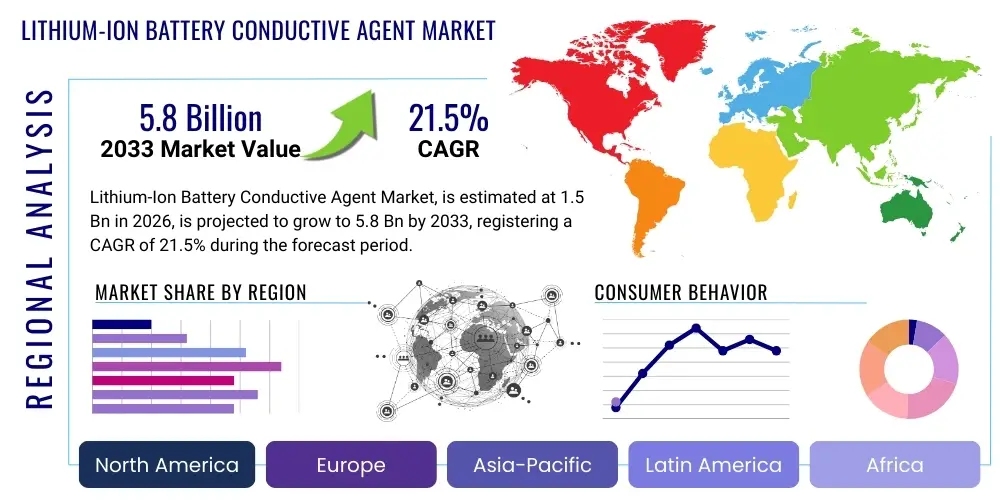

Lithium-Ion Battery Conductive Agent Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440860 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Lithium-Ion Battery Conductive Agent Market Size

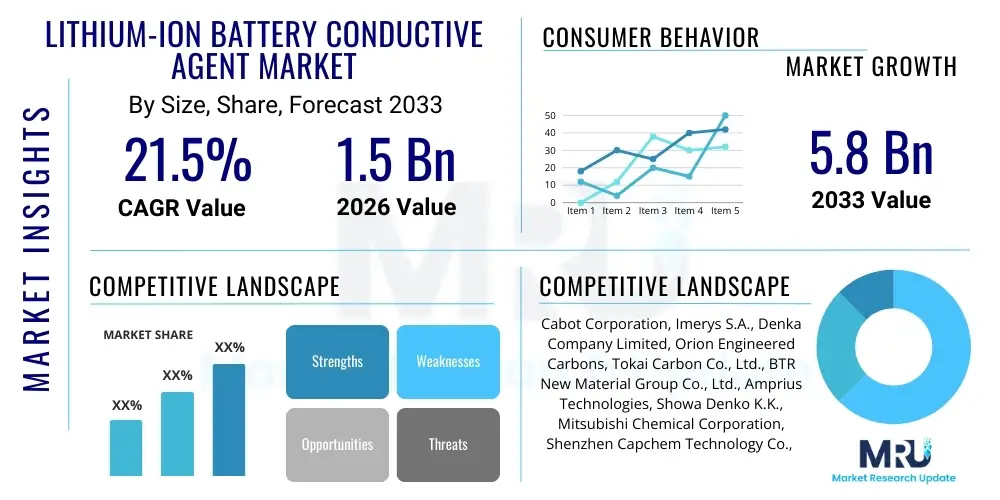

The Lithium-Ion Battery Conductive Agent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the escalating global demand for high-performance rechargeable batteries across diverse applications, particularly within the electric vehicle (EV) sector and advanced consumer electronics. The continuous innovation in battery technology, aiming for higher energy density, faster charging capabilities, and extended cycle life, directly fuels the need for more efficient and sophisticated conductive agents.

The increasing focus on renewable energy storage solutions, coupled with supportive government policies and environmental regulations promoting electrification, further underpins this robust market expansion. Market players are heavily investing in research and development to introduce next-generation conductive materials, such as advanced carbon nanotubes and graphene, which offer superior conductivity, mechanical strength, and thermal stability. These innovations are critical for enhancing the overall performance and safety of lithium-ion batteries, making them more competitive against traditional energy sources and driving their broader adoption across various industries globally.

Lithium-Ion Battery Conductive Agent Market introduction

The Lithium-Ion Battery Conductive Agent Market encompasses the production, distribution, and application of specialized materials designed to enhance the electrical conductivity within lithium-ion battery electrodes. These agents are critical components that facilitate electron transfer between the active material particles, current collectors, and the external circuit, thereby reducing internal resistance, improving power density, and optimizing charging/discharging efficiency. Without effective conductive agents, the active materials in battery electrodes, which are often poor electrical conductors, would not be able to fully participate in the electrochemical reactions, leading to diminished performance and capacity. The primary function of these agents is to form a highly conductive network throughout the electrode structure, ensuring that electrons can flow freely and effectively during battery operation.

Key products within this market include various forms of carbon-based materials, such as carbon black (e.g., acetylene black, furnace black, conductive carbon black), carbon nanotubes (CNTs), and graphene. While carbon black has been a traditional choice due to its cost-effectiveness and good conductivity, the demand for higher energy density and faster charging batteries is accelerating the adoption of advanced materials like CNTs and graphene. These newer materials offer exceptional electrical conductivity, superior mechanical strength, and ultra-high surface area, which are crucial for improving battery cycling stability and rate capability. Major applications for lithium-ion battery conductive agents span across electric vehicles (EVs), where they contribute to longer range and faster charging, portable consumer electronics like smartphones and laptops, and large-scale energy storage systems (ESS) for grid stabilization and renewable energy integration.

The benefits derived from high-quality conductive agents are multifaceted, including enhanced battery capacity retention over numerous charge-discharge cycles, improved safety by reducing localized hot spots, and increased overall lifespan of the battery pack. Furthermore, these agents can contribute to higher power output, essential for applications requiring rapid acceleration or high discharge rates. Driving factors for market growth include the relentless expansion of the global electric vehicle industry, stringent environmental regulations pushing for cleaner transportation and energy solutions, and the continuous technological advancements aimed at improving battery performance. The rising penetration of renewable energy sources necessitating efficient energy storage further propels the demand for advanced conductive agents, making them indispensable for the future of sustainable energy.

Lithium-Ion Battery Conductive Agent Market Executive Summary

The Lithium-Ion Battery Conductive Agent Market is currently experiencing robust growth, primarily propelled by dynamic business trends centered on technological innovation and strategic collaborations aimed at enhancing battery performance and manufacturing efficiency. Companies are increasingly investing in research and development to produce next-generation conductive materials, such as multi-walled carbon nanotubes and graphene derivatives, which offer superior electrical conductivity, improved mechanical properties, and higher specific surface areas compared to conventional carbon black. This push towards advanced materials is driven by the demand from electric vehicle (EV) manufacturers for batteries with longer ranges, faster charging times, and extended lifespans. Furthermore, there is a clear trend towards supply chain optimization and localized production to mitigate geopolitical risks and reduce lead times, especially in critical battery-producing regions.

Regional trends indicate that Asia Pacific, particularly China, South Korea, and Japan, remains the dominant force in the market, largely due to its established leadership in lithium-ion battery manufacturing and a strong governmental focus on EV adoption and renewable energy infrastructure. The region benefits from a well-developed ecosystem for material sourcing, processing, and battery assembly, alongside significant investments in R&D. Europe and North America are also witnessing accelerated growth, spurred by ambitious electrification targets, substantial governmental subsidies for EV purchases, and increasing investments in domestic battery production facilities. These regions are actively working to reduce their reliance on Asian imports by fostering local innovation and establishing robust supply chains for critical battery components, including conductive agents.

Segmentation trends highlight a shift towards high-performance materials. While carbon black continues to hold a significant market share due to its cost-effectiveness and widespread use, the carbon nanotubes (CNTs) and graphene segments are projected to exhibit the highest growth rates. This acceleration is attributable to their superior properties, which are indispensable for achieving the performance benchmarks required by advanced battery applications in EVs and high-end consumer electronics. By application, the electric vehicle segment is unequivocally the largest and fastest-growing, driven by mass adoption and expanding charging infrastructure. Energy storage systems and consumer electronics also remain vital segments, consistently demanding improved battery solutions that benefit from enhanced conductive agents, further diversifying the market's demand landscape.

AI Impact Analysis on Lithium-Ion Battery Conductive Agent Market

Common user questions regarding AI's impact on the Lithium-Ion Battery Conductive Agent Market often revolve around how artificial intelligence can accelerate material discovery, optimize manufacturing processes, predict battery performance, and enhance supply chain resilience. Users are keen to understand if AI can significantly reduce the time and cost associated with developing novel conductive materials with desired properties, such as improved conductivity and dispersion. There is also considerable interest in AI's potential to optimize the formulation and mixing processes of conductive agent slurries, leading to more uniform electrodes and ultimately better battery performance and extended lifespan. Furthermore, questions arise about AI's role in predictive maintenance for manufacturing equipment, quality control, and managing complex global supply chains to mitigate disruptions and ensure a steady flow of raw materials. The overarching expectation is that AI will introduce unprecedented efficiencies, accelerate innovation, and significantly improve the reliability and cost-effectiveness of lithium-ion battery production.

- AI-driven material discovery: Accelerates the identification and synthesis of novel conductive agents (e.g., new graphene or CNT derivatives) with enhanced properties through high-throughput screening and computational modeling.

- Optimized manufacturing processes: Utilizes machine learning algorithms for real-time process control, optimizing mixing, coating, and drying parameters for conductive agent slurries to ensure uniform electrode fabrication and minimize defects.

- Predictive battery performance: Employs AI models to predict the long-term cycling stability, degradation patterns, and overall lifespan of batteries based on conductive agent characteristics, enabling better material selection and battery design.

- Enhanced quality control: Leverages computer vision and AI for automated inspection of electrode surfaces, detecting anomalies in conductive agent distribution and ensuring consistent product quality.

- Supply chain optimization: Implements AI for demand forecasting, inventory management, and risk assessment across the conductive agent supply chain, improving resilience and reducing potential disruptions.

- Reduced R&D cycles: Speeds up the research and development timeline for new conductive agents by simulating material interactions and performance under various conditions, thereby reducing the need for extensive physical experimentation.

- Personalized battery solutions: AI can enable the tailoring of conductive agent formulations to specific battery applications, optimizing performance for diverse requirements such as high power, high energy, or extreme temperatures.

DRO & Impact Forces Of Lithium-Ion Battery Conductive Agent Market

The Lithium-Ion Battery Conductive Agent Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and broader impact forces. Key drivers include the exponential growth of the electric vehicle (EV) industry globally, which mandates high-performance batteries requiring superior conductive materials to achieve longer ranges and faster charging. Additionally, the rapid expansion of renewable energy infrastructure necessitates advanced energy storage systems (ESS), further boosting demand. Stringent environmental regulations and government incentives promoting clean energy and electrification across various sectors also act as powerful stimulants. The continuous innovation in battery technology, focusing on increasing energy density and improving safety, inherently drives the need for more efficient conductive agents, fostering intense research and development efforts within the market.

However, the market faces several notable restraints. The relatively high production cost of advanced conductive materials, such as high-quality carbon nanotubes and graphene, can be a barrier to wider adoption, particularly in cost-sensitive applications. Challenges in achieving uniform dispersion and coating of these nanomaterials within electrode slurries also pose technical hurdles, potentially affecting battery performance and manufacturing efficiency. Furthermore, vulnerabilities in the global supply chain for critical raw materials, coupled with geopolitical tensions, can lead to price volatility and supply disruptions. Safety concerns associated with certain conductive materials, particularly regarding thermal stability and potential for short-circuits if not properly integrated, also represent a significant restraint requiring continuous innovation in material design and manufacturing processes.

Despite these challenges, substantial opportunities exist for market expansion and innovation. The development of novel conductive materials with improved performance-to-cost ratios, alongside the exploration of sustainable production methods, presents significant avenues for growth. The increasing focus on battery recycling and second-life applications opens new markets for conductive agents, as remanufactured batteries will still require optimal performance. Geographical expansion into emerging economies with nascent EV markets and growing industrial electrification further offers untapped potential. The integration of advanced conductive agents with smart grid solutions and other IoT-enabled energy systems creates synergistic opportunities, enhancing overall energy management and efficiency. These opportunities are further shaped by impact forces such as rapid technological innovation, which constantly reshapes material science and manufacturing processes. The evolving regulatory landscape, particularly concerning environmental standards and battery safety, profoundly influences material selection and market entry. Economic volatility can affect investment in battery production and consumer spending on EVs, while the overarching imperative for environmental sustainability continues to accelerate the transition towards advanced battery technologies and the materials that enable them.

Segmentation Analysis

The Lithium-Ion Battery Conductive Agent Market is meticulously segmented to provide a comprehensive understanding of its intricate dynamics and diverse applications. This segmentation allows for a detailed analysis of market trends, growth drivers, and competitive landscapes across different material types, end-use applications, and physical forms of conductive agents. By dissecting the market into these distinct categories, stakeholders can gain precise insights into specific growth opportunities, identify niche markets, and tailor their product development and marketing strategies effectively. This granular approach is essential for navigating the complexities of a rapidly evolving industry, driven by continuous innovation in battery technology and expanding demand across various sectors globally.

- By Type:

- Carbon Black:

- Acetylene Black

- Furnace Black

- Conductive Carbon Black

- Carbon Nanotubes (CNTs)

- Graphene

- Others (Conductive Polymers, Metal Powders)

- Carbon Black:

- By Application:

- Electric Vehicles (EVs)

- Consumer Electronics

- Energy Storage Systems

- Industrial Equipment

- Medical Devices

- By Form:

- Powder

- Slurry

- Dispersion

Value Chain Analysis For Lithium-Ion Battery Conductive Agent Market

The value chain for the Lithium-Ion Battery Conductive Agent Market is a complex network, beginning with the extraction and refining of raw materials, moving through sophisticated manufacturing and processing, and culminating in battery integration and end-use applications. Upstream analysis focuses on the sourcing and production of fundamental raw materials. For carbon black, this involves the thermal decomposition of hydrocarbons like petroleum or natural gas. For carbon nanotubes and graphene, it involves specialized chemical vapor deposition (CVD) processes or exfoliation techniques from graphite. Key suppliers in this stage provide high-purity precursors essential for achieving the desired conductivity and structural integrity of the final conductive agent. Research and development institutions also play a crucial upstream role, innovating new synthesis methods and material formulations to enhance performance and reduce costs.

Midstream activities involve the specialized manufacturing and processing of these raw materials into functional conductive agents. This includes processes like pulverization, surface treatment, and dispersion techniques to ensure optimal particle size, distribution, and compatibility with other battery electrode components. Manufacturers in this segment focus on achieving consistent quality, high purity, and tailored specifications to meet diverse battery requirements. This stage often involves proprietary technologies and significant capital investment in advanced production facilities. Downstream analysis then transitions to the integration of these conductive agents into lithium-ion battery cells. Battery manufacturers purchase these agents and incorporate them into electrode slurries, which are then coated onto current collectors. The performance of the final battery cell heavily relies on the quality and effective dispersion of the conductive agent within the cathode or anode. Further downstream, these cells are assembled into battery modules and packs for various applications, including electric vehicles, consumer electronics, and large-scale energy storage systems.

Distribution channels for conductive agents can be both direct and indirect. Direct channels involve conductive agent manufacturers selling directly to large-scale battery cell producers, particularly for customized or high-volume orders. This often includes technical support and collaborative development. Indirect channels involve distributors, agents, and specialized chemical suppliers who facilitate sales to smaller battery manufacturers or those requiring a broader portfolio of materials. These intermediaries often provide logistical support, local inventory, and technical assistance, bridging the gap between producers and a wider range of customers. The choice of distribution channel depends on factors such as market size, geographic reach, customer relationships, and the specific requirements of the battery industry. The entire value chain is characterized by strong interdependencies and a continuous feedback loop between battery manufacturers and conductive agent suppliers to drive innovation and performance improvements.

Lithium-Ion Battery Conductive Agent Market Potential Customers

The primary potential customers and end-users of lithium-ion battery conductive agents are predominantly manufacturers within the global battery industry, spanning various application sectors. These customers require conductive agents as a critical component for the production of high-performance lithium-ion cells, which are then integrated into a multitude of devices and systems. The largest and most rapidly expanding segment of these customers comprises electric vehicle (EV) manufacturers and their battery suppliers. As the automotive industry shifts towards electrification, the demand for high-energy-density, fast-charging, and long-lasting batteries has soared, directly translating into increased procurement of advanced conductive agents. These customers are highly sensitive to battery performance metrics such as range, cycle life, and safety, making the choice of conductive agent a strategic decision impacting their final product's competitiveness.

Another significant group of potential customers includes manufacturers of portable consumer electronics. This segment encompasses companies producing smartphones, laptops, tablets, wearables, and other personal electronic devices that rely on compact, lightweight, and high-capacity lithium-ion batteries. For these customers, factors like thinness, extended battery life, and rapid charging capabilities are paramount, driving the demand for conductive agents that can deliver superior performance in small form factors. The constant innovation cycles in consumer electronics necessitate a continuous supply of cutting-edge conductive materials to enable newer, more powerful device generations. The competitive nature of this market further compels manufacturers to seek out conductive agents that offer a distinct performance advantage.

Beyond the automotive and consumer electronics sectors, a growing base of potential customers includes developers and integrators of large-scale energy storage systems (ESS). These systems are vital for grid stabilization, renewable energy integration (e.g., solar and wind farms), and industrial backup power solutions. ESS customers prioritize long cycle life, high energy efficiency, and robust safety features, given the scale and criticality of their applications. Furthermore, manufacturers of industrial equipment, such as electric forklifts, automated guided vehicles (AGVs), and power tools, represent another key customer segment requiring durable and reliable lithium-ion batteries enhanced by effective conductive agents. Lastly, the emerging market for medical devices, including implantable devices and portable diagnostic equipment, presents a niche but high-value customer base, where battery reliability and safety are of utmost importance, driving demand for premium conductive agent solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cabot Corporation, Imerys S.A., Denka Company Limited, Orion Engineered Carbons, Tokai Carbon Co., Ltd., BTR New Material Group Co., Ltd., Amprius Technologies, Showa Denko K.K., Mitsubishi Chemical Corporation, Shenzhen Capchem Technology Co., Ltd., SGL Carbon SE, LG Chem, BASF SE, Arkema S.A., Teijin Limited, Asbury Carbons Inc., Hubei Sanneng Carbon-based Materials Co., Ltd., Suzhou Sinarm Co., Ltd., NanoXplore Inc., Jiangxi Zhengtuo New Material Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium-Ion Battery Conductive Agent Market Key Technology Landscape

The Lithium-Ion Battery Conductive Agent Market is characterized by a dynamic and continuously evolving technology landscape, driven by the persistent demand for enhanced battery performance, safety, and cost-effectiveness. The foundational technology involves various forms of carbon-based materials, primarily carbon black. While traditional carbon blacks like acetylene black and furnace black have been mainstays due to their good conductivity and cost efficiency, technological advancements are focused on developing specialized conductive carbon blacks with optimized particle morphology, surface area, and purity to improve slurry processability and electrochemical performance. Innovations in manufacturing techniques, such as plasma torch pyrolysis and advanced catalytic carbon black processes, aim to achieve finer control over material properties, leading to superior conductive networks within the electrode.

The forefront of technological innovation in this market is dominated by nanomaterials, specifically carbon nanotubes (CNTs) and graphene. For CNTs, technologies such as chemical vapor deposition (CVD) are crucial for controlled synthesis, enabling the production of single-walled (SWCNTs) and multi-walled carbon nanotubes (MWCNTs) with desired aspect ratios, diameters, and chirality. These advancements allow for the creation of highly efficient electron pathways at lower loading levels compared to carbon black, contributing to higher energy density and improved rate capability. Research is also focused on functionalizing CNTs to enhance their dispersion in electrode slurries and improve their interface with active materials, addressing a critical challenge in their adoption. Similarly, graphene technology, encompassing methods like chemical exfoliation, mechanical exfoliation, and epitaxial growth, aims to produce high-quality, defect-free graphene and graphene oxide variants. The unique two-dimensional structure of graphene offers exceptional electrical and thermal conductivity, making it highly promising for future battery designs. Technological efforts are concentrated on scaling up graphene production economically and achieving stable, uniform dispersions to fully leverage its extraordinary properties within battery electrodes.

Beyond carbon-based materials, emerging technologies include the development of conductive polymers and metal powders, though their market penetration is currently smaller. Conductive polymers, such as polyaniline or polypyrrole, offer flexibility and potentially lower density, with ongoing research to improve their electrical conductivity and stability in battery environments. Metal powders, typically of nickel or copper, are explored for specialized applications where very high conductivity is required, although their higher density and cost can be limiting factors. Furthermore, advanced dispersion technologies are critical across all material types, including ultrasonic dispersion, high-shear mixing, and surface modification techniques to prevent agglomeration and ensure homogeneous distribution of conductive agents within the electrode matrix. This ensures efficient electron transfer throughout the electrode, maximizing the active material utilization and overall battery performance. The convergence of material science, nanotechnology, and advanced manufacturing processes continues to drive the technological evolution in the lithium-ion battery conductive agent market.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market share, primarily driven by the established leadership of countries like China, South Korea, and Japan in lithium-ion battery manufacturing and electric vehicle production. The region benefits from extensive government support for electrification, a robust supply chain ecosystem, and significant investments in advanced battery R&D. China, in particular, leads in both production and consumption, fueled by its massive EV market and domestic battery industry giants.

- Europe: Exhibits rapid growth due to ambitious decarbonization targets, increasing adoption of electric vehicles, and substantial investments in giga-factories for battery production. Countries such as Germany, France, and Sweden are actively building local battery manufacturing capabilities and fostering innovation in conductive materials to reduce reliance on Asian imports and strengthen regional supply chains.

- North America: Demonstrates strong growth, spurred by supportive government policies, incentives for EV adoption (e.g., Inflation Reduction Act in the USA), and increasing investments by major automotive and battery manufacturers in domestic production facilities. The region is focusing on securing critical raw materials and developing advanced battery technologies to meet growing demand.

- Latin America: An emerging market with considerable potential, driven by growing interest in electric mobility and renewable energy projects. While currently a smaller market, increasing investment in infrastructure and manufacturing could lead to significant expansion in the long term, particularly in countries with rich lithium reserves.

- Middle East and Africa (MEA): Represents a nascent market for lithium-ion battery conductive agents, with growth potential tied to renewable energy initiatives, smart city projects, and gradual adoption of electric vehicles. Investments in energy transition and industrial diversification are key factors influencing market development in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium-Ion Battery Conductive Agent Market.- Cabot Corporation

- Imerys S.A.

- Denka Company Limited

- Orion Engineered Carbons

- Tokai Carbon Co., Ltd.

- BTR New Material Group Co., Ltd.

- Amprius Technologies

- Showa Denko K.K.

- Mitsubishi Chemical Corporation

- Shenzhen Capchem Technology Co., Ltd.

- SGL Carbon SE

- LG Chem

- BASF SE

- Arkema S.A.

- Teijin Limited

- Asbury Carbons Inc.

- Hubei Sanneng Carbon-based Materials Co., Ltd.

- Suzhou Sinarm Co., Ltd.

- NanoXplore Inc.

- Jiangxi Zhengtuo New Material Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Lithium-Ion Battery Conductive Agent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a lithium-ion battery conductive agent and why is it important?

A lithium-ion battery conductive agent is a material, typically carbon-based, added to battery electrodes to improve electrical conductivity. It forms an electron transfer network, enhancing power density, charging speed, and overall efficiency by ensuring active materials can fully participate in electrochemical reactions, which is crucial for modern high-performance batteries.

What are the primary types of conductive agents used in lithium-ion batteries?

The primary types include various forms of carbon black (e.g., acetylene black, furnace black, conductive carbon black) and advanced nanomaterials such as carbon nanotubes (CNTs) and graphene. Each type offers distinct advantages in terms of conductivity, cost, and dispersion characteristics, tailored to specific battery performance requirements.

Which applications drive the highest demand for lithium-ion battery conductive agents?

The electric vehicle (EV) sector is the largest and fastest-growing application segment, requiring high-performance batteries with superior energy density and fast-charging capabilities. Consumer electronics and large-scale energy storage systems (ESS) also represent significant and continuously expanding demand drivers for these specialized materials.

What are the key factors influencing the growth of the conductive agent market?

Key growth factors include the global surge in electric vehicle adoption, increasing demand for renewable energy storage solutions, continuous advancements in battery technology pushing for higher performance, and supportive government policies promoting electrification and sustainable energy transitions worldwide.

What challenges does the Lithium-Ion Battery Conductive Agent Market face?

Major challenges include the high production costs of advanced nanomaterials, technical difficulties in achieving uniform dispersion and coating of these agents within electrode slurries, vulnerabilities in the global supply chain for raw materials, and ongoing safety concerns related to thermal stability and material integration within battery cells.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager