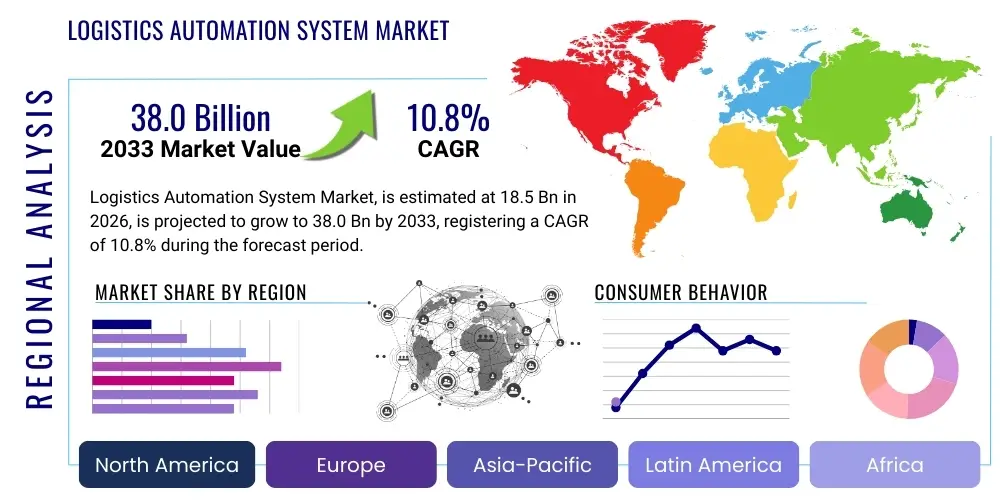

Logistics Automation System Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442158 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Logistics Automation System Market Size

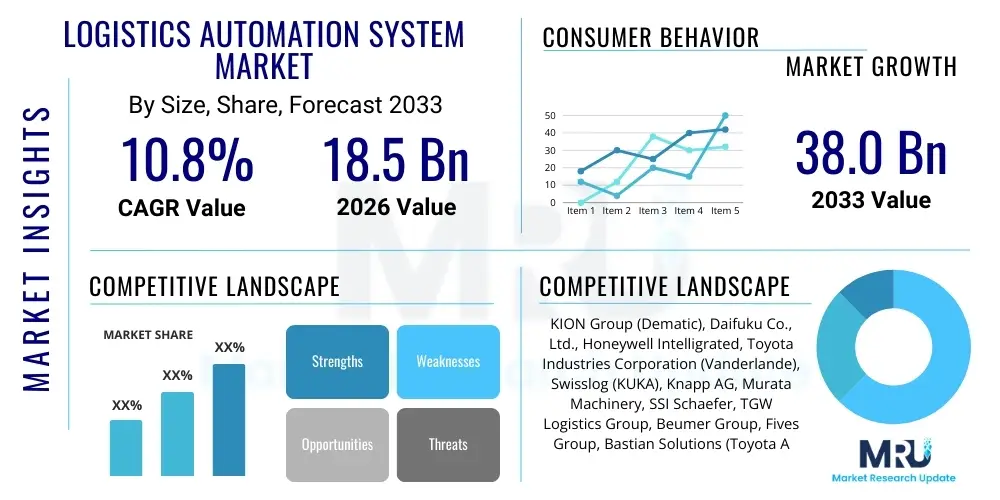

The Logistics Automation System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $38.0 Billion by the end of the forecast period in 2033.

Logistics Automation System Market introduction

The Logistics Automation System Market encompasses the technologies and solutions deployed to streamline, optimize, and execute logistics processes with minimal human intervention. These systems cover the entire supply chain, from raw material handling in manufacturing plants to final mile delivery in distribution centers. Core products include Automated Storage and Retrieval Systems (AS/RS), Conveyors and Sortation Systems, Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), and sophisticated Warehouse Management Systems (WMS) and Warehouse Control Systems (WCS). The primary objective of implementing these systems is to enhance operational efficiency, minimize labor costs, improve inventory accuracy, and accelerate throughput in increasingly complex global supply chains.

Major applications of logistics automation span e-commerce fulfillment, third-party logistics (3PL), automotive manufacturing, food and beverage processing, and pharmaceuticals. E-commerce is the single largest catalyst, demanding rapid, accurate, and scalable solutions to handle fluctuating volumes and high product diversity. The benefits derived from these implementations are substantial, including reduced errors in picking and packing, optimized space utilization within warehouses, and the ability to maintain 24/7 operational capability, which is critical for meeting modern consumer expectations of next-day or same-day delivery. Furthermore, automation improves safety standards by minimizing the need for human workers in hazardous or repetitive tasks.

The market’s strong growth trajectory is fundamentally driven by the escalating demand for faster delivery times, the structural labor shortage in logistics-intensive regions, and the continuous need for supply chain resilience in the face of global disruptions. Technological advancements in robotics, sensor technology, and predictive analytics are making automation solutions more accessible, flexible, and cost-effective, allowing a broader range of enterprises, including mid-sized businesses, to adopt sophisticated automation strategies. This confluence of operational necessity and technological maturity is fueling robust market expansion globally.

Logistics Automation System Market Executive Summary

The Logistics Automation System Market is characterized by intense innovation and strategic mergers and acquisitions aimed at creating integrated end-to-end solutions. Business trends indicate a pivot towards highly flexible and scalable robotic systems, moving away from fixed infrastructure, driven by the volatile nature of demand in e-commerce. Key players are increasingly integrating AI and machine learning capabilities into their software platforms to optimize resource allocation, predict maintenance needs, and enhance route planning efficiency. Investment in micro-fulfillment centers (MFCs) and urban logistics hubs is spurring demand for compact and high-density automation solutions, reshaping traditional warehouse design paradigms. Furthermore, the emphasis on sustainability is encouraging the adoption of energy-efficient automated systems.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive investments in manufacturing automation, burgeoning e-commerce penetration, particularly in China and India, and supportive government policies focused on digitalization and industrial modernization. North America and Europe, while mature, maintain strong market shares, focusing on upgrading legacy systems with advanced robotics and leveraging sophisticated software for system synchronization and real-time optimization. The Middle East and Africa (MEA) and Latin America are emerging as significant growth areas, driven by infrastructure development and the globalization of 3PL services, requiring robust and scalable logistics infrastructure to support regional trade expansion.

Segmentation trends reveal that the software segment, including WMS, WCS, and analytics tools, is exhibiting the highest growth rate, reflecting the industry's need for intelligent orchestration of complex automated hardware. Among hardware components, Autonomous Mobile Robots (AMRs) are rapidly gaining preference over traditional Automated Guided Vehicles (AGVs) due to their inherent flexibility and easier deployment in dynamic environments. By application, e-commerce and 3PL providers remain the dominant segments, prioritizing fulfillment speed and order accuracy, while manufacturing industries are focused on automating intra-logistics processes for just-in-time (JIT) production methodologies.

AI Impact Analysis on Logistics Automation System Market

Common user questions regarding AI's influence in the Logistics Automation System Market typically center on how AI can fundamentally change warehouse operations, particularly concerning predictive maintenance capabilities, optimal inventory placement (slotting optimization), and dynamic workforce management (human-robot collaboration). Users are concerned about the financial commitment required for AI implementation, the necessity of specialized data science expertise, and how AI-driven systems integrate with disparate legacy hardware from multiple vendors. There is a strong expectation that AI will deliver tangible improvements in supply chain visibility, anomaly detection, and demand forecasting, moving logistics from reactive management to proactive strategy, thereby enhancing overall operational resilience and efficiency.

The primary themes emerging from user inquiries highlight AI as the necessary intelligence layer that transforms automated hardware into intelligent, adaptive systems. Concerns about job displacement are balanced by expectations of higher-skilled, supervisory roles needed to manage the AI ecosystems. Users are actively seeking verifiable case studies demonstrating the ROI of machine learning models in complex sorting and picking processes, particularly in high-mix, low-volume environments. The consensus points towards AI being essential for addressing the increasing complexity and personalization demands inherent in modern e-commerce fulfillment, making it a critical differentiator for leading logistics providers and integrators.

AI's influence is profound, enabling automation systems to learn from operational data in real-time, optimizing task assignments and robot movement patterns dynamically. This shift from pre-programmed logic to adaptive intelligence allows warehouses to handle unforeseen spikes in demand or changes in inventory profiles without manual system recalibration. Key expectations include the use of computer vision for quality verification and damage assessment, reinforcement learning for optimizing complex material flow paths, and deep learning models for precise, multi-variate demand forecasting, drastically reducing buffer stock and associated storage costs.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from conveyors, robots, and sorters, predicting equipment failure before it occurs, minimizing costly downtime.

- Dynamic Route Optimization: Real-time calculation and adjustment of routes for AMRs and AGVs based on current congestion, priority tasks, and fluctuating inventory locations.

- Intelligent Inventory Slotting: Applying machine learning to determine the optimal physical location for stock items based on velocity, seasonality, and co-occurrence patterns, maximizing picking efficiency.

- Computer Vision Systems: Employing deep learning models for accurate item identification, quality checks, package dimensioning, and reading damaged or obscured barcodes during sorting.

- Enhanced Human-Robot Collaboration: AI algorithms orchestrating shared workspaces, ensuring seamless and safe interaction between human workers and autonomous robotic systems.

- Automated Decision-Making: Integrating AI into WMS/WCS to automatically assign tasks, manage wave planning, and adjust resource allocation based on instantaneous operational metrics.

- Demand Forecasting Accuracy: Utilizing advanced neural networks for highly accurate, multi-echelon demand forecasting, significantly improving inventory control and reducing stockouts or overstocking.

- Simulated Environment Optimization: Creating digital twins managed by AI to test and refine automation strategies, optimizing throughput before physical deployment.

DRO & Impact Forces Of Logistics Automation System Market

The market is primarily driven by the imperative for operational efficiency, especially against the backdrop of rising labor costs and chronic labor shortages in developed economies. The explosion of e-commerce, which requires massive fulfillment capacity and rapid delivery times, serves as the central demand generator. Restraints include the extremely high initial capital expenditure required for large-scale automation deployments, the complexity of integrating diverse automated systems from different vendors, and the reluctance of smaller logistics providers to abandon proven legacy manual processes. Opportunities lie significantly in the growing adoption of Robots-as-a-Service (RaaS) models, which lower the entry barrier, and the expansion into untapped sectors such as cold chain logistics and healthcare, which demand highly specialized automated handling solutions.

Impact forces currently shaping the competitive landscape are dominated by technological innovation in flexible robotics and the strategic convergence of IT and Operational Technology (OT). The increasing standardization of communication protocols (e.g., VDA 5050 for AGVs) is mitigating integration complexities, thereby accelerating adoption. Global trade volatility and supply chain disruptions, such as those witnessed during the pandemic, have strongly reinforced the necessity for resilient, automated systems capable of functioning reliably with reduced human input. This necessity acts as a powerful long-term driver, prioritizing automation not just for cost savings, but for business continuity and risk mitigation, profoundly influencing procurement decisions across all major end-user industries.

Furthermore, regulatory impact forces are becoming influential, particularly concerning workplace safety standards and data privacy requirements. The ongoing development of lightweight, collaborative robotics (cobots) addresses safety concerns and opens new avenues for augmenting human labor rather than replacing it entirely. Market dynamics are heavily influenced by the competitive pressure among 3PLs to offer superior service levels (speed and accuracy), pushing them to continuously invest in the latest automation technologies to maintain market differentiation. The long lifecycle and high maintenance requirements of fixed automation systems, however, continue to pose a constraint, favoring modular and easily reconfigurable automation solutions moving forward.

Segmentation Analysis

The Logistics Automation System market is highly diversified and segmented across multiple dimensions to address the varied operational needs of different industries. Key segmentation categories include Component (Hardware, Software, Services), Function (Storage Systems, Conveying and Sorting Systems, Mobile Robotics, Picking Systems), Application (Warehouse & Distribution Centers, Manufacturing Plants, Airports), and End-User Industry (E-commerce & Retail, 3PL, Automotive, Food & Beverage, Pharmaceutical & Healthcare). This granularity is essential because automation requirements for a high-mix, low-volume manufacturing environment differ significantly from the high-volume, standard-mix environment of a major e-commerce fulfillment center, requiring specialized hardware and tailored software platforms.

- By Component:

- Hardware (AS/RS, Conveyors and Sortation Systems, Robotic Systems, AGVs/AMRs, Palletizers, Sensors/Scanners)

- Software (Warehouse Management System (WMS), Warehouse Control System (WCS), Execution System (WES), Transportation Management System (TMS), Simulation and Modeling Software)

- Services (Installation, Maintenance and Support, Consulting, System Integration, Managed Services)

- By Function:

- Storage Systems (Automated Storage and Retrieval Systems (AS/RS), Vertical Lift Modules (VLMs), Carousels, Automated Racking)

- Conveying and Sorting Systems (Belt Conveyors, Roller Conveyors, Unit Sortation Systems, High-Speed Cross-Belt Sortation)

- Mobile Robotics (Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Collaborative Mobile Robots)

- Picking Systems (Pick-to-Light/Put-to-Light, Voice Picking, Robotic Picking Arms)

- By Application:

- Warehouse & Distribution Centers

- Manufacturing Facilities

- Freight and Transportation Hubs (Airports, Ports)

- Retail Back-of-Store Operations (Micro-fulfillment)

- By End-User Industry:

- E-commerce and Retail (Including Grocery E-commerce)

- Third-Party Logistics (3PL)

- Manufacturing (Automotive, Electronics, Heavy Industry)

- Food and Beverage (Cold Chain)

- Pharmaceutical and Healthcare

- Aviation and Postal

Value Chain Analysis For Logistics Automation System Market

The value chain for the Logistics Automation System market begins with upstream component manufacturing, primarily involving suppliers of advanced sensors, robotics actuators, high-performance computing hardware, industrial communication modules, and specialized materials like aluminum and steel used in racking and conveying structures. These component providers are critical, as innovations in motor efficiency, battery technology for mobile robots, and sensor precision directly influence the performance and cost of the final automation system. Key upstream activities include research and development focused on miniaturization, power efficiency, and increasing the reliability of complex mechanical parts under continuous operational stress. Strong vendor relationships at this stage are crucial for maintaining supply chain stability and controlling bill of materials (BOM) costs.

The middle segment of the value chain is dominated by system integrators and automation solution providers, who design, assemble, and implement the bespoke systems. This involves complex processes such as detailed facility layout planning, software configuration (WMS/WCS), mechanical assembly, rigorous testing, and integration with the end-user's Enterprise Resource Planning (ERP) systems. Distribution channels are varied: large, global players often use a direct sales and engineering team approach for major, multi-million dollar projects, ensuring deep customization and direct control over project execution. Indirect channels, typically involving local distributors or certified partners, are used to penetrate smaller, geographically fragmented markets or to handle standardized, off-the-shelf components like small AMRs or light-duty conveyors.

Downstream activities involve ongoing maintenance, software upgrades, operational consulting, and support services, which represent a significant and recurring revenue stream for market players. End-users, the logistics operators and manufacturers, derive value through improved throughput, labor cost reduction, and enhanced inventory accuracy. The interaction between system integrators and end-users post-implementation is vital for optimizing the system's performance, especially as operational parameters change. The shift towards cloud-based WMS solutions and Robots-as-a-Service (RaaS) models further complicates the downstream, introducing subscription-based service models alongside traditional capital expenditure purchasing, necessitating robust and responsive service infrastructure to ensure continuous uptime and operational excellence.

Logistics Automation System Market Potential Customers

Potential customers for Logistics Automation Systems are organizations facing immense pressure to optimize their material handling, inventory management, and fulfillment processes due to rising demand complexity, labor constraints, and escalating costs. The primary buyers are large-scale e-commerce retailers (like Amazon and Alibaba), who are continually investing in highly sophisticated fulfillment centers capable of processing millions of orders daily, requiring massive fleets of mobile robots and high-speed sortation systems. Third-Party Logistics (3PL) providers, such as DHL, Kuehne+Nagel, and XPO Logistics, are also critical buyers, as they must offer cutting-edge technological capabilities to retain and attract clients in competitive outsourcing markets.

Furthermore, major manufacturers across the automotive and electronics sectors are significant end-users, focusing on automating intra-logistics flows, feeding assembly lines with just-in-time components, and managing finished goods warehousing. The Food and Beverage industry, particularly those involved in perishable goods and cold chain logistics, represents a growing segment requiring specialized, climate-controlled automation solutions. Lastly, postal and parcel service providers, facing massive increases in package volumes, require high-throughput automated sorting and scanning technology to maintain efficiency and meet regulatory delivery mandates, solidifying their role as cornerstone customers for large fixed automation systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $38.0 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KION Group (Dematic), Daifuku Co., Ltd., Honeywell Intelligrated, Toyota Industries Corporation (Vanderlande), Swisslog (KUKA), Knapp AG, Murata Machinery, SSI Schaefer, TGW Logistics Group, Beumer Group, Fives Group, Bastian Solutions (Toyota Advanced Logistics), Locus Robotics, Geekplus Technology, KION Group (Egemin Automation), Fanuc Corporation, MHS Global, AutoStore, Zebra Technologies, Körber AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Logistics Automation System Market Key Technology Landscape

The technological landscape of the Logistics Automation System market is rapidly evolving, moving beyond traditional, fixed infrastructure like legacy conveyors and ASRS to embrace highly flexible, smart, and interconnected systems. Autonomous Mobile Robots (AMRs) represent a core technology trend, utilizing sophisticated sensor fusion (LiDAR, cameras, ultrasonic) and VSLAM (Visual Simultaneous Localization and Mapping) to navigate dynamic warehouse environments without relying on fixed wire guidance, offering unprecedented flexibility and ease of scalability. Collaborative robotics (Cobots) are also gaining traction, designed to safely share workspaces with humans, performing delicate or repetitive picking and packing tasks with high precision, often utilizing advanced computer vision for object recognition and grasping.

Software and AI form the nervous system of modern automation. Advanced Warehouse Management Systems (WMS) are integrating predictive analytics and machine learning to optimize inventory placement (slotting), manage labor allocation, and dynamically adjust material flow based on real-time order surges. The adoption of the Industrial Internet of Things (IIoT) is pervasive, with embedded sensors monitoring the health and performance of every automated component, feeding data into cloud-based platforms for centralized analysis and preventative maintenance scheduling. Digital twin technology is increasingly leveraged, allowing operators to simulate various operational scenarios and optimize complex automated layouts virtually before deployment, significantly reducing risk and implementation time.

Furthermore, energy efficiency and modularity are key technological considerations. New generations of ASRS and mini-load systems are designed with regenerative braking and lighter components to reduce power consumption. In the realm of conveying and sortation, technologies are focusing on high-speed, low-touch handling to minimize product damage, particularly vital for fragile e-commerce items. The convergence of these hardware and software innovations is leading towards highly adaptable, system-of-systems architectures, allowing logistics operations to quickly reconfigure their automation based on shifts in product demand or inventory profile, ensuring maximum utilization and longevity of investment.

Regional Highlights

Regional variations in the adoption of logistics automation are driven by differences in labor costs, e-commerce maturity, and government investment in infrastructure. Understanding these differences is crucial for market penetration strategies.

- North America: Characterized by high labor costs and immense consumer demand for rapid delivery, North America is a mature but high-growth market, focusing on integrating advanced software (WMS/WES) with highly flexible automation, particularly AMRs and robotic piece-picking solutions. Investment is heavily driven by large e-commerce giants and 3PL providers seeking maximum throughput and efficiency. The shift towards localized, decentralized fulfillment (MFCs) is a major regional driver.

- Europe: Europe boasts a strong manufacturing base (especially automotive and industrial machinery) alongside robust retail and e-commerce growth. The region places a significant emphasis on technological precision, safety standards, and sustainability. Germany, the UK, and the Benelux countries are major hubs for adopting integrated, high-density AS/RS and advanced sortation systems. Robotics-as-a-Service (RaaS) models are seeing increasing acceptance due to favorable regulatory environments and competitive pressures among logistics providers.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by rapid industrialization, massive e-commerce adoption (especially in China, India, Japan, and South Korea), and increasing labor costs in manufacturing centers. China and Japan lead in robotics manufacturing and deployment, driving down the unit cost of automation hardware. Government initiatives supporting smart factories and digital transformation further accelerate the adoption of full-scale warehouse automation and intra-logistics systems in manufacturing.

- Latin America: An emerging market focusing primarily on automating core operations to overcome infrastructural bottlenecks and improve service reliability. Brazil and Mexico are leading the way, driven by foreign investment in manufacturing and the expansion of global 3PL operations. Initial automation investments often focus on basic conveying systems and entry-level WMS implementations, with mobile robotics adoption beginning primarily in large distribution centers serving major metropolitan areas.

- Middle East and Africa (MEA): Growth in MEA is highly dependent on large-scale infrastructure projects, particularly in the UAE and Saudi Arabia, aimed at establishing global trade and logistics hubs. Automation adoption is centralized in major ports, airports, and newly built smart warehouses, where high-end, capital-intensive fixed automation systems (AS/RS and sophisticated sortation) are deployed to handle high volumes of transit cargo and regional distribution efficiently.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Logistics Automation System Market.- Daifuku Co., Ltd.

- KION Group (Dematic)

- Honeywell Intelligrated

- Toyota Industries Corporation (Vanderlande)

- Knapp AG

- Swisslog (KUKA)

- SSI Schaefer Group

- TGW Logistics Group

- Murata Machinery, Ltd.

- Beumer Group

- Fives Group

- Bastian Solutions (Toyota Advanced Logistics)

- MHS Global

- Locus Robotics

- Geekplus Technology Co., Ltd.

- AutoStore

- Zebra Technologies Corporation

- Körber AG

- Fanuc Corporation

- Exotec

Frequently Asked Questions

Analyze common user questions about the Logistics Automation System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of logistics automation?

The central driver is the rapid expansion of e-commerce, which necessitates highly efficient, accurate, and scalable fulfillment solutions to meet increasing consumer expectations for fast delivery, coupled with chronic labor shortages and rising operational costs globally.

How do Autonomous Mobile Robots (AMRs) differ from traditional Automated Guided Vehicles (AGVs) in logistics?

AMRs utilize VSLAM and sensor fusion to navigate dynamically without fixed physical guidance (like wires or tape), allowing for flexible route changes and interaction with human workers. AGVs follow predetermined, fixed paths and require infrastructure modifications for path changes, making AMRs significantly more adaptable to dynamic warehouse environments.

What role does AI and Machine Learning play in optimizing logistics automation systems?

AI is crucial for transforming automation from fixed logic to intelligent adaptation. It enables predictive maintenance, dynamic inventory slotting, real-time route optimization for mobile fleets, and advanced demand forecasting, significantly enhancing overall system efficiency and resilience.

What are the main financial barriers to entry for adopting logistics automation?

The primary barrier is the high initial capital expenditure (CapEx) required for large-scale fixed infrastructure like ASRS and complex sortation systems. However, emerging Robots-as-a-Service (RaaS) models and modular AMRs are lowering this threshold by converting CapEx into operational expenditures (OpEx).

Which geographic region is projected to exhibit the highest growth in the Logistics Automation System Market?

The Asia Pacific (APAC) region is forecasted to display the highest growth rate, driven by massive investments in infrastructure development, governmental focus on smart manufacturing, and the exponential growth of e-commerce markets, particularly in China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager