Lithium Ion Battery Electrolyte Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443237 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Lithium Ion Battery Electrolyte Market Size

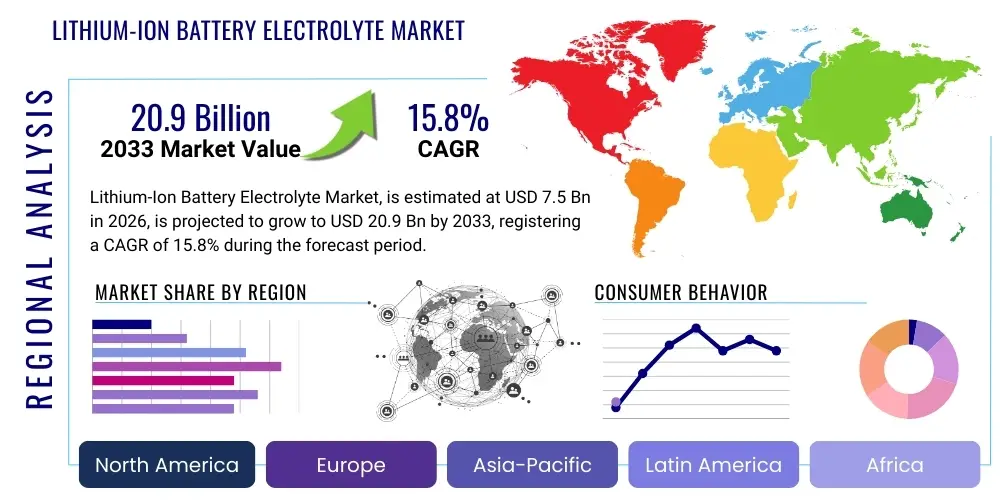

The Lithium Ion Battery Electrolyte Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 27.8 Billion by the end of the forecast period in 2033.

Lithium Ion Battery Electrolyte Market introduction

The Lithium Ion Battery Electrolyte Market encompasses the specialized segment of chemical manufacturing dedicated to producing the intricate solutions vital for the electrochemical functionality of lithium-ion batteries. These electrolytes are complex mixtures, fundamentally composed of a highly purified lithium salt, such as Lithium Hexafluorophosphate (LiPF6), meticulously dissolved within a blend of non-aqueous, highly anhydrous organic solvents, including cyclic carbonates like Ethylene Carbonate (EC) and linear carbonates such as Dimethyl Carbonate (DMC) and Ethyl Methyl Carbonate (EMC). The primary role of this highly engineered liquid medium is to serve as an ionically conductive path, allowing lithium ions to efficiently and reversibly migrate between the positive cathode and the negative anode during the processes of charging and discharging, while critically maintaining electronic insulation to prevent internal short-circuiting. The performance metrics of the electrolyte, including its ionic conductivity, thermal stability, and electrochemical window, directly dictate the overall lifespan, power capability, and safety profile of the final battery cell. Precision manufacturing under strict moisture and impurity control is essential, as contamination can lead to catastrophic battery failure or premature degradation.

Major applications driving the robust demand across this sophisticated market include the burgeoning sector of Electric Vehicles (EVs) and Plug-in Hybrid Electric Vehicles (PHEVs), which require large-format, high-energy-density cells. Concurrently, the proliferation of large-scale grid energy storage systems (ESS) for renewable energy integration—managing intermittent power sources like solar and wind—demands specialized electrolytes optimized for longevity, safety, and high cycle count reliability rather than peak energy density. Furthermore, the persistent demand from consumer electronics, encompassing smartphones, laptops, and various high-power wearable devices, maintains a strong underlying market segment for smaller-format batteries requiring electrolytes tuned for rapid charging and sustained power output. The core benefits delivered by optimized electrolytes include substantially enhanced volumetric and gravimetric energy density, facilitating lighter and more powerful batteries; improved operational resilience, allowing functioning across wider temperature extremes; and significantly prolonged calendar and cycle life, reducing replacement frequency and lowering the total cost of ownership for end-users, thus acting as a major enabler for global decarbonization efforts and the transition to a mobile, electric future.

Key driving factors underpinning the aggressive market expansion include stringent regulatory mandates globally, particularly in Europe and China, compelling the phase-out of internal combustion engine vehicles and accelerating EV adoption. Substantial government and private sector investments in battery Gigafactories worldwide necessitate a parallel scaling of electrolyte component production. Continuous and intensive technological advancements are focused on addressing the inherent limitations of current liquid systems, particularly volatility and flammability, leading to burgeoning R&D in solid-state electrolytes (SSEs) and high-performance lithium salts like LiFSI, which promise superior safety characteristics and higher electrochemical performance ceilings. These technological frontiers are transforming the electrolyte from a mere conducting medium into a highly engineered, active component crucial for unlocking the next generation of battery performance standards.

Lithium Ion Battery Electrolyte Market Executive Summary

The Lithium Ion Battery Electrolyte Market is experiencing rapid structural expansion, primarily propelled by the exponential growth in Electric Vehicle adoption globally and substantial investments in grid modernization focusing on energy storage capacity. Business trends indicate a strong push toward vertical integration among major battery manufacturers (gigafactories), seeking to secure consistent supplies of high-quality electrolyte components and specialized additives. This strategic alignment aims to mitigate supply chain volatility and intellectual property challenges related to next-generation electrolyte formulations, particularly those designed for high-voltage cathodes and fast-charging capabilities. There is also a pronounced commercialization drive for novel electrolyte materials, including ionic liquids and non-flammable organic phosphates, addressing critical safety concerns associated with current liquid systems while emphasizing cost reduction through economies of scale and advanced automated manufacturing processes to meet the escalating volume demands of the automotive sector.

Regional trends highlight the continued, though slightly diminishing, dominance of the Asia Pacific region, led by China, South Korea, and Japan, which collectively control the overwhelming majority of global electrolyte precursor chemical production and finished electrolyte manufacturing capacity. However, a significant strategic realignment is occurring as North America and Europe rapidly scale up domestic electrolyte and component production capacity, supported by extensive governmental subsidies and regulatory frameworks such as the U.S. Inflation Reduction Act and the European Battery Alliance initiatives. These Western regions are focusing intensely on establishing localized, resilient supply chains, aiming to drastically reduce dependence on Asian imports, enhance national energy security, and provide traceability for sustainable sourcing, leading to decentralized and highly competitive regional growth centers focused on advanced, specialized electrolyte chemistries.

Segment trends reveal that Lithium Hexafluorophosphate (LiPF6) currently maintains its position as the leading lithium salt component due to its established performance profile and cost efficiency in existing commercial cells, despite its known thermal instability drawbacks. Consequently, the fastest-growing segment is represented by advanced lithium salts, such as Lithium bis(fluorosulfonyl)imide (LiFSI), and sophisticated functional additives (e.g., fluoroethylene carbonate), which are essential for enabling the use of high-nickel content cathodes (NMC 811, NCMA) and maximizing battery performance under extreme operating conditions. Furthermore, the segmentation by application confirms that the automotive sector is the overriding influence, with prismatic and pouch cells demanding the largest volumes of the most technologically advanced electrolyte formulations, dictating R&D priorities toward long-life, high-safety, and rapid-charge optimized solutions.

AI Impact Analysis on Lithium Ion Battery Electrolyte Market

User inquiries concerning the influence of Artificial Intelligence (AI) and Machine Learning (ML) on the Lithium Ion Battery Electrolyte Market predominantly focus on three critical areas: accelerating materials innovation, optimizing complex manufacturing processes, and predicting operational failure modes. Users are keenly interested in how AI can substantially compress the often decade-long timeline required for traditional chemical discovery. ML models are being trained on vast datasets of known electrolyte properties, allowing researchers to predict the ionic conductivity, chemical stability, and compatibility of hundreds of thousands of novel solvent, salt, and additive combinations computationally, thereby bypassing extensive, time-consuming physical lab synthesis and testing. This capability is particularly crucial for identifying stable electrolyte compositions required for high-voltage (5V+) cathode materials and lithium metal anodes, which are unstable with traditional LiPF6 electrolytes. The summarized key theme is the expectation of AI as an innovation multiplier, drastically enhancing both the speed and safety attributes of new electrolyte formulations.

A major concern highlighted by common user questions relates to the manufacturing integrity of electrolytes at Giga-scale. High-purity electrolyte production is inherently sensitive to trace impurities, moisture, and temperature fluctuations. AI-driven process control systems are being deployed to monitor and adjust parameters in real-time, ensuring stringent quality specifications are maintained across massive production runs. This includes using computer vision and sensor fusion to detect anomalies in mixing ratios, purity levels, and fill operations, leading to minimized waste and maximized batch consistency—a crucial factor for automotive-grade reliability. Furthermore, users frequently query how AI assists in managing the complex logistics of precursor chemicals, predicting supply chain disruptions, and optimizing inventory management for hazardous materials used in electrolyte formulation, which carries high regulatory burden and demands robust safety protocols during transport and storage across international borders.

Finally, the long-term application of AI in battery health management (BMS) is a major user expectation. AI models can analyze real-time electrochemical impedance spectroscopy (EIS) data from batteries in use, correlating changes in the SEI layer composition—which is highly dependent on the initial electrolyte—with expected degradation rates. This predictive capability allows fleet operators and cell manufacturers to accurately gauge the remaining useful life (RUL) of the battery, facilitating predictive maintenance and optimizing charge/discharge cycles based on the specific electrolyte chemistry used, thus translating material science improvements into tangible operational benefits. The integration of digital twins, powered by AI models of the electrolyte system, is becoming the standard for sophisticated battery management, enhancing reliability and safety metrics significantly and enabling new warranty models for electric vehicles and large-scale grid storage installations.

- AI accelerates the discovery and in-silico screening of novel electrolyte materials, predicting thermodynamic stability, conductivity, and interface compatibility with emerging electrodes like high-nickel cathodes.

- Machine Learning algorithms optimize electrolyte manufacturing process parameters, utilizing sensor data feedback loops for real-time adjustments to ensure ultra-high purity and minimize costly batch-to-batch variability in giga-scale facilities.

- Predictive modeling using AI analyzes complex electrolyte degradation mechanisms in operational batteries, allowing for proactive maintenance and targeted development of specific functional additives to extend cycle and calendar life.

- AI-driven simulation tools significantly reduce reliance on expensive and time-consuming experimental testing, especially for screening solvents, salts (e.g., LiFSI, LiTFSI), and their performance under extreme temperature and voltage conditions.

- Integration of AI in Battery Management Systems (BMS) allows for dynamic, adaptive charging and discharge protocols based on the estimated health and localized temperature of the electrolyte, maximizing cell safety and energy efficiency.

- Enhanced supply chain visibility and risk assessment for critical electrolyte precursors, such as lithium carbonate and high-purity fluorine sources, using predictive analytics to manage volatile global chemical markets.

DRO & Impact Forces Of Lithium Ion Battery Electrolyte Market

The Lithium Ion Battery Electrolyte market is fundamentally shaped by powerful, multifaceted forces that determine investment patterns and technological trajectories. The primary Driver is the massive, global political and economic commitment to decarbonization, manifesting in aggressive targets for Electric Vehicle penetration and the deployment of renewable energy infrastructure requiring robust grid storage. This continuous surge in demand for high-performance batteries, particularly those optimized for long range and rapid charging, mandates equivalent advancements in electrolyte technology. Secondly, ongoing cost reductions in battery cell manufacturing, largely achieved through economies of scale (Gigafactories), simultaneously push electrolyte producers to deliver materials at lower costs while maintaining or improving purity and performance standards. This interplay between high demand and cost pressure sustains aggressive capacity expansion, predominantly within the Asia Pacific region, though rapidly localizing elsewhere, particularly in response to protectionist trade policies and regional content requirements promoting domestic sourcing.

However, significant Restraints challenge this expansion. Chief among these is the inherent safety hazard posed by conventional liquid electrolytes, which utilize flammable organic carbonate solvents; thermal runaway events remain a major technical and public concern, necessitating intensive research into flame-retardant additives and alternative chemistries. Another critical restraint is the technical difficulty and high capital expenditure required for producing and handling ultra-high-purity electrolyte components, especially the lithium salt LiPF6, which is highly sensitive to moisture and degrades easily, complicating logistics and storage across diverse climates and long supply routes. Furthermore, the concentrated, non-diversified supply chain for key components, particularly LiPF6 precursors and specialized additives, introduces high geopolitical and market risk, leading to price volatility that can negatively impact battery cell manufacturers' profitability and sourcing security. These constraints underscore the need for disruptive technological breakthroughs to sustain long-term growth and secure reliable access to critical materials.

The primary Opportunities are centered on technological substitution. The commercialization of Solid-State Electrolytes (SSEs)—including inorganic ceramic and polymer systems—represents the most significant opportunity, promising radical improvements in safety and potential use of Li-metal anodes for enhanced energy density, fundamentally reshaping the energy storage landscape. Secondarily, the rising adoption of novel lithium salts, such as LiFSI, offers a pathway to immediately enhance the stability and performance of current liquid systems, especially for high-voltage cathode pairings and enabling higher cell voltages. Geographically, significant opportunities exist in developing localized, end-to-end electrolyte supply chains in North America and Europe, supported by substantial governmental funding and mandates designed to foster regional energy independence and reduce reliance on Asian imports, creating lucrative avenues for new market entrants. The Impact Forces resulting from these dynamics are characterized by intense intellectual property competition and strategic mergers and acquisitions among chemical players and battery producers to secure proprietary formulations and stable supply lines. Regulatory bodies worldwide are exerting pressure, acting as an additional force that compels the industry toward inherently safer, more sustainable, and traceable electrolyte chemistries.

Segmentation Analysis

The Lithium Ion Battery Electrolyte market is segmented based on the critical chemical components that define the electrolyte’s performance, the physical state of the material, and the specific application or battery type for which it is designed. Understanding these segments is crucial as different end-user requirements—such as high power density for power tools versus high energy density for electric vehicles—necessitate fundamentally different electrolyte formulations and investment strategies. The segmentation by electrolyte type, covering liquid, semi-solid, and solid formulations, highlights the ongoing technological evolution toward safer, non-flammable systems, with solid-state electrolytes expected to capture significant market share in the long term due to enhanced safety features and compatibility with future anode technologies like lithium metal. This differentiation drives major R&D spending and dictates manufacturing complexity.

The segmentation by chemical component, specifically the lithium salt used, is vital as the salt dictates the ionic conductivity and the crucial voltage stability window of the cell. While LiPF6 remains the standard, high-growth segments are emerging around newer, more stable salts like LiFSI, which offer better performance at elevated temperatures and higher voltages, albeit often at a premium cost. Similarly, the categorization by solvents (carbonates like EC, DMC, DEC) and specialized additives (SEI forming, flame retardants) allows for granular analysis of material sourcing and supply chain dependencies. Given the high purity requirements, sourcing specialized solvents and additives is a critical operational bottleneck for electrolyte formulators globally.

Finally, the segmentation by application and battery type provides clear insight into market consumption patterns. The automotive segment (prismatic and pouch cells) demands bulk high-volume supply and dictates the highest performance standards regarding safety and longevity. Conversely, the consumer electronics market (cylindrical cells and smaller pouch cells) prioritizes miniaturization and fast charging capabilities. The industrial sector, focused heavily on Energy Storage Systems (ESS), requires electrolytes optimized for maximum cycle life and reliability over density. This multifaceted segmentation allows stakeholders to accurately gauge market growth opportunities and tailor product development and capacity investments to specific, high-value end-user demands across diverse geographical regions.

- By Component:

- Lithium Salts (LiPF6, LiClO4, LiBF4, LiTFSI, LiFSI, LiBOB, Others)

- Solvents (Ethylene Carbonate (EC), Dimethyl Carbonate (DMC), Diethyl Carbonate (DEC), Ethyl Methyl Carbonate (EMC), Propylene Carbonate (PC), Fluoroethylene Carbonate (FEC), Others)

- Additives (Film-Forming Additives, Flame Retardant Additives, Overcharge Protection Additives, Corrosion Inhibitors, Gas-Scavenging Additives)

- By Electrolyte Type:

- Liquid Electrolyte

- Solid Electrolyte (Inorganic Solid Electrolytes (e.g., Garnet, Sulfide), Solid Polymer Electrolytes (SPE))

- Semi-Solid/Gel Electrolyte (Polymer Gel Electrolyte, Ionic Liquid-Based Electrolyte)

- By Application:

- Automotive (Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), Hybrid Electric Vehicles (HEV))

- Consumer Electronics (Smartphones, Laptops, Tablets, Wearables, Power Banks)

- Industrial (Grid Energy Storage Systems (ESS), Power Tools, Uninterruptible Power Supply (UPS), Medical Devices, Aerospace and Defense)

- By Battery Type:

- Prismatic Cell (Common in high-capacity automotive applications)

- Pouch Cell (Flexible, used in EVs and consumer electronics)

- Cylindrical Cell (Standardized format, used in automotive and industrial applications)

- By Regional Analysis:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Taiwan, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Lithium Ion Battery Electrolyte Market

The value chain for the Lithium Ion Battery Electrolyte Market is complex and highly specialized, beginning with the upstream extraction and refining of foundational raw materials. Upstream analysis focuses on the mining and chemical processing of lithium, fluorine, phosphorus, and high-purity organic intermediates necessary for synthesizing the key components. Specialized chemical manufacturers then take these raw inputs to produce ultra-high-purity electrolyte precursors: lithium salts (like LiPF6), various organic carbonate solvents (EC, DMC, EMC), and proprietary performance additives (VC, FEC). These upstream activities demand exceptionally stringent quality control, as even trace amounts of water or impurities can severely compromise battery performance. This segment is heavily centralized, with a few Asian chemical giants dominating the global supply of battery-grade LiPF6 and high-purity carbonate solvents, leading to concentration risks and significant geographical dependence for downstream manufacturers.

Midstream activities involve the highly precise formulation and manufacturing of the finished electrolyte solution. Electrolyte formulators procure the individual components and blend them under highly controlled, dry-room conditions (low dew point) to create customized electrolyte cocktails tailored to specific cell chemistries (e.g., LFP versus NMC). This stage is highly intellectual property-intensive, with manufacturers relying on proprietary additive packages to differentiate their product based on key performance metrics such as cycle life, rate capability, and safety characteristics. Downstream analysis focuses on the primary consumers: large-scale battery cell manufacturers (Gigafactories) such as CATL, LG Energy Solution, and Panasonic. These players integrate the electrolyte into the final cell structure—prismatic, pouch, or cylindrical—during the highly automated cell assembly and formation stages. The purchasing power and technological demands of these downstream cell manufacturers largely dictate the innovation agenda and pricing dynamics throughout the preceding value chain segments.

The distribution channel for bulk commercial supply is predominantly direct, involving direct contractual relationships between the electrolyte formulator and the battery cell manufacturer. This direct model is essential for maintaining strict quality assurance, protecting proprietary formulations, and managing the specialized logistics required for handling corrosive and moisture-sensitive chemicals. Indirect distribution, typically handled by specialized chemical distributors, is usually limited to serving smaller R&D organizations, universities, and niche application manufacturers requiring smaller, custom volumes. Crucially, the localization trend—where electrolyte manufacturing plants are co-located near Gigafactories in regions like North America and Europe—is reshaping the distribution network, minimizing international shipping risks and accelerating just-in-time supply, thereby strengthening regional supply chains and reducing dependence on long, vulnerable global routes.

Lithium Ion Battery Electrolyte Market Potential Customers

The primary and most significant potential customers for the Lithium Ion Battery Electrolyte Market are the Tier 1 large-scale lithium-ion battery cell producers, commonly known as Gigafactories. These customers, including market leaders such as Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution, Samsung SDI, and SK Innovation, are focused on producing millions of kilowatt-hours of battery capacity annually, predominantly for the electric vehicle (EV) market. Their core procurement drivers are security of supply, consistent quality (ultra-low impurity levels), and highly optimized formulations that match their specific high-energy or high-power cell designs. These global players demand standardized contracts, competitive bulk pricing, and demonstrable scalability from their electrolyte suppliers, often entering into multi-year supply agreements to stabilize costs and ensure material flow for their rapidly expanding production lines globally.

A rapidly expanding secondary customer segment comprises manufacturers of stationary Energy Storage Systems (ESS) for grid and commercial applications. Companies involved in deploying utility-scale battery parks require electrolytes specifically engineered for maximum calendar and cycle life, emphasizing durability and safety over volumetric energy density. Their purchasing decisions often focus on electrolytes compatible with LFP (Lithium Iron Phosphate) chemistries, which utilize different solvent and additive requirements compared to nickel-rich automotive cells. Furthermore, high-end consumer electronics manufacturers and their contract cell suppliers (e.g., those serving Apple, Samsung Electronics) form another critical segment, demanding specialized, high-performance electrolytes capable of enduring rapid charging cycles and operating reliably within constrained, high-heat environments typical of smartphones and premium wearables, where small size and low weight are critical design considerations.

The third key customer group includes research and development institutions, material science start-ups, and specialized industrial battery manufacturers (e.g., aerospace, medical devices, defense). These entities typically require smaller volumes but seek highly customized or experimental electrolyte formulations, including advanced salts like LiFSI, ionic liquids, or precursors for solid-state electrolyte development. Electrolyte manufacturers view these customers not just as buyers but as strategic partners in innovation, providing crucial feedback on next-generation materials and allowing for early-stage commercial testing of highly specialized chemical solutions. Supporting these R&D customers is essential for maintaining a competitive edge and preparing for future technological shifts, particularly the widespread commercialization of solid-state battery technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 27.8 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Guotai Huarong Chemical New Material Co. Ltd., Mitsubishi Chemical Corporation, Central Glass Co. Ltd., UBE Corporation, Dongguan Shanshan Technology Co. Ltd., Soulbrain Co. Ltd., Tomiyama Pure Chemical Industries Ltd., Shenzhen Capchem Technology Co. Ltd., Tianjin Jinniu Power Sources Material Co. Ltd., BASF SE, Kanto Chemical Co. Inc., Hefei Haoxing New Energy Technology Co. Ltd., Tinci Materials Technology Co. Ltd., Jiangsu Lixing Chemical Co. Ltd., Wuxi Xiru Technology Co. Ltd., Stella Chemifa Corporation, PolyPlus Battery Company, Mitsui Chemicals, Enchem Co. Ltd., Formosa Plastics Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithium Ion Battery Electrolyte Market Key Technology Landscape

The core technological framework of the Lithium Ion Battery Electrolyte Market is undergoing a strategic evolution, transitioning from mature, conventional LiPF6-based liquid solutions towards advanced chemistries designed for extreme performance and enhanced safety. The present landscape is dominated by liquid electrolytes comprising high-purity lithium salts dissolved in mixtures of cyclic (EC, PC) and linear (DMC, EMC, DEC) carbonates. A key area of refinement involves optimizing the solvent ratio to balance ionic conductivity across operational temperatures, flash points, and viscosity. Most importantly, the technology relies heavily on functional additives—small molecular components added typically at concentrations below 5%—such as vinylene carbonate (VC) or fluoroethylene carbonate (FEC), and various sulfur-containing compounds. These additives are crucial for tailoring the chemical characteristics of the Solid Electrolyte Interphase (SEI) film formed on the graphite anode, ensuring stability against continuous solvent decomposition and enabling effective operation at higher charge voltages, directly correlating to improved cycle life and safety performance, particularly in modern automotive cells requiring prolonged operational reliability.

The major technological trajectory is directed toward eliminating the flammable organic solvent base. Solid-State Electrolytes (SSEs) represent the most transformative research focus, broadly categorized into inorganic solid electrolytes (ISEs) and solid polymer electrolytes (SPEs). ISEs, utilizing materials like sulfidic glasses or garnet-type oxides (e.g., Li7La3Zr2O12 - LLZO), offer high ionic conductivity and inherent non-flammability, but face immense engineering challenges related to achieving intimate, low-resistance contact with the active electrode materials and mitigating mechanical stress during cycling. SPEs, primarily based on polyethylene oxide (PEO) or polyacrylonitrile (PAN) matrices, are flexible and processable but typically suffer from low ionic conductivity at ambient temperatures, necessitating system-level heating, requiring further materials engineering to enable room-temperature operation. Furthermore, hybrid or semi-solid electrolytes, which incorporate polymers or gels to immobilize some liquid solvent while retaining reasonable ionic mobility, are gaining traction as an immediate intermediate step, offering a compromise between the high conductivity of liquids and the improved safety of solids, targeting immediate commercialization in niche and high-safety applications like aerospace.

Beyond material science, advanced manufacturing and computational techniques are central to the key technology landscape. Computational chemistry, including Density Functional Theory (DFT) simulations and Molecular Dynamics (MD), is becoming standard for predicting the electrochemical behavior of new salt-solvent combinations before laboratory synthesis, dramatically accelerating the R&D pipeline and reducing resource expenditure. Manufacturing technology is also being upgraded with advanced vacuum-based continuous mixing systems, highly sophisticated inline spectroscopic analysis (Raman, FTIR), and moisture scrubbing technologies to ensure zero moisture contamination and precise concentration control during formulation—a vital technical requirement for multi-ton, high-quality electrolyte production. Ultimately, the industry is transitioning toward customized, modular electrolyte production units that can be co-located with giga-factories, utilizing advanced sensor arrays and AI to manage real-time quality control, significantly optimizing the just-in-time supply chain for this critical, high-purity chemical input and aligning manufacturing capabilities with global expansion trends.

Regional Highlights

- Asia Pacific (APAC): APAC is the unquestioned global hub for Lithium Ion Battery Electrolyte production and consumption, commanding over 75% of the world's market share. This dominance is driven by the presence of massive battery manufacturing giants (China, South Korea, Japan) and established precursor chemical supply chains. China, in particular, controls the majority of the supply chain for key components like LiPF6, solvents, and additives, leveraging economies of scale to maintain cost leadership. The region is the primary driver of technological scaling and commercialization for current-generation liquid electrolytes, with intense competition driving continuous cost and marginal performance improvements.

- North America: This region is exhibiting the highest growth trajectory globally, spurred by unprecedented governmental initiatives like the Inflation Reduction Act (IRA), which financially incentivizes localizing the entire battery supply chain, including electrolyte production. The strategic focus in North America is on securing supply independence from Asia, attracting billions in capital investment for new domestic electrolyte formulation plants, and heavily supporting domestic R&D efforts in advanced chemistries, especially solid-state electrolytes, to serve the rapidly expanding US EV and grid storage markets.

- Europe: Europe is dedicated to building a localized, sustainable "Battery Valley" supply chain, driven by stringent EU emission standards, the European Green Deal, and the Battery Directive focusing on traceability and recycling. While historically reliant on APAC imports, European players and large joint ventures are establishing significant electrolyte production capacities in key manufacturing hubs like Germany, France, and Poland to serve the localized automotive OEM base. The regional strategy strongly emphasizes high-purity, environmentally compliant materials and achieving complete material traceability for critical battery components to align with EU regulatory requirements.

- Latin America & Middle East and Africa (MEA): These regions are emerging markets that primarily influence the upstream supply chain or are rapidly developing localized demand centers. Latin America, particularly countries with vast lithium reserves (Chile, Argentina), plays a crucial raw material sourcing role, but finished electrolyte manufacturing is nascent. The MEA region is focusing significant capital investment into large-scale ESS projects, particularly in the UAE and Saudi Arabia, and developing localized EV assembly capabilities, gradually creating demand for regional electrolyte distribution and potentially light formulation facilities to serve domestic industrial and mobility needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithium Ion Battery Electrolyte Market.- Guotai Huarong Chemical New Material Co. Ltd.

- Mitsubishi Chemical Corporation

- Central Glass Co. Ltd.

- UBE Corporation

- Dongguan Shanshan Technology Co. Ltd.

- Soulbrain Co. Ltd.

- Tomiyama Pure Chemical Industries Ltd.

- Shenzhen Capchem Technology Co. Ltd.

- Tianjin Jinniu Power Sources Material Co. Ltd.

- BASF SE

- Kanto Chemical Co. Inc.

- Hefei Haoxing New Energy Technology Co. Ltd.

- Tinci Materials Technology Co. Ltd.

- Jiangsu Lixing Chemical Co. Ltd.

- Wuxi Xiru Technology Co. Ltd.

- Stella Chemifa Corporation

- PolyPlus Battery Company

- Mitsui Chemicals

- Enchem Co. Ltd.

- Formosa Plastics Corporation

Frequently Asked Questions

Analyze common user questions about the Lithium Ion Battery Electrolyte market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of electrolyte in a lithium-ion battery?

The primary function of the electrolyte is to facilitate the transport of lithium ions between the cathode and anode electrodes during the charge and discharge cycles, enabling the flow of electrical current while acting as an electronic insulator to prevent internal short circuits and ensure optimal performance.

Which electrolyte component currently dominates the lithium salt segment?

Lithium Hexafluorophosphate (LiPF6) currently dominates the lithium salt segment due to its high ionic conductivity and excellent compatibility with established commercial electrode materials, making it the industry standard despite known issues concerning thermal instability and sensitivity to moisture.

How is the Electric Vehicle (EV) market impacting the demand for electrolytes?

The EV market is the largest and fastest-growing application segment, driving massive demand for high-performance, high-safety electrolytes that offer enhanced thermal stability, extended cycle life, and support for the increasingly important rapid-charging protocols in large-format automotive cells.

What is the significance of Solid-State Electrolytes (SSEs) in future battery technology?

SSEs are critically significant as they eliminate flammable organic solvents, dramatically improving battery safety and enabling the stable use of high-capacity lithium metal anodes, which offers the potential to achieve substantial increases in battery energy density.

Which geographical region leads global production capacity for battery electrolytes?

The Asia Pacific (APAC) region, spearheaded by manufacturers in China, South Korea, and Japan, leads global production capacity for battery electrolytes, controlling the largest manufacturing scale and technological advancements in liquid electrolyte formulation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager