Locking Plate System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441189 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Locking Plate System Market Size

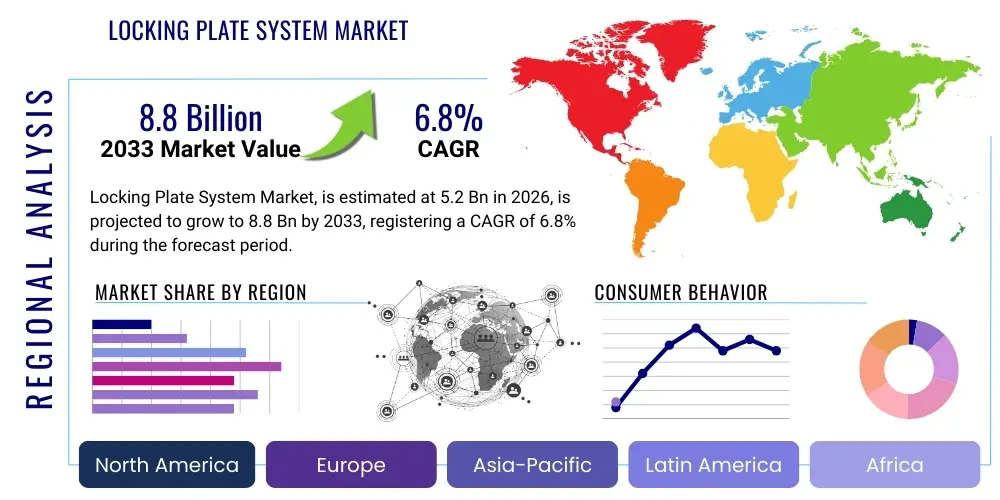

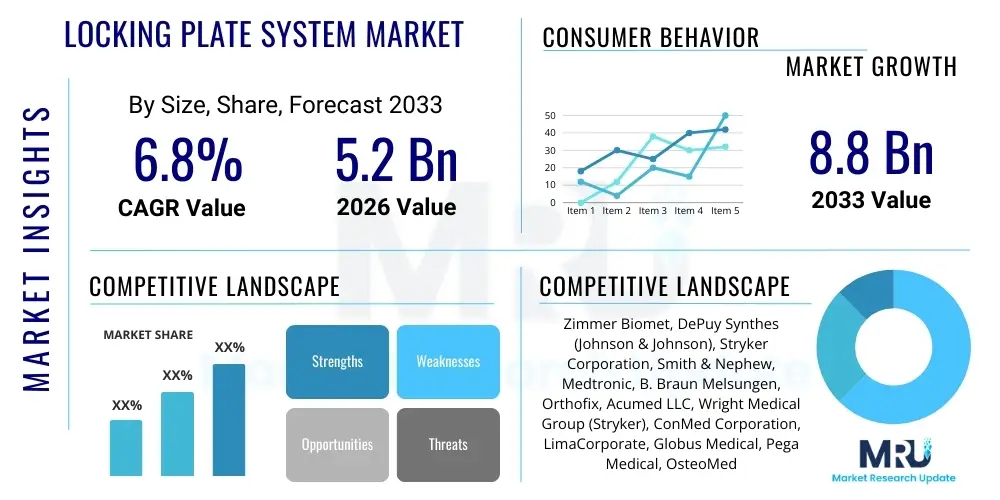

The Locking Plate System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.8 Billion by the end of the forecast period in 2033.

Locking Plate System Market introduction

The Locking Plate System Market encompasses specialized orthopedic implants designed for internal fixation of fractured bones, particularly in complex fractures or osteoporotic bone where conventional plating techniques might fail. These systems utilize threaded holes in the plate and corresponding threaded screw heads, which lock together to create a fixed-angle construct. This stable fixation provides superior biomechanical stability compared to non-locking plates, reducing the risk of screw pull-out and maintaining anatomical reduction, which is crucial for successful bone healing and early patient mobilization. The inherent stability derived from the locking mechanism allows the plate to act as an internal fixator, independent of plate-to-bone compression, making it highly effective for metaphyseal and periarticular fractures.

Major applications for locking plate systems span a wide range of orthopedic surgeries, including trauma management (long bone fractures, complex periarticular fractures), reconstructive procedures (osteotomies), and joint fusion. The increasing global prevalence of road traffic accidents, sports injuries, and degenerative bone diseases, particularly osteoporosis in the aging population, are primary drivers for market expansion. Furthermore, the continuous introduction of sophisticated plate designs—such as anatomically contoured, patient-specific, and minimally invasive options—enhances surgical precision and reduces soft tissue damage, thereby accelerating adoption rates among orthopedic surgeons worldwide. The versatility and improved clinical outcomes associated with these advanced systems solidify their role as the standard of care in modern fracture fixation.

The core benefit of these systems lies in their ability to provide relative stability, promoting secondary bone healing through callus formation, while maintaining the overall alignment and length of the fractured bone segment. This technical superiority over dynamic compression plates (DCPs) is driving the sustained demand. Factors such as improved material science, including the widespread use of titanium and specialized alloy compositions, contribute to enhanced biocompatibility and reduced complication rates. These systems are crucial in treating difficult fractures, especially those involving limited bone stock, providing a foundational technology for advanced orthopedic care globally.

Locking Plate System Market Executive Summary

The Locking Plate System Market is characterized by robust growth, propelled primarily by global demographic shifts, specifically the aging population leading to higher incidences of fragility fractures, and significant advancements in biomaterials and surgical techniques. Business trends indicate a strong focus on product differentiation through anatomical design and specific fracture site optimization (e.g., specific plates for distal radius, proximal tibia, or calcaneus). Key market competitors are heavily investing in integrating digital planning tools and navigation systems with their plating technologies to improve surgical accuracy and efficiency. Furthermore, there is a rising trend towards developing bioabsorbable locking plates, although titanium and stainless steel remain the primary materials due to their proven strength and reliability in load-bearing applications.

Regionally, North America and Europe currently dominate the market share due to established healthcare infrastructure, high healthcare expenditure, and the presence of major orthopedic device manufacturers. However, the Asia Pacific (APAC) region is poised to exhibit the fastest growth over the forecast period, driven by rapidly improving healthcare access, increasing disposable incomes, and the massive volume of orthopedic procedures performed in highly populous nations like China and India. Government initiatives in these emerging markets to upgrade trauma care facilities and control non-communicable diseases are further fueling the demand for advanced internal fixation devices.

In terms of segmentation, the Small Fragment Locking Plates segment holds a commanding position, attributed to the high volume of procedures involving upper extremities, feet, and ankles. Application-wise, trauma surgery remains the largest segment, although joint reconstruction procedures utilizing locking plates are also growing steadily. Trends within end-users show a shift toward Ambulatory Surgical Centers (ASCs) for routine orthopedic procedures, favoring cost-effective and efficient solutions. Companies are focusing their research and development efforts on enhancing plate flexibility and screw design to accommodate varying bone densities and complex fracture patterns, ensuring tailored treatment options for diverse patient populations.

AI Impact Analysis on Locking Plate System Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Locking Plate System Market frequently revolve around improved surgical planning, personalized implant design, and enhancing the precision of plate placement. Users are keenly interested in how AI algorithms can analyze complex 3D radiological data (CT, MRI) to predict fracture stability and recommend the optimal plate geometry, size, and screw trajectory, thereby minimizing surgical time and maximizing biomechanical outcomes. Concerns often center on the regulatory pathway for AI-driven surgical recommendations and the potential integration challenges within existing operating room infrastructure. Expectations are high for AI to standardize complex fracture management and significantly reduce revision rates by optimizing the pre-operative workflow and decision-making process for orthopedic surgeons globally.

- AI algorithms enable precise pre-operative planning, analyzing fracture patterns and predicting optimal plate length and screw placement to maximize stability.

- Integration of machine learning models aids in personalized implant sizing and contouring, enhancing the fit for patient-specific anatomies.

- AI-powered intraoperative navigation systems improve the accuracy of plate positioning and screw insertion, reducing radiation exposure and surgical errors.

- Predictive analytics can forecast potential complications, such as non-union or implant failure, based on patient data and plate mechanical properties.

- Streamlining supply chain and inventory management for specific locking plate SKUs by predicting demand based on seasonal trauma patterns and regional demographics.

- Automated quality control of manufacturing processes ensures consistency in plate threading and material composition using computer vision systems.

DRO & Impact Forces Of Locking Plate System Market

The dynamics of the Locking Plate System Market are significantly shaped by powerful driving forces (D) such as the rising incidence of complex and periarticular fractures in geriatric and high-activity populations, coupled with the proven biomechanical superiority of locking plates over conventional systems. The continuous technological evolution, specifically the introduction of polyaxial locking screws and specialized anatomical plates, serves as a strong growth catalyst. However, the market faces notable restraints (R), including the high cost of premium locking plate systems compared to standard orthopedic implants, posing accessibility challenges in low and middle-income countries. Additionally, stringent regulatory approval processes for new materials and designs often delay market entry, limiting rapid innovation diffusion.

Opportunities (O) abound, particularly through penetration into emerging markets where trauma infrastructure is rapidly modernizing and patient populations are large. The increasing adoption of bioabsorbable and resorbable locking plates presents a massive long-term opportunity, addressing the issue of secondary surgery required for implant removal. Furthermore, strategic partnerships between large device manufacturers and robotics companies to integrate plating systems with robotic guidance offer avenues for premium market growth and enhanced surgical precision. Focusing on minimally invasive surgery (MIS) techniques that utilize locking plates is another critical area for development and market expansion.

The market is subjected to several impact forces. Technological disruption, driven by personalized medicine and 3D printing of patient-specific implants, exerts upward pressure on innovation requirements. Regulatory environment impact forces necessitate rigorous clinical trials and quality assurance measures. Economic forces, such as healthcare expenditure constraints and reimbursement policies, significantly influence procurement decisions in major healthcare systems globally. Finally, demographic impact forces—specifically the global longevity trend—ensure a sustained baseline demand for fracture fixation solutions well into the future, making the market relatively resilient to short-term economic fluctuations and maintaining its positive growth trajectory.

Segmentation Analysis

The Locking Plate System Market is extensively segmented based on several critical parameters, including the product type, the material composition of the plate, the specific clinical application, and the end-user setting. This granular segmentation allows market players to develop highly targeted product portfolios addressing specific surgical needs and anatomical requirements. Product types are primarily categorized based on the size of the bone fragment being fixed, reflecting the anatomical location and the forces the plate must withstand. Material segmentation highlights the shift toward superior strength-to-weight ratio materials like titanium alloys. Application segmentation underlines the market's dependence on trauma and reconstructive surgeries, which account for the majority of demand globally. Furthermore, the segmentation by end-user demonstrates the evolution of the delivery system for orthopedic care, focusing on specialized settings like ASCs for less complex procedures, thereby driving efficiency.

The key drivers within the segmentation analysis are the push towards minimally invasive surgery and the development of fixation systems optimized for challenging bone environments, such as osteoporotic bone. Manufacturers are increasingly designing plates that cater specifically to unique anatomical regions (e.g., foot and ankle, clavicle, and pelvis), moving away from generic plate designs. This trend towards specialization ensures better clinical outcomes and reduces post-operative complications, justifying the premium pricing often associated with advanced locking systems. Geographically, segmentation informs strategic decisions regarding regulatory filings and distribution network establishment, recognizing the varied procurement processes across different regions.

- By Product Type:

- Small Fragment Locking Plates (Upper Extremity, Foot and Ankle)

- Large Fragment Locking Plates (Femur, Tibia, Humerus Diaphysis)

- Specialized and Hybrid Locking Plates (e.g., Pediatric Plates, Spinal Locking Systems)

- By Material:

- Titanium and Titanium Alloys

- Stainless Steel

- Bioabsorbable and PEEK Materials

- By Application:

- Trauma Fixation (Acute Fractures)

- Joint Reconstruction (Osteotomies, Arthrodesis)

- Spinal Procedures (Fusion)

- Orthopedic Oncology

- By End-User:

- Hospitals (Major Trauma Centers)

- Ambulatory Surgical Centers (ASCs)

- Specialty Orthopedic Clinics

Value Chain Analysis For Locking Plate System Market

The value chain for the Locking Plate System Market begins with the upstream activities involving raw material procurement, primarily surgical-grade titanium alloys (Ti-6Al-4V) and medical stainless steel. This stage is crucial as the quality and biocompatibility of the raw materials directly influence the performance and regulatory compliance of the final product. Key activities include material sourcing, purification, forging, and specialized treatments like surface coating. Suppliers must adhere to stringent ISO standards (e.g., ISO 13485) and possess deep expertise in medical metallurgy. Manufacturing, the next phase, involves advanced computer-aided design (CAD), precision machining, sterilization, and rigorous quality control testing, often using automated manufacturing lines to ensure high-volume, defect-free production of complex plate geometries.

Downstream analysis focuses on distribution and the crucial relationship between manufacturers and end-users. Distribution channels are typically a mix of direct sales forces (for major hospitals and key opinion leaders) and specialized third-party distributors who manage inventory, logistics, and localized regulatory compliance across different geographic regions. The complexity of orthopedic implants necessitates highly trained sales representatives who can provide technical support and surgical training to orthopedic surgeons. This education component is a vital part of the downstream value proposition, ensuring optimal product usage and better patient outcomes. Effective inventory management at the distribution level is paramount, given the vast number of plate sizes and configurations required for comprehensive trauma management.

The market employs both direct and indirect distribution strategies. Direct channels facilitate deeper engagement with high-volume institutions, enabling manufacturers to gather real-time feedback crucial for product iteration and enhancement. Indirect channels, typically through authorized dealers, are vital for market penetration in geographically fragmented or emerging regions. Regardless of the route, the final interaction involves the surgeon and the patient, emphasizing the need for robust marketing materials and clinical evidence supporting the biomechanical advantages of locking plates. Optimization of this value chain hinges on reducing manufacturing costs while maintaining material quality and ensuring timely delivery of sterilized implant kits to operating rooms globally.

Locking Plate System Market Potential Customers

The primary consumers and end-users of locking plate systems are institutions and medical professionals involved in the surgical treatment of orthopedic trauma and reconstruction. Hospitals, particularly those designated as Level I and Level II trauma centers, represent the largest segment of potential customers due to their capacity to handle severe, complex, and high-volume fracture cases. These facilities require extensive inventories of both small and large fragment locking plates, often procuring systems through large tenders and long-term supply contracts. The purchasing decisions in hospitals are influenced by clinical efficacy, cost-effectiveness over the product lifecycle, and the robustness of the supporting clinical training and technical service offered by the manufacturer.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing customer segment, especially in developed markets like North America, increasingly focused on managing less complex orthopedic procedures such as distal radius fractures and foot/ankle fixations on an outpatient basis. ASCs prioritize efficiency, streamlined inventory kits, and implants that facilitate rapid turnover and reduced patient stay. This segment demands high-quality, reliable systems that are cost-effective for single-use or high-frequency procedures. The shift of appropriate procedures from inpatient hospital settings to ASCs is a critical trend influencing purchasing strategies and product optimization towards simpler, often pre-sterilized, locking plate configurations.

Specialty Orthopedic Clinics and private practice groups, though smaller in scale than large hospital systems, are also significant buyers, often focusing on niche product lines such as specialized hand or foot locking plates. Additionally, government health agencies and military medical facilities represent a stable customer base, particularly those requiring robust fixation systems for treating high-energy trauma injuries. Ultimately, the buying decision is intrinsically linked to the preferences and training of the orthopedic surgeon, who acts as the primary influencer in determining which specific locking plate system is adopted within a clinical setting, making targeted surgeon education a critical component of market strategy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zimmer Biomet, DePuy Synthes (Johnson & Johnson), Stryker Corporation, Smith & Nephew, Medtronic, B. Braun Melsungen, Orthofix, Acumed LLC, Wright Medical Group (Stryker), ConMed Corporation, LimaCorporate, Globus Medical, Pega Medical, OsteoMed, Double Medical Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Locking Plate System Market Key Technology Landscape

The technological landscape of the Locking Plate System Market is marked by continual innovation focused on enhancing stability, reducing surgical invasiveness, and improving long-term biological outcomes. A pivotal technology advancement is the proliferation of polyaxial locking systems. Unlike traditional fixed-angle systems where screws must be inserted at a perpendicular angle, polyaxial plates allow for a limited range of screw angulation (typically up to 15 degrees off-axis) while still achieving a fixed-angle construct. This flexibility is vital in complex periarticular fractures where optimal screw placement may be hindered by fracture lines or underlying anatomical structures, ultimately providing surgeons with greater intraoperative freedom without sacrificing stability.

Another crucial technological development involves material science, particularly the utilization of advanced titanium alloys (e.g., Grade 5 and Grade 23) which offer superior strength, excellent biocompatibility, and reduced artifact generation in post-operative imaging compared to stainless steel. Furthermore, the development of specialized surface treatments, such as hydroxyapatite coatings or textured surfaces, aims to promote osteoconduction and encourage faster bone integration, potentially reducing the risk of plate-related infections. The market is also seeing increasing adoption of patient-specific instrumentation (PSI) derived from 3D printing and advanced imaging, which allows for the creation of plates perfectly contoured to the patient's anatomy, minimizing required intraoperative bending and potentially shortening surgical time.

Minimally Invasive Surgery (MIS) techniques are intrinsically linked to the technological progress in locking plate design. Plates are increasingly designed for insertion through small incisions, often utilizing specialized targeting guides and insertion instruments that facilitate accurate screw placement without broad soft tissue dissection. The use of sterile, pre-packaged locking plate kits is becoming standard, ensuring readiness, reducing the risk of contamination, and streamlining logistics in the operating room. Furthermore, the integration of Augmented Reality (AR) and robotics in complex procedures, while nascent, promises a future where plate placement precision is significantly enhanced through real-time navigation feedback, further cementing the role of technology as the primary growth driver in this sector.

Regional Highlights

The global Locking Plate System Market exhibits diverse regional performance driven by differential healthcare spending, incidence rates of trauma, and regulatory frameworks. North America, encompassing the United States and Canada, remains the dominant revenue generator. This leadership position is attributed to the highly sophisticated healthcare infrastructure, high reimbursement rates for advanced orthopedic procedures, substantial adoption of premium titanium locking systems, and the strong presence of major market leaders who continuously launch next-generation products in this region first. The high prevalence of degenerative joint conditions requiring osteotomies and a relatively high incidence of sports and road traffic accidents further underpin the consistent demand in this region.

Europe holds the second-largest market share, characterized by mature healthcare systems in Western countries (Germany, UK, France). The demand is stable, driven by an aging demographic and strict standards for implant quality and clinical evidence enforced by regulatory bodies like the European Medicines Agency (EMA). Eastern European nations, however, present significant opportunities for volume growth as they modernize their trauma care systems and increase their adoption of advanced fixation techniques, often migrating away from older, non-locking technologies toward modern standards of care.

Asia Pacific (APAC) is projected to be the fastest-growing region through 2033. Factors contributing to this accelerated growth include the massive patient pool, rapidly improving access to high-quality healthcare, increasing orthopedic tourism in countries like Thailand and South Korea, and rising disposable incomes that enable patients to afford better quality treatment. Government investment in infrastructure, particularly in trauma and emergency services across China and India, is directly boosting the demand for locking plate kits. Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging frontiers. LATAM growth is constrained by economic volatility but shows potential in large economies like Brazil, while MEA expansion is localized in Gulf Cooperation Council (GCC) countries due to high healthcare investments and an expatriate population seeking advanced medical treatments.

- North America (Dominant Market): Characterized by high penetration of titanium locking plates, favorable reimbursement policies, and significant R&D investment, leading to early adoption of specialized and polyaxial systems, especially in trauma centers.

- Europe (Stable Growth): Driven by an aging population and a focus on clinical efficacy and long-term implant performance; market growth is focused on high-quality specialized implants for complex fractures in countries like Germany and France.

- Asia Pacific (Fastest Growing): Fueled by expanding healthcare infrastructure, increasing trauma case volume, and improving affordability; major focus on domestic production expansion and cost-effective solutions in China and India.

- Latin America: Growth is concentrated in urban centers; market penetration relies heavily on pricing strategies and overcoming regulatory and logistical complexities.

- Middle East & Africa (MEA): Growth centered in the GCC region due to high medical tourism and specialized orthopedic facilities; demand is relatively price-sensitive outside major economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Locking Plate System Market.- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Smith & Nephew

- Medtronic

- B. Braun Melsungen AG

- Orthofix Medical Inc.

- Acumed LLC

- Wright Medical Group (Acquired by Stryker)

- ConMed Corporation

- LimaCorporate S.p.A.

- Globus Medical Inc.

- Pega Medical

- OsteoMed (A division of Medartis Holding AG)

- Double Medical Technology Inc.

- Biomedical Engineering (Wuxi) Co., Ltd.

- Advanced Orthopaedic Solutions (AOS)

- Meril Life Sciences Pvt. Ltd.

- Tornier S.A.S. (Acquired by Wright Medical, now Stryker)

- J&J Medical Devices (Orthopaedics segment)

Frequently Asked Questions

Analyze common user questions about the Locking Plate System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of locking plate systems over traditional non-locking plates?

Locking plates offer superior biomechanical stability by creating a fixed-angle construct, which minimizes screw pull-out, preserves bone vascularity, and reduces the need for plate-to-bone compression, making them ideal for complex fractures and osteoporotic bone.

Which material dominates the Locking Plate System Market, and why is it preferred?

Titanium and its alloys (like Ti-6Al-4V) dominate the market due to their high strength-to-weight ratio, excellent biocompatibility, resistance to corrosion, and superior elastic modulus compared to stainless steel, minimizing stress shielding effects.

How is the rising geriatric population influencing the demand for locking plates?

The increasing elderly population directly boosts demand because older patients are highly susceptible to fragility fractures (due to osteoporosis) and complex periarticular fractures, conditions where the stability provided by locking plates is essential for successful healing.

What is the role of 3D printing technology in the future of fracture fixation plates?

3D printing allows for the rapid creation of patient-specific implants (PSIs) and porous plate structures, enhancing anatomical fit, promoting bone ingrowth, and potentially reducing manufacturing lead times for highly customized complex cases.

Which geographical region is expected to show the fastest market growth rate?

The Asia Pacific (APAC) region, driven by rapid improvements in healthcare infrastructure, increasing rates of trauma, and high patient volumes in populous countries like China and India, is projected to exhibit the highest Compound Annual Growth Rate (CAGR).

What is a polyaxial locking plate system?

A polyaxial locking system allows the surgeon to angle the screws within a limited conical range (typically 10-15 degrees) while maintaining the fixed-angle stability characteristic of standard locking systems, offering enhanced flexibility for optimal screw trajectory around fracture fragments.

Are bioabsorbable locking plates becoming commercially viable?

Bioabsorbable locking plates are gaining traction as they eliminate the need for secondary implant removal surgery. While currently holding a smaller market share due to material cost and strength limitations, R&D investments are making them increasingly viable for non-load-bearing or pediatric applications.

What are the key factors determining the choice between small fragment and large fragment locking plates?

The choice is determined by the size and location of the fractured bone. Small fragment plates are used for smaller bones (e.g., wrist, ankle, clavicle), while large fragment plates are designed for high load-bearing bones (e.g., femur, tibia shaft) where greater stiffness and strength are required.

How do locking plates contribute to Minimally Invasive Surgery (MIS) techniques?

Locking plates are designed with specialized insertion instruments and targeting guides that allow for plate delivery and screw placement through smaller incisions, preserving surrounding soft tissue and reducing surgical morbidity and recovery time.

What regulations govern the approval of new locking plate designs?

New locking plate designs are regulated by bodies like the FDA in the US and EMA in Europe, requiring rigorous pre-clinical testing (biomechanical studies, material compatibility) and extensive clinical trials to demonstrate safety and efficacy before commercialization.

What is the primary application segment driving the demand for locking plate systems?

Trauma Fixation, which includes the management of acute and complex fractures resulting from accidents, is the largest and most consistent application segment, driving the majority of the revenue in the global market.

What are the major challenges faced by manufacturers operating in this market?

Major challenges include managing the complexity of regulatory submissions across diverse global markets, intense price competition, and the necessity to continuously innovate to address issues like non-union and infection risks associated with implant presence.

How does the shift towards Ambulatory Surgical Centers (ASCs) affect the market?

The shift increases demand for standardized, efficient, and cost-effective locking plate kits suitable for outpatient procedures, prompting manufacturers to optimize product packaging and logistics for faster operational turnover in ASC environments.

What is the concept of relative stability promoted by locking plates?

Relative stability means the plate stabilizes the bone fragments enough to allow controlled movement at the fracture site, promoting secondary healing through callus formation, which is crucial for successful recovery in metaphyseal and complex fractures.

Which company holds the strongest position in terms of intellectual property and market share?

DePuy Synthes (Johnson & Johnson) and Stryker Corporation historically hold significant market positions globally, largely due to their comprehensive trauma portfolios, extensive distribution networks, and massive intellectual property portfolios covering numerous patented plate and screw designs.

What role does computerized tomography (CT) play in planning locking plate procedures?

CT scans provide critical three-dimensional visualization of complex fracture patterns, allowing surgeons to accurately measure fracture fragment orientation and plan the optimal plate contour and screw trajectory pre-operatively, often utilizing specialized software integrated with the plating system.

What is meant by 'stress shielding' in the context of orthopedic implants?

Stress shielding occurs when an overly stiff implant bears too much mechanical load, shielding the underlying bone from necessary stresses. This can lead to bone density loss (osteopenia) around the implant. Modern locking plates aim to mitigate this through specialized material choices and geometry.

How do global economic trends impact the purchasing of locking plate systems?

In developing economies, budget constraints often favor less expensive stainless steel systems or generic plates. Conversely, stronger economies prioritize premium titanium systems and advanced technologies, linking market penetration to macroeconomic stability and healthcare funding.

Are there specialized locking plates for the pediatric population?

Yes, specialized pediatric locking plates exist. These systems are designed with considerations for growing bone, often incorporating features that minimize damage to the physis (growth plate) and may utilize bioabsorbable materials to avoid the need for subsequent removal surgeries.

What distinguishes specialized locking plates from small and large fragment plates?

Specialized plates are highly anatomical and optimized for very specific, intricate regions like the distal radius, calcaneus, or proximal humerus, where generic plates cannot achieve adequate fit and fixation stability due to complex bone geometry.

How are manufacturers addressing the risk of infection related to implants?

Manufacturers are exploring antimicrobial coatings, advanced surface textures to reduce bacterial adhesion, and using materials that are less prone to bacterial biofilm formation, often integrating these features into high-end titanium locking systems.

What factors drive the high manufacturing cost of locking plates?

The high cost is driven by the use of expensive raw materials (medical-grade titanium), precision manufacturing processes (CNC machining, finishing), stringent quality control requirements, and the necessity of maintaining complex, extensive sterilized inventory kits.

What is the expected technological focus for the market from 2026 to 2033?

The core focus will be on the integration of smart technology (sensors, AI) for post-operative monitoring and load-bearing assessment, coupled with the optimization and scale-up of 3D-printed, patient-specific orthopedic implants.

Why is the training of orthopedic surgeons crucial for market growth?

Locking plate systems require specific surgical techniques for optimal placement and stability. Extensive training and technical support provided by manufacturers are vital for widespread adoption, ensuring clinical success, and reinforcing surgeon confidence in the product line.

What is the significance of the polyaxial feature in treating complex periarticular fractures?

In periarticular fractures, the bone quality is often poor and screw placement is limited by joint surfaces. The polyaxial feature allows screws to be optimally placed in small, stable bone fragments, enhancing overall construct stability in these challenging areas.

How does the competition affect pricing strategies in the locking plate market?

Intense competition, particularly from APAC manufacturers offering cost-effective stainless steel options, forces global leaders to segment their pricing, offering premium titanium products in developed markets while providing more competitive, streamlined product lines in emerging economies.

What distinguishes titanium Grade 5 from Grade 23 in orthopedic implants?

Both are titanium alloys. Grade 5 (Ti-6Al-4V) is strong, while Grade 23 (Ti-6Al-4V ELI - Extra Low Interstitials) offers better ductility and fracture toughness, often making Grade 23 the preferred material for high-stress, critical surgical implants where material fatigue is a concern.

How do reimbursement policies influence product adoption in North America?

Favorable and robust reimbursement policies for complex fracture care and specialized orthopedic procedures encourage hospitals and ASCs to invest in premium, technologically advanced locking plate systems, accelerating the uptake of innovation in the region.

What is the primary distinction between a dynamic compression plate (DCP) and a locking plate?

A DCP relies on compressing the plate against the bone to achieve stability (requiring periosteal stripping), whereas a locking plate acts as an internal fixator, achieving stability through the screw-to-plate interface, independent of compression, preserving bone vitality.

Which application outside of trauma surgery is showing strong growth for locking plates?

Joint Reconstruction, specifically corrective osteotomies around the knee (e.g., High Tibial Osteotomy) and other procedures utilizing precise angular correction enabled by modern locking systems, is demonstrating substantial and sustained growth.

What challenges exist in scaling up the adoption of AI-assisted surgical planning for locking plates?

Challenges include the need for extensive validation datasets, overcoming surgeon resistance to reliance on automated recommendations, and the substantial integration cost required to link AI software with existing hospital PACS and intraoperative navigation hardware.

How are global supply chain issues affecting the availability of locking plate materials?

Fluctuations in the supply of high-grade medical titanium, coupled with logistical bottlenecks, necessitate manufacturers to diversify their sourcing and maintain higher safety stock levels, potentially impacting cost of goods sold and overall market stability.

What are the implications of using PEEK materials in locking plate systems?

PEEK (Polyetheretherketone) is radiolucent (allowing better post-operative imaging without artifact) and has an elasticity closer to human bone, which can reduce stress shielding, making it a viable alternative, though it generally possesses lower strength than metal alloys.

How do government initiatives in APAC influence the regional market growth?

Government mandates to improve public road safety, modernize trauma care infrastructure, and increase health insurance coverage directly translate into higher demand for standardized, high-quality orthopedic implants, favoring the growth of locking plate systems.

What is the significance of the distal radius fracture in the small fragment segment?

Distal radius fractures are among the most common orthopedic injuries, especially in the elderly. The high volume and complexity often necessitate specialized volar locking plates, making the distal radius fixation a massive, high-volume driver for the small fragment segment.

How does the market address the issue of potential implant removal surgery?

The market addresses this by focusing on bioabsorbable plates, which degrade naturally over time, and by improving plate design and surface technology for metallic implants to reduce soft tissue irritation, thereby lowering the need for removal in asymptomatic patients.

Why is the regulatory environment so strict for orthopedic trauma implants?

The regulatory environment is strict because these are Class II or Class III devices that perform critical, high-load bearing functions. Failure can lead to catastrophic patient outcomes (non-union, revision surgery), necessitating robust pre-market evidence of mechanical and biological safety.

What are the competitive advantages of companies that offer full portfolio trauma solutions?

Companies offering a complete suite of trauma solutions (plates, screws, nails, external fixation) benefit from higher negotiating power during large hospital tenders, simplified inventory management for healthcare systems, and enhanced surgeon loyalty through standardized instrument platforms.

How are surface coatings being utilized to enhance locking plate performance?

Surface coatings, such as plasma-sprayed titanium or ceramic layers, are used to modify the osteoconductivity of the implant surface, encouraging faster bone integration and potentially improving the mechanical interface between the plate and the underlying bone structure.

What financial metrics are key determinants for hospital purchasing decisions regarding locking plates?

Hospitals primarily assess the cost-per-case efficiency, the long-term clinical outcome data (reduced revision rates), and the overall value proposition, balancing the premium price of locking plates against potential savings from fewer complications and faster patient recovery.

How do the major manufacturers secure market share through surgeon relationships?

Manufacturers secure market share by investing heavily in surgical education programs, sponsoring research, and providing specialized technical support teams to the operating room, building loyalty and preference among orthopedic key opinion leaders.

What is the difference between monocortical and bicortical screw placement in locking systems?

Bicortical screws engage both the near and far cortices of the bone, offering maximum pull-out strength. Monocortical screws engage only the near cortex; they are typically used in complex locking plate constructs where screw length needs to be minimized to protect underlying neurovascular structures.

How does the expansion of healthcare insurance coverage affect the market in emerging economies?

Increased insurance coverage shifts the cost burden from individual patients to institutional payers, making high-quality, advanced locking plate systems more financially accessible and driving a quality upgrade in standard orthopedic care delivery.

What are the key considerations for locking plate design for the proximal humerus?

Proximal humerus plates require specialized features like multiple locking screw options and complex angular stability to resist rotational forces and maintain stability in the highly cancellous bone of the humeral head, ensuring early mobilization after injury.

Why is spinal fusion an increasing application for locking plates?

Locking plates are being increasingly utilized in anterior cervical and lumbar fusion procedures for superior immediate mechanical stabilization and controlled load sharing, which promotes successful interbody fusion compared to standalone cages or non-locking anterior systems.

What is the current market penetration of bioabsorbable locking plates in trauma surgery?

The penetration remains relatively low, primarily confined to low-stress applications (e.g., craniofacial, pediatric fractures). However, ongoing material research aims to improve their load-bearing capacity to allow for wider use in high-stress trauma applications.

How is competition from generic or local manufacturers impacting pricing?

Local manufacturers, especially in APAC, offer locking plates at significantly lower prices, putting downward pressure on the average selling price of basic fixation systems and forcing multinational companies to differentiate aggressively through technology and specialized instruments.

What clinical outcome measures are most valued by surgeons when selecting a locking plate?

Surgeons highly value low rates of non-union, minimal risk of screw back-out or loosening, preserved soft tissue envelope, and demonstrated ability to achieve anatomical reduction and promote rapid functional recovery for the patient.

How does AI contribute to reducing inventory complexity for hospitals?

AI predictive models analyze surgical schedules, historical procedure volumes, and trauma case severity to accurately forecast demand for specific locking plate sizes and kits, allowing hospitals to optimize stock levels and reduce holding costs significantly.

What technological feature is common across all premium locking plate systems?

All premium systems incorporate fixed-angle stability via the screw-to-plate locking mechanism, ensuring that the construct acts as a single, load-bearing entity, which is the foundational principle providing superior fixation in challenging fracture patterns.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager