Luxury Handbags Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441545 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Luxury Handbags Market Size

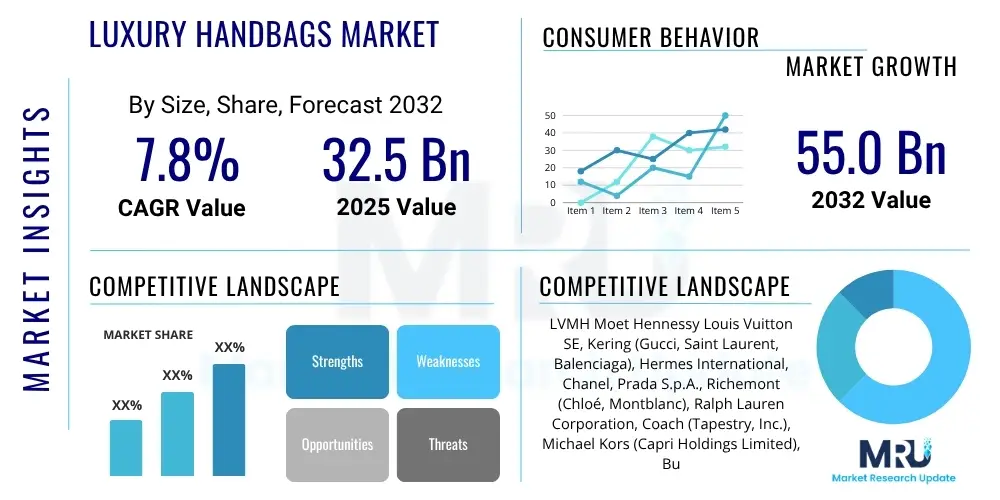

The Luxury Handbags Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $67.5 Billion in 2026 and is projected to reach $107.0 Billion by the end of the forecast period in 2033.

Luxury Handbags Market introduction

The Luxury Handbags Market encompasses the sale of premium, high-end bags distinguished by superior craftsmanship, exclusive materials (such as exotic leathers, specialized textiles, and unique hardware), brand heritage, and elevated price points. These products are not merely utilitarian accessories; they function as significant status symbols, investment pieces, and key drivers of fashion industry trends. The market is defined by exclusivity, meticulous design, and controlled distribution channels, maintaining a strong connection between brand legacy and perceived product value among affluent consumers globally.

The primary applications of luxury handbags span personal use, social events, and professional settings, with consumer purchasing decisions heavily influenced by fashion cycles, seasonal collections, and collaborations with artists or designers. Key benefits include enhanced personal style, perceived social status, and, increasingly, potential resale value, especially for limited edition or highly sought-after models. The driving factors behind market expansion are multifaceted, including rising disposable incomes in emerging economies, the burgeoning demand from younger affluent consumers (Millennials and Gen Z), and the strategic digitalization of luxury brands, which facilitates global reach and personalized consumer engagement.

Furthermore, the market benefits significantly from the expansion of e-commerce platforms specializing in authenticated luxury goods and the growing emphasis on sustainable and ethically sourced materials. Brands are increasingly investing in transparency regarding their supply chains and manufacturing processes to meet the ethical demands of modern consumers. This shift towards responsible luxury, coupled with the continued strong consumer interest in personalization and bespoke services, cements the market's high-growth trajectory and resilience against general economic fluctuations.

Luxury Handbags Market Executive Summary

The global Luxury Handbags Market exhibits robust growth, primarily driven by shifting consumer dynamics towards experiential and collectible luxury items, alongside aggressive digital penetration by established European luxury houses. Current business trends indicate a strong focus on direct-to-consumer (DTC) models, enhancing brand control over pricing and customer experience, and maximizing profit margins. Key players are strategically expanding their product portfolios to capture diverse demographic segments, particularly focusing on 'quiet luxury' aesthetics and casual luxury items (such as high-end backpacks and cross-body bags) to appeal to younger, digitally native audiences while maintaining the desirability of iconic, high-priced signature pieces.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, spearheaded by robust demand in China and increasing affluence in Southeast Asia, cementing its position as the primary growth engine for the luxury sector. North America and Europe remain foundational markets, focusing on sustained innovation in retail experiences and strong resale market activity. Latin America and the Middle East and Africa (MEA) present significant untapped opportunities, characterized by growing ultra-high-net-worth individual populations and evolving luxury retail infrastructure, promising accelerated growth in the latter half of the forecast period.

Segment trends reveal that the women's luxury handbag category maintains the largest market share, though the men's luxury handbag and accessory segment is experiencing the highest proportional growth, driven by changing sartorial norms and the increasing acceptance of high-end male accessories. In terms of material, leather continues to dominate due to its durability and prestige, but the sustainable luxury segment, incorporating innovative, ethical, and vegan materials, is gaining traction rapidly. Distribution analysis confirms that dedicated brand boutiques and online channels are critical, with e-commerce platforms demonstrating superiority in capturing new, geographically dispersed customers effectively.

AI Impact Analysis on Luxury Handbags Market

Common user questions regarding AI in the Luxury Handbags Market revolve around themes of personalization, authentication, efficiency, and trend forecasting. Consumers and industry stakeholders frequently inquire: "How can AI guarantee the authenticity of a pre-owned luxury bag?", "Will AI replace human craftsmanship?", and "How are brands using AI to predict fashion trends and manage inventory?" The consensus indicates a strong user expectation that AI should enhance the luxury experience by making it more personalized, secure, and responsive. Users are particularly concerned about ensuring product provenance and receiving highly tailored recommendations based on purchasing history, browsing behavior, and psychographic profiles, reflecting a desire for both technological assurance and bespoke service.

AI's primary influence is seen in optimizing the backend operations and significantly improving customer engagement. For operations, predictive analytics driven by AI models allow luxury brands to forecast demand for specific styles, colors, and materials with greater accuracy, reducing overstock, minimizing waste, and aligning production cycles closely with fluctuating consumer preferences. This capability is crucial for maintaining the scarcity and exclusivity inherent to the luxury market model, ensuring that supply meets targeted, high-demand opportunities without saturating the market.

On the customer front, AI powers advanced recommendation engines, sophisticated virtual try-on experiences, and highly personalized digital marketing campaigns. Furthermore, technologies utilizing computer vision and machine learning are deployed for enhanced quality control during manufacturing and, crucially, for combating counterfeiting. By analyzing minute details of stitching, material texture, and hardware characteristics, AI systems provide rapid and reliable authentication, significantly boosting consumer confidence in both primary and secondary luxury markets, thereby safeguarding brand equity.

- AI-driven predictive analytics optimize inventory and production schedules, maintaining exclusivity.

- Machine learning algorithms enhance personalized product recommendations and targeted marketing.

- Computer vision and blockchain integration improve supply chain transparency and combat counterfeiting effectively.

- AI chatbots and virtual assistants provide 24/7 personalized customer service experience across digital touchpoints.

- Automated quality control systems ensure adherence to high luxury manufacturing standards.

DRO & Impact Forces Of Luxury Handbags Market

The Luxury Handbags Market is fundamentally driven by the sustained desire for status symbols, the increasing purchasing power of affluent demographics globally, particularly in Asia, and the strategic digital adoption by brands to enhance accessibility and consumer interaction. Restraints primarily involve the persistent threat of counterfeit goods, which erode brand value and market integrity, along with significant volatility in raw material costs, especially for high-quality leathers and exotic skins, often exacerbated by stricter environmental and ethical sourcing regulations. Opportunities lie significantly in expanding the scope of sustainable and traceable luxury materials, penetrating emerging markets with customized product offerings, and leveraging the circular economy through certified resale programs, which attract environmentally conscious consumers and extend product lifecycles.

Key impact forces shaping this market include socio-economic shifts, suchational consumer behavior in Asia Pacific, particularly China and India, continues to fuel market expansion. However, geopolitical instability and economic uncertainty in mature markets occasionally suppress discretionary luxury spending, necessitating dynamic pricing and inventory strategies. Technological advancements, specifically in e-commerce infrastructure, AR/VR integration for virtual shopping, and AI for authentication, act as potent positive forces, enhancing market reach and securing consumer trust. Regulatory shifts, particularly those related to ethical sourcing, animal welfare, and transparency in supply chains, force compliance but simultaneously provide competitive advantages to brands that proactively adopt high ethical standards.

The interplay between these forces dictates market trajectory. While strong brand loyalty and heritage provide an insulating effect against minor economic downturns, the necessity for continuous innovation in materials and digital engagement remains critical. Brands failing to adapt to sustainability demands or those unable to secure their products against sophisticated counterfeiting operations face significant reputational and financial risks. The overall impact force matrix suggests a market characterized by high inherent demand, mitigated by operational complexities related to ethics and supply chain resilience, leading to accelerated growth primarily through technological and geographical expansion.

Segmentation Analysis

The Luxury Handbags Market is segmented based on critical characteristics including material, product type, end-user, and distribution channel, providing a granular view of consumer preferences and market concentration. Segmentation helps in identifying specific niches, such as the growing demand for vegan leather options or the dominance of the tote bag type in the professional segment. The most lucrative segments are currently defined by the high-priced, iconic leather bags targeting female end-users, distributed primarily through exclusive brand-owned stores, yet future growth is expected to pivot towards online channels and specialized men's luxury accessories.

- By Material: Leather, Synthetic, Vegan Leather, Exotic Skins, Fabric/Canvas

- By Product Type: Tote Bags, Shoulder Bags, Clutch Bags, Satchel Bags, Backpacks, Cross-Body Bags

- By End-User: Women, Men, Unisex

- By Distribution Channel: Monobrand Stores, Specialty Stores, Online Retail (E-commerce Platforms and Brand Websites), Department Stores

Value Chain Analysis For Luxury Handbags Market

The value chain for the Luxury Handbags Market begins with intensive upstream activities centered on raw material sourcing, which is highly sensitive to ethical and sustainability standards. Upstream analysis involves the procurement of premium materials—high-grade calfskin, lambskin, or alternative luxury materials—often requiring long-term, exclusive partnerships with tanneries and hardware manufacturers specializing in bespoke components. Control over the quality and provenance of these materials is paramount, as it directly impacts the final product's perceived luxury and price point. Investments in traceability technologies, such as blockchain, are becoming mandatory to assure consumers of the ethical origins of the materials used.

Midstream activities are characterized by labor-intensive, high-precision manufacturing, often conducted in proprietary workshops in countries renowned for craftsmanship (e.g., Italy, France). The process heavily relies on the skill of artisans, emphasizing hand-finishing and rigorous quality control, which justifies the premium pricing. This manufacturing stage includes design, pattern making, cutting, stitching, and the integration of specialized hardware. Brands that maintain localized production facilities gain significant advantage in controlling intellectual property and ensuring the preservation of traditional manufacturing techniques, which is a core component of their brand storytelling.

Downstream analysis focuses on distribution and sales, where brands strive for maximum control and exclusivity. The distribution channel is bifurcated into direct channels (monobrand boutiques and brand e-commerce) and indirect channels (high-end department stores and authorized specialty retailers). Direct channels are preferred as they allow for complete control over the customer experience, brand environment, and pricing strategy, optimizing margins. E-commerce platforms, particularly brand-owned websites, are increasingly vital for global accessibility and personalized engagement, acting as powerful direct channels that minimize reliance on third-party retailers and ensure premium service delivery.

Luxury Handbags Market Potential Customers

The core customer base for the Luxury Handbags Market comprises affluent and high-net-worth individuals (HNWIs) across established and emerging economies. These buyers seek products that embody exclusivity, heritage, and demonstrable quality, viewing luxury handbags not just as functional items but as valuable assets and investments in personal identity and social signaling. While historically focused on mature consumers aged 35 and above, the market is experiencing a significant demographic shift, focusing marketing efforts increasingly on younger, affluent generations who prioritize digital engagement and ethical sourcing alongside brand prestige.

A rapidly expanding segment of potential customers includes Millennials and Gen Z who have achieved financial stability. This demographic is characterized by a high propensity for online research before purchase, a desire for customization, and a strong affinity for brands demonstrating social responsibility and transparency. They often engage with luxury through social media influencers and seek brands that align with their personal values, showing a preference for both iconic pieces and contemporary, functional designs suitable for daily use or travel. They are also active participants in the secondary (resale) market, viewing purchases through the lens of potential investment return.

Geographically, potential customers are highly concentrated in major metropolitan hubs across APAC (especially Shanghai, Hong Kong, Seoul, and Tokyo), key cities in North America (New York, Los Angeles), and European fashion capitals (Paris, London, Milan). Additionally, there is a growing cluster of aspirational consumers in secondary and tertiary cities worldwide who are gaining access to luxury goods through sophisticated global e-commerce logistics and localized digital outreach strategies implemented by major luxury conglomerates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $67.5 Billion |

| Market Forecast in 2033 | $107.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH Group (Louis Vuitton, Dior, Fendi), Kering Group (Gucci, Bottega Veneta), Hermes International, Chanel, Prada S.p.A., Coach (Tapestry Inc.), Michael Kors (Capri Holdings), Burberry Group PLC, Versace, Balenciaga, Celine, Loewe, Valentino, Saint Laurent, Tod's S.p.A., Mulberry Group PLC, Montblanc, Bally, Longchamp, Goyard |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Handbags Market Key Technology Landscape

The Luxury Handbags Market leverages cutting-edge technology primarily to enhance customer experience, ensure authenticity, and optimize supply chain efficiency. Digital transformation efforts focus heavily on creating seamless omnichannel retail environments. Technologies such as Augmented Reality (AR) and Virtual Reality (VR) are deployed to enable virtual try-ons, allowing customers to visualize bags in 3D or placed within their own environments via smartphones, significantly boosting confidence in online purchasing, reducing return rates, and bridging the gap between digital convenience and the necessity of tactile experience inherent in luxury goods.

Authentication and traceability represent another critical technological frontier. Blockchain technology is increasingly adopted by leading brands to create immutable digital records of a product's origin, materials, craftsmanship, and ownership history. This digital passport assures consumers of authenticity, aids in ethical sourcing verification, and facilitates secure transitions in the booming resale market, establishing a transparent lifecycle for high-value items. Furthermore, Near Field Communication (NFC) chips embedded within the products allow for easy verification via smartphone, linking the physical product to its digital twin and strengthening anti-counterfeiting measures.

Retail technology innovations are also transforming physical store experiences. AI-powered clienteling tools equip sales associates with comprehensive customer histories and predictive insights, enabling highly personalized in-store service—a cornerstone of luxury retail. Additionally, sophisticated data analytics, often integrated with CRM systems, provide real-time insights into consumer behavior and regional trend divergence, allowing brands to quickly adapt marketing strategies and inventory distribution. These technological investments move the market beyond traditional retailing into an era defined by data-driven bespoke interactions and enhanced product integrity.

Regional Highlights

- Asia Pacific (APAC): The fastest-growing region, driven by burgeoning middle and affluent classes in China, India, and Southeast Asia. Consumers here demonstrate a high brand consciousness and a significant appetite for iconic European luxury brands, making it the primary engine of global luxury sales.

- Europe: A mature and foundational market, retaining its importance as the center of luxury production, design innovation, and heritage preservation. While domestic consumption is stable, the region benefits massively from luxury tourism and serves as a vital distribution hub for global supply chains.

- North America: Characterized by high penetration of digital commerce and a strong demand for 'accessible luxury' brands, alongside established high-end labels. The market shows robust growth in personalization and is highly responsive to celebrity endorsements and quick fashion cycle adoption.

- Middle East and Africa (MEA): Emerging luxury hub, fueled by high concentrations of ultra-high-net-worth individuals, particularly in the UAE and Saudi Arabia. Demand is high for exclusive, limited-edition items and bespoke services, supported by sophisticated, high-end retail infrastructure.

- Latin America: An opportunistic market facing economic volatility, yet possessing significant potential driven by affluent populations in countries like Brazil and Mexico. Brands often employ localized strategies focusing on high-end department stores and specialized boutiques to cater to concentrated urban wealth.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Handbags Market.- LVMH Group (Louis Vuitton, Dior, Fendi)

- Kering Group (Gucci, Bottega Veneta)

- Hermes International

- Chanel

- Prada S.p.A.

- Coach (Tapestry Inc.)

- Michael Kors (Capri Holdings)

- Burberry Group PLC

- Versace

- Balenciaga

- Celine

- Loewe

- Valentino

- Saint Laurent

- Tod's S.p.A.

- Mulberry Group PLC

- Montblanc

- Bally

- Longchamp

- Goyard

Frequently Asked Questions

Analyze common user questions about the Luxury Handbags market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the Luxury Handbags Market?

Growth is primarily driven by rising disposable incomes in APAC, particularly among young affluent consumers, increasing adoption of e-commerce by luxury brands, and the sustained consumer demand for status symbols and investment-grade accessories.

How is sustainability impacting luxury handbag purchasing decisions?

Sustainability is a crucial factor, influencing purchasing among Millennials and Gen Z who prioritize ethical sourcing, transparency, and the use of innovative, vegan, or traceable materials. Brands integrating circular economy models and transparent supply chains gain significant competitive advantage.

Which distribution channel is expected to see the fastest growth?

Online Retail, encompassing both brand-owned e-commerce sites and certified third-party luxury platforms, is projected to experience the fastest growth due to enhanced digital personalization, global reach, and improved authentication technologies.

What is the role of AI in combating counterfeit luxury handbags?

AI is crucial for anti-counterfeiting efforts by utilizing computer vision to analyze product details and blockchain to provide secure, verifiable digital ownership histories, assuring consumers of the authenticity of high-value transactions.

What is the key trend in material segmentation for luxury handbags?

While traditional leather remains dominant, the fastest-growing trend in material segmentation is the adoption of high-quality, sustainable alternatives, including innovative synthetic materials and authenticated vegan leathers, driven by ethical consumer demands.

The global luxury market landscape is undergoing a significant transformation, necessitating that established brands pivot their strategies toward digital excellence and sustainable practices to maintain relevance and market share. The enduring appeal of heritage and craftsmanship must now be seamlessly integrated with technological innovation to capture the next generation of luxury consumers. The rise of the secondary market, facilitated by digital platforms and robust authentication technologies, is reshaping consumer behavior, effectively positioning luxury handbags as cyclical assets rather than purely discretionary purchases. This shift reinforces the inherent value proposition of high-quality luxury goods, further cementing their status as essential elements of the global fashion economy.

Regional dynamics continue to emphasize the pivotal role of Asian markets, where demographic dividend and rapid urbanization create an expanding base of affluent buyers. Brands are investing heavily in localized marketing and tailored product collections to resonate with diverse cultural preferences within the APAC region. Meanwhile, in North America and Europe, the focus remains on enhancing the experiential retail model, blending physical store environments with cutting-edge digital integrations to provide a holistic and exclusive purchasing journey. The competitive environment is fierce, marked by continuous innovation in design, strategic mergers and acquisitions among major luxury conglomerates, and a heightened focus on talent acquisition in digital commerce and sustainable design.

The long-term outlook for the Luxury Handbags Market remains exceptionally positive, provided brands successfully navigate challenges related to supply chain resilience, geopolitical uncertainty, and evolving consumer ethics. Success will hinge upon maintaining the delicate balance between preserving brand exclusivity and leveraging global accessibility through digital means. The convergence of art, fashion, and technology is setting the stage for a highly customized and authenticated future for luxury accessories, ensuring sustained premium pricing power and robust profitability for market leaders committed to excellence and ethical governance.

Further analysis of the market segments confirms that the demand for products within the $1,500 to $5,000 price band, often termed 'accessible luxury' or 'entry-level designer,' is exhibiting strong volume growth, attracting younger consumers making their first significant luxury purchase. Conversely, the ultra-high-end segment (bags exceeding $10,000, often limited edition or exotic skins) continues to demonstrate resilient value growth, driven almost exclusively by HNWIs and collectors who prioritize scarcity and investment potential. This dual-market dynamic necessitates brands to maintain a distinct tiered product strategy, ensuring that entry-level offerings do not dilute the prestige of their core, heritage products. Operational efficiency, particularly in managing global inventory and logistics for these disparate price points, is a key determinant of competitive success in this nuanced market.

The impact of social media and influencer culture cannot be overstated, acting as a massive accelerant for trend adoption and brand visibility. Brands utilize platforms like Instagram, TikTok, and localized Chinese platforms (Weibo, Xiaohongshu) to generate desire and rapidly disseminate new collection information. The effectiveness of a luxury campaign is increasingly measured not just by traditional media reach but by the level of authentic engagement and user-generated content it inspires. This shift requires continuous monitoring of digital sentiment and rapid response strategies to maintain brand image and manage potential reputation risks associated with highly public scrutiny inherent in digital luxury discourse.

In terms of technology adoption beyond authentication, brands are actively exploring Metaverse applications and Non-Fungible Tokens (NFTs). While still nascent, the creation of digital luxury wearables and corresponding NFTs serves two purposes: offering a new revenue stream and, more importantly, establishing a crucial bridge between physical ownership and the digital identities of modern luxury consumers. This exploration into digital assets demonstrates a commitment by luxury houses to remain at the forefront of cultural and technological shifts, ensuring long-term engagement with the digitally native luxury consumer base and hedging against future shifts in consumer interaction paradigms.

The market faces inherent supply side risks, including the increasing complexity of ethically sourcing exotic materials and the high fixed costs associated with maintaining world-class artisanal workshops. Protection of intellectual property and design originality is paramount, leading to significant legal investments aimed at prosecuting counterfeit operations globally. Brands must also contend with evolving labor regulations and consumer demands for better worker compensation and conditions within their production facilities, leading to increased operational expenditure but contributing positively to brand reputation and long-term sustainability credentials.

The resilience of the market is underpinned by strong consumer perception of value preservation. Unlike many consumer durables, luxury handbags, particularly classic and iconic models, often retain or increase their value over time, making them attractive to discerning buyers. This perception of stability encourages spending even during periods of economic contraction among the wealthiest consumers, positioning the market favorably compared to other retail sectors. Continuous maintenance of brand desirability through exclusive events, targeted VIP services, and strategic scarcity management are foundational elements of success in this high-stakes environment.

The analysis of the competitive landscape reveals a clear hierarchy dominated by European conglomerates like LVMH and Kering, whose vast resources enable them to invest heavily in global expansion, digital infrastructure, and exclusive supply chain controls. Independent luxury houses, while smaller, maintain strong market positions by focusing on extreme exclusivity, impeccable heritage, and ultra-high craftsmanship, often commanding the highest price points in the market. Strategic partnerships, such as collaborations with technology firms or influential artists, are becoming essential tools for smaller players to amplify their voice and reach a broader, often younger, global audience without diluting their core luxury proposition.

Future growth will inevitably be intertwined with geopolitical stability, especially concerning cross-border tourism and consumption patterns. As international travel recovers, duty-free shopping and luxury retail tourism will rebound, providing significant sales uplift to key European and Middle Eastern locations. However, the foundational shift towards localized consumption, where purchases are made within the consumer's home country rather than abroad, is expected to continue, spurred by consistent pricing strategies and enhanced local retail experiences implemented by global luxury brands.

In summary, the Luxury Handbags Market is defined by its commitment to heritage combined with aggressive digitalization. The market segments are clear: women's leather bags dominate revenue, but men's accessories and sustainable materials lead growth. Key stakeholders must master the integration of AI for personalized service and blockchain for authentication, ensuring they capitalize on the massive APAC growth while securing the foundations of exclusivity and craftsmanship that underpin the entire luxury ecosystem.

The sustained success of luxury brands is intrinsically tied to their ability to cultivate and maintain emotional connections with their consumers. Marketing campaigns increasingly focus on storytelling, emphasizing the unique history, the meticulous crafting process, and the ethical journey of the materials, rather than solely the product features. This emotional value is difficult for competitors to replicate and acts as a powerful barrier to entry, distinguishing genuine luxury from premium mass-market products. This focus on narrative purity and brand integrity is vital for maintaining the high margins characteristic of the industry.

Addressing the ethical sourcing component, brands are under mounting pressure to demonstrate not only environmental stewardship but also social responsibility throughout their supply chains. This includes fair wages, safe working conditions, and community engagement in sourcing regions. Certifications and third-party audits are becoming standard practice, driven by consumer scrutiny amplified by digital transparency tools. Failure to adhere to these high ethical standards can quickly lead to significant brand boycotts and irreparable damage to reputation, illustrating the financial consequences of neglecting the S (Social) and G (Governance) aspects of ESG (Environmental, Social, and Governance) criteria within the luxury sector.

Finally, technological advancements are simplifying the purchase journey while preserving the sense of exclusivity. Sophisticated inventory management systems ensure that high-demand, limited-edition products are distributed strategically to VIP clients, enhancing their sense of privilege. The integration of data analytics allows brands to track customer loyalty metrics and effectively segment their clientele, enabling targeted pre-sales and personalized event invitations. This careful management of scarcity and demand, supported by robust technology, ensures that the luxury experience remains aspirational and rewarding, sustaining the market's premium positioning into the next decade.

The evolution of payment technologies also plays a supporting role. The acceptance of varied payment methods, including high-value digital currencies in certain markets, broadens accessibility for a digitally adept global clientele. Moreover, flexible payment solutions and strategic partnerships with high-end credit card companies or financial services tailored for affluent consumers often enhance conversion rates for high-priced items. The overall technological infrastructure must be robust, global, and highly secure to handle the volume and value of transactions characteristic of this segment.

The competitive differentiation amongst the key players is increasingly determined by innovation in non-leather materials. As concerns over animal welfare and environmental impact escalate, brands that successfully develop and market aesthetically comparable, high-performance, and verifiable sustainable alternatives (e.g., mushroom leather, lab-grown materials) will gain significant competitive ground, particularly with younger cohorts. The race for material innovation is becoming as significant as the race for design excellence.

This comprehensive view confirms the luxury handbags market is vibrant, highly strategic, and deeply influenced by global economic forces, technological disruptions, and evolving ethical consumer mandates. Strategic investment in digital capabilities, sustainability, and targeted geographical expansion, particularly in APAC, are non-negotiable prerequisites for sustained success and market leadership over the forecast period.

The Luxury Handbags Market operates within a hyper-competitive ecosystem where maintaining strong brand narratives and consistent quality is non-negotiable. Price elasticity, while low for iconic, heritage items among the ultra-rich, becomes more significant in the accessible luxury segment, requiring meticulous pricing strategies across different geographies to account for taxes, duties, and local consumer purchasing power parity. This intricate pricing architecture is often supported by advanced business intelligence software that tracks competitor pricing and promotional activities in real-time, ensuring competitive positioning without resorting to widespread discounting that could tarnish brand image.

Furthermore, the strategic recruitment and retention of highly skilled artisans and design talent is a hidden but crucial factor in the value chain. As the demand for bespoke and hand-finished items increases, the pool of master craftsmen capable of meeting the stringent quality standards of top luxury houses becomes a critical, scarce resource. Brands are increasingly investing in proprietary training academies and apprenticeship programs to secure this specialized labor pipeline, viewing it as a long-term investment in maintaining the authentic, high-quality production that justifies premium pricing.

In conclusion, the market's future vitality is assured by a combination of global wealth creation and cultural shifts that continue to prioritize personal expression and curated identity through luxury accessories. The strategic integration of technology, from AI-driven personalization to blockchain authentication, acts as a powerful catalyst, mitigating risks and unlocking new growth avenues across both physical and digital consumer touchpoints, solidifying the market's projected expansion through 2033.

The dynamic regulatory environment also shapes market behavior. Import and export tariffs, particularly concerning goods moved between manufacturing hubs (like Italy or France) and major consumption markets (like the US or China), directly affect retail pricing and profitability. Luxury conglomerates employ dedicated trade compliance teams to navigate these complexities, often influencing global sourcing decisions. Furthermore, legislation governing the use of exotic skins and endangered species has tightened considerably, leading many major brands to publicly announce restrictions or complete cessation of their use, pivoting resources instead toward innovative sustainable materials research and development.

The role of mergers and acquisitions (M&A) in the Luxury Handbags Market reflects a strategy of consolidation and diversification. Large conglomerates acquire smaller, niche luxury brands to instantly gain access to specialized design aesthetics, younger customer segments, and localized production expertise. This M&A activity is not just about scale, but about strategically controlling various price points and styles within the overall luxury hierarchy, maximizing market coverage and mitigating risks associated with single-brand dependence or rapidly shifting consumer tastes. This ensures that the market remains dominated by a few powerful entities capable of setting global trends and standards.

Finally, health and safety standards, particularly post-2020, have become integrated into the retail experience. Consumers expect clean, controlled environments, particularly in exclusive boutiques. Brands have responded by implementing highly controlled client appointments and private viewing sessions, ironically enhancing the sense of exclusivity and personalized service while adhering to modern health protocols. These subtle shifts in retail operations underscore the market's adaptability and commitment to maintaining a superior, high-touch consumer experience despite external pressures.

These detailed market features collectively underscore the maturity, resilience, and strategic complexity of the Luxury Handbags Market, providing a robust foundation for the projected financial growth figures and technological integration discussed throughout this report.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager