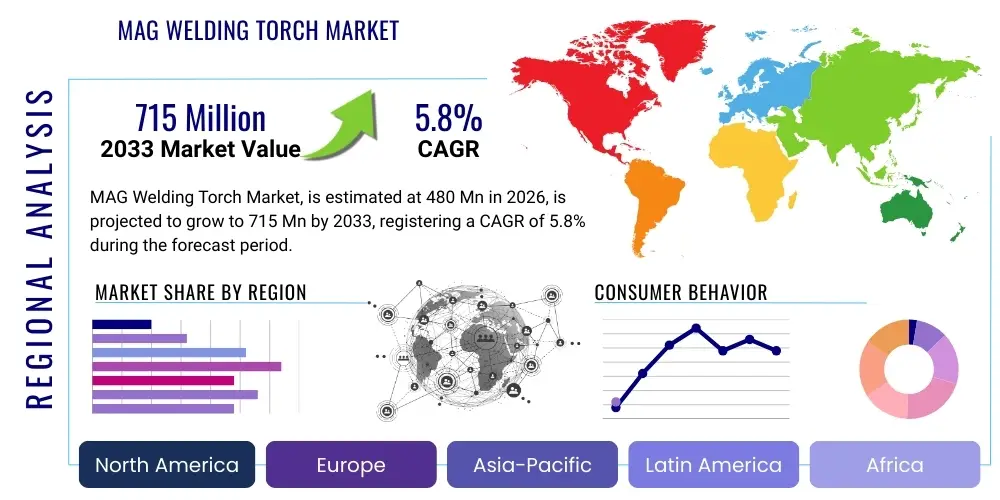

MAG Welding Torch Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443241 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

MAG Welding Torch Market Size

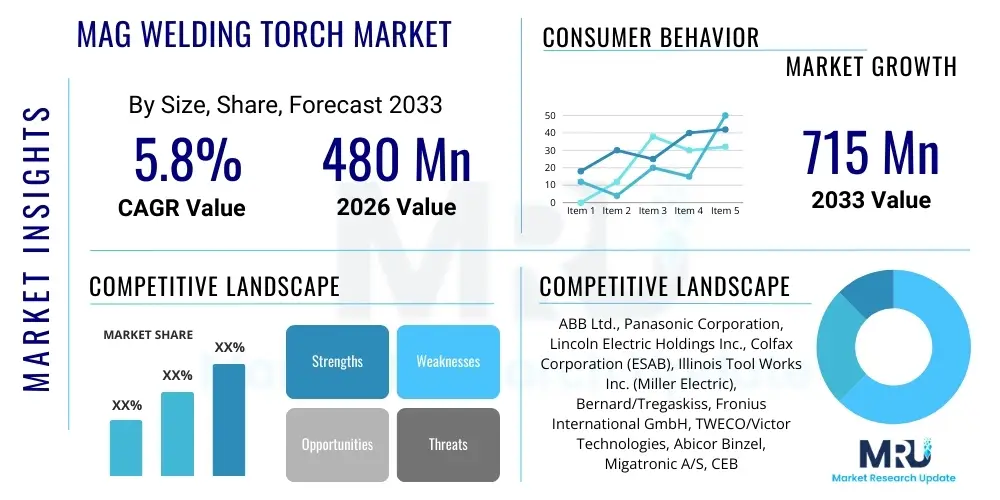

The MAG Welding Torch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 480 Million in 2026 and is projected to reach USD 715 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the accelerating adoption of automated welding systems across key manufacturing sectors globally, coupled with a persistent demand for high-duty cycle equipment capable of handling complex fabrication tasks in controlled environments. The focus on optimizing production efficiency and minimizing operational downtime serves as a foundational driver for sustained market expansion, particularly in industrialized economies transitioning towards Industry 4.0 principles.

MAG Welding Torch Market introduction

The Metal Active Gas (MAG) welding torch market encompasses specialized equipment integral to the Gas Metal Arc Welding (GMAW) process, specifically tailored for ferrous materials using active shielding gases, typically mixtures of argon and carbon dioxide. These torches are essential tools designed to deliver the welding wire, electrical current, and shielding gas simultaneously to the weld pool, ensuring high-quality, efficient welds. The primary product differentiation within this market involves cooling mechanisms, separating torches into air-cooled units for lower current applications and water-cooled units necessary for intensive, high-duty cycle industrial fabrication.

Major applications of MAG welding torches span across critical industrial sectors including automotive manufacturing, where high-speed, repeatable welds are paramount for chassis and body construction; heavy machinery and construction equipment fabrication, demanding robust torches capable of sustained high-amperage usage; and specialized industries like shipbuilding and pressure vessel manufacturing, requiring precision and reliability under stringent quality control standards. The inherent flexibility, speed, and cost-effectiveness of the GMAW process, facilitated by advanced MAG torches, solidify their indispensable role in modern manufacturing operations worldwide.

Key benefits derived from utilizing modern MAG welding torches include enhanced weld quality through precise wire feeding and improved gas shielding mechanisms, significant increases in operational efficiency due to higher duty cycles and faster welding speeds compared to traditional methods, and improved operator ergonomics resulting from lightweight, modular designs. Market growth is principally driven by the widespread global trend toward industrial automation and robotic welding integration, coupled with massive infrastructure investments and the revival of the automotive sector post-pandemic, necessitating reliable and high-performance welding peripherals.

MAG Welding Torch Market Executive Summary

The MAG Welding Torch market is characterized by robust business trends focusing on digitalization, integration with robotic platforms, and ergonomic design improvements. Manufacturers are heavily investing in producing smart torches equipped with integrated sensors for real-time data feedback on parameters such as temperature, voltage, and wire feed speed, catering directly to the demands of Industry 4.0 environments. Competition is centered not just on the durability and duty cycle of the torches but increasingly on the ease of maintenance, modularity, and seamless compatibility with diverse robotic systems and power sources. Furthermore, sustainable manufacturing practices are influencing material choices and component longevity, creating a trend towards more environmentally conscious welding equipment.

Regionally, the Asia Pacific (APAC) dominates the market share due to its massive and rapidly expanding manufacturing base, particularly in China, India, and South Korea, driven by intense activity in automotive production and infrastructure development. North America and Europe, while mature markets, exhibit high adoption rates for advanced, high-precision robotic welding torches, emphasizing quality and automation reliability. Market growth in these regions is heavily influenced by the replacement cycle of older manual equipment with highly automated systems. Latin America and the Middle East & Africa (MEA) represent high-potential emerging markets, boosted by nascent industrialization and large-scale energy and construction projects requiring substantial welding capacity.

Segment trends indicate a strong shift towards Water-Cooled Torches, despite their higher initial cost, due to the increasing prevalence of high-amperage robotic and mechanized welding applications demanding superior heat dissipation and extended duty cycles. The application segment is heavily weighted towards Automotive and Heavy Machinery, where the demand for high throughput and consistent quality is most acute. Key players are strategically focusing on developing patented features related to spatter reduction, liner technology, and quick-change neck systems to gain a competitive edge in serving these demanding application sectors, ensuring market relevance through continuous product innovation aligned with end-user operational imperatives.

AI Impact Analysis on MAG Welding Torch Market

Common user questions regarding AI's influence on the MAG Welding Torch Market frequently revolve around how artificial intelligence can enhance weld quality, optimize operational parameters, and reduce the dependency on highly skilled manual welders. Users are keen to understand the implementation of machine learning for predictive maintenance of torch components (liners, contact tips), ensuring maximum uptime. Furthermore, inquiries focus on AI-driven vision systems integrated with robotic MAG welding cells, aiming for real-time defect detection and adaptive path correction, thereby pushing the boundaries of automated fabrication precision and efficiency, fundamentally altering the traditional welding workflow paradigm.

- AI-driven optimization of welding parameters (voltage, wire feed speed, gas flow) based on material thickness and joint type, enhancing weld quality consistency.

- Predictive maintenance algorithms utilizing sensor data from smart torches to forecast component failure (e.g., contact tip degradation), minimizing unexpected downtime.

- Integration of machine vision and AI for real-time defect detection and quality assurance, surpassing the speed and accuracy of human inspectors.

- Adaptive robotic path planning and control, allowing the MAG torch to automatically adjust its trajectory and angle to compensate for material distortions or fit-up variations.

- Development of self-learning robotic welding systems that rapidly optimize process settings for new parts or materials without extensive manual programming, accelerating time-to-production.

- Enhanced inventory management for consumables (tips, nozzles) through AI analysis of usage patterns and predicted remaining life.

DRO & Impact Forces Of MAG Welding Torch Market

The MAG Welding Torch market dynamics are shaped by a powerful confluence of drivers, restraints, and opportunities, underpinned by significant operational impact forces. Primary drivers include the global push for industrial automation, where mechanized and robotic welding systems necessitate reliable, high-performance torches capable of extended, unattended operation. The resurgence in demand from key manufacturing sectors, notably the automotive industry's push towards electric vehicle (EV) production and related high-strength steel welding requirements, further propels market expansion. Concurrently, large-scale infrastructure and construction projects globally, particularly in developing economies, continuously create demand for durable and efficient welding tools, making MAG technology the preferred choice due to its high deposition rate.

However, the market faces notable restraints. The initial high capital investment required for implementing sophisticated robotic welding systems, including advanced water-cooled torches and peripheral equipment, can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the persistent global shortage of highly skilled welders and maintenance technicians capable of operating and servicing complex automated MAG systems limits widespread adoption in certain regions. Supply chain volatility for specialized raw materials used in torch components (like copper alloys and insulating materials) also presents a constraint, potentially leading to increased production costs and fluctuating delivery times.

Opportunities abound in the development and proliferation of smart, IoT-enabled welding torches that offer connectivity and data feedback for process control and remote diagnostics, capitalizing on the broader Industry 4.0 trend. The market can also capitalize on the growing demand for customized, application-specific torch designs tailored for unique welding environments, such as narrow-access joints or high-radiation environments. The critical impact forces include technological advancements focusing on reducing spatter and increasing the duty cycle, competitive pricing strategies from APAC manufacturers, and stringent global welding safety regulations compelling users to upgrade to safer, modern equipment, ensuring sustained innovation and market evolution.

Segmentation Analysis

The MAG Welding Torch market is comprehensively segmented based on its cooling technology, resulting in air-cooled and water-cooled types, reflecting different operational intensity requirements. Furthermore, segmentation by application is critical, detailing usage across major end-user industries such as Automotive, Heavy Machinery, Shipbuilding, and General Fabrication, each demanding distinct performance attributes from the welding equipment. Geographic segmentation provides insight into regional consumption patterns, influenced heavily by local manufacturing capacity and automation levels, allowing manufacturers to tailor their product offerings and distribution strategies effectively across diverse global markets.

- By Type:

- Air-Cooled Torches

- Water-Cooled Torches

- By Application:

- Automotive & Transportation

- Heavy Machinery & Construction

- Shipbuilding & Marine

- General Fabrication

- Others (Oil & Gas, Energy)

- By Automation Level:

- Manual Torches

- Semi-Automatic Torches

- Robotic Torches

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For MAG Welding Torch Market

The value chain for the MAG Welding Torch market begins with upstream activities involving the sourcing of highly specialized raw materials, including high-pconductivity copper alloys for contact tips and power conductors, advanced thermoplastics and rubber for handles and cable sheathing, and various ceramic or insulated materials for nozzles. Suppliers in this phase must adhere to stringent quality standards as material purity directly impacts the electrical efficiency, heat dissipation, and longevity of the final product. Key activities here include precision machining and specialized metallurgy necessary to create components capable of handling high amperage and extreme thermal cycling reliably over extended periods of use, which differentiates premium torch manufacturers.

The midstream stage involves the design, manufacturing, and assembly of the torch systems. Manufacturing processes include injection molding for handles, precise assembly of complex cable assemblies, and integration of specialized components like quick-change connectors and cooling systems (for water-cooled variants). Rigorous quality control and testing are paramount during this stage, particularly concerning the duty cycle rating and ergonomic factors. Innovative torch manufacturers often focus R&D on modular designs and ergonomic improvements, allowing for easier maintenance and reduced operator fatigue, thereby adding significant value to the final product through enhanced usability and reliability in demanding industrial settings.

Downstream activities focus on the distribution and end-user deployment. Distribution channels are typically complex, involving direct sales teams targeting large OEMs and robotic integrators, and indirect channels relying on specialized welding equipment distributors, industrial supply houses, and online platforms serving smaller fabrication shops. Direct channels are crucial for robotic torches requiring technical consultation and integration support, while indirect channels provide immediate availability and local service for manual and semi-automatic torches. The value chain concludes with aftermarket services, including the supply of high-volume consumables (contact tips, nozzles, diffusers) and maintenance services, which represent a stable and recurring revenue stream for both manufacturers and distributors, cementing customer loyalty and extending the product lifecycle.

MAG Welding Torch Market Potential Customers

The primary consumers and end-users of MAG Welding Torches are enterprises involved in high-volume metal fabrication and assembly where the benefits of speed, consistency, and automation inherent to the GMAW process are crucial. The Automotive and Transportation sector stands as the largest consumer, requiring thousands of torches and associated robotic systems for continuous production of vehicle bodies, chassis, and sub-assemblies, relying on water-cooled, high-duty cycle robotic torches for 24/7 operation. Manufacturers in the Heavy Machinery and Construction sector, including producers of excavators, cranes, and agricultural equipment, are equally significant buyers, demanding rugged, high-amperage torches suitable for thick plate welding and demanding outdoor or industrial environments.

Furthermore, the Shipbuilding and Marine sector represents a highly specialized customer segment, utilizing MAG torches for the construction and repair of hull structures and large vessels, often requiring specialized long-reach or flexible neck torches to navigate complex geometries. General fabrication shops, ranging from SMEs producing structural steel components to large-scale piping manufacturers, form a broad base of customers, typically utilizing a mix of manual air-cooled and semi-automatic water-cooled units depending on their production volumes and material requirements. The common denominator among all potential customers is the need for welding equipment that maximizes productivity while maintaining high standards of weld integrity and minimizing operational costs through extended consumable life and reliable performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 480 Million |

| Market Forecast in 2033 | USD 715 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Panasonic Corporation, Lincoln Electric Holdings Inc., Colfax Corporation (ESAB), Illinois Tool Works Inc. (Miller Electric), Bernard/Tregaskiss, Fronius International GmbH, TWECO/Victor Technologies, Abicor Binzel, Migatronic A/S, CEBORA SpA, KEMPPI Oy, DAIHEN Corporation, OTC Daihen, SKS Welding Systems GmbH, WÜRTH GROUP, Trafimet S.p.A., PARKER TORCHOLOGY, TECNOLUX S.r.l., Weldcraft/CK Worldwide |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MAG Welding Torch Market Key Technology Landscape

The technological landscape of the MAG Welding Torch market is rapidly evolving, driven by the necessity for greater efficiency, longevity, and seamless integration into automated environments. A primary focus is on developing advanced shielding gas distribution mechanisms and optimized contact tip geometry to minimize spatter and improve arc stability, resulting in superior weld bead appearance and reduced post-weld cleaning time. Furthermore, the shift towards modular torch systems is a significant technological trend, allowing end-users to quickly replace only the worn components (e.g., the neck or cable assembly) rather than the entire torch, significantly reducing maintenance costs and operational downtime, which is critical in high-volume production facilities.

Ergonomics and operator safety represent another vital area of innovation for manual and semi-automatic torches. Manufacturers are implementing lightweight materials, optimized handle geometries, and flexible, heavy-duty cable assemblies that reduce physical strain on the operator during extended welding sessions. For robotic applications, the key technological advancements revolve around robust crash protection systems and quick-change couplings that facilitate rapid tool changes without manual intervention, maximizing the robot's utilization rate. This technology minimizes damage following accidental collisions, prolonging the life of the often expensive robotic torch assembly and ensuring production schedules are maintained with minimal disruption.

The integration of smart technology (IoT and sensor technology) is fundamentally transforming the torch into a data source. Modern MAG torches are increasingly featuring integrated sensors for monitoring critical parameters such as temperature, wire feed rate variability, and duty cycle utilization in real-time. This connectivity allows for detailed data logging and analysis, providing operators and maintenance teams with proactive insights into performance degradation, facilitating predictive maintenance, and ensuring adherence to stringent quality parameters, thereby positioning the torch as a key component within the digital factory ecosystem.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global MAG Welding Torch market, driven primarily by China’s dominance in general manufacturing, automotive assembly, and massive infrastructure investments (e.g., Belt and Road Initiative). Countries like India, Vietnam, and South Korea are also witnessing rapid growth due to increasing industrialization and a strong push towards factory automation to improve competitive positioning. The region accounts for the largest volume consumption, characterized by a mixed demand for cost-effective manual torches in general fabrication and highly advanced robotic torches in OEM automotive facilities.

- North America: This region is characterized by high adoption rates of premium, automated, water-cooled MAG torches, primarily driven by the sophisticated US automotive, aerospace, and heavy machinery sectors. The market emphasis is strongly placed on productivity, precision, and adherence to high safety standards. Growth is spurred by manufacturing reshoring efforts and the modernization of aging industrial infrastructure, demanding advanced welding solutions with integrated digital feedback capabilities.

- Europe: Europe represents a mature but technologically advanced market, led by Germany, Italy, and Scandinavia. The focus is heavily concentrated on high-quality robotic welding systems, particularly in the construction equipment and specialized vehicle manufacturing sectors. European manufacturers are leaders in developing ergonomic, environmentally compliant, and highly durable torch designs. Regulatory frameworks promoting energy efficiency and worker safety significantly influence product development and procurement decisions across the continent.

- Latin America (LATAM): LATAM is an emerging market with potential, driven by fluctuating but substantial investments in infrastructure, mining, and oil & gas sectors, particularly in Brazil and Mexico. The demand is currently tilting towards robust, easy-to-maintain semi-automatic and manual torches, but automation adoption is accelerating, especially in multinational automotive assembly plants located in the region.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated around major oil and gas projects, shipbuilding (in certain Gulf nations), and substantial construction activity. The demand for high-duty cycle, water-cooled torches is significant in the energy sector, driven by pipeline and pressure vessel fabrication requirements. The market remains volatile but offers considerable opportunities linked to large government-backed industrial diversification programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MAG Welding Torch Market.- ABB Ltd.

- Panasonic Corporation

- Lincoln Electric Holdings Inc.

- Colfax Corporation (ESAB)

- Illinois Tool Works Inc. (Miller Electric)

- Bernard/Tregaskiss

- Fronius International GmbH

- TWECO/Victor Technologies

- Abicor Binzel

- Migatronic A/S

- CEBORA SpA

- KEMPPI Oy

- DAIHEN Corporation

- OTC Daihen

- SKS Welding Systems GmbH

- WÜRTH GROUP

- Trafimet S.p.A.

- PARKER TORCHOLOGY

- TECNOLUX S.r.l.

- Weldcraft/CK Worldwide

Frequently Asked Questions

Analyze common user questions about the MAG Welding Torch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between air-cooled and water-cooled MAG welding torches?

Air-cooled torches utilize the shielding gas and surrounding air to dissipate heat and are suitable for lower amperage applications and shorter duty cycles (typically below 250A). Water-cooled torches use a circulating coolant system to efficiently manage heat, making them essential for high-amperage, high-duty cycle industrial and robotic welding applications where sustained performance is required without overheating.

How is industrial automation impacting the design requirements of MAG welding torches?

Automation necessitates robust, high-precision robotic torches designed for continuous operation (high duty cycle), featuring integrated crash protection, minimal spatter generation, and rapid, accurate tool centering. Designs prioritize modularity for quick maintenance and seamless integration with robotic controllers and data feedback systems.

Which end-use industry is the largest consumer in the MAG Welding Torch market?

The Automotive and Transportation industry segment is the largest consumer of MAG welding torches globally. This is driven by the industry’s massive scale, high throughput demands, and widespread adoption of robotic welding cells for high-speed, repeatable assembly of vehicles and related components.

What technological advancements are driving market growth?

Key technological advancements include the development of smart, sensor-enabled torches for IoT integration and predictive maintenance, improved consumable materials (tips and liners) for extended life, and enhanced ergonomic designs for manual operation. These innovations directly contribute to increased efficiency and reduced operational costs.

Which geographical region exhibits the fastest growth potential for MAG welding torches?

The Asia Pacific (APAC) region, specifically emerging economies like India and Southeast Asian countries, shows the highest growth potential. This growth is fueled by rapid industrialization, expansion of domestic manufacturing capacity, and increasing investment in infrastructure and automotive sectors across the region.

Competitive Landscape Analysis

The MAG Welding Torch market is highly competitive, dominated by a few multinational conglomerates that offer comprehensive welding solutions, including power sources, feeders, and robotic systems, alongside the torches themselves. Key players leverage their established global distribution networks, brand loyalty, and technological expertise in consumable manufacturing to maintain market dominance. Competition is intensified by specialized manufacturers who focus exclusively on high-performance robotic torch systems and proprietary technologies, often partnering directly with large automotive OEMs and robotic system integrators to secure high-value contracts. Price competition is particularly fierce in the air-cooled segment and in emerging markets, driving continuous innovation in cost-effective manufacturing processes.

Strategic movements within the competitive landscape frequently involve mergers and acquisitions aimed at expanding product portfolios, enhancing regional reach, or acquiring specialized technological capabilities, particularly in the field of smart welding and automation components. Research and development investments are heavily focused on material science to improve the durability and heat resistance of consumables (contact tips, nozzles) and on developing integrated sensor packages for data logging and process monitoring. The ability of a manufacturer to offer a fully integrated, seamlessly communicating welding solution—from power source to torch tip—provides a distinct competitive advantage, especially when targeting high-volume, automated production lines requiring minimal manual intervention and maximum uptime.

Differentiating factors for success include offering superior quality consumables with extended lifetimes, providing specialized training and robust after-sales support, and designing torches optimized for challenging welding environments such as those involving pulsed MAG or specialized high-alloy steels. Furthermore, compliance with diverse global safety and environmental regulations is becoming an increasingly important aspect of competitive positioning, favoring manufacturers capable of demonstrating sustainable practices and products that reduce fume exposure and energy consumption, securing long-term contracts based on reliability and total cost of ownership (TCO) rather than initial purchase price alone.

Detailed Market Dynamics and Future Outlook

The trajectory of the MAG Welding Torch market is inextricably linked to the global acceleration of industrial efficiency goals. As manufacturers strive to reduce operational costs and variability in weld quality, the transition from manual Shielded Metal Arc Welding (SMAW) or TIG to automated MAG welding becomes a necessity. This driver is particularly evident in large-scale fabrication, where the higher deposition rate and increased speed of MAG welding translate directly into shorter production cycles and substantial labor savings. The future outlook suggests a growing divergence between the high-volume, cost-sensitive segment (primarily air-cooled manual torches for small shops) and the technologically advanced, quality-driven segment (robotic water-cooled torches for major OEMs), forcing manufacturers to tailor their R&D and marketing efforts accordingly to capture specific value pools within the market structure.

The increasing complexity of materials used in modern construction, such as high-strength low-alloy (HSLA) steels in automotive and specialized aluminum alloys in aerospace, requires welding processes that offer precise control over heat input and shielding. While MAG welding is primarily used for ferrous metals, the underlying torch technology benefits from advancements in wire feeding precision and arc stabilization, enabling better control across varying material compositions. This technical demand creates significant opportunities for manufacturers who can integrate sophisticated control electronics directly into the torch handle or neck, providing instantaneous feedback and adjustment capabilities that mitigate the risk of metallurgical defects and ensure compliance with rigorous material specifications.

Looking ahead to 2033, sustainability is expected to become a more pronounced market dynamic. Customers are increasingly evaluating welding equipment based not only on performance but also on environmental impact, including energy consumption and the waste generated from consumables. Manufacturers are responding by developing more durable, longer-lasting consumables and designing torches with highly efficient cooling systems that minimize energy use. Furthermore, the standardization of modular components will enhance repairability and reduce electronic waste, aligning with global circular economy principles. This shift towards 'Green Welding' will influence procurement decisions in developed economies and create new competitive barriers related to environmental product declarations and life cycle assessments of MAG torch systems.

Innovation in Robotic MAG Torch Applications

The application of MAG welding torches in robotic systems is undergoing a profound transformation driven by innovation in peripheral technologies and software integration. Traditional robotic welding relied on fixed programming, but the adoption of off-line programming software and advanced sensing capabilities is unlocking unprecedented levels of flexibility and efficiency. New robotic MAG torch systems are equipped with integrated sensors for through-the-arc seam tracking and laser-based vision systems, allowing the robot to dynamically adjust the torch position to compensate for thermal distortion or tolerance stack-up in the workpiece. This technological leap significantly reduces the need for perfect part fit-up, broadening the applicability of robotic welding to complex and inconsistent fabrication tasks.

One critical area of innovation is the development of ultra-lightweight, high-payload robotic torches. As robots become faster and more agile, the torch system must minimize inertia to maintain precision during rapid movements. Manufacturers are utilizing advanced composites and lighter metallic alloys in the torch neck and cable assembly design. This reduces the mechanical load on the robotic arm, enabling quicker acceleration and deceleration, thereby increasing the overall cycle time efficiency of the welding cell. Coupled with this is the integration of proprietary wire feeding technologies that ensure extremely stable wire delivery even during high-speed, complex path changes, minimizing arc interruptions and maximizing the duty cycle.

Furthermore, multi-process welding capabilities are being integrated into modular robotic torch systems. While specialized in MAG, some modern robotic torches are designed with quick-connect features that allow them to swap heads or modules to perform MIG, TIG, or even plasma cutting operations using the same robotic platform. This versatility enhances the ROI for end-users, particularly those involved in diverse fabrication processes. The convergence of hardware innovation (robust, modular design) and software advancement (AI-driven path optimization and real-time process monitoring) defines the cutting edge of robotic MAG welding technology, pushing industrial productivity benchmarks to new heights.

The development of standardized interfaces, such as the widely adopted connection points between the torch cable assembly and the wire feeder, ensures greater interoperability between different brands of welding equipment. This open-architecture approach allows end-users to mix and match components from various vendors based on performance requirements and cost considerations, increasing flexibility in procurement. However, competition remains strong regarding proprietary consumable designs, where manufacturers seek to lock in customer loyalty through patented contact tip and nozzle geometries that promise superior performance or longevity, emphasizing that even standard components are subject to continuous, specialized innovation.

Impact of Consumables on Market Performance

Consumables, which primarily include contact tips, gas nozzles, and wire liners, play a critical, though often overlooked, role in the overall performance and market dynamics of MAG welding torches. The quality and longevity of these components directly affect operational uptime, weld quality, and the total cost of ownership (TCO) for end-users. A short-lived contact tip, for instance, necessitates frequent replacement, leading to excessive downtime in high-volume production facilities. Consequently, market leadership is increasingly determined by the ability of manufacturers to engineer consumables from highly durable materials, often specialized copper alloys and advanced ceramics, that resist spatter adhesion, minimize electrical resistance, and maintain dimensional stability under extreme thermal stress.

The market for consumables is significantly larger than the market for the core torch body itself and provides a steady, high-margin revenue stream. This financial incentive drives continuous innovation in consumable design. For example, advancements in contact tip technology include features such as threaded designs for better alignment, heavy-duty variants with thicker walls for higher duty cycles, and specialized inner coatings to ensure consistent electrical transfer. Furthermore, the integration of quick-change mechanisms for nozzles and tips is a major trend, reducing the time required for maintenance from minutes to seconds, which is a crucial advantage in highly automated environments where every second of production counts towards profitability.

The performance of the wire liner—the conduit through which the welding wire travels—is vital for minimizing wire feeding issues, which can lead to catastrophic arc instability and weld defects. Innovations in liner technology focus on using low-friction materials and flexible construction to handle various wire types (steel, flux-cored) without jamming or causing excessive drag. The quality and design of these consumables, therefore, act as a key differentiator in the torch market, compelling manufacturers to provide bundled solutions that guarantee optimal performance between the torch, the feeder, and the chosen consumables, ensuring that the entire welding system operates at peak efficiency.

Safety and Regulatory Compliance in Torch Manufacturing

Safety and regulatory compliance exert a significant influence on the design and marketing of MAG welding torches globally. Manufacturers must adhere to rigorous international standards set by organizations such as the International Organization for Standardization (ISO), particularly ISO 14175 (relating to shielding gases) and various regional electrical safety codes (e.g., European CE marking, North American CSA/UL standards). These regulations mandate specific requirements for insulation, heat resistance, cable integrity, and voltage rating, ensuring that the torch can be used safely under specified operating conditions, protecting the operator from electrical hazards and thermal burns.

Beyond electrical safety, growing attention is paid to occupational health concerns, notably the reduction of welding fumes and ergonomic design to mitigate repetitive strain injuries. Modern torch designs often incorporate integrated fume extraction nozzles (Fume Extraction Torches) that capture harmful particles at the source, thus reducing the operator's exposure and improving overall workshop air quality, aligning with stricter industrial hygiene regulations in developed markets. This focus on health and safety is becoming a prerequisite for large industrial procurement decisions, positioning compliance as a competitive necessity rather than merely a regulatory obligation.

Ergonomic standards, particularly those relating to the weight, balance, and handle geometry of manual and semi-automatic torches, are increasingly formalized. Manufacturers invest in design engineering to distribute weight evenly and utilize non-slip, heat-resistant materials that reduce operator fatigue, thereby directly impacting productivity and minimizing the risk of accidents caused by handling errors. Ensuring full regulatory compliance and proactively addressing safety concerns through innovative design are essential factors that build trust among major industrial buyers and contribute significantly to market acceptance and brand reputation in the highly professional welding industry.

The development of standardized color-coding and labeling for quick identification of torch type, amperage rating, and required consumables enhances workplace safety by minimizing user error during setup and operation. Compliance testing related to electromagnetic compatibility (EMC) is also paramount, ensuring that the high currents and arc ignition processes do not interfere with other sensitive electronic equipment in highly automated fabrication plants, further solidifying the necessity for advanced engineering in the final product design. These layered safety and regulatory requirements drive up the cost of manufacturing premium torches but simultaneously ensure the quality and reliability demanded by major industrial users.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager