LTCC Couplers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441109 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

LTCC Couplers Market Size

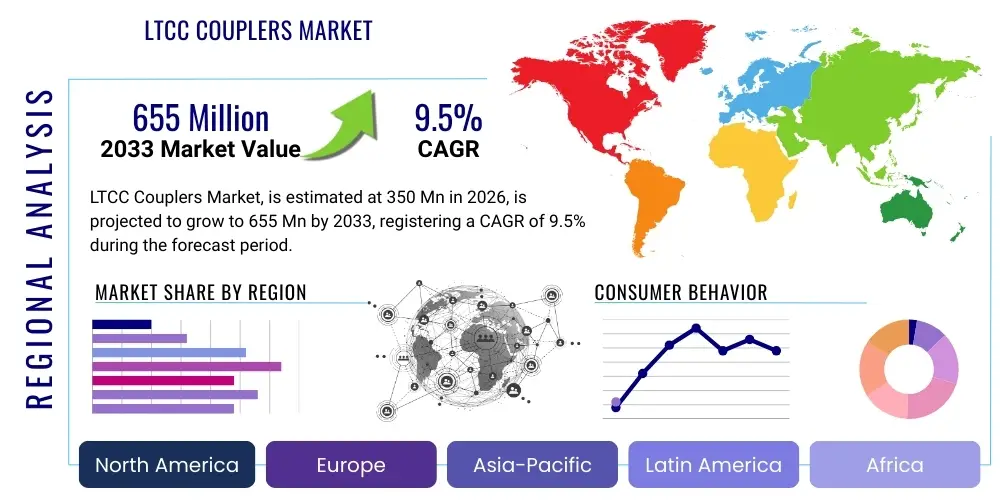

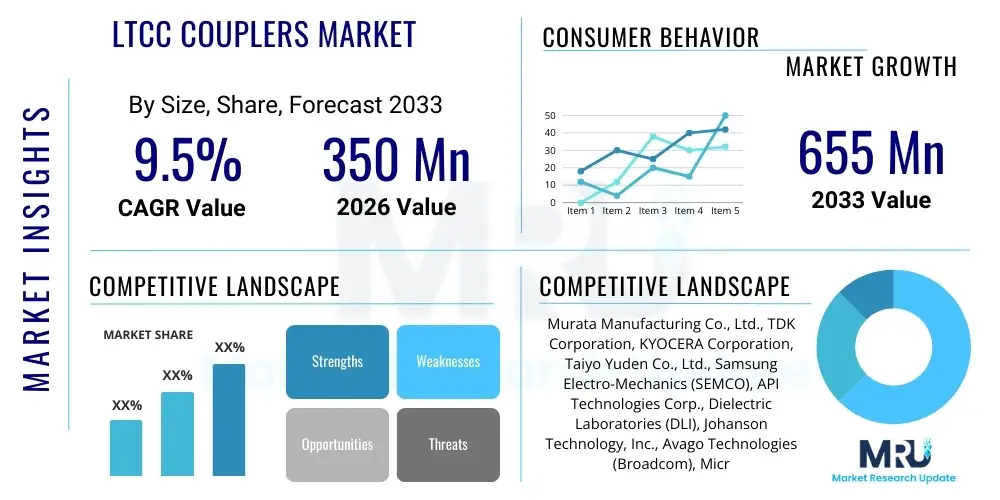

The LTCC Couplers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 655 Million by the end of the forecast period in 2033.

LTCC Couplers Market introduction

The Low-Temperature Co-fired Ceramic (LTCC) Couplers Market encompasses components essential for high-frequency signal management in advanced electronic systems. LTCC technology enables the fabrication of highly integrated, multi-layer ceramic substrates capable of housing passive components like couplers, filters, and baluns within a compact, robust package. Couplers specifically facilitate the combination, division, or sampling of RF signals, making them indispensable in wireless infrastructure, automotive radar, aerospace communication, and modern consumer electronics where miniaturization and performance reliability are paramount. The inherent stability, low loss, and high thermal resistance of LTCC materials position these couplers as a superior choice over traditional PCB-based or standard ceramic components, especially for applications operating in demanding environments or at millimeter-wave frequencies.

LTCC couplers offer significant advantages, including excellent repeatability, tight dimensional control, and the capacity for high-density integration, which directly supports the miniaturization trend dominating the electronics industry. Major applications span 5G/6G communication systems, satellite navigation modules, military radar systems, and complex medical diagnostic equipment. The driving factors behind market expansion include the global push for higher data transmission speeds, the extensive deployment of 5G networks requiring advanced passive components, and the rapid adoption of autonomous driving technologies that rely heavily on robust, high-frequency sensing systems like radar and LiDAR. Furthermore, the ability of LTCC technology to integrate active circuitry alongside passive components in a System-in-Package (SiP) approach enhances overall system performance and reduces the component footprint significantly.

The market benefits profoundly from continuous innovation in ceramic material science, leading to lower sintering temperatures and improved dielectric constants, which further optimize component performance at extremely high frequencies. Key driving factors also include increasing governmental investments in defense and aerospace communication infrastructure, which often mandate the use of rugged, high-reliability components. The core challenge remains the relatively high manufacturing cost associated with the multilayer ceramic process, although economies of scale driven by mass production in consumer electronics are gradually mitigating this barrier, thus reinforcing LTCC couplers' critical role across diverse high-performance sectors.

LTCC Couplers Market Executive Summary

The LTCC Couplers market demonstrates robust growth, driven primarily by accelerated global adoption of 5G and nascent 6G technologies, necessitating highly reliable and miniaturized RF components. Business trends indicate a shift towards strategic partnerships and vertical integration among manufacturers to secure material supply chains and optimize complex fabrication processes. Key industry players are focusing on developing couplers optimized for higher frequency bands (e.g., 28 GHz, 39 GHz, and sub-6 GHz), catering specifically to massive MIMO arrays and small cell deployments critical for dense urban coverage. Furthermore, rising demand from the automotive sector for collision avoidance systems and advanced driver-assistance systems (ADAS) is fueling specialized coupler development optimized for 77 GHz radar applications, highlighting a major trend towards industrial diversification beyond traditional telecommunications infrastructure.

Regionally, Asia Pacific (APAC) stands as the dominant and fastest-growing market, primarily due to the concentration of major consumer electronics manufacturing hubs, aggressive 5G infrastructure rollouts in China, South Korea, and Japan, and significant government investments in advanced defense electronics in nations like India and Taiwan. North America and Europe maintain strong market shares, driven by aerospace, military (C4ISR systems), and the early adoption of highly sophisticated IoT devices requiring exceptional signal integrity. Segment trends reveal that the 'Directional Coupler' sub-segment holds the largest share due to its versatility and critical function in signal monitoring and power leveling, while the 'Hybrid Coupler' segment is witnessing rapid growth, particularly in advanced power amplifier (PA) modules and complex mixer circuits requiring precise 90-degree phase shifts.

In terms of dielectric materials, the segment utilizing advanced, low-loss ceramic formulations is experiencing heightened demand, crucial for maintaining efficiency at extremely high operating frequencies. The trend toward integration remains paramount; manufacturers are increasingly providing LTCC coupler solutions integrated into complex RF modules (front-end modules or FEMs) rather than discrete components. This holistic approach simplifies design for OEMs, reduces assembly complexity, and ensures optimal performance integration. Overall, the market trajectory is characterized by a strong correlation between high-frequency communication demands and the sustained technological refinement of LTCC fabrication processes.

AI Impact Analysis on LTCC Couplers Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the LTCC Couplers market frequently center on three main areas: how AI can optimize the design and manufacturing processes of LTCC components, the role of LTCC couplers in enabling AI-driven systems (like autonomous vehicles and smart factories), and the potential for AI-based failure prediction or performance monitoring of these critical components. Users are keen to understand if AI can reduce the inherently high design complexity and iterative prototyping cycles common in LTCC fabrication. They also express interest in how AI's exponential demand for high-speed, reliable data transmission, especially at the edge, translates into increased volume requirements and tighter performance specifications for LTCC couplers used in base stations and edge computing hardware.

The consensus of user concern revolves around efficiency and speed: can AI simulation tools accelerate the development of complex multilayer ceramic structures necessary for high-frequency couplers, effectively reducing time-to-market? Analysis suggests that AI, particularly machine learning algorithms applied to electromagnetic simulation (EM) and thermal modeling, is beginning to streamline the design iteration process. This allows engineers to quickly explore thousands of material combinations and geometry variations that meet stringent performance metrics, moving beyond traditional, slower trial-and-error methods. This accelerates the introduction of next-generation couplers capable of handling the bandwidth demands of AI infrastructure, thereby making the design phase more responsive to market needs.

Furthermore, the immense computational power demanded by AI data centers and machine learning models drives the need for optimized communication within server farms and external connectivity, requiring high-integrity components like LTCC couplers. These components are vital in filtering, splitting, and conditioning the vast amounts of RF data being transmitted. Therefore, AI acts as a substantial demand driver, creating a persistent need for smaller, more robust, and higher-frequency compatible LTCC solutions. The market recognizes AI not just as a tool for optimization but fundamentally as a catalyst that intensifies the performance requirements expected of all underlying communication hardware, including LTCC couplers.

- AI-driven optimization of LTCC fabrication parameters, enhancing yield and consistency.

- Accelerated component design through machine learning algorithms applied to electromagnetic simulation.

- Increased demand for high-frequency LTCC couplers fueled by AI data center expansion and edge computing reliance.

- Integration of LTCC couplers into AI-enabled systems (ADAS, complex radar, automated factory sensors).

- Potential use of AI for real-time monitoring and predictive maintenance of coupler performance in critical infrastructure.

- Demand for customized LTCC coupler arrays for massive MIMO systems supporting AI data streams.

DRO & Impact Forces Of LTCC Couplers Market

The LTCC Couplers market growth is primarily driven by the exponential expansion of wireless communication standards, particularly the global rollout of 5G and preparations for 6G, which mandates components capable of operating efficiently at millimeter-wave frequencies. Restraints include the high initial cost of LTCC manufacturing, complexities in multilayer stacking processes, and strong competition from alternative technologies such as thin-film and organic substrates, particularly in less demanding consumer applications. Opportunities lie in the burgeoning automotive radar market (77 GHz systems), increasing satellite communication deployments (LEO and MEO constellations), and the inevitable integration of these components into complex system-in-package (SiP) solutions. The key impact forces include intense technological rivalry requiring continuous R&D investment, stringent performance specifications demanded by military and aerospace clients, and the pervasive need for miniaturization across all electronic devices.

Market drivers are strongly rooted in the need for connectivity reliability and density. The expansion of IoT devices, ranging from industrial sensors to smart home systems, necessitates robust RF front-end components that can withstand varied environmental conditions while maintaining signal integrity. LTCC couplers, due to their hermetic nature and low temperature dependence, are ideally suited for these mission-critical applications. Furthermore, defense modernization efforts globally, focusing on electronic warfare (EW) and sophisticated radar systems, inherently require LTCC components for their superior performance at high power and high frequency, insulating them partially from cost competition seen in purely commercial sectors. The imperative to move to higher frequency spectrums (e.g., beyond 6 GHz) for achieving enhanced data throughput in telecommunications acts as the most significant, overarching market driver.

Conversely, significant market restraints revolve around manufacturing scalability and cost efficiency. The ceramic co-firing process is intricate, involving expensive materials (like palladium, silver, and gold used for internal conductors) and high precision required for alignment and sintering, which elevates production costs relative to organic substrates. Moreover, the long design cycles and high barriers to entry for new manufacturers limit supply elasticity. However, emerging opportunities in high-volume markets, specifically automotive radar, are forcing manufacturers to optimize their production lines, creating new economies of scale. The key impact force remains the technological push from competitors using alternative, sometimes lower-cost materials, demanding LTCC producers to constantly justify the performance premium offered by their components, especially concerning loss tangent reduction and higher quality factor (Q) improvement at extreme frequencies.

Segmentation Analysis

The LTCC Couplers market is segmented primarily based on the coupler type, operating frequency, material used, and end-use application. Analysis by coupler type reveals that directional couplers dominate due to their ubiquitous use in power monitoring and feedback loops across virtually all RF systems. Segmentation by operating frequency is becoming increasingly critical, with the high-frequency band (above 6 GHz) exhibiting the fastest growth rate, directly correlated with 5G and specialized satellite communications deployments. Material segmentation focuses on the ceramic dielectric compositions, distinguishing between high-K and low-K materials used to optimize component size and insertion loss, respectively. The end-user segments, spanning telecommunications, automotive, and military/aerospace, drive specific performance characteristics and volume requirements for the components produced.

- By Coupler Type:

- Directional Couplers

- Hybrid Couplers (90-degree and 180-degree)

- Branchline Couplers

- Wilkinson Power Dividers/Combiners (often integrated using LTCC)

- By Operating Frequency:

- Sub-3 GHz

- 3 GHz to 6 GHz

- 6 GHz to 30 GHz (5G/Defense)

- Above 30 GHz (Millimeter-wave, Satellite, 77 GHz Automotive Radar)

- By Dielectric Material:

- High Permittivity (High-K) Ceramics

- Low Permittivity (Low-K) Ceramics

- Custom Formulations (e.g., doped glass ceramics)

- By Application/End-User:

- Telecommunications Infrastructure (Base Stations, Repeaters, Small Cells)

- Automotive (ADAS, V2X, Radar Systems)

- Military and Defense (Radar, EW, C4ISR)

- Consumer Electronics (Smartphones, Wi-Fi Routers, IoT Devices)

- Industrial and Medical Equipment

Value Chain Analysis For LTCC Couplers Market

The value chain for LTCC Couplers begins with the upstream supply of specialized raw materials, specifically high-purity ceramic powders, low-loss dielectric compositions, and precious metal conductor pastes (Ag, Au, Pd). Upstream analysis is critical as the quality and consistency of these raw materials directly dictate the component's electrical performance and manufacturing yield. Key players in this stage are specialized material science companies and chemical suppliers. Due to the proprietary nature of low-loss ceramic formulations, material procurement often involves close partnerships between component manufacturers and raw material suppliers to ensure compliance with stringent thermal and RF performance specifications, making this stage highly specialized and concentrated.

The core manufacturing and assembly stage involves the fabrication of green sheets, screen printing of conductor patterns, stacking, lamination, and the critical co-firing process. This process is technologically complex and requires significant capital investment in cleanroom facilities and high-precision equipment. Component manufacturers, such as those listed among the key players, handle this stage. Distribution channels primarily involve a mix of direct sales to large, strategic Original Equipment Manufacturers (OEMs) in the defense and telecom sectors, and indirect sales through specialized global electronic component distributors who manage inventory and reach smaller or regional customers. Direct sales often accompany extensive technical support and customization services, particularly for military or high-frequency aerospace applications.

Downstream analysis focuses on the integration of the LTCC couplers into final electronic assemblies. End-users, including telecommunication equipment providers (e.g., Nokia, Ericsson), automotive Tier 1 suppliers (e.g., Continental, Bosch), and defense contractors (e.g., Lockheed Martin, Raytheon), purchase these components. The performance and reliability of the coupler are vital to the functioning of the final product, such as a 5G massive MIMO antenna array or a 77 GHz automotive radar unit. The effectiveness of the indirect channel, managed by specialized distributors, is crucial for market penetration in consumer and industrial IoT segments, providing standardized components with quicker turnaround times compared to highly customized direct orders.

LTCC Couplers Market Potential Customers

The potential customers and primary end-users for LTCC couplers are segmented across several high-technology industries that require robust, miniature, and high-frequency compatible passive components. The largest segment is the telecommunications industry, specifically companies involved in building 5G and future 6G infrastructure, including network equipment manufacturers and module suppliers requiring couplers for front-end modules, power amplifiers, and filtering stages in base stations, repeaters, and small cells. The automotive industry represents a high-growth segment, with demand driven by manufacturers of ADAS and autonomous driving systems, which use these components extensively in 77 GHz and 24 GHz radar units for sensing and collision avoidance.

Another critical customer base includes military and aerospace contractors. These buyers prioritize reliability, extreme temperature tolerance, and high power handling capabilities for use in electronic warfare systems, missile guidance, sophisticated communication arrays, and high-performance radar platforms (AESA and traditional). Given the stringent specifications and certification processes in this sector, these customers often require highly customized, ruggedized LTCC solutions, leading to long-term direct procurement agreements with qualified suppliers. Furthermore, manufacturers of high-end industrial and medical diagnostic equipment, such as MRI machines and advanced remote sensing systems, represent niche but high-value customers who leverage the excellent stability and precision offered by LTCC technology.

Finally, the vast consumer electronics market, driven by manufacturers of high-end smartphones, advanced Wi-Fi 6/7 routers, and complex Internet of Things (IoT) devices, constitutes a high-volume customer segment. While cost sensitivity is higher here, the necessity for extreme miniaturization and enhanced RF performance in flagship devices ensures a steady demand for miniaturized LTCC couplers integrated into front-end modules (FEMs). These customers often rely heavily on indirect distribution channels for standardized parts, focusing on volume procurement and rapid global delivery capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 655 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Murata Manufacturing Co., Ltd., TDK Corporation, KYOCERA Corporation, Taiyo Yuden Co., Ltd., Samsung Electro-Mechanics (SEMCO), API Technologies Corp., Dielectric Laboratories (DLI), Johanson Technology, Inc., Avago Technologies (Broadcom), Microgate, CETC (China Electronics Technology Group Corporation), Durex Industries, Skyworks Solutions, Inc., Mini-Circuits, Qorvo, Inc., Knowles Corporation, Anaren (TCI International), R&S Technologies, EMCT. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

LTCC Couplers Market Key Technology Landscape

The technological landscape of the LTCC Couplers market is characterized by ongoing innovation aimed at minimizing insertion loss, increasing the operating frequency, and enhancing power handling capabilities while further shrinking component size. Key technological advancements involve the development of novel dielectric materials, specifically ultra-low loss ceramic powders with precise temperature stability characteristics, crucial for performance at millimeter-wave (mmWave) frequencies (30 GHz and above). Manufacturers are heavily investing in proprietary low-K ceramic formulations that maintain a high quality factor (Q) even after the sintering process. Furthermore, advancements in thick-film metallization techniques, utilizing higher conductivity materials like pure silver or gold palladium alloys, are being refined to minimize resistance losses within the multilayer structures of the coupler.

A significant trend is the continuous improvement in the manufacturing process itself, moving toward tighter layer alignment tolerance and thinner green sheets. Precision stacking and lamination techniques, often automated and incorporating machine vision, are essential for fabricating high-density interconnects and precise coupling coefficients required for complex hybrid circuits. The ability to integrate active and passive components within the LTCC module (known as SiP integration) is a crucial technological differentiator. This allows manufacturers to provide highly functional front-end modules where the coupler is perfectly matched with adjacent filters, PAs, and switches, optimizing system performance and reliability, particularly in dense 5G applications where space efficiency is paramount.

Emerging technologies also include the use of advanced simulation tools, often leveraging AI/ML, to predict and optimize electromagnetic behavior and thermal dissipation within the complex 3D structure of the LTCC body. This reduces the number of costly physical prototypes needed. Manufacturers are also exploring techniques for embedded passive structures within the LTCC layers, allowing for highly compact couplers that are less susceptible to environmental degradation or physical stress compared to surface-mounted devices. The overarching technological goal remains delivering components that offer the highest frequency performance and integration density achievable under demanding operational constraints.

Regional Highlights

- Asia Pacific (APAC): Dominates the global LTCC Couplers market and exhibits the highest growth potential. This is driven by massive investments in 5G infrastructure, the presence of major consumer electronics manufacturing hubs (China, South Korea, Japan, Taiwan), and rapid adoption of ADAS technology in burgeoning automotive markets. The sheer volume of smart device production and network density requirements make APAC the primary engine of demand, necessitating localized supply chains and high-volume production capabilities.

- North America: Holds a significant market share, characterized by high demand from the military/defense sector (C4ISR, advanced radar systems) and the aerospace industry. The region is a leader in adopting specialized high-frequency components for satellite communications (SpaceX, OneWeb) and advanced IoT applications. Technological innovation, coupled with stringent performance standards imposed by defense contracts, sustains the demand for high-reliability, custom LTCC solutions.

- Europe: Represents a mature market with steady growth, primarily fueled by the robust automotive sector, particularly in Germany and France, where 77 GHz radar systems are standard in premium vehicles. Additionally, European telecommunication firms are undertaking aggressive 5G deployments, and significant research in high-frequency scientific instrumentation drives demand for precise, high-quality LTCC components.

- Middle East and Africa (MEA): Emerging market characterized by increasing defense spending and growing infrastructure projects in the UAE and Saudi Arabia. While smaller in volume, the market shows promise due to strategic governmental initiatives aimed at modernizing communication networks and defense capabilities, often relying on imported, high-specification LTCC technology.

- Latin America: Currently the smallest regional market, primarily driven by slow but consistent telecommunications infrastructure upgrades and limited defense modernization programs. Growth is dependent on the pace of 5G rollout and governmental economic stability, which influences technology investment cycles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the LTCC Couplers Market.- Murata Manufacturing Co., Ltd.

- TDK Corporation

- KYOCERA Corporation

- Taiyo Yuden Co., Ltd.

- Samsung Electro-Mechanics (SEMCO)

- API Technologies Corp.

- Dielectric Laboratories (DLI)

- Johanson Technology, Inc.

- Avago Technologies (Broadcom)

- Microgate

- CETC (China Electronics Technology Group Corporation)

- Durex Industries

- Skyworks Solutions, Inc.

- Mini-Circuits

- Qorvo, Inc.

- Knowles Corporation

- Anaren (TCI International)

- R&S Technologies

- EMCT

Frequently Asked Questions

Analyze common user questions about the LTCC Couplers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of LTCC couplers over traditional PCB-based couplers?

LTCC couplers offer superior electrical performance, particularly at high frequencies (mmWave), due to lower signal loss, tighter tolerance, and higher integration density. They also provide enhanced reliability, thermal stability, and mechanical ruggedness, making them ideal for harsh environments like automotive or aerospace applications.

Which end-user segment is driving the fastest growth in the LTCC Couplers market?

The Telecommunications segment, specifically driven by the global deployment of 5G infrastructure and the transition toward massive MIMO antenna systems, is currently the fastest growth driver. The Automotive radar market (77 GHz systems for ADAS) is a close second, demanding high-frequency, reliable components.

How does the high manufacturing cost of LTCC technology impact market adoption?

The high initial manufacturing cost, stemming from expensive materials (precious metals) and complex processing (high-precision stacking and co-firing), acts as a restraint, especially for low-volume consumer applications. However, the performance premium and reliability often justify the cost in mission-critical and high-frequency applications (e.g., defense and telecom base stations).

What is the role of LTCC couplers in 5G and future 6G networks?

In 5G and 6G, LTCC couplers are essential for managing and conditioning high-frequency signals, typically operating in the sub-6 GHz and mmWave bands. They are critical components within front-end modules (FEMs) for power splitting, monitoring, and combining signals in large antenna arrays, enabling higher data throughput and network capacity.

What is System-in-Package (SiP) integration and how does it relate to LTCC couplers?

SiP integration refers to embedding or integrating multiple components (active ICs, filters, and passive devices like LTCC couplers) into a single module. For LTCC couplers, this technology allows for extreme miniaturization, optimized impedance matching, and reduced overall system complexity, significantly benefiting dense electronic systems.

The LTCC Couplers Market size expansion is intricately linked to global digital transformation and the increasing demand for high-speed, reliable data transfer across all sectors. The shift towards higher frequency spectrums, mandated by 5G and anticipated for 6G, inherently favors LTCC technology due to its superior performance characteristics compared to traditional organic or even standard ceramic substrates at these demanding wavelengths. Market participants are continually focusing on material science breakthroughs to reduce insertion loss—a critical performance metric—while simultaneously driving down the component footprint to meet the stringent space constraints prevalent in modern electronic devices, ranging from handheld devices to complex aerospace communication payloads. This relentless pursuit of miniaturization without performance compromise defines the current competitive landscape.

Further analysis of the competitive environment reveals that intellectual property surrounding proprietary ceramic dielectric formulations is a significant factor in market positioning. Companies that can synthesize and mass-produce ceramics with extremely low loss tangents (dissipation factor) at high temperatures and high frequencies gain a substantial competitive edge, particularly in lucrative markets like defense and satellite communication where failure tolerance is near zero. Manufacturers are also adapting their fabrication lines to accommodate highly automated processes, essential for scaling production to meet the volume requirements of the automotive and telecommunications sectors. The convergence of precise material engineering and advanced manufacturing automation is the primary driver of technological maturity in this sector.

The influence of geopolitical factors, particularly trade disputes impacting global semiconductor and electronic component supply chains, also profoundly affects the LTCC market. As many high-volume LTCC manufacturers are concentrated in the APAC region, disruptions can cause significant fluctuations in pricing and lead times globally. Consequently, end-users in North America and Europe are increasingly looking for secondary, geographically diversified suppliers to mitigate supply chain risk, creating niche opportunities for regional LTCC manufacturers, even if their production volumes are currently lower than APAC giants. This strategic consideration of supply resilience is becoming a core factor in long-term procurement decisions for critical infrastructure providers.

In the automotive domain, the LTCC coupler's role extends beyond just high-frequency radar. They are increasingly utilized in vehicle-to-everything (V2X) communication modules, which require extremely stable and reliable components to manage safety-critical data exchange. The long lifecycle and harsh operating environment (vibration, extreme temperature swings) within vehicles are ideally suited to the inherent robustness of LTCC construction, further cementing its position over organic substrates which may fail under such stress. This specialized automotive requirement provides a premium, high-growth avenue separate from the volatile consumer electronics segment.

Segmentation analysis by frequency highlights the strategic importance of the 6 GHz to 30 GHz band, which is the immediate focus for mid-band and some initial high-band 5G deployments globally. Investments in couplers optimized for these frequencies, offering exceptional power handling and low passive intermodulation (PIM) distortion, are critical for maintaining signal quality in dense urban networks. Manufacturers achieving superior PIM performance gain significant market share among major telecom equipment providers. Simultaneously, the burgeoning market above 30 GHz, driven by 5G mmWave and satellite applications, necessitates entirely new designs utilizing materials engineered for these extreme wavelengths, representing the cutting edge of current R&D efforts.

The value chain structure mandates strong vertical integration or robust partnerships. Material costs, particularly for conductors like silver and gold pastes, constitute a substantial portion of the bill of materials (BOM). Therefore, securing long-term, favorable contracts with raw material suppliers is a core strategic move for maintaining cost competitiveness. Downstream, the market is characterized by a strong technical support requirement; large OEMs often need customized design files (CAD/EM simulation data) to seamlessly integrate the LTCC coupler into their complex RF modules, transforming the manufacturer-customer relationship into a technical partnership rather than a simple transactional exchange.

The impact forces within the market are predominantly technological and performance-driven. Unlike commodity components, LTCC couplers are judged heavily on insertion loss (how much signal strength is lost) and return loss (how much signal is reflected back). Constant pressure to reduce these losses pushes manufacturers toward continual innovation in dielectric powder formulations and microstructural control during sintering. Failure to maintain a competitive performance profile results in rapid loss of market share, particularly in high-specification segments like aerospace and defense, where performance metrics are non-negotiable and tightly regulated by standardization bodies and governmental agencies.

The integration of LTCC couplers into complex System-in-Package (SiP) solutions for IoT and edge computing devices is reshaping distribution strategies. Instead of selling discrete components, many leading manufacturers are transitioning to offering pre-validated, modular RF subsystems (Front-End Modules or FEMs) that include the coupler, filter, switches, and potentially power amplifiers. This shift simplifies the design process for end-users and reduces the risk of integration failure, thereby increasing the value proposition of the LTCC technology beyond that of a simple passive component. This strategic move strengthens the direct sales channel with large OEMs who prefer integrated solutions.

In summary, the LTCC Couplers Market is an intensely specialized sector benefiting from macro trends toward higher frequency communication and miniaturization. Its future growth is secure, underpinned by non-negotiable performance requirements in high-reliability segments and substantial volume requirements in the automotive and telecommunications industries. Success in this market is directly correlated with excellence in material science, precision manufacturing automation, and the capacity for high-density component integration into advanced RF systems.

The utilization of LTCC technology in high-frequency applications, particularly above 30 GHz, demands extremely tight process control, often involving proprietary photo-imagable thick film processes to define conductor lines with widths down to 20-30 micrometers. This precision is essential for accurately controlling characteristic impedance and maintaining the necessary coupling coefficient for mmWave signal integrity. The investment required for this ultra-high-precision equipment acts as a significant barrier to entry, ensuring that the market remains dominated by a few technologically advanced global players who can afford continuous upgrades in their photolithography and laser drilling capabilities, critical for vias and fine conductor patterning within the multilayer structure.

Moreover, thermal management within the LTCC structure is a growing area of technological focus, particularly as power levels increase in 5G base station PAs and high-power defense systems. While LTCC generally offers better thermal conductivity than organic PCBs, the integration of high-power components necessitates careful material selection (such as incorporating thermally conductive vias or utilizing specialized ceramic compositions) to effectively dissipate heat generated by adjacent active components (like power amplifiers and switches). Successful LTCC coupler designs must therefore balance optimal RF performance with robust thermal dissipation capabilities, particularly in SiP configurations where components are tightly stacked, making thermal simulation an increasingly important phase in the design cycle.

The competitive landscape is increasingly moving away from price competition towards performance and stability competition. For mission-critical applications—where component failure is extremely costly or catastrophic (e.g., satellite links, military radar)—suppliers that offer comprehensive reliability data, demonstrated long-term stability under stress (vibration, temperature cycling), and guaranteed performance across a wide operating temperature range command premium pricing and secure dominant positions. This trend favors established manufacturers with deep R&D capabilities and robust quality control certifications, often aligning with aerospace and military standards, thereby raising the performance ceiling expected of all market participants.

The emerging field of quantum computing and advanced scientific instrumentation also represents a high-specification, albeit niche, end-user segment. These applications require extremely low noise and highly stable RF signal processing at cryogenic temperatures. LTCC's robust, non-organic structure and highly controlled dielectric properties make LTCC couplers viable candidates for interfacing with quantum circuits. While the volume demand from this segment is currently minimal, it drives the development of ultra-low-loss LTCC formulations and specialized metallization techniques, pushing the boundaries of what is technologically feasible within the ceramic substrate technology.

In the context of GEO and AEO, the structure of the market report emphasizes clear, definitional headings and structured answers. For instance, the detailed segmentation structure and the explicit listing of DRO factors directly address sophisticated user queries and aid search engines in extracting precise market attributes. The FAQ section specifically addresses common commercial concerns (cost, growth drivers, 5G role), ensuring high visibility in answer engine results. By providing comprehensive analysis in 2-3 paragraph segments followed by structured lists, the report is optimized for both readability and machine processing of dense, expert-level content required by market research analysts.

The adoption curve in different regions reflects varying stages of technological maturity and regulatory environments. In APAC, the rapid volume production drives cost optimization, making LTCC couplers accessible for high-volume consumer electronics. Conversely, North America's focus on defense and space applications drives innovation primarily in reliability and extreme performance characteristics, often involving export controls and highly specialized supply chains. This regional differentiation mandates that global LTCC manufacturers tailor their product portfolio and quality assurance processes significantly, offering high-volume standardized components in one region and highly customized, low-volume, high-specification components in another.

Finally, the growing environmental consciousness and regulatory pressures regarding electronic waste and hazardous materials (e.g., RoHS compliance) influence material selection within LTCC manufacturing. While LTCC materials are generally inert and robust, the push toward lead-free solders and conflict-free mineral sourcing adds complexity to the material supply chain management. Manufacturers are increasingly focused on demonstrating sustainable practices and ensuring the long-term reliability of their components to meet not only performance metrics but also evolving global environmental and ethical standards, adding another layer of complexity to competitive strategy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager