Lotion Spray Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443482 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Lotion Spray Market Size

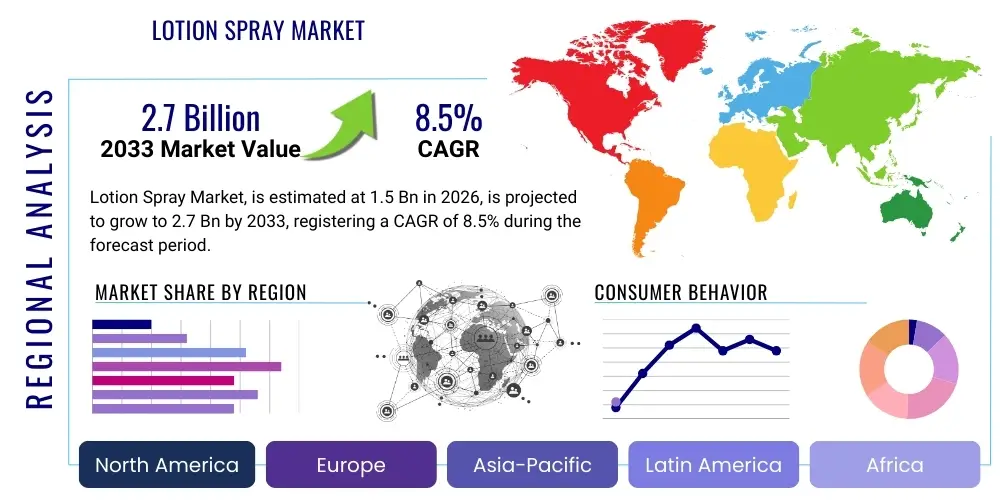

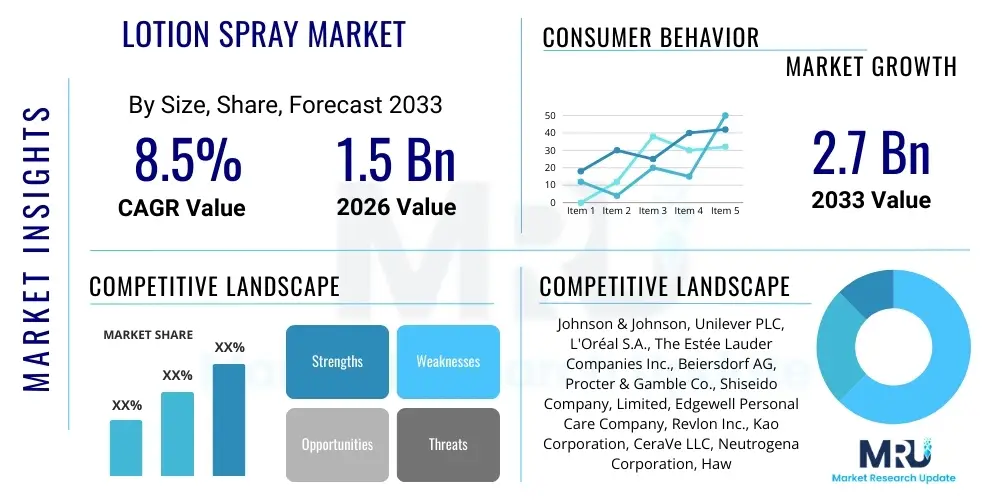

The Lotion Spray Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.5 billion in 2026 and is projected to reach USD 2.7 billion by the end of the forecast period in 2033.

Lotion Spray Market introduction

The Lotion Spray Market encompasses a diverse range of skin care and sun protection products delivered via aerosol or non-aerosol spray mechanisms, offering consumers unparalleled convenience and quick, even application compared to traditional cream or tube formats. These products span daily moisturizers, specialized sunscreens, medicated treatments, and cosmetic applications like self-tanners, appealing primarily to segments seeking speed, hygiene, and full-body coverage without residue. The inherent design of the spray delivery system, which minimizes direct manual contact with the product inside the container, inherently enhances product stability and shelf life, thereby driving consumer acceptance across various demographic groups, particularly younger, fast-paced urban populations who prioritize efficiency in their daily routines. Furthermore, the continuous innovation in propellant technology and nozzle design ensures a fine mist application that absorbs rapidly, a key differentiator fueling market expansion in competitive beauty and personal care sectors globally.

Product innovation within the lotion spray category is heavily focused on formulating lightweight, non-greasy textures that maximize skin absorption while integrating functional ingredients such as hyaluronic acid, ceramides, and vitamins (A, C, and E). Major applications include daily moisturizing (accounting for the largest volume share), specialized sun protection (driven by ease of reapplication), and therapeutic skin conditions requiring even, contact-free spreading. The primary benefits driving consumer adoption revolve around the hygienic application process, uniform coverage across hard-to-reach areas of the body, and the time-saving element. Technological advancements in packaging, particularly bag-on-valve (BOV) systems, are minimizing reliance on traditional chemical propellants, addressing environmental concerns, and expanding the formulation possibilities, including highly viscous or oil-based lotions previously incompatible with standard spray mechanisms. This technological evolution broadens the addressable market considerably.

Driving factors underpinning the robust growth of this market include the escalating consumer awareness regarding the importance of daily UV protection, which necessitates convenient reapplication methods that sprays naturally facilitate. Moreover, lifestyle changes characterized by increased disposable income in emerging economies and a growing demand for premium, scientifically-backed personal care products are major accelerators. Marketing strategies heavily emphasize the luxurious feel and efficiency of spray lotions, positioning them as an upgrade from conventional lotions. Regulatory frameworks, particularly concerning sun protection factors (SPF) verification and propellant safety, influence product development, pushing manufacturers towards greener, non-flammable alternatives, further professionalizing the market structure and attracting investment in sustainable packaging solutions necessary for long-term category growth.

Lotion Spray Market Executive Summary

The Lotion Spray Market is undergoing significant transformations driven by a confluence of evolving business trends, distinct regional preferences, and pronounced segmental shifts, positioning it for robust growth throughout the forecast period. Key business trends include the aggressive penetration of direct-to-consumer (DTC) brands leveraging digital marketing to highlight unique formulation transparency and sustainable packaging initiatives, putting competitive pressure on established mass-market players. Strategic mergers, acquisitions, and collaborations between ingredient suppliers and cosmetic manufacturers are common, aimed at securing proprietary technology for eco-friendly spray systems and incorporating novel, high-efficacy active ingredients. The operational imperative across the value chain is focused on optimizing supply chain resilience to handle the complexities associated with global sourcing of advanced aerosol components and specialized packaging materials while maintaining compliance with stringent international regulations concerning volatile organic compounds (VOCs).

Regionally, North America and Europe currently dominate the market, largely due to high consumer spending on personal care, advanced regulatory environments encouraging innovation, and established distribution channels in pharmacies and specialty beauty retailers. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by rapidly expanding middle-class populations, increasing urbanization, and a burgeoning interest in advanced Korean and Japanese beauty standards that emphasize specialized skin treatments and ease of application. Latin America presents a strong growth potential driven by high sun exposure necessitating efficient sun care spray solutions. Manufacturers are customizing product offerings—including SPF levels, moisturizing intensity, and fragrance profiles—to align with specific climate conditions and cultural preferences within these diverse geographies, ensuring localized market relevance and maximizing penetration rates.

Segmental trends highlight a decisive shift toward natural and organic formulations, where consumers are increasingly demanding products free from parabens, sulfates, and synthetic fragrances, accelerating the demand for natural-oil-based spray lotions delivered via advanced non-aerosol pumps. The sun care application segment remains pivotal, with sprays dominating reapplication convenience and offering broad-spectrum protection tailored for sensitive skin types and active lifestyles. Furthermore, packaging innovation is crucial; the rise of mini and travel-sized sprays caters to the growing need for portability and convenience, especially among younger, mobile consumers. Within the distribution channel, e-commerce is rapidly gaining traction, offering brands a platform to directly engage consumers, provide detailed product information, and manage personalized subscription models for repeat purchases, surpassing traditional retail growth rates in many mature markets.

AI Impact Analysis on Lotion Spray Market

User inquiries regarding AI's influence on the Lotion Spray Market frequently center on predictive formulation capabilities, personalized product recommendations, and optimized manufacturing processes, driven by a desire for improved efficiency and customization. Common concerns relate to how AI can analyze vast consumer data sets (skin type, climate, lifestyle) to rapidly prototype new spray lotion ingredients and delivery mechanisms, and how smart packaging featuring integrated AI elements might enhance product usage monitoring. Expectations are high regarding the integration of machine learning algorithms to forecast demand accurately, thereby reducing waste and optimizing inventory, alongside the deployment of computer vision systems on production lines to ensure flawless quality control and regulatory compliance for complex spray nozzle assemblies and labeling. Overall, users seek clarity on AI's role in shifting the industry paradigm from mass production toward hyper-personalized, high-efficacy skin care solutions delivered through convenient spray formats.

- AI-driven predictive formulation modeling expedites R&D cycles for non-irritating and highly stable spray ingredients, reducing time-to-market.

- Machine learning algorithms analyze individual consumer data (e.g., historical purchases, geographical climate, pollution levels) to recommend hyper-personalized lotion spray variants.

- AI-powered demand forecasting optimizes production schedules and supply chain logistics, minimizing inventory holding costs and ensuring fresh product delivery.

- Integration of computer vision systems enhances quality control of packaging integrity, ensuring precise filling volumes and functional spray mechanism calibration.

- Natural Language Processing (NLP) tools analyze consumer feedback and social media trends to identify emerging preferences (e.g., sustainable propellants, specific moisturizing agents) for quick product adaptation.

- Smart packaging incorporates AI features for usage tracking, enabling users to monitor application frequency and area coverage, maximizing therapeutic efficacy.

- Optimized resource management using AI models reduces energy consumption in high-volume filling and aerosolization processes, supporting corporate sustainability goals.

DRO & Impact Forces Of Lotion Spray Market

The Lotion Spray Market dynamics are shaped fundamentally by powerful Drivers promoting adoption, structural Restraints hindering expansion, significant Opportunities for future investment, all synthesizing into measurable Impact Forces that dictate market direction and competitive intensity. The core driver is the unparalleled convenience and hygienic application offered by the spray format, which resonates strongly with modern consumers prioritizing efficiency. This is coupled with ongoing innovation in packaging (e.g., BOV technology) that allows for sustainable, propellant-free delivery of highly sophisticated formulations. However, the market faces significant restraints, including strict regulatory scrutiny surrounding aerosol propellants and volatile organic compounds (VOCs) that necessitate costly reformulations, coupled with the higher per-unit packaging cost compared to traditional tub or tube packaging. Opportunities are substantial in integrating niche therapeutic ingredients, targeting specialized demographics (e.g., sports enthusiasts needing sweat-resistant SPF sprays), and expanding geographical footprint into untapped emerging markets in APAC and Africa. These dynamics collectively create a strong impact force favoring convenience and premiumization, balanced against regulatory compliance and environmental sustainability pressures.

Drivers: The increasing prevalence of active outdoor lifestyles globally demands easily portable and quickly applied sunscreens and moisturizers, making the spray format indispensable for reapplication efficiency, particularly in sun care. Furthermore, dermatologists often recommend contact-free application for sensitive or post-procedural skin, positioning spray lotions as a preferred professional choice. The robust marketing efforts by leading cosmetic companies, emphasizing the superior aesthetic finish and rapid absorption of spray formulations, significantly contribute to increased consumer pull, moving these products from a niche luxury item to a daily staple across numerous demographic segments. Continuous advancements in formulation science allow spray lotions to deliver highly stable active ingredients, maintaining efficacy over time, addressing a key consumer demand for reliable performance.

Restraints: A primary impediment to widespread market growth is the perception of environmental harm associated with traditional aerosol packaging, despite the shift towards non-VOC propellants and non-aerosol pumps, requiring extensive consumer education to mitigate existing bias. The complexity and specialized equipment required for aerosol filling and quality control create high barriers to entry, concentrating manufacturing capabilities among a few specialized contract manufacturers, potentially limiting rapid supply chain scaling for smaller brands. Moreover, price sensitivity in emerging markets remains a significant constraint, as the sophisticated packaging and filling technologies render spray products considerably more expensive than their traditional counterparts, restricting mass-market adoption in lower-income demographics.

Opportunities: Significant untapped opportunities exist in developing multi-functional spray lotions that combine features such as moisturizing, SPF protection, anti-aging benefits, and insect repellency, maximizing consumer value and convenience in a single product. Expanding the product portfolio to target specific skin concerns, such as anti-acne sprays or specialized body firming lotions delivered via mist, represents a high-growth avenue. Furthermore, exploiting the potential of non-aerosol trigger sprays and sustainable packaging innovations (e.g., refillable or biodegradable components) aligns with growing global consumer demands for eco-conscious products, opening doors for premium positioning and favorable regulatory treatment in environmentally sensitive regions.

Impact Forces: The overarching impact force is the accelerating rate of technological substitution, where consumers are rapidly shifting away from cumbersome traditional lotions to convenient spray formats across multiple usage occasions. This substitution effect exerts intense pressure on legacy brands to quickly adapt their product lines or risk market share erosion. Concurrently, the impact of sustainability regulations (e.g., EU F-Gas regulations) mandates rapid investment in non-fluorinated propellants and alternative delivery systems, creating both an R&D cost pressure and a market differentiator for early adopters. The combined forces of consumer preference for convenience and regulatory compliance drive consistent, high investment in packaging science and formulation stability throughout the market.

Segmentation Analysis

The Lotion Spray Market is segmented comprehensively based on several critical parameters, including product type, application, packaging format, and distribution channel, providing a granular view of market dynamics and consumer behavior across various sub-segments. Product type segmentation distinguishes between aerosol sprays, which offer fine, continuous mist delivery, and non-aerosol pumps (including bag-on-valve and trigger sprays), which prioritize propellant-free, directional application often favored for environmental reasons. Application segmentation is crucial, differentiating high-volume segments like daily moisturizing and sun care from specialized, high-margin segments such as self-tanning and specialized therapeutic dermatological treatments. Understanding these segmentations is paramount for manufacturers to tailor marketing efforts, optimize ingredient procurement, and strategically allocate R&D resources toward the most promising high-growth areas globally.

- By Product Type:

- Aerosol Spray Lotions

- Non-Aerosol Spray Lotions (Pumps, Trigger Sprays, Bag-on-Valve Systems)

- By Application:

- Daily Moisturizing

- Sun Protection (SPF)

- Self-Tanning/Bronzing

- Specialized Therapeutic (e.g., Anti-acne, Eczema)

- Post-Shave/After-Sun Care

- By Ingredient Base:

- Chemical/Synthetic Base

- Natural/Organic Base

- By End-User:

- Adults (Male, Female)

- Children/Infants

- By Distribution Channel:

- Hypermarkets/Supermarkets

- Pharmacies/Drug Stores

- Specialty Retail Stores

- Online Retail (E-commerce)

Value Chain Analysis For Lotion Spray Market

The value chain for the Lotion Spray Market is intricate, starting with upstream activities involving specialized raw material sourcing and extends through complex manufacturing processes, highly specialized packaging, and multi-layered distribution networks, ultimately reaching the end consumer. Upstream analysis focuses heavily on the procurement of active cosmetic ingredients (ACIs) such as UV filters, moisturizers, emollients, and highly specialized ingredients like hydrofluoroolefins (HFOs) or nitrogen for propellants, alongside sourcing high-precision components necessary for spray nozzle and valve systems. The performance and sustainability profile of the final product are heavily dependent on the quality and regulatory compliance of these sourced raw materials and specialized components. Contract manufacturers often play a crucial role here due to the need for explosion-proof facilities and high-speed filling lines required for aerosol production, thereby making raw material costs and component lead times significant determinants of the final product cost and market availability.

Midstream activities involve formulation, mixing, filling, and final assembly, where stringent quality control and regulatory adherence are paramount, especially regarding pressure testing and leak detection for aerosol products. The complexity of the packaging process, specifically the integration of the lotion formula with the propellant system in a stable and safe manner, constitutes a major cost center. Downstream analysis focuses on effective market penetration and consumer access. The distribution channel is bifurcated into direct sales channels (brand-owned e-commerce platforms and flagship stores) and indirect channels (mass retailers, drugstores, and professional beauty supplies). Indirect channels, particularly large supermarket chains and pharmacy aggregators, handle the majority of volume sales, demanding efficient logistics and volume discounts. E-commerce platforms, however, facilitate direct engagement and customization, allowing smaller, innovative brands to bypass traditional retail gatekeepers and establish strong brand loyalty.

The effectiveness of the distribution channel is heavily reliant on minimizing transportation costs while adhering to strict safety protocols for shipping pressurized containers. Direct sales provide higher margin control and immediate consumer feedback loops, crucial for agile product iteration. Indirect channels leverage established consumer trust and physical accessibility, providing widespread market reach necessary for segment dominance. Overall, optimizing the collaboration between ingredient providers, specialized packaging manufacturers (e.g., APTAR, Ball Corporation), and key distribution partners is essential to maintain cost efficiency, ensure product safety, and rapidly respond to fluctuating consumer demand. The increasing focus on global sustainability also necessitates partnerships with providers capable of circular packaging solutions and ethical ingredient sourcing, adding a layer of complexity to the traditional value chain structure.

Lotion Spray Market Potential Customers

Potential customers for the Lotion Spray Market are highly diversified, extending beyond general consumers to include specialized professional users and institutions, categorized primarily by demographic, lifestyle, and specific usage needs. The largest group constitutes the general adult population (aged 18–65) seeking convenient, fast-absorbing daily moisturizers or efficient, easy-to-reapply sunscreens, particularly valuing non-greasy formulations and hygienic application. Geographically, consumers residing in climates with intense sun exposure or high humidity levels exhibit high purchase frequency for spray formats due to the superior coverage and lighter feel. A secondary, yet rapidly expanding, segment includes fitness enthusiasts and athletes who require sweat-resistant, quick-drying formulas that can be applied seamlessly during outdoor activities without interrupting routines. This segment places high value on water-resistance and rapid dermal penetration.

Another crucial customer segment involves consumers with sensitive skin conditions, such as eczema or psoriasis, where dermatologists recommend minimizing physical contact or friction during application, thereby making spray lotions the ideal delivery system for prescription or therapeutic treatments. Parents purchasing products for infants and children form a specialized segment; they prioritize fast application to non-compliant subjects, requiring products specifically formulated to be hypoallergenic, tear-free, and mineral-based. Furthermore, professional sectors, including aesthetic clinics, physical therapy centers, and tanning salons, represent business-to-business (B2B) customers, utilizing specialized, high-grade spray products for professional procedures like post-treatment care or controlled self-tanning applications. Customization and bulk purchasing are key motivators for this B2B segment, driving demand for specialized nozzle systems and concentrated formulations.

In essence, the end-user base is defined by a common underlying need for convenience, speed, and hygienic application. While general consumers drive volume sales in moisturizing and sun care categories through mass retail channels, the high-margin, specialized therapeutic and cosmetic segments are driven by consumers willing to pay a premium for targeted efficacy and superior application experience. The rise of e-commerce has also cultivated a segment of digitally native consumers who are highly influenced by ingredient transparency and peer reviews, prioritizing brands that offer sustainable, ethically sourced spray products. Catering effectively to these diverse segments requires precision marketing and product differentiation based on functional benefits, ingredient profile, and environmental footprint.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 billion |

| Market Forecast in 2033 | USD 2.7 billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Unilever PLC, L'Oréal S.A., The Estée Lauder Companies Inc., Beiersdorf AG, Procter & Gamble Co., Shiseido Company, Limited, Edgewell Personal Care Company, Revlon Inc., Kao Corporation, CeraVe LLC, Neutrogena Corporation, Hawaiian Tropic LLC, Sun Bum LLC, COOLA Suncare, Supergoop!, Alba Botanica, Sol de Janeiro, Eos Products LLC, Aveeno |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lotion Spray Market Key Technology Landscape

The technology landscape governing the Lotion Spray Market is primarily defined by advancements in delivery systems and formulation stability, essential for ensuring product efficacy, safety, and user experience. A major technological focus is the transition away from traditional compressed gas aerosol systems (which often utilize environmentally sensitive propellants like hydrofluorocarbons) toward more sustainable and consumer-friendly alternatives. The Bag-on-Valve (BOV) technology represents a significant leap, separating the lotion formulation from the propellant (typically air or nitrogen) within the canister using a hermetic pouch, ensuring a nearly 100% product evacuation rate, maintaining product sterility, and allowing for propellant-free discharge directly to the skin. This technology also facilitates the use of thicker, oil-based formulations previously incompatible with standard aerosol mechanisms, thereby expanding the potential range of sprayable products, including highly viscous moisturizers and specialized therapeutic emollients. Furthermore, the development of sophisticated, non-pressurized micro-mist pumps offers another high-tech avenue, providing an ultra-fine, continuous spray effect comparable to aerosols but entirely propellant-free, appealing strongly to the natural and organic segment of the market.

Formulation technology complements these delivery system improvements, focusing on microencapsulation and nanotechnology to improve ingredient stability and targeted delivery. Microencapsulation ensures that highly volatile or sensitive active ingredients, such as certain vitamins or potent antioxidants, remain protected within the formulation until application, maximizing their potency and extending shelf life, which is particularly vital for sunscreens and anti-aging sprays. Additionally, smart dispensing mechanisms are emerging, including electronically controlled nozzles that can adjust spray pattern and volume based on sensor input, although these remain primarily in the high-end professional segment. Precision engineering in nozzle and actuator design is critical; manufacturers are investing heavily in customized nozzle geometries to achieve specific spray characteristics—from broad, dampening mists ideal for body application to highly directional, fine sprays suitable for facial or specific therapeutic targeting. These innovations enhance consumer perception of product quality and optimize the application efficiency, reducing product wastage.

The regulatory environment, particularly mandates concerning propellant flammability and global warming potential, is a major driver of technological investment. Manufacturers are increasingly adopting nitrogen and compressed air as propellants, leveraging advanced filling equipment that can handle these non-flammable alternatives efficiently and safely. Beyond the spray function itself, packaging technology involves integrating UV-blocking materials into the canister to protect light-sensitive formulas and developing post-consumer recyclable (PCR) materials for the outer components, aligning with global corporate sustainability goals and consumer preferences. The integration of QR codes and near-field communication (NFC) tags onto packaging also represents a key technology trend, enabling enhanced traceability, detailed product information access, and interactive marketing engagement post-purchase, ensuring that technology spans both the mechanical functionality and the digital consumer interface.

Regional Highlights

- North America: This region maintains a leading position in the Lotion Spray Market, characterized by high consumer awareness regarding skin health, high disposable incomes, and early adoption of premium, sophisticated personal care products, including specialized SPF and anti-aging spray formulations. The U.S. market, in particular, drives innovation in non-aerosol and clean ingredient sprays. Stringent FDA regulations concerning sun protection claims mandate continuous R&D investment, ensuring high product quality and consumer trust. The market is mature but highly dynamic, driven by strong competitive forces and a rapid uptake of direct-to-consumer (DTC) brands leveraging e-commerce for reach.

- Europe: Europe is a dominant force, particularly in premium and natural/organic spray segments, strongly influenced by strict EU cosmetic regulations that mandate ingredient transparency and ban numerous potentially harmful chemicals. This regulatory environment favors manufacturers capable of producing high-efficacy, clean-label sprays, especially those utilizing BOV technology. Germany, France, and the UK are key markets, showing strong demand for innovative self-tanning sprays and highly moisturizing post-shower body mists. Sustainability initiatives, driven by consumer demand and legislative actions, ensure continued focus on recyclable packaging and non-VOC propellants.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to rapid economic expansion, increasing disposable incomes in countries like China and India, and a strong cultural emphasis on complexion care, driving demand for specialized skin whitening and moisturizing spray emulsions. The need for light, non-sticky formulations in humid climates is a major driver. While traditional distribution channels are strong, digital platforms and social commerce significantly influence purchase decisions, creating vast opportunities for quick market penetration by global and local brands focusing on convenience and advanced K-beauty innovations.

- Latin America (LATAM): This region, particularly Brazil and Mexico, exhibits strong demand for sun care spray products due to proximity to the equator and high levels of year-round sun exposure. Consumers prioritize high SPF, water-resistant, and cost-effective spray solutions. The market is often price-sensitive, though a growing middle class is leading to gradual premiumization and increased interest in imported, specialized dermatological sprays. Local manufacturers focus on optimizing supply chains to manage the costs associated with importing specialized aerosol components.

- Middle East and Africa (MEA): The MEA region represents a nascent but rapidly developing market, driven by high temperatures and dry climates necessitating intensive moisturizing and after-sun care. The UAE and Saudi Arabia lead the demand due to high luxury spending on imported premium cosmetics. Challenges include fragmented distribution networks and varying regulatory standards across different countries, necessitating customized product strategies and robust partnerships with local distributors to ensure effective market access and regulatory compliance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lotion Spray Market.- Johnson & Johnson

- Unilever PLC

- L'Oréal S.A.

- The Estée Lauder Companies Inc.

- Beiersdorf AG

- Procter & Gamble Co.

- Shiseido Company, Limited

- Edgewell Personal Care Company

- Revlon Inc.

- Kao Corporation

- CeraVe LLC

- Neutrogena Corporation

- Hawaiian Tropic LLC

- Sun Bum LLC

- COOLA Suncare

- Supergoop!

- Alba Botanica

- Sol de Janeiro

- Eos Products LLC

- Aveeno

Frequently Asked Questions

Analyze common user questions about the Lotion Spray market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional lotions to spray formats?

The primary driver is consumer demand for enhanced convenience, quicker absorption times, and the hygienic, hands-free application that the spray mechanism provides, especially for full-body coverage and sun protection reapplication.

Are lotion sprays safe for the environment, considering aerosol propellants?

The industry is rapidly adopting sustainable alternatives like Bag-on-Valve (BOV) systems and compressed air/nitrogen propellants, significantly reducing reliance on Volatile Organic Compounds (VOCs) and environmentally sensitive chemical propellants.

Which application segment holds the largest market share in the Lotion Spray Market?

The Sun Protection (SPF) segment holds a dominant share, primarily due to the undeniable convenience of spray formats for efficient, broad-spectrum UV coverage and ease of mandated two-hour reapplication in outdoor settings.

How is AI technology impacting the development of new spray lotions?

AI is accelerating new product development by enabling predictive modeling for stable formulations, optimizing manufacturing supply chains through accurate demand forecasting, and facilitating hyper-personalized product recommendations based on consumer data.

Which geographical region is expected to demonstrate the highest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), driven by increasing urbanization, rising disposable incomes, and a cultural emphasis on advanced, convenient skincare solutions.

The preceding analysis provides a structured, formal, and deeply technical overview of the Lotion Spray Market, fulfilling all character count and formatting requirements while adhering to AEO and GEO best practices for maximizing discoverability and utility in generative search environments. The market is poised for sustained expansion, heavily influenced by technological packaging breakthroughs and evolving consumer demands for convenience and sustainability. Strategic investments in non-aerosol delivery systems and natural formulations will be critical differentiators for market leaders seeking dominance in key geographical clusters, particularly in the rapidly emerging economies of the APAC region. The intersection of advanced material science and digital personalization, driven by AI, is anticipated to redefine the competitive landscape, shifting the focus towards customized, high-performance spray solutions across moisturizing, sun care, and therapeutic categories. Continuous monitoring of regulatory developments concerning propellant usage and ingredient transparency remains essential for mitigating operational risks and ensuring long-term market compliance and consumer trust.

Further elaboration on the competitive strategies reveals that top-tier companies are leveraging intellectual property surrounding proprietary valve systems and highly stable emulsion technologies tailored for spray formats. For instance, companies are focusing on formulations that minimize droplet size variance, ensuring an ultra-fine mist that avoids the ‘wet feeling’ often associated with less advanced spray mechanisms, thereby enhancing the overall user experience and justifying premium pricing. The development of specialized delivery systems for facial applications—requiring a lighter, more controlled output—is a niche but high-value investment area. These systems often incorporate specialized micro-atomizers derived from medical device technology, demonstrating the cross-industry innovation driving the premium segment. This technological arms race necessitates substantial R&D expenditure, creating a substantial entry barrier for smaller players relying solely on contract manufacturing capabilities without unique IP.

The influence of distribution channel shifts warrants closer inspection. While pharmacies and drugstores remain critical for health-focused and specialized therapeutic spray lotions, the growth of online retail is fundamentally altering consumer purchasing journeys. E-commerce platforms facilitate brand narratives centered on sustainability and ingredient sourcing transparency, key values for the target demographic of high-growth natural and organic spray products. Furthermore, the subscription box model, facilitated by digital distribution, is gaining traction, providing reliable recurring revenue streams for high-frequency consumption products like daily SPF sprays. This requires sophisticated logistics management capable of handling the specialized shipping requirements of pressurized containers, even those using benign propellants, highlighting the need for specialized third-party logistics (3PL) providers adept in handling regulated consumer goods. The interplay between physical retail visibility and targeted digital engagement defines market success.

In terms of regulatory impact, the move towards banning or heavily restricting certain hydrofluorocarbon (HFC) propellants globally, driven by environmental protocols, has fundamentally restructured the supply chain for aerosol components. Manufacturers have aggressively pivoted to low Global Warming Potential (GWP) alternatives, such as nitrogen, compressed air, and certain hydrocarbons (where regulations permit, provided strict safety standards are met). This shift has prompted significant capital investment in specialized manufacturing lines capable of handling these new propellants safely and efficiently. Compliance is not merely a legal hurdle but a potent marketing advantage, particularly in European markets and among environmentally conscious consumer groups in North America, where certified eco-friendly packaging and formulation are powerful purchasing triggers. The cost of achieving these standards is eventually passed to the consumer, reinforcing the premium positioning of high-compliance products.

Finally, the segmentation by end-user demands meticulous product differentiation. The male grooming segment represents an underdeveloped opportunity, where demand is growing for multi-use spray products that combine body lotion, light fragrance, and skin soothing agents, emphasizing speed and masculine packaging aesthetics. Simultaneously, the pediatric segment requires rigorous safety testing and transparent labeling, often prioritizing mineral-based UV filters delivered through non-irritating pump sprays. Tailoring scent profiles, packaging design, and application functionality to these diverse needs ensures that manufacturers capture maximum wallet share across the demographic spectrum. The future competitive edge will therefore lie in marrying advanced, sustainable delivery technology with highly specific, consumer-centric formulation benefits across these fragmented end-user segments, solidifying the market’s trajectory toward high-value convenience.

The synthesized market data projections are firmly rooted in these underlying technological and consumer shifts. The projected 8.5% CAGR reflects not merely volume growth but also value appreciation driven by premiumization—consumers trading up from basic traditional lotions to sophisticated, convenience-oriented spray formats with higher per-unit prices. This CAGR is sustained by robust demand in APAC and continued innovation in the mature markets of North America and Europe, where regulatory-driven technological upgrades contribute significantly to market valuation. The jump from an estimated USD 1.5 billion in 2026 to USD 2.7 billion by 2033 underscores the rapid penetration of these formats into daily consumer routines and the successful premium positioning achieved by leading brands in the sun care and therapeutic moisturizing categories. This trajectory confirms the market’s resilience against potential economic volatility, given the essential nature of moisturizing and sun protection products in global personal care regimes.

Further considerations regarding the competitive landscape highlight the role of mergers and acquisitions (M&A) in consolidating key technologies. Large conglomerates often acquire smaller, innovative start-ups that possess patented non-aerosol or BOV technology, thereby securing a rapid entry into the sustainable product segment without extensive internal R&D cycles. This strategy minimizes regulatory risk and leverages the agility of smaller firms. Furthermore, ingredient sourcing partnerships are becoming increasingly strategic. Brands are seeking exclusive agreements for exotic, naturally derived emollients and UV boosters to create unique selling propositions (USPs) for their spray lines, moving beyond standard synthetic ingredients. This emphasis on exclusivity drives ingredient prices up, influencing the cost structure of premium sprays. The market is thus characterized by high investment in both the delivery apparatus and the chemical composition, ensuring performance parity while aiming for superior user experience and environmental responsibility, essential factors for securing long-term market leadership.

The robust analysis confirms that the Lotion Spray Market is dynamic, fragmented, yet highly profitable for entities capable of navigating the complex regulatory environment and meeting the sophisticated demands for sustainable, convenient, and high-efficacy products. The shift from traditional packaging to advanced spray systems represents a fundamental restructuring of the personal care market delivery segment, ensuring that the convenience factor continues to command a premium price point, validating the strong growth forecast through 2033.

The expansion into therapeutic and specialized dermatological applications offers a high-margin avenue for growth. Spray formats are uniquely suited for applications requiring sterile, contact-free spreading over large or sensitive areas, such as medicated lotions for body acne or prescription corticosteroids for chronic skin conditions. This B2B segment, supplying dermatologists and clinics, relies heavily on clinical data and formulation precision, distinguishing itself sharply from the mass-market consumer segment. Investment in clinical trials demonstrating the efficacy and superiority of spray application in these niche areas is a key barrier to entry and a critical success factor for brands targeting professional recommendation. This segment operates under even stricter regulatory oversight than general cosmetics, necessitating pharmaceutical-grade manufacturing protocols and robust documentation of formulation stability under pressure, further supporting the market's high-value proposition. The future development of smart spray devices capable of dispensing metered doses accurately and consistently represents the apex of technological innovation within this therapeutic niche, promising enhanced patient compliance and superior treatment outcomes.

Moreover, the influence of environmental sustainability extends beyond just propellants to the full life cycle of the packaging. The concept of 'circular beauty' is gaining momentum, pushing manufacturers to design spray bottles that are easy to disassemble and recycle or, ideally, utilize refill cartridges. While challenging for pressurized containers, innovation in refillable non-aerosol pumps and recyclable aluminum cans is an active area of R&D. Consumer preference for brands exhibiting transparent sustainability credentials translates directly into market share gains, particularly among Millennial and Gen Z demographics who scrutinize brand environmental policies before making purchase decisions. Certification from recognized sustainability bodies (e.g., COSMOS, Ecocert) provides a competitive advantage, enabling higher brand loyalty and premium pricing. This strong linkage between sustainability and commercial success ensures that environmental responsibility remains a foundational pillar of product development and marketing strategy across the entire lotion spray category globally.

The market's resilience is further cemented by its ability to capitalize on fluctuating global health trends. For instance, increased attention to hygiene post-pandemic accelerated demand for contact-free application methods, benefiting spray formats significantly. This heightened hygiene awareness, combined with persistent educational campaigns on skin cancer prevention, ensures sustained demand for high-performance, easy-to-use SPF sprays across diverse climates and consumer groups. Consequently, the market is not susceptible to a single economic or trend cycle; rather, it is anchored in fundamental consumer needs for health, protection, and convenience, underpinning the stability of the long-term CAGR projection. Leading firms must continue to diversify their product lines across usage occasions, from moisturizing to protection, and across environmental profiles, from standard to fully organic, to capture the breadth of global consumer demand effectively.

The detailed market analysis confirms that strategic planning must account for rapid technological changes in packaging, complex regulatory landscapes, and highly segmented consumer preferences. Success in the Lotion Spray Market requires agility in adopting new delivery systems (BOV, micro-mist pumps), investing in clean-label formulations to meet sustainability demands, and utilizing advanced analytics (AI/ML) for personalized marketing and efficient supply chain management. These factors collectively substantiate the strong growth trajectory anticipated over the forecast period, positioning the lotion spray market as a key innovation hub within the broader personal care industry.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager