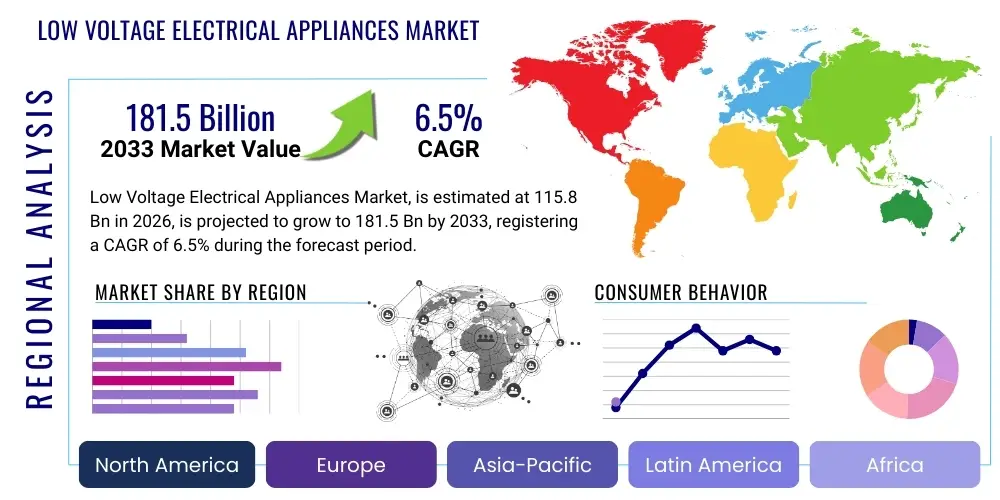

Low Voltage Electrical Appliances Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442683 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Low Voltage Electrical Appliances Market Size

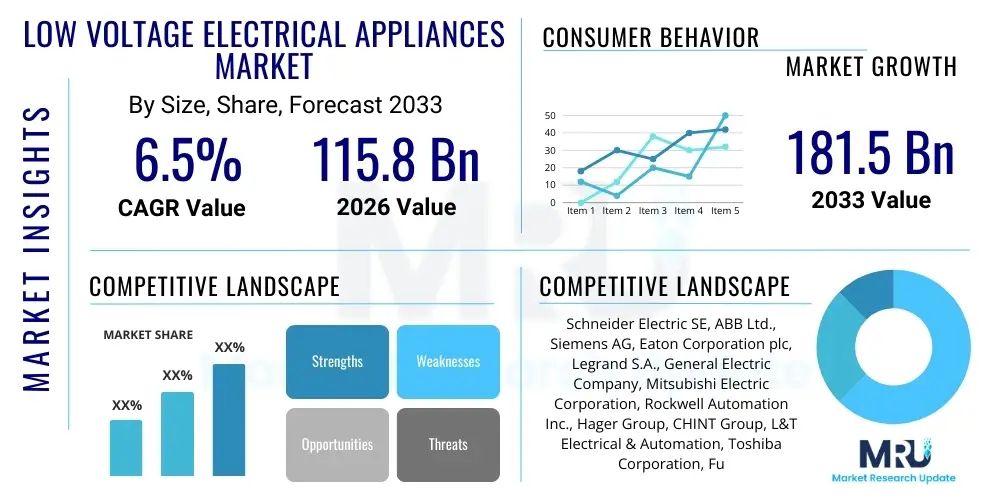

The Low Voltage Electrical Appliances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 115.8 Billion in 2026 and is projected to reach USD 181.5 Billion by the end of the forecast period in 2033.

Low Voltage Electrical Appliances Market introduction

The Low Voltage (LV) Electrical Appliances Market encompasses a critical segment of the electrical infrastructure, covering devices that operate at voltage levels typically below 1,000V AC or 1,500V DC. These essential components include circuit breakers, switches, contactors, relays, fuses, motor control centers (MCCs), and other protective and control equipment. The core function of these appliances is to ensure the safe, reliable, and efficient distribution and management of electrical power across various sectors. Market growth is structurally linked to global electrification trends, infrastructure development, and the modernization of existing electrical grids to meet stringent safety and operational standards.

Major applications of LV electrical appliances span industrial automation, residential and commercial building management systems (BMS), utilities and power generation, and specialized sectors like transportation and data centers. In industrial settings, they are vital for motor protection and process control, ensuring machinery uptime and preventing catastrophic failures. For residential and commercial structures, they form the backbone of electrical safety, managing lighting, heating, ventilation, and power outlets while protecting against overcurrents and short circuits. The intrinsic benefits provided by these products—enhanced system reliability, personnel safety, and compliance with rigorous international standards (such as IEC and UL)—make their integration mandatory in all new construction and retrofitting projects.

The primary driving factors propelling the Low Voltage Electrical Appliances Market include sustained investment in smart cities and smart infrastructure, particularly in developing economies, necessitating advanced circuit protection and monitoring solutions. Furthermore, the global push towards energy efficiency and the proliferation of renewable energy generation sources (solar and wind farms) are demanding more resilient and intelligent LV components capable of handling bidirectional power flows and integrating seamlessly with distributed generation systems. Regulatory environments across major economic zones are consistently raising the bar for electrical safety and energy performance, forcing industries to upgrade to newer, technologically superior LV apparatus, thereby cementing the market's trajectory.

Low Voltage Electrical Appliances Market Executive Summary

The Low Voltage Electrical Appliances Market is undergoing a significant transformation driven by technological integration and evolving infrastructure needs, manifesting robust business trends focused on digitization, modularity, and enhanced connectivity. Business strategies increasingly center on developing intelligent switchgear and circuit protection devices equipped with IoT capabilities for remote monitoring, predictive maintenance, and sophisticated energy management. Key stakeholders are prioritizing strategic acquisitions and collaborations to expand their digital portfolios and geographical reach, particularly targeting high-growth regions undergoing rapid industrialization and urbanization. This move towards 'smart' LV solutions is critical for maintaining competitiveness and addressing the complex demands of modern smart grids and automated factories.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, primarily fueled by massive infrastructure spending in China, India, and Southeast Asian nations, alongside the booming manufacturing and construction sectors. North America and Europe, characterized by highly mature but aging infrastructure, are focusing heavily on retrofitting, grid modernization projects, and adopting stricter energy efficiency standards, leading to steady demand for replacement and upgrade cycles involving advanced LV components. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by oil and gas industry expansion, large-scale utility projects, and diversification efforts requiring resilient electrical infrastructure.

Segmentation trends highlight the increasing prominence of Moulded Case Circuit Breakers (MCCBs) and Air Circuit Breakers (ACBs) due to their enhanced protection features and high current handling capabilities in industrial applications. Control devices, including contactors and relays, are experiencing substantial demand growth, especially in integration with industrial automation systems. Furthermore, the End-User segment analysis shows that the industrial sector retains the largest market share, closely followed by the commercial and residential segments, which are rapidly integrating smart home and building management technologies requiring interconnected LV appliances for centralized control and safety management. The shift towards higher-performance, digitally enabled devices across all segments underscores the market’s evolutionary path toward integrated system management.

AI Impact Analysis on Low Voltage Electrical Appliances Market

User queries regarding the impact of Artificial Intelligence (AI) on the Low Voltage Electrical Appliances Market primarily revolve around themes of predictive maintenance, failure diagnostics, optimization of energy consumption, and the automation of grid management. Users are keen to understand how AI algorithms can interpret vast datasets generated by IoT-enabled LV devices—such as smart circuit breakers and sensors—to anticipate equipment failure before it occurs, thereby minimizing costly downtime and improving operational safety. A significant concern is the necessary investment in digital infrastructure and the potential skill gap required for operators to manage and interpret AI-driven recommendations. Expectations are high regarding the integration of machine learning models into Supervisory Control and Data Acquisition (SCADA) systems, transitioning traditional protection equipment into highly intelligent assets capable of self-diagnosing and adjusting operational parameters in real-time, greatly enhancing the overall reliability of low voltage distribution networks.

The implementation of AI promises to revolutionize the lifecycle management of LV appliances. By analyzing historical load profiles, thermal signatures, and operational anomalies, AI systems can pinpoint specific components nearing the end of their service life, scheduling maintenance proactively rather than reactively. This shift reduces total cost of ownership (TCO) for end-users, particularly in critical infrastructure environments like data centers and heavy manufacturing facilities where uninterrupted power supply is paramount. Furthermore, AI contributes significantly to energy efficiency by dynamically optimizing power distribution based on demand forecasting, reducing wastage, and ensuring optimal load balancing, which is critical as regulatory pressure for decarbonization intensifies across the industrial landscape.

Ultimately, the influence of AI will establish a new competitive advantage based on service differentiation. Companies that successfully embed robust, secure, and user-friendly AI capabilities into their low voltage product offerings will lead the market. This integration moves the LV market beyond simple component manufacturing towards providing comprehensive, data-driven power management solutions. This includes developing software platforms that utilize AI for complex fault root cause analysis, optimizing protection relay settings in dynamic grid conditions, and creating autonomous decision-making loops within distribution panels, transforming passive electrical safety devices into active, intelligent assets integral to the smart grid ecosystem.

- AI enables predictive maintenance, shifting schedules from time-based to condition-based, optimizing uptime and reducing repair costs.

- Machine learning algorithms enhance fault detection and classification accuracy in complex LV networks.

- AI facilitates dynamic load balancing and energy optimization, crucial for integration with fluctuating renewable energy sources.

- Increased data generation from smart LV appliances requires AI for processing, security monitoring, and actionable insights generation.

- AI integration supports the development of autonomous power distribution systems within industrial and commercial buildings.

- It drives the need for new, sophisticated cybersecurity protocols tailored to protect intelligent electrical infrastructure.

DRO & Impact Forces Of Low Voltage Electrical Appliances Market

The dynamics of the Low Voltage Electrical Appliances Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting significant impact forces. A primary Driver is the massive global acceleration of construction activities, particularly infrastructure expansion in emerging economies, requiring foundational electrical safety and control equipment. Concurrently, the increasing stringency of global safety regulations, such as those mandated by IEC 61439 series and local jurisdictional codes, forces industries to continuously upgrade their installed base with compliant, advanced LV switchgear. These regulatory demands coupled with the technological imperative of industrial automation (Industry 4.0) necessitate reliable, communicative control components, providing a continuous stimulus for market growth, especially in the smart manufacturing sector.

However, the market faces significant Restraints that can impede growth rates. A major restraint is the volatility in raw material prices, specifically copper, aluminum, and certain plastics, which directly impacts manufacturing costs and profit margins for LV appliance producers. Furthermore, the inherent complexity and high initial capital expenditure required for adopting advanced digital switchgear and smart power management systems can discourage small and medium enterprises (SMEs) from rapid deployment. The long life cycle of conventional LV components also presents a challenge, as end-users often delay replacement cycles for existing equipment, slowing down the penetration of newer, intelligent products unless mandatory safety retrofits are enforced by regulatory bodies.

Opportunities for expansion are abundant, particularly driven by the accelerating global transition to clean energy. The proliferation of electric vehicles (EVs), distributed renewable energy generation (solar rooftops), and microgrids creates immense demand for specialized LV components capable of managing bidirectional power flow, DC applications, and rapid protection requirements unique to these systems. Additionally, the increasing integration of IoT and cloud-based analytics into LV devices represents a substantial opportunity for manufacturers to transition from product providers to comprehensive solution providers, offering value-added services such as energy monitoring, predictive diagnostics, and remote asset management, opening new recurring revenue streams and bolstering market resilience against macroeconomic fluctuations. The overarching impact forces dictate a sustained market expansion characterized by continuous technological refinement and regional investment diversification.

Segmentation Analysis

The Low Voltage Electrical Appliances Market is strategically segmented based on factors such as product type, application, and end-user, providing a granular view of demand patterns and technological requirements across diverse operational environments. Understanding these segments is crucial for strategic market positioning, allowing manufacturers to tailor their product offerings—ranging from basic circuit protection to complex control and measurement devices—to specific industry needs and regulatory frameworks. The market segmentation highlights differential growth rates, with certain product categories, particularly those integrated with communication capabilities (smart devices), exhibiting faster adoption due to the overarching trend toward system intelligence and remote management, especially in emerging smart infrastructure projects.

By Product Type, the segmentation includes primary devices like circuit breakers (Miniature Circuit Breakers, Moulded Case Circuit Breakers, Air Circuit Breakers), control components (Contactors, Relays, Motor Starters), and ancillary products such as switches, fuses, and signaling devices. The demand for advanced circuit breakers is particularly high in industrial and utility segments due to the requirement for high breaking capacity and system selectivity. Meanwhile, the control devices segment is seeing innovation driven by integration into Industrial Internet of Things (IIoT) architectures, demanding faster, more durable, and digitally communicable contactors and overload relays essential for modern automation and process control systems.

The Application and End-User segmentation further delineates market focus, distinguishing between power distribution, motor control, and general equipment protection, utilized across industrial, commercial, residential, and utility sectors. The industrial segment, encompassing manufacturing, process industries, and critical infrastructure, remains the largest consumer due to high power consumption and the critical need for safety and reliability. Conversely, the commercial segment (data centers, hospitals, office complexes) is growing rapidly, driven by strict standards for uninterruptible power supply and energy monitoring, fueling demand for advanced modular LV switchgear. This detailed segmentation allows stakeholders to accurately target marketing and R&D efforts towards sectors demonstrating the highest long-term growth potential and specialized technical requirements.

- By Product Type:

- Circuit Breakers (MCBs, MCCBs, ACBs, RCCBs/RCDs)

- Switches and Disconnectors

- Fuses

- Contactors and Relays

- Motor Starters and Controllers

- Enclosures and Distribution Boards

- By Application:

- Power Distribution

- Motor Control

- Equipment Protection

- Metering and Monitoring

- By End-User:

- Industrial (Manufacturing, Oil & Gas, Mining)

- Commercial (Data Centers, Hospitals, Office Buildings)

- Residential (Smart Homes, Housing Projects)

- Utilities and Infrastructure (Grid, Rail, Ports)

- By Technology:

- Conventional Devices

- Smart/Digital Devices (IoT Enabled)

Value Chain Analysis For Low Voltage Electrical Appliances Market

The value chain for the Low Voltage Electrical Appliances Market commences with Upstream Analysis, which focuses primarily on the sourcing and processing of core raw materials such as copper, aluminum, steel, high-grade polymers, and insulating materials. This stage is characterized by intense price volatility, making supply chain resilience and strategic hedging critical for manufacturers. Key activities at this stage include refining raw metals, manufacturing components like coils, contacts, and molded cases, and integrating semiconductor elements required for smart and digital devices. Strong relationships with material suppliers and strategic vertical integration offer substantial cost advantages and quality control, especially in ensuring the performance parameters of arc quenching and current interruption components.

Midstream activities encompass the core manufacturing and assembly processes, where components are precision-engineered, assembled, rigorously tested, and certified according to global standards (IEC, UL, CE). This stage includes significant R&D investment focused on enhancing protection capabilities, miniaturization, modularity, and developing communication protocols for smart devices (e.g., Modbus, Ethernet/IP). Distribution Channel dynamics are critical; sales are facilitated through a mix of Direct and Indirect channels. Direct sales are often utilized for large, bespoke industrial projects or utility procurement, where technical consultation and installation support are integral. Indirect channels, including authorized distributors, wholesalers, and electrical retailers, manage the high-volume, standardized product flow to SMEs, commercial installers, and residential markets. Efficiency in the indirect channel, particularly inventory management and logistical speed, is vital for maintaining market responsiveness.

Downstream Analysis centers on installation, commissioning, maintenance, and end-of-life recycling. The performance of the equipment depends heavily on professional installation and system integration, often handled by certified electrical contractors and system integrators who form a vital link to the End-User. Post-sales services, including technical support, spare parts availability, and increasingly, subscription-based services for predictive maintenance enabled by smart devices, contribute significantly to total lifecycle value. The effectiveness of this downstream support network, coupled with adherence to strict safety standards during installation, fundamentally impacts customer satisfaction and the market reputation of the LV appliance manufacturer.

Low Voltage Electrical Appliances Market Potential Customers

The potential customers and end-users of Low Voltage Electrical Appliances represent a diverse spectrum, categorized chiefly by their scale of operations, criticality of power supply, and regulatory environments. The largest and most demanding customer base resides within the Industrial sector, encompassing heavy manufacturing (automotive, steel, cement), process industries (chemicals, pharmaceuticals), and specialized sectors like oil and gas exploration. These entities prioritize equipment resilience, high breaking capacity, extended operational life, and integration into sophisticated motor control centers and distributed control systems (DCS). Their procurement decisions are heavily influenced by total cost of ownership (TCO) and compliance with stringent operational safety protocols.

The Commercial sector, which includes data centers, hospitals, educational institutions, retail complexes, and office buildings, represents the second major customer demographic. These customers place a premium on reliability, energy efficiency, and modularity, often requiring smart switchgear for advanced Building Management Systems (BMS) and ensuring uninterruptible power supplies (UPS). Data centers, in particular, demand extremely high-reliability LV components for power distribution and server rack protection, driving innovation in compact, high-performance circuit protection devices. The growing emphasis on green building certifications also drives commercial buyers toward energy-saving and remotely monitored LV solutions.

Finally, the Residential and Utility/Infrastructure sectors constitute the remaining major customer groups. Residential customers, driven increasingly by smart home trends, seek compact, safe, and easy-to-install devices like Miniature Circuit Breakers (MCBs) and Residual Current Devices (RCDs), with growing demand for smart panelboards and surge protection devices. Utilities and infrastructure operators (power generation, transmission, rail transport) require robust, standards-compliant LV apparatus for auxiliary control circuits, station protection, and ensuring reliability within distribution substations. Their purchasing criteria are dominated by long-term durability, regulatory compliance, and system compatibility within extensive grid infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.8 Billion |

| Market Forecast in 2033 | USD 181.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric SE, ABB Ltd., Siemens AG, Eaton Corporation plc, Legrand S.A., General Electric Company, Mitsubishi Electric Corporation, Rockwell Automation Inc., Hager Group, CHINT Group, L&T Electrical & Automation, Toshiba Corporation, Fuji Electric Co., Ltd., Nidec Corporation, TE Connectivity Ltd., Honeywell International Inc., Sensata Technologies, Inc., OEZ s.r.o., Havells India Ltd., C&S Electric Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Low Voltage Electrical Appliances Market Key Technology Landscape

The technology landscape of the Low Voltage Electrical Appliances Market is rapidly evolving, driven primarily by the transition from electro-mechanical devices to intelligent, solid-state, and networked components. A pivotal technological shift involves the integration of advanced digital signal processing (DSP) capabilities into protective relays and circuit breakers, moving beyond thermal and magnetic tripping mechanisms to precise, software-driven protection characteristics. This allows for greater system selectivity, faster fault isolation, and minimized nuisance tripping, which is crucial for modern industrial processes that require high continuity of service. Furthermore, enhanced arc flash mitigation technology, including ultra-fast switching devices and improved venting systems, is becoming standard, addressing critical safety concerns associated with high-energy faults in LV panels and switchgear.

The rise of the Industrial Internet of Things (IIoT) is mandating the pervasive incorporation of communication interfaces (such as Ethernet, Modbus TCP, and specialized fieldbus protocols) directly into low voltage appliances like smart MCCBs and motor starters. This connectivity enables remote monitoring of critical parameters such as current, voltage, temperature, and power quality, feeding data back to centralized supervisory control systems (SCADA) or cloud-based platforms for analysis. This technological convergence is essential for implementing predictive maintenance strategies, allowing operators to assess the health of electrical assets based on real-time operational data rather than predetermined inspection schedules, dramatically improving asset utilization and reducing unforeseen failures.

Another significant technological focus is on improving energy efficiency through the development of highly accurate metering components and energy management systems integrated within LV distribution boards. Smart meters embedded into the appliances provide granular consumption data, empowering end-users to identify and eliminate energy waste. Moreover, the demand from renewable energy installations requires specialized LV technology, including highly robust DC circuit breakers and protection devices capable of handling the unique challenges of photovoltaic (PV) arrays and battery energy storage systems (BESS). These advancements emphasize modular design, ease of integration, and conformity to stringent cybersecurity standards, necessary for safeguarding networked electrical infrastructure from digital threats.

Regional Highlights

- Asia Pacific (APAC): APAC is undeniably the powerhouse of the global LV Electrical Appliances Market, commanding the highest market share and registering the fastest growth rate. This dominance is attributed to colossal investments in infrastructure, encompassing residential construction, commercial real estate development, and government-backed initiatives like "Make in India" and China's "Belt and Road Initiative." The region's rapid industrialization, particularly the expansion of manufacturing bases and the push for renewable energy generation capacity, drives relentless demand for both conventional and smart LV switchgear, necessitating continuous supply chain expansion from multinational corporations.

- North America: The North American market is characterized by a mature infrastructure base and strict regulatory environment (NEC, UL standards). Growth is primarily fueled by extensive retrofitting and modernization projects aimed at upgrading aging electrical systems in commercial and industrial facilities to enhance safety and incorporate energy efficiency technologies. The burgeoning market for data centers, driven by cloud computing and digitalization, requires high-performance, specialized LV protection devices, ensuring stable growth despite slower new construction rates compared to APAC.

- Europe: The European market demonstrates steady, quality-focused growth, highly regulated by IEC standards and energy directives aimed at sustainability and decarbonization. The emphasis here is on deploying sophisticated, modular LV solutions for smart buildings, integrated energy management systems, and supporting the continent's extensive renewable energy transition. Germany, France, and the UK lead in adopting highly efficient and interconnected LV switchgear, driven by governmental mandates for reducing carbon footprints in both the industrial and residential sectors.

- Middle East and Africa (MEA): This region is experiencing significant market expansion, primarily concentrated in the Gulf Cooperation Council (GCC) countries due to massive investments in oil and gas infrastructure, diversification projects, and large-scale residential and commercial mega-projects (e.g., NEOM in Saudi Arabia). Demand is strong for heavy-duty, reliable LV components capable of withstanding harsh environmental conditions, with a growing trend towards incorporating smart grid technologies and advanced safety features.

- Latin America (LATAM): Growth in LATAM is driven by urbanization and infrastructure improvements in key economies like Brazil and Mexico. Although hampered occasionally by economic instability, the long-term outlook is positive, spurred by necessary investments in modernizing outdated power distribution networks and integrating decentralized power generation sources, which increases the need for dependable and certified LV electrical equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Low Voltage Electrical Appliances Market.- Schneider Electric SE

- ABB Ltd.

- Siemens AG

- Eaton Corporation plc

- Legrand S.A.

- General Electric Company

- Mitsubishi Electric Corporation

- Rockwell Automation Inc.

- Hager Group

- CHINT Group

- L&T Electrical & Automation

- Toshiba Corporation

- Fuji Electric Co., Ltd.

- Nidec Corporation

- TE Connectivity Ltd.

- Honeywell International Inc.

- Sensata Technologies, Inc.

- OEZ s.r.o.

- Havells India Ltd.

- C&S Electric Limited

Frequently Asked Questions

Analyze common user questions about the Low Voltage Electrical Appliances market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Low Voltage Electrical Appliances Market?

The primary driver is global infrastructure development, particularly rapid urbanization and industrialization in emerging economies (APAC). Coupled with this is the mandate for stringent safety and energy efficiency regulations, compelling continuous upgrades to modern, compliant LV switchgear and protective devices.

How is the integration of IoT and AI affecting Low Voltage switchgear?

IoT and AI integration are transforming LV switchgear into "smart" appliances capable of real-time monitoring, remote control, and predictive maintenance. This shift optimizes operational efficiency, minimizes unplanned downtime, and enhances energy management by providing actionable, data-driven insights into system health and load profiles.

Which product segment holds the largest share in the Low Voltage Electrical Appliances Market?

The Circuit Breakers segment, particularly Moulded Case Circuit Breakers (MCCBs) and Miniature Circuit Breakers (MCBs), holds the largest market share. This dominance is due to their indispensable role in providing fundamental overcurrent and short-circuit protection across industrial, commercial, and residential applications globally.

What are the key technological challenges facing the market?

Key challenges include ensuring cybersecurity for interconnected smart LV devices, managing the high initial cost of digital transformation, and standardizing communication protocols across different manufacturers' smart components to achieve seamless system integration within smart grids and industrial automation architectures.

What is the expected CAGR for the Low Voltage Electrical Appliances Market during the forecast period (2026-2033)?

The Low Voltage Electrical Appliances Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033, driven by ongoing infrastructure modernization, sustainable energy initiatives, and technological advancements toward smarter power management systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager