Loader Cranes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443357 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Loader Cranes Market Size

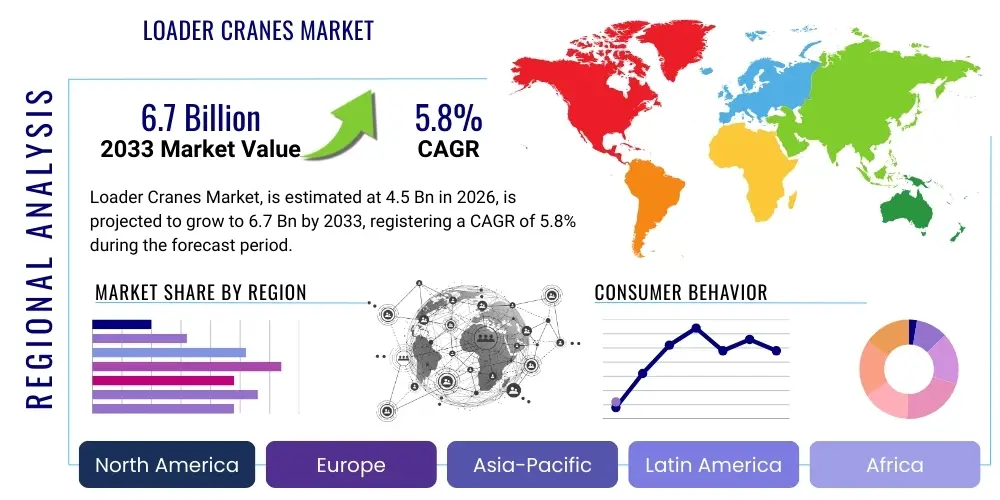

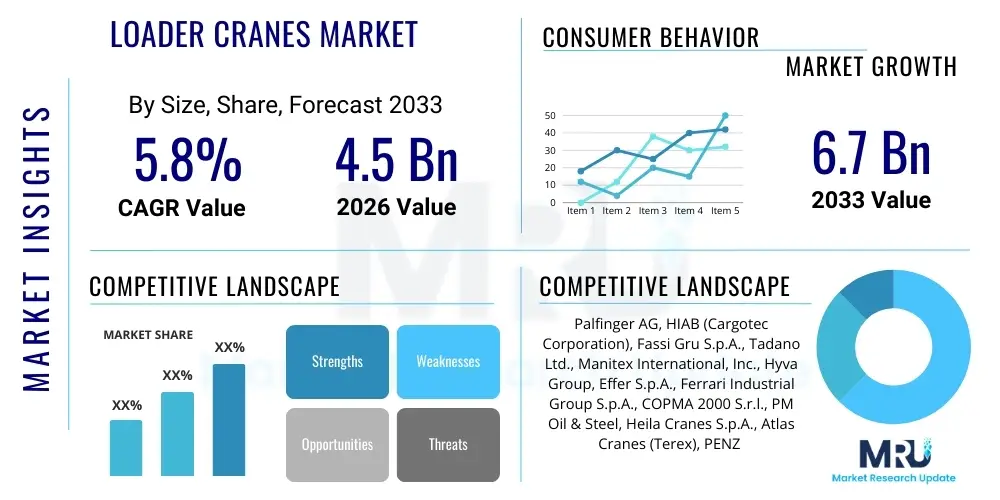

The Loader Cranes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally underpinned by expanding global infrastructure projects, particularly in emerging economies, alongside the continuous demand for efficient, flexible material handling solutions across various industrial sectors.

Loader Cranes Market introduction

Loader cranes, frequently referred to as knuckle boom cranes or articulating cranes, represent sophisticated hydraulic machines mounted primarily on commercial vehicles, designed for loading, unloading, and transporting materials. These devices offer substantial advantages over traditional fixed-boom cranes due to their ability to fold into a compact size when not in use, maximizing the vehicle’s payload capacity and overall efficiency during transit. The complexity of their design allows for intricate maneuvering and precise placement of materials, making them indispensable in confined urban construction environments and diverse logistics operations. Product characteristics emphasize modularity, high lifting capacity relative to weight, and advanced safety features integrated through modern hydraulic and electronic control systems.

The major applications of loader cranes span across critical infrastructure sectors, including construction, where they facilitate the movement of prefabricated elements, steel beams, and heavy construction equipment. Furthermore, the utilities sector utilizes these cranes extensively for installing poles, transformers, and maintaining power lines, demanding high precision and operational stability. In logistics and material handling, especially for specialized transport of bulky goods, forestry, and waste management, the versatility of the articulating boom proves invaluable. The increasing adoption of prefabricated modular construction methods globally directly translates into heightened demand for highly mobile and adaptable lifting equipment such as loader cranes.

Key benefits driving the market include enhanced operational flexibility, reduced operational costs due to efficient single-operator control, and superior safety profiles resulting from integrated load monitoring and stability systems. Furthermore, regulatory mandates emphasizing worker safety and the move towards digitalization in fleet management are pushing manufacturers to innovate, incorporating features like remote diagnostics and telematics. These driving factors, combined with robust investment in global infrastructure development—particularly high-speed rail, road networks, and energy transmission facilities—are primary catalysts for the market's expansion over the forecast period, cementing the loader crane’s role as essential capital equipment.

Loader Cranes Market Executive Summary

The Loader Cranes Market exhibits robust growth driven by converging macro-economic trends, technological integration, and regional infrastructure stimulus. Business trends indicate a strong shift towards high-capacity models equipped with advanced stabilization systems and real-time operational data feedback capabilities, favoring manufacturers that offer comprehensive service and maintenance contracts alongside equipment sales. Key players are aggressively pursuing mergers and acquisitions and strategic partnerships to expand geographic reach and secure access to advanced sensor technology and software integration specialists. The emphasis is moving from merely lifting capabilities to intelligent material handling solutions, particularly in Europe and North America, where regulatory standards are stringent and labor costs are high, necessitating automation.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive government investment in urban development, transportation networks, and industrial expansion, particularly in China and India. While Europe remains a mature market, it leads in the adoption of electric and hybrid loader cranes, driven by stringent carbon emission reduction goals. North America shows stable demand, primarily concentrated in construction and oil & gas pipeline maintenance, with a growing preference for models integrated with sophisticated telematics for fleet optimization. Meanwhile, the Middle East and Africa (MEA) are seeing fluctuating demand linked to large-scale, high-value oil and gas infrastructure projects and diversification efforts into non-oil sectors requiring specialized lifting equipment.

Segment trends reveal that the Heavy-Duty Capacity segment (over 20-ton meter) is experiencing the fastest growth rate, reflecting the increased complexity and size of modern construction components (e.g., precast concrete elements). Hydraulic systems are dominating the technology landscape, though electric actuators and hybrid powertrains are gaining traction in specific urban operational environments. Furthermore, the Construction and Mining end-user segment maintains the largest market share, though logistics and specialized transport are accelerating rapidly due to the proliferation of e-commerce necessitating optimized last-mile delivery and handling of heavy, awkward packages.

AI Impact Analysis on Loader Cranes Market

Analysis of common user questions regarding AI's impact on the Loader Cranes Market centers around three key themes: predictive maintenance efficiency, autonomous operation viability, and enhanced operator assistance systems. Users frequently inquire about how AI-driven diagnostics can minimize downtime and whether current technology can reliably manage complex lifting sequences without human intervention, given the safety critical nature of the equipment. There is also significant user curiosity regarding the integration of machine learning algorithms for optimizing load distribution, stability control, and route planning for transport, ultimately seeking reassurance that AI will augment, not replace, skilled operators, while significantly boosting site safety and project timelines. The general expectation is that AI will transform operational efficiency, moving the industry towards highly optimized, data-driven material handling processes, especially in repetitive or high-risk tasks.

AI's primary influence is currently manifesting in advanced telematics and operational analytics. By leveraging machine learning models, manufacturers are developing highly accurate predictive maintenance systems that analyze thousands of data points—such as hydraulic pressure fluctuations, engine temperature, and vibration patterns—to forecast component failure before it occurs. This transition from reactive or scheduled maintenance to predictive maintenance drastically reduces unplanned downtime, optimizing crane utilization rates across large fleets. Furthermore, AI contributes significantly to complex task automation, particularly in tasks like automated boom positioning and load stabilization algorithms that adjust faster and more precisely than human reflexes, thereby increasing the speed and safety of lifting operations.

In the long term, the integration of deep learning and computer vision into loader cranes is anticipated to revolutionize site safety and efficiency. AI-powered sensors can interpret complex spatial data, allowing the crane to dynamically avoid obstacles, monitor the proximity of personnel (geofencing and anti-collision systems), and automatically calculate the safest and most efficient trajectory for the load path. This move toward 'smart lifting' capabilities not only addresses the core user concern of safety but also fundamentally changes fleet management by providing granular, actionable insights into operator behavior and equipment stress, paving the way for fully autonomous or semi-autonomous operation in highly controlled industrial environments, optimizing total cost of ownership (TCO).

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting hydraulic and mechanical failures based on real-time sensor data analysis.

- Enhanced Operator Assistance (Smart Lifting): Utilizes machine learning for real-time load stability adjustment, anti-sway technology, and automated leveling.

- Optimized Operational Planning: AI algorithms calculate optimal lifting sequences, boom angles, and outrigger setups, maximizing safety envelope usage.

- Autonomous Functionality Development: Stepping stones toward semi-autonomous operation in repetitive tasks like continuous loading/unloading sequences in logistics hubs.

- Advanced Safety Systems: Computer vision and deep learning monitor work zones for personnel detection and collision avoidance in dynamic construction environments.

DRO & Impact Forces Of Loader Cranes Market

The Loader Cranes Market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and market trajectory. The primary Driver is the massive global urbanization trend and corresponding government investments in large-scale infrastructure projects, requiring versatile and mobile lifting solutions. Conversely, significant Restraints include the high initial capital expenditure associated with purchasing advanced, high-capacity loader cranes and the shortage of highly skilled, certified operators capable of maximizing the efficiency of these technologically complex machines. Opportunities are largely centered around digitalization—specifically the adoption of telematics, Internet of Things (IoT) integration, and the transition towards electric and hybrid power systems in response to global sustainability mandates. These forces create a dynamic market environment where technological differentiation provides a substantial competitive advantage.

The impact forces currently exerting the most pressure include rapid technological obsolescence and stringent safety regulations. Manufacturers must constantly innovate to incorporate the latest hydraulic efficiencies, lightweight materials, and electronic control units (ECUs), creating a high barrier to entry and placing pressure on older machinery owners to upgrade. Furthermore, evolving national and international standards for crane safety and emissions (e.g., Euro V, EPA Tier 4 standards) necessitate significant R&D spending. The supply chain instability, particularly concerning specialized hydraulic components and microchips necessary for advanced control systems, also constitutes a potent impact force, affecting production timelines and increasing raw material costs. Consequently, manufacturers who manage their supply chains effectively and invest in modular, adaptable designs are better positioned to mitigate these external pressures.

Another crucial impact force stems from end-user demand for customization and integrated fleet management solutions. Large construction and logistics companies increasingly require cranes that communicate seamlessly with their existing enterprise resource planning (ERP) systems, demanding open-architecture software and comprehensive data reporting capabilities. This focus on total cost of ownership (TCO), rather than initial purchase price, is shifting procurement decisions. Furthermore, the global drive towards sustainable construction practices creates a significant opportunity for manufacturers pioneering alternative fuel sources and developing high-performance, lightweight materials that reduce fuel consumption and operational environmental impact. Addressing these diverse forces requires strategic agility, robust after-sales support networks, and continuous investment in operator training programs.

Segmentation Analysis

The Loader Cranes Market segmentation provides a granular view of demand dynamics across various parameters, including capacity, product type, mounting structure, and end-user application. Analyzing these segments is critical for manufacturers to tailor their product offerings and marketing strategies to specific market niches. Key differentiators include the lifting capacity (ranging from small utility models to high-capacity heavy-duty units) and the type of boom extension mechanism (manual, hydraulic, or telescopic). The market exhibits strong differentiation between standard articulating boom cranes and specialized models designed for specific environments, such as marine applications or extreme cold weather operations, reflecting the highly specialized demands of global industrial customers.

- By Lifting Capacity:

- Light Duty (0–5 Ton Meter)

- Medium Duty (5–20 Ton Meter)

- Heavy Duty (Above 20 Ton Meter)

- By Product Type:

- Stiff Boom Cranes

- Knuckle Boom Cranes (Articulating)

- By Mounting Type:

- Truck Mounted

- Trailer Mounted

- Stationary/Others

- By End-User Industry:

- Construction and Mining

- Logistics and Transportation

- Utilities and Telecommunications

- Forestry and Agriculture

- Waste Management

Value Chain Analysis For Loader Cranes Market

The value chain for the Loader Cranes Market begins with the upstream activities centered on the procurement and processing of core raw materials, predominantly high-tensile steel, aluminum alloys, and specialized hydraulic components (pumps, valves, cylinders). Key upstream suppliers include steel mills, component manufacturers specializing in high-pressure hydraulics, and increasingly, electronics and sensor suppliers for the sophisticated control systems. Optimization at this stage is crucial, as the weight and durability of the materials directly impact the crane's lifting capacity and operational lifespan. Strong relationships with reliable, quality-focused suppliers are paramount for ensuring consistent product quality and mitigating volatility in raw material prices, which significantly influence the final product cost structure.

Midstream activities encompass the core manufacturing processes: design and engineering (where innovations in kinematics, stability, and safety are implemented), precision fabrication, assembly, and rigorous testing. Manufacturers often engage in vertical integration for critical component production or rely on highly specialized vendors for outrigger systems and electronic control units. The integration of advanced manufacturing techniques, such as robotic welding and high-precision CNC machining, ensures the structural integrity and smooth functioning of the articulating boom mechanisms. Successful manufacturers focus heavily on modular design during this stage, allowing for easier customization and quicker assembly on diverse commercial vehicle chassis, which appeals to a broad customer base.

Downstream analysis focuses on distribution, sales, and post-sales service, which are pivotal in the capital equipment sector. Distribution channels are primarily direct sales (for large fleet customers) and indirect sales through specialized dealer networks who often handle customization, installation, and financing. The complexity of loader cranes necessitates robust aftermarket support, including spare parts supply, preventive maintenance programs, and certified technical training for operators and maintenance staff. The profitability in the downstream sector is heavily reliant on the efficacy of the service network, as ongoing maintenance contracts represent a stable and substantial revenue stream, ensuring long-term customer retention and maximizing equipment uptime.

Loader Cranes Market Potential Customers

The primary potential customers and end-users of loader cranes are large civil engineering and infrastructure development firms that require constant, flexible movement of heavy, awkward materials across expansive and often decentralized worksites. These customers prioritize high capacity, reliability, and robust service support, as any equipment failure can lead to severe project delays. Infrastructure clients, including government agencies and utility providers (power, telecom), constitute a major segment, needing cranes for specialized, continuous maintenance work, emphasizing compact size and ease of maneuverability in densely populated or difficult-to-access areas. These large organizational buyers often procure equipment in bulk and demand sophisticated telematics integration for centralized fleet management.

Another significant segment comprises specialized logistics and transport companies, particularly those involved in transporting prefabricated housing modules, bulky machinery, or specialized goods that require self-loading and unloading capabilities at the delivery site. For these buyers, operational speed, vehicle stability, and adherence to strict road legal limits regarding size and weight are critical purchasing criteria. Furthermore, smaller construction contractors and rental companies represent a substantial portion of the market, typically favoring medium-duty knuckle boom cranes due to their versatility and lower operational overhead, providing an accessible solution for diverse, smaller-scale projects that cannot justify the cost of large, dedicated mobile cranes.

The emerging customer base includes waste management and recycling companies requiring robust cranes for handling refuse containers and specialized materials, and forestry operations that need durable, high-reach capabilities for log handling in rugged terrain. For these niche applications, customers seek durability, specialized attachments (like grapples or grabs), and superior protection against harsh environmental conditions. The increasing demand from these diverse sectors confirms the loader crane’s versatility as a foundational tool in modern industrialized economies, driving market growth through application diversification and the continuous requirement for material handling efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Palfinger AG, HIAB (Cargotec Corporation), Fassi Gru S.p.A., Tadano Ltd., Manitex International, Inc., Hyva Group, Effer S.p.A., Ferrari Industrial Group S.p.A., COPMA 2000 S.r.l., PM Oil & Steel, Heila Cranes S.p.A., Atlas Cranes (Terex), PENZ Crane, SENNEBOGEN Maschinenfabrik GmbH, Liebherr Group, XCMG Group, Zoomlion Heavy Industry Science and Technology Co., Ltd., Kato Works Co., Ltd., Cormach S.r.l., Dongyue Machinery Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Loader Cranes Market Key Technology Landscape

The technology landscape of the Loader Cranes Market is increasingly defined by the integration of advanced digitalization and electro-hydraulic precision systems, moving beyond purely mechanical lifting mechanisms. Central to modern crane design is the widespread adoption of proportional hydraulics, which allows for extremely precise and simultaneous control of multiple boom movements, crucial for delicate or complex placement tasks, especially in high-reach scenarios. This is supported by sophisticated Electronic Control Units (ECUs) and load moment indicators (LMIs) that continuously monitor operational parameters, ensuring the crane operates strictly within its safety envelope. Further innovations include the use of lightweight, high-yield steel in boom fabrication, maximizing lifting power while minimizing the overall dead weight of the equipment, thereby enhancing vehicle fuel efficiency and road legality.

Telematics and the Industrial Internet of Things (IIoT) represent a transformative technological shift in this sector. Modern loader cranes are equipped with communication modules that transmit real-time data on usage patterns, fuel consumption, diagnostic codes, and geographical location back to fleet managers. This technological capability enables predictive maintenance, efficient scheduling, utilization monitoring, and security tracking, ultimately reducing operational costs and maximizing Return on Investment (ROI) for fleet owners. Furthermore, remote control technology, often utilizing radio frequency links, has become standard practice, allowing the operator to stand at the optimal vantage point for load placement, significantly improving both safety and precision during complex operations, such as positioning materials high on scaffolding.

Future technological advancements are heavily focused on sustainability and automation. The development of hybrid and fully electric loader crane powertrains is gaining momentum, particularly in noise- and emission-sensitive urban environments and indoor industrial facilities. These systems utilize battery power for boom movements, significantly reducing fuel consumption and localized pollution, aligning with global environmental regulations. Moreover, advanced sensor fusion—combining data from cameras, LiDAR, and ultrasonic sensors—is driving the development of automated stabilization and anti-collision systems. This sensor technology is fundamental to achieving high levels of operational autonomy, where the crane can self-diagnose stability issues and automatically adjust outrigger positions or slow down boom movements to prevent dangerous overload conditions, thus setting new benchmarks for site safety.

Regional Highlights

- North America: The North American market is characterized by high demand for robust, high-capacity truck-mounted knuckle boom cranes, driven by consistent investment in commercial construction and energy infrastructure, including pipeline and utility maintenance. Strict safety standards in the U.S. and Canada necessitate the rapid adoption of advanced telematics and sensor technologies for compliance and efficiency tracking. The region sees strong rental market activity, pushing manufacturers to supply highly durable, low-maintenance models. Furthermore, the specialized transport sector, especially related to oversized cargo and modular building components, ensures continuous demand for customized lifting solutions.

- Europe: Europe represents a mature but highly innovative market, leading the world in the adoption of environmentally friendly loader cranes, specifically hybrid and electric models, spurred by the European Green Deal and stringent urban emission zones. Germany, the Nordic countries, and the Benelux region demonstrate strong demand for precision-oriented knuckle boom cranes used in dense urban construction and logistics. Competition is intense, focusing on technological superiority, lightweight design, and comprehensive dealer networks providing specialized after-sales service and high operator training standards. Regulatory harmonization across the EU facilitates market penetration but also mandates strict adherence to safety and environmental specifications.

- Asia Pacific (APAC): APAC is the fastest-growing region, dominated by the colossal infrastructure expenditure in countries like China, India, and Southeast Asian nations. The demand is massive and spans all capacity segments, though cost-effectiveness and durability are often prioritized in procurement decisions. Urbanization and the development of major transportation corridors (roads, ports, and rail networks) are the primary drivers. While adoption of advanced telematics is accelerating, particularly in sophisticated markets like Japan and South Korea, the sheer volume of construction activity in emerging markets drives demand for standard, reliable, and medium-duty units.

- Latin America: The Latin American market exhibits fluctuating growth, highly dependent on commodity prices and government investment cycles in natural resources and mining, which are heavy users of robust lifting equipment. Brazil and Mexico are the largest national markets, requiring versatile equipment for infrastructure modernization and housing projects. Pricing sensitivity is a significant factor, leading to a focus on TCO and accessibility of local maintenance support. The demand is growing for medium-to-heavy capacity cranes suitable for operation in challenging, often remote, geographical locations.

- Middle East and Africa (MEA): Growth in the MEA region is strongly tied to large-scale, state-funded mega-projects, especially in the GCC countries (Saudi Arabia, UAE) focused on economic diversification (tourism, industrial zones) and major energy projects. There is high demand for extremely robust, high-capacity cranes capable of operating reliably in harsh desert conditions (high heat, dust). The adoption curve for sophisticated telematics is steep in the GCC states, driven by the requirement for centralized control over high-value assets and expatriate labor management, ensuring compliance and efficiency across massive project sites.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Loader Cranes Market.- Palfinger AG

- HIAB (Cargotec Corporation)

- Fassi Gru S.p.A.

- Tadano Ltd.

- Manitex International, Inc.

- Hyva Group

- Effer S.p.A.

- Ferrari Industrial Group S.p.A.

- COPMA 2000 S.r.l.

- PM Oil & Steel

- Heila Cranes S.p.A.

- Atlas Cranes (Terex)

- PENZ Crane

- SENNEBOGEN Maschinenfabrik GmbH

- Liebherr Group

- XCMG Group

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Kato Works Co., Ltd.

- Cormach S.r.l.

- Dongyue Machinery Group

Frequently Asked Questions

Analyze common user questions about the Loader Cranes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Loader Cranes Market?

The primary driver is the accelerating global investment in infrastructure development and urban construction projects, particularly the requirement for versatile, highly mobile lifting equipment capable of efficient material handling in dense urban and remote construction environments, complemented by regulatory emphasis on worker safety.

Which type of loader crane capacity segment is expected to show the fastest growth rate?

The Heavy Duty segment (Above 20 Ton Meter) is anticipated to exhibit the fastest growth. This is due to the increasing size and complexity of modern construction elements, such as large precast concrete and modular components, demanding higher capacity lifting solutions for efficient placement and assembly.

How is digitalization impacting the operational efficiency of loader cranes?

Digitalization, through telematics and IoT integration, significantly enhances operational efficiency by providing real-time data on crane usage, enabling highly accurate predictive maintenance schedules, optimizing route planning for transportation, and improving overall fleet utilization and safety compliance.

What are the main regional trends observed in the Loader Cranes Market?

Asia Pacific is the key growth engine due to massive infrastructure spending. Europe leads in technological adoption, particularly concerning hybrid and electric models driven by environmental regulations. North America demonstrates stable demand focusing on sophisticated telematics and high-capacity truck-mounted units.

What is the difference between a knuckle boom crane and a stiff boom crane?

Knuckle boom (articulating) cranes feature multiple joints, allowing the boom to fold compactly and maneuver around obstacles with greater precision, making them ideal for complex, confined worksites. Stiff boom cranes have a straight, fixed boom, offering higher vertical reach and lifting capacity in simple, open environments but lacking the articulation flexibility of knuckle boom models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Truck Loader Cranes Market Statistics 2025 Analysis By Application (Construction, Forestry & Agriculture, Industrial), By Type (Less Than 50 kNm, 50 to 150 kNm, 151 to 250 kNm, 251 to 400 kNm, 401 to 600 kNm, Over 600 kNm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Loader Cranes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Telescopic Boom, Knuckle Boom), By Application (Construction, Rental, Mining, Oil & gas, Energy), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager