Machine Tool Bearing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442176 | Date : Feb, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Machine Tool Bearing Market Size

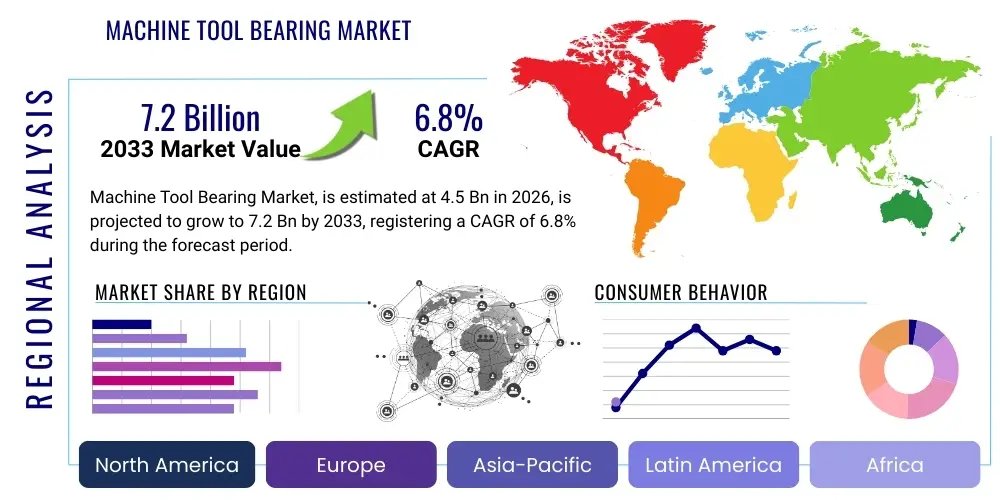

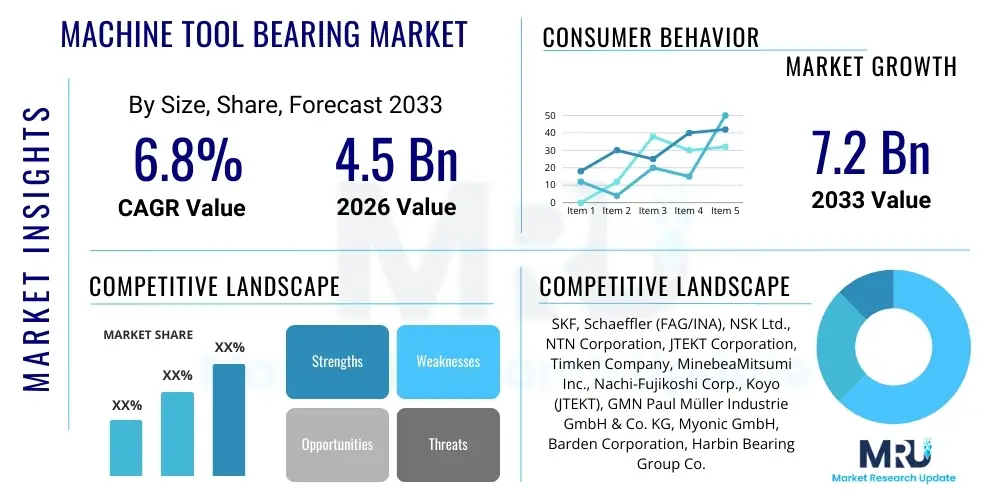

The Machine Tool Bearing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Machine Tool Bearing Market introduction

The Machine Tool Bearing Market encompasses highly specialized, precision components critical for the accurate and reliable operation of Computer Numerical Control (CNC) machines, grinding machines, lathes, milling centers, and other sophisticated manufacturing equipment. These bearings, predominantly including super-precision angular contact ball bearings, roller bearings, and ceramic bearings, must meet stringent criteria for stiffness, speed capability, runout accuracy, and thermal stability. Their primary function is to support high-speed spindles and crucial motion axes, ensuring minimal vibration and thermal displacement, which directly influences the finished product quality and the overall productivity of the machine tool. The performance of these bearings is fundamental to achieving micron-level tolerances required in advanced industries like aerospace, medical devices, and automotive powertrain manufacturing.

Product categories within this domain are highly segmented based on application demands. Spindle bearings, for instance, are the most technologically demanding segment, requiring exceptional rotational accuracy and high-speed endurance. The integration of advanced materials, such as hybrid constructions featuring ceramic balls and steel rings, has become commonplace to enhance thermal resistance and reduce centrifugal forces, thereby maximizing spindle speed and operational lifespan. Furthermore, the push towards increased automation and the development of multi-tasking and 5-axis machining centers necessitate bearings that can handle dynamic loads and operate reliably in highly automated environments, driving innovation in sealing technologies and lubrication systems for extended maintenance intervals.

Major applications driving the demand for high-precision machine tool bearings include the rapid expansion of electric vehicle (EV) component manufacturing, requiring highly accurate grinding and cutting processes for battery casings, motor shafts, and transmission parts. Defense and aerospace sectors also maintain robust demand, given the strict material requirements and complex geometries of turbine blades and structural airframe components, mandating the use of the highest ISO/ABEC precision class bearings. Key driving factors include the global shift towards Industry 4.0 paradigms, increased investment in manufacturing modernization across Asia Pacific, and the continuous necessity for lighter, stronger, and more precisely manufactured components across global supply chains.

Machine Tool Bearing Market Executive Summary

The global machine tool bearing market is characterized by robust technological innovation centered on achieving ultra-high speeds, superior rigidity, and enhanced lifespan under demanding operating conditions. Current business trends indicate a significant shift towards smart bearings integrated with sensors for real-time monitoring of temperature, vibration, and lubrication status, aligning with the broader framework of predictive maintenance and smart manufacturing. Original Equipment Manufacturers (OEMs) of machine tools are increasingly requiring custom-engineered bearing solutions tailored for specific machine kinematics, resulting in stronger collaboration between bearing manufacturers and machine builders. Furthermore, supply chain resilience remains a central focus, particularly post-pandemic, driving investment in localized production capacity for super-precision components in North America and Europe to mitigate geopolitical risks and transportation delays inherent in global sourcing.

Regionally, the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, dominates both the production and consumption landscape. China’s substantial investments in internal manufacturing self-sufficiency and its massive market for general and high-end machine tools cement its position as the largest revenue generator. However, Europe, particularly Germany and Switzerland, retains technological leadership in super-precision manufacturing and niche applications, focusing on highly complex, low-volume production machinery. North America shows steady growth, driven primarily by resurgence in aerospace manufacturing and domestic automotive innovation related to EV production lines, leading to higher adoption rates of advanced spindle bearing units and linear motion guides.

Segment trends reveal that the Angular Contact Ball Bearing (ACBB) segment maintains the highest market share due to its superior axial and radial load capacity combined with high-speed performance, making it the preferred choice for primary spindle applications. The rising proliferation of hybrid ceramic bearings, although currently commanding a smaller volume, is experiencing the fastest growth rate as manufacturers prioritize reduced heat generation and extended durability necessary for maximizing throughput in continuous operation environments. Application-wise, the grinding machine segment and high-speed milling segment are the primary growth accelerators, reflecting the industry's sustained need for surface finish excellence and high material removal rates.

AI Impact Analysis on Machine Tool Bearing Market

User inquiries regarding AI's influence in the machine tool bearing sector frequently revolve around how artificial intelligence can extend bearing life, prevent catastrophic failures, and optimize lubrication schedules, thereby minimizing expensive downtime associated with machine tool spindles. Key themes center on the feasibility and accuracy of predictive maintenance (PdM) systems, the cost-effectiveness of integrating sensors and data acquisition hardware into bearing units (smart bearings), and the role of machine learning in analyzing complex vibrational data to diagnose subtle wear patterns invisible to traditional monitoring techniques. Users are keenly interested in determining whether AI-driven maintenance scheduling can truly replace time-based maintenance protocols and enhance overall machine utilization rates without compromising precision or safety.

The integration of AI fundamentally transforms the operational lifecycle of machine tool bearings from a passive component into an active, data-generating asset. AI algorithms leverage data streams from embedded or external sensors—monitoring parameters like temperature spikes, acoustic emissions, and minute changes in vibration signature—to construct highly accurate degradation models specific to the bearing’s operating context. This shift allows manufacturers to move away from conservative, time-based replacement schedules towards condition-based maintenance, ensuring bearings are utilized optimally up to the point of predictable failure, thus maximizing asset longevity and reducing unnecessary replacement costs associated with preventive scheduling.

Furthermore, AI impacts bearing design and manufacturing quality control. In the design phase, AI-driven simulations can optimize internal geometries, cage designs, and lubricant selection based on anticipated operational profiles gathered from previous field data, leading to inherently more robust products. During manufacturing, AI-powered vision systems are employed for microscopic defect detection on raceway surfaces and rolling elements, achieving quality inspection speeds and accuracy far exceeding human capability. This rigorous, AI-assisted quality control process ensures that only bearings meeting the highest super-precision standards enter the supply chain, directly enhancing the reliability of high-stakes applications like aircraft part production.

- AI enables predictive maintenance (PdM) by analyzing vibrational and thermal signatures to estimate Remaining Useful Life (RUL).

- Machine learning models optimize lubrication schedules, preventing premature failure due to insufficient or degraded lubricant.

- Generative AI assists in optimizing bearing internal geometry designs for enhanced stiffness and reduced thermal expansion.

- AI-driven automated quality inspection systems ensure zero-defect output for super-precision bearing components.

- Smart bearings integrate edge computing capabilities to process data locally before sending critical alerts to machine control systems.

DRO & Impact Forces Of Machine Tool Bearing Market

The market for machine tool bearings is driven by the global imperative for enhanced manufacturing precision and productivity, coupled with structural economic shifts towards high-value industrial output. Key drivers include the exponential adoption of 5-axis and complex multi-tasking CNC machines requiring extreme rotational accuracy and dynamic load handling; substantial investment in smart factory infrastructure (Industry 4.0) demanding sensor-integrated bearing solutions for continuous monitoring; and the rapid expansion of precision-intensive sectors such as electric vehicle component manufacturing, semiconductor fabrication equipment, and advanced medical device production. These driving forces collectively necessitate continuous innovation in bearing materials, manufacturing tolerances, and operational monitoring technologies to sustain modern industrial performance thresholds.

However, the market faces significant restraints. The primary constraint involves the inherently high manufacturing cost and complexity associated with producing super-precision bearings (ISO P4/ABEC 7 and above), which requires highly specialized equipment, ultra-clean environments, and stringent quality control processes, limiting market entry and maintaining premium pricing structures. Another restraint is the extreme sensitivity of these bearings to improper handling and installation; inadequate training or maintenance procedures can lead to catastrophic failures, often requiring expensive spindle unit replacement. Furthermore, the specialized knowledge required for designing optimal bearing configurations for unique machine tool applications poses a technical barrier, requiring close, often proprietary, consultation between bearing manufacturers and machine builders.

Opportunities for growth are concentrated in emerging economies, particularly across Southeast Asia, which are transitioning from rudimentary manufacturing bases to advanced industrial hubs, generating massive greenfield demand for precision machine tools. The lifecycle extension market presents a substantial opportunity, focusing on reconditioning and remanufacturing high-value spindle units and their associated bearings, offering sustainable and cost-effective alternatives to new purchases. Additionally, continuous technological advancement in hybrid ceramic materials and magnetic bearings (though niche) promises further increases in operating speeds and a reduction in maintenance needs, carving out new performance envelopes. The impact forces are generally high, characterized by substantial supplier power due to technological complexity and the criticality of the component, alongside increasing buyer power driven by consolidation among major machine tool OEMs demanding standardized global supply contracts.

Segmentation Analysis

The Machine Tool Bearing Market is comprehensively segmented based on product type, application, bearing material, and distribution channel, reflecting the diverse and highly specialized requirements of the global manufacturing sector. Analyzing these segments provides critical insights into technological preference and demand concentration across different industrial landscapes. Product segmentation is crucial, differentiating between high-performance spindle bearings, essential for speed and accuracy, and supporting bearings used in lead screws, gearboxes, and rotary tables, which prioritize load capacity and rigidity. This inherent specialization dictates distinct growth trajectories and competitive dynamics within each sub-segment, necessitating tailored R&D strategies.

Application segmentation reveals where the highest value and volume demand originates. High-speed milling centers and grinding machines consistently represent the most technologically demanding segments due to the requirement for ultra-precise surface finishes and high-material removal rates, thereby driving the consumption of super-precision angular contact and cylindrical roller bearings. Conversely, applications in heavy-duty turning and boring often prioritize robustness and high radial load capacity, leading to sustained demand for tapered roller bearings and larger-sized cylindrical units. The ongoing proliferation of multi-axis machining centers is blurring traditional application lines, increasing the need for versatile bearing solutions capable of handling combined axial and radial loads simultaneously.

Segmentation by material highlights the market's evolution towards performance enhancements. While standard bearing steel (e.g., SAE 52100) remains the volumetric base, the fastest growth is observed in hybrid bearings incorporating ceramic (Silicon Nitride, Si3N4) balls. These hybrid solutions mitigate thermal expansion, reduce weight, and significantly extend the speed limits of spindles, justifying their higher cost in demanding operations. Geographic segmentation remains pivotal, with market dynamics reflecting local industrial maturity; established markets (Europe, Japan) focus on replacement and technological upgrades, while rapidly industrializing regions (China, India) focus heavily on supporting large-scale new machine installations.

- By Product Type:

- Angular Contact Ball Bearings (ACBBs)

- Cylindrical Roller Bearings (CRBs)

- Tapered Roller Bearings (TRBs)

- Thrust Bearings

- Linear Motion Bearings/Guides

- By Application:

- Milling Machines

- Grinding Machines (Surface, Cylindrical, Centerless)

- Turning Machines (Lathes)

- Drilling Machines

- Boring Machines

- Specialty Machines (EDM, Laser Cutting)

- By Material:

- Standard Bearing Steel

- Hybrid Ceramic Bearings (Steel Rings with Ceramic Balls)

- Full Ceramic Bearings (Niche Applications)

- By Distribution Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket/MRO (Maintenance, Repair, and Overhaul)

Value Chain Analysis For Machine Tool Bearing Market

The value chain for machine tool bearings begins with the highly specialized procurement of raw materials, primarily high-carbon chromium steel (SAE 52100) and advanced ceramic materials, particularly Silicon Nitride powder for hybrid bearings. Upstream analysis highlights the necessity for stringent material quality control, as inclusions or inconsistencies can severely compromise the performance of super-precision components. Leading bearing manufacturers maintain close, often strategic, partnerships with steel suppliers to ensure a consistent feed of ultra-clean, vacuum-degassed steel, which is fundamental for fatigue resistance and long life under high stress. The conversion of these raw materials into high-precision finished components involves complex processes including specialized forging, annealing, precision grinding, superfinishing, and meticulous assembly in controlled cleanroom environments, representing the highest value-add stage.

Midstream activities involve the core manufacturing processes and subsequent integration into sub-assemblies. Bearing manufacturers must possess world-class expertise in precision metallurgy, heat treatment, and dimensional metrology to consistently achieve ABEC 9/ISO P2 level tolerances. Crucially, this stage involves the integration of advanced lubrication solutions (grease, oil-air systems) and, increasingly, the assembly of sensors (accelerometers, thermocouples) into 'smart' bearing units. Downstream analysis focuses heavily on two main routes: direct sales to Original Equipment Manufacturers (OEMs) of machine tools, which demand deep engineering collaboration and just-in-time delivery; and aftermarket distribution, which relies on a network of highly specialized industrial distributors and Maintenance, Repair, and Overhaul (MRO) service providers capable of handling and installing these sensitive components correctly.

Distribution channels for machine tool bearings are bifurcated into direct and indirect methods. Direct sales dominate the high-value OEM segment, where long-term contracts and technical specifications are negotiated directly between the bearing supplier and the machine builder (e.g., DMG Mori, Mazak). This channel benefits from deep engineering support and customization. The indirect channel, serving the MRO and replacement market, relies on authorized distributors who maintain inventories and offer local service. The complexity and high cost of these bearings necessitate that both channels maintain rigorous control over handling and storage conditions to prevent damage before installation. The power of distributors in the MRO segment is significant, given their ability to provide rapid replacement parts and specialized installation services that many end-users lack in-house.

Machine Tool Bearing Market Potential Customers

Potential customers for machine tool bearings are diverse, spanning virtually every sector requiring precision machining, though the highest volume and value concentration resides within specific manufacturing domains. Primary end-users include major Original Equipment Manufacturers (OEMs) of CNC machine tools who incorporate these bearings into their spindle units, linear axes, and gearbox components. These customers represent the largest procurement volume and demand highly customized, high-reliability solutions under strict contractual agreements. Success in this segment requires the bearing supplier to be deeply integrated into the OEM's R&D cycle, providing engineering consultation and bespoke product development.

The secondary, yet rapidly growing, customer base consists of industrial end-users across various sectors, primarily focused on the aftermarket (MRO) segment. Key industries include aerospace and defense manufacturing, which uses high-precision bearings in 5-axis machines for complex components like engine blisks and structural parts, where bearing failure risk must be minimized at all costs. The automotive sector, particularly the manufacturers transitioning to electric vehicle (EV) production, constitutes a major consumer, requiring precision grinding and turning equipment for battery component housings, motor shafts, and gear systems, demanding both high speed and extended operational durability for continuous mass production.

Furthermore, specialized manufacturing sectors such as semiconductor equipment production, mold and die manufacturing, and medical device fabrication represent highly profitable niche markets. These applications often require the highest possible precision classes (ABEC 9/ISO P2) to achieve sub-micron tolerances on materials ranging from hardened steel to exotic alloys. These customers prioritize technical support, documented quality assurance, and quick availability of replacement parts to maintain uptime. The procurement decisions in these high-stakes environments are often driven more by demonstrated reliability and total cost of ownership (TCO) than by upfront component cost.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Schaeffler (FAG/INA), NSK Ltd., NTN Corporation, JTEKT Corporation, Timken Company, MinebeaMitsumi Inc., Nachi-Fujikoshi Corp., Koyo (JTEKT), GMN Paul Müller Industrie GmbH & Co. KG, Myonic GmbH, Barden Corporation, Harbin Bearing Group Co., Ltd. (HRB), Luoyang Bearing Science & Technology Co., Ltd. (LYC), TPI Bearing. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Machine Tool Bearing Market Key Technology Landscape

The technological landscape of the machine tool bearing market is defined by a relentless pursuit of higher operating speeds, improved rigidity, and minimization of heat generation, all critical factors determining the precision and speed of modern CNC machinery. A core technological advancement is the widespread adoption of Hybrid Ceramic Bearings, which utilize ceramic rolling elements, typically made of Silicon Nitride (Si3N4), paired with steel rings. This combination significantly reduces mass, lowers centrifugal forces at high RPMs, decreases friction, and enhances heat dissipation. Consequently, hybrid bearings allow spindles to operate at rotational speeds up to 50% higher than all-steel counterparts while maintaining lower operating temperatures, thus minimizing thermal drift and preserving component longevity under aggressive machining cycles.

Another pivotal technological trend is the development of Smart Bearing Systems, driven by the Industry 4.0 movement. These systems incorporate embedded sensors—such as piezoelectric accelerometers, thermocouples, and acoustic emission sensors—into the bearing housing or directly onto the race. These sensors continuously monitor critical operational parameters in real-time. The data collected is processed using edge computing or transferred to cloud-based AI platforms for predictive analytics, allowing machine operators to accurately predict potential failures due to micro-pitting, lubricant degradation, or excessive preload loss. This technology shifts maintenance paradigms from reactive or preventive to highly efficient condition-based monitoring, maximizing uptime and machine availability.

Furthermore, innovations in bearing cage materials and precision lubrication systems are enhancing performance. Lightweight, high-strength polymer cages are increasingly used to reduce inertial forces and improve dynamic response at high speeds compared to traditional metallic cages. Simultaneously, advanced lubrication methods, particularly minimum quantity lubrication (MQL) and optimized oil-air systems, ensure precise, contaminant-free delivery of lubricant directly to the contact zones, maintaining optimal film thickness without generating excessive heat or requiring extensive sealing. Research is also progressing in the refinement of surface texture modification technologies, such as laser texturing and specialized coatings, aimed at improving lubricant retention and reducing friction coefficient, further contributing to the overall efficiency and lifespan of high-performance machine tool bearings.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest market both in terms of production and consumption, driven primarily by China's colossal manufacturing base and continuous investment in machine tool infrastructure. Key growth factors include supportive government policies promoting industrial automation and the high volume demand generated by sectors like automotive, consumer electronics, and general machinery production across emerging markets like India and Vietnam. Japan and South Korea remain global leaders in technological complexity and production of high-end, super-precision CNC machine tools, ensuring a stable market for ultra-high precision bearing replacement and OEM sales.

- Europe: Europe, particularly the DACH region (Germany, Austria, Switzerland), is recognized for housing world-leading machine tool builders focusing on niche, highly precise, and custom-engineered machines for aerospace, high-end automotive, and tooling industries. The market is defined by a strong focus on high-reliability, long-life bearings and rapid adoption of sensor-integrated (smart) bearing solutions to support Industry 4.0 initiatives. Growth is steady, primarily driven by technological upgrades and the replacement of existing machine park components rather than sheer volume expansion.

- North America: The North American market is experiencing renewed growth spurred by reshoring initiatives and significant investment in aerospace and defense manufacturing, particularly in complex machining centers. The transition towards electric vehicle manufacturing is also a key driver, demanding high-precision grinding and milling capabilities. The market demonstrates a high willingness to adopt advanced and premium technologies, such as hybrid ceramic and specialized coated bearings, prioritizing total cost of ownership (TCO) and long-term performance reliability over initial component cost.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by sporadic, project-based growth. Demand is largely tied to infrastructure projects, energy sector investment, and nascent industrialization efforts. While volume remains lower compared to APAC and Europe, there is growing interest in durable, robust bearing solutions suitable for general-purpose machines, often sourced through international distribution channels. Local manufacturing capacity for super-precision bearings is minimal, making them highly dependent on imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Machine Tool Bearing Market.- SKF

- Schaeffler (FAG/INA)

- NSK Ltd.

- NTN Corporation

- JTEKT Corporation (Koyo)

- The Timken Company

- GMN Paul Müller Industrie GmbH & Co. KG

- Barden Corporation (a Schaeffler company)

- Myonic GmbH

- MinebeaMitsumi Inc.

- Nachi-Fujikoshi Corp.

- Harbin Bearing Group Co., Ltd. (HRB)

- Luoyang Bearing Science & Technology Co., Ltd. (LYC)

- TPI Bearing

- Zhejiang Tiansheng Bearing Co., Ltd.

- C&U Group

- Wafangdian Bearing Group Corp. (ZWZ)

- Rollon S.p.A. (Linear Motion Focus)

- Reliance Precision Engineering Ltd.

- Daido Metal Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Machine Tool Bearing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between angular contact ball bearings (ACBBs) and cylindrical roller bearings (CRBs) in machine tools?

ACBBs are designed to manage combined radial and high axial loads and are primarily used in high-speed spindles requiring high rigidity and precision. CRBs are optimized for extremely heavy radial loads and high-speed rotation but offer less axial load capacity, making them ideal for support positions and gearboxes.

How does the adoption of Industry 4.0 specifically influence the design requirements for machine tool bearings?

Industry 4.0 mandates the integration of sensor technology (smart bearings) to facilitate real-time condition monitoring and predictive maintenance. This requires bearing manufacturers to design units capable of accommodating temperature and vibration sensors, requiring robust sealing and specialized wiring channels without compromising dynamic performance or precision.

Why are hybrid ceramic bearings increasingly preferred over standard steel bearings for high-speed spindles?

Hybrid ceramic bearings, using ceramic balls, offer superior characteristics including lower density (reducing centrifugal forces), higher stiffness, and non-conductivity. This results in reduced heat generation, extended operating speeds, minimal thermal expansion (drift), and enhanced resistance to lubricant degradation, optimizing spindle performance in ultra-high-speed operations.

Which geographical region holds the largest market share for machine tool bearings and what drives this dominance?

The Asia Pacific (APAC) region, led by China, holds the largest market share. This dominance is driven by the vast scale of manufacturing infrastructure expansion, high investment in new CNC machine installations, and substantial indigenous production capabilities of both machine tools and associated bearing components.

What is the main challenge associated with the installation and maintenance of super-precision machine tool bearings?

The main challenge is the extreme sensitivity of these bearings to handling, cleanliness, and precise setting of preload. Improper installation, even minor contamination, or incorrect axial force application (preload) can drastically reduce life or accuracy, necessitating highly specialized tools and trained technicians, significantly raising MRO complexity.

The preceding sections detail the complex technological and market dynamics shaping the machine tool bearing sector. The requirement for precision in advanced manufacturing, coupled with the rapid integration of intelligent systems, ensures that the market remains a high-value, highly competitive domain demanding continuous material science and engineering innovation. The convergence of hardware excellence (super-precision grinding) and software intelligence (AI-driven monitoring) is defining the future of spindle and linear motion components. The market's resilience is tied directly to global manufacturing health, particularly in high-growth, high-value sectors such as aerospace, medical, and next-generation automotive industries, all of which rely on the foundational accuracy provided by these specialized bearings. Technological leadership, particularly in hybrid materials and sensor integration, remains the key differentiator among leading global players. The market segmentation emphasizes that while high-speed spindle bearings are the technological vanguard, reliable standard bearings for supporting axes continue to form a critical volume component of the market. The high entry barriers inherent in super-precision manufacturing ensure that market control remains concentrated among a few established companies with deep intellectual property and proprietary manufacturing processes. The shift toward optimized resource utilization through predictive maintenance, enabled by advancements in AI and integrated sensor technology, is not merely an opportunity but a necessary evolution for maximizing machine tool efficiency in the highly demanding manufacturing environment of the late 2020s and early 2030s. This transition necessitates that end-users invest in new diagnostic infrastructure, driving parallel market growth in monitoring and analysis systems. Furthermore, regulatory pressures towards sustainable manufacturing are subtly influencing material choices and lubrication strategies, favoring solutions that reduce environmental impact without sacrificing performance. The market outlook remains robust, underpinned by global industrial modernization cycles and the increasing complexity of manufactured components across all major economic regions.

In response to increasing demand for rapid replacement and specialized repair services, the aftermarket segment is professionalizing, with more accredited service centers focusing specifically on the high-cost repair and re-grinding of spindle assemblies, a process where the replacement of super-precision bearings is central. This MRO segment is growing faster than the OEM segment in mature economies, highlighting the focus on extending the productive life of high-capital machinery. Geopolitical factors also play an increasingly important role, influencing investment decisions regarding regional sourcing and the diversification of supply chains away from single geographic hubs. Machine tool OEMs are actively seeking dual-source strategies for critical components like spindle bearings to buffer against trade disruptions or regional lockdowns, creating opportunities for high-quality, specialized regional manufacturers to gain market share. The enduring challenge of achieving absolute vibration damping and thermal stability in ultra-high-speed applications continues to drive fundamental research into advanced dampening systems and passive cooling mechanisms integrated directly into the bearing housing, ensuring continuous performance gains beyond incremental material improvements. The market's sustained growth trajectory is therefore a reflection of deep technological commitment and the inextricable link between bearing performance and global manufacturing competitiveness. This comprehensive overview confirms the machine tool bearing market as a vital and intensely specialized component of the global industrial ecosystem, poised for significant growth fueled by both technological imperative and industrial expansion.

The market faces concurrent pressures from both extreme performance demands and cost optimization strategies, compelling manufacturers to innovate materials processing techniques that yield higher performance components at reduced manufacturing complexity. For instance, advancements in thin-film deposition and surface treatments are being explored to enhance wear resistance and longevity in standard steel bearings, offering performance enhancements closer to hybrid bearings without the full cost associated with ceramic elements. The stringent requirements from the semiconductor industry for nanometer-scale precision in wafer handling and processing equipment represent the absolute zenith of demand, influencing bearing design far beyond general industrial applications. These specific high-tech niches often utilize hydrostatic or magnetic bearing technologies, which, while not traditional rolling element bearings, represent the technological frontier of non-contact support systems where absolute positional accuracy is paramount, thereby indirectly pushing the boundaries of traditional rolling bearing performance. The ongoing refinement of internal clearance and preloading techniques, often through automated, laser-guided measurement systems during assembly, is crucial for guaranteeing the specified stiffness and reducing dynamic runout, further defining best practices across the industry. This level of technical complexity confirms the machine tool bearing market's position as a strategically vital component sector where incremental improvements yield significant macro-economic productivity gains, reinforcing its high-value status within the industrial component hierarchy.

Finally, the competitive landscape is highly segmented, with a few multinational corporations dominating the super-precision segment due to historical expertise, established OEM relationships, and massive investment in proprietary manufacturing technology. However, regional manufacturers, particularly those in China, are rapidly closing the technological gap in the P4 (ABEC 7) precision class, increasing competitive intensity in mid-to-high-end conventional CNC applications. Successful market penetration strategies rely increasingly on providing comprehensive technical service packages, including detailed application engineering support, specialized installation tools, and extended warranty programs, recognizing that the bearing is only one part of a highly interdependent spindle system. Future growth hinges on manufacturers' ability to scale the production of smart, customized, and environmentally sustainable bearing solutions while navigating the volatility of raw material costs and ensuring the highest levels of quality control mandated by precision-critical end-users globally. The synthesis of high-quality hardware and predictive intelligence will be the defining characteristic of market leaders in the coming decade, solidifying the market’s projected revenue expansion through 2033. The continuous innovation in sealing solutions to prevent ingress of machining fluids and abrasive dust—a common cause of premature failure in machine tool environments—also represents a critical and enduring area of investment for component lifespan extension.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager