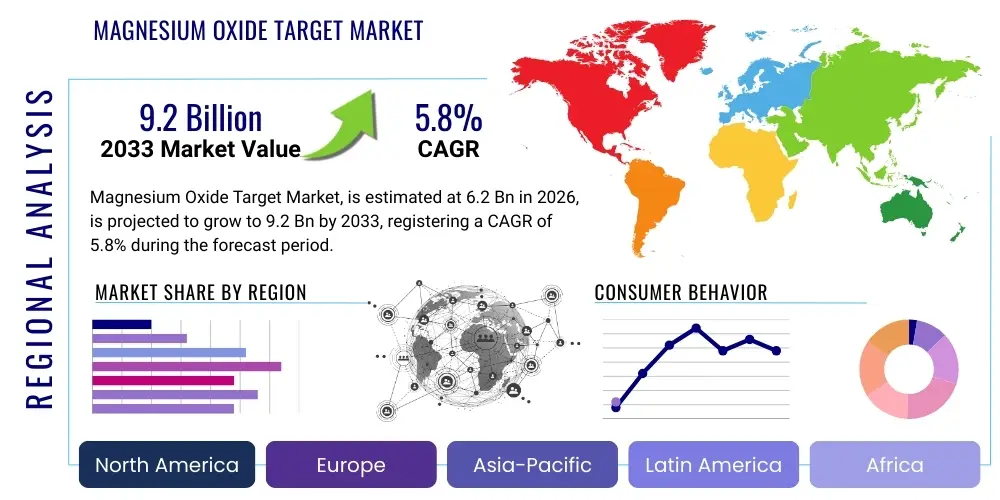

Magnesium Oxide Target Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440890 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Magnesium Oxide Target Market Size

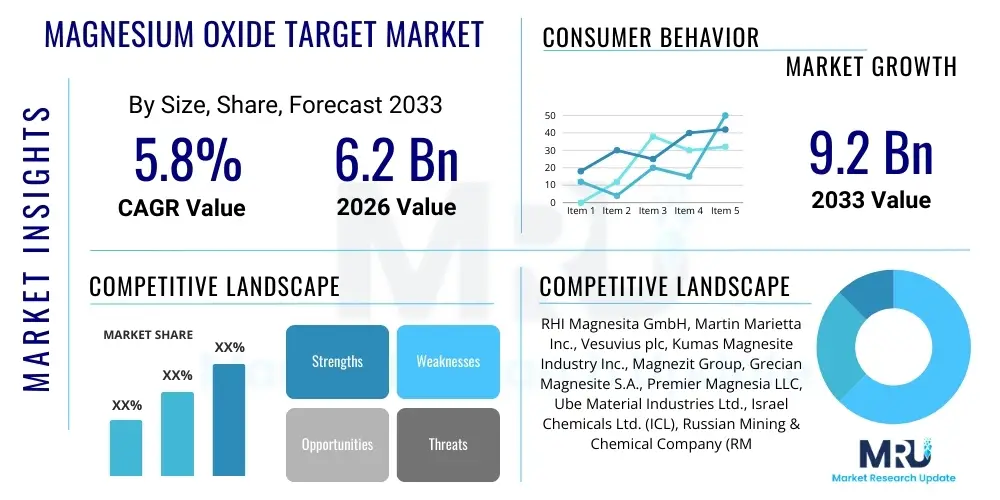

The Magnesium Oxide Target Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $6.2 Billion in 2026 and is projected to reach $9.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the burgeoning demand from the refractory industry, which relies heavily on the high-temperature stability and chemical inertness of magnesium oxide, particularly in steel and cement production. Furthermore, expanding applications in environmental remediation, specifically flue gas desulfurization and water treatment, are expected to provide significant impetus to market expansion across key industrialized economies.

The valuation reflects a robust demand structure driven by infrastructural development and industrial capacity expansion across Asia Pacific (APAC). As emerging economies rapidly urbanize and expand their metallurgical and construction sectors, the need for high-quality refractories and corresponding raw materials like magnesium oxide increases proportionally. Market valuation is also being influenced by technological advancements in production methods, focusing on achieving higher purity levels (such as fused magnesia and dead burned magnesia) crucial for specialized industrial applications and advanced ceramic manufacturing. The shift towards sustainable resource management is further embedding magnesium oxide as an essential component in environmental protection technologies, supporting the projected financial growth.

Magnesium Oxide Target Market introduction

Magnesium Oxide (MgO), often referred to as magnesia, is a versatile inorganic compound characterized by its white solid appearance, exceptional refractory properties, and low solubility in water. It is a critical industrial chemical primarily valued for its extremely high melting point (2,852 °C) and excellent thermal conductivity, making it indispensable in high-temperature processes. Major applications span across the refractory sector (linings for furnaces and kilns), agriculture (as a soil conditioner and animal feed supplement), chemical manufacturing (as a raw material for magnesium salts), and environmental applications (neutralization of acidic wastewater and flue gas desulfurization). The inherent benefits of MgO, including its chemical stability, superior electrical insulation capabilities at high temperatures, and non-toxic nature, ensure its sustained high demand across diverse industries globally.

The market dynamics are fundamentally driven by the robust pace of global industrialization, particularly the expansion of the steel and cement industries, which consume the vast majority of dead burned magnesia (DBM) and fused magnesia (FM). The increasing adoption of advanced materials in construction and metallurgy necessitates higher quality and specialized grades of MgO, thereby pushing manufacturers toward technological innovation in calcination and purification processes. Furthermore, stringent environmental regulations governing industrial emissions, especially in North America and Europe, have significantly bolstered the demand for caustic calcined magnesia (CCM) used in mitigating air and water pollution, serving as a powerful and sustainable market driver that will continue to shape the industry landscape through the forecast period.

Magnesium Oxide Target Market Executive Summary

The Magnesium Oxide market is poised for steady expansion, fueled primarily by sustained growth in the refractory segment, which commands the largest market share due to its critical role in the foundational infrastructure industries of steel and cement. Key business trends indicate a strong move towards consolidation among major producers to ensure supply chain stability and capitalize on economies of scale, particularly in regions with abundant magnesite reserves. Simultaneously, there is a pronounced shift toward the development of specialty MgO products, such as high-purity fused magnesia, catering to niche markets like electrical heating elements, nuclear applications, and advanced ceramics. These product innovations are necessary to meet increasingly stringent performance requirements across sophisticated end-user sectors, creating differentiated value propositions for key market players and driving premium pricing in specialized grades.

Regionally, Asia Pacific (APAC) stands out as the predominant market, driven by massive investments in infrastructure development, burgeoning manufacturing activity in China and India, and the unparalleled capacity of the regional steel industry. However, North America and Europe are expected to show accelerated growth in environmental and chemical segments, focusing on applications such as wastewater treatment and agricultural fertilizers, supported by stricter environmental regulatory frameworks. Segment-wise, while refractories maintain volume leadership, the agricultural and feed supplement segment is experiencing rapid growth, driven by increasing awareness regarding animal health and soil nutrient optimization. Emerging trends also highlight growing research into utilizing MgO derivatives in energy storage, particularly in developing solid-state electrolytes for next-generation battery technologies, representing a long-term transformative opportunity for market diversification.

AI Impact Analysis on Magnesium Oxide Target Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Magnesium Oxide market often revolve around optimizing high-energy consuming production processes, predicting raw material quality variations, and enhancing supply chain resilience. Users are highly concerned about how AI can mitigate the high operating costs associated with the extreme temperatures required for synthesizing dead burned and fused magnesia, specifically seeking solutions for predictive maintenance of rotary kilns and optimization of calcination parameters to reduce energy consumption per ton of output. Furthermore, questions address the application of machine learning for analyzing complex geological data to improve magnesite ore exploration efficiency and the use of computer vision systems for real-time quality control and grading of finished magnesia products, ensuring consistency and adherence to strict end-user specifications, particularly in high-purity grades required for specialized electronics and chemical synthesis.

AI's primary influence will be concentrated on enhancing operational efficiency and enabling advanced material customization within the Magnesium Oxide production lifecycle. AI-driven models can analyze massive datasets pertaining to raw material composition, furnace temperature profiles, and energy inputs to create highly precise operating models that minimize waste and maximize throughput. This capability is crucial for manufacturers aiming to reduce their carbon footprint and stay competitive amid rising global energy prices. Additionally, AI facilitates better inventory management and demand forecasting for different grades of magnesia, allowing producers to align production schedules with volatile market demand from steel, cement, and chemical industries, thereby reducing lead times and optimizing working capital. The integration of AI tools promises a shift from reactive maintenance and quality control to proactive, predictive material management.

- AI optimizes calcination process parameters, leading to significant energy consumption reduction and lower production costs for dead burned magnesia.

- Machine learning models enhance predictive maintenance schedules for rotary and shaft kilns, minimizing unplanned downtime and extending equipment lifespan.

- Advanced analytics improve magnesite ore exploration and selection, ensuring better raw material quality consistency and reduced geological risk.

- AI-driven computer vision systems facilitate real-time quality control and grading of finished magnesia products, especially high-purity grades.

- Predictive modeling enhances supply chain efficiency by accurately forecasting demand fluctuations across diverse end-use sectors like refractories and agriculture.

- AI assists in developing novel MgO composite materials by simulating reaction kinetics and optimizing material properties for specific high-performance applications.

DRO & Impact Forces Of Magnesium Oxide Target Market

The Magnesium Oxide market is currently driven by the continuous expansion of global refractory demand, inherently tied to the accelerated growth in steel production and cement manufacturing, particularly in fast-developing Asian economies. These industries rely on the superior thermal performance of DBM and FM to line their furnaces and kilns, positioning industrial output as the central market driver. Opportunities are abundant in the environmental sector, where MgO is increasingly utilized in flue gas desulfurization (FGD) systems to comply with stricter air quality standards globally. Conversely, the market faces significant restraints, primarily the high energy intensity required for producing high-purity magnesia grades, leading to high operational expenditure and susceptibility to volatile energy prices. Furthermore, the market structure is heavily impacted by the dominance of Chinese production, which often leads to price volatility and complicates competitive strategies for international players, creating an environment where technological superiority and specialized product offerings become crucial differentiators.

Impact forces currently shaping the competitive landscape include regulatory pressures demanding reduced industrial emissions, which simultaneously acts as a driver (for FGD uses) and a restraint (due to compliance costs). Technological advancements in production, such as the increasing adoption of synthetic magnesium oxide processes derived from seawater or brines, are altering the raw material dependency and improving product purity, particularly benefiting pharmaceutical and electronic applications. The threat of substitutes, while relatively low in high-temperature refractory applications, exists in niche chemical and agricultural sectors where compounds like calcium carbonate or dolomite can sometimes offer cost-effective alternatives. However, the fundamental physical and chemical properties of magnesia ensure its irreplaceable role in applications demanding extreme thermal resistance and chemical stability, solidifying its market position against potential substitutes and ensuring long-term demand growth driven by essential industrial processes.

Segmentation Analysis

The Magnesium Oxide market is highly diversified and segmented primarily based on product type, which relates directly to the purity and calcination temperature, dictating its application. The key types include Dead Burned Magnesia (DBM), Caustic Calcined Magnesia (CCM), and Fused Magnesia (FM). DBM and FM are high-temperature products essential for refractories, while CCM is the more chemically active form used extensively in agricultural, chemical, and environmental applications. Further segmentation is carried out by application, which clearly delineates the demand structure across crucial industrial sectors such as Refractories, Agriculture, Chemical, Construction, and Environmental Protection. The segmentation analysis provides granular insights into the end-user requirements, allowing manufacturers to tailor production processes and marketing strategies toward the most lucrative and rapidly evolving segments, such as high-purity CCM for nutraceuticals or specialized FM for advanced ceramics and electrical insulation components.

- By Product Type:

- Dead Burned Magnesia (DBM)

- Caustic Calcined Magnesia (CCM)

- Fused Magnesia (FM)

- Synthetic Magnesium Oxide

- By Application:

- Refractories

- Agricultural (Feed Additives and Fertilizers)

- Chemical Intermediates

- Construction (Sorel Cement and Insulation)

- Environmental (Water Treatment, Flue Gas Desulfurization)

- Pharmaceutical and Nutritional Supplements

- By Source:

- Magnesite Ore

- Brines and Seawater

Value Chain Analysis For Magnesium Oxide Target Market

The value chain for the Magnesium Oxide market begins with the upstream segment, encompassing the exploration, mining, and processing of raw materials, primarily magnesite ore, or the extraction of magnesium hydroxide from seawater and brines. The efficiency of raw material sourcing is critical, as the quality and purity of the magnesite ore directly influence the energy required and the subsequent grade of the finished magnesia product. Key players in this stage focus on securing long-term mining rights and optimizing extraction techniques to ensure a stable supply of consistent quality ore, which often involves heavy capital investment in specialized mining and beneficiation equipment to remove impurities before calcination.

The midstream phase involves the intensive manufacturing process, dominated by calcination—a thermal treatment process—to produce the different types of magnesia. Caustic calcination (low temperature, producing CCM) is less energy-intensive than the dead burning process (extremely high temperature, producing DBM) or fusion (producing FM). Companies invest heavily in advanced kiln technologies, such as high-efficiency rotary kilns and electric arc furnaces (for FM), to improve thermal efficiency and control the specific properties of the oxide crystals, such as density and porosity, which are essential for refractory performance. Technological excellence in this stage is a key determinant of competitive advantage, particularly for producers of high-purity, specialized magnesia grades.

The downstream segment involves distribution, sales, and the end-use applications. Distribution channels are varied: high-volume products like DBM for major steel mills are often sold directly through long-term contracts, ensuring just-in-time delivery and technical support. Lower-volume, specialized products like CCM for pharmaceutical or agricultural use frequently pass through indirect channels, including specialized chemical distributors and local agents who manage inventory and small-batch orders. The complexity of the supply chain requires robust logistics, given that magnesia is a bulk material, and optimizing transportation costs from production sites (often near mines in China or Turkey) to major consumption centers (like Europe and North America) is paramount to maintaining profitability and market competitiveness in the global trading environment.

Magnesium Oxide Target Market Potential Customers

The primary and most critical customer base for the Magnesium Oxide market is the refractory industry, comprising major steel, cement, glass, and non-ferrous metal producers. These end-users, particularly steel manufacturers, demand massive volumes of high-density DBM and FM for lining basic oxygen furnaces (BOF), electric arc furnaces (EAF), and ladle furnaces, as the thermal resistance of MgO is non-negotiable for safe and efficient high-temperature processing. The buying decision in this segment is heavily influenced by product quality consistency, specific crystal structure requirements (high bulk density), and the long-term reliability of the supplier, leading to strong, enduring relationships between magnesia producers and large metallurgical corporations.

A second major segment consists of the agricultural and animal feed industries, which predominantly utilize Caustic Calcined Magnesia (CCM). Farmers and feed manufacturers purchase MgO as a crucial source of magnesium for cattle feed supplements (preventing grass tetany), as a fertilizer component to adjust soil pH, and as a raw material in specialized plant nutritional formulations. These customers prioritize the chemical reactivity and bioavailability of the magnesium oxide, often requiring lower-purity grades compared to the refractory segment, but demanding strict compliance with food safety and agricultural regulatory standards, making consistency in chemical composition and fine particle size critical purchasing factors.

Furthermore, chemical processors and environmental remediation companies form another significant customer cohort. Chemical buyers use MgO as a raw material for synthesizing various magnesium salts (sulfate, chloride) or as a catalyst. Environmental firms utilize MgO, often in slurry form, for neutralizing acidic industrial wastewater and, crucially, for large-scale Flue Gas Desulfurization (FGD) processes in coal-fired power plants and heavy industrial facilities. For these buyers, cost-effectiveness, high surface area, and chemical purity, particularly concerning heavy metal contamination, are the primary purchasing criteria, highlighting the diversification of end-user requirements across the entire spectrum of magnesium oxide products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.2 Billion |

| Market Forecast in 2033 | $9.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | RHI Magnesita GmbH, Martin Marietta Inc., Vesuvius plc, Kumas Magnesite Industry Inc., Magnezit Group, Grecian Magnesite S.A., Premier Magnesia LLC, Ube Material Industries Ltd., Israel Chemicals Ltd. (ICL), Russian Mining & Chemical Company (RMCC), Baymag Inc., Imerys S.A., Sinomag Technology Co. Ltd., Jindu Magnesite Group, Haicheng Houying Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnesium Oxide Target Market Key Technology Landscape

The technological landscape of the Magnesium Oxide market is characterized by ongoing innovation aimed primarily at improving purity, reducing energy consumption, and enhancing the physical properties of the finished product to meet sophisticated end-user demands. Traditional production methods rely on mining natural magnesite ore, followed by high-temperature calcination in rotary or shaft kilns. However, modern technological advancements focus on synthetic production routes, specifically utilizing seawater or subsurface brines, where magnesium hydroxide is precipitated and then processed. These synthetic methods, while often more capital-intensive, yield significantly higher purity grades, such as high-purity MgO (99%+), which are essential for pharmaceutical, electronic substrate, and advanced battery applications, providing a critical competitive edge over mineral-sourced products in specialty markets.

A crucial area of technological focus is the optimization of the calcination process itself. Manufacturers are increasingly adopting advanced furnace designs, incorporating technologies such as oxygen enrichment or plasma firing, to achieve the necessary dead burning temperatures (above 1,400°C) more efficiently. For Fused Magnesia (FM), the use of large electric arc furnaces requires extremely precise control over electrical input and cooling rates to ensure the formation of large, dense periclase crystals, maximizing the material's resistance to slag corrosion and thermal shock in refractories. Furthermore, proprietary particle size distribution control techniques are vital, as the specific granulometry of the magnesia powder significantly impacts the density, strength, and overall performance of the final refractory brick or monolithic.

Another emerging technological area involves environmental sustainability and waste management. Companies are investing in closed-loop systems and utilizing waste heat recovery from the calcination process to improve overall energy efficiency and reduce the environmental footprint associated with manufacturing. Research is also progressing in producing "green" magnesium oxide by coupling production facilities with renewable energy sources or by developing new low-temperature chemical processes that bypass the need for traditional, highly polluting kiln operations. These technological innovations not only address regulatory pressures but also position producers favorably with customers increasingly prioritizing sustainable sourcing and manufacturing practices, thereby defining the future standard for operational excellence in the magnesia industry.

Regional Highlights

-

Asia Pacific (APAC): Dominance in Volume and Refractories

The Asia Pacific region currently holds the largest market share in the Magnesium Oxide market, a position cemented by the region's colossal industrial base, particularly in China and India. China is not only the largest consumer but also the world's leading producer of raw magnesite and finished magnesia products, dominating the supply chain for Dead Burned Magnesia (DBM) and Fused Magnesia (FM). The regional demand is overwhelmingly driven by massive capital expenditure in infrastructure, rapid expansion of the steel industry (which accounts for a significant portion of global steel production), and burgeoning cement manufacturing activities necessary for urbanization. The competitive advantage in APAC is rooted in lower raw material extraction costs and established, high-capacity processing infrastructure, although the industry is increasingly focused on environmental compliance to mitigate the substantial pollution associated with high-temperature magnesia production.

Market growth in Southeast Asia, including countries like Vietnam and Indonesia, is accelerating due to foreign direct investment in manufacturing and localized infrastructure projects, diversifying the regional demand structure beyond China. While refractory applications remain the bedrock of the market, the agricultural sector is rapidly expanding, fueled by intensive farming practices requiring consistent soil nutritional adjustments using Caustic Calcined Magnesia (CCM). Furthermore, as the region modernizes its industrial facilities, demand for sophisticated environmental applications, specifically in Flue Gas Desulfurization (FGD) systems for reducing sulfur emissions from coal plants, is emerging as a critical growth vector, prompting local producers to invest in higher-purity, reactive grades of MgO.

The regulatory environment, particularly in China, is undergoing substantial transformation, shifting focus from sheer production volume to environmental quality and compliance. This shift is leading to the consolidation of smaller, environmentally non-compliant magnesia operations, favoring larger, technologically advanced producers capable of meeting stringent air and water pollution standards. This development is expected to stabilize global pricing and quality, offering opportunities for specialized, high-performance magnesia suppliers who can meet the sophisticated requirements of the region's rapidly maturing industrial ecosystem.

-

North America: Focus on Specialty and Environmental Applications

The North American Magnesium Oxide market is characterized by high demand for specialty grades and a strong focus on environmental and chemical applications, rather than volume dominance in basic refractories. While steel production provides a stable base demand for DBM, the most dynamic growth segments are in agriculture, water treatment, and industrial chemical synthesis. Producers in the U.S. and Canada, such as those utilizing brine resources, specialize in high-purity synthetic magnesium oxide, catering to the exacting standards of the pharmaceutical, feed supplement, and high-end ceramics industries where quality consistency and trace element control are paramount.

Environmental regulations, particularly those enforced by the EPA, are a major driver. North American power generation facilities and industrial boilers rely heavily on MgO-based systems for efficient acid gas and particulate removal, ensuring sustained demand for reactive CCM in environmental control technologies. The agricultural sector is another robust consumer, using MgO extensively in animal feed to address mineral deficiencies and in fertilizer blends for soil amendment, leveraging the region's large-scale commercial farming operations. Manufacturers here emphasize sustainability and localized supply chains to reduce logistical complexities and costs associated with importing bulk raw materials from overseas.

The competitive landscape in North America is highly fragmented, featuring both major international corporations and specialized regional players that leverage their proximity to end-users and access to domestic resources like brines. Technological investment focuses on process automation, efficiency, and developing new applications for high-purity MgO, including exploratory research into its use in advanced material science, such as thermal management components and specialized coatings. The market demonstrates a high willingness to pay a premium for certified, traceable, and high-performance magnesium oxide products tailored to specific, demanding industrial processes.

-

Europe: Strict Standards and Technological Integration

Europe represents a mature but technologically sophisticated market for Magnesium Oxide, heavily influenced by stringent environmental regulations (REACH) and a commitment to high manufacturing standards. The European market, encompassing Western and Eastern Europe, maintains a substantial demand for refractories driven by established steel and cement industries, but growth is increasingly concentrated in high-value, niche applications. European manufacturers often focus on producing high-quality, specialized magnesia products, including fused magnesia and electrofused grades, catering to highly demanding customers in the specialty metals and advanced material sectors.

The emphasis on sustainability is particularly pronounced in Europe, driving demand for innovative applications of MgO in waste treatment, soil remediation, and carbon capture technologies. The European Union's regulatory framework encourages the use of highly efficient, environmentally sound chemical inputs, bolstering the consumption of high-grade CCM for industrial wastewater neutralization and municipal solid waste treatment processes. Furthermore, the region is a leader in implementing industrial furnace efficiency improvements, which, paradoxically, drives demand for higher performance, longer-lasting magnesia refractory linings that offer superior thermal stability and reduced downtime.

Sourcing strategies in Europe are complex due to limited domestic magnesite reserves, leading to high dependence on imports from regions like Turkey, China, and Russia. This reliance necessitates sophisticated supply chain risk management and long-term procurement contracts. Consequently, European players often differentiate themselves through technical service, application expertise, and product customization, rather than competing solely on volume or price. Technological integration, focusing on Industry 4.0 concepts for optimizing production and supply chain visibility, is key to maintaining competitiveness against high-volume producers from Asia, reinforcing Europe’s role as a hub for advanced MgO research and application development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnesium Oxide Target Market.- RHI Magnesita GmbH

- Martin Marietta Inc.

- Vesuvius plc

- Kumas Magnesite Industry Inc.

- Magnezit Group

- Grecian Magnesite S.A.

- Premier Magnesia LLC

- Ube Material Industries Ltd.

- Israel Chemicals Ltd. (ICL)

- Russian Mining & Chemical Company (RMCC)

- Baymag Inc.

- Imerys S.A.

- Sinomag Technology Co. Ltd.

- Jindu Magnesite Group

- Haicheng Houying Group

- Qinghai West Magnesium Co. Ltd.

- Nedmag B.V.

- Possehl Erzkontor GmbH

- CeramTec GmbH

- Tata Steel Europe

Frequently Asked Questions

Analyze common user questions about the Magnesium Oxide Target market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary grades of Magnesium Oxide and their main uses?

The primary grades are Dead Burned Magnesia (DBM), used for high-temperature refractory linings in steel and cement kilns; Fused Magnesia (FM), a high-purity, dense grade for specialized refractories and electrical insulation; and Caustic Calcined Magnesia (CCM), a chemically reactive grade used in agriculture, chemical production, and environmental water treatment applications.

Which geographical region dominates the production and consumption of Magnesium Oxide?

Asia Pacific (APAC), particularly China, dominates both the production and consumption of Magnesium Oxide. This dominance is driven by China's extensive natural magnesite reserves and its large-scale steel and cement industries, which are the largest global consumers of refractory grade MgO.

How do environmental regulations impact the Magnesium Oxide market?

Environmental regulations have a dual impact. They restrain the market by increasing compliance costs for high-energy calcination processes, but they also act as a major driver by increasing the demand for reactive magnesia used in flue gas desulfurization (FGD) and acidic wastewater neutralization systems.

What is the significance of Fused Magnesia (FM) in advanced industrial applications?

Fused Magnesia (FM) is critical due to its exceptionally high density, large crystal structure (periclase), and superior resistance to corrosion and thermal shock. It is essential for high-performance refractory bricks, crucibles, and specialized electrical heating elements requiring maximum thermal stability and purity.

Is synthetic Magnesium Oxide production growing, and why is it important?

Yes, synthetic MgO production, derived from seawater or brines, is growing. This method is crucial because it yields ultra-high-purity grades (99%+ MgO), which are necessary for high-tech, non-refractory applications such as pharmaceuticals, electronic substrates, and emerging solid-state battery electrolytes, where natural ore impurities are intolerable.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Magnesium Oxide Target Market Statistics 2025 Analysis By Application (MRAM, Semiconductor Industry, Scientific Research and Institutions, Other), By Type (99.95% Purity, 99.99% Purity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Magnesium Oxide Target Market Statistics 2025 Analysis By Application (MRAM, Semiconductor Industry, Scientific Research and Institutions), By Type (99.95% Purity, 99.99% Purity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager