Low GI sugar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442487 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Low GI sugar Market Size

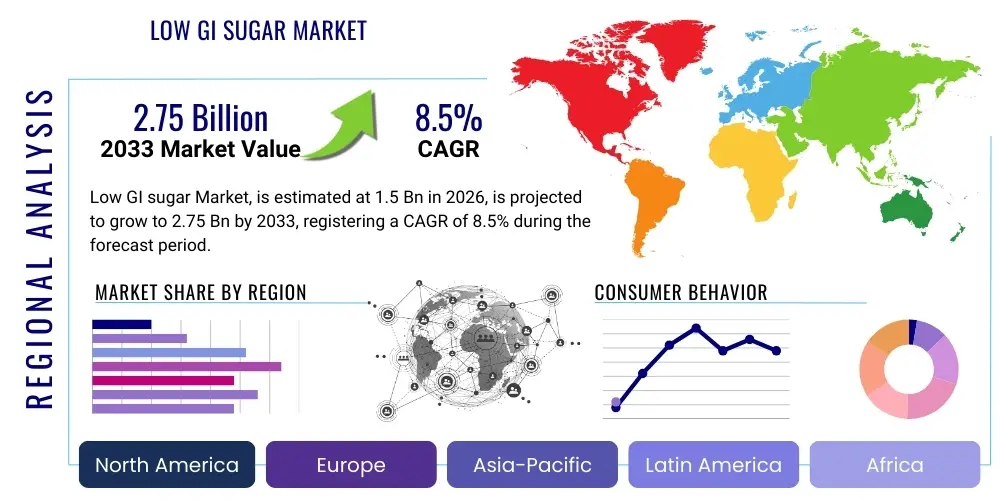

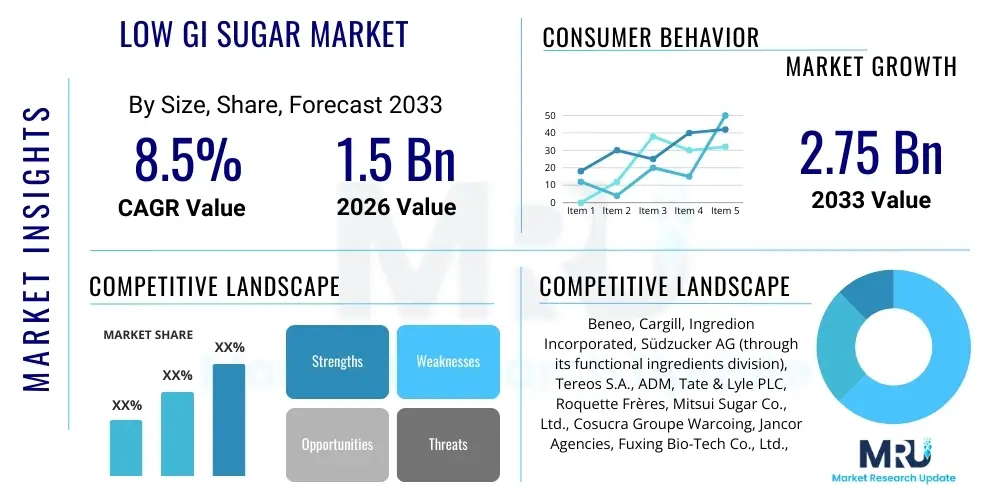

The Low GI sugar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.75 Billion by the end of the forecast period in 2033.

Low GI sugar Market introduction

The Low GI sugar market encompasses natural and processed carbohydrate-based sweeteners characterized by a low Glycemic Index (GI), typically below 55. These products, such as Palatinose (Isomaltulose), certain crystalline fructose variants, and specialized carbohydrate blends, are designed to minimize the rapid spike in blood glucose levels following consumption, offering significant advantages over traditional high-GI sweeteners like sucrose or maltodextrin. The primary product description centers on their functional benefit: providing sweetness without the detrimental metabolic response associated with conventional sugars, making them crucial for dietary management.

Major applications for Low GI sugars span across the food and beverage industry, including sports nutrition products, dietary supplements, fortified functional foods, and beverages targeting diabetic and pre-diabetic consumers. Their use is rapidly expanding into baked goods, confectionery, and dairy alternatives where both texture and controlled energy release are paramount. The inherent benefit of these sugars lies in better blood glucose control, sustained energy release, and reduced risk factors associated with metabolic syndrome, directly appealing to the increasingly health-conscious global population and regulatory push toward healthier food formulations.

Driving factors for this market include escalating global prevalence of chronic diseases such as Type 2 diabetes and obesity, coupled with heightened consumer awareness regarding the health implications of high-sugar diets. Furthermore, governmental initiatives and regulatory changes promoting reduced sugar content in packaged foods and beverages are compelling manufacturers to reformulate existing products, thereby accelerating the adoption of Low GI sugar alternatives as functional replacements that maintain palatability and sweetness profiles while delivering improved nutritional characteristics.

Low GI sugar Market Executive Summary

The Low GI sugar market is undergoing robust expansion driven by pronounced health and wellness trends globally, specifically addressing the public health crisis surrounding diabetes and cardiovascular health. Key business trends involve significant investments in enzymatic conversion technology for high-purity production of ingredients like isomaltulose and the increasing strategic partnerships between raw material suppliers and major food processing companies to ensure stable supply chains. Manufacturers are focusing heavily on clean-label solutions and sustainable sourcing methods to meet consumer demand for transparency and ethical production practices, positioning Low GI sugars not merely as substitutes but as premium, functional ingredients.

Regionally, North America and Europe represent the dominant markets due to high levels of consumer awareness, stringent nutritional labeling requirements, and established healthcare infrastructures that promote preventative dietary management. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid urbanization, changing dietary habits, and the massive scale of the diabetic population in countries like China and India. Regional trends also show a bifurcation: mature markets emphasize innovation in specific applications (e.g., sports gels, clinical nutrition), while emerging markets focus on large-scale adoption in staple processed foods and daily beverages.

Segment trends highlight the dominance of the beverages segment, particularly functional drinks and nutritional shakes, where controlled energy release is a major marketing advantage. In terms of source, natural or plant-derived Low GI options are gaining preference over chemically synthesized ones, aligning with the clean-label movement. Furthermore, the market is seeing a push toward blends of Low GI sugars with natural high-intensity sweeteners (like stevia or monk fruit) to achieve optimum taste profiles and total sugar reduction simultaneously, catering to the nuanced demands of food formulators seeking multi-functional ingredients.

AI Impact Analysis on Low GI sugar Market

Common user questions regarding AI's impact on the Low GI sugar market often revolve around optimizing ingredient formulation, predicting consumer acceptance of novel taste profiles, and enhancing the efficiency of sustainable raw material cultivation. Users are keenly interested in how Artificial Intelligence can accelerate the discovery of new low-glycemic natural sources or optimize enzymatic processes used for industrial production, potentially lowering the high cost currently associated with these specialized ingredients. Key themes emerging from these inquiries include the expectation that AI will dramatically improve speed-to-market for new functional foods, personalize dietary recommendations that incorporate Low GI sugars, and provide superior supply chain visibility to manage sourcing volatility.

AI is fundamentally transforming the R&D landscape within the functional sweetener sector. Machine learning algorithms are being deployed to analyze vast datasets relating to carbohydrate structure, metabolic pathways, and sensory evaluation scores. This allows researchers to rapidly screen potential novel sugar molecules or modify existing structures to improve glycemic response characteristics while maintaining desirable textural and flavor attributes. Furthermore, predictive modeling enables manufacturers to anticipate regulatory changes and customize product formulations for specific regional consumer demographics and their unique dietary preferences, dramatically reducing the time and cost involved in traditional product development cycles.

Beyond R&D, AI is playing a critical role in optimizing the complex supply chain inherent to specialized ingredients like Low GI sugars. Predictive analytics help manage cultivation schedules for raw materials (such as beets or sugarcane used in derivatization processes), optimize fermentation or enzymatic reaction parameters for maximum yield, and streamline logistics to ensure ingredient integrity and minimize waste. This optimization contributes directly to cost efficiency, making Low GI alternatives more accessible for mass-market food production, thus facilitating broader consumer adoption and supporting the overall market expansion.

- AI-driven optimization of enzymatic conversion processes, increasing yield and purity of specialized sugars like Isomaltulose.

- Predictive modeling for sensory analysis and flavor pairing, ensuring new Low GI formulations meet high consumer palatability standards.

- Accelerated discovery of novel low-glycemic index natural botanical sources through machine learning analysis of metabolomics data.

- Enhanced supply chain visibility and demand forecasting for volatile raw materials used in Low GI sugar production.

- Development of personalized nutrition platforms recommending specific Low GI products based on individual metabolic profiles and dietary requirements.

DRO & Impact Forces Of Low GI sugar Market

The market for Low GI sugars is fundamentally shaped by powerful public health drivers, technological limitations related to cost and taste, and expansive application opportunities in the wellness sector. The primary driver is the global increase in lifestyle diseases and a corresponding shift in consumer focus toward preventive healthcare through diet, compelling individuals to seek out lower-glycemic alternatives. However, the market faces significant restraints, notably the relatively higher production cost compared to standard sucrose, which impacts pricing for end-products, and technical challenges related to achieving ideal solubility, stability, and mouthfeel in complex food matrices, often requiring specialized formulation expertise.

Opportunities for growth are vast, particularly within the burgeoning functional food and personalized nutrition segments. As consumers move beyond simple calorie counting to focusing on metabolic health, Low GI sugars offer a compelling value proposition for functional beverages, sports recovery products, and clinical nutrition formulas. Additionally, leveraging innovation in blending technologies—combining Low GI sugars with high-intensity sweeteners—presents a crucial opportunity to deliver maximum sugar reduction while maintaining consumer acceptance and overcoming previous taste profile hurdles associated with single-source alternatives.

The impact forces are heavily tilted toward regulatory intervention and consumer advocacy. Government mandates focused on reducing population sugar intake (such as sugar taxes or mandatory front-of-pack labeling) exert substantial external pressure on the food industry, forcing immediate reformulation efforts that favor functional alternatives like Low GI sugars. Concurrently, the rising influence of digital health trackers and wearable technology allows consumers to directly monitor their glycemic responses, reinforcing the demand for verified Low GI products and accelerating market acceptance beyond niche health food stores into mainstream retail environments globally.

Segmentation Analysis

The Low GI sugar market is comprehensively segmented based on its Source, Application, and Distribution Channel, reflecting the diverse pathways through which these functional ingredients are produced and delivered to end-users. Segmentation by Source distinguishes between naturally derived products, often extracted or minimally processed from specific plants or fruits, and industrially produced variants created through enzymatic conversion or modification of conventional sugars. This distinction is crucial as it directly impacts labeling, consumer perception (clean label vs. processed), and overall production cost structures across the value chain.

Analysis by Application highlights the primary end-use sectors, with Food and Beverage dominating the demand landscape. Within F&B, key categories include baked goods, confectionery, dairy products, and, most prominently, beverages. The market recognizes the inherent value of Low GI sugars in formulations requiring controlled energy release, such as sports nutrition and functional health beverages, positioning them as essential ingredients in specialized dietary products targeting specific health outcomes like sustained energy or blood glucose management. The Distribution Channel segmentation covers sales through direct industrial suppliers (B2B), traditional retail channels (supermarkets, hypermarkets), and increasingly, specialized online retail and e-commerce platforms, which cater specifically to health-conscious consumers seeking niche dietary ingredients.

- By Source:

- Natural (e.g., specific fruit extracts, certain polyols)

- Processed/Derived (e.g., Isomaltulose/Palatinose, specialty crystalline fructose)

- By Application:

- Food (Bakery, Confectionery, Dairy)

- Beverages (Functional Drinks, Nutritional Shakes, Juices)

- Nutraceuticals and Dietary Supplements

- Pharmaceuticals (Syrups, Oral Dosage Forms)

- By Distribution Channel:

- Industrial/B2B Sales

- Retail (Supermarkets, Hypermarkets)

- Online Retail/E-commerce

Value Chain Analysis For Low GI sugar Market

The value chain for the Low GI sugar market begins with upstream analysis focusing on the sourcing and preparation of raw materials, which typically involves specialized crops such as sugar beet, cane, or specific high-fiber grains, depending on the desired end product (e.g., producing Isomaltulose from sucrose). This stage requires robust agricultural partnerships and efficient primary processing to extract basic carbohydrates. The critical value-add stage occurs in the midstream, involving highly specialized biochemical processing, such as enzymatic conversion or crystallization, which requires significant capital investment in bioreactors and purification technologies to ensure the low GI characteristic and high purity required for food-grade applications.

Downstream analysis focuses on the integration of these specialized ingredients into final consumer products. Low GI sugar manufacturers sell large volumes directly to industrial clients (B2B), including major beverage producers, packaged food companies, and pharmaceutical manufacturers. These industrial users then undertake complex formulation work, often blending the Low GI sugar with other functional ingredients to achieve specific taste, texture, and nutritional profiles suitable for mass market appeal. The success at this stage hinges on the technical support provided by the ingredient suppliers to ensure seamless application integration.

Distribution channels for Low GI sugars are segmented into direct and indirect routes. Direct distribution involves bulk sales via dedicated logistics networks to large industrial food and beverage manufacturers, ensuring supply consistency and traceability. Indirect channels involve wholesalers, specialized ingredient distributors, and increasingly, e-commerce platforms that serve smaller, niche food startups or specialized health product formulators. The efficiency of the distribution network is paramount, particularly for maintaining quality control and freshness, although Low GI sugars generally exhibit excellent stability compared to some other functional ingredients. The overall value chain emphasizes technical expertise, high quality control standards, and strategic B2B relationships.

Low GI sugar Market Potential Customers

The primary cohort of potential customers for the Low GI sugar market includes individuals managing chronic metabolic health conditions, particularly diabetic and pre-diabetic populations who require strict control over their blood sugar intake. For these consumers, Low GI products are not merely a dietary choice but a medical necessity that aids in maintaining stable energy levels, preventing glycemic spikes, and reducing long-term health complications associated with poorly managed blood glucose. The appeal is centered on the ability to enjoy familiar tastes without compromising their health management goals, driving demand in both clinical nutrition and mainstream grocery sectors.

A second major customer segment comprises proactive health and wellness enthusiasts, including athletes, bodybuilders, and the broader demographic of millennials and Gen Z who prioritize functional food attributes. These consumers seek sustained energy for physical performance, mental clarity, and general preventative health maintenance. They are highly educated about nutritional science and actively seek products labeled for low GI, sustained energy release, or complex carbohydrate content. This segment drives innovation in sports drinks, energy bars, and functional breakfast cereals, demonstrating a willingness to pay a premium for verified nutritional benefits.

On the industrial side, the end-users (or B2B buyers) are large multinational Food and Beverage (F&B) corporations and specialized nutraceutical manufacturers. These companies are the ultimate purchasers of bulk Low GI sugar ingredients. Their purchasing decisions are motivated by regulatory compliance (meeting sugar reduction targets), competitive advantage (offering healthier product lines), and the need to maintain palatability while complying with clean-label and consumer health demands. Their consistent high volume demand forms the backbone of the industrial market, making them crucial potential customers for ingredient suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.75 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Beneo, Cargill, Ingredion Incorporated, Südzucker AG (through its functional ingredients division), Tereos S.A., ADM, Tate & Lyle PLC, Roquette Frères, Mitsui Sugar Co., Ltd., Cosucra Groupe Warcoing, Jancor Agencies, Fuxing Bio-Tech Co., Ltd., Hangzhou Focus Corporation, Sensus, Galam Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low GI sugar Market Key Technology Landscape

The technological landscape for Low GI sugar production is primarily centered around precision processing and sophisticated enzymatic conversion techniques. For ingredients like Isomaltulose (Palatinose), the critical technology involves enzymatic rearrangement of sucrose molecules using specific bacterial enzymes, such as those derived from Protaminobacter rubrum. This biocatalytic approach ensures a high yield of the desired low GI disaccharide, which is characterized by a more stable chemical bond resistant to rapid digestion. Advancements in enzyme immobilization and continuous flow processing have been instrumental in scaling up production efficiently, lowering operating costs, and maintaining the stringent quality control necessary for food and pharmaceutical applications.

Another crucial area of technological advancement involves extraction and purification methods for naturally occurring Low GI sweeteners or their precursors. Techniques such as membrane filtration, chromatographic separation, and ion exchange are employed to isolate specific low GI components (e.g., certain polyols or rare sugars) from botanical sources with high purity, minimizing the presence of unwanted high GI contaminants. Furthermore, specialized crystallization technologies are used to achieve specific particle sizes and morphologies, which critically influence solubility, texture, and stability when integrated into complex food and beverage formulations, particularly critical for applications like protein bars or dry mixes.

Finally, emerging technologies focus on improving functionality and sensory attributes. Microencapsulation and blending technologies are increasingly employed to mask any undesirable off-flavors sometimes associated with novel sugar substitutes or to enhance the synergistic sweetness when Low GI sugars are combined with high-intensity sweeteners. Research is also progressing in genetic engineering and synthetic biology to develop more efficient microbial strains or yeast capable of biosynthesizing rare or complex low GI sugars sustainably, promising future scalability and cost reduction, which will be vital for further mainstream adoption across all major application segments.

Regional Highlights

- North America: This region holds a significant market share, driven by high consumer awareness regarding diet and chronic disease management, supported by substantial per capita healthcare expenditure. The market is highly influenced by regulatory pressures from the FDA and strong adoption trends in the sports nutrition and functional beverage sectors. Major food manufacturers in the U.S. and Canada are actively reformulating products to align with clean label demands and mandated nutritional guidelines, creating robust B2B demand for ingredients like Low GI sugar. Furthermore, the prevalence of personalized nutrition trends and the adoption of dietary tracking technology reinforces consumer preference for verified low-glycemic foods, maintaining North America's position as a premium market for novel sugar alternatives.

- Europe: Europe is characterized by strict regulatory standards (e.g., EFSA approvals) and a strong historical focus on quality and natural sourcing, contributing to high market penetration. Countries like Germany, the UK, and France are leaders in the functional dairy and fortified bakery segments utilizing Low GI ingredients. The European market emphasizes innovation in sustainable sourcing and transparency in production methods, driven by environmentally conscious consumers. The presence of major ingredient suppliers and strong R&D collaboration between academia and industry ensures a constant stream of novel Low GI product applications, cementing Europe's role as a technological frontrunner in the specialized sweetener space.

- Asia Pacific (APAC): The APAC region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) due to several socioeconomic factors. Rapid economic development, rising disposable incomes, and the massive scale of the pre-diabetic and diabetic population in countries such as India and China are accelerating the demand for preventative dietary solutions. While awareness is still developing in some rural areas, urban populations are rapidly adopting Westernized diets and seeking healthier packaged food alternatives. Local ingredient manufacturers are expanding production capacities, often focusing on region-specific natural sources and leveraging government health campaigns to drive mass adoption of low-glycemic functional foods and daily consumption beverages.

- Latin America (LATAM): The LATAM market, while smaller, is growing steadily, propelled by increasing awareness of metabolic diseases and government initiatives aimed at curbing sugar consumption, particularly in countries like Mexico and Brazil where sugary beverage consumption is historically high. Challenges include price sensitivity and fragmented distribution networks. However, the emerging middle class is driving demand for premium imported functional food products, opening opportunities for Low GI sugar suppliers to partner with local manufacturers for localized, healthy reformulation efforts, specifically in the dairy and juice concentrate sectors.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) countries, which face extremely high rates of diabetes and obesity. The implementation of sugar taxes and mandatory health labeling in countries such as Saudi Arabia and the UAE is forcing rapid market shifts. Demand is primarily centered around imported specialized ingredients used in high-end functional foods and hospital clinical nutrition. Market expansion is dependent on overcoming infrastructure limitations and consumer education, but the urgent need for dietary solutions presents a strong long-term growth trajectory for Low GI sugar usage in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low GI sugar Market.- Beneo

- Cargill

- Ingredion Incorporated

- Südzucker AG (through its functional ingredients division)

- Tereos S.A.

- ADM

- Tate & Lyle PLC

- Roquette Frères

- Mitsui Sugar Co., Ltd.

- Cosucra Groupe Warcoing

- Jancor Agencies

- Fuxing Bio-Tech Co., Ltd.

- Hangzhou Focus Corporation

- Sensus

- Galam Group

- PureCircle (focusing on blends and synergy)

- Celanese Corporation (specialty polyols)

- Foodchem International Corporation

- Shandong Jianyuan Bioengineering Co., Ltd.

- Fraken Biochem Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Low GI sugar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary definition and mechanism of Low GI sugar?

Low GI (Glycemic Index) sugar is a specialized carbohydrate sweetener, such as Isomaltulose (Palatinose), with a GI value typically below 55. Its primary mechanism involves slower and more gradual digestion and absorption in the small intestine compared to high-GI sugars like sucrose, leading to a flatter and lower blood glucose response, thereby providing sustained energy.

How do High Production Costs restrain the market growth?

The relatively high cost of Low GI sugars stems from the specialized raw material sourcing and the intensive, high-technology enzymatic conversion processes required for their production. This elevated cost often necessitates a higher retail price for the final food or beverage product, which can limit mass-market adoption in price-sensitive consumer segments globally.

Which application segment currently drives the highest demand for Low GI sugar ingredients?

The functional beverages and specialized nutritional shakes segment currently drives the highest demand. This segment leverages the primary benefit of Low GI sugars—sustained energy release without glycemic spikes—making them ideal for sports nutrition, clinical formulas, and energy drinks targeted at optimizing athletic performance and metabolic health.

What role does enzymatic conversion technology play in the manufacturing process?

Enzymatic conversion is a critical biocatalytic process used to chemically rearrange conventional sugar molecules, typically sucrose, into a low GI isomer (like Isomaltulose). This technology is essential for industrial production, ensuring high purity, stability, and scale necessary to meet the increasing B2B demand from the food and pharmaceutical industries globally.

Which region is expected to demonstrate the fastest growth rate for Low GI sugars by 2033?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This acceleration is attributed to rapidly growing consumer awareness, increased disposable income supporting health-focused purchases, and the urgent need to address the soaring prevalence of diabetes and obesity across key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager