Liver Biopsy System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441741 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Liver Biopsy System Market Size

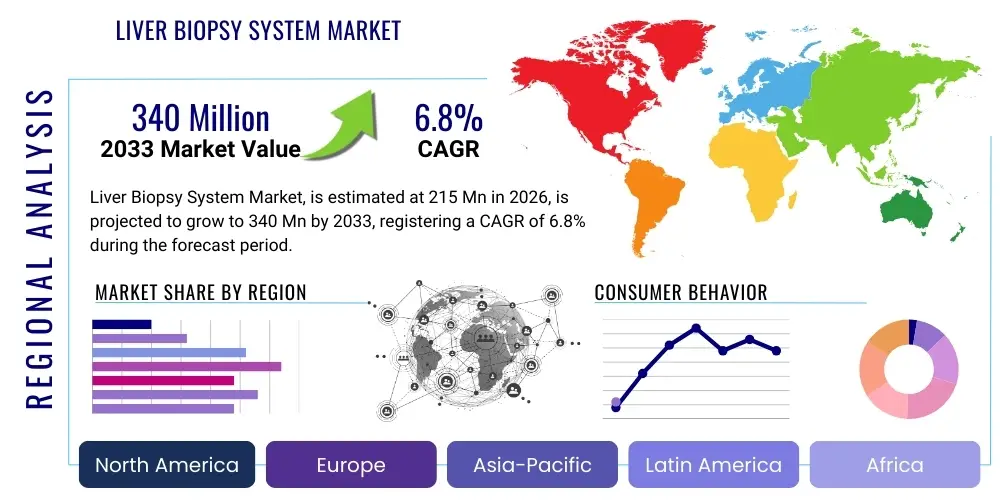

The Liver Biopsy System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $215 Million in 2026 and is projected to reach $340 Million by the end of the forecast period in 2033.

Liver Biopsy System Market introduction

The Liver Biopsy System Market encompasses a highly specialized sector dedicated to the provision of sophisticated medical instruments and procedural kits essential for the acquisition of hepatic tissue samples for definitive diagnostic evaluation. These systems are indispensable tools across hepatology, gastroenterology, and oncology departments globally, functioning as the gold standard for histological assessment when non-invasive methodologies fail to provide conclusive data. The primary utility of a liver biopsy lies in its ability to accurately stage the severity of chronic diffuse liver diseases, such as advanced fibrosis and cirrhosis stemming from various etiologies, including viral infection, alcohol consumption, and metabolic dysfunction (NAFLD/NASH). The procedure yields critical microscopic evidence needed to guide personalized treatment protocols and predict long-term patient outcomes, solidifying its continued necessity within the diagnostic algorithm.

The product portfolio within this market is diverse, ranging from advanced, spring-loaded, single-action automated core biopsy needles, designed for maximal sample yield and minimal patient discomfort, to semi-automatic devices and specialized systems used for transjugular or laparoscopic approaches. Automated systems typically utilize gauges ranging from 14G to 18G, striking a necessary balance between obtaining an adequate sample size (crucial for assessing heterogeneity) and minimizing the risk of complications, particularly bleeding. The integration of these systems is critically dependent on real-time imaging technologies, predominantly high-resolution ultrasound and, occasionally, computerized tomography (CT) guidance. These imaging adjuncts ensure precise targeting of focal lesions, such as hepatocellular carcinoma (HCC), and avoidance of vascular structures, thereby upholding procedural safety and diagnostic reliability, which are paramount considerations for clinicians.

The fundamental driving factors propelling the demand for Liver Biopsy Systems are deeply rooted in global epidemiological trends. The pandemic of obesity and Type 2 diabetes has dramatically fueled the prevalence of Non-Alcoholic Steatohepatitis (NASH), a condition requiring tissue confirmation for entry into crucial clinical drug trials. Furthermore, the persistent global burden of chronic viral hepatitis (Hepatitis B and C), despite advancements in antivirals, continues to generate a high volume of cases requiring fibrosis staging. The market also benefits from continuous innovation focused on reducing procedural invasiveness, such as the introduction of smaller gauge needles and coaxial systems, which address key historical restraints like patient apprehension and the risk of post-procedural complications. These innovations, coupled with increased accessibility to interventional procedures in developing healthcare economies, guarantee sustained market expansion throughout the forecast period.

Liver Biopsy System Market Executive Summary

The Liver Biopsy System market trajectory is defined by several intertwined business trends, chief among them the intense focus on developing disposable and ergonomic biopsy devices that seamlessly integrate with modern imaging suites. Manufacturers are strategically positioning their portfolios to capitalize on the high-growth NASH segment, often through collaborations with Contract Research Organizations (CROs) that manage large-scale pharmaceutical trials requiring standardized, high-quality tissue acquisition protocols globally. A prevailing commercial trend involves consolidating offerings, where major medical device companies provide comprehensive procedural kits—including needles, coaxial guides, and specialized trays—to optimize supply chain efficiency and enhance ease of use for hospital purchasing departments. Competitive dynamics are increasingly centered on achieving superior diagnostic yield per procedure, translating into reduced need for repeat biopsies and improved clinical efficacy, which provides significant value to high-volume institutions.

Regional dynamics exhibit a clear differentiation between established and emerging markets. North America holds its market leadership position owing to mature regulatory frameworks, advanced healthcare reimbursement structures, and the highest per capita incidence of metabolic liver disease requiring rigorous histological assessment. Conversely, the Asia Pacific (APAC) region is demonstrating explosive growth, fueled by massive government investment in health infrastructure, rising awareness regarding chronic viral hepatitis and fatty liver disease, and the rapid expansion of private diagnostic center networks. European growth remains stable, anchored by standardized clinical practice guidelines that necessitate biopsy for specific staging requirements, although cost containment policies within public health systems exert moderate downward pressure on device pricing, favoring value-based procurement strategies.

Segmentation analysis highlights critical shifts in end-user demand. The Automated Core Biopsy Devices segment is dominating product type revenue, reflecting the clinical preference for speed and reliability, particularly in time-sensitive procedures. Application-wise, the NASH/MASLD segment is the key growth engine, vastly outpacing traditional applications like general oncology or chronic hepatitis management, due to the global urgency and high R&D spending directed toward treating metabolic liver disease. End-user consumption patterns confirm that large academic and tertiary care hospitals remain the central purchasers, demanding premium products with proven safety records. However, the rapidly expanding footprint of specialized Ambulatory Surgical Centers (ASCs) is creating a secondary market focused on convenient, low-cost, disposable systems designed for high procedural throughput and streamlined patient recovery protocols, indicating a fragmentation of end-user needs.

AI Impact Analysis on Liver Biopsy System Market

User inquiries and clinical discussions surrounding Artificial Intelligence in the Liver Biopsy System Market are heavily concentrated on three core areas: precision enhancement during the procedure, automated analysis post-procedure, and the potential for AI to optimize patient selection. Clinicians and researchers frequently ask how AI-driven predictive modeling, utilizing complex patient data from radiological imaging, blood tests, and medical history, can precisely identify the optimal quadrant and depth for needle insertion, ensuring the highest concentration of pathological tissue is sampled—a critical factor, especially in heterogeneous diseases like NASH. There is a strong expectation that integrating AI algorithms into ultrasound and CT scanners will dramatically refine real-time navigation, moving beyond simple operator-guided imagery toward dynamic, feedback-loop-controlled needle placement, thereby mitigating the risk of critical errors such as vascular or bile duct injury.

The most immediate and transformative impact of AI is observed in the histopathology laboratory, which processes the acquired tissue sample. Deep learning models are being trained on vast datasets of digitized liver slides to perform quantitative analysis far exceeding human capacity. These algorithms can instantaneously and objectively calculate crucial metrics such as the Non-Alcoholic Steatohepatitis Activity Score (NAS), fibrosis staging (F0-F4), and precise measurements of steatosis (fat accumulation). This automation addresses the historical challenge of inter-observer variability among pathologists, leading to standardized, faster, and more reproducible diagnostic reports. The reliability provided by AI-assisted pathology strengthens the value proposition of the biopsy itself, assuring clinicians that the physical tissue sample will yield the most objective and actionable diagnostic information possible.

While AI does not replace the physical Liver Biopsy System hardware, it fundamentally transforms the procedural efficiency and the diagnostic utility derived from the obtained tissue. Furthermore, AI plays a pivotal role in optimizing resource allocation and clinical workflow. By analyzing pre-biopsy images and determining the likelihood of obtaining an adequate, diagnostic sample, AI can potentially flag difficult cases, allowing interventional radiologists to adjust their technique or choice of system proactively. Looking forward, there is strong momentum for AI to help rationalize the use of biopsy. If AI-driven non-invasive models (combining imaging and blood markers) can reliably rule out advanced fibrosis (F3-F4) with high negative predictive value, the number of unnecessary biopsies performed solely for screening may decrease. However, for therapeutic monitoring and definitive diagnosis—the core market drivers—the demand for tissue and thus, the Liver Biopsy System, is expected to remain firm, supported by AI ensuring maximal utility from every sample obtained.

- AI-enhanced Image Guidance: Real-time optimization of needle insertion trajectory, minimizing damage to vascular structures through dynamic feedback systems.

- Sample Adequacy Assessment: Machine learning models evaluating tissue quantity, length, and quality immediately post-acquisition to reduce non-diagnostic samples.

- Automated Histopathology Analysis: Utilizing deep learning for rapid, standardized, and objective quantification of fibrosis, steatosis, and inflammation (e.g., NAS scoring).

- Predictive Modeling for Site Selection: AI algorithms analyzing radiological data (e.g., elastography maps) to guide the clinician to the area of highest pathological severity.

- Clinical Decision Support: Integrating AI tools to stratify patient risk and necessity for invasive biopsy based on multi-modal clinical and imaging data integration.

DRO & Impact Forces Of Liver Biopsy System Market

The Liver Biopsy System Market is fundamentally driven by critical, long-term epidemiological forces, most notably the relentless global rise of metabolic syndrome, leading directly to the exponential increase in Non-Alcoholic Steatohepatitis (NASH), soon to be rebranded as Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD). This condition mandates histological confirmation for diagnosis and regulatory validation of treatment success in the massive pharmaceutical drug pipeline dedicated to its cure. The necessity for definitive tissue diagnosis remains unchallenged in complex cases such as differentiating between various types of liver cancer (HCC vs. metastases) or accurately staging advanced fibrosis and cirrhosis. Additionally, sustained technological advancements in system design—such as specialized coatings for enhanced visibility, thinner gauge needles (16G, 18G) with improved tensile strength, and ergonomic features in automated devices—continuously enhance user confidence and clinical applicability, serving as a constant forward thrust for market adoption and renewal.

Market expansion faces formidable restraints, primarily from the rapid technological maturity and clinical acceptance of non-invasive screening tools. Elastography methods (e.g., FibroScan) and advanced biomarker panels offer quick, risk-free, and relatively low-cost methods for initial assessment of liver stiffness and fibrosis, successfully triaging patients and significantly reducing the need for biopsy in routine monitoring. Furthermore, the inherent risks associated with percutaneous biopsy, including potential complications like bleeding, pain, and, in severe cases, visceral injury, maintain a level of patient and clinician reluctance, limiting adoption where non-invasive data is sufficient. Economic restraints also apply, as high procurement costs for premium, disposable, automated systems, coupled with inconsistent reimbursement coverage across lower-income regions, hinder widespread market penetration and adoption.

Significant opportunities are emerging from the burgeoning focus on micro-invasive techniques, moving toward fine-needle core biopsies that drastically reduce trauma while still providing adequate tissue for advanced molecular analysis. The development of biopsy systems specifically optimized for use in robotic or laparoscopic surgery settings also presents a niche high-value opportunity, especially in oncology. Strategically, the largest opportunity lies in catering directly to the needs of the NASH clinical trial landscape, which requires standardized, auditable biopsy kits and procedural support across numerous global sites for large-scale, multi-year studies. Expanding market penetration in key APAC and LATAM countries, coupled with educational programs emphasizing the improved safety profiles of modern image-guided techniques, represents a long-term commercial opportunity to offset saturation effects in mature markets.

- Drivers: Exponential increase in the global incidence and prevalence of NASH/MASLD; mandatory requirement for definitive histological confirmation in liver disease clinical trials; continuous product innovation focusing on automated, high-yield, and safe disposable devices; persistent need for differential diagnosis in liver masses and oncology.

- Restraints: Widespread adoption and technological maturity of non-invasive alternatives (e.g., elastography, advanced serum markers); residual risk of procedural complications (bleeding, pain) associated with invasiveness; high initial capital expenditure and per-use cost of premium disposable systems.

- Opportunities: Leveraging the massive, sustained demand from the NASH pharmaceutical research pipeline; developing systems tailored for micro-invasive, targeted biopsy procedures; strategic geographical expansion into high-growth APAC markets; integration of biopsy systems with AI-enhanced imaging guidance technologies.

- Impact Forces: The substantial clinical necessity driven by chronic disease burden ensures continuous demand (positive force), but this demand is increasingly refined by non-invasive tools (negative force), making technological superiority and documented safety profiles (mitigating force) paramount for market success.

Segmentation Analysis

The segmentation analysis of the Liver Biopsy System Market provides critical insights into the evolving preferences of clinicians and the specific demands of different medical specialties. Understanding this granular market structure allows manufacturers to align their research and development efforts with high-growth sectors, ensuring product features address explicit clinical needs, whether those needs emphasize speed, sample size, or flexibility of approach. The primary axes of segmentation—product type, procedure type, application, and end-user—reveal complex market dynamics where technological advancements in needle design directly influence procedural choice and clinical application success rates. The shift towards disposable technology, visible across all product segments, is a unifying factor driven by heightened global standards for infection control and efficiency in modern surgical and interventional environments.

In terms of product type, the market is differentiated between needle-based systems, including automated core biopsy devices and semi-automated systems, and specialized accessory products. Automated devices typically command a higher market share due to their ease of use, speed, and consistent sample quality, minimizing operator variability. Conversely, Fine Needle Aspiration (FNA) Systems maintain their niche, primarily used for cytological diagnosis of diffuse lesions or smaller, non-palpable masses where only cellular material is required, prioritizing speed and minimal invasion over histological structure. The Accessories and Kits segment, including coaxial introducers, tissue retrieval devices, and specialized fixation transport media, is also growing rapidly, driven by the desire for standardized, single-use procedural trays that enhance clinical workflow efficiency.

From an application perspective, the diagnosis and staging of liver cancer and chronic hepatitis/cirrhosis are traditional strongholds. However, the diagnosis and management of Non-Alcoholic Steatohepatitis (NASH) is projected to exhibit the highest growth rate during the forecast period. This strong growth is directly tied to the massive patient population affected by metabolic syndrome globally and the requirement for precise, often repeated, biopsies necessary for monitoring efficacy during numerous ongoing pharmaceutical trials. End-users are dominated by specialized hospitals and large diagnostic centers equipped with advanced imaging capabilities and interventional radiology suites, increasingly demanding systems that integrate sterile design features and compatibility with real-time imaging modalities, while Ambulatory Surgical Centers (ASCs) seek convenience and efficiency.

- By Product Type:

- Automated Core Biopsy Devices: Preferred for high-quality histological samples (e.g., NASH staging).

- Semi-Automated Biopsy Devices: Offering flexibility and cost efficiency, utilized primarily in less acute settings.

- Aspiration Systems (Fine Needle Aspiration): Focused on obtaining cellular material for cytological assessment.

- Biopsy Needles (Disposable and Reusable): Covering a range of gauges (14G to 20G) and tip configurations.

- Accessories and Kits: Coaxial introducers, tissue traps, fixation solutions, and procedural trays.

- By Procedure Type:

- Percutaneous Biopsy (Ultrasound or CT Guided): The most common, least invasive, and fastest approach for diffuse or superficial lesions.

- Transvenous Biopsy (Internal Jugular or Hepatic Vein Access): Reserved for patients with severe coagulopathy or ascites, reducing abdominal wall trauma risks.

- Laparoscopic Biopsy: Utilized during concurrent surgical procedures or for targeted sampling of difficult-to-reach lesions.

- By Application:

- Liver Cancer Diagnosis and Staging (Hepatocellular Carcinoma, Metastases): Critical for guiding ablation and surgical planning.

- Chronic Hepatitis (B and C): Used for staging fibrosis progression despite viral suppression.

- Non-Alcoholic Steatohepatitis (NASH) / Metabolic Dysfunction-Associated Steatotic Liver Disease (MASLD): Key application driving market growth due to clinical trial requirements.

- Cirrhosis and Fibrosis Staging: Essential for prognostic assessment and transplant evaluation.

- Other Liver Diseases (Autoimmune, Drug-Induced Injury): Used for differentiating complex, non-viral etiologies.

- By End User:

- Hospitals and Surgical Centers: Large volume users requiring diverse and premium product lines.

- Diagnostic Laboratories and Ambulatory Surgical Centers (ASCs): Increasing volume, prioritizing cost-effective, high-throughput disposable kits.

- Specialized Research Institutions: Focus on advanced, highly precise biopsy systems for tissue banking and molecular studies.

Value Chain Analysis For Liver Biopsy System Market

The value chain for the Liver Biopsy System Market is intricate, commencing with highly technical upstream activities. Raw material sourcing involves procuring specialized medical-grade stainless steel (often 304 or 316L) known for its tensile strength and resistance to corrosion, essential for constructing the needle shaft and cutting mechanisms. Precision engineering is paramount at this stage, focusing on micro-machining the cutting edges and ensuring flawless integration of spring-loading systems in automated devices. Suppliers of ergonomic plastics and specialized packaging solutions that maintain sterility also form a vital part of the upstream segment. Regulatory compliance (e.g., FDA 510(k), CE Mark) is built into every stage of component manufacturing, significantly adding intellectual value and ensuring product safety before assembly, marking a high barrier to entry for new competitors who lack expertise in medical device material science and quality assurance protocols.

Moving downstream, the manufacturing and assembly phase involves complex integration of mechanical, material, and sometimes electronic components (for advanced guided systems). Critical value is added through stringent sterilization processes (typically gamma irradiation or ETO sterilization) and meticulous quality control checks, ensuring the needle deployment speed and depth are consistent across all units—a non-negotiable requirement for clinical safety. Distribution then follows, segmented into direct sales channels for major hospital networks and large GPOs (Group Purchasing Organizations) in North America and Western Europe, which facilitates tailored training and long-term service agreements. Indirect channels, involving authorized regional distributors, are crucial for market penetration in developing nations, where local logistics, regulatory navigation, and established relationships with governmental purchasing bodies are leveraged to maintain efficient supply lines and access to smaller clinics.

The final layer of the value chain involves the end-user clinical interaction and post-sale support. Hospitals and ASCs gain significant value not just from the device itself but from the accompanying clinical training, technical support for integration with imaging systems, and disposal protocols provided by the manufacturers. In the context of the high-growth NASH market, added value is created through standardized kit configurations designed to meet specific protocol requirements set forth by pharmaceutical sponsors, ensuring tissue collection consistency across global trials. The ultimate metric of success in this chain is the consistent delivery of a system that guarantees high diagnostic yield with minimal procedural complications, thereby reducing costs associated with subsequent diagnostic workups or repeat biopsies, solidifying the economic and clinical justification for its use.

Liver Biopsy System Market Potential Customers

The foundational customer base for Liver Biopsy Systems consists of Interventional Radiologists (IRs) and specialized Gastroenterologists/Hepatologists operating within large tertiary and academic medical centers. These specialists rely on liver biopsies for definitive staging of complex chronic diseases, such as advanced cirrhosis, and for obtaining tissue diagnosis for focal liver masses, often requiring complex image-guided approaches (ultrasound, CT, or even specialized MRI-guidance). These high-volume centers prioritize systems that offer superior tissue quality, reliable depth penetration control, and features that enhance procedural safety, such as advanced co-axial guide needles and tips optimized for visibility under various imaging modalities. Their purchasing decisions are heavily influenced by clinical efficacy data, peer recommendations, and the availability of immediate technical support and comprehensive training programs provided by the vendor, often negotiated through bulk purchasing agreements.

A rapidly expanding segment of potential customers includes Ambulatory Surgical Centers (ASCs) and specialized diagnostic clinics that focus heavily on outpatient procedures. As liver disease screening and follow-up management become increasingly decentralized, these facilities require simplified, cost-effective, and highly reliable disposable biopsy kits that support rapid patient throughput. For ASCs, the key purchasing criteria revolve around minimizing reprocessing costs, maximizing ease of use for general interventional practitioners, and ensuring minimal post-procedure recovery time for patients. This customer segment is less focused on complex, multi-functional systems and more on standardized, sterile, single-use solutions, indicating a shift towards convenience and operational efficiency as drivers of procurement within this specific market niche.

Crucially, the pharmaceutical and biotechnology industry represents a significant indirect, yet powerful, customer base. Companies sponsoring NASH, oncology, and viral hepatitis drug trials globally are the ultimate drivers of demand for biopsy systems in clinical research sites worldwide. While the physical purchase is made by the hospital or the Clinical Research Organization (CRO), the selection and specification of the biopsy system (e.g., needle gauge, required sample length, fixation medium) are often dictated by the pharmaceutical trial protocol to ensure data integrity and standardization across multi-center studies. Therefore, manufacturers must tailor specific biopsy kits and support documentation to meet the rigorous regulatory and histological requirements of these high-value research customers, making compliance with Good Clinical Practice (GCP) and delivering consistent tissue quality a prerequisite for engaging with this profitable sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $215 Million |

| Market Forecast in 2033 | $340 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BD (Becton, Dickinson and Company), Boston Scientific Corporation, Cook Medical, Argon Medical Devices, Hologic, Sterylab, Cardinal Health, Angiotech Pharmaceuticals (now part of Argon), Olympus Corporation, Möller Medical GmbH, TSK Laboratory (NIPRO), INRAD Inc., Merit Medical Systems, Teleflex Incorporated, Hakko Medical Co. Ltd., Genicon, Inc., Biocare Medical, Fujifilm Holdings Corporation, Terumo Corporation, Medtronic Plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Liver Biopsy System Market Key Technology Landscape

The modern technological landscape of the Liver Biopsy System Market is fundamentally shaped by advances in three core areas: precision mechanics, material science, and digital integration. Mechanically, the paramount innovation remains the ultra-fast, spring-loaded automated gun, designed to minimize the duration the needle resides within the liver parenchyma. This high-speed, controlled firing mechanism ensures a clean cut and capture of the tissue core before the patient’s respiratory motion or tissue elasticity can cause fragmentation or displacement, which is a critical determinant of diagnostic adequacy. Ongoing technological enhancements focus on improving the consistency of the tissue notch size and ensuring reliable deployment, often involving specialized dampening systems to minimize recoil and enhance user control, particularly vital when targeting small lesions or performing biopsies in pediatric patients where precision is exceptionally demanding.

In material science, advancements are concentrated on optimizing needle tip configuration and enhancing visibility under imaging guidance. Needles now frequently incorporate specialized echogenic or highly reflective tip markers to dramatically improve visualization under ultrasound, allowing for greater confidence in precise placement, particularly crucial in obese patients or those with complex anatomical variations. Furthermore, the use of advanced metallic alloys provides the necessary rigidity for deep tissue penetration while maintaining sufficient flexibility to navigate curved paths in specialized procedures like transvenous biopsies. The rise of coaxial introducer systems is another key technological development, enabling multiple tissue samples to be harvested through a single percutaneous entry point, thereby adhering to the minimally invasive philosophy and significantly reducing procedural risk associated with multiple punctures, addressing the critical need for enhanced safety and patient comfort.

Digital integration, specifically leveraging image fusion technology, represents the forward frontier. Fusion platforms allow clinicians to merge pre-operative, high-resolution scans (MRI or CT) that delineate complex lesions or fibrosis maps with real-time ultrasound during the procedure. This technology enhances targeting accuracy, especially when monitoring changes in specific areas within a large liver mass or tracking disease progression in heterogeneous fibrosis. Furthermore, the development of disposable, pre-packaged biopsy kits with integrated radiofrequency identification (RFID) or barcode tracking systems ensures seamless integration into hospital inventory and electronic health record (EHR) systems. This streamlining of logistics and enhanced traceability supports the stringent regulatory and audit requirements increasingly demanded by both healthcare providers and clinical trial sponsors, effectively linking the physical hardware (the system) with the necessary digital infrastructure.

Regional Highlights

North America maintains its dominant position in the global Liver Biopsy System Market, driven by the highest prevalence rates of lifestyle-related liver diseases, especially Non-Alcoholic Steatohepatitis (NASH), linked to high rates of obesity and Type 2 diabetes. The region benefits from a highly sophisticated healthcare infrastructure, characterized by widespread availability of advanced interventional radiology suites and specialized hepatology centers. Crucially, the US market is fueled by robust R&D expenditure and significant activity in the pharmaceutical sector, where thousands of patients are enrolled in NASH clinical trials, each requiring initial and often sequential liver biopsies for mandatory assessment endpoints. Furthermore, established, generous reimbursement policies for image-guided, high-complexity diagnostic procedures encourage the routine adoption of premium, automated biopsy devices, ensuring high expenditure on technologically advanced solutions.

Europe represents a mature yet steadily growing market, supported by strong governmental healthcare spending and adherence to well-defined clinical guidelines established by organizations such as the European Association for the Study of the Liver (EASL). Western European nations (Germany, France, UK) are key consumers, demonstrating high utilization rates of automated systems, particularly where standardized care pathways dictate tissue confirmation for complex chronic diseases and oncology cases. However, market growth in Europe is somewhat tempered by stringent price negotiations by public health systems, which often favor cost-efficient, high-volume contracts over premium pricing. The focus here is on procedural consistency and safety, driving demand for disposable kits that minimize infection risk and maximize procedural standardization across varied clinical environments.

The Asia Pacific (APAC) region is forecasted to be the most dynamic and fastest-expanding market segment, projecting the highest Compound Annual Growth Rate over the forecast period. This explosive growth is attributable to massive populations in China and India grappling with both chronic viral hepatitis (HBV/HCV) and the rapidly emerging epidemic of NASH due to changing dietary habits and urbanization. Government investments in healthcare infrastructure modernization, coupled with the expansion of the private healthcare sector, are rapidly improving access to interventional diagnostic procedures. Local manufacturers are increasing their capacity, often partnering with global leaders, to provide cost-effective biopsy solutions. This convergence of high disease burden, improving economic capacity, and technological accessibility positions APAC as the essential strategic target for future market expansion efforts.

- North America: Market leader due to high prevalence of NASH, robust healthcare infrastructure, and extensive clinical trial activity requiring definitive biopsy results; high adoption of premium automated devices.

- Europe: Stable growth fueled by structured public healthcare systems, standardized clinical guidelines (EASL), and high adoption of advanced, safe biopsy techniques, balanced against public cost containment pressures.

- Asia Pacific (APAC): Fastest-growing region, driven by the huge patient pool, increasing healthcare investment, rising prevalence of both viral and metabolic liver diseases, and improving technological accessibility in high-growth economies.

- Latin America (LATAM): Emerging market characterized by increasing awareness of chronic liver diseases and gradual investment in public and private diagnostic centers, necessitating affordable, reliable biopsy solutions.

- Middle East and Africa (MEA): Growth primarily concentrated in Gulf Cooperation Council (GCC) countries, focusing on establishing specialized medical hubs and addressing rising lifestyle-related liver conditions, attracting sophisticated medical technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Liver Biopsy System Market.- BD (Becton, Dickinson and Company)

- Boston Scientific Corporation

- Cook Medical

- Argon Medical Devices, Inc.

- Hologic, Inc.

- Sterylab S.r.l.

- Cardinal Health, Inc.

- Möller Medical GmbH

- Merit Medical Systems, Inc.

- Teleflex Incorporated

- TSK Laboratory (NIPRO)

- INRAD Inc.

- Hakko Medical Co. Ltd.

- Genicon, Inc.

- Biocare Medical LLC

- Olympus Corporation

- Terumo Corporation

- Medtronic Plc.

- FUJIFILM Holdings Corporation

- Angiotech Pharmaceuticals (now part of Argon Medical)

- C. R. Bard (Acquired by BD)

- Medax S.p.A.

- PercuVision LLC

- Specialty Medical Supply Inc.

- Integra LifeSciences Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the Liver Biopsy System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Liver Biopsy System Market?

The predominant driver is the escalating global prevalence of chronic liver diseases, particularly Non-Alcoholic Steatohepatitis (NASH), which necessitates definitive histological confirmation for accurate disease staging, prognosis determination, and monitoring treatment efficacy in pharmaceutical clinical trials, thereby creating sustained demand for reliable tissue sampling tools.

How do non-invasive methods impact the demand for Liver Biopsy Systems?

Non-invasive methods, such as transient elastography and serum biomarkers, act as a restraint by reducing the need for routine biopsies and serving as initial screening tools. However, biopsy remains the mandated gold standard for definitive staging of advanced fibrosis (F3-F4) and regulatory approval of NASH drugs, ensuring continued demand for high-quality tissue sampling devices in complex diagnostic and research settings.

Which technology trend is most critical in improving biopsy procedures?

The most critical technological trend is the development of fully automated, high-speed, spring-loaded core biopsy devices combined with coaxial introducer systems. These technologies significantly enhance sample quality and length, reduce procedural time, and minimize patient risk by allowing multiple precise samples through a single, controlled puncture site, resulting in superior diagnostic adequacy.

Which geographical region is projected to experience the fastest growth in this market?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This growth is primarily fueled by a vast, rapidly aging patient population, rising incidence of both viral hepatitis and metabolic liver diseases, coupled with significant governmental and private investment in expanding interventional diagnostic healthcare infrastructure across major countries like China and India.

What role does Artificial Intelligence (AI) play in the current liver biopsy landscape?

AI is increasingly used to enhance both procedural safety and diagnostic accuracy. It assists in pre-procedural planning by optimizing needle trajectory via image analysis and post-procedurally by automating and standardizing the histopathological quantification of fibrosis, steatosis, and inflammation on digitized slides, providing objective, rapid results and reducing inter-observer variability among pathologists.

Who are the primary end-users driving revenue in the Liver Biopsy System Market?

Large tertiary care hospitals and academic medical centers are the primary revenue drivers, as they manage the most complex cases requiring definitive diagnosis and are deeply involved in clinical research. However, Ambulatory Surgical Centers (ASCs) are rapidly emerging as key consumers of specialized, high-volume disposable biopsy kits, seeking operational efficiency and lower per-procedure costs for outpatient settings.

How important is the concept of sample adequacy in the market?

Sample adequacy is critically important; it directly correlates with the diagnostic utility of the procedure and significantly influences market demand for premium systems. Manufacturers focus R&D on features (like high-speed firing and specific needle gauges, typically 14-16G) that ensure the consistent acquisition of large, non-fragmented tissue cores needed for accurate histological grading and staging, particularly in complex NASH trials.

What is the significance of the transvenous biopsy approach?

The transvenous biopsy approach (typically via the internal jugular vein) is a crucial segment, specifically utilized for patients presenting with severe contraindications to percutaneous biopsy, such as ascites (fluid accumulation) or significant clotting disorders. While more technically complex, it offers a safer route for high-risk patients by accessing the liver through the vascular system, minimizing the risk of peritoneal bleeding.

How do regulatory standards influence product development in this market?

Regulatory standards (FDA, CE Mark) heavily influence product development by mandating rigorous testing for biocompatibility, sterility, and mechanical reliability. Strict requirements for diagnostic quality and patient safety drive manufacturers to innovate disposable, high-precision systems and often require extensive clinical data to demonstrate the consistency of diagnostic yield and complication rates compared to established methods.

What is the impact of specialized needle coatings on market trends?

Specialized needle coatings and tip configurations are a key technological differentiator. For instance, echogenic coatings significantly enhance needle visibility under ultrasound, leading to more precise targeting, fewer re-attempts, and ultimately, greater procedural safety and effectiveness. This focus on imaging compatibility drives clinical preference for advanced, premium devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager