Magnetic Encoder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442876 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Magnetic Encoder Market Size

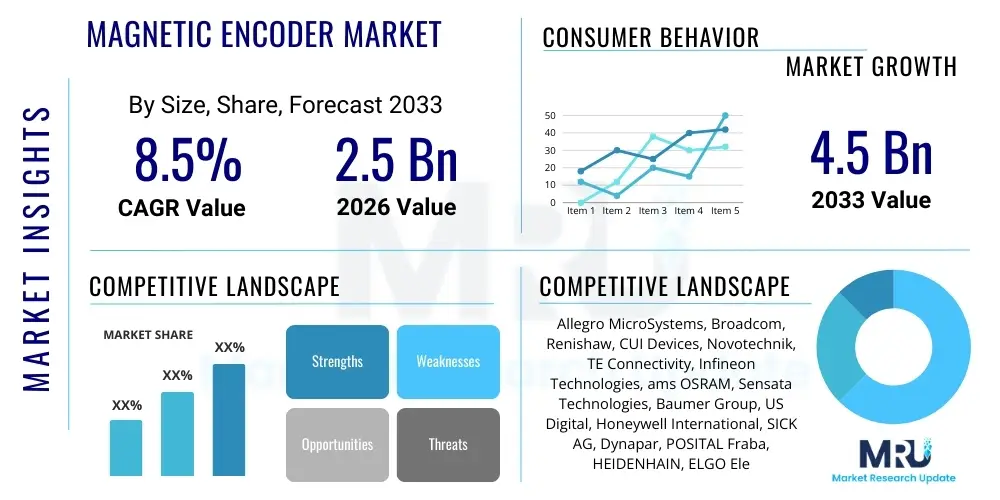

The Magnetic Encoder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.5 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for high-precision, robust, and compact position sensing solutions across critical industrial sectors, notably industrial automation, robotics, and the rapidly expanding electric vehicle (EV) sector. Magnetic encoders offer significant advantages over traditional optical counterparts, including superior resilience to environmental contaminants such as dust, moisture, and vibration, making them ideal for harsh operating conditions prevalent in manufacturing and automotive applications.

Magnetic Encoder Market introduction

Magnetic encoders are sophisticated electromechanical devices designed to convert mechanical motion (linear or rotary) into electrical signals, providing precise feedback on position, speed, and direction. These critical components utilize magnetic fields and specialized sensors, primarily Hall effect or Magnetoresistive (MR) technologies, to detect changes in the magnetic flux generated by a magnetized wheel or strip. Their core functionality lies in their ability to deliver accurate real-time data necessary for closed-loop control systems, which is indispensable for modern high-performance machinery. The technological evolution toward smaller form factors and higher resolution, coupled with increasing requirements for durability, has firmly positioned magnetic encoders as the preferred sensing solution in demanding environments.

The product portfolio encompasses rotary magnetic encoders, which measure angular position, and linear magnetic encoders, which track movement along a straight axis. Major applications span a diverse technological landscape, including factory automation systems, servo and stepper motor control, medical imaging equipment, consumer electronics, and crucial automotive safety systems like steering angle sensing and powertrain management. The inherent benefits of magnetic encoders—such as non-contact operation minimizing wear, immunity to contamination, and exceptional shock resistance—make them highly attractive compared to optical encoders, where contamination can severely degrade performance and lifespan. This robustness directly translates into reduced maintenance costs and enhanced operational reliability, driving widespread adoption across capital-intensive industries.

Driving factors propelling this market include the global thrust toward Industry 4.0, necessitating increasingly precise and reliable sensor feedback for interconnected industrial processes, and the concurrent rise in the use of collaborative robots (cobots) and autonomous guided vehicles (AGVs) in logistics and manufacturing facilities. Furthermore, the stringent quality control standards in advanced manufacturing, coupled with rapid innovation in magnetic sensing materials and integrated circuit design, are fostering the development of higher-resolution, lower-power consumption magnetic encoders. These advancements ensure that magnetic encoders remain a foundational technology enabling the continuous optimization of automated systems worldwide.

Magnetic Encoder Market Executive Summary

The Magnetic Encoder Market is characterized by vigorous business trends centered around technological miniaturization, digitalization, and integration into multi-sensor fusion architectures. Key business strategies observed among market leaders involve strategic acquisitions focused on enhancing intellectual property in advanced sensing technologies, such as Anisotropic Magnetoresistance (AMR) and Giant Magnetoresistance (GMR), and forming long-term supply agreements with major automotive Tier 1 suppliers and robotics manufacturers. The trend toward customized encoder solutions designed for harsh environments, including specialized coatings and shielding for high temperature or electromagnetic interference (EMI) exposure, represents a significant avenue for differentiated market penetration. Furthermore, the shift from standalone encoders to integrated motor-encoder packages simplifies system design and reduces total cost of ownership for end-users, fueling growth in the embedded control systems sector globally.

Regionally, the market exhibits divergent growth patterns. Asia Pacific (APAC) stands out as the primary growth engine, propelled by aggressive governmental investments in smart manufacturing infrastructure and the massive scale of electronics and automotive production in countries like China, South Korea, and Japan. North America and Europe maintain technological leadership, particularly in high-reliability, mission-critical applications such as aerospace and advanced medical robotics, demonstrating high average selling prices (ASPs). These mature markets are driven more by the replacement cycle and the adoption of cutting-edge, high-resolution encoders required for complex automation tasks, while the APAC region focuses on volume production and rapid industrial scaling. Political stability and favorable trade policies for technology transfer are crucial in sustaining the supply chain necessary for continuous market expansion across these regions.

Segment trends highlight the dominance of rotary encoders due to their essential role in motor feedback systems, which underpin nearly all automated machinery. However, the linear encoder segment is experiencing accelerated growth, driven by the increasing deployment of high-precision linear stages used in semiconductor manufacturing and advanced metrology equipment. By sensing technology, Hall effect sensors maintain market share in cost-sensitive and low-to-medium resolution applications, but Magnetoresistive technologies (GMR/AMR) are rapidly gaining traction in high-end applications demanding superior angular accuracy and resolution, even in extremely compact packages. The shift toward digital output formats, which offer improved noise immunity and easier integration into modern microcontroller-based systems, is also a powerful underlying segment trend shaping future product development strategies globally.

AI Impact Analysis on Magnetic Encoder Market

Common user questions regarding AI’s impact on the Magnetic Encoder Market frequently revolve around whether AI algorithms can improve sensor accuracy, how predictive maintenance enabled by AI affects encoder lifespan requirements, and the role of encoder data in training machine learning models for industrial control. Users are keen to understand if AI integration will lead to smarter, self-calibrating encoders or if the core sensing technology remains foundational while AI manages the interpretation layer. The consensus among market stakeholders is that AI will not replace the fundamental function of magnetic encoders but rather significantly enhance the utility and value derived from the raw data they produce. Key themes include real-time anomaly detection, optimizing complex motion trajectories, and integrating encoder feedback seamlessly with holistic operational technology (OT) and information technology (IT) systems. Expectations are high that AI will enable faster diagnostics and system reconfiguration, ultimately increasing the overall efficiency of automated processes where magnetic encoders are deployed.

- AI enables advanced diagnostics and predictive maintenance by analyzing high-frequency encoder data patterns to anticipate component failure before catastrophic breakdown, minimizing unplanned downtime.

- Machine learning algorithms utilize position and speed feedback from magnetic encoders to optimize complex kinematic movements in robotics and CNC machinery, leading to enhanced throughput and precision.

- Self-calibration features leveraging AI are being developed to automatically compensate for environmental variations (temperature, vibration) or mechanical misalignment, maintaining high accuracy without manual intervention.

- AI-driven anomaly detection improves system security and operational integrity by instantly flagging unusual velocity or position readings that deviate from established operational norms.

- The massive datasets generated by fleets of industrial machines equipped with magnetic encoders are critical inputs for training reinforcement learning models used for optimized factory management and energy consumption reduction.

DRO & Impact Forces Of Magnetic Encoder Market

The Magnetic Encoder Market is strongly influenced by a robust combination of growth drivers, critical restraints, and significant opportunities, which collectively determine the market trajectory. The core drivers include the rapid global adoption of industrial automation and robotics, driven by rising labor costs and the need for improved production efficiency. The accelerating shift toward electrification in the automotive sector, necessitating high-resolution position sensing for electric motors, steering columns, and braking systems, further provides major impetus. Key restraints, however, persist, notably the vulnerability of some magnetic sensing elements to strong external magnetic fields or high-frequency electromagnetic interference (EMI), which can compromise accuracy in specific industrial settings. Furthermore, intense price competition from established optical encoder manufacturers and emerging low-cost solutions, particularly in lower-resolution applications, pressures profit margins. Opportunities are vast, focused on developing integrated encoder-on-chip solutions, pioneering applications in specialized medical devices requiring miniature, high-reliability sensing, and capitalizing on the burgeoning market for advanced drone and aerospace navigation systems.

The impact forces within the market are predominantly technological and competitive. Technological forces involve the continuous improvement in Magnetoresistive (MR) sensor sensitivity and the successful integration of sensing elements with microcontrollers (SoC encoders), leading to smaller, smarter, and cheaper products. Competitive impact forces involve aggressive patent filing and product differentiation based on resolution, robustness, and connectivity standards. Economic forces, such as fluctuating raw material costs (especially specialized magnetic materials and rare earth elements), introduce volatility, while regulatory forces, particularly those related to automotive safety (ISO 26262), drive demand for highly reliable and certified magnetic encoders designed for functional safety compliance. The balance of these forces dictates market evolution, favoring suppliers who can innovate rapidly while maintaining stringent quality control.

The market faces the dual challenge of continuous resolution enhancement—to meet the exacting standards of high-end CNC and metrology equipment—and simultaneous cost reduction for mass-market applications like consumer robotics and standard motor feedback. The transition toward Industry 5.0 concepts, emphasizing human-robot collaboration, places a premium on highly reliable, intrinsically safe, and fast-response encoders. Suppliers investing in advanced shielding techniques, digital interfaces (e.g., BiSS, SSI, SPI), and superior thermal stability are best positioned to capture premium market share. Ultimately, the market’s growth is fundamentally tied to the health of the global capital expenditure cycle in manufacturing, infrastructure, and vehicle production, making it susceptible to macroeconomic fluctuations but resilient due to its critical role in enabling modern automated systems.

Segmentation Analysis

The Magnetic Encoder Market segmentation offers a granular view of product utilization and market dynamics, primarily categorized based on the type of motion measured, the underlying sensing technology employed, the nature of the output signal, and the diverse industrial applications they serve. This multifaceted segmentation helps stakeholders identify high-growth niches and tailor product development to specific end-user requirements, ranging from high-volume, cost-sensitive automotive applications to low-volume, high-precision aerospace use cases. Understanding these segments is crucial for strategic planning, as distinct geographical regions often show a preference for certain technological types depending on their industrial specialization (e.g., Asia Pacific leading in consumer electronics automation driving demand for miniature rotary encoders).

Rotary encoders, which dominate the market revenue, are essential for motors and robotic joints, requiring high angular accuracy, while linear encoders are pivotal in machine tools, large-scale automation, and measurement systems, demanding linearity and long-distance fidelity. The differentiation between sensing technologies (Hall Effect vs. Magnetoresistive) is critical, determining the trade-off between cost, complexity, and achievable resolution. Magnetoresistive sensors, due to their higher sensitivity, are increasingly penetrating markets that were previously the exclusive domain of optical sensors. The ongoing convergence of these technologies and the push toward integrated, smart sensors are key trends influencing market profitability across all defined segments.

- By Type:

- Rotary Magnetic Encoders (Absolute and Incremental)

- Linear Magnetic Encoders (Tape/Strip and Ring/Scale)

- By Sensing Technology:

- Hall Effect Sensors

- Magnetoresistive (MR) Sensors (GMR, AMR, TMR)

- By Output:

- Analog Output (Sine/Cosine)

- Digital Output (TTL, HTL, Serial Communication Protocols like SSI, BiSS, SPI, etc.)

- By Application:

- Industrial Automation (Robotics, CNC Machinery, Material Handling)

- Automotive (Steering, Powertrain, Braking Systems)

- Aerospace and Defense

- Medical Equipment (MRI, CT Scanners, Surgical Robotics)

- Consumer Electronics and Office Equipment

- Motor Feedback Systems

Value Chain Analysis For Magnetic Encoder Market

The value chain for the Magnetic Encoder Market begins with upstream activities focused on the procurement and refinement of specialized raw materials, primarily encompassing rare earth magnets (such as Neodymium Iron Boron), advanced semiconductor materials for sensor elements (silicon substrates), and specialized plastics and metals for housing and mechanical components. This phase requires sophisticated material engineering to ensure magnetic stability, thermal performance, and mechanical durability. Critical upstream suppliers include specialized magnetic material manufacturers, semiconductor wafer fabrication plants, and dedicated ASIC designers who develop the integrated circuits necessary for signal conditioning and processing. Ensuring a stable and quality-controlled supply of these high-specification components is fundamental to maintaining product performance and cost competitiveness in the downstream market.

Midstream activities involve the core manufacturing and assembly processes. This includes the precise magnetization of scales or rings, the fabrication and packaging of the sensing elements (Hall or MR chips), and the integration of these components into a robust mechanical housing along with necessary electronics for signal processing (interpolation and communication). Quality control and calibration are paramount in this stage, as the accuracy and resolution of the final encoder depend heavily on the mechanical precision and electrical signal integrity achieved during assembly. Companies often employ highly automated production lines, especially for high-volume rotary encoders used in motor feedback, leveraging specialized expertise in micromachining and cleanroom assembly practices to minimize defects.

Downstream analysis focuses on the distribution channels and the final end-user interaction. Distribution channels are varied, incorporating both direct sales to large Original Equipment Manufacturers (OEMs) in the robotics and automotive sectors, and indirect channels relying on technical distributors and specialized system integrators who add value through integration support and localized service. Direct sales ensure tight control over product specifications and enable customization, particularly for complex industrial machinery and aerospace applications. Indirect channels provide broad market reach, catering to smaller and medium-sized enterprises (SMEs) and maintenance, repair, and overhaul (MRO) markets. The end-users, such as factory automation providers and automotive manufacturers, increasingly demand not just the encoder itself, but comprehensive technical support, application-specific expertise, and long-term supply chain reliability.

Magnetic Encoder Market Potential Customers

Potential customers for magnetic encoders are highly diversified, reflecting the technology's ubiquity in motion control and measurement systems across almost every industrial sector. The largest segment of end-users consists of industrial automation manufacturers, including producers of multi-axis robots, CNC machine tools, and factory conveyor systems, who require precise feedback for servo motor control and motion synchronization. The automotive industry represents another critical buyer, utilizing encoders for functional safety applications like electronic power steering (EPS) systems, braking, throttle position sensing, and, increasingly, in the electric motor traction systems of electric vehicles (EVs), where high speed and reliability under harsh conditions are non-negotiable. Furthermore, manufacturers of complex medical diagnostic equipment, such as magnetic resonance imaging (MRI) machines and precision fluid handling systems, rely on the non-contact reliability and high resolution of magnetic encoders to ensure patient safety and diagnostic accuracy.

Beyond these primary segments, substantial demand originates from the aerospace and defense sectors, where magnetic encoders are integrated into flight control surfaces, targeting systems, and sensor gimbals, valuing their resilience to vibration and extreme temperatures far above standard industrial tolerances. The consumer electronics market, specifically manufacturers of advanced printers, scanners, and high-end photographic equipment, utilizes miniature magnetic encoders for cost-effective, high-precision positioning within compact devices. System integrators, who build customized automation solutions for specific factory floor challenges, act as influential indirect customers, bundling encoders with motors and controllers. Finally, the research and development community, including university labs and metrology specialists, purchases high-accuracy linear and rotary encoders for experimentation and calibration purposes, driving demand for the absolute highest resolution products available on the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allegro MicroSystems, Broadcom, Renishaw, CUI Devices, Novotechnik, TE Connectivity, Infineon Technologies, ams OSRAM, Sensata Technologies, Baumer Group, US Digital, Honeywell International, SICK AG, Dynapar, POSITAL Fraba, HEIDENHAIN, ELGO Electronic, ifm electronic, Tamagawa Seiki, Pepperl+Fuchs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Magnetic Encoder Market Key Technology Landscape

The technology landscape of the Magnetic Encoder Market is dynamically evolving, driven primarily by innovations in sensor physics and microelectronics integration. The core technological foundation rests upon two primary sensing methods: the Hall Effect, which is mature and cost-effective, generally suited for lower-resolution and simpler positioning tasks; and Magnetoresistive (MR) technologies, including Giant Magnetoresistance (GMR), Anisotropic Magnetoresistance (AMR), and Tunnel Magnetoresistance (TMR). MR sensors offer significantly higher sensitivity, enabling extremely high resolution and angular accuracy, making them indispensable for demanding applications such as high-performance servo drives and precision measurement systems. Recent advancements focus heavily on optimizing TMR sensors, which provide the best combination of resolution, speed, and low power consumption, allowing integration into battery-operated or miniature devices.

Beyond the core sensing element, significant technological focus is placed on enhancing signal processing capabilities and interface standards. Modern magnetic encoders incorporate sophisticated Application-Specific Integrated Circuits (ASICs) that perform high-speed signal conditioning, interpolation, and linearization. This digital integration transforms the raw sinusoidal sensor output into high-resolution digital position data, often communicated through high-speed, noise-immune serial interfaces such as BiSS-C, SSI, or proprietary industrial Ethernet protocols. The shift toward these digital interfaces improves data integrity, especially over long transmission distances, and simplifies integration into Industrial Internet of Things (IIoT) architectures. The integration of diagnostic capabilities directly into the encoder ASIC is also a critical trend, allowing real-time monitoring of sensor health and environmental conditions.

Furthermore, material science improvements are key to enhancing the robustness and long-term stability of magnetic encoders. This includes developing new, highly stable magnetic materials that retain their flux density under extreme temperature cycling and the use of advanced encapsulation techniques to shield sensitive sensor elements from moisture, dust, and aggressive chemical environments common in process industries. The market is also seeing the emergence of "encoder-on-chip" solutions, where the magnet, sensor, and processing logic are all integrated into a single, compact semiconductor package, drastically reducing the physical size and simplifying the integration into micro-actuators and high-density electronic assemblies, paving the way for ubiquitous sensor deployment across smaller, more agile automation systems.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, primarily due to the vast industrialization occurring in China, India, and Southeast Asian nations, coupled with established high-tech manufacturing bases in Japan and South Korea. This region leads in the adoption of magnetic encoders in consumer electronics manufacturing, high-volume automotive production, and increasingly, in domestic robotics and automation systems driven by governmental mandates favoring advanced manufacturing techniques. The competitive landscape here is characterized by a mix of major global suppliers and highly competitive local manufacturers focusing on volume and cost-effectiveness.

- North America: North America is a mature market driven by demand for high-reliability, premium-grade encoders, especially in defense, aerospace, and advanced medical robotics. The market is focused on high-resolution products, specialized functional safety compliance (ISO 26262), and the integration of encoders into sophisticated IoT and AI-driven predictive maintenance platforms. Innovation is focused on advanced GMR/TMR sensing and robust digital communication standards suitable for mission-critical applications.

- Europe: Europe maintains a strong position, benefiting from a powerful industrial base in Germany and Italy (known for high-end CNC and industrial machinery). The region emphasizes strict quality standards, especially in the automotive sector and machine tool manufacturing. European market demand is heavily influenced by the push toward sustainable and energy-efficient automation (Green Manufacturing), necessitating precision control enabled by high-accuracy magnetic encoders.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, primarily tied to foreign direct investment in infrastructure, mining, and specific regional automotive manufacturing hubs (e.g., Mexico, Brazil). Market adoption is concentrated on standard industrial automation applications and motor feedback, often leveraging established international brands and distributors for technical expertise and supply chain stability.

- Middle East and Africa (MEA): Growth in the MEA region is sector-specific, largely driven by large-scale capital projects in oil and gas, infrastructure development, and defense procurements. While the total market size is smaller compared to APAC or North America, demand for rugged, explosion-proof, and environmentally resistant magnetic encoders is high, reflecting the challenging operational environments prevalent in the region's dominant industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Magnetic Encoder Market.- Allegro MicroSystems

- Broadcom

- Renishaw

- CUI Devices

- Novotechnik

- TE Connectivity

- Infineon Technologies

- ams OSRAM

- Sensata Technologies

- Baumer Group

- US Digital

- Honeywell International

- SICK AG

- Dynapar

- POSITAL Fraba

- HEIDENHAIN

- ELGO Electronic

- ifm electronic

- Tamagawa Seiki

- Pepperl+Fuchs

Frequently Asked Questions

Analyze common user questions about the Magnetic Encoder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of magnetic encoders over optical encoders in industrial settings?

Magnetic encoders offer superior robustness and environmental resilience, functioning reliably in conditions where contaminants like dust, oil, moisture, or heavy vibration would cause immediate failure or significant degradation in optical encoders. This non-contact sensing method ensures longer lifespan and requires less maintenance, which is crucial for maximizing uptime in factory automation.

Which sensing technology is driving high-resolution growth in the magnetic encoder market?

Magnetoresistive (MR) technologies, particularly Giant Magnetoresistance (GMR) and Tunnel Magnetoresistance (TMR), are driving high-resolution growth. These sensors provide significantly higher sensitivity and accuracy compared to traditional Hall effect sensors, allowing modern magnetic encoders to challenge the precision capabilities historically dominated by optical sensing devices in demanding applications like metrology and high-end robotics.

How is the Electric Vehicle (EV) industry impacting the demand for magnetic encoders?

The EV industry is a major growth catalyst, generating high demand for magnetic encoders used in critical motor control feedback, steering angle measurement, and brake-by-wire systems. Magnetic encoders are preferred due to their tolerance for high temperatures, high rotational speeds, and immunity to electrical noise inherent in EV powertrains, ensuring reliability and functional safety compliance (ISO 26262).

What role does the integration of ASICs play in modern magnetic encoder design?

ASICs (Application-Specific Integrated Circuits) are essential for modern encoders as they integrate complex functions like signal conditioning, high-speed interpolation, linearization, and digital communication protocols (e.g., BiSS, SSI). This integration significantly enhances the encoder’s precision, reduces overall footprint, improves noise immunity, and provides advanced diagnostics capabilities, leading to 'smart' sensors.

Which geographical region is projected to experience the fastest growth in magnetic encoder adoption?

The Asia Pacific (APAC) region, spearheaded by rapid industrial expansion, governmental investments in smart manufacturing (Industry 4.0), and massive production scales in the automotive and consumer electronics sectors in countries like China, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) for magnetic encoder adoption throughout the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Magnetic Encoder ICs Market Statistics 2025 Analysis By Application (Healthcare Equipment, Industrial Equipment, Office Equipment and Household Appliances, Assembly Robots and Autonomous Vehicles), By Type (Linear Encoder ICs, Rotary Encoder ICs), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Motion Encoder IC Market Statistics 2025 Analysis By Application (Healthcare, Machine Tool, Consumer Electronics, Assembly Equipment), By Type (Magnetic Encoder IC, Optical Encoder IC), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager