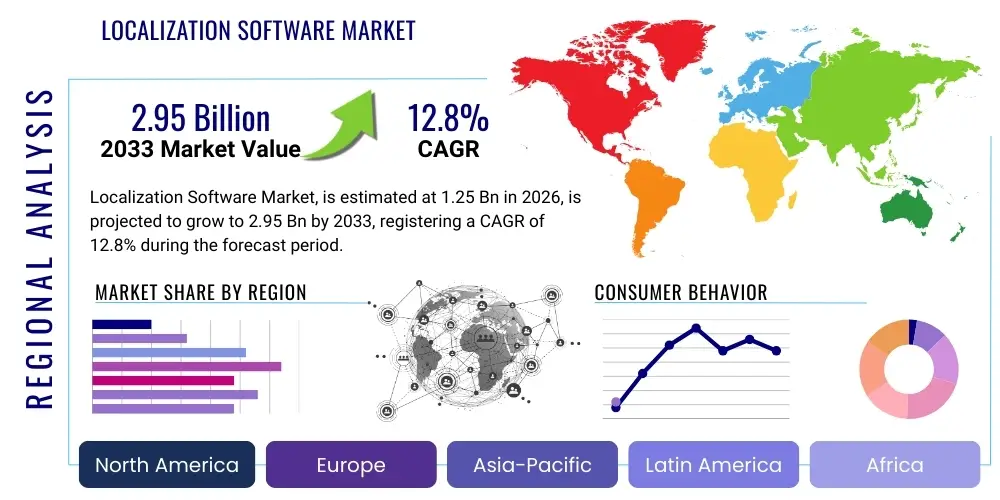

Localization Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441012 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Localization Software Market Size

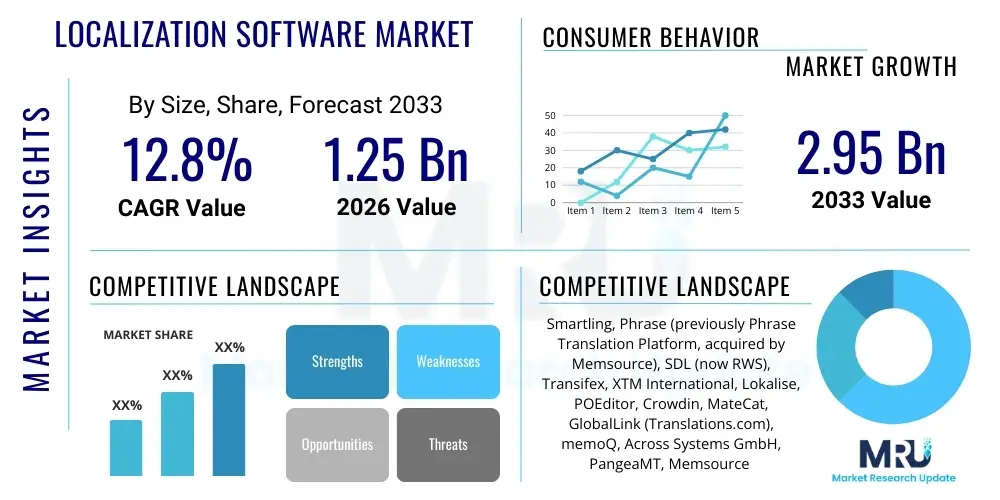

The Localization Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.95 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the accelerating demand for global digital content and the imperative for businesses across various sectors, particularly e-commerce, technology, and media, to deliver culturally relevant user experiences. The shift towards cloud-based Translation Management Systems (TMS) and the integration of sophisticated Artificial Intelligence (AI) and Neural Machine Translation (NMT) technologies are key factors underpinning this robust market expansion, enabling faster, more accurate, and cost-effective content adaptation at scale. Furthermore, enterprises are increasingly recognizing localization software not just as a compliance necessity but as a critical strategic tool for market penetration and competitive advantage in diverse international arenas, thereby boosting investment in advanced linguistic technology infrastructure.

Localization Software Market introduction

The Localization Software Market encompasses tools and platforms designed to manage the complex process of adapting digital content—including websites, software interfaces, documentation, and multimedia—for specific linguistic and cultural markets (locales). These platforms, primarily Translation Management Systems (TMS), Computer-Assisted Translation (CAT) tools, and various Globalization Management Systems (GMS), automate workflow, manage translation memory (TM), glossaries, and terminology databases, ensuring consistency, efficiency, and quality across extensive localization projects. Product description often centers on features such as integration capabilities with Content Management Systems (CMS), robust project management dashboards, and collaboration features for geographically dispersed translation teams, all crucial for handling continuous localization pipelines typical in agile software development environments. The core function is to streamline the entire content lifecycle from source content creation to target locale deployment.

Major applications of localization software span multiple high-growth industries. In the technology sector, it is indispensable for localizing user interfaces (UI) and user experience (UX) for mobile and desktop applications, ensuring global accessibility. For e-commerce and retail, these tools facilitate the rapid translation and cultural adaptation of product catalogs, marketing materials, and checkout processes, which directly impacts conversion rates in international markets. The media and entertainment industry utilizes localization software for subtitling, dubbing script management, and overall content adaptation to meet diverse regulatory and cultural viewing preferences worldwide. Additionally, heavily regulated sectors like healthcare and finance rely on these systems for accurate translation of legal documents and regulatory compliance content, where precision and auditability are paramount, demanding integrated quality assurance mechanisms within the software suite.

The principal benefits derived from adopting professional localization software include significant cost reduction through automation and leveraging existing translation assets (via TM), drastically improved time-to-market for globally launched products, and enhanced translation quality and consistency across all touchpoints. Driving factors for market growth include the explosive proliferation of multilingual digital content, the necessity for simultaneous product launches in multiple geographic regions, and the competitive pressure on multinational corporations (MNCs) to provide native-like digital experiences to maximize customer engagement. The increasing globalization of small and medium-sized enterprises (SMEs), facilitated by accessible, cloud-based software solutions, also plays a critical role, democratizing access to professional localization tools previously limited to large enterprises. This confluence of technological capability and increasing market demand ensures sustained investment and innovation within the localization software ecosystem.

Localization Software Market Executive Summary

The Localization Software Market is currently defined by disruptive business trends focused on scalability, integration, and service provision. There is a marked shift towards highly flexible, subscription-based Software-as-a-Service (SaaS) models, moving away from traditional on-premise deployments. This trend is coupled with intense demand for deep integration capabilities, requiring localization platforms to seamlessly connect with existing enterprise stacks, including specialized CMS, CRM, and DevOps toolchains, often through robust API connectivity. The competitive landscape is evolving as providers differentiate themselves not just on core translation efficiency, but on specialized vertical features, such as tailored quality assurance tools for gaming localization or regulatory compliant workflows for the life sciences sector. Consolidation is also evident, with major players acquiring niche AI translation technology firms to rapidly enhance their machine translation (MT) and automation capabilities, signaling a strong focus on end-to-end linguistic service automation.

From a regional perspective, North America and Europe currently represent the largest revenue generators due to the presence of key technology giants, extensive early adoption of sophisticated enterprise software, and mature infrastructure for global operations. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is fueled by significant digital transformation efforts across emerging economies like India, China, and Southeast Asian nations, alongside the region’s inherent linguistic diversity, which necessitates advanced localization solutions for regional market penetration. Latin America is also emerging as a significant market, driven by the expansion of international e-commerce platforms requiring robust Spanish and Portuguese content adaptation. Regional trends emphasize mobile localization and support for complex, double-byte character sets, particularly within the APAC market, pushing vendors to develop region-specific technological optimizations.

Segmentation trends highlight the continued dominance of Translation Management Systems (TMS) within the component segment, serving as the central nervous system for large-scale localization efforts. Within the deployment segment, cloud-based solutions are overwhelmingly preferred due to their scalability, low upfront capital expenditure, and accessibility for distributed teams, cementing SaaS as the primary deployment model. Enterprise adoption remains the largest end-user segment, yet the SME sector is exhibiting accelerated growth, largely attributed to affordable, tailored solutions designed for smaller content volumes and faster implementation cycles. Technology-driven segments, especially those incorporating Neural Machine Translation (NMT) and workflow automation, are demonstrating superior growth rates, reflecting the market’s pivot towards speed and efficiency gains derived from AI-powered linguistic technologies.

AI Impact Analysis on Localization Software Market

Users frequently raise concerns centered around the dichotomy of quality versus speed in AI-driven localization, questioning whether the efficiency gains offered by Neural Machine Translation (NMT) and generative AI risk compromising linguistic accuracy and cultural nuance, especially in highly sensitive or creative content. A major theme is job displacement, with translators and localization managers seeking clarity on how AI integration will redefine their roles—shifting from direct translation tasks to post-editing, quality control, and strategic linguistic data management. Furthermore, companies are keenly interested in the feasibility and trustworthiness of AI for handling highly complex localization tasks, such as regulatory document translation or adapting highly technical software strings, alongside concerns regarding data privacy, security, and the ethical implications of using proprietary linguistic data to train third-party AI models. Expectations are high regarding fully automated, yet customizable, workflows that seamlessly integrate human expertise where necessary, demanding greater transparency in how AI models are trained and deployed to ensure bias mitigation and domain-specific accuracy.

The core concerns revolve around the "last mile" quality challenge. While NMT excels at volume and speed for standard operational content, users inquire about AI's ability to maintain brand voice, handle sarcasm or idioms, and deliver culturally resonant messaging without extensive human intervention. They are seeking intelligent quality estimation (QE) models embedded within the software that can accurately flag segments requiring human review, thus optimizing the post-editing (PEMT) process rather than simply overwhelming editors with raw machine output. The market is also heavily scrutinizing platform security, particularly for solutions handling confidential intellectual property, demanding stringent compliance with regulations like GDPR and specific regional data residency requirements, which are often compounded when utilizing cloud-based AI infrastructure provided by hyperscalers.

Ultimately, the analysis indicates a user expectation for Localization Software vendors to evolve into intelligent orchestration platforms. Users demand robust tools that manage the entire AI pipeline: from linguistic data curation for model training to dynamic workflow routing based on content type and required quality level, concluding with highly efficient human-in-the-loop validation processes. The market anticipates AI will not eliminate the localization workforce but necessitate upskilling, transforming linguists into localization strategists who manage AI performance and ethical deployment. This shift underscores the competitive advantage of platforms offering customized, domain-specific NMT engines that move beyond general-purpose translation capabilities, directly addressing user concerns about generic output quality and enabling localization teams to handle exponentially higher content volumes without proportional increases in staffing.

- AI-driven Quality Estimation (QE) models reduce human review time.

- Increased reliance on Neural Machine Translation (NMT) for high-volume content, accelerating time-to-market.

- Shift in human translator roles towards post-editing (PEMT) and linguistic data management.

- Integration of generative AI for synthetic content creation and rapid adaptation of marketing copy.

- Enhanced automation of complex workflows, including file preparation and deployment, requiring minimal manual intervention.

- Development of customized, domain-specific machine translation engines tailored for specialized verticals (e.g., medical, legal).

- Introduction of robust ethical AI frameworks addressing linguistic bias and data privacy in localization processes.

DRO & Impact Forces Of Localization Software Market

The Localization Software Market is propelled by powerful macro-economic and technological drivers, yet constrained by significant operational hurdles, presenting substantial opportunities for strategic growth. The primary driver is the pervasive requirement for global digital expansion, where companies must localize their digital presence to access and succeed in international consumer bases. This is coupled with the continuous growth of content volume across all digital channels, mandating automated solutions to maintain pace. Restraints largely stem from the inherent complexity of integrating diverse software systems—specifically connecting TMS platforms with legacy enterprise Content Management Systems (CMS), which often lack standardized APIs or robust globalization features, leading to complex, costly, and time-consuming integration projects. The requirement for skilled personnel capable of managing advanced AI-driven localization workflows and understanding data governance requirements also represents a significant operational restraint, as the talent pool lags technological advancements.

Opportunities in the market are abundant, particularly focusing on underserved segments and technological innovation. The expansion into niche and low-resource languages presents a compelling avenue for specialization, enabled by advanced transfer learning techniques in machine translation. The massive potential within the Small and Medium-sized Enterprise (SME) segment, often reliant on basic or rudimentary tools, can be unlocked by offering easily deployable, cost-effective SaaS solutions designed for limited budgets and complexity. Furthermore, the opportunity to specialize localization software for specific high-value industries—such as gaming (requiring highly iterative narrative and audio localization tools) or financial services (demanding extreme security and regulatory compliance features)—allows vendors to capture premium market share by offering deep vertical expertise rather than generalized functionality. The continuous development of real-time localization capabilities for live content and streaming services represents another frontier for market penetration and technological differentiation.

Impact forces currently shaping the market trajectory are dominated by technological disruption and shifting regulatory landscapes. The widespread adoption of cloud computing has reduced the friction of deployment and lowered the barrier to entry for new software solutions, intensifying competition and driving rapid feature iteration among vendors. The regulatory impact, particularly concerning data residency requirements (e.g., specific rules in China or the EU) and stringent industry-specific compliance standards (like those in pharmaceuticals or medical device labeling), forces vendors to continually update their platforms to ensure clients can operate legally in diverse jurisdictions. Economically, the imperative for cost optimization in corporate global operations amplifies the adoption of automation tools, creating a positive feedback loop for localization software vendors that demonstrate high ROI through workflow efficiencies and reduced human error. These forces combine to push the market towards greater intelligence, security, and specialized service offerings.

Segmentation Analysis

The Localization Software Market is meticulously segmented across component type, deployment model, end-user industry, and organization size to reflect the diverse needs and adoption patterns of global enterprises. The component segmentation typically delineates between core translation infrastructure, such as Translation Management Systems (TMS) and Computer-Assisted Translation (CAT) tools, and auxiliary components like services (consulting, integration, and training). The choice of segmentation reflects a customer's operational scale and specific technical requirements, with large enterprises typically opting for integrated TMS solutions offering end-to-end control, while smaller entities may prioritize standalone CAT tools for individual linguistic tasks. Understanding these segments is crucial for vendors designing targeted marketing strategies and product roadmaps, ensuring that features like scalability, integration ease, and advanced AI capabilities are appropriately tailored to the specific needs of each defined market segment.

- By Component:

- Translation Management Systems (TMS)

- Computer-Assisted Translation (CAT) Tools

- Services (Consulting, Integration, Maintenance & Support)

- By Deployment Model:

- Cloud-Based (SaaS)

- On-Premise

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-user Industry:

- IT and Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Retail and E-commerce

- Media and Entertainment

- Manufacturing and Automotive

- Healthcare and Life Sciences

- Government and Public Sector

Value Chain Analysis For Localization Software Market

The value chain for the Localization Software Market begins with the upstream segment, dominated by intense Research and Development (R&D) focused on linguistic technology and core software architecture. This initial stage involves developing sophisticated Neural Machine Translation (NMT) engines, creating robust cloud infrastructures capable of handling massive linguistic data loads, and building advanced Natural Language Processing (NLP) models. Key players in this phase include specialized AI labs, academic institutions partnering with commercial entities, and the software vendors themselves who invest heavily in proprietary TM algorithms and workflow automation technology. The quality and performance of the upstream components—specifically the accuracy and speed of the underlying MT engines—directly determine the value offered in the downstream process, emphasizing continuous technological innovation as the core differentiator in the market.

The midstream process focuses on software development, integration, and deployment. This includes coding the user interface, ensuring interoperability via robust APIs that connect to various Content Management Systems (CMS) and version control repositories (like Git), and rigorous testing for scalability and security. Distribution channels are primarily direct, involving vendors selling their proprietary TMS/CAT solutions directly to enterprise clients through sales teams and licensing agreements, particularly for large, complex on-premise deployments. Indirect channels, however, are rapidly gaining traction, predominantly through partnerships with Global System Integrators (GSIs), specialized Localization Service Providers (LSPs), and increasingly, cloud marketplace listings (e.g., AWS, Azure marketplaces), which provide an accessible route for SMEs to adopt SaaS solutions efficiently and integrate them rapidly into their existing cloud environments.

The downstream analysis centers on the utilization and application of the software by end-users. This involves Localization Service Providers (LSPs) who utilize the software to manage client projects efficiently, corporate localization departments within large MNCs, and freelance translators utilizing CAT tools. The direct beneficiaries are the businesses that achieve faster time-to-market for localized products and the end-consumers who receive higher-quality, culturally appropriate content. The value chain concludes with ongoing maintenance, support, and continuous feature updates (often delivered automatically via the cloud) based on user feedback and evolving linguistic standards. Customer success teams play a critical role here, ensuring high adoption rates and integration effectiveness, thus securing recurring revenue through high customer retention and reduced churn.

Localization Software Market Potential Customers

Potential customers for Localization Software span nearly every sector engaged in international commerce or digital product delivery, but they can be broadly categorized into two main groups: dedicated Localization Service Providers (LSPs) and corporate End-Users. LSPs, ranging from boutique translation agencies to large multinational LSPs, represent a core customer segment. They require enterprise-grade Translation Management Systems (TMS) that offer high throughput, robust multi-vendor management capabilities, advanced project tracking dashboards, and seamless integration with various external CAT tools used by their extensive network of freelance linguists. These customers prioritize automation features that optimize margins and allow them to scale project capacity rapidly in response to client demand.

Corporate End-Users, the second major group, include businesses that manage their localization in-house or require deep technological control over their content supply chain. This segment is highly fragmented across industries. Technology and software companies (SaaS, hardware) are crucial buyers, utilizing the software to manage agile localization of product interfaces, technical documentation, and customer support content. E-commerce and Retail companies require tools capable of handling vast, dynamic product catalogs and optimizing multilingual SEO. Furthermore, highly regulated sectors like Healthcare and Life Sciences are significant customers, demanding software solutions that adhere strictly to quality, traceability, and regulatory compliance standards (e.g., FDA requirements for medical device labeling or pharmaceutical documentation).

The evolving customer base also includes Small and Medium-sized Enterprises (SMEs) that are increasingly globalizing through digital platforms. These SMEs are potential buyers of entry-level, user-friendly, cloud-based solutions that offer immediate utility without requiring specialized IT infrastructure or large upfront investments. Their needs are often focused on simpler translation and review workflows for website and marketing localization. Overall, potential customers seek solutions that minimize linguistic drift, maximize content reuse (via Translation Memory efficiency), and provide verifiable ROI by dramatically speeding up their global content delivery timelines, ensuring localization is an enabler of rapid market expansion rather than a bottleneck.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.95 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smartling, Phrase (previously Phrase Translation Platform, acquired by Memsource), SDL (now RWS), Transifex, XTM International, Lokalise, POEditor, Crowdin, MateCat, GlobalLink (Translations.com), memoQ, Across Systems GmbH, PangeaMT, Memsource (now Phrase), Text United, Smartcat, Gridly, LingoHub, Lingotek, OneSky. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Localization Software Market Key Technology Landscape

The technology landscape of the Localization Software Market is defined by convergence between robust workflow management and advanced linguistic intelligence. Neural Machine Translation (NMT) technology stands as the foundational accelerator, having replaced statistical machine translation (SMT) models, offering significantly higher quality output that minimizes post-editing effort, particularly when models are customized using client-specific Translation Memory (TM) and terminology databases. Complementing NMT are intelligent workflow automation tools embedded within Translation Management Systems (TMS). These tools leverage machine learning (ML) to dynamically route content based on complexity, content type, and target language, automatically triggering quality checks, resource allocation, and project milestone adherence, thus providing end-to-end efficiency that legacy systems could not match.

A second critical technological pillar is the adoption of highly scalable, microservices-based, cloud architectures. This shift supports Continuous Localization (CL) environments essential for agile software development, allowing for small, iterative localization jobs rather than large, infrequent batches. Cloud infrastructure ensures that localization assets (TM, glossaries) are universally accessible and constantly updated in real-time for distributed teams globally. Furthermore, sophisticated API integration capabilities are paramount. Modern localization software must offer deep connectivity with a vast array of third-party systems, including source code repositories (e.g., GitHub, GitLab), headless CMS platforms (e.g., Contentful, Sanity), and marketing automation tools, effectively embedding localization seamlessly into the overall digital product pipeline rather than treating it as a separate, manual step.

The emerging technological focus is on enhancing quality assurance (QA) through artificial intelligence and leveraging linguistic big data. AI-driven Quality Estimation (QE) models are being integrated to predict the required human effort for post-editing specific segments, allowing project managers to accurately forecast costs and timelines. Moreover, technologies focused on visual context and in-context editing—allowing translators to see how their translation appears within the actual user interface or webpage—significantly reduces contextual errors and rework. The ongoing evolution of terminology management systems, now often using ML to suggest and enforce term usage proactively during the translation process, further solidifies the role of technological innovation in driving higher quality and efficiency across the entire localization lifecycle.

Regional Highlights

The global localization software market exhibits distinct regional dynamics, driven by varying levels of technological maturity, linguistic complexity, and the extent of cross-border commerce:

- North America: Dominates the market share due to the early and extensive adoption of cloud-based enterprise solutions and the high concentration of major technology firms and software developers requiring sophisticated, real-time localization capabilities for global product launches. The region is a leader in adopting AI and NMT technologies and has high demand for integration with agile DevOps environments.

- Europe: Represents a mature market characterized by stringent linguistic quality requirements and regulatory diversity (e.g., GDPR, numerous official languages). Adoption is high, particularly among automotive, manufacturing, and BFSI sectors. Demand is high for robust TMS solutions that manage regulatory compliance and complex multi-language documentation efficiently.

- Asia Pacific (APAC): The fastest-growing region, driven by rapid digital transformation, increasing internet penetration, and immense linguistic diversity. Key markets like China, India, and Southeast Asia are fueling massive demand for localization of mobile apps, e-commerce platforms, and digital content, pushing vendors to excel in handling complex character sets and low-resource languages.

- Latin America (LATAM): Showing strong growth, primarily fueled by rising e-commerce penetration and the expansion of global companies into key markets like Brazil and Mexico. The region requires highly scalable solutions that support major languages (Spanish, Portuguese) and offer cost-effective, cloud-based models suitable for growing SMEs.

- Middle East and Africa (MEA): Emerging market characterized by specific localization needs related to right-to-left (RTL) languages (Arabic, Hebrew) and unique cultural sensitivities. Growth is driven by investment in infrastructure and media localization, requiring specialized tools that correctly handle complex scripting and visual layout adaptation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Localization Software Market.- Smartling

- Phrase (Memsource)

- RWS (formerly SDL)

- Transifex

- XTM International

- Lokalise

- POEditor

- Crowdin

- MateCat

- GlobalLink (Translations.com)

- memoQ

- Across Systems GmbH

- PangeaMT

- Text United

- Smartcat

- Gridly

- LingoHub

- Lingotek

- OneSky

- Trados (RWS)

Frequently Asked Questions

Analyze common user questions about the Localization Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between TMS and CAT tools in localization software?

A Translation Management System (TMS) is an enterprise-level platform managing end-to-end localization workflows, project management, and resource allocation across teams. Computer-Assisted Translation (CAT) tools, conversely, are desktop or cloud applications focused specifically on aiding the individual translator with features like Translation Memory (TM) and terminology lookup to improve translation efficiency and quality at the linguistic level.

How is AI impacting the cost efficiency of localization?

AI, primarily through Neural Machine Translation (NMT), significantly reduces localization costs by accelerating the initial translation draft creation, minimizing the volume of content requiring full human translation. This shifts human effort to Post-Editing Machine Translation (PEMT), offering substantial throughput increases and cost savings per word, making global expansion more economically viable for enterprises.

Which deployment model is dominating the Localization Software Market?

The cloud-based (SaaS) deployment model is dominating the market. Cloud solutions offer superior scalability, lower total cost of ownership (TCO) compared to traditional on-premise systems, and facilitate real-time collaboration necessary for continuous localization pipelines within agile software development environments.

What are the key challenges when integrating Localization Software with existing enterprise systems?

Key challenges include ensuring seamless API connectivity with diverse Content Management Systems (CMS) and development repositories, managing data security and regulatory compliance across different cloud environments, and overcoming incompatibilities arising from proprietary or legacy systems lacking standardized integration protocols.

How is the Localization Software Market supporting the gaming industry?

The market supports the gaming industry through specialized features such as real-time in-context editing, integrated voice-over and subtitling management, and tools designed for high-volume, iterative content updates inherent to live service games. Specialized software often handles unique file formats and requires robust version control for narrative continuity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager