Low Lift Safety Valve Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442354 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Low Lift Safety Valve Market Size

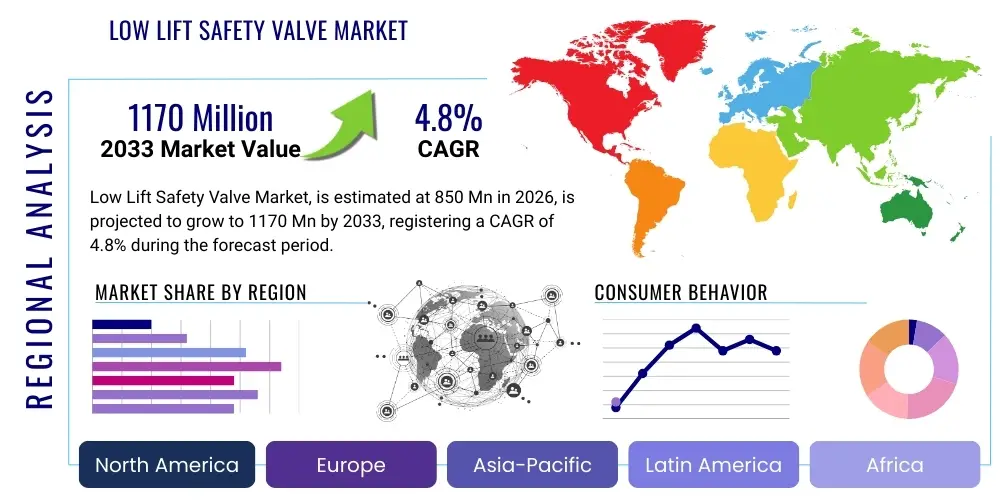

The Low Lift Safety Valve Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1170 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by stringent global regulatory standards regarding pressure equipment safety across heavy industrial sectors, particularly in the oil and gas, power generation, and chemical processing industries. The mandatory periodic replacement and maintenance cycles of these critical safety components contribute significantly to sustained demand, insulating the market against cyclical downturns in capital expenditure to a certain degree.

The valuation reflects the increasing complexity and scale of industrial infrastructure worldwide. Developing nations are undergoing rapid industrialization, necessitating the installation of new pressure containment systems, which inherently require robust overpressure protection mechanisms like low lift safety valves. Furthermore, the push towards modernization and efficiency in established industrial economies involves upgrading older safety systems to meet updated ASME, API, and ISO standards, thereby boosting the retrofit segment of the market. The relatively high cost of specialty alloys required for high-temperature and corrosive applications also contributes to the rising market valuation.

The projected increase in market size is also predicated on the growing adoption of specialized low lift safety valves designed for harsh environments, such as those used in hydrogen production facilities or carbon capture systems. As energy transition efforts gain momentum, the requirement for reliable safety measures in novel industrial processes ensures a steady expansion pipeline for manufacturers. Geographic expansion into high-growth regions like Asia Pacific, driven by heavy investment in refining and petrochemical complexes, will be a primary vector for achieving the forecasted market valuation by 2033.

Low Lift Safety Valve Market introduction

The Low Lift Safety Valve Market encompasses the manufacturing, distribution, and maintenance of pressure relief devices specifically engineered to open gradually and achieve full lift only after a moderate increase in pressure above the set point. These valves are fundamentally designed to protect pressure vessels, boilers, and piping systems from catastrophic failure caused by overpressure scenarios, ensuring process integrity and operational personnel safety. A key differentiating characteristic of low lift valves, compared to full lift or high lift designs, is their suitability for liquid service or applications where rapid pressure blowdown could induce damaging hydraulic shock. The core functionality involves the precise calibration of spring force to counteract system pressure, ensuring the valve activates reliably when the system reaches its maximum allowable working pressure (MAWP).

Major applications for low lift safety valves are concentrated in sectors requiring meticulous control over pressure discharge, including feedwater heaters, heat exchangers, liquid storage tanks, and pump discharge lines in chemical processing plants. They are indispensable in utility boilers and steam distribution networks, particularly where minimizing fluid loss during a relief event is economically or environmentally crucial. The primary benefit derived from deploying these valves is the prevention of equipment damage, minimization of unplanned downtime, and ensuring compliance with globally recognized safety regulations such as those mandated by the American Society of Mechanical Engineers (ASME) Boiler and Pressure Vessel Code (BPVC). Their reliability and passive operation make them cornerstones of industrial safety infrastructure.

Driving factors for sustained market growth include stringent governmental regulations globally mandating safety standards for pressure equipment, continuous investment in oil and gas midstream and downstream activities, and the resurgence of the conventional power generation sector, particularly in Asia. The aging global infrastructure necessitates frequent replacement cycles, further bolstering demand. Furthermore, technological advancements focusing on improved materials science, such as the use of highly corrosion-resistant alloys, and enhanced sealing mechanisms to reduce fugitive emissions, are expanding the functional life and applicability of low lift safety valves, stimulating market expansion.

Low Lift Safety Valve Market Executive Summary

The Low Lift Safety Valve Market demonstrates resilience driven by regulatory imperatives and infrastructural expansion, maintaining a steady CAGR projection towards 2033. Key business trends involve consolidation among major global manufacturers aiming for economies of scale and broader geographical reach, alongside a growing emphasis on smart valve technologies incorporating integrated sensors for condition monitoring and predictive maintenance capabilities. Manufacturers are increasingly focusing on delivering highly customized solutions tailored to specific process fluid properties (corrosive, viscous, abrasive) and extreme operating conditions (high temperature, cryogenic), moving beyond standardized product offerings to capture high-margin, specialty application segments. Supply chain optimization remains a critical focus area, specifically concerning the sourcing of high-grade raw materials like stainless steel, Monel, and Hastelloy, which are vital for valve longevity and performance.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive capital expenditure in refining, petrochemical complexes, and power infrastructure expansion in countries like China, India, and Southeast Asia. North America and Europe, characterized by mature industrial bases, exhibit stable demand primarily driven by replacement, retrofit projects, and stringent enforcement of environmental and safety regulations requiring the upgrade to newer, certified low-emission valves. The Middle East and Africa (MEA) region shows significant potential due to ongoing upstream and downstream oil and gas projects, although market volatility in oil prices occasionally affects investment cycles. Trends in regional procurement favor local manufacturing and service partnerships to minimize lead times and ensure rapid access to critical spares.

Segmentation analysis highlights the dominance of the conventional spring-loaded type based on sheer volume, although pilot-operated safety valves (POSVs) are gaining traction in high-pressure, large-diameter applications due to superior operational precision and repeatability. By material type, carbon steel remains prevalent for general utility services, but the demand for exotic alloys is accelerating across the chemical and LNG sectors. The end-user segment is led by the Oil & Gas industry, followed closely by Power Generation and Chemical Processing. Market strategies are increasingly focused on lifecycle service offerings, including calibration, repair, and genuine parts supply, which represents a stable, high-margin revenue stream for market incumbents, supporting the overall valuation growth outlined in this executive summary.

AI Impact Analysis on Low Lift Safety Valve Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Low Lift Safety Valve Market center predominantly around enhancing preventative maintenance schedules, predicting failure modes before they occur, and optimizing valve performance testing protocols. Users are keen to understand how AI-driven analysis of operational telemetry—such as pressure fluctuations, vibration signatures, acoustic emissions, and temperature variance—can reduce the current reliance on time-based maintenance, which is often inefficient and expensive. A significant area of concern relates to regulatory compliance and whether AI-assisted diagnostics can be reliably certified by bodies like ASME, ensuring that predictive insights meet the stringent safety requirements inherent in pressure relief devices. Furthermore, users inquire about the feasibility and ROI of retrofitting existing valve fleets with smart sensing technology capable of generating the necessary data volume for effective AI model training, seeking clarity on the cost-benefit ratio of digitalization in a historically mechanical-centric domain.

The key themes emerging from user expectations revolve around achieving "zero unplanned downtime" for critical safety systems. Users anticipate that AI algorithms will not only flag deviations but also recommend precise maintenance actions, minimizing human intervention and diagnostic errors. There is a strong expectation that AI will standardize and optimize the sizing and selection process for new valve installations by leveraging vast databases of operational conditions and failure histories, thereby improving initial system design safety factors. However, concerns persist regarding data security, ownership of operational data collected by smart valves, and the need for standardized communication protocols (e.g., Industrial IoT standards) to seamlessly integrate valve performance data into broader plant-wide asset management systems.

In essence, AI's influence is seen as transformative, shifting safety valve management from a reactive or time-scheduled process to a highly proactive, condition-based strategy. This shift promises substantial operational efficiency improvements, reduced catastrophic risk exposure, and optimized spare parts inventory management. The immediate impact is concentrated in the realm of advanced diagnostics and reliability engineering, positioning AI as an essential tool for maximizing the mean time between failure (MTBF) of these life-critical components while potentially extending the required recalibration intervals, subject to regulatory approval of AI-driven reliability proof.

- Predictive Maintenance (P-M) Implementation: AI models analyze acoustic, vibration, and thermal data from installed valves to predict spring fatigue, seat leakage, or chattering events, shifting maintenance from scheduled to condition-based, minimizing unnecessary interventions.

- Optimized Valve Sizing and Selection: Utilizing ML algorithms to process historical operational data and process requirements, leading to more accurate valve selection, reducing oversizing or undersizing risks, and enhancing overall system safety margins.

- Real-Time Performance Monitoring: AI integration into smart sensor packages allows for continuous, high-fidelity monitoring of valve set point integrity and responsiveness, providing immediate alerts for non-compliance or degradation.

- Regulatory Compliance Verification: Automated documentation and anomaly reporting capabilities, streamlining audit processes and demonstrating continuous compliance with international safety codes (e.g., API 527 leakage standards).

- Enhanced Calibration Efficiency: AI tools assist technicians in analyzing calibration curves and historical drift, optimizing the test bench process and improving the accuracy of set-pressure adjustments, thereby reducing operational variance.

- Digital Twin Development: Creating digital representations of valve performance allows for simulation of various failure scenarios and pressure transients, enhancing operator training and emergency response planning without impacting live processes.

DRO & Impact Forces Of Low Lift Safety Valve Market

The dynamics of the Low Lift Safety Valve Market are shaped by a complex interplay of stringent regulatory mandates, infrastructural growth, technological constraints, and economic fluctuations, collectively summarized as the Drivers, Restraints, and Opportunities (DRO). The foremost driver is the non-negotiable requirement for safety and regulatory compliance dictated by global bodies like ASME, API, and various national labor and environmental protection agencies; mandatory certification and periodic testing cycles ensure sustained demand regardless of immediate economic climate. This is augmented by the continuous expansion of core industrial sectors—oil and gas, refining, petrochemicals, and power generation—in emerging economies, necessitating the installation of new pressure containment systems and associated safety relief valves. Furthermore, the increasing focus on operational longevity and energy efficiency compels end-users to invest in higher quality, precisely engineered low lift valves that minimize operational leakage and reduce fluid loss during relief events, favoring premium manufacturers.

Restraints primarily encompass the high capital cost associated with valves constructed from exotic alloys (necessary for severe service environments) and the inherent complexity of selecting and maintaining these devices. Incorrect selection or improper calibration remains a significant operational risk, requiring specialized expertise that adds to the operational expenditure (OPEX) for end-users. The market is also sensitive to commodity price volatility, particularly for crude oil and natural gas, which directly impacts capital expenditure cycles in the oil and gas sector—a major consumer. Additionally, the proliferation of counterfeit or sub-standard valves, especially in unregulated emerging markets, poses both a safety risk and a competitive challenge to certified manufacturers, undermining pricing power and market integrity.

Opportunities reside predominantly in the advancement of 'smart' valve technology, integrating IoT sensors and diagnostics to facilitate predictive maintenance and remote monitoring, creating high-value service contracts. The burgeoning market for liquefied natural gas (LNG), hydrogen energy, and carbon capture and storage (CCS) systems presents entirely new high-specification application areas requiring specialized low lift valves capable of handling extreme cryogenic temperatures or highly corrosive media. Another substantial opportunity lies in the burgeoning aftermarket service sector, including mandatory re-certification, repair, and recalibration services, which offer stable, recurring revenue streams that are less susceptible to fluctuations in new infrastructure investment, ensuring manufacturers can capture lifetime value from installed bases. The impact forces indicate a market moderately elastic to regulatory change but inelastic concerning the need for the product itself, driven by safety mandate.

Segmentation Analysis

The Low Lift Safety Valve Market is meticulously segmented based on product type, material of construction, function, and end-user industry, allowing for a granular analysis of demand patterns and strategic focus areas. Understanding these segments is crucial for manufacturers to tailor their production, marketing, and distribution strategies to meet the diverse technical specifications required across various industrial applications. Segmentation by product type reveals a fundamental division between conventional spring-loaded valves, known for their robustness and simplicity, and pilot-operated valves, favored for large-bore, high-pressure applications where precise set-point accuracy and modulation are paramount. Each segment caters to distinct operational needs and regulatory requirements, driving differential pricing and market share distribution.

The segmentation based on material is highly critical due to the vast range of operating environments, from high-temperature steam systems to corrosive chemical services. This segment ranges from basic cast iron and carbon steel for general utility applications to high-performance materials such as stainless steel (304/316), duplex steels, and nickel alloys (e.g., Inconel, Monel) essential for sour gas service, caustic environments, or high-purity applications. The material segment directly correlates with valve durability, price point, and certification requirements. Furthermore, segmentation by end-user—led by Oil & Gas (Upstream, Midstream, Downstream), Power Generation (Fossil Fuel, Nuclear, Renewables), and Chemicals & Petrochemicals—highlights the concentrated demand centers that drive bulk volume and specialized product development.

The functional segmentation, although less frequently published, often separates valves by media (steam, gas, liquid) or by pressure class (e.g., ASME Class 150 to Class 2500). The liquid service segment is where low lift valves historically find their strongest application, designed to minimize pressure accumulation while mitigating the risk of hydraulic hammer upon reseating. This systematic segmentation allows market players to specialize in high-growth niches, such as cryogenic valves for LNG facilities or highly engineered valves for nuclear power generation, maximizing profitability through technical differentiation and specific regulatory expertise.

- By Product Type:

- Conventional Spring-Loaded Low Lift Valves

- Bellows Low Lift Safety Valves

- Pilot-Operated Low Lift Safety Valves (POSVs)

- Power-Actuated Safety Valves (PASVs)

- By Material:

- Carbon Steel

- Stainless Steel (304, 316, Duplex)

- Alloy Steel (Chrome Moly)

- Exotic Alloys (Monel, Hastelloy, Inconel)

- By End-User Industry:

- Oil & Gas (Refining, Petrochemicals, Production)

- Power Generation (Thermal, Nuclear, Geothermal)

- Chemical Processing

- Water and Wastewater Treatment

- Pharmaceuticals and Food & Beverage

- Marine and Shipbuilding

- By Application/Service:

- Liquid Service

- Steam Service

- Gas/Air Service

- Multi-Phase Service

Value Chain Analysis For Low Lift Safety Valve Market

The value chain for the Low Lift Safety Valve Market begins fundamentally with the upstream segment, dominated by the procurement of specialized raw materials—primarily high-grade steel, specialized corrosion-resistant alloys, and engineered sealing components (e.g., PTFE, graphite). The high cost and strict quality requirements for these inputs mean manufacturers rely heavily on certified raw material suppliers who can provide detailed material traceability documentation (MTRs) essential for product certification. Fluctuations in global metal prices directly impact manufacturing costs and, consequently, the final price of the valve. Efficiency in forging, casting, and precision machining processes is critical at this stage, as safety valve components demand extremely tight tolerances for reliable operation and seal integrity.

The core manufacturing process involves precision engineering, assembly, calibration, and rigorous testing, often witnessed and approved by third-party inspection agencies (e.g., Lloyd’s, TUV). Direct distribution channels involve large, integrated manufacturers selling directly to major Engineering, Procurement, and Construction (EPC) firms involved in large industrial projects, ensuring technical support and customized sizing solutions are delivered seamlessly. Indirect distribution relies heavily on authorized distributors and specialized industrial supply houses who maintain regional inventories, provide immediate replacements, and often house certified repair and calibration shops, crucial for the aftermarket segment.

The downstream segment primarily involves installation, commissioning, and continuous lifecycle services. Low lift safety valves are critical infrastructure, demanding frequent inspection, periodic testing, and mandatory recalibration (often yearly or bi-annually) as dictated by regulatory codes like API 576. This service component, executed by manufacturers or certified service partners, represents a significant and stable high-margin revenue stream. End-users’ primary objective is lifecycle cost management, where the initial capital expenditure (CAPEX) is often overshadowed by the long-term operational and maintenance expenditure (OPEX), leading to a preference for high-reliability valves with strong manufacturer support networks.

Low Lift Safety Valve Market Potential Customers

Potential customers and primary buyers of low lift safety valves are concentrated in highly regulated, asset-intensive industries where uncontrolled pressure release constitutes an extreme hazard to personnel, environment, and process continuity. The largest segment remains the Oil & Gas industry, including integrated energy companies, independent refineries, gas processing plants, and upstream drilling operators, who utilize these valves extensively on separation equipment, storage tanks, heat exchangers, and processing columns. These customers prioritize compliance, material robustness (especially resistance to H2S and CO2), and long-term reliability under continuous operational stress. Procurement is often centralized through large EPC contractors during the construction phase of new facilities, transitioning to internal maintenance and specialized service providers for replacement and overhaul.

The Power Generation sector, spanning conventional fossil fuel (coal and gas), nuclear, and large industrial boiler operators, represents another essential customer base. In these applications, low lift valves manage steam and high-pressure feedwater systems, demanding adherence to specific ASME codes (Section I for boiler service, Section VIII for pressure vessels). These buyers are driven by the imperative of maximizing uptime and adherence to strict operational safety limits. The procurement decision here is often heavily influenced by vendor track record, certified flow capacity (Kv), and the ability to integrate with sophisticated plant safety systems.

Chemical and Petrochemical plants form the third major customer group, utilizing low lift safety valves across diverse processes involving hazardous or corrosive fluids (e.g., acids, ammonia, volatile organic compounds). Customers in this segment require highly specialized materials (e.g., exotic alloys and special trim packages) to prevent corrosion and ensure containment. These buyers are increasingly focused on valves designed to meet the lowest possible fugitive emission standards (e.g., ISO 15848-1) to meet stringent environmental regulations. Other substantial buyers include municipal water treatment facilities for pump protection and large industrial HVAC systems, though typically utilizing lower specification valves compared to the heavy industrial core markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1170 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Flowserve Corporation, Curtiss-Wright Corporation, Baker Hughes Company (GE), Weir Group PLC, IMI plc, KSB SE & Co. KGaA, LESER GmbH & Co. KG, Farris Engineering (Curtiss-Wright), Pentair PLC, TYCO International Ltd., Crosby (Emerson), Conbraco Industries Inc. (Apollo Valves), Válvulas OMEGA S.A., Safetech Engineering, Goetze Armaturen GmbH, Mercer Valve Co., Inc., Nabic Valves, Shanghai Gude Valve Co., Ltd., Zwick Armaturen GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Lift Safety Valve Market Key Technology Landscape

The technology landscape of the Low Lift Safety Valve Market is marked by evolutionary improvements rather than revolutionary shifts, focusing heavily on enhancing sealing integrity, material durability, and operational diagnostics. A key technological trend is the advancement in bellows design, particularly the incorporation of balanced bellows in low lift valves. These designs minimize the effects of varying back pressure on the valve's set pressure, ensuring stable and repeatable performance in systems where downstream pressure fluctuates significantly, such as in relief headers or manifold systems. Material science remains critical, with continuous innovation in seating materials like specialized ceramics and engineered elastomers that offer superior wear resistance, reducing leakage rates over the operational lifespan and extending the time between mandated overhaul cycles, thereby lowering OPEX for the end-user.

The most significant modern technological evolution is the pervasive integration of Industrial Internet of Things (IIoT) sensors and transducers, transforming traditional mechanical valves into 'smart' assets. These integrated diagnostic systems monitor key performance indicators such as temperature, seat leak detection (via acoustic monitoring), stem position, and vibration levels in real-time. This capability enables manufacturers to offer predictive maintenance services, leveraging edge computing to analyze data locally before transmission. This shift is crucial for high-consequence industries where the sudden failure of a relief device is unacceptable. Furthermore, the development of sophisticated testing methodologies, including non-intrusive testing (NIT) which allows verification of set pressure while the plant is online, significantly minimizes downtime and enhances compliance efficiency, driven by ultrasonic and acoustic testing technologies.

Another area of focus is computational fluid dynamics (CFD) modeling, which is extensively utilized during the design phase to optimize flow paths, minimize pressure drop, and reduce noise and vibration (chattering) tendencies inherent in safety valve operation. This modeling ensures that the valve achieves its certified capacity efficiently and safely under various fluid conditions. Given the increasing complexity of industrial processes and the move towards higher pressures and temperatures, technological investment is focused on developing certified low lift valves for niche applications like supercritical steam in power plants and extremely low-temperature applications in LNG facilities, demanding specialized cryogenic testing protocols and specific material handling capabilities that are essential for market differentiation and compliance with stringent operational standards.

Regional Highlights

- Asia Pacific (APAC): APAC is undeniably the fastest-growing region, driven by unparalleled levels of industrialization, particularly in China, India, and Southeast Asian nations like Indonesia and Vietnam. Massive state-backed investments in new power generation capacity (coal, gas, and nuclear), rapid expansion of refining and petrochemical complexes, and the development of large-scale LNG receiving terminals are creating immense demand for low lift safety valves. The region's growth is characterized by significant capital expenditure on new construction projects, favoring large volume orders, though competition, especially from domestic valve manufacturers in China, is intense. Compliance with international standards (ASME, API) is becoming increasingly mandatory, fueling demand for high-quality, certified imported valves in critical applications.

- North America: This region holds a dominant market share in terms of value, primarily due to the maturity of its energy infrastructure, rigorous regulatory environment, and high adoption rate of specialized, high-specification valves. Demand is strongly supported by the resurgence of the oil and gas sector, particularly associated with shale exploration and midstream infrastructure (pipeline and compression stations). Crucially, a significant portion of the North American market is driven by replacement and retrofit cycles in aging industrial facilities, coupled with the rapid adoption of 'smart' valve technology for asset performance management and reducing environmental emissions, emphasizing quality and certified service contracts over lowest initial cost.

- Europe: The European market is characterized by strict enforcement of directives like the Pressure Equipment Directive (PED) and a strong commitment to environmental standards, which fuels demand for low-emission and high-integrity safety valves. While new capital projects are more moderate than in APAC, steady demand is generated by the nuclear power maintenance cycle, specialized chemical manufacturing, and investment in sustainable energy infrastructure, including bio-refineries and hydrogen projects. Germany, Italy, and the UK are key markets, focusing on advanced manufacturing techniques and precision engineering in their valve production and servicing capabilities.

- Middle East and Africa (MEA): This region is a vital hub, driven by massive upstream and downstream investments by national oil companies (NOCs) aiming to expand production and refining capacity. Countries like Saudi Arabia, UAE, and Qatar are undergoing large-scale petrochemical complex construction, resulting in substantial, cyclical demand for high-pressure and sour service low lift safety valves. Market growth is closely tied to global oil and gas prices, but the long-term strategic investments in diversification ensure continued need for certified safety equipment. Local content requirements are also influencing foreign manufacturers to establish regional service and assembly facilities.

- Latin America: Market growth in Latin America is uneven but shows significant potential, primarily linked to resource extraction activities in Brazil, Mexico, and Argentina. Investment in offshore oil and gas platforms and domestic refining infrastructure drives the need for high-specification valves. Economic instability and political factors can sometimes restrain major CAPEX spending, making the aftermarket and essential maintenance segment particularly important for sustained market revenue. Compliance with international certifications remains a key determinant for successful market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Lift Safety Valve Market.- Emerson Electric Co.

- Flowserve Corporation

- Curtiss-Wright Corporation

- Baker Hughes Company (GE)

- Weir Group PLC

- IMI plc

- KSB SE & Co. KGaA

- LESER GmbH & Co. KG

- Farris Engineering (Curtiss-Wright)

- Pentair PLC

- TYCO International Ltd.

- Crosby (Emerson)

- Conbraco Industries Inc. (Apollo Valves)

- Válvulas OMEGA S.A.

- Safetech Engineering

- Goetze Armaturen GmbH

- Mercer Valve Co., Inc.

- Nabic Valves

- Shanghai Gude Valve Co., Ltd.

- Zwick Armaturen GmbH

Frequently Asked Questions

Analyze common user questions about the Low Lift Safety Valve market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a low lift and a high lift safety valve, and where are low lift valves typically required?

Low lift safety valves (often conventional safety valves) open gradually and reach their full lift height at a higher overpressure compared to high lift valves. Their primary application is in liquid service (e.g., pump protection, liquid-filled heat exchangers) where the reduced flow capacity upon initial opening helps mitigate the risk of hydraulic shock (water hammer) caused by rapid depressurization. They are essential where fluid volume loss must be minimized and smooth pressure relief is required.

Which regulatory standards govern the design and use of low lift safety valves, and why is compliance critical?

The design, manufacturing, and maintenance of low lift safety valves are rigorously governed by international standards, most notably the American Society of Mechanical Engineers (ASME) Boiler and Pressure Vessel Code (BPVC), Sections I and VIII, and the American Petroleum Institute (API) Recommended Practices (e.g., API 520 and 521). Compliance is critical because these valves are the last line of defense against catastrophic overpressure failure, and certification ensures the valve performs reliably and predictably within defined safety margins, protecting both equipment and personnel.

How is the market for low lift safety valves being influenced by the rise of smart manufacturing and IIoT technology?

Smart manufacturing is transforming the market through the integration of Industrial Internet of Things (IIoT) sensors into safety valves. These 'smart valves' facilitate predictive maintenance (P-M) by continuously monitoring operational parameters (vibration, acoustics, temperature). This shift allows end-users to move away from costly, time-based maintenance schedules to condition-based interventions, maximizing operational uptime, ensuring regulatory compliance, and proactively detecting potential seat leakage or spring degradation before critical failure.

What is the role of specialized materials, such as exotic alloys, in the Low Lift Safety Valve Market growth?

Specialized materials like Hastelloy, Monel, and Duplex stainless steel are increasingly vital, driving market value in high-specification sectors like chemical processing, sour gas handling, and cryogenic services (e.g., LNG). These exotic alloys provide superior corrosion resistance, high-temperature stability, and extended service life in severe environments. The growing global focus on highly corrosive or extreme pressure processes necessitates the use of these advanced materials, securing high-margin growth segments for manufacturers capable of precision alloy machining and certification.

Which geographic region is expected to demonstrate the highest growth in demand for low lift safety valves through the forecast period?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, primarily due to unprecedented levels of investment in new energy and industrial infrastructure projects across China, India, and Southeast Asia. Expansions in refining capacity, petrochemical production, and large-scale conventional and renewable power generation facilities mandate the installation of vast numbers of certified pressure relief devices, significantly accelerating regional market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager