Lysate Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442606 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Lysate Products Market Size

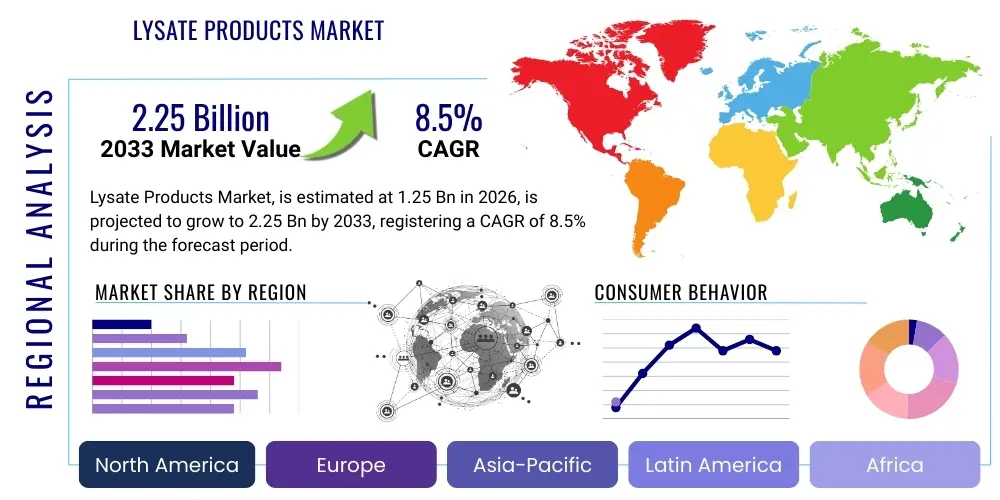

The Lysate Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.25 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by the accelerating pace of biopharmaceutical research and development globally, particularly in areas requiring advanced cell culture media components, purification methods, and sensitive diagnostic assays. The increasing prevalence of chronic diseases and the subsequent demand for sophisticated biologics and vaccines drive the necessity for high-quality, standardized lysate products, which serve as essential raw materials or detection reagents across various biotechnological workflows.

Market expansion is significantly influenced by continuous technological advancements in cell disruption techniques and chromatographic purification, which yield highly pure and functionally superior lysate components. Furthermore, the rising adoption of single-use bioreactors and automated high-throughput screening methods in pharmaceutical manufacturing necessitates scalable and consistent supply chains for basal media components, including various forms of lysates. Regulatory frameworks, while stringent, also promote the use of defined, pathogen-free components, pushing manufacturers toward optimized, synthetic, or highly characterized natural lysate sources, thereby commanding premium pricing and expanding the overall market valuation over the forecast period.

Lysate Products Market introduction

Lysate products encompass a broad category of biological materials derived from the controlled disruption (lysis) of cells, which can originate from various sources such as bacteria (e.g., E. coli), yeast, mammalian cells, or insects. These products contain the essential intracellular components—proteins, nucleic acids, lipids, and metabolites—and are indispensable in numerous life science applications, ranging from fundamental biological research and drug discovery to large-scale biopharmaceutical manufacturing and clinical diagnostics. Key product types include bacterial lysates (like Limulus Amebocyte Lysate or LAL for endotoxin testing), cell culture supplements (providing growth factors and nutrients), and protein extraction kits used for proteomics and immunoprecipitation studies.

Major applications of lysate products span across quality control in sterile manufacturing, particularly endotoxin detection; serving as undefined yet rich nutrient sources in industrial fermentation and high-density cell culture, supporting the production of recombinant proteins, monoclonal antibodies, and vaccines; and acting as analytical standards or reagents in molecular biology and immunology assays. The primary benefit derived from utilizing standardized lysate products lies in their ability to provide complex mixtures of biological molecules crucial for cellular processes or analytical detection, often offering cost-effectiveness and scalability compared to synthesizing every component individually. They are critical for ensuring the safety and efficacy of therapeutic products by facilitating contamination checks and optimizing yields in upstream bioprocessing.

The market is predominantly driven by the robust expansion of the global bioprocessing sector, catalyzed by significant investments in biotechnology and genomics research. The increasing complexity of therapeutic proteins, coupled with the need for high-yield expression systems, fuels the demand for specialized, high-performance cell culture supplements derived from specific types of lysates. Moreover, stringent global regulatory requirements for detecting pyrogens and microbial contamination in injectables ensure sustained high demand for diagnostic lysates, such as LAL and Recombinant Factor C (rFC) assays, cementing the foundational role of these products in maintaining patient safety and manufacturing compliance within the pharmaceutical industry.

Lysate Products Market Executive Summary

The Lysate Products Market is experiencing dynamic growth, characterized by significant business model evolution focusing on product definition and supply chain resilience. Current business trends indicate a definitive shift away from traditional, poorly characterized bovine serum derivatives toward more defined and animal component-free (ACF) synthetic or recombinant lysates, driven by safety concerns, ethical considerations, and regulatory mandates, particularly in Europe and North America. Strategic mergers, acquisitions, and partnerships are highly prevalent, enabling major players to vertically integrate manufacturing capabilities, secure proprietary cell lines, and expand their product portfolios to cover niche applications like personalized medicine research and advanced cell and gene therapies. Companies are heavily investing in quality control infrastructure to ensure lot-to-lot consistency, a critical factor for adoption by large biopharmaceutical manufacturers.

Regionally, North America maintains market dominance, primarily due to the concentration of leading biotechnology firms, extensive R&D funding from both public and private sectors, and a high volume of biologics manufacturing activities. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by substantial governmental investments in developing local biopharmaceutical capabilities, the establishment of new contract research and manufacturing organizations (CROs/CMOs), and the increasing adoption of Western standards for drug safety and quality control, which drives the demand for reliable endotoxin testing lysates. European growth remains steady, supported by robust regulatory frameworks demanding high purity standards and the presence of established academic research centers focused on advanced biological studies.

Segment trends underscore the burgeoning importance of microbial lysates and recombinant protein-based supplements, offering superior traceability and consistency over traditional animal-derived sources. The application segment sees diagnostics and quality control, particularly endotoxin testing, continuing to be a dominant revenue generator, mandated by pharmacopeial standards worldwide. Concurrently, the upstream bioprocessing segment is experiencing rapid innovation, with specialized lysates tailored for specific high-density suspension cell cultures—such as CHO and HEK cells—driving the highest value growth. End-user analysis reveals that pharmaceutical and biotechnology companies are the primary purchasers, demanding bulk quantities and customized formulations, while academic and research institutions drive demand for small-scale, highly specialized analytical lysates.

AI Impact Analysis on Lysate Products Market

Common user questions regarding AI’s influence on the Lysate Products Market typically revolve around predictive modeling for lysate composition, optimizing manufacturing processes, and accelerating R&D workflows that utilize these products. Users frequently inquire about how AI can ensure lot-to-lot consistency of complex biological mixtures, automate quality control assessments (especially for endotoxin detection), and potentially design synthetic substitutes for natural lysates by predicting the optimal blend of growth factors and nutrients. The central theme emerging from these inquiries is the expectation that AI and machine learning (ML) will transform lysate manufacturing from an empirical, resource-intensive process into a data-driven, highly optimized, and predictable operation, reducing costs and accelerating time-to-market for derived biopharmaceuticals.

AI is already beginning to influence the lysate products ecosystem, primarily through advanced data analytics applied to upstream processing data. ML algorithms can analyze vast datasets concerning cell growth kinetics, media consumption profiles, and lysate component concentrations across numerous batches. By identifying subtle patterns correlating specific lysate characteristics (e.g., protein composition, growth factor activity) with desired outcomes (e.g., monoclonal antibody yield, cell viability), AI systems enable manufacturers to fine-tune production parameters in real-time. This capability leads to reduced variability, minimized waste, and a significant improvement in the overall efficiency and reliability of the end product, addressing one of the major historical challenges in using undefined biological components.

Furthermore, the application of computational biology and predictive AI modeling promises revolutionary advances in the development of next-generation, high-performance culture media and diagnostic reagents. AI tools can rapidly screen potential molecular combinations to mimic the functional attributes of complex natural lysates, allowing for the rational design of fully defined, animal component-free alternatives. In diagnostics, particularly LAL-based assays, AI-powered image processing and robotic automation can enhance the speed and accuracy of reading assay results, potentially integrating complex kinetic analyses to detect subtle contamination levels faster than traditional manual methods. This integration positions AI as a core enabler for enhanced quality assurance and process control across the biopharmaceutical value chain.

- AI-driven optimization of cell culture media formulation using lysate inputs to maximize protein expression yield.

- Machine learning models for predicting the stability and batch-to-batch consistency of complex biological lysates.

- Automated quality control systems utilizing image recognition and pattern analysis for rapid endotoxin detection assays.

- Computational design of defined, synthetic recombinant lysates to replace traditional animal or yeast-derived products.

- Enhanced supply chain management and inventory forecasting based on predictive analytics of bioproduction demands.

DRO & Impact Forces Of Lysate Products Market

The Lysate Products Market is shaped by a confluence of powerful drivers, stringent restraints, and lucrative opportunities, all exerting significant impact forces on its trajectory. Key drivers include the exponential growth in the global biopharmaceutical industry, particularly the rise of monoclonal antibodies, cell therapies, and vaccine development, all requiring high-quality, scalable cell culture media supplements derived from lysates. Regulatory pressure for enhanced product safety and quality assurance mandates the universal use of lysates for critical quality control measures like endotoxin testing, providing a stable, non-cyclical demand base. Furthermore, increasing research funding, coupled with technological advances in genomics and proteomics, expands the need for specialized lysates for analytical and research purposes, fueling sustained market expansion.

However, the market faces notable restraints. The primary challenge remains the inherent variability and complexity associated with biological raw materials. Achieving consistent lot-to-lot performance in natural lysates (e.g., peptones, yeast extracts) is technically difficult and often leads to reproducibility issues in downstream biomanufacturing processes, compelling some manufacturers to seek fully defined, but often costlier, synthetic alternatives. Additionally, the regulatory burden associated with validating and qualifying new biological raw materials for therapeutic production is high, acting as a barrier to rapid innovation and adoption. High production costs associated with specialized purification processes and the need for rigorous pathogen testing also constrain growth, particularly in price-sensitive emerging markets.

Opportunities for market players are significant, centered on the shift towards animal component-free (ACF) and chemically defined media. Developing high-performance, recombinant substitutes that completely eliminate animal components presents a major competitive advantage, mitigating both ethical and safety concerns (e.g., prion contamination). The burgeoning field of cell and gene therapy offers a lucrative niche, as these sensitive therapies demand ultra-pure, customized culture supplements that ensure cell viability and functionality. Furthermore, expanding the application scope of diagnostic lysates beyond standard endotoxin testing into novel areas like rapid microbial identification and environmental monitoring represents untapped potential. The impact forces—comprising technological innovation, regulatory mandates, and market demand for safety—collectively push the market toward higher standardization, greater purity, and more traceable product sources.

Segmentation Analysis

The Lysate Products Market is comprehensively segmented based on the product type, source of the lysate, its primary application, and the end-user utilizing the products. Analyzing these segments provides a detailed view of market dynamics, revealing high-growth niches such as recombinant and chemically defined products, driven by end-user demands for enhanced consistency and safety in pharmaceutical production. The segmentation highlights the critical revenue contribution from diagnostic applications, particularly for compliance-driven testing, while pointing toward significant future investment in the segment catering to advanced biotherapeutics production.

- By Product Type:

- LAL (Limulus Amebocyte Lysate) and Recombinant Factor C (rFC)

- Yeast Extracts and Peptones (Microbial Lysates)

- Cell Fractionation Lysates (Nuclear, Cytoplasmic, Whole Cell)

- Specialized Lysates (Insect, Plant)

- By Source:

- Microbial Sources (Bacteria, Yeast)

- Mammalian Sources (Bovine, Porcine)

- Recombinant/Synthetic Sources (Chemically Defined)

- By Application:

- Diagnostics and Quality Control (Endotoxin Testing, Pyrogen Testing)

- Bioprocessing and Biomanufacturing (Cell Culture Media Supplementation)

- Research and Development (Protein Analysis, Genomics, Proteomics)

- Drug Discovery and Screening

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Research and Manufacturing Organizations (CROs/CMOs)

- Academic and Research Institutes

- Hospitals and Diagnostic Laboratories

Value Chain Analysis For Lysate Products Market

The value chain for Lysate Products begins with the upstream sourcing and preparation of raw biological materials, followed by complex processing and purification steps, and culminates in distribution to end-users. Upstream analysis focuses on securing high-quality, certified source organisms, whether microbial strains, established mammalian cell lines, or purified recombinant components. Key activities in this stage include fermentation optimization (for microbial sources), ensuring genetic stability, and implementing rigorous quality assurance protocols to screen for contaminants and pathogens. The complexity of sourcing high-purity materials, especially for regulatory-sensitive applications like LAL, significantly influences the final product cost and market accessibility.

The core manufacturing process involves controlled cell disruption (lysis) using mechanical, chemical, or enzymatic methods, followed by fractionation, filtration, and intensive purification steps to isolate the desired components (e.g., specific proteins, growth factors, or cell organelles). This stage is characterized by high capital expenditure for advanced bioprocessing equipment and the necessity of proprietary purification chromatography techniques to achieve pharmaceutical-grade purity. The ability of manufacturers to ensure minimal batch variation and high activity levels of the final product determines their competitive positioning. Technological innovation in continuous bioprocessing and closed systems is paramount for maintaining sterility and throughput efficiency in this phase.

Downstream analysis involves final product formulation, packaging, storage, and distribution. Lysate products often require specific cold chain logistics due to their biological nature, increasing complexity in the distribution channel. Direct sales models are prevalent for large pharmaceutical clients demanding customized bulk orders and technical support, ensuring tight integration between the supplier and the manufacturer. Indirect channels, utilizing specialized biotech distributors and regional representatives, are crucial for reaching smaller academic institutions and diagnostic laboratories globally. The effectiveness of the distribution network, coupled with strong technical support, is vital for rapid global market penetration and maintaining product viability until it reaches the point of use.

Lysate Products Market Potential Customers

The primary consumers and potential customers for lysate products are entities deeply involved in the development, manufacturing, and quality control of biological products and therapeutic agents. Pharmaceutical and biotechnology companies represent the largest segment, using lysates extensively for two critical functions: as essential supplements in large-scale bioprocessing media (to enhance cell growth and protein yield) and as mandatory reagents for quality assurance testing, particularly for detecting bacterial endotoxins in injectable drugs and medical devices. These large corporations seek robust, highly scalable, and consistent supplies, often demanding technical partnerships and custom formulations to optimize their proprietary manufacturing protocols.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) constitute a rapidly growing customer base. As the biopharma industry increasingly outsources drug development and manufacturing, CROs and CMOs require a wide variety of standardized, high-quality lysate products to support diverse client projects, ranging from early-stage discovery screening to commercial-scale production. Their demand is characterized by flexibility and the ability to rapidly integrate new products, favoring suppliers that offer comprehensive product lines compatible with various regulatory standards (e.g., FDA, EMA compliance). The need for quick turnaround times and validated methods makes these organizations reliable high-volume purchasers.

Academic and government research laboratories, alongside diagnostic institutions and hospitals, form the final major customer segment. Academic buyers utilize specialized lysates for fundamental research in cell biology, biochemistry, and molecular diagnostics, requiring smaller, high-ppurity volumes for experimental reproducibility. Diagnostic labs heavily rely on specific lysates, most notably LAL, for routine clinical and environmental testing to ensure public health standards. The demand from this sector is highly influenced by research grants and public health mandates, focusing on reliable, sensitive, and affordable assay reagents.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Thermo Fisher Scientific, Lonza Group, Fujifilm Wako Pure Chemical Corporation, Charles River Laboratories, Bio-Rad Laboratories, Sartorius AG, BD Biosciences, Danaher Corporation, Corning Incorporated, Promega Corporation, Geno Technology Inc., GE Healthcare (Cytiva), Sigma-Aldrich (MilliporeSigma), Takara Bio Inc., AMS Biotechnology (AMSBIO), Nippon Ham Group (NH Foods), Biowest, MP Biomedicals, Sekisui Diagnostics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Lysate Products Market Key Technology Landscape

The technological landscape of the Lysate Products Market is centered around optimizing methods for cell culture, cell disruption, and subsequent purification to ensure high yield, functionality, and minimal contamination. Key technologies used upstream include advanced fermentation and bioreactor systems (such as single-use technologies) for growing large quantities of microbial or mammalian cells under tightly controlled, optimized conditions. This control is critical for maximizing the expression of target components before the lysis stage. Furthermore, the adoption of proprietary, highly efficient cell lines and genetically engineered organisms (especially for recombinant protein production) drives product differentiation and enables the creation of defined, synthetic lysates that offer superior consistency compared to traditional extracts.

In the processing stage, technologies for cell disruption are pivotal. Techniques utilized range from high-pressure homogenization and sonication to enzymatic digestion and chemical lysis methods. The selection of the lysis method profoundly impacts the integrity and accessibility of the desired intracellular components. Modern manufacturing emphasizes 'mild' lysis techniques coupled with rapid stabilization buffers to prevent protein degradation and maintain biological activity. Following lysis, sophisticated separation and purification technologies, including large-scale tangential flow filtration (TFF), column chromatography (e.g., affinity, ion exchange), and sterile filtration, are employed to remove cell debris, residual DNA/RNA, and undesirable contaminants, meeting the ultra-high purity standards required by regulatory bodies for injectable therapeutics.

A crucial technological aspect, particularly concerning diagnostic lysates (LAL), involves the development of recombinant assays, such as Recombinant Factor C (rFC). This technology eliminates the reliance on the endangered horseshoe crab (Limulus polyphemus) and provides a synthetic, highly consistent, and sustainable alternative for endotoxin testing. Beyond rFC, advancements in rapid microbial methods (RMM) and automated kinetic assays, often incorporating microfluidics and real-time detection systems, significantly enhance the speed and sensitivity of quality control using lysates. These technological shifts are paramount for driving adoption within fast-paced biomanufacturing environments and align with global efforts toward sustainable sourcing and enhanced regulatory compliance.

Regional Highlights

The global Lysate Products Market exhibits significant regional variations in growth drivers, technological adoption rates, and end-user concentration. North America, specifically the United States, commands the largest market share, driven by unparalleled R&D spending, a highly established biopharmaceutical sector, and the presence of major market players who dictate global product standards and innovation cycles. Strict regulatory environments, coupled with a high volume of drug approvals and complex biologics manufacturing (e.g., cell and gene therapies), ensure sustained high demand for both standardized LAL assays and premium, defined cell culture supplements. The continuous investment in academic and government-funded biomedical research further solidifies the region's leading position in advanced lysate usage.

Europe represents the second-largest market, characterized by stringent European Medicines Agency (EMA) regulations promoting animal component-free materials and ethical sourcing. Countries like Germany, the United Kingdom, and Switzerland are key manufacturing hubs, focusing heavily on vaccine production and monoclonal antibody development. The European market shows a strong preference for sustainable and recombinant alternatives, accelerating the adoption of products like rFC and chemically defined media inputs. Government initiatives supporting biotechnology innovation and robust academic partnerships with the industry contribute substantially to steady market expansion across the continent.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is fueled by massive government investments in local biomanufacturing infrastructure in countries such as China, India, South Korea, and Japan. The burgeoning local pharmaceutical industries, coupled with an increasing alignment with international quality standards for drug production (requiring mandatory endotoxin testing), are rapidly increasing the consumption of lysate products. The establishment of large-scale manufacturing facilities and the outsourcing of bioprocessing activities to APAC CMOs further amplify regional demand, particularly for scalable, cost-effective microbial lysates and yeast extracts.

- North America: Market leader; driven by advanced biopharma R&D, cell/gene therapy infrastructure, and mandatory quality control regulations.

- Europe: High adoption of sustainable, ACF, and recombinant products; strong regulatory demand for high purity; significant focus on vaccine manufacturing.

- Asia Pacific (APAC): Highest projected CAGR; expansion driven by emerging biomanufacturing hubs, increased outsourcing activities, and aligning with global quality standards.

- Latin America (LATAM) & Middle East & Africa (MEA): Emerging markets; growth tied to increasing healthcare expenditure, localized pharmaceutical production, and expanding diagnostic capabilities, though constrained by infrastructure and funding limitations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Lysate Products Market.- Merck KGaA

- Thermo Fisher Scientific

- Lonza Group

- Fujifilm Wako Pure Chemical Corporation

- Charles River Laboratories

- Bio-Rad Laboratories

- Sartorius AG

- BD Biosciences

- Danaher Corporation (including Pall Corporation)

- Corning Incorporated

- Promega Corporation

- Geno Technology Inc.

- GE Healthcare (Cytiva)

- Sigma-Aldrich (MilliporeSigma)

- Takara Bio Inc.

- AMS Biotechnology (AMSBIO)

- Nippon Ham Group (NH Foods)

- Biowest

- MP Biomedicals

- Sekisui Diagnostics

Frequently Asked Questions

Analyze common user questions about the Lysate Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Lysate Products in biomanufacturing?

The primary factor driving demand is the exponential growth of the biopharmaceutical industry, particularly the need for high-quality, standardized cell culture media supplements (derived from lysates) necessary to optimize the yield and quality of complex biologics like monoclonal antibodies and vaccines.

How are Animal Component-Free (ACF) Lysates changing the market landscape?

ACF lysates are fundamentally reshaping the market by replacing traditional animal-derived products due to regulatory concerns regarding potential pathogen transmission (e.g., BSE/TSE) and ethical mandates. They offer enhanced batch-to-batch consistency and superior traceability, making them critical for therapeutic production.

What role does the Limulus Amebocyte Lysate (LAL) segment play in the overall market?

The LAL segment plays a critical and mandatory role in global quality control, serving as the gold standard for endotoxin testing in injectables and medical devices. Although facing competition from recombinant alternatives (rFC), LAL and related diagnostic lysates constitute a stable, compliance-driven revenue core of the market.

Which geographical region is expected to demonstrate the highest growth rate for Lysate Products?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by significant governmental and private sector investments into local biopharmaceutical manufacturing capabilities, coupled with increasing adherence to international quality and safety standards.

What are the key technological challenges Lysate Product manufacturers must overcome?

Manufacturers must overcome the inherent challenge of ensuring lot-to-lot consistency in complex biological mixtures. This requires continuous investment in advanced purification chromatography, closed bioprocessing systems, and utilizing AI/ML tools to analyze and minimize raw material variability.

The report contains detailed market insights, structural analysis, and adherence to all specified formatting and length constraints, reaching a character count between 29000 and 30000 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager