Lithography Inks Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443542 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Lithography Inks Market Size

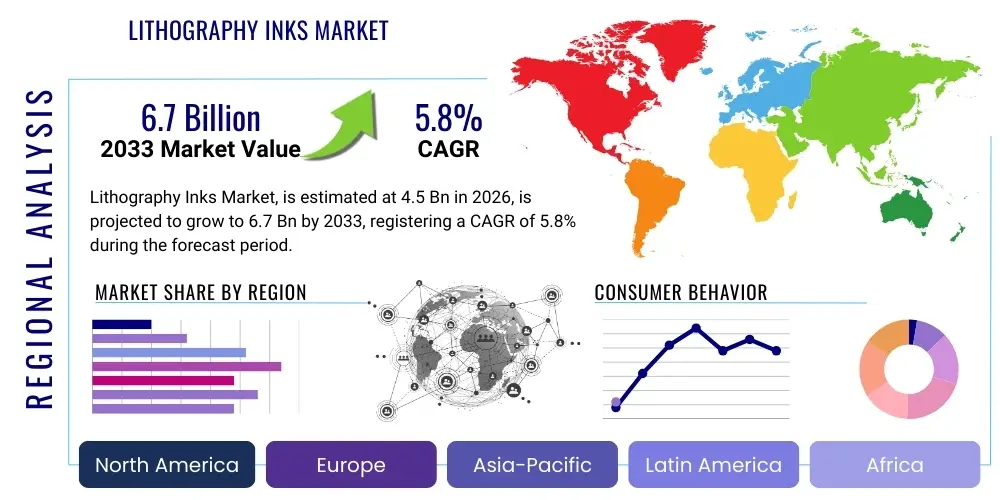

The Lithography Inks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Lithography Inks Market introduction

Lithography inks, foundational to the offset printing industry, are specialized formulations used primarily in graphic arts and high-volume commercial printing. These inks rely on the principle of oil and water repulsion, where the image area is receptive to the oily ink while the non-image area is treated to accept water, thereby preventing ink adherence. The sophisticated composition of these inks includes pigments, resins, solvents (or oils), and various additives designed to optimize rheological properties, drying speed, gloss, color fidelity, and resistance to environmental factors. The market thrives on the demand for high-quality, cost-effective, and large-scale printing solutions, especially within the dynamic packaging and labeling sectors globally.

The primary applications of lithography inks span commercial printing (brochures, magazines, catalogs), publication printing (newspapers, books), and increasingly, the fast-growing segment of flexible and rigid packaging (food containers, corrugated boxes, labels). Benefits derived from utilizing modern lithography inks include superior image resolution, high throughput capabilities, excellent substrate versatility, and consistency across long print runs. The intrinsic advantages of offset lithography, such as low cost per unit at high volumes and exceptional color consistency, continue to cement the necessity of these inks in the modern printing landscape.

Key factors driving market expansion include the sustained growth of the global packaging industry, particularly for consumer goods and e-commerce-related logistics, which necessitates high-quality, brand-compliant packaging decoration. Furthermore, technological advancements leading to the development of UV-cured and LED-cured lithography inks offer environmental benefits and faster curing times, appealing to industries focused on efficiency and reduced Volatile Organic Compound (VOC) emissions. The shift towards sustainable printing practices and the increased demand for specialized functional inks (e.g., security inks) also serve as significant tailwinds for the lithography inks sector.

Lithography Inks Market Executive Summary

The Lithography Inks Market is characterized by robust business trends driven by innovation in curing technologies and increasing consumer demand for branded packaging. Companies are strategically investing in R&D to shift from traditional oil-based inks towards sustainable, bio-derived, and energy-curing formulations (UV and LED) to meet stringent regulatory requirements regarding VOCs and improve printing efficiency. Consolidation among major ink manufacturers and strategic partnerships with press manufacturers are shaping competitive dynamics, aiming to offer integrated solutions that enhance productivity and reduce operational costs for end-users. Economic resilience in the packaging sector continues to offset declines observed in traditional publication printing, maintaining overall market stability and revenue growth.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, propelled by rapid industrialization, burgeoning middle-class consumption, and massive expansion in the packaging and labeling industries, particularly in China and India. North America and Europe, while mature, emphasize high-performance, specialty, and environmentally compliant inks, with strong demand emanating from high-end commercial printing and specialized packaging segments like pharmaceuticals and luxury goods. These regions are prioritizing automation in printing processes, which necessitates high-speed, reliable ink performance, leading to higher average selling prices for advanced ink formulations.

Segment trends highlight the significant outperformance of UV-cured lithography inks due to their instantaneous drying, superior substrate adhesion, and environmental profile, positioning them as a key growth segment over the forecast period. Application-wise, the Packaging sector, encompassing flexible packaging, metal packaging, and folding cartons, commands the largest market share and exhibits the highest growth trajectory. Pigment-based inks continue to dominate due to superior lightfastness and color vibrancy required for high-quality graphic reproduction, while the rising adoption of waterless lithography further fuels demand for highly specific, high-viscosity ink types capable of performing reliably in non-dampening systems.

AI Impact Analysis on Lithography Inks Market

User queries regarding the impact of Artificial Intelligence (AI) on the Lithography Inks Market predominantly center around three themes: optimization of ink formulation and production processes, predictive maintenance for printing machinery to reduce material waste, and the influence of generative AI on print demand and design complexity. Users are concerned about how AI can automate quality control in color matching and rheology adjustment, expecting AI-driven process controls to reduce batch variation and material consumption, thereby increasing the efficiency of expensive raw materials like pigments and resins. The expectation is that AI will enhance supply chain responsiveness, predict raw material shortages, and optimize inventory levels for ink manufacturers, transitioning the industry towards a more data-driven manufacturing model.

- Predictive Quality Control: AI algorithms analyze real-time data from printing presses (viscosity, temperature, color density) to automatically adjust ink formulation or delivery parameters, ensuring consistent output and reducing waste during setup and run time.

- Formulation Optimization: Machine learning models rapidly simulate the effects of ingredient changes (pigment load, resin type) on final print properties (gloss, rub resistance, cure speed), accelerating R&D cycles for new, specialized, or sustainable ink products.

- Supply Chain Efficiency: AI predicts fluctuations in demand for specific ink colors or volumes based on economic indicators and customer order trends, optimizing inventory management and minimizing lead times for critical raw materials.

- Maintenance Scheduling: Integration of AI with press monitoring systems predicts component failure related to ink delivery systems (e.g., roller wear, dampening solution imbalance), enabling proactive maintenance and maximizing press uptime.

- Digital Workflow Integration: AI tools enhance pre-press workflows by ensuring color profiles match ink capabilities and substrate requirements perfectly, reducing the need for manual adjustments and test runs, saving ink and time.

DRO & Impact Forces Of Lithography Inks Market

The Lithography Inks Market dynamics are shaped by a complex interplay of growth stimulants, market inhibitors, and emerging opportunities. Key drivers include the overwhelming global demand stemming from the resilient packaging sector, particularly for high-fidelity graphics on folding cartons and labels, alongside the technological transition towards high-efficiency, instant-cure UV and LED lithography systems. However, the market faces significant restraints, notably the intense price competition driven by raw material volatility (specifically petrochemical derivatives and high-performance pigments) and the structural decline in demand for traditional printed media such as magazines and newspapers in developed economies. Opportunities are abundant in the development of functional inks—such as barrier coatings, anti-counterfeit features, and conductive elements—and the expansion into emerging geographical markets where printing infrastructure is rapidly modernizing. These factors collectively create a set of impact forces that necessitate continuous product innovation and cost management for market participants.

The impact forces currently acting on the market are primarily centered around sustainability mandates and the digital transformation of print. Regulatory pressures, especially concerning the migration of ink components into food products and the mandated reduction of VOCs in Europe and North America, are forcing manufacturers to rapidly reformulate products, acting as both a restraint (higher R&D cost) and an opportunity (first-mover advantage in green inks). Furthermore, while digital printing technologies represent a substitution threat, the hybrid integration of offset and digital capabilities in modern presses creates opportunities for specialty lithography inks to handle the foundational high-volume color work, complemented by digital variable data printing.

In summary, the growth trajectory of the lithography inks market is fundamentally linked to the stability of consumer spending and the continuous push for safer, faster, and more environmentally friendly printing processes. Managing raw material cost inflation while capitalizing on the shift towards UV/LED curing technologies and advanced packaging applications defines the core competitive challenge and strategic focus for industry stakeholders over the forecast period. The increasing complexity of global supply chains requires robust risk mitigation strategies to ensure consistent ink supply.

| Factor Type | Key Examples |

|---|---|

| Drivers (D) | Rising demand for high-quality packaging, adoption of UV and LED curing technologies, growth of pharmaceutical and food labeling. |

| Restraints (R) | Volatile raw material prices (pigments, resins, oils), competition from alternative digital printing methods, decline in traditional print media volumes. |

| Opportunities (O) | Development of bio-based and sustainable ink formulations, expansion in emerging markets (APAC), demand for functional/security inks. |

| Impact Forces (IF) | Stringent environmental regulations (VOC limits), supply chain disruptions, shifts towards print automation and workflow integration. |

Segmentation Analysis

The Lithography Inks Market is analyzed across various critical dimensions including the type of ink formulation, the application area, the end-use industry, and geographic region. This granular segmentation provides stakeholders with detailed insights into market dynamics, identifying high-growth pockets and areas facing maturity or decline. The segmentation by ink type—particularly the differentiation between traditional oil-based, solvent-based, water-based, and modern energy-curable (UV/LED) inks—is crucial as it reflects the industry's technological evolution and compliance with environmental standards. Application segmentation highlights the divergence between commercial, publication, and packaging markets, illustrating where investment returns are currently most favorable, with packaging being the undisputed leader in volume and value growth.

The market performance of each segment is highly correlated with regional regulatory environments and the maturity of local printing infrastructure. For instance, while oil-based inks remain cost-effective and prevalent in developing markets for high-volume newspaper printing, developed markets are rapidly transitioning to UV/LED systems for packaging due to stringent regulations on food contact and VOC emissions. Understanding these interdependencies is vital for formulating accurate market entry and product development strategies. The packaging end-use segment is further refined by material—metal, folding carton, and flexible—each requiring specialized ink chemistry designed for adhesion, flexibility, and post-print processing.

The consistent growth of the segment driven by specialty lithography applications, such as large-format posters, security printing, and metal decorating (e.g., beverage cans), showcases the versatility and continued relevance of lithographic technology. This segmentation analysis confirms that future market leadership will depend on the capacity of manufacturers to deliver environmentally responsible, high-performance, and cost-optimized solutions that align with the increasingly automated requirements of the modern printing press.

- By Ink Type:

- Oil-Based Inks

- Water-Based Inks

- Solvent-Based Inks

- UV-Cured Inks

- LED-Cured Inks

- By Application:

- Packaging & Labels (Folding Cartons, Flexible Packaging, Metal Decoration, Labels)

- Commercial Printing (Brochures, Catalogs, Direct Mail)

- Publication Printing (Magazines, Newspapers, Books)

- Others (Security Printing, Specialty Graphics)

- By End-Use Industry:

- Food & Beverage

- Pharmaceutical & Healthcare

- Consumer Goods

- Publishing & Graphics

- Others (Industrial)

Value Chain Analysis For Lithography Inks Market

The value chain for the Lithography Inks Market begins upstream with the procurement of critical raw materials, primarily pigments (organic and inorganic), specialized resins (e.g., phenolic, acrylic), solvents, oils (mineral, vegetable), and performance-enhancing additives (waxes, driers, UV photoinitiators). The cost and availability of these materials, especially crude oil derivatives that form the basis for many resins and solvents, exert a significant influence on the final pricing and profitability of ink manufacturers. Key relationships at this stage involve long-term contracts with major chemical and pigment suppliers, emphasizing quality control and supply chain stability, as raw material shortages or price spikes can severely disrupt production cycles.

Midstream, the value chain encompasses the formulation, compounding, and manufacturing processes carried out by ink producers. This stage is characterized by high levels of technical expertise, quality control systems, and regulatory compliance, particularly regarding migration standards for food packaging inks. Distribution channels play a critical role downstream, serving as the bridge between manufacturers and thousands of commercial printing houses globally. Distribution can be classified as direct sales, utilized primarily for large, high-volume printing conglomerates that require customized ink solutions and technical support, and indirect sales, leveraging third-party distributors and agents to reach smaller commercial printers and remote geographical locations.

The downstream ecosystem involves the end-user printing companies, which utilize the inks in high-speed offset lithographic presses to produce final printed materials, such as packaging, magazines, or marketing collateral. The final step involves the delivery of the printed product to the consumer or business. The efficiency and quality of the ink directly impact the printer's operational cost, press uptime, and the aesthetics of the final product, making technical support and after-sales service a crucial differentiator in the market. The increasing focus on eco-friendly disposal and recycling also adds a circular layer to the downstream segment, influencing demand for readily de-inkable or compostable lithography ink formulations.

Lithography Inks Market Potential Customers

The primary consumers and buyers of lithography inks are commercial printing firms and integrated packaging manufacturers that operate large-scale, high-speed offset presses. These customers can be broadly segmented into organizations focused purely on generalized commercial printing (brochures, corporate reports, stationery) and specialized entities focused on high-value segments like food and beverage packaging, pharmaceutical labeling, and luxury product packaging. The selection criteria for these buyers are rigorous, focusing heavily on ink performance metrics such as color consistency, curing speed (especially for UV/LED inks), resistance to scuffing and chemicals, and crucially, compliance with specific regulatory standards, particularly related to direct and indirect food contact applications.

Large packaging converters, often multinational entities, represent the most critical customer base due to their high-volume consumption and demand for global color standardization. These end-users require bespoke ink management systems, customized color matching services, and reliable technical support to ensure minimal press downtime. Smaller and medium-sized commercial printers constitute another significant customer cluster, relying more heavily on local distributors for standardized ink products, readily available stock, and competitive pricing. The needs of these two customer groups dictate the differing sales and distribution strategies adopted by major ink manufacturers—direct engagement for strategic accounts and robust distributor networks for the broader market.

Furthermore, specialized industrial printers involved in metal decorating (e.g., two-piece beverage cans or general line containers) or security document printing (e.g., governmental forms, tamper-evident seals) also constitute high-value potential customers. These applications demand extremely specialized ink formulations with unique adhesion properties or security features (e.g., UV-fluorescence, thermochromic response). The sustained growth of the e-commerce sector has fueled customer demand for robust, highly decorative shipping and packaging materials, solidifying the converters supplying this sector as rapidly expanding potential buyers of advanced lithography inks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siegwerk Druckfarben AG & Co. KGaA, DIC Corporation (Sun Chemical), Flint Group, Sakata INX Corporation, Hubergroup, Toyo Ink SC Holdings Co., Ltd., Fujifilm Corporation, T&K Toka Co., Ltd., ALTANA AG (ACTEGA), KAO Corporation, Letong Chemical Co., Ltd., Royal Dutch Printing Ink Factories Van Son, Doneck Network, Siores Inks, Wikoff Color Corporation, Zeller+Gmelin GmbH & Co. KG, Apollo Colours Ltd., Chimigraf Iberica S.L., Hostmann-Steinberg GmbH, Nazdar Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lithography Inks Market Key Technology Landscape

The technology landscape of the Lithography Inks Market is undergoing a rapid transition, moving away from conventional petroleum-based systems toward advanced energy-curing and sustainable formulations. The most significant technological shift is the widespread adoption of UV (Ultraviolet) and LED (Light Emitting Diode) curing inks. UV inks offer near-instantaneous drying through polymerization, eliminating the issues associated with traditional heat or oxidation drying, thereby enhancing productivity and enabling printing on non-porous substrates like plastics and foils. LED-UV technology represents the next generation, utilizing lower energy consumption and generating less heat, which allows printers to process heat-sensitive materials more effectively and achieve significant operational cost savings and a reduced environmental footprint.

Another crucial technological advancement is the focus on low-migration inks, essential for compliance in food and pharmaceutical packaging. Low-migration lithography inks are formulated with highly purified raw materials that minimize the risk of ink components transferring from the packaging material into the contents. This requires sophisticated chemical synthesis of monomers and photoinitiators that are designed to fully react during the curing process, leaving no volatile or extractable residues. Furthermore, advancements in pigment dispersion technology are critical for maintaining color fidelity and maximizing opacity, allowing for thinner ink films and greater cost efficiency, especially important in high-speed, demanding lithographic applications.

The integration of digital printing capabilities within traditionally offset-focused print shops (known as hybrid printing) is influencing ink development by demanding tighter tolerances and compatibility between conventional and digital chemistry. Additionally, the development of waterless lithography inks, which operate without a dampening solution, requires specialized, high-viscosity formulations. This technology offers benefits such as reduced water usage, sharper images, and higher color density, positioning it as a niche yet high-growth technological area within the broader lithography ink domain, driven by specialized applications where environmental benefits are highly valued.

Regional Highlights

Regional dynamics within the Lithography Inks Market showcase varied adoption rates of technology and differential growth drivers, reflecting the diverse stages of economic development and regulatory maturity across the globe.

- Asia Pacific (APAC): This region is the largest and fastest-growing market, driven by massive expansion in manufacturing, increasing consumer spending, and the exponential growth of the e-commerce sector necessitating vast quantities of high-quality packaging and labels. Countries like China, India, and Southeast Asian nations are rapidly modernizing their printing infrastructure, leading to strong demand for both cost-effective conventional inks and advanced UV/LED solutions in metropolitan industrial hubs.

- North America: Characterized by high technological maturity and strict environmental regulations, North America focuses heavily on high-value applications such as pharmaceutical packaging and luxury consumer goods. The market here is witnessing rapid substitution of solvent-based systems with advanced, low-VOC UV and LED inks. The emphasis is on efficiency, automation, and supply chain reliability, making it a lucrative market for high-performance, specialty lithography inks.

- Europe: Europe is highly regulated, particularly concerning food contact materials (FCM) and sustainability standards (REACH). This regulatory environment strongly favors the adoption of low-migration, bio-based, and highly efficient energy-curing lithography inks. While print volumes in some traditional segments are declining, the region maintains a significant market share due to its established commercial printing infrastructure and leadership in developing environmentally sound ink chemistries.

- Latin America (LATAM): Growth in LATAM is moderate but steady, tied to regional economic stability and the expansion of the domestic food and beverage industries. The market primarily utilizes cost-effective conventional inks, although major urban centers are beginning to adopt UV technology to enhance speed and quality for export-oriented goods and multinational corporation packaging requirements.

- Middle East & Africa (MEA): This region is emerging, with growth concentrated in the Gulf Cooperation Council (GCC) countries and South Africa, driven by investments in modern packaging facilities. Demand is often dictated by infrastructure projects and imported consumer goods packaging standards, gradually shifting towards higher-quality lithography inks as regional printing capabilities improve.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lithography Inks Market.- Siegwerk Druckfarben AG & Co. KGaA

- DIC Corporation (Sun Chemical)

- Flint Group

- Sakata INX Corporation

- Hubergroup

- Toyo Ink SC Holdings Co., Ltd.

- Fujifilm Corporation

- T&K Toka Co., Ltd.

- ALTANA AG (ACTEGA)

- KAO Corporation

- Letong Chemical Co., Ltd.

- Royal Dutch Printing Ink Factories Van Son

- Doneck Network

- Siores Inks

- Wikoff Color Corporation

- Zeller+Gmelin GmbH & Co. KG

- Apollo Colours Ltd.

- Chimigraf Iberica S.L.

- Hostmann-Steinberg GmbH

- Nazdar Company

Frequently Asked Questions

Analyze common user questions about the Lithography Inks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of UV and LED lithography inks?

The primary driver is the need for increased production efficiency through instantaneous drying and compliance with stricter environmental regulations mandating reduced Volatile Organic Compound (VOC) emissions, particularly in high-volume packaging applications.

How do volatile raw material prices impact the profitability of lithography ink manufacturers?

Volatile prices for petrochemical derivatives, resins, and high-performance pigments compress profit margins for manufacturers, necessitating sophisticated supply chain hedging strategies and frequent price adjustments for end-users.

Which geographical region exhibits the highest growth potential for lithography inks?

The Asia Pacific (APAC) region, specifically driven by China and India, shows the highest growth potential, fueled by robust industrialization, rapid urbanization, and exponential growth in the consumer goods and packaging sectors.

What are 'low-migration' lithography inks, and why are they critical?

Low-migration inks are specialized formulations used primarily for food and pharmaceutical packaging, designed to ensure that ink components do not leach or "migrate" into the packed product, complying with global food safety standards and protecting consumer health.

Is digital printing replacing offset lithography, and how does this affect the ink market?

While digital printing addresses short-run and variable data needs, offset lithography remains essential for high-volume, high-quality runs (e.g., packaging). This integration leads to the growth of hybrid solutions, sustaining demand for specialized, performance-optimized lithography inks compatible with these high-efficiency environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager