation and contract negotiations with gigafactory operators. Indirect channels may include authorized distributors or system integrators focusing on regional support or smaller-scale equipment, but major, fully integrated production lines are almost always procured directly from the OEM to ensure tailored installation, comprehensive training, and continuous technical support.

Downstream analysis focuses on the end-users: the battery cell manufacturers (e.g., gigafactories). These manufacturers utilize the pretreatment machines to transform raw materials (foils, slurries) into finished electrode assemblies, which then move to final cell assembly and testing. The performance and efficiency of the downstream operations are entirely dependent on the quality and throughput achieved during the pretreatment phase. A defect generated by a slitter, for example, can lead to the rejection of thousands of cells downstream. The service and maintenance segment also constitutes a critical downstream component, as pretreatment machines require continuous calibration, spare parts supply, and software updates. Given the global dispersion of gigafactories, providing timely and specialized maintenance—often utilizing remote diagnostics and augmented reality tools—is a significant element of the downstream value proposition offered by the pretreatment machine OEMs, ensuring maximum operational efficiency and minimizing production bottlenecks.

Lithium Battery Pretreatment Machine Market Potential Customers

The primary and most significant potential customers for Lithium Battery Pretreatment Machines are large-scale battery cell manufacturers, commonly known as gigafactories or megafactories, specializing in the mass production of lithium-ion batteries. These entities, including major Asian manufacturers (CATL, LG Energy Solution, Samsung SDI, BYD), European consortia (Northvolt), and burgeoning North American players (Tesla, GM ventures, Ford ventures), have immense capital expenditure budgets dedicated to establishing and expanding production lines. Their purchasing decisions are driven by the necessity for equipment capable of extreme precision, high throughput (often exceeding 10 GWh capacity per line), full automation, and compliance with rigorous automotive safety and quality standards (ISO/TS 16949). These customers seek turnkey solutions that integrate seamlessly with their existing manufacturing execution systems (MES) and guarantee minimal downtime and superior yield rates, focusing purchasing power on vendors with proven track records in mass production environments.

Secondary potential customers include smaller or emerging battery manufacturers and specialized companies focusing on specific niche applications, such as high-performance aerospace or medical batteries, where customizability and ultra-high quality trump sheer volume. Furthermore, independent research institutions, government laboratories, and major university research centers constitute a critical, albeit smaller, customer segment. These entities require R&D scale pretreatment machinery that offers exceptional flexibility, precise parameter control, and the capability to rapidly test novel electrode materials and processes (e.g., solid-state electrolytes or new binder systems) without the massive throughput of commercial lines. Their demand profile leans toward versatile, modular equipment rather than dedicated, high-speed production systems, providing opportunities for specialized, smaller machinery manufacturers to cater to the innovation ecosystem.

A burgeoning segment of potential customers includes specialized battery recycling and material recovery firms that are increasingly integrating small-scale pretreatment or specialized disassembly machinery into their processes. While their requirements differ slightly—focusing on safe handling and preparation of end-of-life batteries—they utilize similar precision cutting, separating, and handling technologies adapted for recycling feedstock preparation. Lastly, the automotive OEMs themselves, who are increasingly engaging in backward integration to secure their battery supply chains, represent a growing customer base. As companies like Volkswagen, Stellantis, and others establish their own captive gigafactories or joint ventures, they become significant buyers of pretreatment machinery, demanding tailored solutions that match their specific vehicle platform requirements and production philosophies, thereby exerting substantial influence over machine specifications and procurement trends in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wuxi Lead Intelligent Equipment Co., Ltd., Shenzhen Sinexcel Electric Co., Ltd., Toray Engineering Co., Ltd., Manz AG, Komax Group, Yinghe Technology Co., Ltd., PNT Co., Ltd., Fuji Machine Mfg. Co., Ltd., CKD Corporation, Hirano Tecseed Co., Ltd., CITIC Heavy Industries Co., Ltd., Bystronic Group, Koem, Guangzhou Kinte Electric Co., Ltd., Jiangsu Jiatuo New Energy Technology Co., Ltd., Putailai New Energy Technology Co., Ltd., VMI Group (Meyn), Haoneng Technology Co., Ltd., Hangke Technology Co., Ltd., Blue Solutions (Bolloré Group). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Battery Pretreatment Machine Market Key Technology Landscape

The technology landscape of the Lithium Battery Pretreatment Machine Market is rapidly evolving, driven by the need for higher energy density, faster charging capabilities, and improved safety protocols in next-generation lithium-ion cells. Central to this evolution are advances in high-precision coating and drying techniques. Slot-die coating technology, which allows for extremely uniform deposition of electrode slurry at high speeds, remains dominant, but innovation focuses on multi-layer simultaneous coating capabilities and closed-loop process control integrating sophisticated viscosity and flow meters. Furthermore, the integration of advanced vacuum drying and infrared heating technologies minimizes drying time while ensuring solvent residues are within micro-traceable limits, critical for preventing subsequent cell degradation. The pursuit of dry electrode processing, leveraging technologies like laser ablation or powder-based processing, represents a potentially radical technological disruption, although its commercial maturity for mass-market automotive applications is still pending widespread acceptance.

Automation and precision mechanics constitute another core technological pillar. High-speed calendering machines now incorporate real-time non-contact thickness measurement systems (e.g., utilizing X-ray or beta sensors) coupled with ultra-fast feedback loops to maintain electrode density consistency across the entire width and length of the foil, minimizing local resistance variations. Similarly, slitting and winding/stacking machines are heavily reliant on highly accurate tension control systems and state-of-the-art robotic manipulation. Slitting technology is moving towards minimal-burr rotary cutting or advanced laser cutting to eliminate micro-shorts. For stacking machines, which are crucial for large prismatic cells, the adoption of high-speed, high-accuracy vision-guided robotic arms (Z-stacking, V-stacking) is paramount, ensuring electrode alignment accuracy often within a tolerance of ±50 microns, a factor directly influencing long-term cell reliability and safety performance.

The convergence of physical machinery with digital intelligence (Industry 4.0 concepts) defines the cutting edge of the technology landscape. Key technologies here include Industrial Internet of Things (IIoT) connectivity, enabling machine-to-machine communication and centralized monitoring of complex production lines. Digital twin technology is increasingly being utilized for simulating pretreatment processes, allowing manufacturers to optimize machine setups and predict maintenance requirements before physical changes are implemented. Moreover, the integration of sophisticated computer vision systems powered by AI for continuous surface inspection and defect categorization is now standard for top-tier equipment. These systems generate massive datasets, which, when analyzed by machine learning algorithms, drive continuous process improvement and predictive quality management, ensuring that the throughput capacity of modern machines (which can run materials at over 100 meters per minute) is not compromised by quality bottlenecks.

Regional Highlights

The Lithium Battery Pretreatment Machine Market exhibits distinct regional dynamics, primarily dictated by global gigafactory investment patterns and governmental industrial policy. Asia Pacific (APAC) stands as the undisputed center of gravity, driven overwhelmingly by manufacturing powerhouses in China, South Korea, and Japan. China, hosting the largest installed battery production capacity globally (driven by players like CATL and BYD), generates the highest demand for pretreatment machinery, particularly high-speed, cost-effective equipment. South Korean and Japanese manufacturers (Samsung SDI, LG Energy Solution, Panasonic) prioritize ultra-high precision and technological superiority, often driving the global standard for innovation in areas like high-throughput stacking and advanced coating methodologies. APAC’s dominance is expected to continue, although the focus is shifting towards capacity upgrades and efficiency improvements in mature markets, and new capacity build-out in Southeast Asian countries like Thailand and Indonesia.

Europe and North America represent the fastest-growing emerging markets for pretreatment machinery, fueled by aggressive localization efforts aimed at building domestic supply chains. The European market, supported by the EU Battery Regulation and significant public funding (e.g., through IPCEI projects), is witnessing a massive influx of investment for gigafactories (e.g., Northvolt, ACC). European demand emphasizes machinery compliance with strict environmental standards, energy efficiency, and high integration capability for sustainable manufacturing practices. Similarly, North America, galvanized by the Inflation Reduction Act (IRA), is experiencing a historic surge in gigafactory construction, driving urgent demand for reliable, high-capacity equipment, often leading to partnerships and joint ventures between Asian equipment suppliers and Western automation firms to meet local supply requirements and rapidly scale production capacity.

- Asia Pacific (APAC): Dominates market share due to the highest concentration of existing and planned gigafactories; focuses on high volume and speed; key markets are China, South Korea, and Japan.

- Europe: Highest growth rate fueled by localization strategies and political mandates for energy independence; strong demand for energy-efficient and highly automated equipment that complies with EU sustainability standards.

- North America: Significant capital investment surge driven by the IRA; focuses on securing domestic supply chain capacity and demands robust, reliable machinery for new facility build-outs.

- Latin America & MEA: Nascent but growing markets, primarily driven by resource extraction economies (e.g., lithium mining in Chile) and emerging regional ESS needs; currently relies heavily on imported technology and machinery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Battery Pretreatment Machine Market.- Wuxi Lead Intelligent Equipment Co., Ltd.

- Shenzhen Sinexcel Electric Co., Ltd.

- Toray Engineering Co., Ltd.

- Manz AG

- Komax Group

- Yinghe Technology Co., Ltd.

- PNT Co., Ltd.

- Fuji Machine Mfg. Co., Ltd.

- CKD Corporation

- Hirano Tecseed Co., Ltd.

- CITIC Heavy Industries Co., Ltd.

- Bystronic Group

- Koem

- Guangzhou Kinte Electric Co., Ltd.

- Jiangsu Jiatuo New Energy Technology Co., Ltd.

- Putailai New Energy Technology Co., Ltd.

- VMI Group (Meyn)

- Haoneng Technology Co., Ltd.

- Hangke Technology Co., Ltd.

- Blue Solutions (Bolloré Group)

Frequently Asked Questions

Analyze common user questions about the Lithium Battery Pretreatment Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-precision lithium battery pretreatment machines?

The surging global demand for high-energy-density batteries for Electric Vehicles (EVs) and Energy Storage Systems (ESS) is the primary driver. These applications require micron-level precision in electrode preparation (coating, slitting, stacking) to ensure safety, reliability, and maximum cell lifespan, thereby necessitating advanced, automated pretreatment machinery.

How is Artificial Intelligence (AI) specifically integrated into modern pretreatment equipment?

AI is integrated through high-speed machine vision systems for real-time, non-contact defect inspection on electrode foils. It also powers predictive maintenance algorithms to minimize equipment downtime and optimizes complex process parameters (e.g., coating thickness and tension) to maximize manufacturing yield and quality consistency.

Which machine segment is expected to show the highest growth rate during the forecast period?

The Stacking and Winding Machines segment, particularly advanced stacking robots necessary for large format prismatic and pouch cells commonly used in EVs and ESS, is projected to exhibit the highest growth rate due to the increasing capacity demands and technical complexity associated with these larger cell formats.

What is the main restraint impacting the Lithium Battery Pretreatment Machine Market?

The main restraint is the extremely high capital expenditure and lengthy implementation time required for procuring and installing sophisticated, fully automated, high-precision pretreatment production lines. This poses a significant barrier to entry for smaller manufacturers and increases financial risk for scaling operations.

Are there disruptive technologies currently emerging in the pretreatment process?

Yes, the most significant emerging disruptive technology is Dry Electrode Processing. This technique aims to eliminate the use of costly and energy-intensive solvents in the coating and drying phases, potentially reducing both the manufacturing footprint and the overall energy consumption required for electrode production, fundamentally altering machine design requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager