Luxury Outerwear Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441406 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Luxury Outerwear Market Size

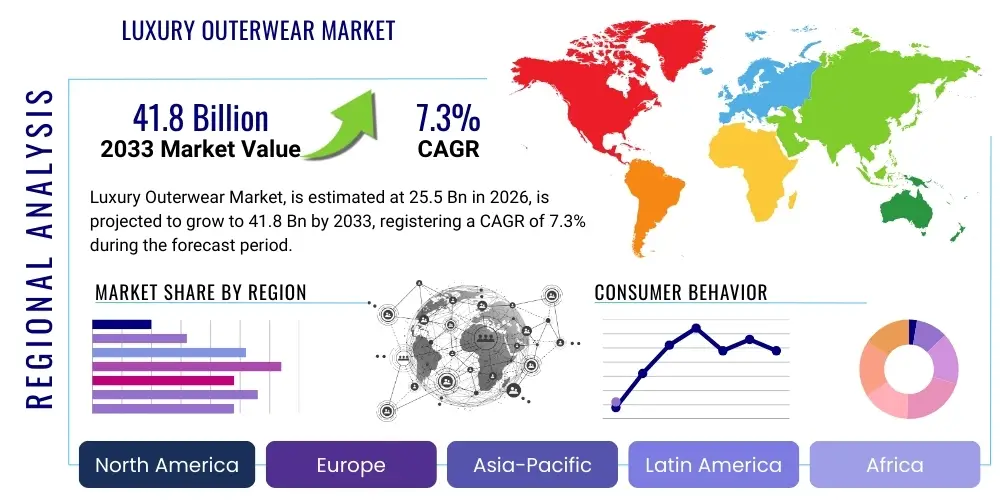

The Luxury Outerwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 41.8 Billion by the end of the forecast period in 2033.

Luxury Outerwear Market introduction

The Luxury Outerwear Market encompasses high-end apparel designed for protection against the elements, including coats, jackets, trenches, and parkas, characterized by premium materials, superior craftsmanship, and exclusive branding. These products are often seen as status symbols, blending functionality with high fashion aesthetics. The market is significantly driven by increasing disposable income among high-net-worth individuals (HNWIs) and the growing aspirational spending of the millennial and Gen Z populations globally. Key applications range from extreme weather protection (performance luxury) to urban fashion statements (lifestyle luxury).

The core proposition of luxury outerwear extends beyond mere utility; it involves sophisticated design, sustainable sourcing, and technological integration. Benefits include exceptional durability, timeless style, and exclusivity, which justify the high price point. The market is witnessing a strong trend towards "quiet luxury," where logo visibility is minimized in favor of quality and subtle branding, appealing to a consumer base seeking understated elegance and longevity in their investments. Furthermore, the convergence of athletic wear and luxury, known as athleisure, continues to drive innovation, particularly in materials offering lightweight warmth and multi-season functionality.

Major driving factors fueling market expansion include successful digital transformation by luxury brands, allowing them to reach global consumers through sophisticated e-commerce platforms and personalized virtual experiences. Additionally, climate change variability necessitates versatile and durable outerwear, enhancing consumer demand for multi-functional, high-performance garments. The influence of celebrity endorsements and fashion influencers on social media further amplifies brand visibility and desirability, particularly in fast-growing luxury markets in Asia Pacific.

Luxury Outerwear Market Executive Summary

The Luxury Outerwear Market is defined by intense competition, rapid digitalization, and a fundamental shift toward sustainability and ethical sourcing. Business trends indicate major luxury houses are consolidating their supply chains to ensure traceability and quality control, while simultaneously investing heavily in direct-to-consumer (DTC) channels to maximize margins and customer relationship management. Inventory management, optimized through predictive analytics and AI, is becoming crucial to minimize waste and ensure exclusivity. The rise of rental and resale platforms for luxury items also presents a duality, offering new revenue streams while potentially impacting full-price primary sales, forcing brands to emphasize product longevity and timeless design over fleeting trends.

Regional trends highlight the continued dominance of Europe and North America as centers for design innovation and high consumer spending, although the Asia Pacific region, particularly China and South Korea, exhibits the highest growth trajectory due to expanding middle and affluent classes. Brands are customizing collections to meet local cultural preferences, such as lighter, technical fabrics for warmer climates or emphasizing specific color palettes. In terms of segmental trends, the Jackets and Coats category remains the largest contributor, with down-filled outerwear (parkas and puffers) showing strong momentum, particularly in urban settings. The material segment is seeing a significant shift away from traditional furs toward high-quality vegan alternatives and recycled technical fibers, driven by consumer ethical mandates.

The market structure is becoming increasingly polarized, with established heritage brands leveraging their legacy and emerging niche brands disrupting the space with innovative, often sustainable, micro-collections. Success in this environment requires seamless integration of the physical and digital shopping experience (omnichannel retailing), hyper-personalized marketing strategies, and verifiable transparency in manufacturing processes. The next few years will see increased mergers and acquisitions as larger conglomerates seek to acquire specialized talent and innovative textile technologies, solidifying their dominance across diverse product offerings and geographic footprints.

AI Impact Analysis on Luxury Outerwear Market

User inquiries regarding AI's impact on luxury outerwear overwhelmingly revolve around three core themes: customization and personalization at scale, optimizing volatile supply chains, and combating counterfeiting. Consumers are particularly keen on understanding how AI facilitates designing unique, tailored garments (predictive design based on regional climate and personal style data) and how it improves the shopping experience through virtual try-ons and sophisticated recommendation engines. Luxury brands, conversely, are focused on using AI to forecast demand accurately—a critical need given the long lead times and high inventory costs associated with premium materials—and employing machine learning algorithms for enhanced quality control in manufacturing.

AI is fundamentally transforming the design-to-delivery lifecycle of luxury outerwear. Machine learning models analyze vast datasets of fashion trends, social media sentiment, sales history, and material performance to inform design teams, allowing for the creation of collections that are highly optimized for specific target markets weeks or months ahead of traditional trend forecasting cycles. This predictive capability significantly reduces the risk of overproduction and markdowns, maintaining the perceived value and exclusivity inherent to luxury goods. Furthermore, AI-powered chatbots and virtual assistants provide 24/7 personalized concierge services, enhancing customer engagement and loyalty, especially among digitally native luxury consumers.

The operational integration of AI extends deep into manufacturing and authentication. Computer vision systems are being deployed to inspect stitching, fabric integrity, and color consistency during production with microscopic precision, far surpassing human capabilities in ensuring flawless luxury quality. Crucially, blockchain integrated with AI tagging is emerging as the definitive solution for verifying authenticity. Every garment can be tracked from raw material sourcing through to the final sale, providing consumers with undeniable proof of origin and protecting brand integrity against the pervasive threat of high-quality replicas.

- AI-driven predictive demand forecasting minimizes overstock and waste, upholding brand exclusivity.

- Generative AI assists designers in creating hyper-personalized silhouettes and material combinations based on climatic and style data.

- Computer vision and machine learning enhance quality control, identifying manufacturing defects invisible to the human eye.

- AI-powered virtual try-on tools improve the e-commerce conversion rate and reduce returns.

- Blockchain and AI tagging provide verifiable digital authenticity certificates, mitigating counterfeiting risks.

- Dynamic pricing optimization based on real-time inventory and competitive analysis.

- Personalized marketing campaigns delivered through AI-driven customer segmentation tools.

DRO & Impact Forces Of Luxury Outerwear Market

The market dynamics are governed by a complex interplay of forces. Key drivers include the escalating global population of high-net-worth and ultra-high-net-worth individuals, particularly across Asia, who view luxury outerwear as essential components of their personal branding and lifestyle investment portfolio. Simultaneously, the accelerating consumer focus on product longevity, durability, and verifiable ethical sourcing compels brands to innovate in material science and transparency, creating a positive feedback loop for high-quality, high-priced luxury goods. Restraints primarily involve the high production costs associated with premium, sustainable materials and meticulous craftsmanship, which maintain high entry barriers for new brands. Economic volatility and inflation in key consumer markets can temporarily dampen discretionary spending on ultra-luxury items, forcing consumers to defer purchases. The pervasive issue of intellectual property infringement and counterfeiting, particularly sophisticated online replicas, continues to erode brand trust and market share.

Opportunities for significant growth are centered around the untapped potential of performance luxury, where technical outerwear optimized for extreme sports or urban mobility meets high fashion standards. This fusion attracts younger, active consumers willing to pay a premium for technologically advanced fabrics and ergonomic design. The expansion of e-commerce channels, particularly through optimized mobile interfaces and social commerce integration, provides unprecedented access to consumers in geographically dispersed secondary and tertiary markets. Furthermore, developing robust circular economy models—including branded repair services, certified resale programs, and garment recycling—appeals directly to the environmentally conscious luxury buyer, generating new avenues for sustainable revenue growth and enhanced brand perception.

Impact forces acting on the market are multifaceted, encompassing macroeconomic shifts and technological disruption. Geopolitical stability directly affects consumer confidence and luxury tourism, a critical component of high-end retail sales. Technological advancements in sustainable materials (e.g., bio-fabricated textiles, recycled carbon fibers) pressure traditional suppliers to adapt or risk obsolescence. The strongest impact force remains changing consumer demographics, where Gen Z demands immediate value, transparent supply chains, and experiential retail, necessitating rapid adaptation in branding and distribution strategies. Ultimately, the successful navigation of these forces determines long-term brand equity and market leadership in the highly competitive luxury sector.

Segmentation Analysis

The Luxury Outerwear Market is meticulously segmented based on product type, material, end-user, and distribution channel, reflecting the diverse needs and preferences of affluent consumers globally. Product segmentation reveals that specialized categories like Parkas and Down Jackets often lead in value due to complex manufacturing and high material costs (e.g., premium down insulation or advanced GORE-TEX membranes), driven by both necessity in colder climates and their emergence as high-fashion staples. Conversely, Leather and Fur/Faux Fur garments, though cyclical, maintain their position as investment pieces, demanding exceptional quality control and ethical sourcing verification.

Segmentation by material is crucial, highlighting the market's migration from traditional, potentially controversial materials towards sustainable and high-tech alternatives. Technical fabrics, including proprietary water-resistant and breathable textiles developed through material science, are gaining share rapidly as functionality becomes synonymous with modern luxury. Distribution channel analysis confirms that flagship brand stores and specialized luxury multi-brand boutiques still hold substantial sway, offering the critical immersive, personalized service required for high-value transactions. However, the online channel is the fastest-growing segment, propelled by investments in high-resolution visualization, personalized stylist services, and global logistical excellence, allowing brands to bypass geographical limitations.

End-user segmentation clearly delineates between Men's, Women's, and Unisex/Gender-Neutral collections. The Women’s segment traditionally commands a larger market share due to a wider variety of styles and season-specific purchasing habits, while the Men's segment is rapidly increasing, particularly in performance-driven luxury jackets and tailored coats suitable for professional environments. The increasing adoption of gender-neutral designs by high-fashion houses reflects a shift in consumer identity and further complicates traditional segmentation, forcing brands to focus more intensely on individual style profiles rather than binary gender categories.

- By Product Type:

- Coats (Trench Coats, Tailored Coats, Overcoats)

- Jackets (Bomber Jackets, Biker Jackets, Blazer Jackets)

- Vests and Gilets

- Parkas and Down Jackets

- Rainwear and Windbreakers

- By Material:

- Leather and Suede

- Wool and Cashmere

- Down and Feathers

- Technical/Synthetic Fabrics (GORE-TEX, Recycled Nylon, Proprietary Blends)

- Faux Fur and Sustainable Alternatives

- By End-User:

- Men

- Women

- Unisex/Gender-Neutral

- By Distribution Channel:

- Offline Retail (Brand Flagship Stores, Luxury Multi-brand Boutiques, Department Stores)

- Online Retail (E-commerce Portals, Brand Websites, Luxury Marketplaces)

Value Chain Analysis For Luxury Outerwear Market

The value chain for luxury outerwear is exceptionally complex and high-touch, commencing with meticulous upstream analysis focused on sourcing the rarest and highest quality raw materials. Upstream activities are dominated by specialized suppliers of premium materials such as ethically sourced cashmere, high-grade technical leathers, traceable high-fill power down, and advanced bio-based synthetic fibers. Relationships at this stage are often long-term and exclusive, revolving around verifying sustainability credentials and ensuring consistent, superior quality necessary for luxury branding. Given the consumer demand for transparency, traceability technology (like blockchain) is increasingly integrated at the raw material stage to document origin and processing methods.

The downstream segment involves manufacturing, assembly, distribution, and retail. Manufacturing typically takes place in specialized facilities known for expert craftsmanship, often concentrated in Italy, France, or specific regions renowned for technical textile work. This stage demands skilled labor, precise stitching, and complex assembly processes, resulting in high unit costs. Distribution channels are highly controlled; direct channels, via brand-owned boutiques and e-commerce platforms, are increasingly prioritized as they offer maximum control over branding, customer experience, and pricing integrity. Indirect channels, such as select luxury department stores and authorized retailers, are carefully managed to maintain brand exclusivity and prevent parallel imports.

The distinction between direct and indirect distribution significantly impacts margin realization and customer relationship management. Direct channels allow for real-time customer data collection, enabling personalized marketing and superior after-sales services, which are critical for luxury retention. Indirect distribution extends market reach but requires careful negotiation regarding merchandising, store presentation, and sales training to ensure the retailer upholds the luxury brand’s image. Overall, the value chain is characterized by a relentless focus on quality checkpoints, ethical compliance, and investment in sophisticated logistics to handle high-value, temperature-sensitive goods, ensuring the product maintains its pristine condition from atelier to customer wardrobe.

Luxury Outerwear Market Potential Customers

Potential customers for the Luxury Outerwear Market are diverse yet share a common characteristic: high discretionary income and a prioritization of quality, status, and longevity over price. The primary demographic includes High Net Worth Individuals (HNWIs) and Ultra-HNWIs, who purchase luxury outerwear as staple investment pieces, prioritizing timeless design, bespoke tailoring, and rare materials. For these end-users, the purchase is often driven by exclusivity and the desire for verifiable provenance, making brands with a strong heritage and proven craftsmanship highly desirable. They represent the most stable segment, often purchasing multiple high-value items seasonally.

A rapidly expanding segment consists of aspirational consumers, particularly millennials and Gen Z in emerging economies. These buyers may save specifically for one significant luxury outerwear piece—often a down jacket or a trendy, branded parka—which serves as a potent status symbol and entry point into the luxury lifestyle. Their purchasing decisions are heavily influenced by social media trends, celebrity collaborations, and the brand's alignment with social and environmental values. This group demands dynamic digital engagement, seamless online shopping experiences, and clear communication regarding sustainability efforts.

Furthermore, the market serves specialized niches, including professionals and enthusiasts in cold climate regions or those requiring high-performance gear (performance luxury). These buyers prioritize technical specifications, thermal regulation, and durability, often viewing the purchase as a critical functional investment, though they still expect impeccable design. Brands targeting this segment must excel in material innovation and verifiable performance metrics. Overall, successful engagement requires understanding the varying motivations—from investment and status to performance and ethical alignment—across these distinct customer profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 41.8 Billion |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH (Moncler, Fendi, Dior), Kering (Balenciaga, Gucci), Prada S.p.A., Canada Goose, Burberry Group PLC, Hermès International, Brunello Cucinelli, The North Face (VF Corp), Zegna Group, Ralph Lauren Corporation, Stone Island, Mackage, Bogner, Moose Knuckles, Arc'teryx, Woolrich International, Valentino, Loro Piana, Max Mara, Giorgio Armani |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Luxury Outerwear Market Key Technology Landscape

The Luxury Outerwear Market is characterized by the strategic adoption of advanced material science and digital technology to enhance product functionality, sustainability, and consumer experience. Material innovation centers heavily on developing high-performance, lightweight technical fabrics that offer superior thermal regulation, breathability, and water resistance without compromising on tactile luxury feel. Key technologies include proprietary bonding techniques for seam sealing, advanced membrane technology (like GORE-TEX and its high-end competitors), and bio-fabricated materials such as vegan leather alternatives derived from fruit waste or mycelium. Furthermore, the push for circularity necessitates the use of traceable recycled nylon and polyester made from ocean plastic, often utilizing chemical recycling methods to maintain fiber quality comparable to virgin materials.

Beyond the physical product, digital technologies are redefining manufacturing and retail. Three-dimensional (3D) body scanning and digital pattern-making software are utilized to achieve unparalleled precision in bespoke and made-to-measure outerwear, significantly reducing production waste and speeding up sampling cycles. In retail, Augmented Reality (AR) and Virtual Reality (VR) tools, particularly in mobile applications, enable customers to virtually try on high-value garments before purchase, offering a bridge between the convenience of e-commerce and the necessary tactile reassurance of luxury shopping. This digital integration improves customer confidence and dramatically lowers the return rate associated with online luxury apparel sales.

Crucially, technology serves as the backbone for establishing trust and authenticity. The implementation of near-field communication (NFC) chips or quick response (QR) codes linked to blockchain ledgers is becoming standard practice. When scanned, these embedded technologies provide the consumer with an immutable record of the garment’s entire history—from the source of the raw materials and ethical manufacturing location to care instructions and warranty details. This technical transparency satisfies the modern luxury consumer's demand for full disclosure and serves as a powerful defense mechanism against the increasingly sophisticated global counterfeiting industry, thereby preserving the brand's core value proposition.

Regional Highlights

The global Luxury Outerwear Market exhibits distinct purchasing behaviors and growth patterns across major regions, necessitating tailored strategies from global brands.

- North America: This region is a powerhouse for performance luxury and fashion-forward utility. Driven by severe seasonal weather and a culture of casual affluence, the market demands products that fuse technical functionality (e.g., advanced weatherproofing, durability) with cutting-edge design. Brands originating here, and those successfully adapting, focus heavily on innovation in sustainable materials and robust digital marketing. The US market, in particular, shows strong affinity for high-quality down parkas and technical shell jackets that transition easily from outdoor activities to urban environments. Significant growth is sustained by a high concentration of affluent consumers and a well-developed e-commerce infrastructure supporting quick, high-value transactions.

- Europe: As the historic cradle of luxury fashion, Europe remains critical for maintaining brand heritage and perceived value. The market here is segmented, with Western Europe (France, Italy, UK) emphasizing classic tailoring, high-grade wools, cashmere coats, and artisan craftsmanship. Brands leverage their centuries-old reputations for quality and exclusivity. However, the region is also leading in ethical luxury, with stringent consumer expectations regarding labor standards and environmental impact. Retail is highly reliant on flagship stores and specialized boutiques, ensuring a meticulous physical brand experience.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rising disposable incomes in Mainland China, South Korea, and Japan. Chinese consumers, especially the younger Gen Z and millennial cohorts, are major drivers, often seeking bold, branded outerwear that signals success and aligns with rapidly changing fashion micro-trends. The demand is massive for technical outerwear that suits dense urban living. E-commerce platforms and social media campaigns are the dominant methods of market penetration, necessitating heavy investment in digital infrastructure. South Korea stands out for its deep integration of high fashion with tech, promoting high-end streetwear outerwear and collaborative designer pieces.

- Latin America, Middle East, and Africa (LAMEA): This region presents varied opportunities. The Middle East, especially the UAE and Saudi Arabia, shows high demand for ultra-luxury, high-statement outerwear, often purchased year-round for international travel or display, regardless of local climate. Purchases are generally concentrated among the ultra-HNW segment. Latin America presents a challenging but growing market, constrained by economic volatility but showing strong aspirational buying, focusing on accessible luxury segments and international brand recognition. Retail tends to be concentrated in major cosmopolitan centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Luxury Outerwear Market.- LVMH Moët Hennessy Louis Vuitton SE (Dior, Fendi)

- Kering SA (Gucci, Balenciaga)

- Prada S.p.A.

- Canada Goose Holdings Inc.

- Burberry Group PLC

- Hermès International SCA

- Moncler S.p.A.

- Brunello Cucinelli S.p.A.

- The North Face (VF Corporation)

- Zegna Group

- Ralph Lauren Corporation

- Stone Island (owned by Moncler)

- Mackage

- Bogner

- Moose Knuckles

- Arc'teryx (Amer Sports)

- Woolrich International

- Valentino S.p.A.

- Loro Piana S.p.A. (LVMH)

- Max Mara Fashion Group

Frequently Asked Questions

Analyze common user questions about the Luxury Outerwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards sustainable materials in luxury outerwear?

The shift is primarily driven by heightened consumer awareness regarding climate change and ethical production. High-net-worth consumers, particularly Gen Z and millennials, increasingly demand verifiable transparency, traceable sourcing (e.g., non-mulesing wool, recycled textiles), and circularity initiatives, pressuring brands to adopt bio-based and recycled high-performance fabrics.

How is AI impacting the customization and design process in luxury outerwear?

AI facilitates hyper-customization by analyzing vast datasets of regional climate conditions, material performance, and personalized style preferences. This allows brands to offer made-to-order services, predict niche trend demands, and optimize design efficiency, minimizing material waste and ensuring products meet individual customer specifications precisely.

What are the primary differences between luxury performance outerwear and traditional luxury outerwear?

Traditional luxury outerwear focuses on aesthetic appeal, heritage materials (cashmere, premium wool), and craftsmanship for social status. Performance luxury, conversely, prioritizes technical functionality, using advanced synthetic or hybrid fabrics (e.g., GORE-TEX) for superior thermal regulation, lightness, and weather resistance, blending high-tech utility with high fashion design.

Which geographic region presents the most significant growth opportunity for luxury outerwear brands?

The Asia Pacific (APAC) region, particularly Mainland China and South Korea, offers the highest growth opportunity. This is attributed to rapid urbanization, the exponential growth of the affluent middle class, and high aspirational spending on global luxury brands, supported by robust digital consumption channels.

What role does blockchain technology play in preserving brand integrity in the luxury outerwear market?

Blockchain provides an immutable digital ledger for tracking a garment’s entire lifecycle, from raw material sourcing to final sale. This transparency verifies the product's authenticity, protects against counterfeiting, and assures the customer of ethical sourcing and production standards, safeguarding the brand's reputation and premium value.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager